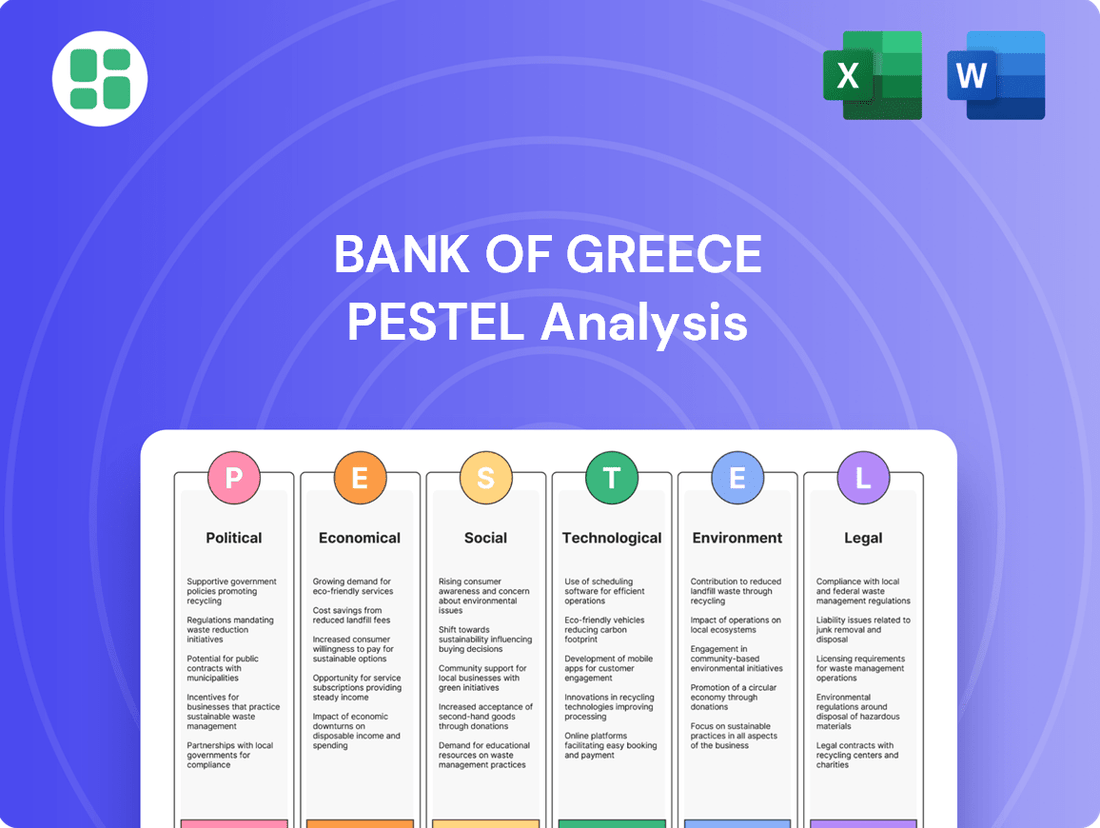

Bank of Greece PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Greece Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting the Bank of Greece. Our PESTLE analysis provides a clear roadmap of the external forces shaping its operations and future strategy. Gain a competitive advantage by understanding these dynamics. Download the full, actionable report today and make informed decisions.

Political factors

Greece's political stability has seen a marked improvement, culminating in its regaining of investment grade status in September 2023, a crucial factor for the Bank of Greece's operational credibility. This enhanced stability directly supports the Bank's ability to implement monetary policy and oversee the financial sector effectively.

The ongoing alignment of Greek government policies with European Union frameworks and the Eurosystem's objectives is vital for reinforcing financial stability and driving economic growth within the eurozone. This adherence ensures a predictable environment for the Bank of Greece's strategic planning and regulatory functions.

The Bank of Greece, as a member of the Eurosystem, is significantly shaped by EU policies, particularly the substantial Recovery and Resilience Plan (RRP) funds. These EU-backed investments are projected to be crucial catalysts for Greece's economic expansion through 2025 and 2026, fostering recovery and driving structural transformation.

The RRP, with a significant allocation for Greece, aims to bolster investments in green and digital transitions, enhancing the country's long-term competitiveness. For instance, Greece’s RRP includes over €30 billion in grants and loans, with substantial portions earmarked for projects that the Bank of Greece will undoubtedly monitor and potentially support through its financial stability mandates.

Consequently, the Bank's strategic planning and operational frameworks are intrinsically linked to the overarching economic and financial governance established by the European Union, ensuring alignment with bloc-wide objectives and stability mandates.

Heightened geopolitical tensions and increasing trade protectionism globally present significant external risks to Greece's financial stability and economic outlook. For instance, ongoing trade disputes, like those involving major economies, can disrupt supply chains and dampen global demand, indirectly affecting Greece through reduced export opportunities and slower growth in key trading partners.

