Blue Ridge Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blue Ridge Bank Bundle

Blue Ridge Bank navigates a complex landscape shaped by customer loyalty, the threat of new digital challengers, and the bargaining power of its suppliers. Understanding these forces is crucial for any stakeholder looking to grasp the bank's competitive position.

The complete report reveals the real forces shaping Blue Ridge Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Blue Ridge Bank hinges on specialized providers of core banking software, cybersecurity, and financial technology. If these solutions are highly proprietary with substantial switching costs, or if there are limited alternative vendors, suppliers can command higher prices, directly impacting the bank's operational expenses.

Payment network providers, such as Visa and Mastercard, wield significant bargaining power. Their extensive reach and essential role in processing transactions make them critical partners for banks like Blue Ridge. This reliance limits a bank's ability to negotiate favorable terms for card services.

In 2024, Visa and Mastercard continued to dominate the global payment processing landscape. Visa reported over $14 trillion in processed payment volume in the fiscal year ending September 30, 2023, while Mastercard processed over $9 trillion in the same period. This sheer scale underscores their leverage over financial institutions that depend on their networks.

Human capital, especially specialized talent in wealth management, cybersecurity, and advanced analytics, represents a critical supplier group for banks like Blue Ridge Bank. The intense demand for these skills means that professionals in these fields often possess significant bargaining power.

In 2024, the competition for top talent in cybersecurity, for instance, has driven up compensation packages considerably. Reports indicate that average salaries for experienced cybersecurity analysts have seen double-digit percentage increases year-over-year, directly impacting a bank's personnel expenses and its capacity for strategic investment in new technologies.

This scarcity of highly skilled individuals in niche banking areas directly translates to increased operational costs for Blue Ridge Bank. Higher salaries and more robust benefits packages are necessary to attract and retain this essential talent, potentially squeezing profit margins and affecting the bank's agility in pursuing innovation.

Supplier Power 4

The bargaining power of suppliers for Blue Ridge Bank is a significant consideration, particularly with the increasing reliance on data analytics and cloud service providers. These specialized vendors are crucial for managing vast amounts of data, improving customer experiences, and meeting stringent regulatory requirements. As banks like Blue Ridge Bank push for digital transformation and greater operational efficiency, their dependence on these tech-focused suppliers naturally grows.

This growing dependence can shift the balance of power, potentially allowing these suppliers to exert more influence over pricing and service level agreements. For instance, the global cloud computing market, a key area for such services, was projected to reach over $1 trillion by 2024, indicating substantial vendor leverage. Banks may find themselves with fewer alternatives for highly specialized data solutions, making supplier terms more impactful.

- Increased reliance on specialized vendors for data analytics and cloud services.

- Growing importance of these services for digital transformation and regulatory compliance.

- Potential for vendors to influence pricing and service terms due to heightened dependence.

- The global cloud computing market's significant growth underscores vendor market power.

Supplier Power 5

The bargaining power of suppliers for Blue Ridge Bank is significant, particularly in specialized areas like regulatory compliance and legal services. Banks operate within a highly regulated environment, making expertise in these fields essential for avoiding costly penalties and maintaining their operational licenses. Firms offering these critical services, especially those with a proven track record in banking regulations and remediation, can command higher prices due to their indispensable nature.

For instance, the financial services sector saw a substantial increase in spending on compliance. In 2023, global financial institutions spent an estimated $42.4 billion on regulatory technology (RegTech) solutions, a figure projected to grow substantially by 2025. This underscores the demand for specialized services that help banks navigate complex legal and regulatory frameworks. Blue Ridge Bank, like its peers, must secure these services to ensure adherence to mandates from bodies such as the Federal Reserve and the Office of the Comptroller of the Currency.

The concentration of specialized legal and compliance firms also contributes to their leverage. When only a few providers possess the deep, niche expertise required, they have greater capacity to dictate terms. This is particularly true for services related to anti-money laundering (AML) and know your customer (KYC) regulations, areas where specialized legal counsel and technology providers are in high demand. The cost of non-compliance, including hefty fines and reputational damage, further strengthens the suppliers' position, as banks are willing to pay a premium to mitigate these risks.

- High Demand for Specialized Expertise: Banks require specialized legal and compliance services to navigate complex regulations, increasing supplier power.

- Cost of Non-Compliance: The potential for significant fines and reputational damage incentivizes banks to secure essential compliance services, strengthening supplier leverage.

