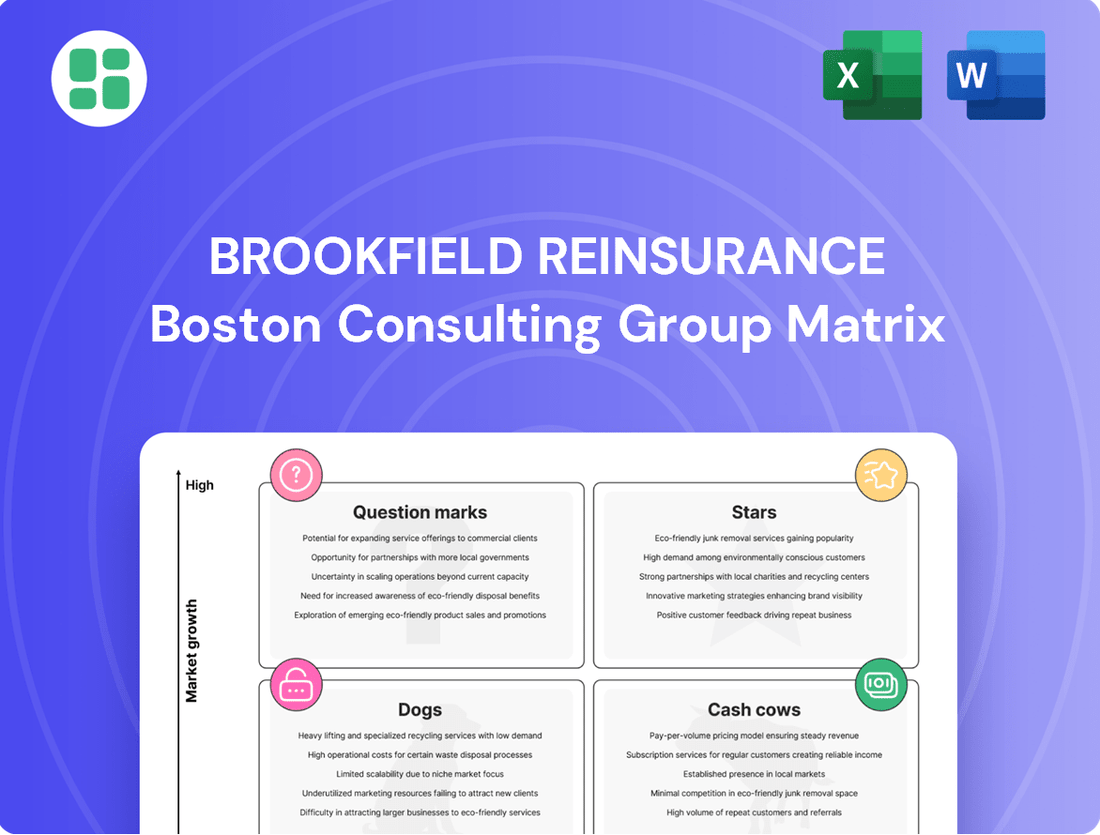

Brookfield Reinsurance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

Brookfield Reinsurance's BCG Matrix offers a strategic snapshot of its diverse portfolio, highlighting potential growth areas and areas requiring careful management. Understanding where its business units fall as Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Brookfield Reinsurance.

Stars

Brookfield Reinsurance has aggressively expanded its annuity operations, a move that significantly bolsters its position in the market. A key driver of this expansion was the completion of the American Equity Investment Life Holding Company (AEL) acquisition in May 2024. This strategic move brought over $50 billion in new insurance portfolio assets, instantly making Brookfield Reinsurance a major player in North American annuities.

The company's strategy centers on scaling this newly acquired platform and broadening its retirement services. This aggressive growth in annuities is designed to diversify revenue streams and capitalize on the increasing demand for retirement solutions. By integrating AEL, Brookfield Reinsurance is setting itself up for substantial future growth in this sector.

Brookfield Reinsurance's Pension Risk Transfer (PRT) business is a significant growth engine, demonstrating robust expansion in 2024. The company originated over $700 million in PRT premiums in the first quarter of 2024, with a total of $5 billion in PRT deals executed throughout the year. This strong performance highlights the increasing demand for de-risking solutions from pension plan sponsors.

