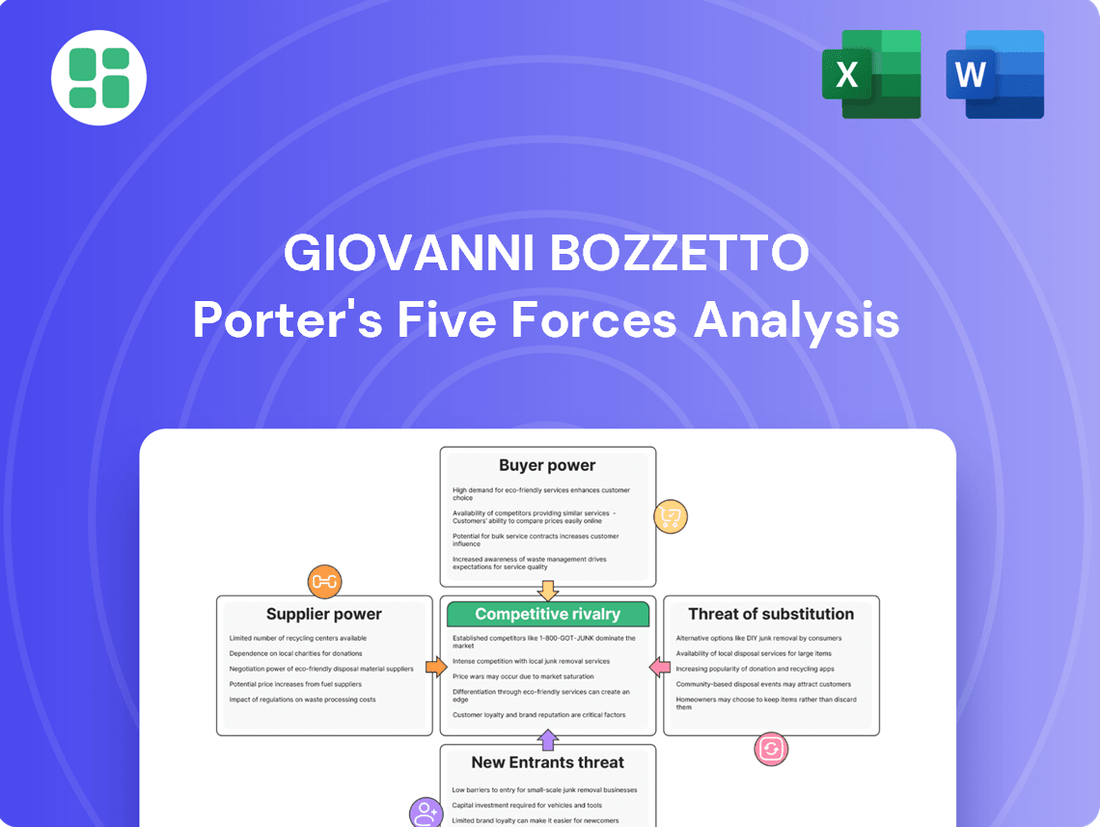

GIOVANNI BOZZETTO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GIOVANNI BOZZETTO Bundle

GIOVANNI BOZZETTO operates within a dynamic market, where understanding the interplay of competitive forces is paramount. This initial glimpse highlights the critical factors influencing its strategic landscape, from the power of its suppliers to the intensity of rivalry among existing players.

The complete report reveals the real forces shaping GIOVANNI BOZZETTO’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

In the specialty chemicals sector, the number and scale of raw material providers significantly influence supplier bargaining power. If a few dominant suppliers control a large portion of the market, they can exert considerable leverage over companies like Bozzetto, potentially dictating terms and prices. Conversely, a fragmented supplier base with numerous smaller players generally diminishes this power.

Switching costs for Bozzetto represent a significant factor in the bargaining power of its suppliers. If Bozzetto, a key player in the chemical sector, were to change suppliers, it would likely face substantial expenses related to re-qualifying new chemical formulations to meet its stringent quality standards. For instance, in 2024, the chemical industry saw average product development cycles extend, meaning a new supplier's materials could require extensive testing and validation, potentially costing hundreds of thousands of euros and delaying production.

