Aveanna Healthcare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aveanna Healthcare Bundle

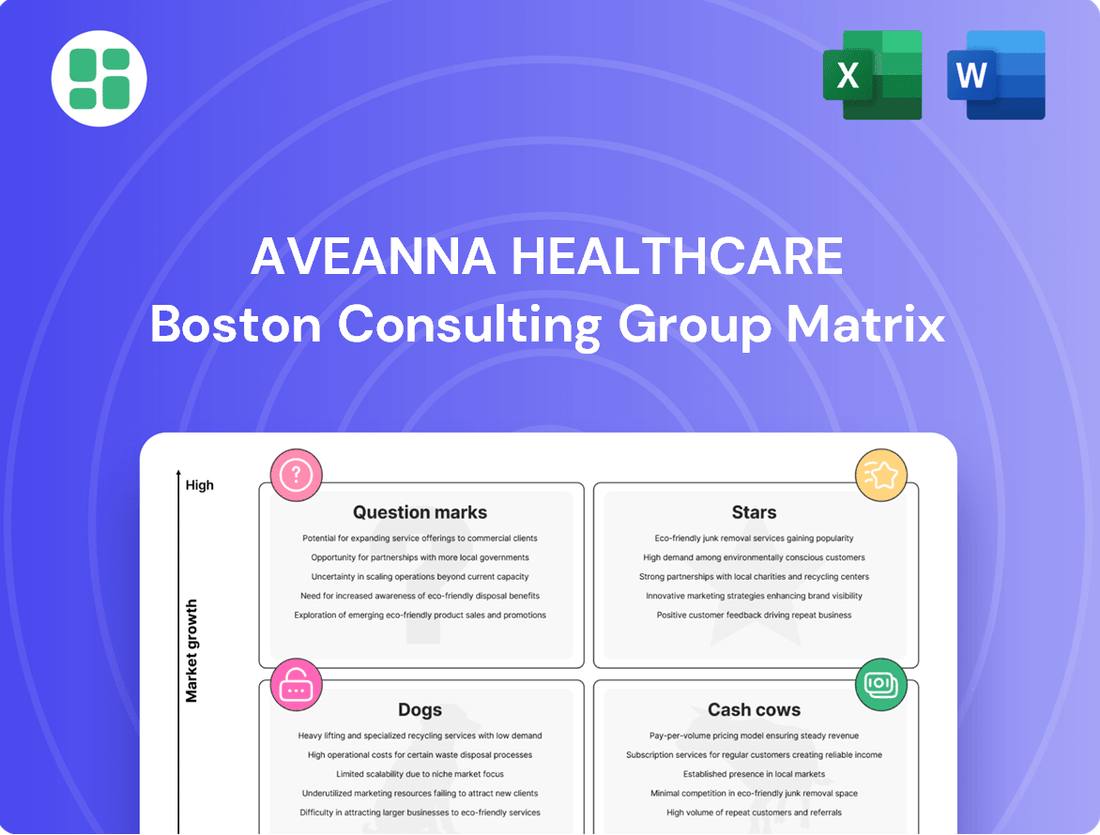

Understanding Aveanna Healthcare's product portfolio through the BCG Matrix is crucial for strategic growth. This analysis helps identify which services are generating significant revenue (Cash Cows) and which require further investment to become market leaders (Stars). Don't miss out on the opportunity to gain a comprehensive understanding of Aveanna's market position.

This preview offers a glimpse into Aveanna Healthcare's strategic positioning. To unlock the full potential of this analysis, purchase the complete BCG Matrix report. It provides detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and product decisions within the healthcare sector.

Stars

Aveanna Healthcare's Pediatric Private Duty Services (PDS) is positioned as a Star within the company's BCG Matrix. This segment demonstrated robust performance, with a revenue increase of $65.0 million in Q1 2025, marking a substantial 16.5% growth. PDS is a key contributor to Aveanna's overall revenue, which is anticipated to surpass $2.15 billion for the entirety of 2025.

