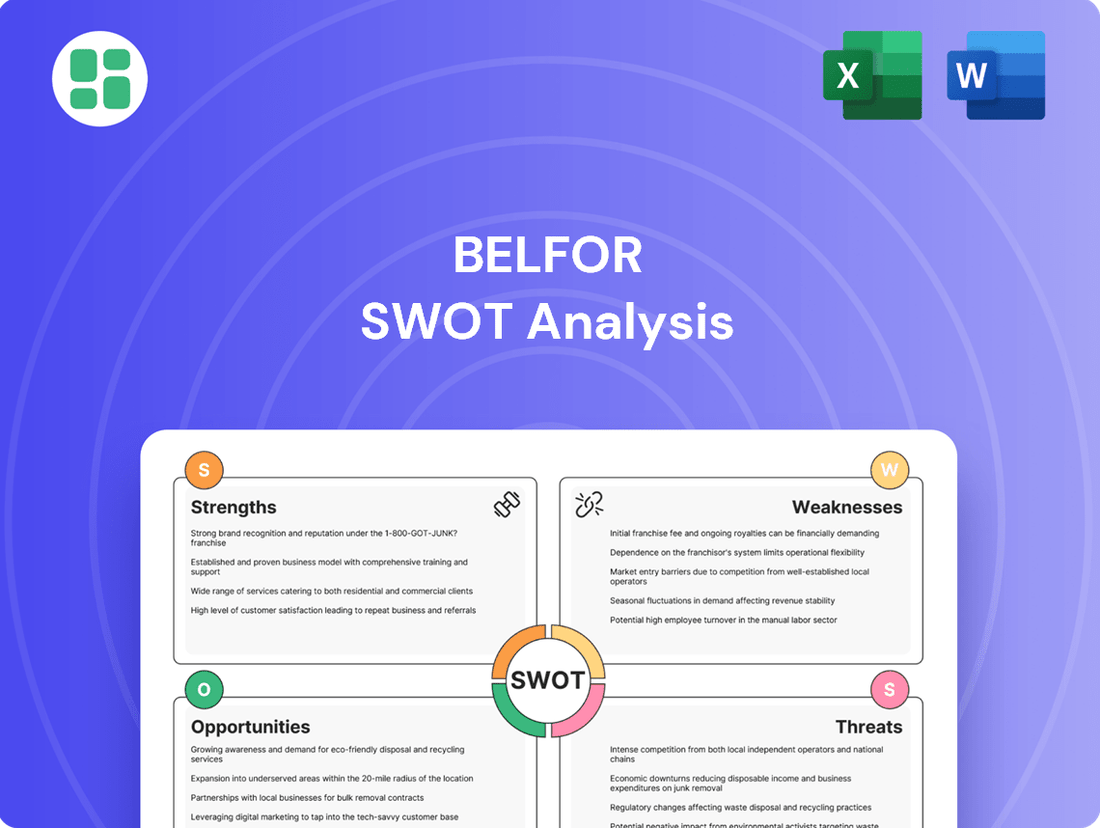

Belfor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Belfor Bundle

Belfor's impressive operational capabilities and strong brand recognition are key strengths, but they also face significant competitive pressures and evolving market demands. Our full SWOT analysis dives deep into these dynamics, revealing critical opportunities for expansion and potential threats that require proactive mitigation.

Want the full story behind Belfor's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BELFOR stands as the undisputed global leader in disaster recovery and property restoration, a testament to its extensive operational footprint. With a presence in over 23 countries and more than 550 offices worldwide, the company possesses an unparalleled ability to deploy resources rapidly and effectively, regardless of location.

This vast international network is a critical strength, allowing BELFOR to deliver consistent, high-quality services across diverse geographical markets. Its significant global reach solidifies its market leadership and provides a competitive advantage in responding to large-scale or widespread disaster events.

BELFOR's comprehensive service portfolio is a significant strength, covering water, fire, and storm damage restoration, alongside mold remediation and reconstruction. This all-encompassing approach ensures clients can address multiple recovery needs through a single provider.

The company further distinguishes itself by offering specialized solutions like contents restoration and advanced electronics restoration, catering to a broader and more complex set of client requirements. This depth of service minimizes the need for clients to engage multiple vendors.