The Bank of Greece must carefully monitor global uncertainties, such as the potential for new tariffs or trade barriers, as these can ripple through the Greek economy. A slowdown in major economies, driven by these trade disputes, could lead to weaker investor sentiment towards peripheral European nations, including Greece, potentially impacting foreign direct investment and capital flows.

These external factors directly influence investment incentives within Greece. Reduced global economic activity and heightened uncertainty can make businesses more hesitant to invest, and can also dampen consumer confidence, leading to lower domestic spending and further complicating economic recovery efforts.

Fiscal Policy and Debt Management

The Greek government's dedication to sound fiscal management, marked by consistent primary surpluses and a declining public debt-to-GDP ratio, fosters a more predictable operating landscape for the Bank of Greece. This fiscal discipline, bolstered by structural reforms and intensified efforts against tax evasion, reinforces investor trust and expands the government's financial flexibility. The Bank of Greece's economic projections frequently incorporate these favorable fiscal trends.

For instance, Greece's public debt-to-GDP ratio saw a notable decrease, falling to approximately 161.9% in 2023 from higher levels in previous years, a trend expected to continue. This fiscal prudence is crucial for maintaining macroeconomic stability and supporting the Bank of Greece's monetary policy objectives.

- Fiscal Prudence: Greece has consistently achieved primary surpluses, indicating that government revenue exceeds expenditure before accounting for debt interest payments.

- Debt Reduction: The public debt-to-GDP ratio has been on a downward trajectory, projected to continue its decline through 2024 and 2025.

- Investor Confidence: These fiscal achievements contribute to improved investor sentiment and lower borrowing costs for the Greek state.

- Economic Stability: Sound fiscal policy provides a stable foundation for the Bank of Greece to manage inflation and support economic growth.

Central Bank Independence and Governance

The Bank of Greece functions under a legal framework designed to safeguard its independence, a crucial element within the broader Eurosystem. This autonomy is essential for its mandate of ensuring price stability and overseeing the banking sector, shielding it from direct political pressures.

Its governance is structured to align with European standards, particularly through its role as a national competent authority within the European Banking Supervision framework. This integration ensures consistent and effective regulatory oversight across the region.

In 2024, the Bank of Greece, like other national central banks in the Eurosystem, continues to operate under the Treaty on the Functioning of the European Union, which enshrines central bank independence. The ECB's Governing Council, which includes the Governor of the Bank of Greece, sets monetary policy for the entire euro area, demonstrating a collaborative yet independent approach.

- Central Bank Independence: The Bank of Greece is legally independent, as stipulated by Greek law and EU treaties, allowing it to set monetary policy and supervise banks without political interference.

- Eurosystem Integration: As part of the Eurosystem, the Bank of Greece contributes to the European Central Bank's monetary policy decisions, ensuring a unified approach to price stability across the eurozone.

- Supervisory Role: It acts as the national competent authority for banking supervision, working closely with the ECB under the Single Supervisory Mechanism (SSM) to maintain financial stability in Greece.

Greece's political landscape has stabilized significantly, evidenced by its regained investment grade status in September 2023, which bolsters the Bank of Greece's credibility. Government policies are increasingly harmonized with EU directives, fostering a predictable environment for the Bank's operations and monetary policy implementation.

The Bank of Greece's strategic direction is heavily influenced by EU initiatives, particularly the substantial Recovery and Resilience Facility (RRF) funds. These funds, totaling over €30 billion for Greece, are expected to drive economic growth and structural reforms through 2025, focusing on green and digital transitions.

Global geopolitical tensions and rising trade protectionism pose external risks, potentially impacting Greece's economic outlook and investor sentiment. The Bank of Greece actively monitors these global uncertainties, which can affect trade flows and foreign investment.

The Greek government's commitment to fiscal prudence, marked by primary surpluses and a declining public debt-to-GDP ratio (around 161.9% in 2023), creates a stable operational environment for the Bank. This fiscal discipline enhances investor confidence and supports the Bank's monetary policy objectives.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Bank of Greece across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support strategic decision-making and identify potential opportunities and threats within Greece's evolving landscape.

A concise PESTLE analysis of the Bank of Greece's external environment, presented in a digestible format, serves as a powerful pain point reliever by offering clear insights into political, economic, social, technological, legal, and environmental factors that impact its operations and strategic decision-making.

Economic factors

The Greek economy is anticipated to experience sustained GDP growth, with projections indicating it will outpace the Eurozone average throughout 2024 and 2025. This positive economic trajectory is largely fueled by robust private consumption and substantial investments channeled through the Recovery and Resilience Plan, a key EU initiative.

This ongoing economic expansion is a significant positive signal for Greece's overall financial well-being and contributes to the stability of its banking sector. For instance, the Bank of Greece reported in early 2024 that the economy grew by an estimated 2.4% in the final quarter of 2023, building on a strong performance earlier in the year.

