Biesse Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biesse Bundle

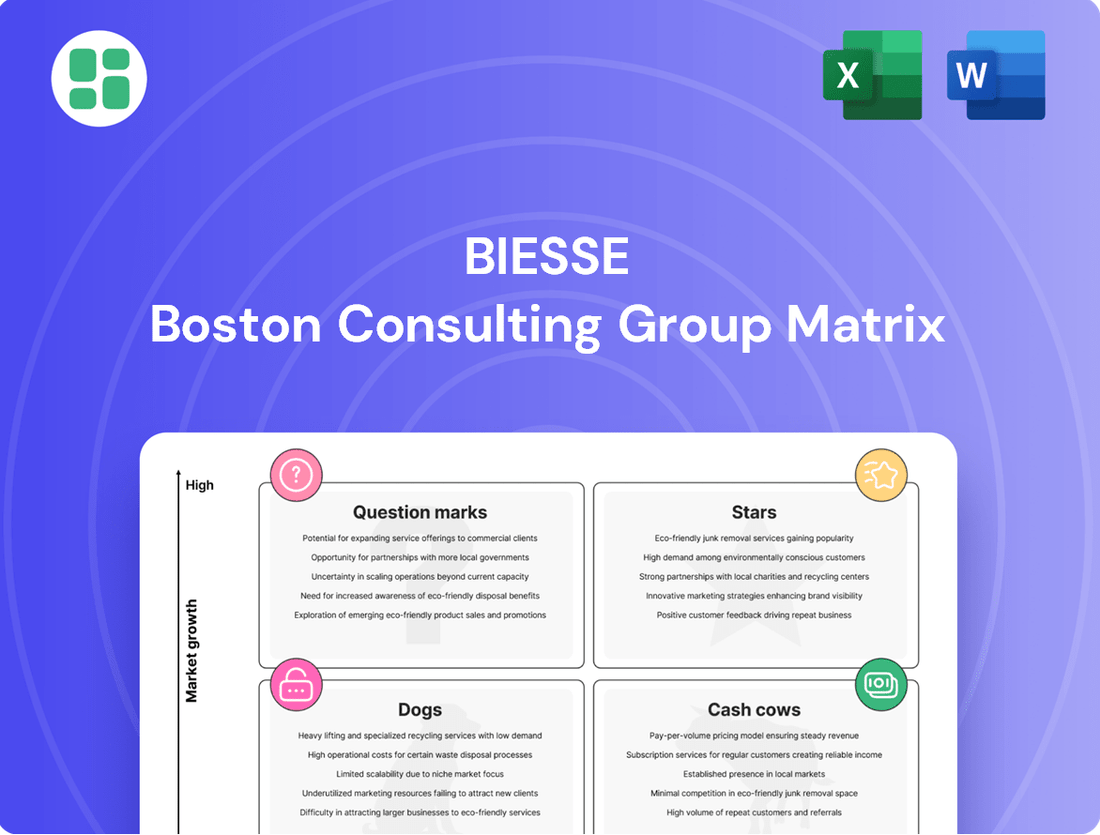

Unlock the strategic potential of Biesse's product portfolio with a clear understanding of its BCG Matrix. See which products are poised for growth, which are generating steady revenue, and which may require a re-evaluation. Purchase the full BCG Matrix for actionable insights and a roadmap to optimize your investments.

Stars

Biesse's strategic push into integrated multi-material solutions, highlighted by the upcoming Biesse Technic at LIGNA 2025, aims to capture a significant share of the advanced manufacturing market. This initiative, bolstered by acquisitions such as GMM and Bavelloni, positions Biesse as a comprehensive provider for diverse material processing needs, from wood to glass and stone.

The company's focus on offering single-source solutions for complex industrial processes is a direct response to evolving customer demands and market trends. For instance, the demand for customized interior design and construction, which often involves multiple materials, is a key driver for this integrated approach. This strategy is crucial for navigating current market volatility and securing future growth by offering unparalleled versatility.

Biesse's advanced CNC machining centers are a clear Star in their BCG portfolio. These high-end machines, capable of processing diverse materials with exceptional precision and automation, consistently attract significant market demand. Their continuous updates with cutting-edge technology ensure they remain at the forefront of industries like furniture manufacturing and construction, driving strong sales and market share.