The favorable market conditions further solidify PDS's Star status. The pediatric home healthcare sector is experiencing accelerated expansion, with an estimated compound annual growth rate (CAGR) of 9.5% projected for 2024-2025. This growth is further expected to reach 10.9% by 2029, fueled by rising instances of chronic childhood illnesses and an increase in preterm births.

Within Aveanna Healthcare's portfolio, specialized pediatric therapies, particularly rehabilitation services, are strong contenders in the BCG matrix. These services are crucial for children with developmental delays or injuries, offering vital support for their growth and well-being.

The pediatric home healthcare market saw rehabilitation therapy services capture the largest share in 2024, a trend projected to continue. This dominance highlights the significant demand for Aveanna's specialized pediatric offerings, positioning them as a star performer within the company's strategic framework.

Aveanna Healthcare's strategic acquisition of Thrive Skilled Pediatric Care in June 2025 significantly bolsters its Star position in the pediatric home healthcare market. This move expands Aveanna's reach to 36 states, enhancing its market share in a sector projected for robust growth.

High-Acuity Home-Based Care

Aveanna Healthcare's high-acuity home-based care, focusing on medically fragile children, is a clear Star in its BCG Matrix. This segment is experiencing robust growth due to increasing demand for specialized in-home medical services, offering a more cost-effective and patient-centric alternative to traditional hospitalizations.

This niche benefits from favorable healthcare trends, emphasizing the shift of care delivery from acute facilities to home settings. Such specialized care commands higher reimbursement rates, contributing significantly to Aveanna's revenue and market position.

In 2024, the demand for pediatric home healthcare services, particularly for complex cases, continued to surge. Aveanna's focus on this area positions it to capitalize on this trend:

- Growing Market: The pediatric home health market is expanding, driven by advancements in medical technology enabling more complex care at home.

- Cost Efficiency: Home-based care is generally more affordable than inpatient hospital care, making it attractive to payers and families.

- Patient Preference: Many families prefer to care for medically fragile children in the comfort of their own homes.

- Reimbursement Advantage: High-acuity services often receive preferential reimbursement rates, enhancing profitability.

Value-Based Care Agreements in PDS

Aveanna Healthcare's PDS (Personalized Disease Management Services) segment is a key area for growth, particularly with its strategic emphasis on value-based care agreements. These agreements are designed to reward providers for achieving specific patient outcomes and managing costs effectively, aligning with the Star quadrant's characteristics of high growth and high market share.

By securing more of these value-based contracts, Aveanna aims to boost its revenue streams through performance bonuses and improved reimbursement. This focus is crucial for attracting and retaining skilled caregivers, which is essential for expanding services in a high-demand market.

- Focus on Value-Based Care: Aveanna is actively increasing its portfolio of value-based care agreements within its PDS segment.

- Performance Incentives: These agreements offer bonus payments and enhanced reimbursement for meeting clinical outcome and cost efficiency targets.

- Caregiver Recruitment: The attractive financial incentives from these agreements help in attracting and retaining more caregivers, fueling expansion.

- Market Demand: This strategy capitalizes on the growing demand for high-quality, outcome-driven home healthcare services.

Aveanna Healthcare's Pediatric Private Duty Services (PDS) is a standout Star in its BCG Matrix, demonstrating exceptional growth and market leadership. In Q1 2025, PDS revenue surged by $65.0 million, a 16.5% increase, contributing significantly to Aveanna's projected 2025 revenue exceeding $2.15 billion.

The broader pediatric home healthcare market is booming, with an estimated CAGR of 9.5% for 2024-2025, expected to reach 10.9% by 2029. This expansion is driven by rising chronic childhood illnesses and preterm births, creating a fertile ground for Aveanna's PDS segment.

Specialized pediatric rehabilitation services, a key component of Aveanna's offerings, also claim a Star position. These services dominated the market share in 2024 and are projected to maintain this lead, reflecting strong demand for Aveanna's expertise in supporting children with developmental needs.

The strategic acquisition of Thrive Skilled Pediatric Care in June 2025 further cemented Aveanna's Star status, expanding its footprint to 36 states and bolstering its market share in this high-growth sector.