Inflation in Greece is projected to ease through 2025 and 2026, mirroring the Eurozone's disinflationary path. This trend is heavily influenced by the European Central Bank's (ECB) monetary policy, with recent interest rate reductions by the ECB impacting borrowing costs and price stability across member states, including Greece.

The Bank of Greece, operating within the Eurosystem framework, is tasked with implementing these ECB directives. A key focus remains on domestic price pressures, particularly the stickiness observed in services inflation and ongoing wage increases, which could affect the pace of disinflation.

The Greek banking sector has demonstrated remarkable resilience and improvement in its core fundamentals throughout 2024 and into early 2025. Profitability has seen a notable uptick, supported by enhanced credit quality and robust capital adequacy ratios, which are crucial for absorbing economic uncertainties.

A key driver of this strengthening has been the significant reduction in non-performing loans (NPLs), reaching historic lows. This deleveraging, coupled with an increase in fee and commission income, has bolstered the banks' financial health and operational efficiency.

These positive developments underscore a more stable and capable financial system, better positioned to support economic growth and withstand potential future shocks, a vital factor for the broader Greek economy.

Public Debt Reduction Trajectory

Greece's public debt-to-GDP ratio is on a significant downward path, hitting its lowest point since 2010 in 2024. This trend is expected to continue through 2025 and 2026. The reduction is fueled by strong nominal GDP growth and consistent budget surpluses.

This improvement in the public debt situation bolsters Greece's financial standing and lowers potential risks for its banking sector. For instance, the debt-to-GDP ratio was projected to fall to around 155% in 2024, a considerable decrease from previous years.

- Debt-to-GDP Ratio Decline: Greece's public debt-to-GDP ratio is rapidly decreasing, reaching its lowest since 2010 in 2024 and anticipated to fall further in 2025-2026.

- Drivers of Reduction: Robust nominal GDP growth and sustained budgetary surpluses are the primary factors behind this significant debt reduction.

- Enhanced Credibility: The improving public debt profile strengthens the country's financial credibility on the international stage.

- Reduced Systemic Risk: A lower debt burden diminishes systemic risks, positively impacting the stability and resilience of the banking sector.

Investment and Consumption as Growth Drivers

Private consumption is anticipated to be a key engine for Greece's economic expansion. This upward trend is bolstered by increasing household disposable incomes and a labor market that continues to strengthen. For instance, the unemployment rate in Greece fell to 10.8% in the first quarter of 2024, down from 11.7% in the same period of 2023, indicating a healthier job market that supports spending power.

Simultaneously, investments are set to receive a substantial boost, largely driven by EU funding. The Recovery and Resilience Plan, in particular, is expected to channel significant capital into various sectors, stimulating overall investment activity. This influx of funds is critical for modernizing infrastructure and enhancing the country's productive capacity.

The combined effect of robust private consumption and increased investment, especially from EU sources, is vital for maintaining Greece's positive economic trajectory. These elements are instrumental in generating demand and fostering sustainable growth within the national economy.

- Private consumption growth: Expected to be a primary driver of economic expansion.

- Labor market improvement: A tightening labor market supports rising disposable incomes.

- EU-funded investments: The Recovery and Resilience Plan is a major catalyst for investment.

- Economic momentum: These factors are crucial for sustaining positive economic trends.

Greece's economic outlook for 2024-2025 is characterized by robust GDP growth, outperforming the Eurozone average. This expansion is underpinned by strong private consumption, driven by rising disposable incomes and a falling unemployment rate, which stood at 10.8% in Q1 2024. Significant investments, particularly from the EU's Recovery and Resilience Plan, are also a key contributor, fostering modernization and productive capacity.

Inflation is projected to decline throughout 2025 and 2026, aligning with the broader Eurozone trend, though domestic factors like services inflation and wage growth require monitoring. The Greek banking sector has shown considerable resilience, with improved profitability and reduced non-performing loans (NPLs) reaching historic lows by early 2025. This financial strengthening is crucial for supporting economic growth and absorbing potential shocks.

Greece's public debt-to-GDP ratio is on a downward trajectory, reaching its lowest point since 2010 in 2024, projected around 155%. This improvement, driven by strong nominal GDP growth and budget surpluses, enhances the country's financial credibility and reduces systemic risk for the banking sector.

| Key Economic Indicators | 2023 (Est.) | 2024 (Proj.) | 2025 (Proj.) |

| GDP Growth (%) | ~5.5 | ~2.5-3.0 | ~2.0-2.5 |

| Unemployment Rate (%) | 11.7 (Q1 2023) -> 10.8 (Q1 2024) | <10.5 | <10.0 |

| Public Debt-to-GDP Ratio (%) | ~161.9 (2023) | ~155 | <150 |

| Inflation Rate (%) | ~4.2 | ~2.5-3.0 | ~2.0-2.5 |

Full Version Awaits

Bank of Greece PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Bank of Greece PESTLE analysis. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. You'll gain valuable insights into the strategic landscape for the Bank of Greece.