- Concentration of Providers: A limited number of firms with deep expertise in banking regulations and remediation create a concentrated supplier market.

- Regulatory Landscape: The ever-evolving and stringent regulatory environment, including mandates from agencies like the Federal Reserve, necessitates reliance on specialized external providers.

The bargaining power of suppliers for Blue Ridge Bank is amplified by the critical need for specialized technology and human capital. Key suppliers in areas like core banking software, cybersecurity, and advanced analytics often possess proprietary solutions with high switching costs, limiting the bank's options and driving up expenses.

Payment networks such as Visa and Mastercard hold substantial sway due to their ubiquitous presence and essential role in transaction processing. Their vast scale, evidenced by billions in processed volumes in 2023, makes them indispensable partners, limiting Blue Ridge Bank's ability to negotiate favorable terms.

The demand for skilled professionals in wealth management, cybersecurity, and data analytics is intense. In 2024, salary increases for experienced cybersecurity analysts saw double-digit year-over-year growth, directly impacting Blue Ridge Bank's personnel costs and its capacity for strategic investments.

| Supplier Category | Key Services | Impact on Blue Ridge Bank | 2023/2024 Data Point |

|---|---|---|---|

| Technology Providers | Core Banking Software, Cybersecurity, Cloud Services | High switching costs, potential for price increases | Global cloud computing market projected over $1 trillion in 2024 |

| Payment Networks | Transaction Processing | Limited negotiation leverage due to essential role | Visa processed >$14 trillion; Mastercard processed >$9 trillion (FY ending Sep 2023) |

| Human Capital | Cybersecurity, Wealth Management, Data Analytics | Increased personnel costs due to talent scarcity | Double-digit % salary increases for cybersecurity analysts |

| Legal & Compliance | Regulatory Adherence, AML/KYC | Higher fees for specialized expertise, cost of non-compliance | Financial institutions spent ~$42.4 billion on RegTech in 2023 |

