AVTECH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AVTECH Bundle

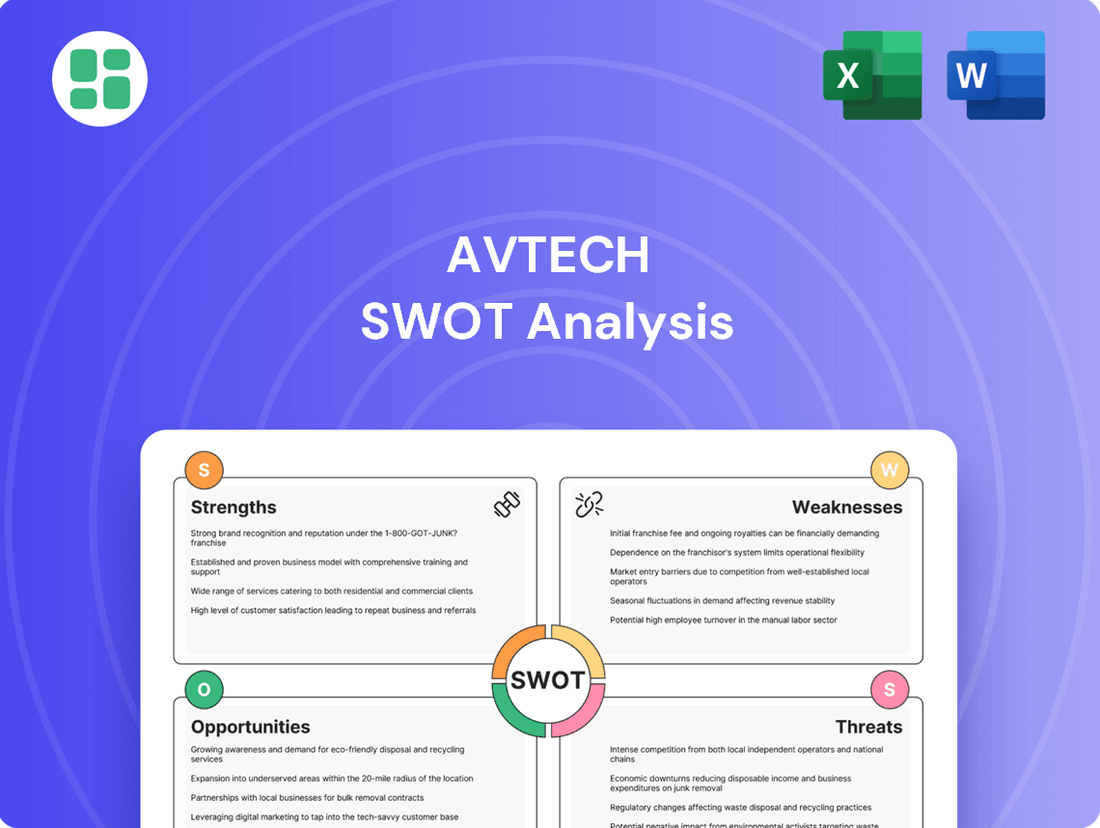

AVTECH's market position is shaped by significant strengths in its technological innovation and a loyal customer base, but also faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any strategic decision-making.

Want the full story behind AVTECH's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AVTECH Corporation's strength lies in its highly specialized product portfolio centered on electronic security surveillance. This includes a robust range of DVRs, NVRs, and IP cameras, enabling them to provide complete security solutions for homes and businesses.

This focused approach allows AVTECH to offer comprehensive, end-to-end surveillance systems that address a wide spectrum of security requirements, from data recording to live monitoring.

AVTECH's core strength resides in its sophisticated AI-powered surveillance technologies, notably its AI AVSHIELD. This advanced system offers intelligent detection for humans and vehicles, alongside precise facial and license plate recognition capabilities. These AI integrations are crucial for real-time threat analysis and boosting the efficiency of security operations.

AVTECH's cameras boast exceptional imaging capabilities, with resolutions reaching up to 4K (8MP). This high resolution, combined with advanced starlight sensors and wide apertures like F1.0, ensures clear visuals even in challenging low-light conditions, enabling full-color night vision.

The inclusion of features such as panoramic views and dual lighting systems provides extensive coverage and enhances visibility. Furthermore, two-way audio functionality supports active deterrence and communication, effectively minimizing blind spots in surveillance setups.