The company's commitment to innovation is evident in their presence at key industry events such as IndiaWood 2025 and LIGNA 2025. These platforms showcase Biesse's latest advancements, reinforcing their position as a leader in the CNC machining sector. For instance, Biesse reported a substantial increase in orders for their advanced machining solutions in the first half of 2024, reflecting the robust demand for these high-performance products.

Biesse's investment in smart manufacturing, exemplified by its SOPHIA IoT platform and Easy Maintain app, positions these digital solutions as a high-growth area. These tools facilitate real-time machine monitoring and predictive maintenance, crucial for optimizing production.

The push towards Industry 4.0 and 5.0 environments underscores the value of Biesse's interconnected systems. By enhancing efficiency and competitiveness for their clientele, these digital offerings solidify their status as Stars in the BCG matrix.

Solutions for High-Growth Niche Applications

Biesse's ability to develop highly specialized solutions for rapidly expanding niche markets, like bespoke cabinetry or cutting-edge composites for the automotive sector, positions them as Stars. These tailored offerings, demanding sophisticated technology and precision, enable Biesse to thrive even when broader markets face headwinds. For example, in 2024, Biesse reported a significant increase in orders for CNC machines specifically designed for advanced composite processing, a key growth area.

- Niche Market Focus: Biesse excels in customizing machinery for high-demand, specialized applications.

- Technological Edge: Investment in advanced technology allows for precision and efficiency in these niches.

- Resilience: Niche markets often exhibit less volatility, providing a stable revenue stream.

- Growth Potential: Capturing value in emerging or specialized sectors fuels overall company growth.

Strategic Regional Market Expansion (e.g., India, Americas)

Biesse's strategic push into emerging markets like India, underscored by their active engagement at IndiaWood 2025 and the establishment of local manufacturing, positions these regions as significant Stars in their portfolio. This localized approach is crucial for capturing growth in a market projected to see substantial expansion in furniture and woodworking machinery demand.

The company's reinforced footprint in the Americas, including business integrations, is designed to boost market penetration and customer engagement. In 2024, the North American woodworking machinery market showed resilience, with Biesse aiming to leverage these expansions to secure a larger share amidst evolving industry trends.

- IndiaWood 2025 Participation: Demonstrates Biesse's commitment to the Indian market, a key growth driver.

- Local Manufacturing in India: Enhances competitiveness and supply chain efficiency in a rapidly developing economy.

- North American Business Integrations: Strengthens market presence and customer service capabilities in a mature yet dynamic market.

- Revenue Diversification: These regional expansions are critical for mitigating risks associated with reliance on single markets and achieving sustained revenue growth.

Biesse's advanced CNC machining centers are a prime example of their Stars. These machines consistently capture substantial market share due to their high precision and automation capabilities, essential for industries like furniture and construction. The company's proactive engagement at events like IndiaWood 2025 and LIGNA 2025 highlights their commitment to showcasing these leading-edge products.

The company's investment in digital solutions, such as the SOPHIA IoT platform, also positions them as Stars. These tools enhance operational efficiency through real-time monitoring and predictive maintenance, aligning perfectly with the demands of Industry 4.0 and 5.0 environments. Biesse's focus on these interconnected systems solidifies their leadership in smart manufacturing.

Biesse's specialized solutions for rapidly growing niche markets, including bespoke cabinetry and advanced composites for the automotive sector, are also Stars. These tailored offerings leverage sophisticated technology to meet specific, high-demand applications, ensuring strong performance even in fluctuating broader markets. For instance, Biesse saw a notable increase in orders for composite processing machines in 2024.

