BioMarin Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BioMarin Pharmaceutical Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping BioMarin Pharmaceutical's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate industry complexities and identify strategic opportunities. Download the full report now for a decisive market advantage.

Political factors

The regulatory landscape, particularly concerning orphan drugs, profoundly shapes BioMarin's operations. The U.S. Food and Drug Administration's (FDA) Orphan Drug Designation program, alongside similar international efforts, provides crucial incentives for developing treatments for rare diseases. In 2023 alone, the FDA greenlit 53 new orphan drug approvals, adding to the 624 rare disease treatments approved since the program's inception, underscoring a favorable environment for companies like BioMarin.

BioMarin actively leverages these supportive frameworks, holding 7 active FDA orphan drug designations as of 2024. This strong alignment with regulatory initiatives highlights the company's strategic focus on rare genetic disorders and its success in navigating the pathways designed to encourage such specialized drug development.

Government healthcare spending and research funding are critical drivers for companies like BioMarin, particularly in the rare disease sector. Fluctuations in these areas can significantly alter market dynamics. For instance, in 2023, the National Institutes of Health (NIH) dedicated around $6.5 billion to rare disease research, marking a 4.2% rise in federal research investment.

Furthermore, the political landscape is showing increasing support for rare disease innovation. Proposed legislation aims to bolster tax credits for rare disease research and potentially streamline approval processes for new therapies, creating a more favorable environment for BioMarin's pipeline and commercialization efforts.

Global pharmaceutical trade policies are pivotal for BioMarin's ability to reach patients worldwide. While the company has minimal direct exposure to U.S. tariffs on goods from China, Mexico, and Canada impacting its supply chain and sales, broader international trade agreements and regulations significantly shape how its rare disease therapies can be distributed and adopted in various markets.

Drug Pricing and Reimbursement Policies

Government and payer reimbursement policies are absolutely crucial for the commercial viability of BioMarin's specialized, high-priced therapies for rare diseases. These policies directly impact patient access and, consequently, BioMarin's revenue streams.

For example, BioMarin's gene therapy Roctavian, designed for hemophilia A, has encountered significant reimbursement challenges in various markets. This has led the company to strategically concentrate its commercial rollout and sales efforts primarily in countries with more established reimbursement frameworks, such as the United States, Germany, and Italy.

The complexities of drug pricing and reimbursement can significantly affect BioMarin's market penetration and overall financial performance. Navigating these evolving landscapes is a key strategic consideration for the company.

- Roctavian's Market Focus: BioMarin's Roctavian, a gene therapy for hemophilia A, is currently prioritized for commercialization in markets with established reimbursement, including the US, Germany, and Italy, due to pricing and reimbursement complexities in other regions.

- Impact on Rare Disease Therapies: Reimbursement policies for high-cost, specialized treatments are a critical determinant of market access and commercial success for BioMarin's portfolio.

- Navigating Payer Landscapes: BioMarin must continually adapt to diverse and evolving payer policies globally to ensure patient access to its life-changing therapies.

Political Stability and Geopolitical Risks

Political stability in BioMarin's key markets, such as the United States and Europe, is crucial for predictable regulatory pathways and sustained market access. Geopolitical tensions or instability in regions where BioMarin operates or sources materials can disrupt its global supply chains and hinder international expansion plans. For instance, the ongoing geopolitical shifts in Eastern Europe and the Middle East in 2024 continue to present potential risks to global trade and investment, indirectly impacting companies like BioMarin.

A stable political environment fosters consistent healthcare policies and reimbursement frameworks, which are vital for pharmaceutical companies. BioMarin's reliance on government approvals and pricing regulations means that shifts in political power or policy direction can significantly influence its revenue streams and strategic decisions. The pharmaceutical sector, in particular, is sensitive to government funding for research and development, as well as policies affecting drug pricing and market exclusivity.

- US Political Climate: The U.S. remains BioMarin's largest market, making the political landscape and healthcare policy decisions in Washington D.C. a primary concern.

- European Union Regulations: Navigating the diverse political and regulatory environments across EU member states is essential for BioMarin's European market penetration.

- Global Supply Chain Vulnerabilities: Geopolitical events in 2024 have highlighted the fragility of global supply chains, a factor that could affect BioMarin's access to raw materials and distribution networks.

- R&D Funding and Healthcare Policy: Government support for rare disease research and evolving healthcare policies directly impact BioMarin's ability to bring new therapies to market and secure favorable pricing.