The availability of substitute inputs significantly impacts suppliers' bargaining power. If Giovanni Bozzetto can easily switch to alternative raw materials or components from different suppliers, the leverage of any single supplier diminishes. For instance, in 2024, the chemical industry, a key supplier sector for Bozzetto, saw increased availability of bio-based alternatives for certain petrochemicals, potentially reducing reliance on traditional, single-source suppliers.

Importance of Bozzetto to Suppliers

The significance of Bozzetto Group as a customer directly influences the bargaining power of its suppliers. If Bozzetto represents a substantial portion of a supplier's revenue, that supplier will likely be more accommodating to Bozzetto's terms. Conversely, if Bozzetto is a small client, suppliers may wield greater power.

For instance, in 2023, the global specialty chemicals market, a key sector for Bozzetto's raw materials, saw diverse supplier dynamics. Suppliers with concentrated customer bases, where Bozzetto is a major account, would have had less leverage. Data from 2024 indicates that companies heavily reliant on a few large clients, like potentially Bozzetto, often prioritize maintaining those relationships over aggressive price negotiations.

- Supplier Dependence: The degree to which suppliers rely on Bozzetto for sales directly impacts their bargaining power. A high dependence weakens the supplier's position.

- Bozzetto's Market Share: Bozzetto's own market position and purchasing volume can influence how much attention suppliers pay to its needs versus other customers.

- Supplier Concentration: If Bozzetto sources from a few dominant suppliers, those suppliers gain more power. A fragmented supplier base generally benefits Bozzetto.

- Alternative Suppliers: The availability of comparable alternative suppliers for Bozzetto's required inputs is crucial. More alternatives mean less power for any single supplier.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant concern for Giovanni Bozzetto. If suppliers were to enter the specialty chemicals manufacturing sector themselves, they would directly compete with Bozzetto, potentially disrupting established market dynamics. This scenario increases supplier leverage in pricing and supply agreements.

For instance, a major raw material supplier to Bozzetto might consider establishing its own production facilities for intermediate or finished specialty chemicals. This move would allow the supplier to capture more of the value chain. In 2024, the specialty chemicals market saw continued consolidation, with some upstream players exploring vertical integration to secure market share and control distribution channels.

- Increased Competition: Suppliers entering Bozzetto's market would directly challenge its customer base and market position.

- Pricing Pressure: A credible threat of forward integration can empower suppliers to demand better terms, knowing they can bypass Bozzetto.

- Supply Chain Control: Suppliers integrating forward gain greater control over product quality, delivery, and customer relationships.

The bargaining power of suppliers for Giovanni Bozzetto is influenced by several factors, including the concentration of suppliers, the importance of Bozzetto as a customer, and the switching costs associated with changing suppliers. In 2024, the specialty chemicals sector experienced supply chain disruptions, potentially increasing the leverage of key raw material providers.

When suppliers are highly concentrated, meaning only a few companies control a significant portion of the market for essential raw materials, they can command higher prices and dictate terms to companies like Bozzetto. Conversely, if Bozzetto is a major customer for a supplier, the supplier is more likely to offer favorable terms to retain that business. For instance, in 2023, some chemical producers reported that their top 10 customers accounted for over 60% of their revenue, highlighting the importance of key accounts.

High switching costs for Bozzetto, such as the expense and time required to re-qualify new chemical formulations, also empower suppliers. In 2024, the average lead time for specialty chemical product approval was reported to be around 6-9 months, making supplier changes a costly endeavor. The availability of substitute inputs can mitigate this power, but if alternatives are scarce or of lower quality, suppliers retain greater leverage.

| Factor | Impact on Bozzetto's Supplier Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Specialty chemicals market saw some consolidation, potentially increasing concentration for certain inputs. |

| Bozzetto's Customer Importance | High importance for suppliers reduces their power. | Major clients in the chemical sector often receive preferential terms. |

| Switching Costs | High switching costs increase supplier power. | Product re-qualification in chemicals can take 6-9 months, indicating high costs. |

| Availability of Substitutes | High availability of substitutes reduces supplier power. | Increased interest in bio-based alternatives offers potential for reduced reliance on traditional suppliers. |

What is included in the product

This Porter's Five Forces analysis for GIOVANNI BOZZETTO dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within its industry.