Strategic acquisitions, such as the integration of JUNKCO+, bolster BELFOR's capabilities by adding new service lines, like junk removal and demolition. This expansion in 2024 directly broadens their market reach and strengthens their ability to manage diverse project scopes.

BELFOR's strong brand reputation is a significant asset, underscored by its CEO receiving the Corporate Leadership Award in 2025 for community rebuilding efforts. This recognition highlights the company's commitment beyond just business operations.

The company's franchise brands consistently appear on Entrepreneur's Franchise 500® list, a testament to their financial stability and unwavering dedication to quality service. Furthermore, BELFOR's position as a top-ranked company on the Qualified Remodeler TOP 500 list reinforces its consistent performance and dependability in the industry.

Extensive Experience and Technical Expertise

BELFOR's extensive experience, spanning nearly 80 years since its 1946 founding, translates into unparalleled technical expertise in disaster recovery. This long history means they've seen and solved a vast array of restoration challenges, building a deep well of knowledge. Their team, comprising over 14,000 professionals, completes more than 350,000 restoration jobs annually, a testament to their operational capacity and proven effectiveness in handling complex projects.

Strategic Acquisitions and Franchise Expansion

BELFOR Franchise Group has actively pursued growth by expanding its franchise network and making strategic acquisitions. The company ended 2024 with significant plans for 2025, including entering the Canadian market and incorporating new brands into its portfolio.

This expansion strategy is designed to broaden its service capabilities and increase its overall market penetration. For instance, BELFOR Franchise Group has been actively acquiring companies to integrate into its existing brands, aiming to offer a more comprehensive suite of services to customers.

- Franchise Expansion: BELFOR Franchise Group aims to significantly increase its franchise locations across North America and into new international markets, such as Canada, in 2025.

- Strategic Acquisitions: The company has a history of acquiring complementary businesses to enhance its service offerings, a strategy expected to continue through 2025.

- Brand Integration: New brands are being integrated to diversify revenue streams and cater to a wider customer base, strengthening its market position.

BELFOR's global leadership in disaster recovery is built on an extensive operational footprint, spanning over 23 countries with more than 550 offices. This unparalleled reach allows for rapid and effective resource deployment anywhere. The company's comprehensive service portfolio, covering everything from water and fire damage to mold remediation and reconstruction, ensures clients can address multiple recovery needs with a single provider. Strategic acquisitions, like the integration of JUNKCO+ in 2024, further broaden their capabilities and market reach.

| Metric | 2024/2025 Data | Significance |

|---|---|---|

| Global Offices | 550+ | Unmatched operational reach and rapid response capability. |

| Countries of Operation | 23+ | Ability to serve diverse international markets consistently. |

| Annual Restoration Jobs | 350,000+ | Demonstrates extensive experience and operational capacity. |

| Employee Base | 14,000+ Professionals | Significant human capital for handling diverse and large-scale projects. |

| Acquisitions (2024) | JUNKCO+ (example) | Expansion of service lines and market penetration. |

What is included in the product

Analyzes Belfor’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

BELFOR's business model shows a notable weakness in its heavy reliance on disaster-driven revenue. This means a significant portion of their income comes from unpredictable catastrophe events, which can lead to considerable swings in their financial performance year-over-year.

For instance, while 2023 saw a robust demand for restoration services following numerous weather events, a year with fewer major disasters could significantly impact BELFOR's top line. This volatility makes it harder to predict future earnings and can make the company appear riskier to investors, potentially affecting its valuation.

BELFOR, like many in the property restoration and construction sectors, grapples with ongoing skilled labor shortages. This persistent challenge directly impacts operational capacity, making it harder to scale resources effectively to meet demand.

The difficulty in both hiring and retaining qualified professionals translates into tangible business pressures. Expect increased labor costs as competition for talent intensifies, potentially impacting profit margins. Furthermore, these shortages can lead to project delays, affecting service delivery timelines and potentially compromising the quality of restoration work.

Belfor's extensive global footprint, with operations spanning numerous countries and involving many franchise partners, creates a significant challenge in ensuring consistent service delivery and operational quality. Maintaining uniform standards across such a diverse network can be difficult, potentially leading to discrepancies in customer experiences and brand perception.