Government incentives and regulatory support for rare disease treatments remain a significant tailwind for BioMarin. The U.S. FDA's Orphan Drug Designation program continues to be a key driver, with 7 active designations for BioMarin as of 2024, reflecting the company's strategic alignment with these policies. Furthermore, increased federal investment in rare disease research, such as the NIH's approximately $6.5 billion allocation in 2023, signals a favorable political climate for innovation in this sector.

Navigating diverse global reimbursement policies is critical, as demonstrated by BioMarin's strategic focus on markets like the US, Germany, and Italy for its gene therapy Roctavian due to pricing and reimbursement complexities elsewhere. Political stability in key markets like the US and EU is essential for predictable policy environments, while geopolitical shifts in 2024 underscore potential vulnerabilities in global supply chains and international expansion.

| Factor | BioMarin Relevance | 2023/2024 Data Point |

| Orphan Drug Incentives | Facilitates development of rare disease therapies | 7 active FDA orphan drug designations for BioMarin (2024) |

| Government Research Funding | Supports R&D in rare diseases | NIH rare disease research funding: ~$6.5 billion (2023) |

| Reimbursement Policies | Impacts market access and revenue for high-cost therapies | Roctavian prioritized in US, Germany, Italy due to reimbursement |

| Geopolitical Stability | Affects supply chain and market access | Global geopolitical shifts in 2024 present supply chain risks |

What is included in the product

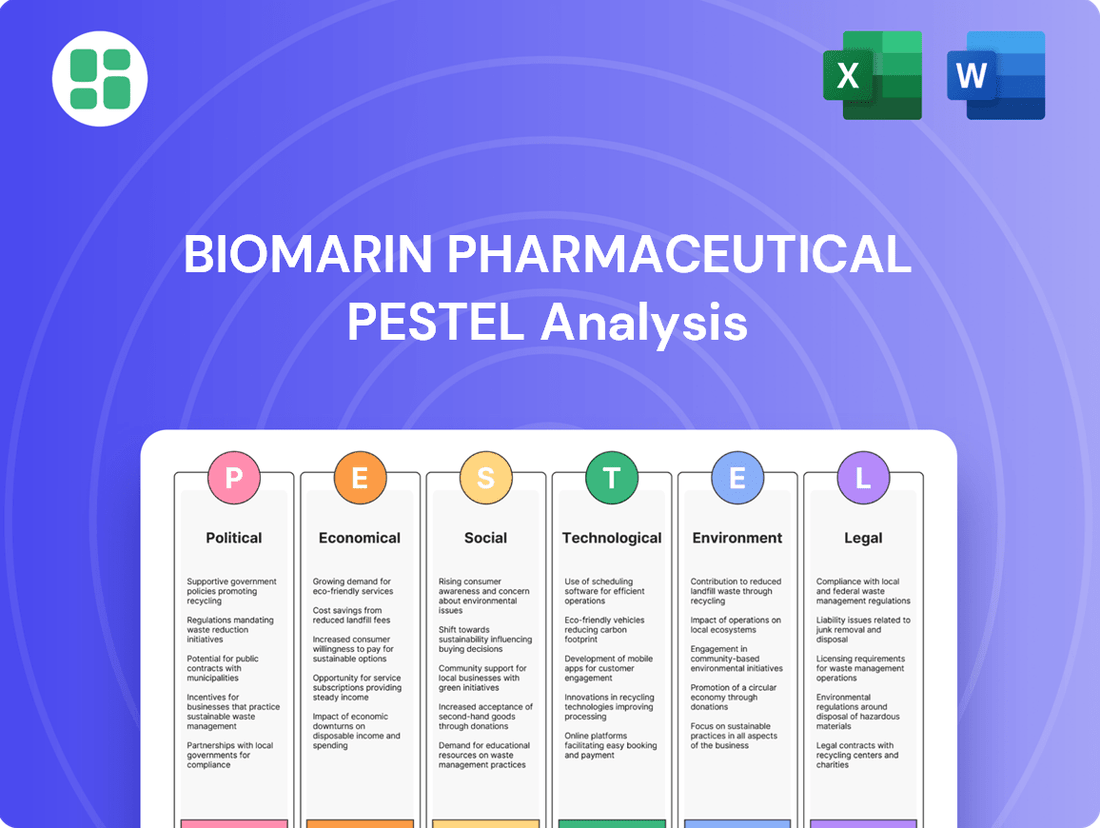

This PESTLE analysis offers a comprehensive examination of the external forces shaping BioMarin Pharmaceutical's operating landscape, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights into potential threats and opportunities, enabling strategic decision-making and proactive adaptation to industry trends.

