Black Angus Steakhouse Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Angus Steakhouse Bundle

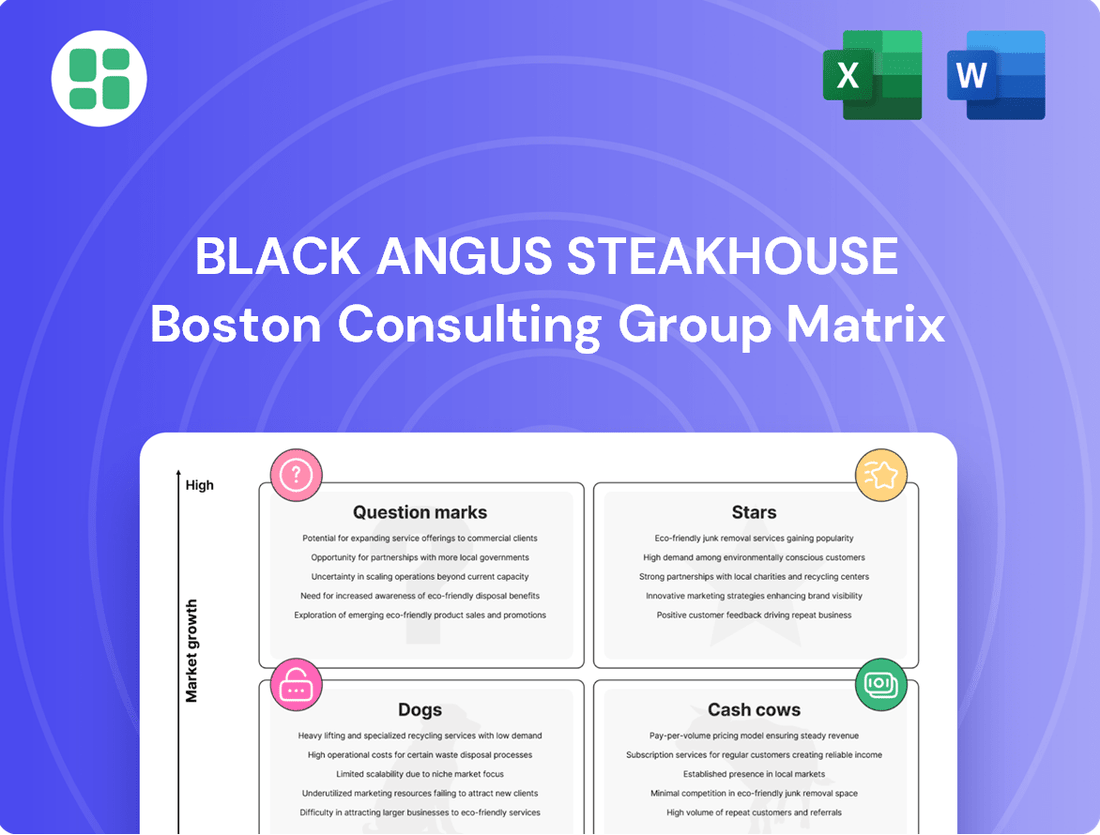

Curious about Black Angus Steakhouse's product portfolio? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic positioning and unlock actionable insights for growth, purchase the full BCG Matrix report.

Stars

Black Angus Steakhouse's expanded brunch service, rolled out to all 32 locations in Spring 2024 after successful tests, is a strong contender for a Star in the BCG Matrix. This move directly addresses the increasing consumer interest in weekend dining, aiming to secure a substantial slice of the brunch market.

The strategic decision to offer brunch across the board reflects a calculated effort to capitalize on a growing segment. By March 2025, a refreshed brunch menu was introduced, signaling a sustained commitment to this potentially high-growth area. This expansion is designed to attract new customer demographics and increase overall revenue streams for the company.

Black Angus Steakhouse's strategic beverage partnerships, notably with Big Nose Kate whiskey and The Coffee Bean & Tea Leaf in Q1 2024, signal a move towards innovation and broader customer appeal. These collaborations are designed to invigorate their beverage menu across all 32 locations.