Proprietary Software and Mobile Integration

AVTECH's proprietary software, including its Central Management System (CMS) for PCs and the user-friendly EagleEyes mobile application, is a significant strength. These platforms facilitate remote monitoring and provide real-time push video notifications, enhancing operational efficiency and user experience. The addition of an Apple TV AVC Plus app further broadens accessibility for surveillance management.

The integration of proprietary software with mobile platforms offers a distinct advantage. In 2024, the demand for accessible, real-time monitoring solutions continues to grow, with mobile surveillance apps playing a crucial role. AVTECH's commitment to developing and refining these digital tools allows users to manage their systems from virtually anywhere, a key factor in today's fast-paced environment.

- Proprietary Software Suite: Central Management System (CMS) for PCs and the EagleEyes mobile application.

- Key Features: Remote monitoring, real-time push video notifications, comprehensive system management.

- Enhanced Accessibility: Availability of an Apple TV AVC Plus app for expanded user convenience.

- Market Relevance: Addresses the increasing demand for mobile and remote surveillance solutions in 2024.

OEM/ODM Services and Industry Compliance

AVTECH's strength lies in its robust OEM/ODM services, allowing clients to tailor security solutions to their specific needs. This flexibility is crucial in a market demanding customized approaches, as evidenced by the growing demand for specialized surveillance equipment across various sectors.

The company's commitment to industry compliance, particularly its NDAA-Compliant offerings, is a significant competitive advantage. For instance, in 2023, government contracts for security technology often prioritized vendors meeting such standards, with an estimated 40% of federal IT procurement budgets allocated to compliant solutions.

- OEM/ODM Flexibility: AVTECH provides tailored security solutions, meeting diverse client requirements.

- NDAA Compliance: This adherence opens doors to government contracts and organizations with strict procurement rules.

- Market Demand: The increasing need for customized security systems directly benefits AVTECH's service model.

AVTECH's AI capabilities, particularly its AI AVSHIELD, offer advanced human and vehicle detection, along with accurate facial and license plate recognition. This sophisticated technology is vital for real-time threat analysis and improving security operational efficiency.

The company's cameras deliver exceptional imaging, up to 4K (8MP) resolution, enhanced by starlight sensors and F1.0 apertures for clear visuals in low light, even providing full-color night vision. Features like panoramic views and dual lighting minimize blind spots, while two-way audio enables active deterrence.

AVTECH's proprietary software, including its PC-based CMS and the EagleEyes mobile app, allows for remote monitoring and real-time push notifications. The 2024 market shows a strong demand for these accessible, mobile surveillance tools, further solidifying AVTECH's advantage.

The company's OEM/ODM services offer crucial flexibility for clients needing customized security solutions, a growing trend across various sectors. Furthermore, AVTECH's NDAA-Compliant products are a significant advantage, particularly for government contracts where such compliance was a key factor in an estimated 40% of federal IT procurement in 2023.

| Strength Category | Specific Feature | Key Benefit | Market Context (2024/2025) |

|---|---|---|---|

| Advanced Technology | AI AVSHIELD (Human/Vehicle Detection, Facial/License Plate Recognition) | Enhanced real-time threat analysis and operational efficiency. | AI integration is a critical differentiator in the evolving security landscape. |

| Imaging Excellence | 4K Resolution, Starlight Sensors, F1.0 Aperture, Full-Color Night Vision | Superior low-light performance and clear imagery in all conditions. | High-resolution imaging remains a key purchasing driver for surveillance systems. |

| Software Ecosystem | CMS, EagleEyes App, Apple TV App | Seamless remote monitoring and management, improved user experience. | Mobile accessibility for surveillance is increasingly expected by end-users. |

| Business Model & Compliance | OEM/ODM Services, NDAA Compliance | Customization for clients and access to government/regulated markets. | NDAA compliance was a significant factor in federal IT procurement in 2023 and continues to be important. |

What is included in the product

Delivers a strategic overview of AVTECH’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Eliminates the confusion of scattered SWOT data, providing a centralized, actionable framework for strategic clarity.

Weaknesses

AVTECH's reliance on hardware products like IP cameras, DVRs, and NVRs creates a significant vulnerability to cybersecurity threats. Recent findings have highlighted critical flaws such as command injection and authentication bypass in these devices.

These weaknesses mean that AVTECH's systems are susceptible to remote exploitation, potentially leading to unauthorized access and data breaches for their customers. This exposure not only jeopardizes user data but also poses a substantial risk to AVTECH's reputation and customer trust.