Aveanna's high-acuity home-based care for medically fragile children is another clear Star, benefiting from the trend of shifting care from hospitals to home settings. These specialized services often command higher reimbursement rates, enhancing profitability and market standing.

| Segment | BCG Quadrant | Key Growth Drivers | 2025 Revenue Impact | Market Outlook |

| Pediatric Private Duty Services (PDS) | Star | Rising chronic illnesses, preterm births, value-based care contracts | $65.0M increase in Q1 2025 (16.5% growth) | 9.5% CAGR (2024-2025), 10.9% by 2029 |

| Pediatric Rehabilitation Services | Star | Demand for developmental support, patient preference for home care | Largest market share in 2024, projected to continue | Strong growth in specialized pediatric therapies |

| High-Acuity Home-Based Care (Medically Fragile Children) | Star | Shift to home-based care, cost-efficiency, patient preference | Significant revenue contribution, preferential reimbursement | Increasing demand for complex in-home medical services |

What is included in the product

Aveanna Healthcare's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment decisions.

A clear Aveanna Healthcare BCG Matrix visually clarifies strategic resource allocation, alleviating the pain of uncertainty.

Cash Cows

Aveanna Healthcare's established adult home health services are a classic Cash Cow. While not experiencing the rapid expansion seen in their pediatric offerings, this segment is a bedrock of stability for the company. The market for adult home health is mature, benefiting from a growing elderly demographic that increasingly favors receiving care in the comfort of their own homes.

This segment consistently generates reliable cash flow for Aveanna. Because the market is well-established and demand is steady, the need for significant new investment to capture market share is relatively low. This allows Aveanna to leverage the profits from adult home health to fund growth in other areas or to return capital to shareholders.

For instance, in 2023, Aveanna reported that its home health segment, which largely comprises adult services, contributed significantly to its overall revenue. While specific segment breakdowns can fluctuate, the consistent demand ensures this part of the business remains a dependable source of income, underpinning Aveanna's financial strength.

Personal care assistance within Aveanna Healthcare operates as a Cash Cow. These services are crucial for patients' daily living, securing a high market share in a low-growth environment. In 2024, the demand for these services remained robust, driven by an aging population and the increasing prevalence of chronic illnesses, contributing significantly to Aveanna's stable revenue streams.

The Medical Solutions (MS) segment at Aveanna Healthcare is a prime example of a Cash Cow. This unit, focused on providing essential enteral nutrition and related products, benefits from a steady demand.

In 2024, the MS segment consistently generated robust cash flow, supporting Aveanna's overall financial health. Its stable revenue streams, a hallmark of Cash Cows, allow for efficient operations and contribute significantly to the company's profitability without requiring substantial reinvestment for aggressive growth.

Efficient Payer Partnerships

Aveanna Healthcare's strong relationships with preferred payers and government entities are a significant Cash Cow. These long-standing partnerships, which have been expanded over time, provide a stable foundation for the company's revenue. This stability comes from guaranteed reimbursement rates and a consistent flow of patient referrals, minimizing the need for costly new market acquisition efforts.

These efficient payer partnerships contribute directly to Aveanna's predictable revenue streams. In 2024, for instance, the company's focus on these established relationships helped maintain a steady operational performance. The reduced marketing and sales expenses associated with these mature contracts further enhance profitability.

- Stable Reimbursement: Partnerships with preferred payers ensure consistent and predictable payment rates for services rendered.

- Consistent Patient Referrals: Established relationships with government entities and payers lead to a reliable influx of patients.

- Reduced Overhead: Less investment is needed in sales and marketing compared to penetrating new markets.

- Predictable Revenue: These factors combine to create a steady and dependable income stream for Aveanna.

Leveraging Existing Geographic Footprint

Aveanna Healthcare's extensive geographic footprint, spanning over 340 locations across 36 states, positions it firmly as a Cash Cow within its BCG Matrix. This established network enables efficient service delivery and significant economies of scale, reducing the need for substantial new capital expenditures.

