Boot Barn Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boot Barn Bundle

Boot Barn navigates a competitive landscape shaped by powerful buyer bargaining, moderate supplier influence, and a significant threat from substitutes like online retailers. Understanding these dynamics is crucial for any stakeholder in the Western wear market.

The full Porter's Five Forces Analysis reveals the real forces shaping Boot Barn’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers in the western and workwear apparel market directly impacts Boot Barn's bargaining power. When a few major brands hold a significant share of sought-after products, these suppliers can command higher prices, increasing Boot Barn's cost of goods sold. For instance, in 2023, the top three brands in the western boot segment accounted for over 50% of total sales, giving them considerable leverage.

Suppliers offering highly recognized and sought-after brands like Ariat, Wrangler, or Carhartt possess more power due to strong consumer demand. Boot Barn's ability to offer a wide assortment of these leading brands is a strength, but it also means these suppliers can command better terms, influencing Boot Barn's cost of goods sold.

The costs associated with switching suppliers, like re-tooling systems or losing customer brand loyalty, can empower existing suppliers. Boot Barn's established vendor relationships might incur some switching costs, but its growing exclusive brand portfolio aims to lessen this reliance.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to retailers like Boot Barn. If major brands, which are Boot Barn's suppliers, were to establish their own direct-to-consumer sales channels, such as dedicated retail stores or robust e-commerce platforms, they could bypass traditional retailers. This would directly increase the bargaining power of these suppliers, as they would gain more control over their sales and customer relationships.

While some of Boot Barn's suppliers do operate their own direct-to-consumer (DTC) channels, Boot Barn's strength lies in its extensive physical retail footprint and its well-developed omnichannel strategy. This comprehensive distribution network, encompassing numerous brick-and-mortar locations and integrated online sales, is a considerable asset that individual suppliers would find difficult and costly to replicate quickly or effectively. For instance, as of early 2024, Boot Barn operates over 300 stores across the United States, providing a reach that many individual brands cannot easily match.

- Supplier Forward Integration Risk: Brands selling directly to consumers through their own stores or websites increases supplier power by cutting out retailers.

- Boot Barn's Competitive Advantage: Boot Barn's extensive physical store network and omnichannel capabilities offer a distribution advantage that is hard for suppliers to replicate.

- DTC Channel Growth: The ongoing trend of brands investing in DTC channels could intensify this threat, impacting retailer margins and market share.

Importance of Boot Barn to Suppliers

Boot Barn's position as the nation's largest specialty retailer in western and workwear, boasting over 470 stores across 49 states and a significant e-commerce presence, underscores its importance to its suppliers. This extensive network provides a vital distribution channel for many brands within its niche.

The sheer volume of sales Boot Barn generates through its widespread operations grants it considerable leverage when negotiating with suppliers. For many brands, Boot Barn represents a substantial portion of their market access and revenue stream.

- Significant Market Reach: Over 470 stores and a strong online platform.

- Crucial Distribution Channel: Essential for western and workwear brands.

- Sales Volume Leverage: High sales potential gives Boot Barn negotiation power.

The bargaining power of suppliers for Boot Barn is moderate, influenced by brand concentration and the threat of forward integration. While a few key brands hold significant sway, Boot Barn's extensive retail footprint and omnichannel strategy offer a counterbalancing advantage. The company's substantial market reach makes it a crucial partner for many suppliers, giving it leverage in negotiations.

| Factor | Impact on Boot Barn | Supporting Data (as of early 2024) |

|---|---|---|

| Supplier Concentration | Moderate to High | Top 3 western boot brands represent >50% of segment sales (2023). |

| Brand Strength | Suppliers of strong brands have more power. | Brands like Ariat, Wrangler, Carhartt are key. |

| Switching Costs | Low to Moderate | Boot Barn's exclusive brands aim to reduce reliance. |

| Forward Integration Threat | Moderate | Some suppliers have DTC channels. |

| Boot Barn's Distribution Power | High | Over 300 stores (growing to over 470 by early 2024) across 49 states. |