A concise BioMarin PESTLE analysis, presented in a clear, summarized format, serves as a pain point reliever by offering quick referencing for critical external factors during strategic discussions.

Economic factors

The global rare disease treatment market is expanding, reaching $161.3 billion in 2022 and expected to hit $236.7 billion by 2027, presenting a substantial growth avenue for BioMarin.

However, BioMarin's financial performance is closely tied to the volatility of healthcare spending and reimbursement policies. In 2022, reimbursement rates across BioMarin's primary markets averaged 78.5%, a figure that directly impacts the company's revenue streams and overall profitability.

Broader global economic conditions, including the potential for downturns, can significantly influence healthcare spending and patient access to expensive therapies. For instance, in 2024, many developed economies are navigating persistent inflation and higher interest rates, which could lead to tighter budgets for healthcare systems and individuals alike, potentially impacting demand for BioMarin's specialized treatments.

While BioMarin focuses on rare genetic diseases, sectors where demand is often less elastic, economic pressures on healthcare systems and patients can still indirectly affect reimbursement rates and the ability of patients to afford out-of-pocket costs. As of early 2025 projections, global GDP growth is expected to be moderate, but regional variations and potential economic shocks could still create headwinds for widespread access to novel, high-cost pharmaceuticals.

The environment for research and development (R&D) investment, encompassing both government funding and private capital, plays a critical role in shaping BioMarin Pharmaceutical's ability to advance its pipeline of innovative treatments. BioMarin's robust financial standing, evidenced by its growing operating cash flow and substantial liquidity, directly fuels its capacity to invest in its pipeline and pursue strategic acquisitions, which are essential for maintaining its leadership in genetic therapies.

As of the first quarter of 2024, BioMarin reported an operating cash flow of $309 million, a notable increase from the previous year, underscoring its financial strength and commitment to innovation. This financial health is paramount for BioMarin as it navigates the high costs and long timelines associated with developing cutting-edge genetic therapies, ensuring a steady stream of investment into promising research and development initiatives.

Inflation and Interest Rates

Inflation and interest rates significantly influence BioMarin Pharmaceutical's financial landscape. Rising inflation can increase operational expenses, from raw materials to labor, impacting profitability. Higher interest rates, like the Federal Reserve's target range of 5.25%-5.50% as of early 2024, make borrowing more expensive, potentially hindering BioMarin's ability to finance crucial research and development projects or strategic acquisitions.

These macroeconomic forces also affect investment returns on BioMarin's cash reserves and the valuation of its future earnings. For instance, a higher discount rate due to increased interest rates can lower the present value of expected cash flows, a key consideration in valuation models like Discounted Cash Flow (DCF). While BioMarin's specific financial reports might not flag inflation and interest rates as primary risks, their pervasive impact on cost of capital and investment attractiveness remains a constant consideration for any global pharmaceutical company.

- Inflationary pressures can directly increase BioMarin's cost of goods sold and R&D expenditures.

- Rising interest rates impact the cost of debt financing for capital-intensive projects and can reduce the attractiveness of long-term investments.

- Global economic uncertainty, often linked to inflation and interest rate volatility, can affect patient access to expensive therapies and healthcare budgets.

Competitive Landscape and Market Saturation

The rare disease market, BioMarin's core focus, is becoming increasingly crowded. This heightened competition can lead to pricing pressures and a struggle to maintain market share for its specialized treatments. For instance, in 2024, several new gene therapies for conditions like hemophilia entered or were nearing market entry, directly challenging BioMarin's existing and pipeline products.

BioMarin's global expansion strategy faces hurdles, particularly with high-priced therapies. The adoption of Roctavian, a gene therapy for severe hemophilia A, has been slower than expected in certain European markets in 2024, partly due to reimbursement challenges and the need for specialized treatment centers. This indicates that market penetration for novel, expensive treatments requires significant effort beyond product approval.

Key competitive factors impacting BioMarin include:

- Intensifying competition: The rise of other biotech firms focusing on gene and cell therapies for rare diseases.

- Market saturation: In certain niche indications, the number of available therapies is growing, fragmenting patient populations.

- Pricing and reimbursement: Navigating diverse global healthcare systems for high-cost treatments remains a significant challenge.

- New market entry barriers: Establishing a presence and gaining traction for novel therapies in less developed rare disease markets.