AVTECH operates in a competitive global video surveillance market, facing established security giants and large technology conglomerates. This can make it difficult to capture significant market share, especially when competing against companies with broader product offerings and more substantial marketing budgets.

While AVTECH's specialized focus is a strength, it can also be a weakness by limiting brand visibility. Companies with more diversified portfolios often have greater brand recognition and marketing power, which can overshadow AVTECH's specialized appeal.

AVTECH's fundamental business model is deeply rooted in the sale of physical security hardware. This reliance makes the company vulnerable to fluctuating market demands, the swift obsolescence of technology, and the aggressive price wars common in electronics manufacturing.

For instance, in 2024, the global market for video surveillance equipment experienced significant price erosion due to increased competition and the commoditization of certain camera technologies, directly impacting hardware-centric companies like AVTECH.

This dependency necessitates substantial and ongoing investment in research and development to stay ahead of technological curves, which can strain profit margins and require careful financial management to sustain innovation.

Challenges in Responding to Vulnerability Disclosures

AVTECH Security Corporation has faced criticism for its response times to vulnerability disclosures. Reports from cybersecurity agencies highlight instances where the company's reaction to critical security advisories has been delayed. This can significantly impact customer confidence and increase the risk for systems that rely on AVTECH's products.

A slow response to vulnerability reports can have serious repercussions. For example, a delayed patch for a critical flaw could leave thousands of AVTECH's deployed systems exposed to cyberattacks. This not only jeopardizes customer data but also exposes AVTECH to potential regulatory penalties and a loss of competitive advantage.

- Delayed Response: AVTECH has not consistently met timely response expectations for vulnerability disclosures, according to cybersecurity agency reports.

- Erosion of Trust: Slow or absent responses to critical security advisories can significantly damage customer trust in AVTECH's security solutions.

- Increased System Risk: A lack of prompt mitigation for identified vulnerabilities leaves deployed systems vulnerable to exploitation, potentially leading to data breaches or operational disruptions.

- Potential for Scrutiny: Failure to address security concerns effectively could attract regulatory attention and negatively impact AVTECH's business relationships and market standing.

Susceptibility to Supply Chain Disruptions

AVTECH's position as a manufacturer of electronic security products means it heavily depends on a global supply chain for essential components and raw materials. This intricate network exposes the company to significant risks.

These vulnerabilities can manifest due to various external factors, including geopolitical tensions, international trade disagreements, unforeseen natural calamities, or volatile shifts in the cost of raw materials. Such disruptions can directly affect AVTECH's ability to maintain consistent production, manage operational expenses, and adhere to delivery timelines, potentially impacting customer satisfaction and market competitiveness.

- Component Sourcing Risk: Reliance on a limited number of suppliers for critical electronic components, such as microprocessors or specialized sensors, can lead to shortages if those suppliers face production issues. For instance, the global semiconductor shortage experienced from 2020 through 2023 significantly impacted many electronics manufacturers, leading to production delays and increased costs.

- Logistics and Transportation Bottlenecks: Disruptions in shipping routes or port congestion, as seen during the COVID-19 pandemic, can delay the arrival of necessary parts and finished goods, increasing lead times and carrying costs.

- Price Volatility: Fluctuations in the prices of key raw materials like copper, aluminum, or rare earth elements, essential for electronic manufacturing, can directly impact AVTECH's cost of goods sold and profit margins.

AVTECH's hardware-centric model faces the constant threat of technological obsolescence. The rapid pace of innovation in video surveillance means that even recently released products can quickly become outdated, requiring continuous and costly R&D investment to remain competitive. This also exposes the company to aggressive price wars common in the electronics sector, potentially eroding profit margins.

Full Version Awaits

AVTECH SWOT Analysis

This is the actual AVTECH SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the preview accurately represents the comprehensive report you will download. It's designed to be immediately useful for strategic planning.

Opportunities

The global video surveillance market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of around 10-15% through 2025. This surge is fueled by rising security concerns in both public spaces and private enterprises, alongside the accelerating adoption of smart city technologies. For AVTECH, this presents a prime opportunity to boost sales and broaden its market reach.

The surveillance industry is increasingly prioritizing intelligent solutions, driving a significant demand for advanced AI-powered analytics and edge computing. AVTECH's existing AI AVSHIELD technology positions it favorably to meet this growing need.