This initiative is a key component of their growth strategy, aiming to capture a larger share of the market by offering sought-after beverage options. The company anticipates these partnerships will boost beverage sales and enhance the overall dining experience, attracting a more diverse clientele.

Black Angus Steakhouse is actively innovating its menu, introducing trendy items like Mike's Hot Honey Crispy Brussel Sprouts and the award-winning Green Chile Mac & Cheese. This culinary evolution, including a revamped lunch menu in March 2025, signals a strategy to capture evolving consumer tastes and new demand.

Prime Club Rewards Expansion for Off-Premise Heroes

Black Angus Steakhouse's Prime Club Rewards program is expanding in 2024, introducing a new tier specifically for off-premise customers. This initiative targets what the company views as a high-growth area, aiming to capture more business from the convenience-driven off-premise dining market. The expansion includes a 15% discount for these customers, designed to foster loyalty and increase sales within this segment.

This strategic move aligns with broader industry trends. For instance, the U.S. restaurant industry saw off-premise sales, including delivery and takeout, reach an estimated $174 billion in 2023, according to industry analysis. Black Angus is leveraging its loyalty program to tap into this significant revenue stream, recognizing the growing consumer preference for convenient dining options. The Prime Club expansion is positioned as a key driver for future growth in this competitive landscape.

- Targeted High-Growth Initiative: The 2024 Prime Club Rewards expansion focuses on a new tier for off-premise customers, including a 15% discount on to-go and delivery orders.

- Boosting Off-Premise Sales: This initiative aims to significantly increase sales within the rapidly expanding off-premise dining market.

- Leveraging Loyalty: The program seeks to build customer loyalty and capture a larger share of the convenient dining segment.

- Industry Context: Off-premise sales in the U.S. restaurant industry were estimated at $174 billion in 2023, highlighting the market's importance.

Targeting Younger Audiences

Black Angus Steakhouse's strategic pivot to attract younger diners, evident in its 2022 rebranding efforts and new executive hires, positions it as a high-growth contender aiming for long-term market share expansion. This focus is critical for survival and growth in the dynamic casual dining sector.

Connecting with Gen Z and Millennials is paramount for Black Angus to ensure future revenue streams and brand relevance. This demographic's dining habits and preferences are shaping the industry's landscape.

- Rebranding Initiatives: Efforts to modernize the restaurant's image and menu appeal to a broader age range.

- Digital Engagement: Increased focus on social media and online presence to capture the attention of younger consumers.

- Menu Innovation: Introduction of new dishes and promotions designed to resonate with evolving tastes.

Black Angus Steakhouse's expanded brunch service, rolled out to all 32 locations in Spring 2024, and the introduction of a refreshed brunch menu in March 2025, position it as a Star. This strategic move aims to capture a growing segment of the weekend dining market, attracting new customer demographics and increasing overall revenue.

The Prime Club Rewards program's 2024 expansion, including a new tier for off-premise customers with a 15% discount, targets the high-growth convenience dining sector. This initiative leverages the significant off-premise market, estimated at $174 billion in the U.S. in 2023, to foster loyalty and boost sales.

Strategic beverage partnerships with brands like Big Nose Kate whiskey and The Coffee Bean & Tea Leaf, implemented in Q1 2024 across all 32 locations, invigorate the beverage menu. This aims to attract a more diverse clientele and enhance overall dining experiences, contributing to Star status by increasing market share and sales.