BioMarin's financial health is bolstered by strong operating cash flow, with $309 million reported in Q1 2024, enabling significant R&D investment. However, persistent inflation and interest rates, such as the Fed's 5.25%-5.50% range in early 2024, increase operational costs and borrowing expenses, potentially impacting future financing for crucial projects and acquisitions.

Global economic uncertainty, characterized by moderate GDP growth projections for 2025 but with regional variations, can strain healthcare budgets and patient affordability for high-cost genetic therapies. Reimbursement rates, averaging 78.5% in BioMarin's key markets in 2022, are directly sensitive to these economic conditions, influencing revenue streams.

| Economic Factor | Impact on BioMarin | Data Point/Example |

|---|---|---|

| Inflation | Increases operational costs (COGS, R&D) | Rising raw material and labor costs |

| Interest Rates | Raises cost of debt financing, affects investment valuation | Federal Reserve target range: 5.25%-5.50% (early 2024) |

| Economic Growth | Influences healthcare spending and patient access | Moderate global GDP growth projected for 2025; regional variations exist |

| Reimbursement Policies | Directly impacts revenue streams | Average reimbursement rates: 78.5% (2022) |

Preview Before You Purchase

BioMarin Pharmaceutical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BioMarin Pharmaceutical covers all critical external factors influencing its operations and strategic decisions. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental aspects impacting the company.

Sociological factors

Societal shifts are significantly impacting the rare disease market, with a growing understanding and demand for specialized treatments. It's estimated that about one in every ten Americans, roughly 30 million people, live with a rare disease. This heightened awareness directly fuels market expansion, with projections indicating the rare disease sector could reach an impressive $442.98 billion by 2030, offering BioMarin a substantial avenue for growth.

BioMarin Pharmaceutical actively partners with patient advocacy groups, weaving their real-world experiences into its operations, from research and development to product lifecycle management. This commitment is evident in programs such as the Europe and Canada Patient Advocates Summit (ECPAS), fostering direct dialogue and incorporating patient perspectives into BioMarin's strategic direction.

The BioMarin RareConnections™ program further underscores this focus by providing dedicated support and resources for patients and their families, demonstrating a deep understanding of the unique challenges faced by individuals with rare genetic diseases. These collaborations ensure that BioMarin's business strategies remain aligned with the evolving needs and priorities of the patient communities it serves.

Societal demand for universal healthcare coverage and integrated care models significantly influences how BioMarin's specialized therapies reach patients. For instance, in 2024, many developed nations continue to grapple with expanding equitable access to advanced treatments, a trend likely to persist into 2025, impacting BioMarin's market penetration strategies.

Patient advocacy groups play a crucial role, often collaborating with BioMarin to overcome hurdles in accessing rare disease treatments. These groups, empowered by increasing societal awareness, actively push for policy changes and financial support mechanisms, ensuring that BioMarin's innovative therapies are not just developed but also accessible to those who need them most.

Public Perception of Biotechnology and Gene Therapy

Public perception of advanced biotechnologies, especially gene therapies, significantly shapes the market acceptance and adoption of BioMarin's innovative treatments. While the transformative potential of gene therapy is widely acknowledged, factors like patient hesitancy and the necessity for specialized administration infrastructure, as exemplified by the rollout of Roctavian, underscore the continuous importance of public understanding and trust.

Public trust in gene therapy is a crucial element for BioMarin's success. For instance, while the FDA approval of Roctavian in 2023 for severe hemophilia A was a landmark achievement, widespread patient and physician confidence in its long-term safety and efficacy will be key to its commercial uptake. Surveys in 2024 continue to show a mix of optimism and caution regarding gene editing technologies, with a significant portion of the public expressing concerns about potential unforeseen side effects.

- Public Awareness: Ongoing educational initiatives are vital to bridge the knowledge gap regarding the benefits and risks of gene therapy.

- Ethical Considerations: Societal views on genetic modification and its ethical implications can influence regulatory pathways and public acceptance.

- Trust in Institutions: Confidence in regulatory bodies and the pharmaceutical companies developing these therapies directly impacts patient willingness to undergo treatment.

- Accessibility Concerns: Perceived inequities in access to expensive gene therapies can also foster public skepticism.

Demographic Shifts and Disease Prevalence

Demographic shifts, while not always directly quantified in relation to rare diseases, can significantly impact diagnosis rates. For instance, an aging global population might see an increase in certain age-related conditions, though BioMarin's core focus remains on genetic disorders often diagnosed in childhood or early adulthood. The company's emphasis on early detection, as seen with treatments for achondroplasia, directly targets younger demographics, a strategy inherently influenced by population age structures and birth rates.