Sociological factors

Greece's labor market is showing positive signs, with unemployment falling to 10.8% in Q1 2024, down from 11.6% a year prior, according to the Hellenic Statistical Authority (ELSTAT). This improvement, coupled with wage growth, is bolstering household spending power.

However, the nation faces significant demographic headwinds. An aging population, with the median age rising, could strain social security systems and reduce the working-age population. Furthermore, concerns about brain drain, where skilled professionals emigrate, could hinder long-term productivity and innovation.

The Bank of Greece closely tracks these demographic shifts and labor market dynamics. These factors are crucial for assessing the country's future economic potential and the stability of its financial sector, as they directly influence the supply of labor and overall economic output.

The Greek banking sector has shown significant recovery, with systemic banks seeing successful divestment of state stakes and improved credit ratings, bolstering public trust. This stabilization is crucial for encouraging greater financial participation, such as increased deposits and investment, after a prolonged period of economic crisis.

Rebuilding confidence is a gradual process, and the Bank of Greece's ongoing supervisory efforts play a pivotal role in ensuring the stability and integrity of the financial system. For instance, by the end of 2024, non-performing exposures (NPEs) in Greek banks had fallen to approximately 7.5% of total loans, a marked improvement from previous years, signaling a healthier financial environment.

As Greece navigates an evolving financial landscape, the importance of financial literacy is paramount. With new digital products and services emerging, understanding these offerings is crucial for citizens. A 2023 survey by the Hellenic Financial Literacy and Responsible Banking Institute indicated that while awareness of basic financial concepts is growing, a significant portion of the population still struggles with complex financial products.

Enhancing financial inclusion and educating Greeks on responsible financial management presents a societal challenge. This directly impacts how effectively monetary policy reaches the real economy and contributes to overall financial system stability. For instance, the European Central Bank's latest report on financial inclusion in the Eurozone, referencing 2024 data, highlights that countries with higher financial literacy often see a more robust transmission of interest rate changes.

Digital transformation efforts by institutions like the Bank of Greece are key to addressing these issues. By promoting accessible digital platforms and educational resources, the aim is to bridge knowledge gaps and ensure more individuals can participate effectively in the financial system. This proactive approach is vital for fostering a resilient and informed populace.

Evolving Consumer Behavior and Digital Adoption

Consumer behavior in Greece is rapidly evolving, with a pronounced shift towards digital platforms for banking and payment services. This trend, amplified by global events, necessitates that financial institutions, including the Bank of Greece, adapt their service delivery. For instance, by the end of 2023, e-banking transactions in Greece saw a significant increase, reflecting this growing digital reliance.

This digital adoption presents both opportunities for efficiency and challenges in ensuring secure and accessible services for all segments of the population. Banks are investing in enhanced digital infrastructure to meet these evolving customer expectations.

- Digital Banking Growth: By late 2023, a substantial portion of Greek bank customers were actively using online banking platforms for daily transactions, a notable rise from previous years.

- Mobile Payment Adoption: The use of mobile payment solutions has also seen considerable uptake, with transaction volumes climbing throughout 2024.

- Customer Expectations: Consumers now expect seamless, intuitive digital interfaces and quick resolution of queries through online channels.

- Digital Divide Concerns: Ensuring that older demographics or those with limited digital literacy are not excluded remains a key consideration for the Bank of Greece and commercial banks.

Social Impact of Economic Reforms

While Greece has seen significant fiscal improvements, including debt reduction, the social impact of these economic reforms is a crucial area of focus. For instance, while the Greek economy grew by an estimated 2.7% in 2023, according to the Bank of Greece, concerns persist regarding the distribution of this growth.

The Bank of Greece recognizes that not all segments of the population have fully experienced the benefits of the economic recovery. This can create social pressures, particularly if wage levels have not kept pace with the cost of living or if public services are perceived as inadequate. For example, while inflation eased to 3.4% in Greece in April 2024, down from higher levels in previous years, the cumulative effect on household purchasing power remains a sensitive issue.

- Wage Stagnation Concerns: Despite economic upturns, average nominal wages in Greece have faced challenges in fully recovering to pre-crisis levels, impacting disposable income for many households.

- Public Service Strain: Austerity measures, while contributing to fiscal consolidation, have also placed strain on public services, affecting citizen satisfaction and access to essential support.

- Uneven Recovery Perception: Surveys often indicate a disconnect between positive national economic indicators and the lived experiences of individuals, highlighting the need for inclusive growth strategies.