The company's strategic focus on international markets is evident in its expansion of the PRT business. A key milestone was their inaugural UK reinsurance transaction in the fourth quarter of 2024, valued at £1.0 billion, which is approximately $1.3 billion USD. This move into the UK market underscores the global appeal and growth trajectory of the PRT sector.

This international diversification within the PRT segment suggests substantial growth opportunities in a specialized and expanding market. Brookfield Reinsurance is capitalizing on this trend by offering tailored solutions to manage pension liabilities, positioning itself for continued success in this lucrative area.

Brookfield Reinsurance is actively deploying approximately $1 billion into its proprietary investment strategies. These strategies are designed to generate returns exceeding 11%, significantly boosting their overall portfolio yield to nearly 6%.

This proactive approach to securing higher-yielding assets, leveraging their robust asset management capabilities, is a key driver of their impressive earnings growth. It highlights a distinct competitive edge and market leadership in achieving superior investment performance.

Property and Casualty (P&C) Business Growth

Brookfield Reinsurance's Property and Casualty (P&C) segment is experiencing robust growth, significantly boosted by the full quarter of earnings from the Argo Group acquisition completed in late 2023.

This strategic move into the U.S. specialty P&C market signals Brookfield Reinsurance's ambition to capture substantial market share within promising P&C niches. The strong financial contribution from Argo Group underscores the success of this integration and positions the P&C business as a burgeoning market leader.

- Argo Group Acquisition Impact: The full quarter's earnings from Argo Group, acquired in late 2023, have demonstrably strengthened Brookfield Reinsurance's P&C segment performance.

- U.S. Specialty P&C Focus: The acquisition targets significant market share in specific, high-growth U.S. specialty P&C areas.

- Market Leadership Potential: The robust earnings contribution suggests the P&C business is rapidly ascending to a leadership position within its targeted niches.

- Strategic Growth Driver: P&C operations are a key growth engine for Brookfield Reinsurance, leveraging strategic acquisitions to expand its market footprint.

International Expansion Initiatives

Brookfield Reinsurance, rebranded as Brookfield Wealth Solutions, is strategically expanding its global footprint. A key focus is the United Kingdom's burgeoning pension and annuity market, a sector offering substantial growth potential.

The company has already made significant strides, completing its inaugural UK reinsurance transaction. This milestone, coupled with securing the necessary UK licensing, marks a definitive entry into this new territory. Brookfield Wealth Solutions aims to leverage these achievements to carve out a leading market position.

- UK Pension and Annuity Market Growth: The UK pension risk transfer market saw significant activity in 2023, with an estimated £40 billion in buy-ins and buy-outs completed, indicating strong demand for reinsurance solutions.

- Strategic Diversification: This international push represents a deliberate move to diversify revenue streams and capitalize on high-growth opportunities outside of North America.

- Market Entry Validation: The successful completion of their first UK transaction and obtaining regulatory approval validates the company's strategy and operational readiness for international markets.

Brookfield Reinsurance's annuity operations, significantly boosted by the May 2024 acquisition of American Equity Investment Life Holding Company (AEL), are positioned as a star performer. This move added over $50 billion in assets, instantly establishing Brookfield as a major annuity player. The company is actively scaling this platform to capitalize on the growing demand for retirement solutions.

The Pension Risk Transfer (PRT) business is another star, demonstrating impressive growth throughout 2024. With over $700 million in PRT premiums originated in Q1 2024 and $5 billion in deals executed for the full year, this segment is a key growth engine. The successful inaugural UK reinsurance transaction in Q4 2024, valued at £1.0 billion ($1.3 billion USD), further solidifies its star status through international expansion.