The prevalence of certain rare genetic diseases can be indirectly affected by demographic trends. For example, shifts in family planning or increased awareness campaigns in specific age groups can influence the diagnosis rates of conditions like phenylketonuria (PKU), a metabolic disorder BioMarin has historically addressed. As of 2024, global life expectancy continues to rise, potentially increasing the number of individuals living with chronic conditions, though the direct link to rare genetic diseases requires specific epidemiological data.

- Global Population Growth: The world population is projected to reach approximately 8.1 billion by mid-2025, creating a larger potential patient pool for rare disease treatments.

- Aging Demographics: While BioMarin focuses on rare genetic diseases often diagnosed early, an aging population globally could indirectly influence healthcare resource allocation and research priorities.

- Focus on Pediatric Populations: BioMarin's strategy to target conditions like achondroplasia in younger patients aligns with demographic trends showing a significant proportion of the population in pediatric and adolescent age groups.

- Increased Awareness and Diagnosis: Improved healthcare infrastructure and public health initiatives in various regions, driven by demographic needs, can lead to earlier and more accurate diagnoses of rare genetic disorders.

Societal awareness of rare diseases continues to grow, with an estimated 30 million Americans living with such conditions as of 2024. This heightened awareness is a significant driver for BioMarin, as the rare disease market is projected to reach $442.98 billion by 2030. BioMarin actively collaborates with patient advocacy groups, integrating their experiences into its business strategy and product development, as seen with initiatives like the RareConnections™ program.

Public perception of advanced biotechnologies, particularly gene therapy, directly impacts BioMarin's market acceptance. While Roctavian's 2023 FDA approval for hemophilia A was a milestone, sustained public and physician confidence in gene therapy's long-term safety and efficacy remains crucial for broader adoption. Public trust in regulatory bodies and the companies developing these therapies is paramount for patient willingness to undergo treatment.

Demographic trends, such as a growing global population projected to reach 8.1 billion by mid-2025, expand the potential patient pool for rare disease treatments. BioMarin's strategic focus on pediatric populations, for conditions like achondroplasia, aligns with the significant proportion of the global population in younger age groups, emphasizing early detection and intervention.

| Sociological Factor | Impact on BioMarin | Supporting Data/Trend (2024-2025) |

| Increased Rare Disease Awareness | Drives market growth and demand for specialized therapies. | 30 million Americans live with rare diseases; market projected to reach $442.98 billion by 2030. |

| Patient Advocacy & Collaboration | Informs R&D, product lifecycle, and market access strategies. | BioMarin's RareConnections™ program and partnerships with advocacy groups. |

| Public Perception of Gene Therapy | Influences market acceptance, adoption, and commercial uptake. | Ongoing public caution regarding gene editing technologies alongside optimism for transformative potential. |

| Global Population Growth | Expands the potential patient pool for rare disease treatments. | World population projected to reach 8.1 billion by mid-2025. |

Technological factors

BioMarin Pharmaceutical is a key player in advancing gene therapy and genetic discovery, focusing on rare genetic diseases. The company's pipeline demonstrates this commitment, with recent progress in promising treatments.

Notable advancements include positive Phase 1 data for BMN 333, a long-acting C-type natriuretic peptide, showcasing BioMarin's ongoing research in novel therapeutic approaches. The acquisition of Inozyme further strengthens this, bringing BMN 401 into their portfolio, a potential first-in-disease therapy for ENPP1 Deficiency, highlighting the company's strategic expansion in genetic medicine.

BioMarin's commitment to innovation extends beyond gene therapy, focusing on advancing its established enzyme replacement therapies and protein therapeutics. These core offerings, including ALDURAZYME®, BRINEURA®, NAGLAZYME®, PALYNZIQ®, and VIMIZIM®, consistently demonstrate robust patient demand.

In 2023, BioMarin reported strong performance from its enzyme therapies, with PALYNZIQ® alone generating $234.5 million in net product revenue, underscoring the significant market penetration and ongoing patient need for these treatments.

Advances in genetic screening and diagnostic tools are fundamentally shaping the landscape for rare genetic disease therapies. These technological leaps enable earlier and more precise identification of eligible patients, directly expanding the potential market for BioMarin's treatments. For instance, the increasing adoption of next-generation sequencing has significantly improved the diagnostic yield for rare conditions.