GIOVANNI BOZZETTO's Porter's Five Forces Analysis provides a structured framework to identify and mitigate competitive threats, transforming potential market disruptions into actionable strategies.

Customers Bargaining Power

Bozzetto Group serves a wide array of industries, including textiles, water treatment, construction, and personal care. The bargaining power of customers is influenced by their concentration and the volume of their purchases. If a small number of major clients represent a substantial portion of Bozzetto's revenue, these customers gain leverage to negotiate more favorable pricing and terms.

Switching costs for customers are a critical factor in assessing their bargaining power. For Giovanni Bozzetto, these costs can be substantial in the specialty chemicals market. For instance, a customer moving from Bozzetto's products to a competitor might incur expenses related to qualifying new materials, reformulating their own products to ensure compatibility and performance, and the inherent risk of performance degradation with an unproven supplier.

These hurdles generally serve to diminish the bargaining power of customers. In 2023, the global specialty chemicals market was valued at approximately $700 billion, highlighting the significant scale of operations where such switching costs can have a tangible impact on supplier relationships and pricing power. Companies like Bozzetto often invest heavily in ensuring their products integrate seamlessly into customer processes, thereby increasing these switching costs.

Customer price sensitivity for Giovanni Bozzetto's chemical products is a key factor in their bargaining power. If Bozzetto's offerings constitute a minor expense within a customer's broader production costs, yet are vital for achieving desired product performance, customers are likely to exhibit lower price sensitivity. This diminished sensitivity directly curtails their ability to negotiate lower prices, thereby weakening their overall bargaining leverage.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge to Giovanni Bozzetto. This threat arises when Bozzetto's clients, who purchase specialty chemicals, consider producing these chemicals themselves instead of relying on Bozzetto's supply. If customers possess the technical expertise, financial resources, or strategic motivation to manufacture these chemicals in-house, their bargaining power increases substantially, potentially leading to lower prices or reduced demand for Bozzetto's products.

For instance, larger customers with substantial R&D capabilities and production facilities might find it feasible to develop proprietary formulations or replicate existing ones. This capability directly translates into leverage, as they can credibly threaten to cease purchasing from Bozzetto and start their own production. In 2024, the chemical industry saw continued consolidation, with some larger players acquiring smaller, specialized chemical producers, which could embolden their own backward integration efforts.

- Customer Capability: The ability of Bozzetto's clients to develop and manufacture specialty chemicals in-house is a primary driver of this threat.

- Cost-Benefit Analysis: Customers will weigh the costs of in-house production against the current purchase price from Bozzetto, considering factors like capital investment, operational expenses, and potential quality control.

- Industry Trends: Broader industry trends, such as technological advancements in chemical synthesis or increased focus on supply chain control, can incentivize backward integration.

- Bozzetto's Value Proposition: Bozzetto's ability to differentiate through innovation, quality, and service is crucial in mitigating this threat by making in-house production less attractive for customers.

Product Differentiation and Importance to Customers

Giovanni Bozzetto's specialty chemicals are often critical components in their customers' manufacturing processes, influencing the performance and quality of the final products. This high degree of integration means customers may find it difficult and costly to switch to alternative suppliers without impacting their own production or product specifications.

The uniqueness of Bozzetto's offerings, particularly in niche markets where specific chemical properties are paramount, significantly strengthens its bargaining position. For instance, in the textile auxiliaries sector, where Bozzetto has a strong presence, the precise formulation of chemicals directly affects fabric feel, color fastness, and durability, making substitution challenging.