The company's broad presence maximizes the utilization of existing resources, directly contributing to its strong cash-generating capabilities. For instance, in 2024, Aveanna reported a robust operational efficiency, leveraging its widespread infrastructure to serve a large patient base.

- Established Network: Over 340 locations across 36 states.

- Economies of Scale: Efficient service delivery and cost optimization.

- Resource Utilization: Maximizing existing infrastructure to generate cash.

- Reduced Capital Needs: Minimizing investments in new facilities.

Aveanna Healthcare's established adult home health services function as a Cash Cow, providing a stable revenue stream. This segment benefits from a mature market with consistent demand, particularly from an aging population. The company's extensive geographic footprint, with over 340 locations across 36 states, further enhances its ability to generate reliable cash flow by leveraging economies of scale and maximizing resource utilization.

| Segment | BCG Category | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Adult Home Health | Cash Cow | Mature market, stable demand, low investment needs | Consistent contributor to revenue, underpinning financial stability. |

| Personal Care Assistance | Cash Cow | High market share in low-growth environment, essential daily living support | Robust demand driven by aging population, ensuring stable revenue. |

| Medical Solutions (Enteral Nutrition) | Cash Cow | Steady demand for essential products, efficient operations | Consistently generated robust cash flow, supporting overall profitability. |

| Payer Partnerships | Cash Cow | Long-standing relationships, guaranteed reimbursement, consistent referrals | Maintained steady operational performance, enhancing profitability through reduced marketing costs. |

Preview = Final Product

Aveanna Healthcare BCG Matrix

The Aveanna Healthcare BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, professionally designed matrix ready for your strategic analysis and business planning.

Dogs

Underperforming regional operations within Aveanna Healthcare, such as certain smaller branches experiencing consistently low patient volumes and minimal profitability, could be categorized as Dogs. These specific units might be found in markets with intense local competition or where Aveanna's service offerings aren't resonating as strongly. For instance, if a particular state saw a revenue decline of 5% in its home health segment during 2023, while the national average grew by 3%, that state's operations might be flagged.

Commoditized basic home care services, characterized by low differentiation and fierce price competition, often represent Aveanna Healthcare's Dogs. These services, where the company holds a limited market share, may yield minimal profits and demand significant resources for upkeep without strategic repositioning. For instance, in 2024, the home health aide market faced increased pressure from new entrants, driving down average hourly rates by an estimated 5% compared to 2023, impacting profitability for providers focused solely on these basic offerings.

Aveanna Healthcare's legacy systems, such as older electronic health record platforms or inefficient billing software, could be classified as Dogs. These systems often require significant financial investment for maintenance, estimated to consume a substantial portion of IT budgets without offering a clear return on investment or a competitive edge. For instance, in 2024, many healthcare providers reported that maintaining outdated IT infrastructure diverted funds that could otherwise be used for digital transformation initiatives, impacting their ability to innovate in patient care delivery or streamline operations.

Segments with Declining Reimbursement Rates

Aveanna Healthcare's "Dogs" in the BCG Matrix likely represent service lines facing declining reimbursement rates, particularly within certain payer contracts where negotiation leverage is minimal. These segments may struggle to even cover their operational costs, acting as a drag on overall profitability. For instance, specific home health services or certain managed care plans could fall into this category if payment rates haven't kept pace with rising labor and supply expenses.

The pressure on these segments is exacerbated by factors like increased competition and regulatory changes that can limit pricing power. In 2024, the healthcare industry continued to grapple with inflation impacting labor and supplies, putting further strain on providers with fixed or declining reimbursement. This environment makes it challenging for Aveanna to maintain healthy profit margins in these specific areas.

Consider these potential "Dog" segments for Aveanna Healthcare:

- Certain Home Health Services: Specific types of home health care, especially those with long-standing, lower reimbursement rates from government payers or specific managed care organizations, could be under pressure.

- Pediatric Private Duty Nursing in Low-Reimbursement States: While a core service, specific geographic areas or payer mixes with persistently low rates for pediatric private duty nursing might qualify.

- Durable Medical Equipment (DME) with Limited Markups: If Aveanna offers DME as part of its service bundle, certain items with very tight margins or declining reimbursement could be considered "Dogs."