What is included in the product

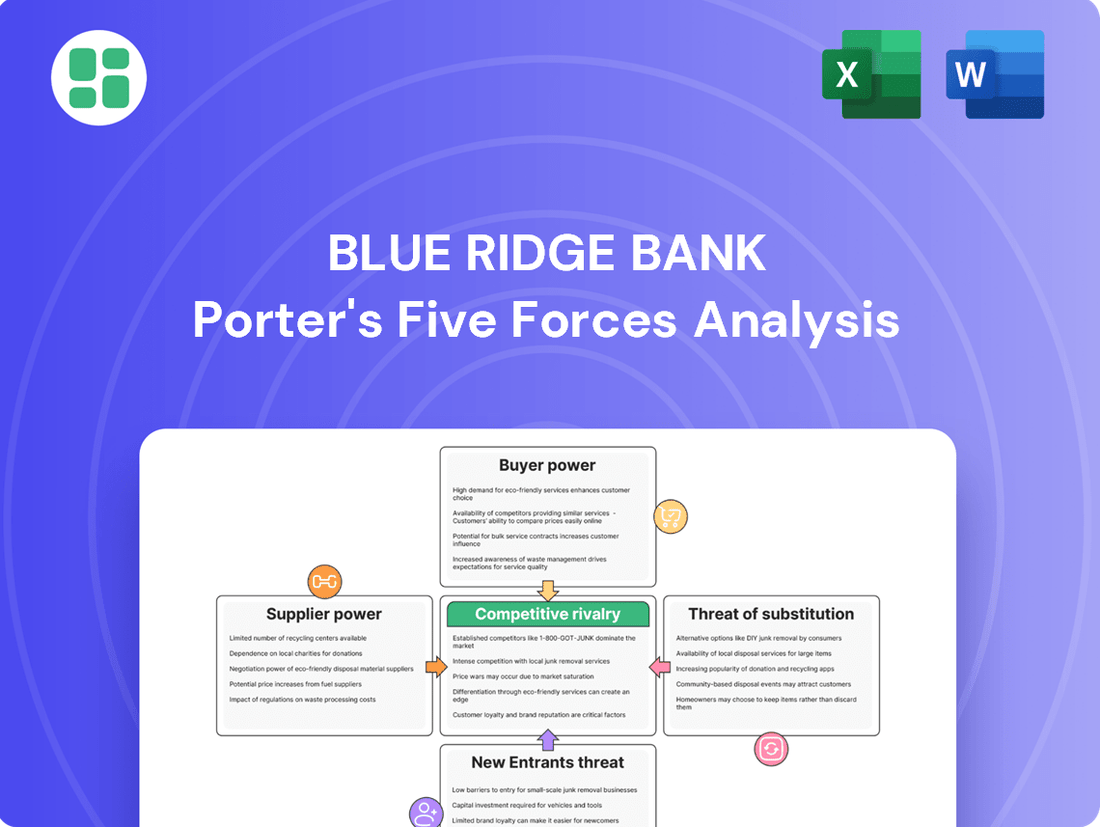

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Blue Ridge Bank's strategic positioning.

Instantly visualize competitive pressures with a dynamic, interactive model that highlights the most impactful forces for Blue Ridge Bank.

Customers Bargaining Power

Blue Ridge Bank's customers, encompassing both individuals and businesses, wield significant bargaining power. This stems from the banking sector's intense competitiveness, allowing customers to readily compare offerings like interest rates on savings and loans, along with service fees, across numerous financial institutions. For instance, in 2024, the average interest rate on a savings account hovered around 0.46%, while Certificates of Deposit (CDs) offered higher yields, creating a clear benchmark for customers to evaluate Blue Ridge Bank's products against.

Customers at Blue Ridge Bank face numerous banking alternatives, ranging from large national institutions to local credit unions. This wide selection means customers can easily switch providers if they find better rates or services elsewhere, a significant factor in 2024 as many consumers re-evaluated their banking relationships. The low cost associated with changing banks for everyday services directly impacts Blue Ridge Bank's ability to command premium pricing or retain clients without offering competitive advantages.

The bargaining power of customers in the banking sector is significantly amplified by digitalization. Online banking platforms and mobile apps empower customers with unprecedented transparency, allowing them to easily compare interest rates, fees, and product offerings across multiple institutions. This ease of access to information reduces switching costs and makes customers less dependent on traditional branch relationships, as evidenced by the growing adoption of digital-only banks.

In 2024, the trend of customers leveraging digital channels for banking services continued to strengthen. For instance, reports indicate that a substantial percentage of routine banking transactions, such as deposits and fund transfers, are now conducted digitally, reflecting a clear shift in customer behavior. This digital savviness means customers are more informed and have a wider array of choices at their fingertips, thereby increasing their leverage when selecting financial products and services.

Buyer Power 4

For Blue Ridge Bank, the bargaining power of customers, particularly in wealth management, is significant. High-net-worth individuals and large corporate clients wield considerable influence due to the sheer volume of assets they entrust to the bank. This often translates into their ability to negotiate for more personalized service offerings, reduced management fees, or more favorable contract terms, directly impacting the bank's revenue streams in this lucrative segment.

These sophisticated clients are well-informed and have alternatives, meaning they can easily switch providers if their demands aren't met. For instance, a client managing over $10 million might expect a dedicated relationship manager and bespoke investment strategies, something smaller clients wouldn't typically require. This ability to move substantial assets puts pressure on banks to remain competitive and client-centric.

In 2024, the wealth management sector continued to see intense competition, with many firms vying for the attention of affluent clients. Data from industry reports indicated that fee compression remained a key concern, with average wealth management fees for larger portfolios often falling below 1% annually. This trend underscores the ongoing power of these high-value customers to drive down costs.

- High-Net-Worth Individuals (HNWIs): Clients with substantial investable assets, typically defined as $1 million or more, possess greater leverage.

- Corporate Clients: Large businesses entrusting significant treasury or investment funds to Blue Ridge Bank also exert considerable bargaining power.

- Fee Sensitivity: Affluent clients are increasingly price-sensitive and will shop around for the best fee structures.

- Demand for Customization: These clients expect tailored investment strategies and personalized service, which can increase operational costs for the bank.

Buyer Power 5

Blue Ridge Bank faces considerable buyer power, primarily driven by customer sensitivity to interest rates. In 2024, with interest rates experiencing volatility, customers actively sought out the best loan terms and deposit yields. This means Blue Ridge Bank must constantly adjust its pricing to remain competitive, as customers can easily shift their business to institutions offering more favorable rates.