Brookfield Reinsurance's investment strategies, deploying approximately $1 billion to yield over 11%, contribute to a strong overall portfolio yield of nearly 6%, highlighting their market leadership in investment performance. The Property and Casualty (P&C) segment, bolstered by the full quarter earnings from the late 2023 Argo Group acquisition, is also a star, showing robust growth and a clear path to market leadership in U.S. specialty P&C niches.

| Segment | Key 2024 Data Points | BCG Matrix Category |

|---|---|---|

| Annuities (AEL Acquisition) | $50B+ in new insurance portfolio assets | Star |

| Pension Risk Transfer (PRT) | $5B PRT deals executed; £1B (approx. $1.3B USD) UK transaction | Star |

| Proprietary Investment Strategies | $1B deployed; >11% target returns; ~6% portfolio yield | Star |

| Property & Casualty (P&C) | Full quarter earnings from Argo Group; U.S. specialty P&C focus | Star |

What is included in the product

Brookfield Reinsurance's BCG Matrix analyzes its business units by market growth and share.

It identifies units for investment, divestment, or cash generation.

Brookfield Reinsurance's BCG Matrix offers a clear, actionable roadmap, relieving the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

Brookfield Reinsurance's established life and annuity blocks, especially those predating recent acquisitions, are solid cash cows. These mature segments offer predictable, high profit margins and generate substantial, consistent cash flow with minimal need for further promotional investment. Their long-term liability structures align perfectly with Brookfield's investment strategy, ensuring a steady stream of returns.

Brookfield Reinsurance's broad capital solutions business acts as a cash cow. This segment offers insurance and reinsurance services to a wide range of clients, both individuals and institutions. The mature nature of this industry allows them to consistently generate stable, predictable earnings.

Their extensive network and deep expertise are key drivers for this reliable cash flow. These operations are a significant contributor to their fee-related earnings and distributable operating earnings, providing a steady income stream. For instance, in 2023, Brookfield Reinsurance reported significant growth in its capital solutions segment, underscoring its cash-generating capabilities.

Brookfield Reinsurance's strategic shift towards higher-yielding investments is a key driver of its financial strength. This focus consistently produces robust net investment income, demonstrating the effectiveness of their capital allocation.

In the first quarter of 2024, the company's gross portfolio yield approached 6%, underscoring its ability to generate substantial returns. This strong yield capability positions these investments as significant cash generators for Brookfield Reinsurance.

The company's expertise in deploying capital efficiently into these lucrative strategies translates into impressive profit margins derived from its asset base. This operational efficiency further bolsters the cash-generating capacity of its investment portfolio.

American National Business

American National, now under Brookfield Reinsurance, is a prime example of a cash cow within their portfolio. It’s a stable, mature life and annuity business that consistently generates strong profits and cash flow. This stability means it doesn't need significant new capital to grow, allowing Brookfield Reinsurance to redirect those funds elsewhere.

As a mature acquisition, American National's contribution is predictable. In 2023, Brookfield Reinsurance reported that its Life & Annuity segment, which includes American National, saw significant growth. For instance, the segment’s net earnings attributable to shareholders were $1.1 billion for the year ended December 31, 2023, up from $886 million in 2022, showcasing its robust performance.

- Stable Earnings: American National provides a reliable stream of income for Brookfield Reinsurance.

- Low Investment Needs: As a mature business, it requires minimal capital for expansion.

- Operational Synergies: Integration with Brookfield Reinsurance enhances efficiency and profitability.

- Strong 2023 Performance: The Life & Annuity segment, housing American National, demonstrated substantial earnings growth.

Canadian Annuity Market Presence

Brookfield Annuity Company holds a commanding second position in Canada's Pension Risk Transfer (PRT) market, a testament to its deep-rooted presence in a mature yet expanding sector. This robust market standing translates into reliable profitability and consistent cash flow generation from its Canadian endeavors.

The annuity business in Canada, particularly in PRT, is characterized by its stability. For instance, in 2023, the Canadian PRT market saw significant activity, with total transaction volumes reaching billions of dollars, underscoring the consistent demand and Brookfield's ability to capture a substantial share.

- Market Leadership: Brookfield Annuity Company is the second-largest provider in Canada's PRT market.

- Stable Cash Generation: Its strong position in a mature market ensures consistent profitability and cash flow.

- Capital Strength: The entity benefits from strong capitalization, reinforcing its role as a reliable cash generator.

- Sector Growth: While mature, the Canadian PRT market continues to see growth, providing a stable environment for cash cow operations.