Exposure to Rising Operating Costs

Belfor's disaster recovery services require substantial capital for specialized equipment, swift deployment infrastructure, and a robust, trained workforce. This inherent operational structure makes the company particularly vulnerable to escalating expenses in key areas.

The industry faces significant pressure from rising labor wages and the increasing cost of building materials. For instance, the U.S. Bureau of Labor Statistics reported a 4.5% increase in construction material costs in the year leading up to April 2024. If Belfor cannot pass these increased costs onto clients through adjusted pricing, its profit margins could be squeezed.

- Specialized Equipment: High upfront investment and ongoing maintenance costs.

- Labor Costs: Demand for skilled technicians and rapid response teams drives up wages.

- Material Costs: Fluctuations in the price of building and restoration supplies directly impact project expenses.

Intense Competitive Landscape

The home restoration service market is incredibly crowded, with a vast array of competitors. This includes major national brands, established franchise operations, and many smaller local businesses all vying for customers. This intense competition often forces companies like Belfor to engage in aggressive pricing, which can put a strain on profit margins and make it challenging to grow market share.

This competitive pressure is evident in the fragmented nature of the industry. For instance, while specific market share data for the entire home restoration sector can be fluid, reports from 2024 indicate that the top 10 companies in related disaster restoration services often hold less than 30% of the overall market, highlighting the prevalence of smaller, localized players.

- Numerous Competitors: From large national chains to local contractors, the market is saturated.

- Price Wars: Intense rivalry often leads to price reductions, impacting profitability.

- Market Share Battles: Gaining and retaining customers requires constant effort against many alternatives.

- Fragmented Industry: The presence of many small players makes it difficult to achieve significant market dominance.

BELFOR's reliance on unpredictable disaster events creates significant revenue volatility, making financial forecasting challenging and potentially increasing perceived risk for investors.

Skilled labor shortages directly limit operational capacity, leading to increased labor costs and potential project delays, impacting service quality and profit margins.

Maintaining consistent service quality across a vast global network of operations and franchisees is a persistent challenge, potentially leading to brand perception issues.

Same Document Delivered

Belfor SWOT Analysis

This is a real excerpt from the complete Belfor SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of their strategic positioning.

You're viewing a live preview of the actual Belfor SWOT analysis file. The complete version, detailing all Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

The file shown below is not a sample—it’s the real Belfor SWOT analysis you'll download post-purchase, in full detail and ready for your strategic planning.

Opportunities

The escalating frequency and severity of climate-related disasters, including hurricanes, wildfires, and floods, are creating a substantial and growing demand for disaster restoration services worldwide. This trend directly benefits BELFOR, as it translates into a consistent and expanding market for their specialized recovery and remediation expertise.

BELFOR can capitalize on advancements in technology, like AI and IoT, to make restoration work more precise and efficient. These tools can streamline everything from initial damage assessments to the actual cleanup and rebuilding phases.

By continuing to embrace digital transformation, BELFOR is already seeing benefits in faster response times and more accurate damage evaluations. This digital edge translates directly into better service for clients, especially during critical recovery periods.

For instance, in 2024, the global property restoration market is projected to reach over $100 billion, a significant portion of which is being influenced by technological adoption. BELFOR's investment in digital tools positions it to capture a larger share of this growing market by offering superior, tech-enabled services.

Belfor has a substantial opportunity to expand its reach into emerging markets, especially in the Asia Pacific region. This area is experiencing rapid urbanization and significant infrastructure development, which directly correlates with a growing need for property restoration services. For instance, countries like Vietnam and Indonesia are projected to see substantial GDP growth in 2024 and 2025, fueling construction and, consequently, the demand for disaster recovery and property maintenance.

Furthermore, Belfor can leverage its strategy of acquiring companies to diversify its service offerings. This approach allows for the integration of niche capabilities, such as specialized mold remediation or advanced water damage restoration techniques, into its existing portfolio. This diversification not only broadens its customer base but also creates new, high-margin revenue streams, as seen in the growing market for sustainable building materials and retrofitting services.

Strategic Partnerships within the Industry

Belfor can significantly enhance its market position by forging strategic partnerships. Collaborations with insurance providers, exemplified by programs like the Claims Partnership Program, can streamline claims processing and cultivate deeper relationships with key stakeholders. This approach not only expedites service delivery but also reinforces trust and reliability for policyholders.