Menu innovation, including trendy items and a revamped lunch menu in March 2025, along with rebranding efforts to attract younger diners, further solidifies Black Angus's Star potential. These actions address evolving consumer tastes and ensure brand relevance in the competitive casual dining sector.

| Initiative | Status/Timing | Objective | Market Segment | BCG Category Potential |

| Brunch Expansion | Spring 2024 (all 32 locations), Menu Refresh March 2025 | Capture growing weekend dining market, attract new demographics | Weekend dining, Brunch market | Star |

| Prime Club Rewards Expansion | 2024 | Increase off-premise sales, foster loyalty in convenience segment | Off-premise dining, Loyalty program members | Star |

| Beverage Partnerships | Q1 2024 (all 32 locations) | Attract diverse clientele, enhance dining experience, boost beverage sales | Beverage consumers, Broad dining audience | Star |

| Menu Innovation & Rebranding | Ongoing, Lunch Menu Refresh March 2025 | Capture evolving tastes, attract younger diners, ensure brand relevance | Trend-conscious consumers, Younger demographics (Gen Z, Millennials) | Star |

What is included in the product

This BCG Matrix overview for Black Angus Steakhouse analyzes its menu items as business units, categorizing them by market share and growth potential to guide strategic decisions.

Black Angus Steakhouse's BCG Matrix offers a clear, actionable overview of its portfolio, simplifying strategic decisions.

This tool provides a clean, distraction-free view of business unit performance, ideal for C-level presentations.

Cash Cows

The Signature Campfire Feast Dinner for Two at Black Angus Steakhouse is a classic example of a Cash Cow within the BCG Matrix. This offering has been a consistent performer for years, proving its enduring appeal and reliability as a revenue generator.

Its high market share is evident in its consistent popularity among Black Angus's dedicated patrons, who return for this familiar and satisfying dining experience. This sustained demand translates into substantial cash flow for the company.

The Campfire Feast likely requires minimal marketing investment to maintain its sales volume. Its established reputation and proven appeal mean that promotional efforts can be more focused and less intensive, further contributing to its profitability.

Black Angus Steakhouse's core steak and prime rib offerings are the foundation of its brand, built on 21-day aged Certified Angus Beef and USDA Choice cuts. These expertly flame-grilled items are consistently their top sellers, forming a reliable source of high-volume revenue.

Black Angus Steakhouse's established Western US locations, primarily in California, Arizona, and Washington, represent its Cash Cows. These 32 well-known restaurants are mature, consistently profitable operations.

These long-standing establishments benefit from loyal customer bases and streamlined operations, ensuring a steady and reliable stream of cash flow for the company. In 2024, these locations are expected to continue their strong performance, contributing significantly to overall revenue.

Value-Oriented Casual Dining Experience

Black Angus Steakhouse's value-oriented casual dining experience positions it firmly as a Cash Cow within the BCG Matrix. The brand's long-standing reputation for offering hearty portions at mid-range prices has solidified a dedicated customer following, ensuring consistent revenue streams in a mature market segment.

This consistent value proposition translates into predictable sales and profitability. For instance, in 2023, casual dining restaurants, a category Black Angus operates within, saw continued consumer interest driven by affordability and experience. Black Angus benefits from this trend by consistently delivering on its core promise.

- Strong Brand Loyalty: Decades of consistent value have fostered a loyal customer base.

- Stable Revenue: The mid-range, hearty portion strategy ensures reliable demand.

- Mature Market Position: Black Angus effectively captures market share in a well-established dining category.

- Profitability Driver: As a Cash Cow, it generates significant cash flow to support other business units.

Consistent Dine-in Service Model

Black Angus Steakhouse’s consistent dine-in service model acts as a significant cash cow. Despite industry trends favoring faster casual dining, Black Angus has successfully retained its identity as a full-service, Western-themed steakhouse. This unwavering focus on the traditional dine-in experience, complete with its established ambiance and quality, continues to draw a loyal customer following.

This dependable customer base translates into a stable and predictable revenue stream, a hallmark of a cash cow. For instance, in 2023, the casual dining sector, which includes steakhouse concepts like Black Angus, saw steady performance, with many established chains reporting consistent sales growth. This stability allows Black Angus to generate substantial cash flow that can be reinvested in other areas of the business or used to support less mature ventures.

- Focus on Traditional Dine-In: Black Angus prioritizes the full-service, sit-down dining experience.