What is included in the product

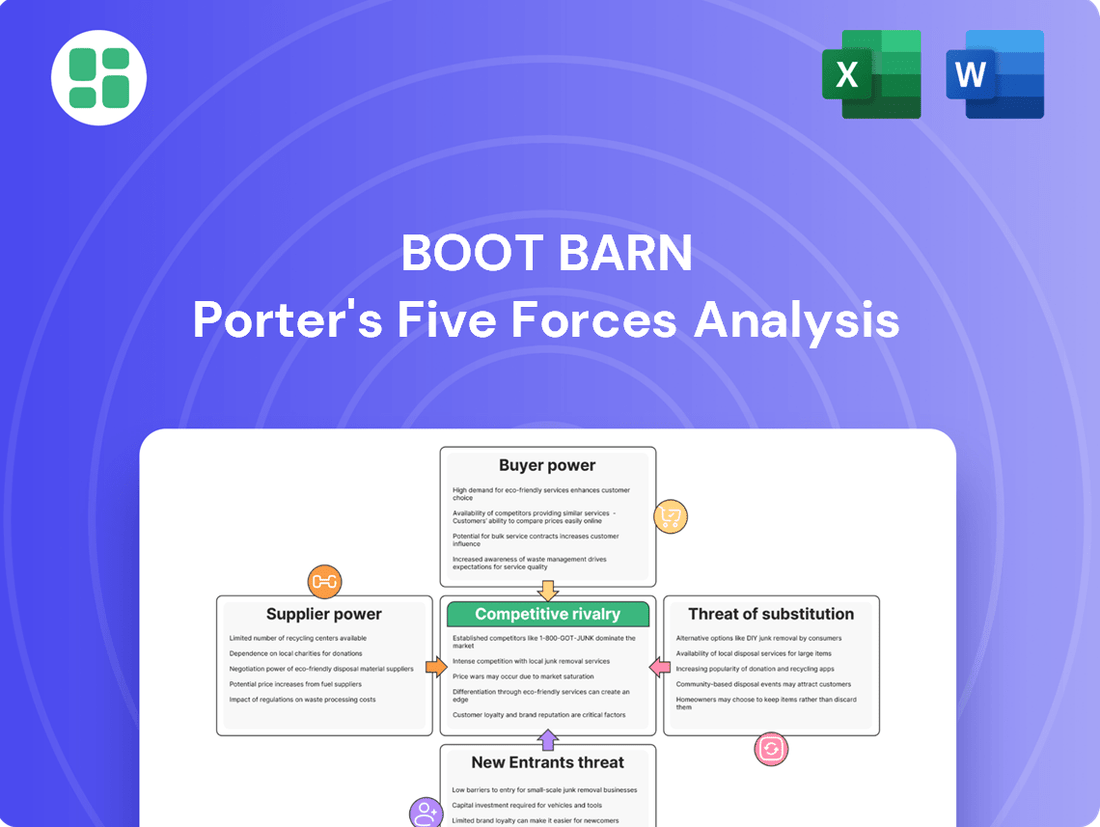

This analysis examines the competitive forces impacting Boot Barn, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the Western wear and workwear markets.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Boot Barn's customers, particularly those in essential workwear sectors like ranching, farming, and construction, often prioritize durability and functionality over minor price differences. However, for fashion-driven western wear, price sensitivity can increase, especially during economic downturns when discretionary spending tightens.

In 2024, the average consumer price index for apparel and footwear saw a modest increase, suggesting that while raw material costs might be rising, retailers like Boot Barn are absorbing some of these pressures to maintain customer loyalty, particularly in their core workwear segments.

The availability of numerous alternative retailers significantly boosts customer bargaining power for Boot Barn. Customers can easily shop at other specialty Western wear stores, large sporting goods chains that carry similar apparel, general department stores, and a vast array of online platforms. This wide selection means customers can readily compare prices, product quality, and styles, putting pressure on Boot Barn to remain competitive.

In 2024, the online retail sector continued its robust growth, with e-commerce sales projected to reach over $2.7 trillion globally. This digital landscape offers consumers unparalleled access to a multitude of retailers, including direct-to-consumer brands and marketplaces, all vying for their business. For Boot Barn, this means customers have readily accessible alternatives, empowering them to seek out the best deals and product assortments beyond just their physical stores or primary website.

Customers today have unprecedented access to information. Online research, price comparison tools, and product reviews empower shoppers to make well-informed decisions, directly impacting retailers like Boot Barn. This transparency intensifies pressure for competitive pricing and superior value propositions.

Switching Costs for Customers

For customers looking for western and work apparel, the ease of switching between retailers is generally quite high. This means consumers can readily move from one store or online platform to another without significant inconvenience or expense. This low barrier to switching can put pressure on retailers to compete on price and product selection.

