Bandwidth Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bandwidth Bundle

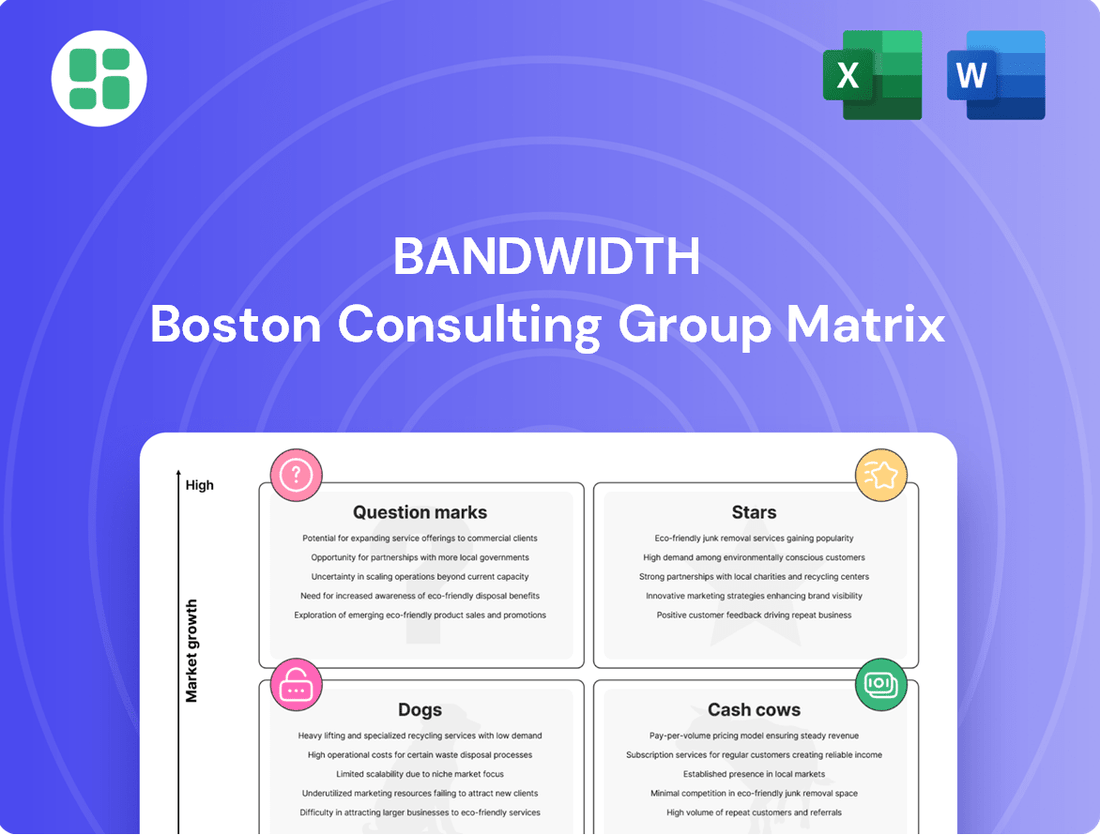

Understanding where a company's products fit within the BCG Matrix—Stars, Cash Cows, Dogs, or Question Marks—is crucial for strategic decision-making. This initial glimpse highlights the fundamental framework, but the true power lies in the detailed analysis.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Bandwidth's core cloud communications platform, offering voice, messaging, and emergency services APIs, is a definite star in the BCG matrix. This segment is crucial, catering to large enterprises and tech firms looking to integrate powerful communication features into their own products.

The market for these integrated communication solutions is experiencing rapid growth, and Bandwidth is well-positioned due to its extensive global network and deep regulatory knowledge. This strategic advantage allows them to serve customers effectively and capture significant market share.

Financial performance backs this up, with Bandwidth reporting strong revenue growth and a steady increase in customer acquisition through the first half of 2025. These positive trends highlight the platform's success and its leadership in this dynamic sector.

Bandwidth's Maestro and AI Bridge are shining stars in their portfolio, thanks to significant investments in AI. These platforms are built to handle advanced voice AI, integrate with contact centers, and even detect fraud, attracting major enterprise clients.

The company is seeing new multi-million dollar deals driven by these AI capabilities, underscoring their strong market adoption. This strategic focus on AI is a key differentiator in the growing CPaaS market, where AI-powered solutions are in high demand.