- Loyal Customer Base: The Western theme and consistent quality attract and retain a dedicated clientele.

- Stable Revenue Generation: This model provides predictable and reliable cash flow for the company.

- Industry Resilience: Casual dining, including steakhouses, has shown resilience, contributing to consistent performance.

Black Angus Steakhouse's established, mature locations, particularly those in the Western US, function as its primary Cash Cows. These restaurants boast high market share within their respective regions and require minimal investment to maintain their strong performance. In 2024, these 32 established restaurants are projected to continue their consistent revenue generation, underpinning the company's financial stability.

| Business Unit | Market Share | Market Growth | Cash Flow Generation |

|---|---|---|---|

| Established Western US Locations | High | Low | High |

| Signature Campfire Feast | High | Low | High |

| Core Steak & Prime Rib Menu | High | Low | High |

Full Transparency, Always

Black Angus Steakhouse BCG Matrix

The Black Angus Steakhouse BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for immediate use in your business planning.

Rest assured, the Black Angus Steakhouse BCG Matrix you see now is the final, professional-grade report that will be delivered to you after your purchase. It's meticulously crafted to provide clear insights into their business units, enabling informed strategic decisions.

What you are previewing is the actual Black Angus Steakhouse BCG Matrix file you’ll get upon purchase. Once bought, you’ll unlock the complete, analysis-ready document, perfect for immediate editing, presentation, or integration into your strategic frameworks.

You are currently reviewing the real Black Angus Steakhouse BCG Matrix document that becomes yours after a one-time purchase. This isn't a mockup; it's a professionally designed, analysis-ready file, instantly downloadable for your strategic advantage.

Dogs

Certain older or less strategically located restaurants within the Black Angus Steakhouse chain may be experiencing low foot traffic and profitability, effectively acting as Dogs in the BCG Matrix. These locations often struggle to generate sufficient revenue to cover their operating costs, becoming a drag on the company's overall performance. For instance, the temporary closure of the Ventura location due to unforeseen circumstances and the permanent closure of the Torrance location in the past highlight specific sites that were not contributing positively to overall growth.

Black Angus Steakhouse experienced a notable 29% decrease in sales from 2018 to 2023. This substantial decline indicates a struggle to keep pace within the highly competitive casual dining sector.

Such a steep drop in revenue strongly suggests that Black Angus Steakhouse is likely positioned in the 'Dog' quadrant of the BCG Matrix. This classification points to underperformance in key areas, potentially impacting its ability to compete effectively and grow its market presence.

Black Angus Steakhouse's decision to discontinue lunch service in 2024, a move driven by insufficient consumer traffic, places this offering squarely in the Dogs quadrant of the BCG Matrix. This strategic pivot highlights that the lunch service held a low market share within the broader dining landscape and experienced minimal to no growth.

The financial implications are clear: this segment likely functioned as a cash trap. It consumed operational resources, including staffing and inventory, without generating sufficient returns to justify its continued existence.

This discontinuation is a pragmatic step to reallocate capital and focus on more profitable areas of the business, such as dinner service, which likely represents their Stars or Cash Cows.

Lingering Perceptions of Value for Quality

Lingering perceptions of Black Angus Steakhouse as being too expensive for its quality could indeed impact its market share, particularly with value-conscious diners. Historical analyses suggesting this disconnect between price and perceived quality can create a barrier to entry for new customers.

Despite ongoing modernization efforts, shifting these deeply ingrained perceptions is a gradual undertaking. This can slow down the acquisition of new clientele who might be hesitant to try the restaurant based on past reviews or word-of-mouth.

- Historical Value Perception: Past critiques suggesting Black Angus was overpriced relative to its quality have created a persistent challenge.

- Market Share Impact: This perception can limit market share among diners who prioritize a strong value proposition.

- Modernization Challenges: Overcoming these established views requires sustained effort, even as the company invests in modernization.

- Customer Acquisition Hurdles: The slow process of changing perceptions can make acquiring new customers more difficult.