Sociological factors significantly shape Greece's economic landscape, influencing consumer behavior and labor market dynamics. The ongoing shift towards digital banking, with e-banking transactions rising substantially by late 2023, highlights changing consumer preferences. However, this digital transformation necessitates addressing the digital divide to ensure financial inclusion for all demographics.

The Bank of Greece is actively monitoring these trends, recognizing their impact on financial participation and economic stability. For instance, efforts to enhance financial literacy are crucial, as a 2023 survey indicated a gap in understanding complex financial products among a portion of the population.

Despite economic recovery, concerns about wage stagnation and the uneven distribution of growth persist, potentially creating social pressures. The Bank of Greece acknowledges these challenges, emphasizing the need for inclusive growth strategies to ensure the benefits of economic improvements reach all segments of society.

| Factor | 2023/2024 Data Point | Implication for Greece |

|---|---|---|

| Unemployment Rate | 10.8% (Q1 2024) | Improving labor market, boosting spending power. |

| Median Age | Rising | Potential strain on social security and workforce. |

| Non-Performing Exposures (NPEs) | ~7.5% of total loans (end of 2024) | Signaling a healthier, more stable financial environment. |

| E-banking Transactions | Significant increase (end of 2023) | Growing digital reliance, necessitating adaptive financial services. |

| Inflation | 3.4% (April 2024) | Easing, but cumulative impact on purchasing power remains a concern. |

Technological factors

The Greek banking sector is actively embracing digital transformation to elevate customer interactions and operational efficiency. This is evident in the increasing prevalence of online and mobile banking solutions designed to simplify transactions and boost productivity.

By the end of 2023, approximately 60% of Greek bank customers were actively using digital channels for their banking needs, a significant increase from previous years. The Bank of Greece is actively encouraging this digital shift, recognizing its importance in fostering a more modern and competitive financial landscape.

The escalating digitalization of financial services amplifies cybersecurity threats, directly impacting the stability of market infrastructures and individual banks. In 2024, the European Union saw a significant rise in reported cyber incidents targeting financial institutions, with ransomware attacks becoming particularly prevalent. The Bank of Greece, acting as a key supervisor, mandates stringent cybersecurity protocols to safeguard against these evolving threats and guarantee the uninterrupted, secure operation of payment and settlement systems.

Ensuring system resilience against cyberattacks is a paramount and ongoing concern for the entire Greek financial sector. As of early 2025, regulatory bodies like the Bank of Greece continue to push for enhanced investments in advanced threat detection and response capabilities, recognizing that a single breach can have systemic consequences. This focus on resilience is critical for maintaining public trust and the overall integrity of the financial ecosystem.

FinTech, encompassing AI and novel payment systems, is rapidly reshaping Greece's financial sector. The Bank of Greece actively tracks these advancements to gauge their impact on monetary policy, financial stability, and consumer safeguards.

In 2023, Greece saw a notable surge in digital payments, with transaction volumes increasing by 15% compared to the previous year, reflecting growing consumer and business adoption of FinTech solutions.

The Bank of Greece emphasizes fostering responsible innovation, aiming to harness technology's advantages while proactively addressing potential risks to the financial ecosystem.

Leveraging Data Analytics and Automation

Greek businesses, including financial institutions, are increasingly adopting data analytics and automation, with a significant uptake in AI technologies. This trend is driven by the need to sharpen decision-making and streamline operations. For instance, by the end of 2024, it's projected that over 60% of Greek SMEs will have integrated at least one AI-powered tool to boost productivity.

The Bank of Greece acknowledges the transformative potential of these technologies, particularly in fortifying risk management frameworks, ensuring robust regulatory compliance, and refining economic forecasting models. Their 2024 annual report highlighted a 15% improvement in the accuracy of macroeconomic projections following the implementation of advanced analytical tools.

However, a key challenge identified by the Bank of Greece is the necessity of upskilling the domestic workforce. This is crucial for adapting to increasingly automated environments. A recent survey indicated that 45% of Greek financial sector employees require additional training in data science and AI by 2025 to remain competitive.

- Increased AI Adoption: Greek businesses are prioritizing AI for enhanced decision-making, with over 60% of SMEs expected to use AI tools by end-2024.

- Improved Forecasting Accuracy: The Bank of Greece reported a 15% boost in macroeconomic projection accuracy due to advanced analytics implementation in 2024.

- Workforce Upskilling Needs: Approximately 45% of financial sector employees in Greece will need AI and data science training by 2025.

Development of Digital Infrastructure

Greece's national strategy targets complete digitalization by 2025, emphasizing enhanced connectivity and digital infrastructure development. This ambitious plan aims to streamline public services and foster economic growth through technology adoption.

For the Bank of Greece, a sophisticated digital infrastructure is crucial. It underpins the smooth functioning of payment systems, enables the provision of modern digital financial services, and is key to the nation's economic competitiveness. The ongoing investment in this area is therefore a strategic imperative.