Services Highly Susceptible to Caregiver Shortages

Certain home care services are especially vulnerable to caregiver shortages. These are often the segments that require specialized training or are compensated at lower rates, making them less attractive to potential employees. If Aveanna Healthcare cannot overcome these staffing hurdles, these service lines could face significant limitations, potentially hindering their ability to meet existing demand.

For instance, pediatric home care, particularly for medically fragile children, demands highly skilled nurses and aides. The 2024 landscape shows a continued strain on specialized pediatric nursing, with reports indicating shortages in many regions. This directly impacts Aveanna's capacity to deliver these critical services.

- Pediatric Private Duty Nursing: Requires specialized skills and often involves complex care, making it harder to staff consistently.

- High-Acuity Home Health: Patients requiring intensive medical support necessitate experienced caregivers, exacerbating shortage impacts.

- Services in Rural or Underserved Areas: These locations often face greater competition for a smaller pool of qualified caregivers, amplifying the problem.

Aveanna Healthcare's "Dogs" likely encompass specific, underperforming regional operations and commoditized service lines facing intense competition and declining reimbursement rates.

These segments, such as basic home health aide services or legacy IT systems, demand significant resources without yielding substantial returns, potentially hindering innovation and overall profitability.

For example, in 2024, the home health aide market saw hourly rates decrease by an estimated 5% due to new entrants, impacting providers focused on these basic offerings.

Furthermore, challenges in staffing highly skilled caregivers for services like pediatric private duty nursing in low-reimbursement states can also classify these areas as "Dogs" due to limited capacity and profitability.

| Service Segment Example | Key Challenges | Potential Impact (2024 Data/Trends) |

|---|---|---|

| Basic Home Health Aide Services | Low differentiation, price competition, increased new entrants | Estimated 5% decrease in average hourly rates compared to 2023 |

| Legacy IT Systems | High maintenance costs, lack of competitive edge, diversion of funds | Diverts funds from digital transformation initiatives |

| Pediatric Private Duty Nursing (Low Reimbursement Areas) | Shortage of specialized caregivers, declining reimbursement rates | Continued strain on specialized pediatric nursing supply |

Question Marks

The expansion of telehealth and remote patient monitoring (RPM) positions Aveanna Healthcare's offerings in this area as a Question Mark. While the overall home healthcare market is embracing these technologies, Aveanna's current penetration in these advanced, tech-driven services might be limited, necessitating substantial investment to grow and compete effectively. For instance, a 2024 report indicated that RPM adoption in home health increased by 25% year-over-year, highlighting the market opportunity but also the potential investment needed for Aveanna to capture a significant share.

Entering new geographic markets, such as expanding into states where Aveanna Healthcare currently has minimal or no operational footprint, would likely classify these ventures as Question Marks within the BCG matrix. These new state entries represent high-growth potential opportunities, but they inherently demand significant upfront capital for building out infrastructure, recruiting and training clinical staff, and establishing brand awareness.

For example, if Aveanna were to consider entering a state like Montana in 2024, where its current presence is negligible, this would be a classic Question Mark. The home healthcare market in Montana, while potentially growing, would require substantial investment to overcome logistical challenges and establish a competitive foothold against existing providers. The initial returns are uncertain, necessitating careful market analysis and strategic execution.

Aveanna Healthcare's investment in advanced AI-integrated diagnostics and robotic-assisted therapy systems positions it within the Question Mark quadrant of the BCG Matrix. This reflects the high-growth potential of these innovative technologies in the home care sector, driven by increasing demand for efficient and personalized patient care. For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow significantly, with some forecasts suggesting a compound annual growth rate (CAGR) of over 37% through 2030.

However, Aveanna's current market share and demonstrated return on investment (ROI) in these cutting-edge, capital-intensive areas are likely to be low. The significant upfront investment required for AI diagnostics and robotic therapy, coupled with the nascent stage of widespread adoption and integration, presents a challenge. This necessitates careful strategic resource allocation to capitalize on future growth without overextending current capabilities.