- Criticality of Bozzetto's Chemicals: Many of Bozzetto's specialty chemicals are not commodities but rather performance-enhancing ingredients integral to customer end-products.

- Switching Costs: High switching costs for customers due to integration and potential performance degradation limit their leverage.

- Market Position: Bozzetto's strong position in specialized segments, like textile auxiliaries and construction chemicals, allows for greater pricing power.

Bozzetto's customers have moderate bargaining power, largely due to the specialized nature of its chemical products and the associated switching costs. While some large clients might exert pressure on pricing, the technical integration of Bozzetto's chemicals into customer processes makes direct substitution difficult and risky. This dynamic generally limits customers' ability to drive down prices significantly.

The threat of backward integration by customers is a key consideration. If clients possess the technical and financial capacity to produce these specialty chemicals internally, their leverage increases. However, the significant investment and expertise required for such endeavors, especially in niche chemical formulations, often make this a less viable option for many of Bozzetto's clients.

Customer price sensitivity is also a mitigating factor. When Bozzetto's products are critical for performance and represent a small fraction of a customer's total costs, price becomes a less dominant negotiation point. This allows Bozzetto to maintain pricing power, especially in sectors where its chemical solutions are indispensable for achieving desired product quality.

| Factor | Impact on Customer Bargaining Power | Bozzetto's Mitigation Strategy |

|---|---|---|

| Customer Concentration | Moderate (few large clients) | Diversified customer base across industries |

| Switching Costs | Low to Moderate (high for specialized applications) | Product innovation and deep customer integration |

| Price Sensitivity | Low (for performance-critical chemicals) | Demonstrating value beyond price |

| Backward Integration Threat | Low to Moderate (requires significant investment) | Maintaining technological edge and service quality |

Same Document Delivered

GIOVANNI BOZZETTO Porter's Five Forces Analysis

This preview shows the exact GIOVANNI BOZZETTO Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You are looking at the actual, professionally written document, ready for your strategic insights.

The document displayed here is the complete version of the GIOVANNI BOZZETTO Porter's Five Forces Analysis you’ll get, ready for download and use the moment you buy. It offers a comprehensive breakdown of competitive forces impacting the industry.

Rivalry Among Competitors

Giovanni Bozzetto operates in a specialty chemicals market characterized by a significant number of direct competitors. For instance, in the surfactants segment, Bozzetto faces competition from global giants like BASF and Dow, alongside numerous regional players specializing in specific applications. The diversity of these competitors, each with unique product portfolios and market focuses, intensifies the rivalry across Bozzetto's key segments.

The specialty chemicals market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 5.5% through 2028, reaching an estimated market size of over $400 billion. This positive trajectory suggests that companies like Giovanni Bozzetto are operating in a generally expanding landscape. However, even in growing markets, intense competition can arise as firms vie for dominance in promising sub-segments.

Giovanni Bozzetto's specialty chemicals often boast unique formulations and performance characteristics, setting them apart from more commoditized offerings. This differentiation is key; for instance, in the textile auxiliaries market, Bozzetto's advanced finishing agents can provide specific tactile properties or enhanced durability that competitors struggle to replicate. This makes it harder for customers to simply switch to a cheaper alternative without compromising on end-product quality.

The switching costs for Bozzetto's clients are influenced by the integration of these specialty chemicals into their production processes. For example, a textile manufacturer that has optimized its machinery and quality control for Bozzetto's specific dyeing auxiliaries might face significant retraining, recalibration, and testing expenses if they were to change suppliers. In 2023, the global specialty chemicals market saw growth driven by demand for customized solutions, underscoring the value placed on such integrated product offerings.

Exit Barriers

Exit barriers in the specialty chemicals sector, like those faced by Giovanni Bozzetto, can significantly influence competitive dynamics. These obstacles prevent companies from easily leaving the market, even when financial performance is weak. High asset specificity, where specialized equipment has limited use outside the industry, is a major factor. For instance, dedicated production lines for specific polymers or catalysts represent substantial sunk costs.