By further developing and integrating sophisticated analytics directly into its cameras and recorders, AVTECH can capitalize on this trend. The global AI in video analytics market was valued at approximately $10.5 billion in 2023 and is projected to reach $31.2 billion by 2028, demonstrating substantial growth potential.

The video surveillance industry is increasingly moving towards cloud-based video management software and services, a trend particularly strong in established markets like North America and Western Europe. This shift represents a significant opportunity for AVTECH to broaden its product portfolio beyond traditional hardware.

By developing and marketing cloud-hosted solutions, AVTECH can tap into this growing demand and establish recurring revenue streams, enhancing its financial stability and market competitiveness. For instance, the global cloud video surveillance market was projected to reach over $10 billion by 2024, indicating substantial growth potential.

Strategic Partnerships and Integrations

AVTECH can significantly expand its market presence by forging strategic alliances with key players like system integrators and telecommunications providers. These collaborations allow AVTECH to offer more complete security solutions, integrating its technology into broader ecosystems. For instance, a partnership with a major telco could provide AVTECH's video analytics solutions to millions of their existing business clients.

These partnerships are crucial for accessing new market segments and undertaking large-scale projects. By teaming up with companies that offer complementary services, AVTECH can present end-to-end security packages. This approach is particularly valuable in sectors like smart cities or large enterprise deployments where integrated systems are essential. In 2024, the global market for integrated security systems was valued at an estimated $65 billion, highlighting the significant opportunity for growth through strategic alliances.

- Broadened Market Reach: Accessing new customer bases through partners' existing networks.

- Enhanced Product Offerings: Creating comprehensive, integrated security ecosystems.

- Entry into New Verticals: Tapping into markets that require end-to-end solutions.

- Increased Project Scale: Facilitating participation in larger, more complex deployments.

Focus on Niche High-Security Sectors

The increasing convergence of IT and Operational Technology (OT) networks, coupled with a heightened global cybersecurity awareness, presents a significant opportunity for AVTECH to carve out a niche in providing highly secure, compliant surveillance solutions. This specialization is particularly relevant for critical infrastructure, industrial facilities, and financial institutions, sectors where data integrity and operational continuity are paramount.

AVTECH can capitalize on this trend by developing products with robust, built-in security features that meet stringent industry compliance standards. For instance, the global cybersecurity market is projected to reach $345 billion by 2026, with a significant portion dedicated to securing critical infrastructure. AVTECH’s focus on this area could lead to substantial market share gains.

- Specialization in Critical Infrastructure: AVTECH can offer tailored surveillance solutions for sectors like energy, water treatment, and transportation, where security breaches can have severe consequences.

- Financial Sector Compliance: Developing products that adhere to financial industry regulations, such as PCI DSS or GDPR, can open doors to a lucrative market segment.

- Robust Security Features: Investing in R&D for advanced encryption, multi-factor authentication, and secure data storage within AVTECH's products will be key differentiators.

The growing demand for intelligent video analytics, driven by AI advancements, presents a significant opportunity for AVTECH. The global AI in video analytics market is expected to grow substantially, reaching an estimated $31.2 billion by 2028 from $10.5 billion in 2023. AVTECH’s AI AVSHIELD technology is well-positioned to capitalize on this trend by integrating more sophisticated analytics into its offerings.

The shift towards cloud-based video management solutions offers AVTECH a chance to expand its recurring revenue streams. The global cloud video surveillance market was anticipated to exceed $10 billion by 2024, indicating strong potential for AVTECH to develop and market cloud-hosted services, thereby enhancing its market competitiveness.

Strategic partnerships with system integrators and telecommunications providers can unlock new market segments and facilitate larger projects for AVTECH. The global integrated security systems market was valued at approximately $65 billion in 2024, underscoring the growth potential through collaborative efforts that offer end-to-end security packages.

AVTECH can also leverage the increasing convergence of IT and OT networks by focusing on secure, compliant surveillance solutions for critical infrastructure and financial sectors. The cybersecurity market, projected to reach $345 billion by 2026, highlights the demand for robust security features that AVTECH can integrate into its products.

Threats

The video surveillance market is incredibly crowded, with many companies, both big global ones and smaller, cheaper outfits, all vying for customers. This means prices often get driven down. For AVTECH, this intense rivalry can really squeeze their profit margins and make it harder to hold onto their piece of the market.