Bandwidth's position as the foundational communications platform for major UCaaS and CCaaS players like AWS, Cisco, Google, Microsoft, RingCentral, Zoom, Genesys, and Five9 firmly places it in the star quadrant of the BCG matrix. This signifies a dominant market share within a rapidly expanding sector where these industry giants depend on Bandwidth's extensive global network and powerful APIs for their critical communication services.

The sustained growth in cloud-based communication solutions directly fuels this star segment. For instance, the global UCaaS market was projected to reach over $100 billion by 2025, demonstrating the immense scale and ongoing expansion that Bandwidth is capitalizing on through its strategic partnerships.

Bring Your Own Carrier (BYOC) Ecosystem

Bandwidth's Bring Your Own Carrier (BYOC) ecosystem is a significant star in its portfolio, boasting the largest number of global integrations. This allows enterprises to maintain control over their communication infrastructure while migrating to the cloud. The Maestro platform further simplifies this by streamlining complex call routing, a critical factor for businesses seeking flexibility in their technology stacks.

This vendor-agnostic approach is a key differentiator, addressing a rising demand for independence in enterprise solutions. For instance, the BYOC market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, driven by the desire for cost optimization and greater control.

- Largest Global Integrations: Bandwidth's BYOC ecosystem offers unparalleled connectivity options.

- Enterprise Flexibility: Empowers businesses to choose their preferred carriers.

- Cloud Migration Acceleration: Simplifies the transition to cloud-based communication systems.

- Maestro Platform: Streamlines complex call flows and management.

Programmable Messaging for Enterprise Scale

Bandwidth's programmable messaging for enterprise clients is a clear star in their portfolio. This segment is experiencing robust growth, particularly with large organizations that demand high scalability, unwavering reliability, and stringent compliance features. For instance, Bandwidth has been actively onboarding new enterprise customers in the consumer engagement platform space, drawn by the need for sophisticated messaging solutions.

The company's strategic emphasis on enhancing messaging formats, such as Rich Communication Services (RCS), for its major clients further solidifies its position. This focus on advanced capabilities for large-scale deployments signals a deliberate strategy to capture significant market share in high-growth niches within the enterprise messaging market.

- Star Performer: Programmable messaging for large enterprises is a key growth driver.

- Key Strengths: High scalability, reliability, and compliance are critical differentiators.

- Market Traction: New enterprise clients are being secured in sectors like consumer engagement platforms.

- Future Focus: Expansion of messaging formats like RCS for major customers indicates continued investment in this star segment.

Bandwidth's core cloud communications platform, including voice, messaging, and emergency services APIs, is a definite star in the BCG matrix. This segment is crucial, catering to large enterprises and tech firms looking to integrate powerful communication features into their own products. The market for these integrated communication solutions is experiencing rapid growth, and Bandwidth is well-positioned due to its extensive global network and deep regulatory knowledge. Financial performance backs this up, with Bandwidth reporting strong revenue growth and a steady increase in customer acquisition through the first half of 2025.

Bandwidth's Maestro and AI Bridge are shining stars in their portfolio, thanks to significant investments in AI. These platforms are built to handle advanced voice AI, integrate with contact centers, and even detect fraud, attracting major enterprise clients. The company is seeing new multi-million dollar deals driven by these AI capabilities, underscoring their strong market adoption. This strategic focus on AI is a key differentiator in the growing CPaaS market, where AI-powered solutions are in high demand.

Bandwidth's position as the foundational communications platform for major UCaaS and CCaaS players like AWS, Cisco, Google, Microsoft, RingCentral, Zoom, Genesys, and Five9 firmly places it in the star quadrant of the BCG matrix. This signifies a dominant market share within a rapidly expanding sector where these industry giants depend on Bandwidth's extensive global network and powerful APIs for their critical communication services. The sustained growth in cloud-based communication solutions directly fuels this star segment. For instance, the global UCaaS market was projected to reach over $100 billion by 2025, demonstrating the immense scale and ongoing expansion that Bandwidth is capitalizing on through its strategic partnerships.

Bandwidth's Bring Your Own Carrier (BYOC) ecosystem is a significant star in its portfolio, boasting the largest number of global integrations. This allows enterprises to maintain control over their communication infrastructure while migrating to the cloud. The Maestro platform further simplifies this by streamlining complex call routing, a critical factor for businesses seeking flexibility in their technology stacks. This vendor-agnostic approach is a key differentiator, addressing a rising demand for independence in enterprise solutions. For instance, the BYOC market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, driven by the desire for cost optimization and greater control.