Brookfield Reinsurance's established life and annuity blocks, particularly those acquired prior to recent strategic moves, function as prime cash cows. These mature segments consistently deliver high profit margins and generate substantial, predictable cash flows with minimal need for additional investment. Their long-term liability structures are well-suited to Brookfield's investment approach, ensuring a steady return stream.

The company's broad capital solutions business also operates as a significant cash cow, providing insurance and reinsurance services to a diverse client base. The maturity of this sector allows for consistent and stable earnings. In 2023, Brookfield Reinsurance saw substantial growth in this segment, highlighting its reliable cash-generating capabilities.

American National, now part of Brookfield Reinsurance, exemplifies a cash cow with its stable, mature life and annuity operations. This business generates strong profits and cash flow without requiring extensive new capital, allowing Brookfield to reallocate resources effectively. For the year ended December 31, 2023, Brookfield Reinsurance's Life & Annuity segment, including American National, reported net earnings attributable to shareholders of $1.1 billion, a notable increase from $886 million in 2022.

| Segment | Role in BCG Matrix | Key Characteristics | 2023 Performance Indicator |

|---|---|---|---|

| Established Life & Annuity Blocks | Cash Cow | Predictable, high profit margins, minimal investment needs | Steady cash flow generation |

| Capital Solutions Business | Cash Cow | Mature industry, stable earnings, diverse client base | Substantial growth in segment revenue |

| American National (Life & Annuity) | Cash Cow | Mature operations, strong profits, low capital requirements | Net earnings of $1.1 billion for the segment in 2023 |

Preview = Final Product

Brookfield Reinsurance BCG Matrix

The Brookfield Reinsurance BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures complete transparency, as you can assess the quality and comprehensiveness of the strategic analysis before committing. Rest assured, the file is ready for immediate use, whether for internal planning or client presentations, without any alterations or additional content.

Dogs

Underperforming legacy portfolios, often inherited from past acquisitions, can represent a drag on a company like Brookfield Reinsurance. These might be smaller, non-core insurance books that don't fit the current strategic direction. For instance, if a significant portion of these legacy assets are in lines of business with declining customer bases or facing intense competition, their growth potential would be limited.

These portfolios can demand considerable administrative resources without generating commensurate returns. Think of the costs associated with managing older policy blocks, which might involve legacy IT systems or specialized claims handling. In 2024, many insurers were actively reviewing such portfolios, aiming to streamline operations and reduce these overheads.

The strategic imperative is to identify these underperformers and consider divestment or run-off strategies. This frees up capital that can be redeployed into more promising areas, such as high-growth insurance products or strategic acquisitions that better align with long-term value creation goals. For example, a company might sell off a legacy annuity block to invest in a burgeoning cyber insurance offering.

Segments where Brookfield Reinsurance offers products that are not highly differentiated and face intense price competition could be categorized as Dogs. These areas often struggle with minimal market share gains or profitability, even with substantial marketing investment. For instance, in the highly competitive annuity market, where product features can be very similar across providers, Brookfield Reinsurance might find itself in such a position if it cannot establish a unique selling proposition.

These "Dog" segments might require significant marketing spend for minimal returns, draining resources that could be better allocated. In 2023, the U.S. annuity market saw significant growth, but intense competition meant that companies without clear differentiation struggled to capture new customers. Without a clear strategy to innovate or carve out a niche, these offerings risk becoming a drag on overall performance.

Small, non-strategic holdings, such as minor equity stakes or small reinsurance contracts, might fall into the 'Dogs' category within Brookfield Reinsurance's BCG Matrix. These assets typically don't contribute significantly to the company's earnings or long-term strategy, potentially tying up valuable capital without offering substantial returns or strategic benefits.

Brookfield's business model often emphasizes large-scale capital deployment and strategic integration, suggesting a preference for assets that offer clear growth potential or synergistic advantages. Consequently, smaller, less impactful holdings may be viewed as inefficient in this context.

Inefficient Operational Units

Inefficient operational units within Brookfield Reinsurance, if they exist, would be those struggling with high operating expenses relative to their revenue generation or strategic contribution. These could be legacy systems, underperforming business lines, or units that haven't integrated effectively into the broader company's strategy. For instance, a unit with a cost-to-income ratio significantly above the industry average, say over 70% in a sector where 50% is typical, would signal inefficiency.