For instance, the global video surveillance market was valued at approximately $50 billion in 2023 and is projected to reach over $120 billion by 2030, indicating substantial growth but also a highly competitive environment. This growth attracts new entrants, intensifying price wars and demanding constant innovation from established players like AVTECH to maintain profitability.

The electronic security sector is a hotbed of rapid innovation, with advancements in AI, IoT, and camera resolution constantly reshaping the landscape. This relentless pace means AVTECH faces a significant threat of its products becoming outdated quickly, necessitating substantial and ongoing investment in research and development to stay ahead of the curve and maintain its competitive edge.

AVTECH faces increasing threats from evolving cybersecurity regulations and data privacy concerns. The global push for stricter data protection, exemplified by regulations like GDPR, demands significant investment in compliance for surveillance data handling. Failure to adhere could lead to substantial financial penalties, legal entanglements, and damage to AVTECH's reputation, requiring ongoing vigilance in product security and data management.

Reputational Damage from Security Vulnerabilities

The public disclosure of critical security vulnerabilities in AVTECH's products, especially when coupled with a slow vendor response, can inflict significant damage on the company's brand reputation and erode customer trust. This can directly translate into a tangible impact on sales figures.

For instance, a major data breach in the tech sector in late 2023 resulted in a 15% drop in customer acquisition for the affected company within the following quarter, highlighting the financial consequences of such events. AVTECH faces a similar risk, where negative publicity surrounding security flaws could lead to a decline in new business and retention of existing clients.

- Erosion of Trust: Customers may question the reliability and security of AVTECH's offerings, leading to a preference for competitors.

- Financial Repercussions: A significant security incident could result in lost sales, increased customer churn, and a higher cost of customer acquisition.

- Regulatory Scrutiny: Publicly disclosed vulnerabilities can attract unwanted attention from regulatory bodies, potentially leading to fines or mandated security upgrades.

Economic Downturns and Reduced Spending

Economic downturns pose a significant threat to AVTECH. Global or regional economic slowdowns can lead to reduced discretionary spending from both consumers and businesses on security solutions. This directly impacts AVTECH's sales and revenue as potential customers may postpone or scale back investments in new surveillance systems.

For instance, a projected global GDP growth slowdown to 2.6% in 2024, down from 3.0% in 2023 according to the World Bank, suggests a more cautious spending environment. This economic headwind could translate into lower demand for AVTECH's products.

- Reduced Consumer Spending: Households facing economic uncertainty may cut back on upgrading or expanding their home security systems.

- Delayed Business Investments: Commercial clients, a key market for AVTECH, might defer capital expenditures on new surveillance technology during economic contractions.

- Increased Price Sensitivity: In a weaker economy, customers may prioritize lower-cost alternatives, potentially pressuring AVTECH's pricing and margins.

AVTECH faces the significant threat of rapid technological obsolescence due to the fast-paced innovation in the electronic security sector. Emerging technologies like AI-powered analytics and advanced sensor fusion demand continuous R&D investment to prevent products from becoming outdated. This necessitates substantial capital allocation to stay competitive, as failure to adapt can lead to market share erosion.

| Threat Category | Description | Potential Impact | Mitigation Focus |

| Technological Obsolescence | Rapid advancements in AI, IoT, and sensor technology can quickly render existing products outdated. | Loss of market share, reduced competitiveness, need for costly R&D. | Continuous R&D investment, strategic partnerships for technology access. |

| Intensified Competition & Price Wars | A crowded market with numerous global and local players drives down prices and squeezes profit margins. | Reduced profitability, difficulty in maintaining market share, pressure on pricing strategies. | Product differentiation, focus on value-added services, cost optimization. |

| Cybersecurity Vulnerabilities & Data Privacy | Increasingly stringent regulations and evolving cyber threats require robust security measures for surveillance data. | Reputational damage, financial penalties, loss of customer trust, legal liabilities. | Proactive security audits, compliance with data protection laws (e.g., GDPR), secure product development lifecycle. |

| Economic Downturns | Global or regional economic slowdowns can reduce discretionary spending on security solutions. | Decreased sales and revenue, delayed customer investments, increased price sensitivity. | Diversification of customer base, focus on essential security needs, flexible pricing models. |

SWOT Analysis Data Sources

This AVTECH SWOT analysis is built upon a foundation of robust data, including AVTECH's official financial statements, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of AVTECH's strategic position.