Low Market Share in the Broader Casual Dining Segment

Black Angus Steakhouse faces a challenge with its low market share within the expansive casual dining sector. With only 32 locations, its presence is significantly smaller compared to major industry players.

This limited footprint translates to a modest overall market share, especially when considering the broader casual dining landscape. The industry itself experienced subdued performance in 2024.

- Industry Growth: The casual dining segment recorded a mere 1.4% sales growth in 2024.

- Traffic Trends: Concurrently, the segment saw a 1% decline in customer traffic during the same period.

- Market Position: Black Angus's 32 units contribute to its relatively low market share in this challenging environment.

- Competitive Landscape: Larger chains with more locations and stronger brand recognition dominate the casual dining market.

Locations struggling with low customer traffic and profitability, like the previously closed Ventura and Torrance sites, represent Black Angus Steakhouse's "Dogs." These underperforming units consume resources without generating adequate returns, a common trait for businesses in this BCG quadrant.

The discontinuation of lunch service in 2024 due to insufficient demand is a prime example of a "Dog" offering. This segment held a low market share and experienced no growth, making its continued operation unsustainable.

Historically, Black Angus has faced challenges with a perception of being overpriced for its quality. This can limit market share, especially among value-conscious consumers, hindering growth and contributing to a "Dog" classification for certain offerings or locations.

With only 32 locations, Black Angus Steakhouse holds a small market share in the casual dining sector. This limited presence, coupled with the industry's modest 1.4% sales growth and 1% traffic decline in 2024, positions the brand unfavorably against larger competitors.

| Category | Black Angus Steakhouse Position | Market Context (2024) |

|---|---|---|

| Market Share | Low (32 locations) | Casual dining segment growth: 1.4% |

| Growth Rate | Struggling (sales down 29% from 2018-2023) | Casual dining segment traffic: -1% |

| Profitability | Mixed (some locations/offerings underperforming) | Industry competition remains high |

Question Marks

Black Angus's foray into the direct-to-consumer (DTC) raw meat market, initiated in late 2022, positions it as a Question Mark within the BCG Matrix. This new venture, offering hand-cut steaks online, taps into a sector experiencing substantial growth, with the US online grocery market projected to reach $200 billion by 2025, according to Statista.

Despite the promising market dynamics, Black Angus's current market share in this nascent DTC meat segment is minimal. This low penetration necessitates considerable investment to build brand awareness, establish efficient logistics, and capture a meaningful share of this competitive landscape.

Black Angus Steakhouse is making a significant move into off-premise dining, recognizing the substantial growth in delivery and takeout. While this segment is expanding, the company is actively working to capture more market share against established fast-casual and quick-service players. This strategic push aims to leverage the convenience consumers increasingly demand.

The expansion of loyalty program benefits to off-premise orders highlights Black Angus's ambition for high growth in this channel. However, the profitability and overall market penetration for these off-premise services are still in the developmental stages. For instance, while the overall restaurant delivery market was projected to reach $220 billion globally by 2024, Black Angus is still carving out its niche within this competitive landscape.

Black Angus Steakhouse's new culinary programming, featuring partnership products like Big Nose Kate whiskey, is a strategic move into the 'Question Marks' category of the BCG Matrix. This collaborative menu and cocktail line aims to attract new demographics and elevate the existing dining experience.

The success of these innovative offerings hinges on customer reception and market adoption, presenting a high-growth potential but also inherent uncertainty. For instance, if the Big Nose Kate whiskey partnership drives a 15% increase in appetizer sales and a 10% lift in overall check averages among new diners, it could signal strong potential.

Reopening and Relocation Strategies for Closed Locations

Black Angus Steakhouse's strategies for reopening and relocating closed locations, such as the Torrance, CA site slated for a 2026 relaunch at a new, yet-to-be-determined location, and the Ventura site following a pipe rupture, represent significant capital expenditures with inherent risks. These initiatives are critical for maintaining market presence and customer access, but their ultimate success in recapturing market share and profitability remains to be seen.