This dynamic directly impacts the bank's profitability. For instance, a 0.25% difference in a mortgage rate can translate to thousands of dollars over the loan's life, making customers highly attuned to such variations. Similarly, deposit rates influence where individuals and businesses choose to park their funds. Blue Ridge Bank's ability to attract and retain both borrowers and depositors hinges on its agility in responding to these market shifts.

- Customer sensitivity to interest rates: High, as evidenced by rapid shifts in deposit and loan seeking behavior.

- Competitive pricing pressure: Forces Blue Ridge Bank to remain agile in its rate strategies to retain market share.

- Impact on profitability: Small rate differentials can significantly influence customer decisions and, consequently, the bank's net interest margin.

- 2024 market conditions: Characterized by fluctuating rates, amplifying buyer power and the need for competitive offerings.

Blue Ridge Bank's customers possess significant bargaining power due to the highly competitive banking landscape and the ease with which they can switch providers. This power is amplified by digital tools that offer transparency in pricing and services, forcing the bank to maintain competitive offerings. In 2024, this meant customers could readily compare rates, impacting Blue Ridge Bank's ability to retain clients without offering clear advantages.

The ability for customers to easily switch banks, especially for routine transactions, significantly reduces their switching costs. This allows them to leverage better rates and services from competitors, putting pressure on Blue Ridge Bank to be highly competitive. In 2024, the trend of digital banking adoption meant customers were more informed and had greater choice, increasing their leverage.

High-net-worth individuals and corporate clients, in particular, wield substantial bargaining power due to the volume of assets they manage. They often negotiate for personalized services and lower fees, directly impacting Blue Ridge Bank's revenue. For instance, in 2024, fee compression in wealth management meant that average fees for larger portfolios often fell below 1% annually, reflecting this customer leverage.

| Customer Segment | Bargaining Power Drivers | 2024 Impact Example |

|---|---|---|

| Retail Depositors | Interest rate sensitivity, ease of switching | Average savings account rates around 0.46% in 2024 |

| Borrowers (Mortgage, Loans) | Interest rate sensitivity, competitive loan offerings | 0.25% rate difference can save thousands over loan life |

| High-Net-Worth Individuals | Asset volume, demand for customization, fee sensitivity | Wealth management fees for large portfolios often below 1% |

| Corporate Clients | Treasury/investment fund volume, negotiation for terms | Ability to move substantial assets influences service levels and pricing |

Same Document Delivered

Blue Ridge Bank Porter's Five Forces Analysis

This preview shows the exact Blue Ridge Bank Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. This detailed report is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Competitive rivalry within Blue Ridge Bank's operating regions is fierce, with a mix of large national institutions and smaller community banks vying for market share. These larger banks often leverage their scale to offer a wider array of products and more competitive pricing, while community banks emphasize personalized service and deep local ties.

Competitive rivalry at Blue Ridge Bank is intense, with banks vying across a broad spectrum of financial products. This includes deposit accounts, various loan types like commercial, retail, and mortgage, as well as wealth management services. Banks are constantly competing on key factors such as interest rates offered, service fees, the sophistication of their digital banking platforms, the quality of customer service, and the overall range of products available to clients.

The regional banking sector in 2024 is characterized by intense competition, driven by sluggish loan growth and a heightened focus on managing the cost of deposits. This environment forces banks like Blue Ridge Bank to aggressively pursue both deposit acquisition and attractive lending opportunities, squeezing profit margins.

Banks are actively working to preserve their net interest margins, a key profitability metric, as economic conditions shift. For instance, as of Q1 2024, the average net interest margin for U.S. banks hovered around 3.2%, a figure that can be significantly impacted by deposit pricing strategies and loan portfolio performance.

Competitive Rivalry 4

Mergers and acquisitions can reshape the competitive landscape, potentially creating larger, more powerful entities. The regional banking sector, for instance, is anticipating a surge in M&A activity as institutions seek to bolster their scale, improve operational efficiency, and expand their market reach.

This consolidation trend means that while the sheer number of competitors might decrease, the remaining players could become more formidable rivals. For example, in 2023, the U.S. banking industry saw a significant number of M&A deals, with many smaller and mid-sized banks combining to achieve greater economies of scale and compete more effectively against larger national institutions.

- Increased Scale: Banks merging aim to grow their asset base and deposit volumes, enhancing their lending capacity and market influence.

- Efficiency Gains: Consolidation often leads to cost savings through the elimination of redundant operations and shared back-office functions.