Physician awareness and the widespread availability of genetic screening are critical drivers for patient access to enzyme replacement therapies. As diagnostic capabilities improve, more patients are identified, leading to greater demand for BioMarin's specialized treatments. This trend is evidenced by the growing number of patients being diagnosed and subsequently seeking treatment options.

Biomanufacturing Innovations and Scalability

The capacity to produce intricate biologics and gene therapies efficiently at a large scale is a crucial technological consideration. BioMarin's strategic move to place its Roctavian gene therapy manufacturing facility in an 'idle state' due to existing supply adequacy, coupled with its focus on achieving profitability, underscores the critical nature of managing manufacturing capacity and operational efficiency.

Technological advancements in biomanufacturing are directly impacting BioMarin's ability to scale production for its novel therapies. For instance, the company's investment in advanced manufacturing technologies is aimed at reducing production costs and increasing throughput for its gene therapies, which are notoriously complex to manufacture.

- Manufacturing Efficiency: Innovations in cell culture, purification, and analytical testing are key to lowering the per-unit cost of gene therapies, a major hurdle for market accessibility.

- Scalability Challenges: The transition from clinical trial batches to commercial-scale manufacturing presents significant technological hurdles that require specialized expertise and infrastructure.

- Capacity Management: BioMarin's decision regarding Roctavian production highlights the delicate balance between having sufficient manufacturing capacity to meet demand and avoiding overcapacity, which impacts profitability.

Personalized Medicine Trends

The growing emphasis on personalized medicine and genetic therapies perfectly complements BioMarin's core business strategy. This technological shift is a major tailwind for the company.

The global personalized medicine market is experiencing explosive growth, projected to expand from $493.73 billion in 2023 to over $1 trillion by 2030. This significant market expansion highlights the robust technological trend underpinning BioMarin's focus on rare genetic diseases.

- Personalized Medicine Market Growth: Expected to more than double from $493.73 billion in 2023 to over $1 trillion by 2030.

- Alignment with BioMarin: BioMarin's focus on rare genetic diseases directly benefits from this trend.

- Technological Advancements: Innovations in genomics and gene editing are key drivers.

Technological advancements in diagnostics, such as next-generation sequencing, are crucial for identifying patients with rare genetic diseases, directly expanding the market for BioMarin's therapies. The company's strategic manufacturing decisions, like idling Roctavian production, reflect the critical need for efficient and scalable biomanufacturing technologies to manage costs and capacity effectively.

The burgeoning personalized medicine market, projected to exceed $1 trillion by 2030, aligns perfectly with BioMarin's focus on genetic therapies, driven by ongoing innovations in genomics and gene editing. This technological synergy is a significant tailwind, enabling more precise and effective treatments for specific patient populations.

| Technological Factor | Impact on BioMarin | Supporting Data/Trend |

|---|---|---|

| Advancements in Genetic Diagnostics | Improved patient identification and market expansion | Increased adoption of next-generation sequencing |

| Biomanufacturing Innovations | Cost reduction and scalability for gene therapies | Strategic capacity management for Roctavian |

| Personalized Medicine Growth | Direct alignment with BioMarin's therapeutic focus | Global market projected to exceed $1 trillion by 2030 (from $493.73 billion in 2023) |

Legal factors

Intellectual property rights are the bedrock of innovation in biotechnology, particularly for companies like BioMarin focusing on rare genetic diseases. These protections are crucial for recouping the significant investment in research and development.

BioMarin vigorously defends its intellectual assets. A notable example is its 2024 legal action in the European Unified Patent Court against Ascendis Pharma A/S, alleging infringement of a patent related to long-acting C-Type Natriuretic Peptide variants. This case underscores the importance BioMarin places on safeguarding its patented technologies.

BioMarin Pharmaceutical operates within stringent regulatory frameworks, necessitating meticulous adherence to guidelines set by bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for drug development and approval. The company's ability to bring novel therapies to market, such as its treatments for rare genetic diseases, hinges on successfully navigating these complex pathways. For instance, in 2024, BioMarin continued to advance its pipeline, with regulatory submissions and potential approvals being critical milestones for revenue generation and market expansion.

As a global pharmaceutical company, BioMarin Pharmaceutical must navigate a complex web of data privacy regulations, including the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. These laws are critical for protecting sensitive patient information collected during clinical trials and for product development. Failure to comply can result in significant fines and reputational damage.