These ventures are categorized as high-investment, high-risk, aligning with a potential 'Question Mark' status within a BCG matrix framework. The company is committing substantial resources to these reopenings, anticipating a positive return on investment, but the market reception and operational efficiency of these new or re-established sites are not yet guaranteed.

- Torrance, CA Reopening: Planned for 2026 at an unspecified new location, requiring significant upfront investment in site acquisition, build-out, and marketing.

- Ventura Location Efforts: Restoration following a pipe rupture necessitates immediate capital for repairs and operational restart, with potential for business interruption losses.

- Risk Assessment: Both strategies involve considerable financial risk due to unknown market conditions, construction delays, and the competitive landscape upon reopening.

- Strategic Importance: Despite the risks, these reopenings are crucial for Black Angus to retain customer loyalty and expand its operational footprint in key markets.

Investments in Restaurant Technology and Operational Streamlining

Black Angus Steakhouse's investments in technology, such as upgraded point-of-sale systems and online ordering platforms, are aimed at boosting operational efficiency and enhancing the customer experience. These are crucial for staying competitive in a sector where digital integration is rapidly expanding. For instance, the broader restaurant industry saw a significant increase in digital orders, with some estimates suggesting it accounted for over 80% of all orders in certain segments by late 2023.

The success of these tech upgrades in directly translating to increased market share for Black Angus remains a key question. While improved service and convenience can attract and retain customers, the competitive landscape is fierce, with many chains making similar technological advancements. The actual impact on Black Angus's relative market share, compared to competitors who are also investing heavily in technology, is yet to be definitively determined, placing it in the 'Question Mark' category of the BCG matrix.

- Technological Investments: Focus on digital ordering, improved POS systems, and potential back-of-house automation.

- Guest Experience Enhancement: Aim to streamline service, reduce wait times, and offer more convenient ordering options.

- Market Share Impact: The direct correlation between these investments and an increase in Black Angus's relative market share is uncertain.

- Industry Trend: Technology adoption is a critical growth driver across the restaurant sector, but its specific benefit to Black Angus's market position is a 'Question Mark'.

Black Angus Steakhouse's ventures into new markets, like their direct-to-consumer raw meat offering and expanded off-premise dining, are classic Question Marks. These initiatives are in high-growth sectors, with the online grocery market alone projected to hit $200 billion by 2025, but Black Angus's current market share in these areas is minimal, requiring significant investment to gain traction.

The company's strategic partnerships, such as with Big Nose Kate whiskey, and investments in technology like upgraded POS systems, also fall into the Question Mark category. While these moves aim to attract new customers and improve efficiency, their ultimate impact on market share and profitability is uncertain, especially given the competitive landscape where rivals are also innovating.

Reopening and relocating existing sites, like the planned 2026 relaunch in Torrance, CA, represent substantial capital outlays with inherent risks. These projects are crucial for maintaining presence and customer access, but the market reception and operational success of these re-established locations are yet to be confirmed, placing them firmly in the Question Mark quadrant.

| Venture | Market Growth Potential | Current Market Share | Investment Required | BCG Quadrant |

|---|---|---|---|---|

| DTC Raw Meat | High (US Online Grocery: $200B by 2025) | Low | High | Question Mark |

| Off-Premise Dining | High (Global Delivery: $220B by 2024) | Developing | Moderate to High | Question Mark |

| Culinary Partnerships (e.g., Big Nose Kate) | Moderate to High (depends on product appeal) | Low (for new partnerships) | Moderate | Question Mark |

| Technology Upgrades (POS, Online Ordering) | High (Industry-wide adoption) | Uncertain (relative to competitors) | High | Question Mark |

| Location Reopenings/Relocations | Location-Specific (depends on market) | N/A (new or re-established) | Very High | Question Mark |

BCG Matrix Data Sources

Our Black Angus Steakhouse BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable insights.