Such units would be prime candidates for a strategic review, potentially leading to restructuring to streamline operations, reduce costs, or even divestment if they no longer align with Brookfield Reinsurance's core objectives. In 2024, the insurance industry saw a continued focus on operational efficiency, with many companies investing in digital transformation to cut overheads.

- Low Revenue Contribution: Units generating revenue below expectations or industry benchmarks.

- High Operating Costs: Expenses disproportionately exceeding the income or strategic value generated.

- Lack of Synergy: Operations that do not complement or enhance other parts of Brookfield Reinsurance.

- Poor Performance Metrics: Consistently failing to meet key performance indicators (KPIs) related to efficiency and profitability.

Exiting Niche Markets

Exiting niche markets where growth has stagnated or market share is negligible would classify these segments as Dogs within Brookfield Reinsurance's BCG Matrix. This strategic move aligns with their focus on scaling and consolidating core annuity and pension risk transfer operations. For instance, if a particular specialty insurance line, like niche marine liability, showed minimal premium growth and a sub-1% market share in 2024, it would likely be considered a Dog.

- Divestment Rationale: Divesting from low-return, non-synergistic niche markets frees up capital and management attention for more promising core businesses.

- Strategic Alignment: This action supports Brookfield Reinsurance's stated strategy of concentrating resources on high-growth areas like pension risk transfer, where they aim for market leadership.

- Financial Impact: Exiting these segments can improve overall profitability and return on equity by eliminating underperforming assets and associated operational costs.

- Market Dynamics: In 2024, the global reinsurance market saw continued consolidation, making divestment from smaller, less profitable niches a common strategy for many players seeking greater efficiency.

Segments categorized as Dogs within Brookfield Reinsurance's BCG Matrix are those with low market share and low growth potential, often representing underperforming or non-core assets. These could include niche insurance products with declining demand or legacy portfolios that are costly to maintain. For example, a specific line of business with minimal premium growth and a high cost-to-serve ratio would fit this description.

These "Dog" segments typically demand significant resources for minimal returns, potentially hindering overall profitability. In 2023, the insurance industry faced increased scrutiny on operational efficiency, with companies actively shedding non-core or underperforming assets to optimize capital allocation. Brookfield Reinsurance, like others, would likely review such segments for potential divestment or run-off strategies.

The strategic approach for these segments involves identifying opportunities for divestment or managed run-off to free up capital. This capital can then be redeployed into higher-growth areas, such as expanding their pension risk transfer business or investing in new, innovative insurance products. By exiting these low-return areas, Brookfield Reinsurance can enhance its overall financial performance and strategic focus.

Brookfield Reinsurance's focus on large-scale capital deployment and strategic integration means that smaller, less impactful holdings or inefficient operational units are often viewed critically. These "Dogs" might not offer significant synergy or growth potential, tying up valuable capital without substantial returns, as seen in the general trend of market consolidation in 2024.

Question Marks

Emerging digital insurance solutions would fall into the Question Marks category of Brookfield Reinsurance's BCG Matrix. This signifies investments in high-growth potential markets where Brookfield currently has a limited presence. For instance, Brookfield Reinsurance's strategic investments in InsurTech startups, aiming to leverage AI for personalized policy underwriting and claims processing, exemplify this. These ventures are positioned in a rapidly expanding digital insurance sector, but their market share within Brookfield's overall portfolio is still nascent.

New geographic market entries beyond the UK are positioned as question marks in Brookfield Reinsurance's BCG Matrix. These represent markets with significant growth potential but currently minimal market share, demanding substantial upfront investment for establishment and penetration.

For instance, exploring entry into emerging Asian markets like Vietnam or Indonesia, where insurance penetration rates are still relatively low compared to developed economies, would fit this category. These regions often exhibit robust GDP growth, fueling demand for insurance products, but require tailored strategies and considerable capital to build brand recognition and distribution networks.

In 2024, the global insurance market is projected to see continued growth, with emerging markets expected to outpace developed ones. However, the specific investment required for a new entrant to gain even a 1% market share in a complex market like India or Brazil could run into hundreds of millions of dollars, reflecting the high cost of entry and the need to overcome established local players.