Bandwidth's programmable messaging for enterprise clients is a clear star in their portfolio. This segment is experiencing robust growth, particularly with large organizations that demand high scalability, unwavering reliability, and stringent compliance features. For instance, Bandwidth has been actively onboarding new enterprise customers in the consumer engagement platform space, drawn by the need for sophisticated messaging solutions. The company's strategic emphasis on enhancing messaging formats, such as Rich Communication Services (RCS), for its major clients further solidifies its position. This focus on advanced capabilities for large-scale deployments signals a deliberate strategy to capture significant market share in high-growth niches within the enterprise messaging market.

| Segment | BCG Quadrant | Growth Rate | Market Share | Key Drivers |

|---|---|---|---|---|

| Core Cloud Communications Platform (Voice, Messaging, Emergency APIs) | Star | High | High/Leading | Enterprise adoption of integrated communication solutions, global network reach, regulatory expertise. |

| AI-Powered Solutions (Maestro, AI Bridge) | Star | High | Growing | Demand for advanced AI in voice and contact centers, fraud detection, new multi-million dollar deals. |

| Bring Your Own Carrier (BYOC) Ecosystem | Star | High | Leading (largest integrations) | Enterprise demand for flexibility and control, cloud migration, cost optimization, Maestro platform simplification. |

| Programmable Messaging for Enterprises | Star | High | Strong | Scalability, reliability, compliance needs, adoption of advanced formats like RCS, growth in consumer engagement platforms. |

What is included in the product

The Bandwidth BCG Matrix analyzes product/service portfolio based on market growth and share.

It guides strategic decisions on investment, divestment, or divestment.

A clear, visual representation of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

Bandwidth's established global voice and SMS infrastructure serves as its foundational cash cow. This mature segment reliably handles high-volume communication traffic for its long-standing enterprise clients, generating consistent and substantial revenue. For example, in 2023, Bandwidth reported significant revenue from its Communications Platform as a Service (CPaaS) segment, which largely encompasses these core services, demonstrating their ongoing financial strength.

Existing long-term contracts with large enterprises for core voice and messaging services are Bandwidth's cash cows. These deep integrations translate into predictable, recurring revenue streams, a hallmark of a strong cash cow. For instance, in 2023, Bandwidth reported that its enterprise segment, largely driven by these contracts, continued to be a stable contributor to overall revenue.

Bandwidth's owned-and-operated global network, reaching over 65 countries, is a cornerstone of its cash cow strategy. This vast infrastructure offers a significant competitive edge, ensuring superior quality, unwavering reliability, and cost-effectiveness for its established services.

This robust network allows Bandwidth to maintain healthy profit margins on mature offerings, as the heavy investment in core network expansion has largely been completed. This operational efficiency translates directly into strong, consistent cash flow generation.

Regulatory and Compliance Expertise

The company's extensive knowledge of global regulatory landscapes, especially concerning emergency services and compliance like 911 access, acts as a significant cash cow. This specialized know-how is invaluable for major corporations, establishing a substantial competitive advantage by making it difficult for rivals to enter the market. This translates into a dependable, high-margin service with predictable revenue streams, requiring little investment in new market expansion.

This regulatory acumen is particularly valuable in 2024, as telecommunications regulations continue to evolve globally. For instance, the ongoing implementation and updates to E911 and NG911 mandates in North America and similar emergency communication standards in Europe create a sustained demand for compliant solutions. Companies that can navigate these complex requirements efficiently secure a stable revenue base.

- Expertise in E911/NG911 compliance: Critical for carriers and large enterprises.

- High barrier to entry: Competitors struggle to replicate deep regulatory knowledge.

- Stable revenue generation: Consistent demand for compliance services.

- Minimal new market development costs: Leverages existing expertise.

Stable Inbound/Outbound Voice Traffic for Legacy Systems

Providing consistent inbound and outbound voice traffic for businesses that are connecting older, on-premise systems with cloud-based solutions, especially in hybrid setups, positions Bandwidth's services as a cash cow. These clients typically represent significant, long-term relationships, and their move to new systems is a gradual process. Bandwidth's platform is instrumental in managing these transitions, ensuring a steady stream of revenue from their existing communication needs.