BioMarin's stated commitment to transparency in its Environmental, Social, and Governance (ESG) activities underscores its dedication to upholding these stringent legal frameworks. This commitment suggests proactive measures are in place to ensure data handling practices align with global privacy standards, a crucial aspect for any company operating with patient data. For instance, GDPR violations can lead to fines up to 4% of global annual turnover or €20 million, whichever is higher, highlighting the financial imperative for compliance.

Product Liability Laws

Product liability laws are a critical legal hurdle for pharmaceutical firms, especially those like BioMarin, which focus on innovative and intricate treatments such as gene therapies. The potential for adverse events, even with rigorous testing, means companies must be acutely aware of regulations governing the safety and efficacy of their products. Failure to meet these standards can lead to significant legal repercussions and damage to reputation.

While specific BioMarin product liability case data isn't readily available, the broader pharmaceutical industry faced substantial product liability claims. For instance, in 2023, the U.S. judicial system saw ongoing litigation related to various pharmaceutical products, with settlements and judgments often running into millions of dollars. This underscores the financial exposure companies face.

Key considerations for BioMarin under product liability laws include:

- Adherence to stringent manufacturing and quality control standards to minimize defects.

- Thorough post-market surveillance and reporting of adverse events to regulatory bodies.

- Clear and accurate labeling and patient information to inform users of potential risks.

- Robust risk management strategies to proactively address potential product-related harms.

Anti-Trust and Competition Laws

BioMarin Pharmaceutical, operating within the specialized rare disease sector, faces scrutiny under anti-trust and competition laws. These regulations are designed to prevent any single entity from dominating the market and stifling innovation or fair pricing. As competition in rare disease therapies intensifies, regulatory bodies are actively observing market behaviors to ensure a level playing field.

The growing number of companies entering the rare disease space, a trend highlighted in economic analyses, signals increased regulatory attention. This heightened awareness means BioMarin must remain vigilant about its market practices to avoid accusations of monopolistic behavior.

- Regulatory Oversight: Competition authorities globally, including the U.S. Federal Trade Commission (FTC) and the European Commission, monitor mergers, acquisitions, and pricing strategies in the pharmaceutical industry.

- Market Dynamics: Increased competition in rare diseases, with an estimated market value projected to reach $250 billion by 2027 according to some industry forecasts, necessitates careful adherence to competition laws.

- Potential for Scrutiny: BioMarin's significant market share in certain rare disease categories could attract closer examination from regulators if its actions are perceived to limit patient access or hinder new entrants.

BioMarin's operations are heavily influenced by intellectual property laws, as seen in its 2024 patent infringement case against Ascendis Pharma A/S. This highlights the critical need to protect its innovations in rare disease treatments. Adherence to stringent FDA and EMA regulations is paramount for drug approval and market access, with ongoing pipeline advancements in 2024 depending on successful navigation of these complex pathways. Furthermore, compliance with global data privacy laws like GDPR and HIPAA is essential, given the sensitive patient data handled in its research and development efforts.

The company must also contend with product liability laws, a significant concern given the nature of its advanced therapies. Robust quality control, post-market surveillance, and clear patient information are vital to mitigate risks. BioMarin also operates under antitrust and competition laws, especially as the rare disease market, projected to reach $250 billion by 2027, becomes more competitive, requiring vigilance against monopolistic practices.

Environmental factors

BioMarin Pharmaceutical is actively addressing its environmental impact and prioritizing ethical sourcing within its supply chain, recognizing the risks associated with forced and child labor. The company's commitment is underscored by its Supply Chain Statement, which details measures taken to ensure responsible practices, aligning with modern slavery legislation.

Pharmaceutical manufacturing, by its nature, can produce substantial waste streams. BioMarin, recognizing its role as a global corporate citizen, is committed to operating in a manner that supports environmental health. This commitment is evidenced by their establishment of a Global Environmental Sustainability Committee and local green teams, which actively work on improving waste management practices.

BioMarin Pharmaceutical's operations, encompassing its research, development, and manufacturing facilities, inherently contribute to energy consumption and a resulting carbon footprint. These activities require significant power for laboratories, specialized equipment, and maintaining controlled environments.

The company's stated commitment to Environmental, Social, and Governance (ESG) transparency signals a proactive approach to managing its environmental impact. This likely includes initiatives aimed at improving energy efficiency and reducing greenhouse gas emissions across its global sites.

While specific, recent figures for BioMarin's total energy consumption or carbon footprint for 2024 or early 2025 are not publicly detailed in readily available reports, the industry trend and BioMarin's stated ESG goals suggest a focus on sustainability is integral to their operational strategy.