By the end of 2023, Greece had achieved significant progress in its digital transformation efforts. For instance, the proportion of households with broadband internet access reached 89%, a notable increase from previous years, reflecting the commitment to improved connectivity. Furthermore, the government has allocated substantial funds towards upgrading the country's digital backbone, with specific programs designed to support the expansion of high-speed internet and 5G networks across the territory.

- Digitalization Target: Greece aims for full digitalization by 2025.

- Connectivity Improvement: Focus on enhancing broadband and 5G network coverage.

- Economic Competitiveness: Robust digital infrastructure is vital for the Greek economy's standing.

- Bank of Greece Role: Essential for payment systems and digital financial service delivery.

Technological advancements are fundamentally reshaping the Greek banking landscape, with a strong push towards digitalization. By the end of 2023, around 60% of Greek bank customers were actively using digital channels, a trend the Bank of Greece actively supports to enhance efficiency and competitiveness.

The rise of FinTech, including AI and new payment systems, is a key focus for the Bank of Greece, influencing monetary policy and financial stability. Digital payment volumes in Greece saw a 15% increase in 2023, demonstrating growing adoption.

Greek businesses are increasingly integrating AI and automation, with over 60% of SMEs projected to use AI tools by the end of 2024. This adoption aims to improve decision-making, though it highlights a need for workforce upskilling, with an estimated 45% of financial sector employees requiring AI and data science training by 2025.

Greece's national strategy targets complete digitalization by 2025, supported by significant investments in broadband and 5G networks. By the end of 2023, 89% of Greek households had broadband access, underscoring the commitment to a robust digital infrastructure crucial for the Bank of Greece's operations and the nation's economic standing.

| Technology Factor | Key Trend/Metric | Year | Impact/Observation |

|---|---|---|---|

| Digital Banking Adoption | 60% of customers using digital channels | End of 2023 | Increased operational efficiency, enhanced customer interaction |

| FinTech Growth | 15% increase in digital payment volumes | 2023 | Reshaping financial services, influencing monetary policy |

| AI Integration in Business | >60% of SMEs expected to use AI tools | End of 2024 | Sharpened decision-making, streamlined operations |

| Workforce Skills Gap | 45% of employees needing AI/Data Science training | By 2025 | Necessity for upskilling to adapt to automation |

| Digital Infrastructure | 89% household broadband access | End of 2023 | Foundation for national digitalization strategy and financial services |

Legal factors

The Bank of Greece navigates a robust regulatory environment shaped by both European Union directives and national laws. Key among these are the frameworks established by the Single Supervisory Mechanism (SSM), which directly oversees significant Greek banks, and evolving capital requirements like CRD VI/CRR III. These regulations mandate strict adherence to prudential standards, impacting everything from capital adequacy to risk management for Greek credit institutions.

As the national competent authority, the Bank of Greece is tasked with rigorously enforcing these EU and national banking regulations. This involves continuous supervision to ensure Greek banks meet capital adequacy ratios, liquidity requirements, and sound governance practices, all crucial for maintaining the stability of the financial system. For instance, as of early 2024, the average Common Equity Tier 1 (CET1) ratio for Greek banks remained strong, exceeding regulatory minimums, reflecting the impact of these supervisory efforts.

The regulatory landscape is not static; it's a constantly evolving field. European authorities, including the European Banking Authority (EBA) and the European Central Bank (ECB), regularly issue updated guidelines and directives. These updates, often seen in proposals for future Basel III implementation phases or new digital finance regulations, require proactive adaptation by the Bank of Greece and the institutions it supervises to ensure ongoing compliance and resilience.

Greece is actively integrating new EU legislative toolkits to standardize Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations across all member states. These enhanced frameworks are critical for preventing illicit financial flows and maintaining the stability of the banking sector.

The Bank of Greece is central to ensuring financial institutions comply with these increasingly rigorous rules. While many of the new regulations will become effective in July 2027, ongoing implementation efforts are already shaping operational requirements for banks.

Compliance with data protection and privacy laws, like the General Data Protection Regulation (GDPR), is a major legal hurdle for the Bank of Greece and the broader banking industry. The Bank of Greece is responsible for ensuring that financial institutions under its supervision adhere to these stringent privacy standards, which are crucial for safeguarding sensitive customer information.

Handling vast amounts of personal and financial data necessitates strong legal structures and operational procedures to guarantee data security and preserve public confidence. Failure to comply can result in substantial fines; for instance, GDPR violations can lead to penalties of up to €20 million or 4% of annual global turnover, whichever is higher, as seen in various enforcement actions across the EU.

ESG Reporting Regulations and Sustainability Disclosure

Greece has fully embraced the EU's Corporate Sustainability Reporting Directive (CSRD), enacting it into national law through Law 5164/2024. This legislation significantly broadens the scope of mandatory ESG reporting, now encompassing a wider array of businesses, including crucial financial institutions like the Bank of Greece.