The strategic expansion into emerging markets, particularly India, and the strengthening of their presence in North America are key drivers for Biesse's Star status. Their participation at IndiaWood 2025 and local manufacturing initiatives in India, alongside business integrations in the Americas, are designed to capture significant growth and diversify revenue streams. The North American market demonstrated resilience in 2024, a trend Biesse aims to capitalize on.

| Product/Service Area | BCG Category | Key Drivers | 2024 Performance Indicator |

|---|---|---|---|

| Advanced CNC Machining Centers | Star | High precision, automation, broad industry demand | Substantial increase in orders (H1 2024) |

| SOPHIA IoT Platform & Digital Solutions | Star | Industry 4.0/5.0 integration, predictive maintenance | Growing adoption in smart manufacturing initiatives |

| Niche Market Solutions (e.g., Composites) | Star | Specialized technology, high-demand applications | Significant increase in composite machine orders (2024) |

| Emerging Markets (e.g., India) & North America Expansion | Star | Market growth potential, localized strategies | Strengthened market penetration and customer engagement |

What is included in the product

The Biesse BCG Matrix categorizes business units based on market growth and share, guiding strategic resource allocation.

A clear BCG Matrix visualizes your portfolio, easing the pain of resource allocation decisions.

Cash Cows

Biesse's established range of traditional woodworking machinery, such as standard edgebanders and saws, represents a significant Cash Cow. This segment, despite a general slowdown in order intake observed in 2023-2024, maintains a substantial market share and consistently generates cash flow. This stability is a result of its mature market position and strong brand loyalty.

The mature nature of these reliable products means they demand comparatively lower promotional investments when contrasted with newer innovations. This efficiency in marketing spend directly contributes to the segment's stable and predictable profitability, reinforcing its status as a Cash Cow for Biesse.

Biesse's extensive global installed base of machinery fuels a consistent and substantial demand for after-sales service and spare parts. This segment acts as a reliable Cash Cow, generating predictable revenue streams with typically high profit margins, thereby contributing significantly to the company's financial stability.

The company's commitment to supporting its installed base is evident in strategic investments, such as its spare-parts hub in India. This initiative not only streamlines operations and enhances efficiency but also directly improves customer satisfaction, further solidifying the Cash Cow status of its after-sales service and spare parts business.

Biesse's established glass and stone processing lines, including those under the Bavelloni brand, represent significant cash cows. These mature segments, prior to recent acquisitions, commanded high market shares, translating into consistent and dependable cash flow generation.

The company's ongoing investment in these lines aims to sustain their productivity and market standing. For instance, in 2024, Biesse continued to allocate resources to modernize its glass processing machinery, ensuring it remains competitive in established segments.

Proprietary Components (e.g., HSD Spindles)

Biesse's proprietary components, like HSD spindles, are integral to their machinery, often holding a dominant position within the company's own product lines. These high-quality, internally manufactured parts are critical for machine performance and reliability, leading to strong demand across Biesse's diverse machine portfolio. This consistent internal demand and their contribution to profit margins solidify their status as a Cash Cow.

The HSD spindles, a prime example, are known for their precision and durability, which translates into a significant share of Biesse's component sales. Their critical function ensures that customers rely on Biesse for both the machinery and the essential parts that keep it running optimally. This creates a predictable and substantial revenue stream for the company.

- High Market Share: HSD spindles often represent a substantial portion of Biesse's internal component sales, reflecting their widespread integration.

- Profit Margin Contribution: These proprietary components typically yield higher profit margins compared to externally sourced parts due to controlled manufacturing and reduced supply chain markups.

- Revenue Stability: The consistent need for these components across Biesse's machine base provides a reliable and steady source of income.

- Technological Advantage: Biesse's investment in developing and manufacturing these high-quality components offers a competitive edge and reinforces customer loyalty.

European Market Dominance (EMEA)

The EMEA region is Biesse's undisputed stronghold, consistently contributing over 60% of its consolidated net revenues. This dominance, cultivated over many years, allows Biesse to capitalize on its established brand and extensive distribution channels to generate substantial cash flow.

Despite prevailing macroeconomic headwinds, this established market segment serves as a crucial bedrock for the Group's revenue and profitability. Biesse's deep roots in EMEA provide a stable platform for its operations.

- Largest Revenue Contributor: EMEA consistently accounts for more than 60% of Biesse's total net revenues, highlighting its market leadership.

- Brand and Distribution Leverage: Decades of presence have built strong brand recognition and robust distribution networks, facilitating consistent cash generation.

- Foundational Profitability: Despite economic fluctuations, this mature market remains a primary engine for Biesse's overall financial performance.