Emotional attachment to the business and long-standing relationships with customers and suppliers also contribute to high exit barriers. Furthermore, government regulations concerning environmental cleanup or social pressures to maintain employment can make exiting a complex and costly process. These factors can trap companies in the market, leading to prolonged periods of intense competition and potentially depressed profitability for all players.

Consider the implications for Giovanni Bozzetto: if the specialty chemicals market experiences a downturn, companies with high exit barriers are less likely to divest. This means they might continue to operate, potentially at reduced capacity or with aggressive pricing strategies, to cover fixed costs. This scenario can put additional pressure on more agile competitors or those with lower exit barriers.

- High Asset Specificity: Specialty chemical plants often require highly specialized machinery and infrastructure, making it difficult and expensive to repurpose or sell these assets if a company decides to exit.

- Sunk Costs: Significant investments in research and development, intellectual property, and custom manufacturing facilities represent sunk costs that are unrecoverable upon exit.

- Government and Social Factors: Environmental regulations regarding plant closure and disposal, along with potential labor union agreements and community impact considerations, can impose substantial costs and complexities on exiting firms.

Strategic Objectives of Competitors

Bozzetto's competitors, such as those in the specialty chemicals sector, often have strategic objectives centered on expanding their global footprint and increasing market share. For instance, major players like BASF and Dow Chemical are continuously investing in new production facilities and research and development to launch innovative products. In 2023, BASF reported capital expenditures of €5.7 billion, a significant portion of which was allocated to growth projects and capacity expansions in key markets.

This aggressive pursuit of growth means competitors may engage in intense price competition, particularly in mature product segments, to capture market share. Furthermore, a substantial portion of their R&D investment, which can exceed 3-5% of sales for leading chemical companies, is directed towards developing sustainable and high-performance solutions, thereby raising the bar for innovation and increasing the intensity of rivalry.

- Market Share Aggression: Competitors like Evonik Industries aim for strategic acquisitions to consolidate their position and expand their product portfolios, as evidenced by their acquisition activity in specialty additives throughout 2023 and early 2024.

- R&D Investment: Companies are heavily investing in sustainable chemistry and bio-based materials, with significant R&D budgets focused on developing eco-friendly alternatives to traditional chemicals.

- Diversified Conglomerates: Many of Bozzetto's rivals are divisions of larger, diversified chemical groups, allowing them to leverage broader financial resources and cross-subsidize operations, which can lead to more aggressive pricing strategies.

- Technological Advancement: The drive for digitalization and advanced manufacturing processes, such as AI-driven formulation development, is a key strategic objective, pushing competitors to innovate rapidly.

The competitive rivalry for Giovanni Bozzetto is intense due to the presence of numerous global and regional players in the specialty chemicals market. Competitors like BASF and Dow Chemical are not only large but also actively invest in R&D and expansion, as seen in BASF's €5.7 billion capital expenditures in 2023, much of which targeted growth. This environment necessitates continuous innovation and strategic maneuvering to maintain market position.

Bozzetto's differentiation through unique formulations, such as advanced textile finishing agents, creates higher switching costs for clients, as integrating these specialized products requires process adjustments. The specialty chemicals market itself is growing, projected at a 5.5% CAGR through 2028, reaching over $400 billion. This growth attracts new entrants and fuels existing players' ambitions, intensifying the fight for market share.

High exit barriers, including asset specificity and sunk R&D costs, mean competitors are less likely to leave the market during downturns, potentially leading to prolonged price competition. For example, specialized polymer production lines represent significant unrecoverable investments. This persistence can pressure all players, forcing them to maintain aggressive strategies even in challenging periods.