- Market Share Expansion: M&A provides a direct route to acquiring new customers and entering new geographic or product markets.

- Formidable Rivals: Post-merger entities can leverage their combined strengths to offer more competitive pricing and services, intensifying rivalry.

Competitive Rivalry 5

Blue Ridge Bank's strategic pivot back to community banking intensifies rivalry in its core markets. By exiting some fintech partnerships and scaling back mortgage operations, the bank is sharpening its focus on traditional lending and deposit-gathering services. This shift means competition will be fiercer with other community banks that also emphasize personal relationships and local knowledge.

The bank's decision to re-emphasize community banking is a direct response to a market where trust and local presence remain crucial. For instance, in 2024, community banks continued to hold a significant share of small business loans, a segment Blue Ridge Bank is likely targeting more aggressively. This focus means rivals will compete on personalized service and understanding local economic nuances, rather than solely on technological innovation.

- Focus on Core Services: Blue Ridge Bank's strategic shift back to community banking emphasizes competition in traditional lending and deposit services.

- Local Market Expertise: Rivalry is heightened as banks leverage their understanding of local economic conditions and customer needs.

- Personal Relationships: The emphasis on community roots means competition will be driven by customer service and established trust.

- 2024 Market Dynamics: Community banks' continued strength in small business lending highlights the competitive landscape Blue Ridge Bank is re-engaging with.

Competitive rivalry within Blue Ridge Bank's operating regions is intense, with both large national players and smaller community banks vying for customers. This competition spans deposit accounts, loans, and wealth management, with banks differentiating on interest rates, fees, digital platforms, and customer service. The 2024 landscape is marked by slower loan growth and a strong focus on deposit costs, forcing banks to compete aggressively on pricing to maintain margins, which averaged around 3.2% for U.S. banks in Q1 2024.

Mergers and acquisitions are actively reshaping the competitive environment, with many banks consolidating to gain scale and efficiency. This trend, evident in 2023's significant M&A activity, means remaining competitors can become more formidable. Blue Ridge Bank's strategic shift back to community banking intensifies rivalry in its core markets, focusing on personalized service and local expertise, areas where community banks continue to hold strong positions, particularly in small business lending.

| Metric | 2023 Average (U.S. Banks) | 2024 Trend |

| Net Interest Margin | ~3.2% (Q1 2024) | Pressure to maintain due to deposit costs |

| Small Business Lending Share | Significant for Community Banks | Targeted by community-focused banks |

| M&A Activity | High in 2023 | Expected to continue, increasing competitor scale |

SSubstitutes Threaten

Fintech companies are a major threat, offering specialized financial services that can replace traditional banking products. Think of online lending platforms, peer-to-peer payment systems, and digital investment advisors. These often provide more streamlined or cost-effective alternatives to what banks traditionally offer.

For instance, the digital lending market has seen substantial growth. In 2024, it's projected that fintech lenders will originate a significant portion of all U.S. consumer loans, capturing market share from traditional banks. This trend highlights how readily customers are adopting these substitute services for their financial needs.

Credit unions present a significant threat of substitution for traditional banks like Blue Ridge Bank. These member-owned cooperatives often boast lower fees and more competitive interest rates on loans and savings accounts, directly appealing to cost-conscious consumers. For instance, in 2024, the average credit union auto loan rate was often notably lower than that of large commercial banks, making them an attractive alternative for borrowers.

Non-bank financial institutions pose a significant threat by targeting specific loan segments. For instance, specialized mortgage companies and auto finance lenders can often process applications more quickly or offer highly customized loan terms, directly competing with traditional banks. In 2023, fintech lenders saw significant growth, capturing an increasing share of the personal loan market, a segment historically dominated by banks.

Threat of Substitutes 4

Robo-advisors and online wealth management platforms are emerging as significant substitutes for traditional human-led wealth management. These digital alternatives provide automated investment strategies and portfolio management, often at a fraction of the cost charged by human advisors. For instance, by 2024, the global robo-advisory market was projected to reach hundreds of billions of dollars in assets under management, demonstrating a clear shift in investor preference towards these more accessible and cost-effective solutions.

This trend is particularly pronounced among younger, tech-savvy demographics who are comfortable with digital interfaces and seek lower fee structures. Many robo-advisors charge annual management fees in the range of 0.25% to 0.50%, a stark contrast to the 1% or higher fees often associated with traditional financial advisory services. This cost advantage, coupled with the convenience of 24/7 access and automated rebalancing, makes them an attractive option for investors prioritizing efficiency and affordability.