Biesse's established woodworking machinery, like edgebanders and saws, are prime examples of Cash Cows. These products, despite a slight dip in orders in 2023-2024, maintain a strong market share and reliably generate cash. Their mature market position and customer loyalty mean they require less marketing spend, contributing to steady profits.

The extensive installed base of Biesse machinery ensures consistent demand for after-sales services and spare parts. This segment acts as a dependable Cash Cow, offering predictable revenue with healthy profit margins, which significantly bolsters the company's financial health. For instance, Biesse's investment in its Indian spare parts hub in 2024 aims to enhance efficiency and customer satisfaction, further securing this revenue stream.

Biesse's glass and stone processing lines, including those under the Bavelloni brand, also function as Cash Cows. These mature segments historically held high market shares, translating into stable cash flow generation. Biesse continued to invest in modernizing its glass processing machinery in 2024 to maintain its competitive edge in these established markets.

Proprietary components such as HSD spindles are critical Cash Cows for Biesse. These high-quality, internally manufactured parts are essential for machine performance and reliability, driving strong demand across Biesse's product range. The HSD spindles, known for their precision and durability, represent a significant portion of Biesse's component sales, ensuring a predictable and profitable revenue stream.

| Biesse Cash Cow Segments | Key Characteristics | 2024 Relevance |

|---|---|---|

| Traditional Woodworking Machinery | High market share, mature market, low promotional cost | Stable revenue despite market fluctuations |

| After-Sales Service & Spare Parts | High profit margins, predictable demand from installed base | Consistent revenue stream, supported by strategic investments (e.g., India hub) |

| Glass & Stone Processing Lines | Established market position, high market share (historically) | Continued investment in modernization to sustain competitiveness |

| Proprietary Components (e.g., HSD Spindles) | Critical for machine performance, strong internal demand, high profit margins | Significant contribution to component sales and overall profitability |

Full Transparency, Always

Biesse BCG Matrix

The Biesse BCG Matrix document you are currently previewing is the identical, fully-formatted report you will receive immediately after your purchase. This means no watermarks, no sample data, and no alterations – just the complete, professionally designed strategic tool ready for your immediate use. You can confidently expect the same high-quality analysis and clear visualization that will empower your business decision-making. This is your direct gateway to actionable insights, presented exactly as intended for strategic planning and competitive advantage.

Dogs

Legacy machine models with low demand represent the Dogs quadrant in the Biesse BCG Matrix. These are older, less technologically advanced products that have been surpassed by newer, more efficient alternatives. For instance, Biesse might have older woodworking machinery that is no longer competitive in terms of speed or precision compared to their latest CNC routers.

These older models typically face very low market demand. In 2024, Biesse’s focus is on phasing out such products, as they contribute minimally to overall revenue. The company actively encourages customers to transition to their more advanced, high-performing solutions, thereby reducing the burden of maintaining inventory and support for declining product lines.

Products heavily reliant on expired government incentives, such as those boosted by Italy's 'Superbonus 110%,' now fall into the Dogs category of the BCG Matrix. These product lines experienced an artificial surge in demand, but with the incentives winding down, sales have sharply declined. This leaves Biesse with offerings in a low-growth, less appealing market, potentially tying up valuable capital.

Non-strategic niche products with limited market penetration represent Biesse's potential Dogs in the BCG Matrix. These are offerings that, despite some initial development, haven't captured substantial market share. For instance, if Biesse explored a specialized woodworking tool for a very specific craft that didn't resonate broadly, it could fall into this category.

These products typically operate in slow-growing markets and have minimal sales, meaning they don't contribute significantly to revenue or profit. Biesse's reported focus on cost rationalization in 2024 likely includes scrutinizing such underperforming assets to reallocate resources more effectively towards their core, high-growth areas.

Underperforming Regional Sub-Segments

Underperforming regional sub-segments within Biesse's global operations represent areas where the company has not achieved significant market share or sustained growth. These markets might consume valuable resources without generating proportional returns, potentially hindering overall financial performance.

Biesse's strategic review, potentially influenced by market volatility, could lead to the divestment or restructuring of these weaker regional operations. For instance, if a specific European sub-market showed a revenue decline of 5% in 2023 compared to 2022, while the overall company revenue grew by 3%, it would be a candidate for such re-evaluation.