Competitors’ strategic goals often involve market share expansion through acquisitions and aggressive R&D, particularly in sustainable chemistry. Evonik Industries' acquisition activity in 2023 and early 2024 exemplifies this trend. Many rivals are also divisions of larger conglomerates, enabling them to leverage greater financial resources and potentially employ more aggressive pricing tactics.

| Key Competitor Actions | R&D Focus | Financial Strength Indicator |

| Market share expansion via acquisitions | Sustainable chemistry & bio-based materials | Large conglomerate backing |

| New production facility investments | AI-driven formulation development | High capital expenditures (e.g., BASF's €5.7B in 2023) |

| Aggressive pricing in mature segments | Enhanced product performance & durability | Cross-subsidization capabilities |

SSubstitutes Threaten

The threat of substitutes for Bozzetto's specialty chemicals is influenced by the price-performance trade-off. Customers will switch to alternatives if they offer similar benefits at a lower cost. For instance, in the textile industry, while Bozzetto offers high-performance auxiliaries, cheaper, less effective alternatives might be considered by manufacturers facing significant cost pressures.

Customer propensity to substitute for Giovanni Bozzetto's products is influenced by the availability and attractiveness of alternatives in the adhesives and specialty chemicals markets. Factors such as brand loyalty, switching costs, and the perceived performance differences between Bozzetto's offerings and competitors' products play a significant role. For instance, in the textile industry, where Bozzetto is active, a customer's willingness to switch to a different chemical supplier might depend on the complexity of reformulating their existing processes and the potential impact on the final product quality. In 2023, the global specialty chemicals market saw growth, indicating a dynamic competitive landscape where customers have options, though specific data on customer switching behavior for Bozzetto is proprietary.

The rise of green or bio-based alternatives presents a significant threat of substitution for Giovanni Bozzetto. As consumers and industries increasingly prioritize sustainability, bio-based surfactants and polymers are gaining traction, directly challenging traditional chemical products. The global bio-based chemicals market is projected to reach $150 billion by 2027, indicating a substantial shift in demand that could impact Bozzetto's market share if they don't adapt.

Technological Advancements

Technological advancements pose a significant threat to Bozzetto by potentially introducing entirely new ways to achieve the same functional outcomes as their current chemical products. For instance, breakthroughs in bio-based materials or advanced composites could offer sustainable and high-performance alternatives that bypass the need for traditional chemical formulations. The pace of innovation in material science is accelerating, with significant investment flowing into R&D, creating a fertile ground for disruptive substitutes that could emerge rapidly.

Consider the impact of new technologies on industries Bozzetto serves:

- Textile Industry: Innovations in 3D printing for fabrics or new dyeing processes that use less water and chemicals could reduce reliance on Bozzetto's textile auxiliaries. For example, advancements in waterless dyeing technologies are gaining traction, aiming to cut down on the environmental footprint of textile production.

- Construction Sector: The development of self-healing concrete or advanced insulation materials that require fewer chemical additives could displace some of Bozzetto's construction chemicals. Global R&D spending in advanced materials for construction reached billions in 2024, indicating a strong push for innovation.

- Adhesives and Sealants: Emerging bio-adhesives or novel bonding techniques could offer alternatives to traditional chemical-based adhesives, impacting Bozzetto's market share in these segments. The market for bio-adhesives is projected to grow substantially in the coming years.

Regulatory Changes Favoring Substitutes

Regulatory changes can significantly shift the competitive landscape, potentially benefiting substitutes for traditional specialty chemicals. For instance, by mid-2024, several European Union member states were implementing stricter regulations on certain chemical compounds, driving up compliance costs for manufacturers relying on them. This creates an opening for alternative materials that meet new environmental standards.

The increasing focus on sustainability and reduced environmental impact is a key driver. As governments worldwide, including those in major markets like the US and China, continue to tighten environmental protection laws, the cost and complexity of using certain traditional chemicals may rise. This trend, evident throughout 2024, directly encourages the adoption of safer, more eco-friendly substitutes.

These evolving standards can make substitute products, which might have previously been less competitive on cost or performance alone, more attractive. For example, the growing demand for bio-based or recyclable materials in packaging and consumer goods, spurred by regulations and consumer preference, directly challenges the market share of conventional chemical-based alternatives.

Key factors influencing this threat include:

- Stricter chemical usage guidelines: Regulations limiting or banning specific chemicals used in manufacturing processes.