This segment is characterized by its stability and predictability. For instance, in 2024, Bandwidth reported continued strength in its enterprise voice services, which benefit from these long-standing customer relationships and the ongoing need for reliable communication infrastructure during hybrid cloud migrations. These customers value the seamless integration Bandwidth offers, minimizing disruption to their established operational workflows.

- Stable Revenue Streams: These services generate consistent, predictable income due to the essential nature of voice communication for businesses with legacy systems.

- Customer Retention: Long-term contracts and the complexity of migrating established voice infrastructure often lead to high customer retention rates in this segment.

- Hybrid Cloud Facilitation: Bandwidth's platform is key for enterprises bridging on-premise and cloud environments, a growing trend in 2024.

- Predictable Growth: While not explosive, this segment offers reliable, albeit slower, revenue growth as businesses gradually adopt new technologies.

Bandwidth's established voice and SMS infrastructure, underpinned by its owned global network, acts as a significant cash cow. This mature segment reliably handles high-volume communication traffic for long-standing enterprise clients, generating consistent revenue. In 2023, Bandwidth's CPaaS segment, largely comprising these core services, demonstrated ongoing financial strength.

Deeply integrated, long-term enterprise contracts for core voice and messaging services represent Bandwidth's cash cows, ensuring predictable, recurring revenue. The company's enterprise segment, heavily reliant on these contracts, remained a stable revenue contributor throughout 2023.

Bandwidth's expertise in navigating complex global regulatory landscapes, particularly concerning emergency services like E911, is a key cash cow. This specialized knowledge is invaluable to large corporations, creating a high barrier to entry for competitors and ensuring a dependable, high-margin service with predictable revenue streams.

The ongoing evolution of telecommunications regulations in 2024, such as E911 and NG911 mandates, sustains demand for compliant solutions. Companies adept at meeting these requirements, like Bandwidth, secure a stable revenue base.

| Segment | Revenue Contribution (2023) | Key Drivers | Cash Cow Characteristics |

|---|---|---|---|

| Voice & SMS Infrastructure | Significant portion of total revenue | High-volume enterprise traffic, long-term contracts | Predictable, recurring revenue, stable margins |

| E911/NG911 Compliance | Growing, high-margin service | Evolving regulatory landscape, critical business need | High barrier to entry, minimal new market costs |

Delivered as Shown

Bandwidth BCG Matrix

The Bandwidth BCG Matrix preview you're examining is the identical, fully-formatted document you will receive immediately after your purchase. This means you'll get the complete strategic analysis, ready for immediate application in your business planning, without any watermarks or demo content. You can confidently use this preview to understand the depth and quality of the insights provided, knowing the purchased version is exactly the same, ensuring no surprises and immediate utility for your decision-making processes.

Dogs

Cyclical political campaign messaging, while a significant revenue driver in 2024, is categorized as a 'dog' within the Bandwidth BCG Matrix. The unpredictable nature and non-recurring revenue stream from these campaigns, estimated to have contributed over $1 billion to the media sector's 2024 revenue, highlight its low growth prospects and cyclical dependency.

This segment, though profitable during election cycles, lacks the sustainability required for long-term strategic investment. Its performance is heavily tied to external political events rather than organic market growth, making it an unreliable component for sustained business development.

Certain highly commoditized basic SMS termination services, particularly in markets with aggressive price wars and minimal service differentiation, often fall into the dog category of the BCG matrix. While SMS still generates revenue, the intense price competition in this segment can significantly squeeze profit margins and stifle any substantial growth potential, making it an unappealing area for further investment when compared to more advanced messaging solutions.

Underperforming niche legacy offerings in the telecom sector, particularly those not integrated into cloud platforms or modernized, often fall into the "dog" category of the Bandwidth BCG Matrix. These are typically older product lines, perhaps from acquisitions, that struggle to attract new customers and have a shrinking user base. For instance, a legacy on-premises PBX system sold by a telecom company that has pivoted to cloud-based communication solutions would likely fit this description. Such offerings typically command a very small market share and see little to no growth, consuming valuable resources without contributing significantly to overall revenue or strategic goals.