- Low Market Share: Regions where Biesse holds a minimal percentage of the total addressable market.

- Stagnant or Declining Growth: Markets exhibiting consistently low or negative year-over-year revenue growth.

- Resource Drain: Operations consuming capital, personnel, or management attention without substantial contribution.

- Strategic Misalignment: Sub-segments that do not fit with Biesse's core competencies or long-term strategic goals.

Obsolete Software or Control Systems

Obsolete software or control systems represent a significant challenge for companies like Biesse. These outdated platforms often lack compatibility with current digital workflows, making integration difficult and costly. For instance, older CNC machine software might not support Industry 4.0 protocols, hindering data exchange and automation efforts.

Maintaining these legacy systems can be inefficient, consuming resources without providing a competitive edge. In 2024, the demand for seamless connectivity and data-driven insights is paramount. Companies that rely on unsupported software risk falling behind in terms of operational efficiency and innovation.

Biesse's strategic focus on digital solutions, such as its SOPHIA platform, clearly signals a deliberate move away from less integrated and outdated software. SOPHIA aims to connect machines, manage production, and provide real-time data, a stark contrast to the limitations of older systems. This shift is crucial for Biesse to remain competitive in a rapidly evolving manufacturing landscape.

- Limited Digital Integration: Older software often fails to connect with modern IoT devices and cloud-based management systems.

- High Maintenance Costs: Supporting unsupported systems can incur significant expenses for patches and workarounds.

- Reduced Operational Efficiency: Lack of compatibility hinders automation and data analytics, impacting productivity.

- Competitive Disadvantage: Companies with outdated systems struggle to match the agility and insights offered by digitally advanced competitors.

Dogs in Biesse's BCG Matrix represent products with low market share and low growth prospects, often legacy or non-strategic offerings. These products consume resources without generating significant returns, prompting Biesse to focus on phasing them out or reallocating capital. For instance, older machinery lacking modern connectivity or software tied to expired incentives exemplify these underperforming assets.

In 2024, Biesse's strategic emphasis on cost rationalization and digital solutions like SOPHIA directly addresses the challenges posed by these Dog products. The company aims to streamline operations by reducing support for obsolete systems and divesting underperforming regional segments. This proactive approach ensures resources are channeled towards high-growth areas, enhancing overall competitiveness.

The company's financial reports for 2023, showing a 3% revenue growth overall, highlight the need to address areas with declining revenue, such as specific European sub-markets experiencing a 5% drop. Identifying and managing these "Dogs" is crucial for Biesse to maintain its market position and drive future profitability.

| Biesse Product Category | BCG Matrix Quadrant | 2024 Strategic Focus | Rationale |

|---|---|---|---|

| Legacy CNC Routers | Dog | Phase-out / Transition | Low demand, surpassed by newer tech. |

| Woodworking Machinery (Incentive-Dependent) | Dog | Resource Reallocation | Demand decline post-incentive expiry. |

| Non-Strategic Niche Tools | Dog | Cost Rationalization | Limited market penetration, low sales. |

| Underperforming Regional Operations | Dog | Divestment / Restructuring | Low market share, stagnant growth. |

| Obsolete Software/Control Systems | Dog | Upgrade / Replace | Lack of digital integration, high maintenance. |

Question Marks

The newly integrated GMM Group product lines, encompassing GMM, Bavelloni, and Techni Waterjet, are currently in an early phase within Biesse's BCG Matrix analysis. These acquisitions significantly enhance Biesse's presence in the stone, glass, and metal processing sectors, adding valuable multi-material capabilities.

While these product lines represent a strategic expansion, their market penetration and revenue generation are still in the nascent stages of development. Biesse's 2024 financial reports indicate ongoing investment in integrating these new offerings and driving their market adoption, with the goal of transforming them into strong market performers.

Biesse's advanced robotic automation solutions, designed for seamless integration, currently sit in the Question Mark category of the BCG Matrix. These offerings tap into a rising need for enhanced manufacturing efficiency, a trend that saw the global industrial robotics market reach an estimated $60 billion in 2023, with a projected compound annual growth rate of over 15% through 2030.