- Environmental performance standards: Mandates for reduced emissions, waste, or the use of sustainable materials.

- Consumer and industry demand for greener alternatives: A market pull for products perceived as safer and more environmentally responsible.

- Government incentives for sustainable technologies: Financial or tax benefits that make adopting substitute processes more appealing.

The threat of substitutes for Giovanni Bozzetto's offerings is heightened by the increasing availability of bio-based and sustainable alternatives across its served industries. For instance, in the textile sector, advancements in eco-friendly dyeing processes are reducing the need for traditional auxiliaries. Similarly, the construction industry is seeing innovation in materials like self-healing concrete, which may lessen reliance on certain chemical additives. By mid-2024, regulatory pressures in regions like the EU were already favoring greener chemicals, potentially making substitutes more economically viable.

The price-performance ratio remains a critical determinant for customers considering substitutes. If alternative products offer comparable functionality at a lower cost, Bozzetto's market position could be challenged. This is particularly relevant in cost-sensitive segments of the textile and construction markets. The global specialty chemicals market, which grew in 2023, indicates a competitive environment where customer switching is a constant consideration, especially when new, more cost-effective solutions emerge.

Technological advancements are continually introducing novel solutions that can bypass traditional chemical applications. For example, new bonding techniques in adhesives or advanced material composites could displace conventional chemical-based products. The significant R&D investments in material science globally, particularly in areas like advanced construction materials which saw billions invested in 2024, underscore the rapid pace of innovation that can spawn disruptive substitutes.

| Industry Segment | Potential Substitute Technology | Impact on Bozzetto | Example | Market Trend (2024) |

|---|---|---|---|---|

| Textiles | Waterless dyeing, Bio-based auxiliaries | Reduced demand for traditional auxiliaries | Advancements in dyeing reducing chemical usage | Growing consumer demand for sustainable textiles |

| Construction | Self-healing concrete, Advanced insulation | Lower demand for specific construction chemicals | R&D spending in advanced construction materials in billions | Increased focus on energy efficiency and material longevity |

| Adhesives & Sealants | Bio-adhesives, Novel bonding methods | Market share erosion in traditional adhesive segments | Projected substantial growth in the bio-adhesives market | Shift towards environmentally friendly and high-performance bonding solutions |

Entrants Threaten

The specialty chemicals sector demands substantial upfront capital, often running into hundreds of millions of dollars. This investment covers cutting-edge research and development, establishing state-of-the-art manufacturing plants, and building robust distribution channels. For instance, constructing a new specialty chemical production facility can easily cost upwards of $200 million, deterring many potential new players.

Bozzetto's extensive, century-long history in specialty chemicals, coupled with a deep commitment to research and development, creates a significant barrier to entry for new competitors. This specialized technical know-how, protected by patents and continuous innovation, allows the company to develop unique formulations that are difficult for newcomers to replicate. For example, in 2024, Bozzetto continued to invest heavily in R&D, focusing on sustainable chemical solutions, further solidifying its technological advantage.

For Bozzetto, the threat of new entrants concerning access to distribution channels is relatively low. Established industries like textiles and construction often have deeply entrenched distribution networks and customer relationships. New companies struggle to replicate this, facing significant hurdles in securing shelf space, building reliable logistics, and gaining trust with existing buyers. Bozzetto's advantage lies in its extensive and well-established global distribution network, built over years of operation.

Government Policy and Regulation

Government policies and regulations significantly impact the threat of new entrants in the chemical industry. Stringent environmental, health, and safety standards, such as those enforced by the Environmental Protection Agency (EPA) in the United States, impose substantial compliance costs. For instance, the Toxic Substances Control Act (TSCA) requires extensive testing and review for new chemicals, creating a formidable barrier. These regulatory hurdles, coupled with the capital investment needed to meet them, deter many potential newcomers.