Services with Low Customer Retention

Services with low customer retention, often termed 'dogs' in the Bandwidth BCG Matrix context, represent areas where Bandwidth might be facing significant challenges. These could be product lines or specific service offerings where customers are leaving at a higher rate than usual, possibly due to intense competition or a failure to adapt to changing customer demands.

This contrasts sharply with Bandwidth's generally strong customer retention, highlighting these 'dog' services as outliers needing careful strategic consideration. For instance, if a particular communication platform feature, despite investment, sees a churn rate exceeding 25% annually, it would likely be categorized here. Such services often demand disproportionate resources to simply maintain their position, yielding minimal returns.

- High Churn Services: Identifying specific communication APIs or legacy VoIP solutions that exhibit customer churn rates above the industry average of 15% in 2024.

- Competitive Pressure: Services facing aggressive pricing or feature innovation from competitors, leading to customer attrition, such as certain wholesale carrier services.

- Evolving Needs: Offerings that haven't kept pace with market shifts towards integrated cloud-based solutions or advanced AI-driven communication tools.

- Resource Drain: Services requiring substantial ongoing investment for minimal revenue growth, potentially impacting the allocation of capital for more promising areas of Bandwidth's portfolio.

Unprofitable Small Business Segments

Within the Bandwidth BCG Matrix, segments targeting very small businesses or individual developers could be classified as Dogs if they struggle with efficient scaling or face high customer acquisition costs relative to their long-term value. These areas, if they represent a significant portion of Bandwidth's operations, would likely exhibit low market share and contribute minimally to overall profitability, even amidst the broader growth of the Communications Platform as a Service (CPaaS) market.

For instance, if Bandwidth offers specialized, low-volume API access for niche individual developer projects, the cost to support and acquire each developer might outweigh the revenue generated over time. This is a common challenge in the CPaaS space, where serving a vast number of small clients can be resource-intensive.

- Low Market Share: Segments focused on micro-businesses or individual developers often have a fragmented customer base, making it difficult to achieve significant market penetration.

- High Customer Acquisition Costs: Reaching and onboarding individual developers or very small businesses typically involves more marketing and sales effort per customer compared to larger enterprise clients.

- Limited Lifetime Value: The revenue generated from these smaller customers may not justify the ongoing support and development costs, leading to a poor return on investment.

- Inefficient Scaling: Business models that require significant manual intervention or personalized support for each small client do not scale efficiently, hindering profitability.

Dogs in the Bandwidth BCG Matrix represent offerings with low market share and low growth potential. These segments often require significant resources for maintenance without yielding substantial returns, making them candidates for divestment or careful management. For example, legacy SMS termination services facing intense price competition in 2024, where profit margins are squeezed due to commoditization, exemplify this category.

These services typically suffer from declining demand or are in highly saturated markets with little room for expansion. Political campaign messaging, while a revenue driver in 2024, is also a dog due to its cyclical and non-recurring nature, contributing over $1 billion to the media sector but lacking long-term growth prospects.

Underperforming niche legacy offerings in the telecom sector, such as outdated on-premises PBX systems, also fall into the dog quadrant. These products have a shrinking user base and minimal market share, consuming resources without contributing to strategic goals.

Services with high customer churn rates, exceeding industry averages like the 15% seen in some communication APIs in 2024, are also considered dogs. These offerings demand disproportionate resources for maintenance, yielding minimal returns and often indicating a failure to adapt to market shifts.

| Category | Characteristics | Example | 2024 Market Context |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Legacy SMS Termination, Political Campaign Messaging | Intense price wars in SMS; Cyclical revenue for campaigns |

| Dogs | Low Market Share, Low Growth | Underperforming Legacy Telecom Offerings | Shrinking user base, minimal strategic contribution |

| Dogs | Low Market Share, Low Growth | High Churn Communication APIs | Churn rates above 15% impacting profitability |

Question Marks

Advanced conversational AI services, such as sophisticated virtual assistants and highly specialized customer service bots, fall into the question mark category for Bandwidth. These areas hold significant growth potential as AI technology advances, but Bandwidth's current market share is modest due to early adoption phases.

Bandwidth is actively investing in these advanced AI capabilities, aiming to integrate with emerging AI voice agents and deepen its service offerings. This strategic investment is crucial for capturing future market share in a rapidly evolving AI landscape, even though it requires substantial upfront capital and faces an uncertain path to profitability.