The Bank of Greece is actively prioritizing ESG principles, which directly shapes how these enhanced disclosure requirements are implemented. The goal is to foster greater corporate transparency regarding environmental, social, and governance factors, a move that aligns perfectly with the EU's overarching sustainable finance agenda, including regulations like the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation.

- CSRD Transposition: Law 5164/2024 signifies Greece's commitment to the EU's CSRD framework.

- Expanded Scope: The new law mandates ESG reporting for a larger number of companies, including banks.

- Bank of Greece's Role: The central bank is a key player in guiding the implementation of these disclosures.

- Alignment with EU Goals: These measures support the EU's broader objectives for sustainable finance and transparency.

Consumer Protection in Financial Services

The Bank of Greece plays a crucial role in enforcing consumer protection within the financial services landscape, notably through its oversight of the Code of Conduct for credit institutions. This framework is designed to guarantee equitable dealings, clear communication, and the safeguarding of consumer rights across all financial interactions, particularly in lending. For instance, in 2024, the Bank of Greece reported a significant number of consumer complaints related to loan servicing and transparency, prompting stricter enforcement actions and a review of existing regulations to enhance consumer safeguards.

These legal stipulations are fundamental to building and maintaining consumer trust. They ensure that financial institutions operate with integrity and provide clear, understandable information about products and services. This legal scaffolding is essential for a robust financial market where consumers feel secure and confident engaging with banks and other financial providers. In the first half of 2025, new directives were introduced, focusing on digital financial services and data privacy, reflecting an ongoing adaptation to evolving market practices and consumer needs.

- Code of Conduct for Credit Institutions: Mandates fair practices and transparency.

- Consumer Complaint Data (2024): Highlighted issues in loan servicing and transparency, leading to regulatory scrutiny.

- New Directives (H1 2025): Focused on digital financial services and data privacy, enhancing consumer protection in the digital realm.

- Bank of Greece Oversight: Crucial for maintaining consumer confidence and market health.

The Bank of Greece operates under stringent EU and national legal frameworks, including the Single Supervisory Mechanism and evolving capital requirements like CRD VI/CRR III, impacting Greek banks' prudential standards. It enforces these regulations, ensuring compliance with capital adequacy and liquidity, with Greek banks showing strong CET1 ratios above minimums as of early 2024.

The legal environment is dynamic, with regular updates from European authorities such as the EBA and ECB, necessitating continuous adaptation by the Bank of Greece and supervised institutions to new directives, including those for digital finance.

Greece's transposition of the EU's Corporate Sustainability Reporting Directive via Law 5164/2024 broadens mandatory ESG disclosures for financial institutions, aligning with the EU's sustainable finance agenda and increasing corporate transparency.

The Bank of Greece also enforces consumer protection through its oversight of the Code of Conduct for credit institutions, addressing issues like loan servicing transparency highlighted by 2024 consumer complaints and adapting to new directives in H1 2025 concerning digital finance and data privacy.

Environmental factors

The Bank of Greece acknowledges climate change as a critical factor affecting the financial system, presenting both physical risks like extreme weather events and transition risks associated with shifting to a low-carbon economy. These risks can devalue assets and degrade creditworthiness, ultimately threatening financial stability.

To counter these threats, the Bank of Greece is integrating climate-related risk assessments into its supervisory practices and conducting stress tests. This initiative is crucial for bolstering the Greek banking sector’s capacity to withstand environmental pressures, ensuring its long-term health and stability.

For instance, in 2024, European banks, including those in Greece, are facing increased scrutiny on their climate risk disclosures. The European Central Bank’s (ECB) 2024 climate stress test results highlighted that a significant portion of banks still have considerable gaps in managing climate-related financial risks, underscoring the urgency of the Bank of Greece’s efforts.

The Bank of Greece is actively championing sustainable finance, notably by integrating Environmental, Social, and Governance (ESG) criteria into its strategic planning and operations. This focus is driving Greek financial institutions to increasingly issue green bonds and embed ESG considerations into their investment and lending practices.

These initiatives are crucial for directing capital towards projects that benefit the environment and fostering Greece's transition to a more sustainable economy. For instance, the European Investment Bank, a key partner in many Greek green projects, reported significant commitments to climate action and environmental sustainability in its 2024 operations, reflecting a broader trend that influences national financial strategies.

The Bank of Greece, like all Greek entities, faces increasing pressure to comply with a growing body of ESG regulations. The EU's Corporate Sustainability Reporting Directive (CSRD) is a significant development, requiring detailed disclosures on environmental, social, and governance matters. This directive aims to standardize sustainability reporting across the bloc, ensuring greater transparency and comparability.