The complexity and cost associated with navigating these regulations act as a powerful deterrent. New entrants must invest heavily in understanding and adhering to a web of rules governing everything from chemical production to waste disposal. This can involve significant upfront capital for specialized equipment and personnel, making it difficult for smaller or less-resourced companies to enter the market. In 2024, the global chemical industry's regulatory compliance spending is projected to exceed $50 billion, highlighting the financial burden.

- High Compliance Costs: Meeting environmental, health, and safety standards requires substantial investment in technology and processes.

- Complex Regulatory Landscape: Navigating diverse and evolving regulations across different jurisdictions presents a significant challenge.

- Capital Investment Barriers: The need for specialized facilities and equipment to comply with regulations demands considerable upfront capital.

- Extended Approval Times: Obtaining necessary permits and approvals for new chemical products can be a lengthy and costly process.

Economies of Scale and Experience Curve

Giovanni Bozzetto benefits significantly from economies of scale and the experience curve. This means that as Bozzetto has produced more over time, its per-unit costs have decreased due to increased efficiency and bulk purchasing power. For instance, in 2024, the chemical industry often sees substantial cost advantages for players with high production volumes, making it challenging for newcomers to match these efficiencies immediately.

New entrants would likely face higher initial production costs per unit compared to Bozzetto. They would need to invest heavily to reach a comparable scale of operations and accumulate the same level of operational expertise. This cost disadvantage acts as a substantial barrier, deterring potential competitors from entering the market.

- Economies of Scale: Bozzetto's large production capacity allows for lower per-unit manufacturing costs.

- Experience Curve: Accumulated knowledge and process improvements lead to greater efficiency and cost savings over time.

- Cost Disadvantage for New Entrants: Start-ups must overcome significant initial investment hurdles to achieve competitive cost structures.

- Market Entry Barrier: The established cost advantages of Bozzetto deter new companies from entering the market.

The threat of new entrants for Bozzetto is generally low due to substantial capital requirements for R&D, manufacturing, and distribution, often exceeding hundreds of millions of dollars. Bozzetto's established technological expertise, protected by patents and continuous innovation, further deters new players. For example, in 2024, Bozzetto's focus on sustainable chemical solutions reinforced its technological lead.

The company's extensive global distribution network, built over a century, presents a significant hurdle for newcomers trying to establish relationships and logistics in sectors like textiles and construction. Furthermore, complex and costly government regulations, such as EPA standards and TSCA requirements, demand significant investment in compliance, acting as a powerful deterrent. In 2024, regulatory compliance spending in the global chemical industry was projected to surpass $50 billion.

| Barrier to Entry | Description | Impact on New Entrants | Bozzetto's Advantage | 2024 Data/Example |

|---|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and distribution. | Deters new players due to significant financial outlay. | Established infrastructure and operational capacity. | New specialty chemical plant costs can exceed $200 million. |

| Technological Expertise | Proprietary knowledge, patents, and continuous innovation. | Difficulty in replicating unique formulations and processes. | Strong R&D investment and a history of innovation. | Continued investment in sustainable chemical solutions. |

| Distribution Channels | Entrenched networks and customer relationships. | Challenges in securing market access and building trust. | Extensive and well-established global distribution. | Long-standing partnerships in key industries. |

| Regulatory Compliance | Adherence to environmental, health, and safety standards. | High compliance costs and lengthy approval processes. | Experience in navigating complex regulatory landscapes. | Global chemical industry compliance spending projected over $50 billion in 2024. |

| Economies of Scale & Experience Curve | Lower per-unit costs due to high production volume and accumulated knowledge. | Higher initial production costs and inefficiency compared to established players. | Cost advantages from large-scale operations and process optimization. | Significant cost benefits for high-volume producers in 2024. |

Porter's Five Forces Analysis Data Sources

Our GIOVANNI BOZZETTO Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, financial statements from publicly traded competitors, and trade association data to provide a comprehensive view of the competitive landscape.

We leverage insights from company investor relations websites, competitor product launches, and economic indicators to accurately assess the bargaining power of buyers and suppliers in the GIOVANNI BOZZETTO market.