Brookfield Reinsurance's focus on specialized, untapped risk transfer products represents a strategic move into areas with significant growth potential but limited current market penetration. These products are designed to address emerging, high-impact risks such as advanced cyber threats and specific climate-related coverages, markets where the demand is growing rapidly but established solutions are still developing. This strategy aligns with a Stars or Question Marks position on the BCG Matrix, indicating high potential but currently low adoption and market share.

Minority Investments in High-Growth Startups

Strategic minority investments in high-growth insurance or reinsurance startups, particularly those leveraging new technologies or business models, could be positioned as Stars within Brookfield Reinsurance's BCG Matrix framework. These ventures operate in rapidly expanding markets, offering significant potential for future growth and market share capture. For instance, in 2024, the insurtech sector saw substantial venture capital inflows, with companies focusing on AI-driven underwriting and personalized customer experiences attracting considerable attention and funding. Brookfield Reinsurance's involvement would allow it to tap into these innovative ecosystems without the immediate commitment of a full acquisition.

While these startups operate in growing markets, Brookfield Reinsurance's direct market share through such investments would initially be low, requiring further capital commitment for significant impact. This aligns with the Star classification, where initial market share might be modest but the growth rate is high. For example, a minority stake in a startup experiencing 30-40% year-over-year revenue growth in a burgeoning digital insurance segment would fit this profile. The strategy here is to nurture these nascent businesses, providing capital and expertise, with the aim of increasing ownership or benefiting from their eventual market dominance.

- Star Classification: Minority stakes in high-growth insurtech startups leveraging AI or new distribution models.

- Market Growth: Focus on segments like embedded insurance or parametric solutions experiencing rapid adoption.

- Initial Market Share: Low direct market share, characteristic of a Star, with potential for significant future gains.

- Capital Commitment: Requires ongoing investment to support growth and potentially increase ownership over time.

Expansion into Untraditional Annuity Product Lines

Expanding into untraditional annuity product lines, such as guaranteed lifetime withdrawal benefits (GLWBs) or hybrid products combining insurance and investment features, could position Brookfield Reinsurance's offerings as 'Question Marks' within a BCG framework. These innovative products cater to evolving retirement needs, potentially tapping into younger demographics or those seeking more flexible income solutions.

While these newer products operate in potentially high-growth sub-segments of the retirement market, their success hinges on significant investment in consumer education, advisor training, and robust distribution channels. For instance, the market for registered index-linked annuities (RILAs), a type of untraditional annuity, saw substantial growth, with sales reaching an estimated $40 billion in 2023, indicating a strong appetite for innovative retirement solutions.

- Untraditional Products: Focus on innovative annuity types like GLWBs and hybrid solutions.

- Market Potential: Target untapped demographics and specific financial planning needs in growing sub-segments.

- Investment Required: Significant marketing and distribution efforts are crucial for market penetration.

- Growth Example: RILA sales hit approximately $40 billion in 2023, demonstrating market receptiveness to new annuity formats.

Emerging digital insurance solutions, particularly those leveraging AI for underwriting and claims, are classified as Question Marks. These represent high-growth potential markets where Brookfield Reinsurance's current market share is limited, requiring substantial investment for penetration.

New geographic market entries, such as Vietnam or Indonesia, also fall into the Question Marks category. These markets offer robust GDP growth but demand significant capital and tailored strategies to build brand recognition and distribution networks against established local players.

Untraditional annuity products like GLWBs are considered Question Marks. While the market for innovative retirement solutions is growing, with RILA sales reaching approximately $40 billion in 2023, these new offerings require substantial investment in education and distribution to gain traction.

| Category | Description | Example | Market Growth Potential | Investment Need |

| Question Marks | High growth, low market share | AI-driven InsurTech startups, new geographic markets (e.g., Vietnam), innovative annuities (e.g., GLWBs) | Emerging markets outpacing developed ones; RILA sales $40B in 2023 | High (market entry, brand building, product development) |

BCG Matrix Data Sources

Brookfield Reinsurance's BCG Matrix leverages comprehensive market data, including financial statements, industry growth projections, and competitor analysis, to accurately position its business units.