Boot Barn actively addresses this by cultivating strong customer loyalty. A key strategy is its 'B Rewarded' loyalty program, which has successfully enrolled millions of active members. This program is designed to incentivize repeat business and foster a dedicated customer base, effectively mitigating the impact of low switching costs.

The success of Boot Barn's loyalty program is evident in its high repeat customer rate. By offering tangible benefits and a rewarding experience, Boot Barn encourages customers to remain engaged with the brand, thereby reducing their inclination to switch to competitors. For instance, in fiscal year 2023, Boot Barn reported that its loyalty members accounted for a significant portion of its sales, demonstrating the program's effectiveness.

- Low Switching Costs: Customers can easily shift between retailers for western and work products.

- Loyalty Program: Boot Barn's 'B Rewarded' program aims to build and retain customer loyalty.

- Millions of Members: The loyalty program boasts a substantial active membership base.

- High Repeat Purchase Rate: The program contributes to a strong rate of customers returning to Boot Barn.

Customer Concentration

Boot Barn's customer base is characterized by its extreme fragmentation. The company primarily serves individual consumers, a stark contrast to industries dominated by large, institutional buyers. This wide dispersion of customers means no single individual or small group holds substantial sway over Boot Barn's pricing strategies or the variety of products it offers.

The lack of customer concentration significantly reduces the bargaining power of buyers. For instance, in fiscal year 2023, Boot Barn reported net sales of $1.6 billion, with the vast majority of these sales coming from a broad retail customer base. This diffuse demand structure prevents any individual customer segment from dictating terms, thereby protecting Boot Barn's profit margins and operational flexibility.

- Highly Fragmented Customer Base: Boot Barn's customers are primarily individual consumers, not large corporate entities.

- Limited Individual Leverage: No single customer or small group possesses significant power to influence pricing or product selection.

- Reduced Buyer Power: This fragmentation inherently lowers the bargaining power of customers, benefiting Boot Barn.

- Fiscal Year 2023 Performance: The company achieved $1.6 billion in net sales, underscoring the broad reach of its customer appeal.

Boot Barn's customers have moderate bargaining power, primarily driven by low switching costs and the wide availability of alternatives in the western and workwear market. While the company's loyalty program, 'B Rewarded,' with millions of active members, helps to mitigate this power by encouraging repeat business, the fragmented nature of its customer base means no single buyer can significantly influence pricing or product offerings.

| Factor | Bargaining Power Level | Impact on Boot Barn |

| Customer Concentration | Low | Protects margins due to lack of individual leverage. |

| Switching Costs | Low | Increases pressure for competitive pricing and product selection. |

| Information Availability | High | Empowers customers to compare prices and value, intensifying competition. |

| Loyalty Program Effectiveness | Mitigating | Builds retention and reduces customer churn, lessening the impact of low switching costs. |

Full Version Awaits

Boot Barn Porter's Five Forces Analysis

This preview showcases the complete Boot Barn Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the Western wear and work boot retail industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, providing actionable insights without any alterations or placeholders.

Rivalry Among Competitors

Boot Barn faces a fragmented competitive environment, featuring numerous specialized and general retailers. While it stands as the largest dedicated western and workwear retailer, its market presence is challenged by a diverse set of competitors. These range from small, local boutiques to larger, national chains such as Tractor Supply Co., which offers a broad selection of work-related apparel and accessories. The rise of e-commerce also introduces significant competition from online-only retailers, further intensifying the rivalry.

The western wear market is showing a healthy expansion, with a projected compound annual growth rate (CAGR) between 3.00% and 5.22% starting in 2024. This steady growth, while positive, can also ramp up competition as companies battle for a larger piece of the expanding pie.

Boot Barn is actively pursuing this growth through its ambitious store opening strategy and a strong emphasis on its private label brands. These moves are designed to secure a significant market share within this growing industry.

Boot Barn distinguishes itself through a broad selection of popular national brands, alongside an expanding collection of its own high-profit private label brands, all presented within a carefully designed shopping environment. This strategy aims to attract a diverse customer base seeking both well-known and unique offerings.

The company's commitment to product differentiation is evident in its growing private label segment, which contributed 19% to sales in fiscal year 2023, up from 16% in fiscal year 2022. This focus on exclusive brands helps to build customer loyalty and improve profit margins, as these items generally carry higher markups than national brands.