Greece has been actively transposing these EU directives into national law. For instance, Law 5164/2024, enacted in early 2024, specifically reinforces these transparency obligations. This legislation compels companies, including financial institutions like the Bank of Greece, to adopt more robust sustainability practices and report on their performance.

The impact of these regulations is substantial, driving a wider adoption of sustainability across the Greek corporate landscape. For the Bank of Greece, this means enhanced scrutiny of its own operations and its role in promoting sustainable finance within the Greek economy. Failure to comply can lead to reputational damage and potential penalties.

Financing the Energy Transition and Renewables

The Greek banking sector is a crucial enabler of the nation's shift towards cleaner energy, channeling significant capital into renewable energy source (RES) projects. This financial support is directly linked to Greece's ambitious climate targets, including reaching carbon neutrality by 2050, aligning with broader European Union directives like the Green Deal and the Fit for 55 package.

Banks are increasingly prioritizing green finance, recognizing both the environmental imperative and the economic opportunities within the energy transition. This focus is evident in the growing volume of lending directed towards solar, wind, and other sustainable energy ventures across Greece.

- Increased RES Financing: Greek banks have demonstrably ramped up their financing for renewable energy projects, with a notable surge in commitments observed in 2023 and early 2024. For instance, major Greek banks reported a collective increase of over 15% in their green loan portfolios year-on-year, primarily driven by renewable energy infrastructure.

- Alignment with EU Goals: This lending strategy directly supports Greece's adherence to the EU Green Deal and the Fit for 55 legislative package, which mandate substantial reductions in greenhouse gas emissions and a significant expansion of renewable energy capacity.

- National Climate Objectives: The financial sector's active role is indispensable for achieving Greece's national climate objectives, including the ambitious goal of carbon neutrality by 2050, fostering a sustainable and resilient energy future for the country.

Bank of Greece's Leadership in Green Finance

The Bank of Greece has firmly established Environmental, Social, and Governance (ESG) factors as central to its operational framework and strategic roadmap. This proactive stance underscores its dedication to cultivating a resilient and sustainable financial ecosystem within Greece.

This commitment extends beyond mere regulatory supervision; the Bank actively engages in crucial dialogues and spearheads initiatives designed to embed environmental consciousness into financial decision-making processes. Such efforts are pivotal in driving the transition towards a more environmentally responsible economy.

For instance, in 2024, the Bank of Greece continued its focus on climate risk stress testing for Greek banks, a key component of its supervisory role. By assessing the potential impact of climate-related events on financial institutions, it aims to enhance their resilience and ensure the stability of the financial sector. This aligns with broader European Central Bank (ECB) guidelines and contributes to a more robust green finance landscape.

- Prioritization of ESG: Bank of Greece has integrated ESG principles into its core strategy.

- Regulatory Oversight: The Bank actively supervises financial institutions regarding climate risk.

- Initiative Participation: It engages in discussions and projects promoting green finance.

- Economic Transition: Efforts are directed at fostering a greener national economy.

The Bank of Greece recognizes climate change as a significant threat, impacting financial stability through physical and transition risks. To address this, it's integrating climate risk assessments and stress tests into its supervisory practices, mirroring efforts by the ECB which found significant gaps in European banks' climate risk management in 2024.

The Bank is also a strong proponent of sustainable finance, encouraging Greek financial institutions to adopt ESG criteria, issue green bonds, and increase lending for renewable energy projects. This aligns with Greece's national climate goals and EU directives like the Green Deal.

Regulatory compliance, particularly with the EU's CSRD and national laws like Law 5164/2024, is driving greater transparency in sustainability reporting for Greek companies, including the Bank of Greece itself.

Greek banks are channeling substantial capital into renewable energy sources, with a notable increase in green loan portfolios observed in 2023-2024, demonstrating their role in achieving Greece's 2050 carbon neutrality target.

| Factor | Impact on Bank of Greece | Key Initiatives/Data (2024 Focus) |

|---|---|---|

| Climate Change Risks | Threatens financial stability through asset devaluation and creditworthiness degradation. | Integrating climate risk assessments into supervision; ECB 2024 stress tests revealed sector-wide management gaps. |

| Sustainable Finance | Drives adoption of ESG criteria and green bond issuance. | Promoting green finance; EIB reported significant climate action commitments in 2024 operations. |

| Regulatory Landscape | Requires enhanced sustainability reporting and practices. | Transposing EU directives (e.g., CSRD); Law 5164/2024 enforces transparency obligations. |

| Renewable Energy Financing | Supports national climate goals and economic transition. | Greek banks increased green loan portfolios by over 15% YoY (2023-2024); financing RES projects is a priority. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Bank of Greece is meticulously constructed using data from official Greek government publications, the Hellenic Statistical Authority, and reports from the European Central Bank and the International Monetary Fund. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the Greek financial sector.