Value-Based Agreements for Home Health & Hospice

Aveanna Healthcare's Home Health & Hospice (HHH) segment presents a potential Question Mark within its BCG Matrix. While the company is actively pursuing value-based agreements in its Personal Duty Services (PDS) division, a similar expansion in HHH faces challenges due to slower historical growth rates. This segment requires significant strategic focus to align clinical pathways and demonstrate cost efficiencies necessary to unlock bonus payments and solidify market leadership in these evolving payment models.

The HHH segment's performance in 2024 underscores the need for a refined approach to value-based care. For instance, while national trends in home health showed a modest increase in patient volumes, Aveanna's specific HHH growth may lag, necessitating a deeper dive into operational efficiencies and patient outcome metrics. Successfully navigating value-based agreements in this sector hinges on proving superior clinical quality and cost-effectiveness, which can be more complex to quantify than in other healthcare settings.

- Strategic Alignment: Focusing on aligning clinical protocols and care coordination within HHH to meet the specific requirements of value-based payment models.

- Outcome Measurement: Developing robust systems for tracking and reporting key clinical outcome indicators that are critical for bonus eligibility in value-based agreements.

- Cost Efficiency: Implementing operational improvements to reduce the overall cost of care delivery without compromising patient quality, a key driver for success in these contracts.

- Market Leadership: Positioning Aveanna's HHH services as leaders in value-based care by demonstrating consistent achievement of quality benchmarks and financial performance.

Post-Acute Care Partnerships with Hospitals

Developing more extensive Hospital-at-Home programs and deepening post-acute care partnerships with hospital systems represents a Question Mark for Aveanna Healthcare within its BCG Matrix analysis. This strategic avenue holds substantial growth potential as healthcare providers increasingly aim to expedite patient discharges, thereby reducing hospital lengths of stay and associated costs.

Success in this domain hinges on Aveanna's capacity to cultivate robust and scalable collaborations with hospital networks. Effective management of intricate patient transitions, ensuring seamless care coordination from hospital to home, is paramount. For instance, in 2024, the demand for home-based care solutions continued to surge, with reports indicating that hospital systems are actively seeking partners to manage post-acute care needs more efficiently, aiming to improve patient outcomes and control expenditure.

- Growth Potential: Hospitals are incentivized to reduce inpatient days, creating a demand for effective post-acute care at home.

- Partnership Dependency: Aveanna's ability to secure and manage these partnerships is crucial for success.

- Operational Complexity: Managing complex patient transitions requires sophisticated care coordination and logistical capabilities.

- Market Trend: The shift towards value-based care models favors home-based and post-acute care services.

Aveanna Healthcare's strategic investments in advanced telehealth and remote patient monitoring (RPM) technologies are classified as Question Marks. While the home healthcare market is rapidly adopting these innovations, Aveanna's current market share in these tech-driven services may require substantial investment to grow and compete effectively. For example, a 2024 industry survey revealed a 25% year-over-year increase in RPM adoption among home health agencies, underscoring the market opportunity and the capital needed for Aveanna to capture a significant portion of this growing segment.

| Initiative | Market Growth Potential | Aveanna's Current Market Share | Investment Required | Strategic Consideration |

| Telehealth & RPM Expansion | High | Low to Moderate | High | Requires significant investment to scale and gain market traction. |

| New Geographic Market Entry | Moderate to High | Negligible | High | Overcoming logistical hurdles and building brand awareness in new states demands substantial capital. |

| AI Diagnostics & Robotic Therapy | Very High | Very Low | Very High | Nascent adoption and high capital costs necessitate careful resource allocation. |

| Home Health & Hospice (HHH) Value-Based Care | Moderate | Moderate | Moderate to High | Aligning clinical pathways and demonstrating cost efficiencies are key to success in value-based agreements. |

| Hospital-at-Home Programs | High | Low to Moderate | High | Building robust hospital partnerships and managing complex patient transitions are critical. |

BCG Matrix Data Sources

Our BCG Matrix draws from comprehensive financial disclosures, industry growth forecasts, and competitive market analysis to provide a clear strategic overview.