Despite these efforts, competitive rivalry remains a significant factor. Competitors can attempt to mimic Boot Barn's product assortment or engage in price-based competition, necessitating ongoing innovation and robust brand development to maintain its market position and appeal.

Brand Identity and Loyalty

Boot Barn has cultivated a robust brand identity as a national lifestyle retailer, attracting a broad customer base that extends beyond traditional western wear enthusiasts. This strong brand recognition is a significant factor in its competitive standing.

The company's 'B Rewarded' loyalty program is instrumental in fostering deep customer loyalty, effectively creating a barrier for new entrants and existing competitors. This program encourages repeat business and strengthens customer relationships.

Boot Barn’s ongoing investment in marketing campaigns and active community engagement initiatives further solidifies its competitive advantage. For instance, their 2024 fiscal year saw continued investment in brand building, contributing to a 5.1% increase in same-store sales for the fourth quarter of fiscal year 2024.

- Brand Identity: Boot Barn is recognized nationally as a lifestyle retailer, appealing to a wide demographic.

- Customer Loyalty: The 'B Rewarded' program cultivates significant customer loyalty, acting as a competitive moat.

- Marketing & Engagement: Continuous marketing and community involvement reinforce Boot Barn's market position.

- Sales Performance: In Q4 FY24, Boot Barn reported a 5.1% rise in same-store sales, reflecting strong customer engagement and brand appeal.

Exit Barriers

Boot Barn faces intensified competition due to high exit barriers in the retail sector. Significant investments in physical stores, large inventories, and complex supply chains make it difficult and costly for underperforming competitors to leave the market. This can trap less profitable players, leading to prolonged and fiercer rivalry as they strive to survive.

The retail industry, including apparel and footwear, often involves substantial fixed costs. Boot Barn's own expansion strategy, with plans to open approximately 40 new stores in fiscal year 2024, contributes to these industry-wide fixed costs. These high costs can influence how existing businesses behave competitively, as exiting is not a simple decision.

- High Fixed Costs: Retailers often have substantial investments in brick-and-mortar locations, inventory management systems, and distribution networks.

- Inventory Investment: For Boot Barn, carrying a wide range of Western and workwear apparel and footwear requires significant capital tied up in inventory.

- Supply Chain Complexity: Establishing and maintaining efficient supply chains for diverse product lines adds another layer of commitment and cost.

- Brand and Reputation: Companies invest heavily in building brand recognition and customer loyalty, which are assets difficult to liquidate upon exit.

Boot Barn operates in a competitive landscape with numerous specialized and general retailers, including Tractor Supply Co. and online-only sellers. The western and workwear market is projected to grow between 3.00% and 5.22% annually from 2024, intensifying rivalry as companies vie for market share. Boot Barn's strategy of expanding its store count and private label brands, which reached 19% of sales in FY23, aims to capture this growth and differentiate itself.

Despite Boot Barn's strong brand identity and loyalty programs like 'B Rewarded,' competitors can replicate product assortments or engage in price wars. The company's 5.1% same-store sales increase in Q4 FY24 highlights its success in engaging customers amidst this competition. High exit barriers in retail, due to significant investments in stores and inventory, mean that even struggling competitors remain, perpetuating intense rivalry.

SSubstitutes Threaten

Customers may choose general-purpose footwear, apparel, and accessories from broader retailers if they find them adequate for their needs, bypassing specialized western or workwear. This trend is especially noticeable in the casual western wear segment, which is experiencing growth.

For instance, in 2024, the broader athleisure market, a significant competitor for casual western wear, continued its expansion, with global sales projected to reach over $320 billion. This indicates a substantial pool of consumers prioritizing comfort and versatility over niche specialization.

This availability of alternatives means Boot Barn must continually emphasize the unique value proposition of its specialized products, such as durability, specific functionality for work, and authentic western style, to retain customers who might otherwise opt for more generic, less expensive options.

Shifting fashion trends pose a significant threat. If mainstream styles move away from western aesthetics, demand for Boot Barn's core offerings could decline. For instance, a major fashion influencer championing a completely different look could divert consumer attention and spending.

However, Boot Barn has been actively working to counter this. By embracing western wear's integration into broader lifestyle fashion, the company is broadening its appeal. This strategy aims to capture consumers who appreciate the western look as part of a larger, more diverse wardrobe, not just for specialized occasions.