Expanding these alliances into adjacent sectors, such as interior design firms, presents another avenue for growth. Integrating services with interior designers allows Belfor to offer a more comprehensive and seamless client experience, particularly in restoration projects. This cross-sector collaboration can lead to increased client satisfaction and opportunities for bundled service offerings.

These strategic alliances are crucial for competitive advantage. For instance, in 2024, the property restoration market saw increased demand for integrated services, with clients valuing end-to-end solutions. By partnering effectively, Belfor can tap into new customer bases and diversify its revenue streams.

- Streamlined Claims: Partnerships with insurers, like the Claims Partnership Program, improve efficiency and client relations.

- Enhanced Client Experience: Collaborations with interior designers offer integrated restoration and design services.

- Market Expansion: Alliances in related sectors broaden Belfor's reach and service integration capabilities.

Growth in Construction and Infrastructure Development

The construction sector is poised for significant expansion in 2025, with projections indicating robust growth, particularly in civil engineering and large-scale infrastructure projects. This upward trend presents a prime opportunity for BELFOR to capitalize on increased demand for its specialized reconstruction and restoration services. For instance, the U.S. Department of Commerce reported a 10.5% increase in construction spending in early 2024, a momentum expected to carry into 2025, especially for public works.

This burgeoning construction environment allows BELFOR to broaden its reach within the commercial and industrial sectors. As more large-scale projects commence, the need for specialized disaster recovery and restoration expertise becomes paramount. This expansion could translate into new contracts and a strengthened market position for BELFOR.

- Projected 2025 growth in construction spending, particularly in infrastructure.

- Increased demand for BELFOR's reconstruction and restoration services.

- Opportunity to expand commercial and industrial client base.

- Leveraging infrastructure investment for service diversification.

The increasing frequency and severity of climate-related disasters worldwide present a consistent and growing demand for BELFOR's specialized recovery and remediation services. Technological advancements, such as AI and IoT, offer opportunities to enhance the precision and efficiency of restoration work, as seen in the projected over $100 billion global property restoration market in 2024, where tech adoption is a key driver.

BELFOR is well-positioned to expand into emerging markets, particularly in the Asia Pacific region, driven by rapid urbanization and infrastructure development. For example, countries like Vietnam and Indonesia are expected to experience significant GDP growth in 2024 and 2025, boosting construction and the need for property restoration. Diversifying service offerings through strategic acquisitions, like integrating specialized mold remediation, can create new, high-margin revenue streams, tapping into markets like sustainable building materials.

Strategic partnerships, such as BELFOR's Claims Partnership Program with insurers, streamline claims processing and foster stronger stakeholder relationships, improving client trust. Collaborations with adjacent sectors, like interior design firms, can offer a more integrated client experience, leading to increased satisfaction and bundled service opportunities. The construction sector's projected robust growth in 2025, especially in infrastructure, with U.S. construction spending showing a 10.5% increase in early 2024, offers BELFOR significant opportunities to expand its commercial and industrial client base and leverage service diversification.

Threats

The property restoration sector is notoriously fragmented, with a vast number of local and regional players vying for business alongside national brands. This crowded landscape means Belfor constantly faces rivals offering similar services, potentially leading to price wars that erode profitability.

In 2024, the property restoration market continued to see significant activity, driven by an increase in severe weather events. For instance, reports indicate a rise in insured losses from natural catastrophes, creating both opportunities and intense competition for established firms like Belfor as they seek to capture market share in affected areas.

This intense competition necessitates continuous investment in technology, service quality, and marketing to differentiate Belfor and maintain its competitive edge. Failure to innovate or adapt to market demands could result in losing ground to more agile or aggressive competitors, impacting revenue growth and market position.

Economic uncertainties, such as the potential for recessions and persistent inflationary pressures, present a significant threat to Belfor. Rising inflation, which saw the US CPI hit 3.4% year-over-year in April 2024, directly increases operational costs for construction and restoration services, from materials to labor. This, coupled with fluctuating interest rates impacting borrowing costs and client budgets, could lead to reduced spending on discretionary restoration projects.