Climate Change Impact and Resource Scarcity

While BioMarin Pharmaceutical's core business isn't directly tied to immediate environmental outputs, broader concerns like climate change and resource scarcity can still ripple through its operations. These factors can influence the cost and availability of raw materials essential for drug manufacturing, potentially impacting BioMarin's supply chain stability and increasing operational expenses. For instance, disruptions caused by extreme weather events, a consequence of climate change, could affect logistics and the sourcing of specialized biological components.

BioMarin actively engages in environmental stewardship, recognizing its role in fostering a healthier planet for its employees and the communities it serves. This commitment extends to minimizing its environmental footprint throughout its value chain. While specific 2024/2025 data on BioMarin's direct environmental impact costs is not publicly detailed, the company's broader sustainability reports often highlight initiatives aimed at reducing waste and energy consumption.

- Supply Chain Vulnerability: Climate-related events can disrupt global supply chains, affecting BioMarin's access to critical raw materials and specialized manufacturing components.

- Operational Cost Increases: Resource scarcity, particularly for energy and water, can lead to higher operating costs for BioMarin's research and manufacturing facilities.

- Environmental Stewardship: BioMarin's commitment to sustainability aims to mitigate indirect environmental risks and contribute positively to ecological health.

Ethical Considerations in Genetic Research and Bioremediation

BioMarin Pharmaceutical's commitment to genetic research brings significant ethical considerations to the forefront. The company must navigate complex issues surrounding the responsible use of genetic information and ensure patient privacy and consent are paramount. In 2024, the global biotechnology market, heavily influenced by genetic advancements, was valued at approximately $1.7 trillion, underscoring the scale and impact of such research.

Furthermore, the potential for bioremediation, using biological organisms to clean up environmental pollutants, presents both opportunities and ethical challenges. BioMarin's work in gene therapy could indirectly influence the development of novel bioremediation techniques, requiring careful assessment of ecological impacts and unintended consequences. For instance, advancements in gene editing technologies, while promising for disease treatment, also raise questions about their application in environmental modification.

The ethical framework guiding BioMarin's operations must extend to the societal implications of its genetic discoveries. Public perception and acceptance of gene-based therapies and environmental applications are crucial for long-term success. As of early 2025, discussions around the ethical boundaries of genetic engineering continue, with regulatory bodies worldwide scrutinizing new applications.

- Genetic Research Ethics: Ensuring informed consent, data privacy, and equitable access to therapies derived from genetic research.

- Bioremediation Responsibility: Evaluating the ecological safety and long-term impact of introducing genetically modified organisms for environmental cleanup.

- Societal Acceptance: Fostering public trust and understanding regarding the ethical dimensions of genetic technologies.

- Regulatory Compliance: Adhering to evolving global standards for genetic research and its applications.

BioMarin Pharmaceutical is actively working to minimize its environmental impact, focusing on waste reduction and energy efficiency across its operations. While specific 2024/2025 data on their direct environmental performance metrics are not yet widely published, the company's commitment to ESG principles suggests ongoing initiatives. For example, the global pharmaceutical industry's push towards sustainability aims to reduce carbon footprints, a trend BioMarin is likely aligning with.

The company acknowledges that climate change and resource scarcity pose potential risks to its supply chain, impacting the availability and cost of raw materials. Extreme weather events, a consequence of climate change, could also affect logistics and the sourcing of specialized biological components, potentially increasing operational expenses.

BioMarin's engagement in genetic research, valued within a global biotechnology market estimated at around $1.7 trillion in 2024, brings ethical considerations regarding data privacy and consent. The company must also carefully assess the ecological impacts of potential bioremediation applications derived from its gene therapy work, ensuring responsible use of genetic technologies.

| Environmental Factor | Impact on BioMarin | 2024/2025 Relevance |

|---|---|---|

| Climate Change | Supply chain disruptions, increased operational costs due to resource scarcity. | Growing concern for raw material sourcing and logistics stability. |

| Waste Management | Potential for significant waste streams in pharmaceutical manufacturing. | Ongoing focus on improving waste management practices through committees and green teams. |

| Energy Consumption | Significant power required for R&D and manufacturing facilities, contributing to carbon footprint. | Likely initiatives for energy efficiency and greenhouse gas emission reduction. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for BioMarin Pharmaceutical is built on a robust foundation of data from leading financial institutions, regulatory bodies, and scientific journals. We draw insights from market research reports, government health policies, and global economic indicators to provide a comprehensive view.