The threat of substitutes, particularly through DIY and repair options, presents a notable challenge for Boot Barn. Customers may opt to mend their existing work boots or apparel rather than investing in new, specialized items. This is especially true for less critical or more commoditized work gear where the cost savings of repair or a generic alternative outweigh the benefits of premium, specialized products. For instance, a simple stitching repair on a pair of work pants might deter a purchase of new ones, impacting sales in those specific categories.

Online General Retailers

Online general retailers, including giants like Amazon and Walmart, present a significant threat of substitution for Boot Barn. These platforms offer a vast selection of apparel and footwear, often at highly competitive price points, potentially drawing customers away from specialized western wear. For instance, Amazon's extensive marketplace features numerous third-party sellers of boots and Western-style clothing that can directly compete with Boot Barn's product assortment.

Boot Barn actively mitigates this threat by leveraging its robust omnichannel strategy. The company integrates its physical store presence with dedicated e-commerce platforms, such as sheplers.com and countryoutfitter.com, to provide a seamless shopping experience. This approach aims to foster customer loyalty and differentiate Boot Barn from generalized online retailers by offering specialized expertise and a curated selection.

To counter the broad reach of online general retailers, Boot Barn focuses on its unique value proposition:

- Specialized Product Assortment: Offering a curated selection of western and work boots, apparel, and accessories that general retailers may not carry or highlight.

- Brand Loyalty and Community: Cultivating a strong brand identity and connection with the western lifestyle community, which general retailers often lack.

- Omnichannel Integration: Providing a consistent and convenient experience across online and brick-and-mortar stores, including services like buy online, pick up in-store.

Rental or Second-hand Markets

The rise of rental services for specialized work gear or the expansion of the second-hand market for clothing presents potential substitutes for new purchases. While not a direct threat to Boot Barn's core offerings of Western and work boots, these broader retail trends could subtly shift consumer preferences towards more cost-effective or sustainable options.

For instance, the growth of recommerce platforms, which saw significant expansion in 2023 and 2024, demonstrates a consumer willingness to explore pre-owned goods. While direct rental of boots is uncommon, the underlying principle of accessing goods without outright ownership could, in niche scenarios or for less critical footwear needs, represent a form of substitution.

- Rental Services: While not widespread for footwear, rental models for specialized equipment in other sectors indicate a growing consumer acceptance of temporary access over ownership.

- Second-hand Markets: The recommerce sector, valued at billions globally and projected for continued growth, shows a consumer trend towards pre-owned apparel, potentially impacting demand for new items across various categories.

- Indirect Impact: These trends, though less direct for Boot Barn, highlight a broader shift in consumer behavior that prioritizes value and sustainability, which could indirectly influence purchasing decisions.

The threat of substitutes for Boot Barn is significant, stemming from both general retailers offering similar casual wear and specialized alternatives like DIY repair or rental services.

Broad retailers, including online giants, provide a vast array of footwear and apparel at competitive prices, directly competing with Boot Barn's curated western and workwear selection. For example, in 2024, the athleisure market alone was projected to exceed $320 billion globally, indicating a large consumer base prioritizing comfort and versatility over niche specialization.

Furthermore, the growing recommerce market, which saw substantial expansion in 2023 and 2024, highlights consumer willingness to purchase pre-owned goods, potentially impacting demand for new items across various apparel categories.

Boot Barn counters these threats by emphasizing its specialized product assortment, fostering brand loyalty within the western lifestyle community, and leveraging a strong omnichannel strategy to provide a seamless customer experience.

| Substitute Category | Examples | 2024 Market Insight | Impact on Boot Barn | Mitigation Strategy |

|---|---|---|---|---|

| General Retailers | Amazon, Walmart, Target | Athleisure market projected over $320 billion | Offers broad appeal, potentially drawing customers from niche western wear | Specialized assortment, brand loyalty, omnichannel integration |

| DIY & Repair | Mending existing boots/apparel | Cost savings on minor repairs | Reduces demand for new, specialized workwear | Focus on durability and unique functionality of new products |

| Rental & Second-hand | Recommerce platforms, specialized equipment rental | Recommerce market billions globally, growing | Consumer preference for value and sustainability, indirect impact on new purchases | Highlighting value of new, specialized items; reinforcing brand experience |

Entrants Threaten

Entering the Western wear and workwear retail sector, particularly for a company aiming to replicate Boot Barn's extensive physical presence, demands considerable financial resources. This includes significant outlays for prime retail locations, stocking a wide variety of merchandise, and establishing the necessary operational infrastructure.