The persistent shortage of skilled labor, particularly in trades crucial for property restoration, poses a significant threat to Belfor. This ongoing challenge can directly impact operational efficiency, potentially leading to increased labor costs as companies compete for a limited pool of qualified workers. For instance, in 2024, the construction industry, which heavily relies on skilled trades, continued to face substantial labor gaps, with reports indicating millions of unfilled positions nationwide.

This scarcity can translate into difficulties in staffing projects promptly, potentially causing delays in service delivery and impacting Belfor's ability to meet client timelines. Furthermore, the pressure to attract and retain talent may necessitate higher wage demands, affecting profitability. If not managed effectively, these factors could also lead to a compromise in service quality or extended project completion times, ultimately damaging Belfor's reputation and customer satisfaction.

Evolving Regulatory Landscape and Compliance Costs

The property restoration industry faces a growing challenge from evolving regulations. Changes in environmental standards, building codes, and health and safety requirements directly impact BELFOR's operations. For instance, stricter asbestos abatement rules or new lead paint disclosure mandates can significantly increase project timelines and material costs. These shifts necessitate ongoing investment in training and updated equipment to ensure compliance, adding to overall operational expenses.

Failure to adapt to these regulatory changes carries substantial risks. Non-compliance can result in hefty fines, suspension of operating licenses, and damage to BELFOR's reputation. For example, in 2024, several restoration companies faced penalties for failing to adhere to updated OSHA safety protocols for working with hazardous materials. BELFOR must remain vigilant in monitoring and implementing these changes to maintain its market position and avoid costly legal entanglements.

- Increased compliance costs: Investment in new training, certifications, and specialized equipment to meet updated environmental and safety standards.

- Operational complexities: Adapting project methodologies and documentation to satisfy new building codes and health regulations.

- Risk of penalties: Potential fines and legal action for non-adherence to federal, state, and local regulatory mandates.

- Reputational damage: Negative publicity and loss of client trust resulting from compliance failures.

Reputational Risks from Large-Scale Operations

Belfor, a leader in disaster recovery and restoration, faces significant reputational risks with its large-scale operations. The sensitive nature of these services means any misstep during critical recovery phases can have a profound impact. For instance, a major fire at a large industrial facility in Texas in late 2023, where Belfor was involved, generated significant social media attention regarding cleanup timelines. A perceived delay or subpar quality in such a high-profile situation can erode client confidence and damage public perception, especially given the prevalence of online reviews and immediate news dissemination.

The impact of negative publicity in the disaster recovery sector is amplified. In 2024, a survey by Reputation Institute found that 80% of consumers consider a company's reputation when making purchasing decisions, a figure that likely holds true for critical services like disaster recovery. If Belfor experiences a widely publicized failure in a large-scale project, it could lead to:

- Loss of future contracts from clients wary of similar issues.

- Increased scrutiny from regulatory bodies and industry watchdogs.

- Difficulty attracting and retaining top talent if the company's image suffers.

- A decline in market share as competitors highlight perceived shortcomings.

Belfor operates in a highly competitive market, facing numerous rivals offering similar restoration services. This intense competition, exacerbated by an increase in severe weather events in 2024, can lead to price wars and pressure on profit margins, requiring continuous investment in differentiation and service quality to maintain market share.

Economic headwinds, including persistent inflation which saw the US CPI at 3.4% year-over-year in April 2024, directly increase Belfor's operational costs for materials and labor. Fluctuating interest rates also impact client budgets, potentially reducing demand for discretionary restoration projects.

A significant threat to Belfor is the ongoing shortage of skilled labor in essential trades, a challenge that continued to affect the construction industry in 2024 with millions of unfilled positions. This scarcity can lead to project delays, increased labor costs, and potential compromises in service quality, impacting profitability and reputation.

Evolving regulations concerning environmental standards, building codes, and health and safety present operational complexities and increased compliance costs for Belfor. Failure to adapt to these changes, such as stricter asbestos abatement rules, can result in substantial fines and reputational damage.

Belfor faces significant reputational risks, as a perceived delay or subpar quality in its high-profile disaster recovery projects can erode client confidence and public perception. In 2024, 80% of consumers considered reputation in purchasing decisions, highlighting the critical need for Belfor to maintain a strong public image.

SWOT Analysis Data Sources

This Belfor SWOT analysis is informed by a robust blend of internal financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded strategic perspective.