- Digital platforms offer automated portfolio management, reducing reliance on human advisors.

- Lower fees are a key differentiator, with robo-advisors typically charging 0.25%-0.50% annually.

- Younger, tech-savvy investors are increasingly adopting these digital wealth management solutions.

- The global robo-advisory market is experiencing substantial growth, indicating a strong substitution threat.

Threat of Substitutes 5

The threat of substitutes for traditional banking services is intensifying, particularly with the rise of embedded finance. This trend sees financial services, such as lending or payments, integrated directly into non-financial platforms like e-commerce sites or ride-sharing apps. For instance, a customer buying goods online might be offered instant credit at checkout, bypassing the need to apply for a loan from a bank.

This seamless integration means consumers can access financial products precisely when and where they need them, often without a direct interaction with a financial institution. By 2024, the global embedded finance market was projected to reach significant figures, with some estimates suggesting it could handle trillions of dollars in transactions annually, demonstrating its growing impact as a substitute.

The convenience and contextual relevance offered by embedded finance present a direct challenge to traditional banks. Customers may opt for these integrated solutions due to their ease of use and immediate availability, potentially reducing their reliance on conventional banking channels for everyday financial needs.

Key aspects of this substitute threat include:

- Seamless Integration: Financial services are embedded within customer journeys on non-financial platforms.

- Point-of-Need Access: Consumers access financial products at the exact moment of need, like at checkout.

- Reduced Friction: Eliminates the need for separate applications or direct engagement with a bank.

- Market Growth: The embedded finance market is experiencing rapid expansion, indicating a significant shift in consumer behavior.

The threat of substitutes for traditional banking services is multifaceted, encompassing digital alternatives and integrated financial solutions. These substitutes often offer greater convenience, lower costs, or specialized services that directly challenge Blue Ridge Bank's offerings.

Fintech companies, credit unions, and non-bank lenders are actively capturing market share by providing more attractive rates and streamlined processes. For instance, in 2024, fintech lenders were projected to originate a significant portion of U.S. consumer loans, while credit unions often offered lower auto loan rates compared to major banks. Robo-advisors also present a strong substitute in wealth management, with the global market expected to manage hundreds of billions of dollars in assets by 2024, driven by lower fees and accessibility for younger investors.

Embedded finance further amplifies this threat by integrating financial services into non-financial platforms, allowing consumers to access credit or make payments at the point of need. The rapid growth of the embedded finance market, potentially handling trillions in transactions annually by 2024, highlights a significant shift in consumer behavior away from traditional banking interactions.

| Substitute Type | Key Advantage | 2024 Market Indicator |

|---|---|---|

| Fintech Lenders | Streamlined process, competitive rates | Significant share of U.S. consumer loan originations |

| Credit Unions | Lower fees, better interest rates | Often lower auto loan rates than commercial banks |

| Robo-Advisors | Lower management fees (0.25%-0.50% annually), accessibility | Global market managing hundreds of billions in AUM |

| Embedded Finance | Convenience, point-of-need access | Potential for trillions in annual transactions |

Entrants Threaten

The threat of new entrants in banking remains relatively low, largely due to the substantial capital requirements and the complex web of regulatory hurdles. For instance, establishing a new national bank in the US typically requires a minimum of $1 million in capital, with many needing significantly more to meet operational and reserve demands. In 2024, the ongoing scrutiny from bodies like the Federal Reserve and the Office of the Comptroller of the Currency means that securing a banking charter is a lengthy and resource-intensive undertaking, discouraging many potential new players.

New players entering the banking sector face significant hurdles in building customer trust and a solid brand reputation, which are cornerstones of financial services. This process demands substantial time and capital investment. For instance, in 2024, the average cost for a new bank to acquire a customer can range from $50 to $200, depending on the marketing channels used.

Convincing consumers to entrust their hard-earned money to an unknown entity is a formidable task, particularly when competing against established institutions like Blue Ridge Bank, which benefits from decades of customer loyalty and a proven track record. By the end of 2023, Blue Ridge Bank reported a customer retention rate of 92%, highlighting the difficulty new entrants face in dislodging loyal customers.