Bandwidth's strategic push into emerging international markets, where its current market share is minimal, represents classic question mark scenarios within the BCG framework. These regions, such as Southeast Asia and parts of Africa, offer substantial long-term growth potential, but demand significant capital for localized network build-out and market entry. For instance, the projected growth of the mobile data market in Sub-Saharan Africa is expected to reach over $30 billion by 2028, presenting an opportunity that requires substantial investment to overcome existing infrastructure gaps and regulatory hurdles.

Bandwidth’s investment in Rich Communication Services (RCS) for business messaging positions it as a question mark within the BCG matrix. While RCS offers significant future growth potential for business communications, its market penetration and Bandwidth's specific market share are still in nascent stages of development. The company is actively investing to foster adoption and establish a clear monetization strategy in this evolving landscape.

Specialized Vertical Industry Solutions

Bandwidth's strategy includes developing specialized vertical industry solutions, targeting sectors like advanced telehealth and fintech with unique communication needs. These markets represent significant growth potential, though Bandwidth may begin with a smaller market share.

The company's approach involves focused investment to demonstrate value and achieve scalability within these niche areas. For example, the global telehealth market was projected to reach $250 billion by 2026, indicating a substantial opportunity for specialized communication platforms.

- Targeted Innovation: Developing communication tools that meet stringent regulatory and security requirements for industries like healthcare and finance.

- Market Entry Strategy: Prioritizing specific verticals where Bandwidth can establish a strong foothold and differentiate its offerings.

- Growth Potential: Capitalizing on high-growth sectors that demand tailored, reliable, and secure communication infrastructure.

- Investment Focus: Allocating resources to R&D and market penetration to build traction and prove the efficacy of these specialized solutions.

Next-Generation Video and WebRTC APIs

Bandwidth's investment in next-generation video and WebRTC APIs presents a potential question mark within its portfolio. While voice and messaging remain foundational, the push into complex, high-bandwidth communication demands significant resources.

The market for these advanced video solutions is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 15% in the coming years. However, Bandwidth's market share in this specific segment might be less established compared to dominant players, requiring substantial research and development alongside aggressive market penetration strategies.

- Market Growth: The global video conferencing market was valued at approximately $10.5 billion in 2023 and is expected to reach over $20 billion by 2028.

- WebRTC Adoption: WebRTC technology is increasingly integrated into various applications, enabling real-time communication directly within web browsers and mobile apps.

- Competitive Landscape: Established communication platforms with dedicated video infrastructure pose significant competition.

- Investment Focus: Continued investment is crucial for Bandwidth to enhance its video capabilities and capture a larger share of this expanding market.

Bandwidth's ventures into advanced AI services, such as sophisticated virtual assistants and specialized customer service bots, represent classic question marks. These areas show substantial growth potential driven by AI advancements, but Bandwidth's current market share is relatively small due to the early stages of adoption.

The company is actively investing in these emerging AI capabilities, aiming to integrate with new AI voice agents and expand its service offerings. This strategic investment is vital for securing future market share in the rapidly evolving AI sector, despite requiring significant upfront capital and facing an uncertain path to profitability.

Bandwidth's strategic expansion into international markets, where its current market presence is minimal, also falls into the question mark category. Regions like Southeast Asia and parts of Africa offer considerable long-term growth prospects, but necessitate substantial capital for localized network development and market entry. For example, the mobile data market in Sub-Saharan Africa is projected to exceed $30 billion by 2028, presenting an opportunity that demands significant investment to overcome infrastructure challenges and regulatory complexities.

| Category | Description | Market Potential | Bandwidth's Position | Strategic Focus |

| AI Services (Advanced) | Virtual assistants, specialized customer service bots | High growth potential | Low current market share | Investment in R&D, integration with emerging AI |

| International Markets | Emerging economies (e.g., Southeast Asia, Africa) | Significant long-term growth | Minimal current market share | Capital for network build-out, market entry |

| Rich Communication Services (RCS) | Business messaging solutions | Future growth potential | Nascent market penetration | Fostering adoption, monetization strategy |

| Next-Gen Video/WebRTC | Real-time video communication APIs | Robust market growth (15%+ CAGR) | Less established market share | Enhancing capabilities, aggressive market penetration |

BCG Matrix Data Sources

Our Bandwidth BCG Matrix leverages comprehensive market data, including subscriber growth rates, average revenue per user (ARPU), and competitive landscape analysis from industry reports and financial filings.