The success of these robotic systems hinges on their market adoption and scalability, which are still in formative stages. Biesse must invest significantly in research, development, and targeted marketing to clearly articulate the return on investment to a broader clientele, aiming to capture a larger share of this expanding automation market.

Biesse's integration of AI and Machine Learning into its machinery and software is a strategic move to boost precision, enable predictive maintenance, and deliver greater operational intelligence. This represents a nascent but high-potential growth area for the company, promising to unlock significant efficiencies and new service revenue streams.

While market penetration for these advanced technologies is currently low, Biesse's investment in educating customers and demonstrating the tangible benefits of AI/ML is crucial. Success here could solidify Biesse's position as a leader in the smart manufacturing space, differentiating it from competitors.

Solutions for Emerging Advanced Materials

Biesse's move into processing advanced materials like composites and new metal alloys positions it in a high-growth, yet uncertain, market segment. These areas, while offering significant future potential, are still developing, meaning Biesse's current market share is likely minimal.

To succeed, Biesse needs to strategically invest in research and development for specialized machinery and actively engage in market development to build its presence. For instance, the global advanced materials market was valued at approximately $120 billion in 2023 and is projected to grow substantially, with composites alone expected to reach over $20 billion by 2028.

- High Growth Potential: Advanced materials markets are experiencing rapid expansion, driven by demand in aerospace, automotive, and renewable energy sectors.

- Low Market Share: Biesse's entry into these nascent segments means its current market share is likely small, requiring focused effort to gain traction.

- Strategic Investment: Significant investment in R&D for specialized processing equipment and targeted market development is essential for Biesse to capture these opportunities.

- Market Dynamics: The success hinges on Biesse's ability to adapt its technology and offerings to the unique processing requirements of these evolving materials.

Market Penetration in Specific New Geographies

Biesse's strategy for market penetration in specific new geographies, particularly those with nascent markets and high growth potential where their current share is minimal, positions these ventures as Question Marks within the BCG framework. These initiatives demand significant investment in establishing robust sales and service networks, tailoring offerings to local needs, and building brand awareness from the ground up. The success hinges on effectively navigating local market dynamics and securing a competitive advantage.

- Geographic Focus: Targeting regions like Southeast Asia or certain African nations where industrial automation is rapidly growing but Biesse's presence is limited.

- Investment Needs: Significant capital allocation for building local sales teams, service centers, and potentially manufacturing or assembly hubs. For instance, expanding into a new continent might require an initial investment of tens of millions of euros for infrastructure and market development.

- Market Receptiveness: Success is contingent on understanding and adapting to local customer preferences, regulatory environments, and competitive landscapes to gain traction.

- Potential Outcome: If Biesse can successfully establish a strong market presence, these Question Marks could evolve into Stars, driving substantial future revenue growth.

Biesse's advanced robotic automation solutions are currently positioned as Question Marks in the BCG Matrix. These offerings target the increasing demand for manufacturing efficiency, a sector that saw the global industrial robotics market valued at approximately $60 billion in 2023 and is projected for robust growth.

The success of these robotic systems depends on market adoption and scalability, which are still in early development stages. Biesse must invest heavily in R&D and marketing to demonstrate clear ROI and capture a larger share of this expanding automation market.

Biesse's AI and Machine Learning integration represents a high-potential, nascent growth area. While current market penetration is low, Biesse's focus on customer education and benefit demonstration is key to becoming a smart manufacturing leader.

Processing advanced materials like composites and new metal alloys places Biesse in a high-growth, uncertain segment with minimal current market share. Strategic R&D and market development are crucial, especially given the global advanced materials market was valued at around $120 billion in 2023.

| Category | Description | Market Growth | Biesse's Share | Investment Need |

| Robotic Automation | Enhancing manufacturing efficiency | High (15%+ CAGR projected) | Low to Medium | High |

| AI/ML Integration | Boosting precision, predictive maintenance | High | Low | High |

| Advanced Materials Processing | New metal alloys, composites | High (Composites projected >$20B by 2028) | Low | High |

| New Geographies | Emerging markets with limited Biesse presence | High | Very Low | Very High |

BCG Matrix Data Sources

Our Biesse BCG Matrix is built on comprehensive market intelligence, integrating financial performance data, industry growth trends, and competitor analysis to provide actionable strategic insights.