The threat of new entrants for Blue Ridge Bank is moderate. Establishing a fully compliant and secure banking operation requires significant upfront investment in technology. This includes core banking systems, robust cybersecurity, and user-friendly digital platforms, with costs often running into millions of dollars for even smaller institutions. For example, in 2024, many fintech startups focused on niche banking services still faced substantial capital requirements to build out their infrastructure, often needing to secure tens of millions in funding before even launching.

Threat of New Entrants 4

The threat of new entrants for Blue Ridge Bank is moderately high, largely due to the significant capital requirements and extensive regulatory hurdles inherent in the banking sector. Establishing a new bank demands substantial upfront investment in technology, infrastructure, and regulatory compliance, creating a formidable barrier for many potential competitors.

Talent acquisition poses another significant challenge. New banks must attract and retain experienced professionals in crucial areas like banking operations, compliance, risk management, and customer service. The competition for these skilled individuals, especially in specialized financial roles, can be intense, driving up labor costs and making it difficult for newcomers to build a robust and competent team.

- Capital Requirements: New banks need millions in capital to meet regulatory standards, a significant barrier to entry.

- Regulatory Hurdles: Obtaining banking licenses and adhering to strict compliance regulations is a lengthy and costly process.

- Skilled Labor Competition: Banks compete for talent in compliance, risk management, and IT, with average salaries for compliance officers in the US reaching around $80,000-$100,000 annually in 2024.

- Brand Recognition and Trust: Established banks like Blue Ridge Bank benefit from existing customer loyalty and a trusted brand, which new entrants must work hard to build.

Threat of New Entrants 5

While traditional banking faces high barriers like capital requirements and regulatory hurdles, the financial landscape is shifting. The rise of fintech companies, often operating with leaner cost structures and innovative digital platforms, presents a new avenue for entry into specific banking services. For instance, by early 2024, venture capital funding for fintech startups globally had already reached tens of billions, indicating significant investment in these disruptive models.

Furthermore, the potential for large technology firms, with their vast customer bases and technological prowess, to acquire banking licenses or partner with existing institutions could significantly lower the effective barrier to entry for certain segments of the market. These so-called challenger banks can leverage technology to offer services with substantially lower overhead compared to legacy institutions, directly impacting market share and customer acquisition.

- Fintech Disruption: Challenger banks are unbundling traditional banking services, focusing on niche areas like payments, lending, or wealth management, often with superior user experience.

- Technology Giants: Companies like Apple and Google are increasingly offering financial services, leveraging their existing ecosystems to attract users.

- Regulatory Evolution: Open banking initiatives in various regions are designed to foster competition by allowing third-party providers access to customer data with consent, potentially easing entry for new players.

- Capital Efficiency: Digital-first banks require less physical infrastructure, leading to lower operating costs and the ability to offer more competitive pricing.

The threat of new entrants for Blue Ridge Bank is moderate. While traditional banking requires substantial capital and faces rigorous regulatory oversight, fintech innovation is lowering some barriers. For example, in 2024, the cost to build a basic digital banking platform can be significantly less than establishing a brick-and-mortar branch network, allowing agile startups to target specific customer segments.

New entrants must overcome established brand loyalty, a significant hurdle given Blue Ridge Bank's 2023 customer retention rate of 92%. Building trust and acquiring customers, which can cost $50-$200 per customer in 2024, demands considerable marketing investment. Furthermore, competition for skilled banking talent, with compliance officers earning $80,000-$100,000 annually in 2024, adds to the operational cost for newcomers.

| Factor | Impact on New Entrants | Blue Ridge Bank's Position |

| Capital Requirements | High (Millions needed for charter, tech, compliance) | Established, well-capitalized |

| Regulatory Hurdles | Significant (Lengthy licensing, ongoing compliance) | Experienced in compliance |

| Brand Recognition & Trust | Low (Needs years and investment to build) | High (92% customer retention in 2023) |

| Technology Investment | High (Core systems, cybersecurity, digital platforms) | Ongoing upgrades, competitive digital offerings |

| Talent Acquisition | Challenging (Competition for specialized roles) | Established HR and competitive compensation |

Porter's Five Forces Analysis Data Sources

Our Blue Ridge Bank Porter's Five Forces analysis is built upon a foundation of comprehensive data, including SEC filings, annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial statements. This blend of official disclosures and expert analysis ensures a robust understanding of the competitive landscape.