The sheer scale of capital needed to acquire or lease numerous store locations, manage a comprehensive inventory, and build out the retail experience presents a formidable hurdle. For instance, establishing a single retail store can cost anywhere from $100,000 to over $500,000 depending on size and location, making a multi-store rollout a multi-million dollar undertaking.

Boot Barn's significant brand recognition and customer loyalty present a substantial barrier to new entrants. With millions of actively engaged 'B Rewarded' loyalty members, the company has cultivated a deep connection with its customer base.

Building comparable brand equity and trust from the ground up would require immense investment and time for any new competitor aiming to enter the Western and workwear market.

Boot Barn benefits from deeply entrenched relationships with a broad spectrum of premier western and workwear brands. This ensures a consistent and diverse product offering that is crucial for attracting and retaining customers.

New competitors face a significant hurdle in replicating Boot Barn's established supplier network. Cultivating these same brand partnerships, particularly with sought-after or exclusive labels, demands considerable time and investment, making market entry challenging.

Economies of Scale

Boot Barn’s position as the largest specialty retailer in its sector provides significant cost advantages through economies of scale. This scale impacts purchasing, marketing, and distribution, allowing Boot Barn to negotiate better terms with suppliers and spread fixed costs over a larger volume of sales.

New entrants face a substantial hurdle due to these established economies of scale. They would likely start with smaller operations, making it difficult to match Boot Barn's pricing or achieve comparable profit margins from the outset. For instance, in 2023, Boot Barn reported net sales of $1.7 billion, a testament to its operational volume.

- Purchasing Power: Boot Barn can secure lower per-unit costs for inventory due to its high purchase volumes.

- Marketing Efficiency: Larger marketing budgets can be spread across a wider customer base, reducing the cost per customer acquisition.

- Distribution Network: An established and efficient distribution network lowers per-unit shipping and warehousing costs.

- Price Competitiveness: Lower operating costs enable Boot Barn to offer more competitive pricing, a key factor in the retail sector.

Regulatory Hurdles and Local Permits

Navigating the labyrinth of regulatory hurdles and obtaining local permits presents a significant barrier for new entrants looking to establish a retail presence, especially for a company like Boot Barn that operates numerous stores across various states. This process can be incredibly time-consuming and complex, requiring adherence to diverse zoning laws and specific operational permits in each jurisdiction.

For instance, in 2024, the average time to obtain a business license in the United States can range from a few weeks to several months, depending on the state and municipality. This extended timeline and the sheer volume of paperwork involved directly impede the speed at which new competitors can scale their operations, offering established players like Boot Barn a degree of protection.

- State and Local Zoning Laws: Each locality has unique zoning regulations that dictate where retail establishments can operate, impacting site selection and development costs for new entrants.

- Permitting Processes: Obtaining necessary permits, such as building permits, occupancy permits, and potentially specific permits for retail operations, adds layers of complexity and delays.

- Compliance Costs: The financial burden of compliance, including fees for permits and potential legal counsel to navigate regulations, can be substantial for new businesses.

- Time to Market: The cumulative effect of these regulatory requirements can significantly extend the time it takes for a new competitor to open its first store, creating a substantial entry barrier.

The threat of new entrants into the Western wear and workwear retail market is moderate, largely due to the substantial capital investment required for physical retail expansion and brand building. Boot Barn's established economies of scale, with $1.7 billion in net sales in 2023, provide significant pricing advantages. Furthermore, strong supplier relationships and regulatory complexities add further barriers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing multiple retail locations and inventory requires millions of dollars. A single store can cost $100,000-$500,000+. | High. Significant financial resources are necessary for market entry. |

| Brand Loyalty & Equity | Boot Barn has millions of loyalty members and strong brand recognition. | High. Replicating this trust and customer base is time-consuming and costly. |

| Supplier Relationships | Access to premier western and workwear brands is crucial. | High. Cultivating these partnerships takes time and investment. |

| Economies of Scale | Boot Barn's large operational volume ($1.7B in 2023 sales) leads to cost advantages. | High. New entrants struggle to match pricing and margins initially. |

| Regulatory Hurdles | Navigating zoning laws and permits across different states is complex and time-consuming. | Moderate to High. Delays market entry and increases compliance costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Boot Barn is built upon a foundation of industry-specific market research reports, financial disclosures from public companies, and trade association data. We also leverage insights from economic indicators and consumer spending trends to provide a comprehensive view of the competitive landscape.