Atrys Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atrys Bundle

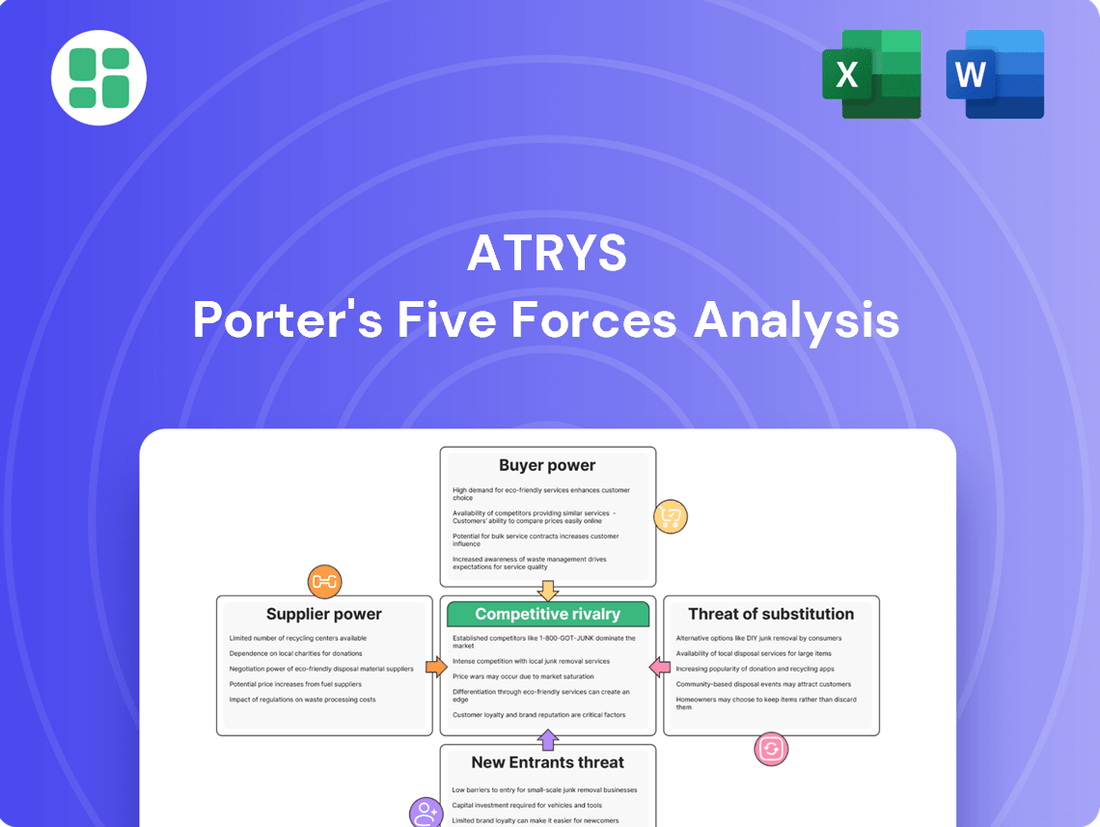

Atrys operates within a dynamic market shaped by powerful competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic advantage.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Atrys’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Atrys Health's dependence on specialized medical imaging, radiation oncology equipment, and AI software means suppliers of these advanced technologies hold considerable sway. The proprietary nature of these solutions, coupled with high costs to switch vendors, grants these suppliers significant bargaining power. For instance, a leading provider of AI-driven diagnostic imaging software, which Atrys might utilize, could have a strong position if their technology is patented and offers unique analytical capabilities unmatched by competitors.

The bargaining power of highly skilled medical professionals in sectors like precision medicine and advanced diagnostics, including radiation oncology and genomics, is significant. These specialized roles, demanding expertise from oncologists to geneticists and data scientists, face high demand and limited supply. For instance, the global shortage of radiologists, a key role in diagnostics, is projected to worsen, further amplifying their leverage.

Atrys Health's reliance on specialized genomic sequencing equipment and consumables means its bargaining power with suppliers is somewhat constrained. The niche nature of these high-tech components often means a limited pool of manufacturers, giving those suppliers considerable leverage. For instance, the global market for next-generation sequencing (NGS) consumables, a key area for Atrys, is dominated by a few major players, which can influence pricing and availability.

Data Infrastructure and Cloud Service Providers

Atrys's reliance on advanced telemedicine and AI means it needs strong data infrastructure, often involving cloud services. The demand for secure, compliant (like HIPAA or GDPR) healthcare data handling and high-performance computing for AI can narrow down the choices for providers.

This situation can grant specialized cloud and data infrastructure companies significant bargaining power. For instance, the global cloud computing market, valued at approximately $600 billion in 2023, sees intense competition, but the niche requirements for healthcare data can shift leverage towards providers meeting those stringent standards.

- Healthcare data security and compliance requirements (e.g., GDPR, HIPAA) can limit the pool of suitable cloud providers.

- The need for high-performance computing for AI models further concentrates bargaining power among specialized infrastructure providers.

- In 2024, the global cloud infrastructure services market is projected to reach over $300 billion, indicating substantial investment but also highlighting the importance of specialized offerings for sectors like healthcare.

Research and Development Partners

In the dynamic landscape of precision medicine, Atrys's reliance on specialized R&D partners, such as academic institutions and biotech firms, grants these entities considerable bargaining power. These collaborators often possess unique intellectual property or cutting-edge technologies that are crucial for Atrys to innovate and bring new diagnostic and therapeutic solutions to market. For instance, a partnership with a leading university lab in genomics could be essential for developing Atrys's next-generation sequencing assays.

The bargaining power of these R&D partners is amplified if they have few alternative collaborators or if their specific expertise is in high demand. In 2024, the global R&D spending in the life sciences sector reached an estimated $250 billion, highlighting the competitive environment for securing top-tier research collaborations. Atrys's ability to secure exclusive rights or favorable terms with these partners directly impacts its competitive advantage and future product pipeline.

- High Demand for Specialized Expertise: Partners with niche skills in areas like AI-driven drug discovery or advanced bioinformatics are highly sought after.

- Intellectual Property Control: R&D partners often retain ownership of foundational IP, giving them leverage in licensing and revenue-sharing agreements.

- Limited Alternatives: If a partner's technology is unique and difficult to replicate, their bargaining power increases significantly.

Suppliers of specialized medical equipment and AI software for Atrys Health possess significant bargaining power due to the proprietary nature of their offerings and high switching costs. For example, providers of advanced AI diagnostic imaging software, if patented and offering unique capabilities, can command strong leverage. This concentration of power is evident as the global market for medical imaging equipment continues to grow, with specialized AI components becoming increasingly critical.

The bargaining power of highly skilled medical professionals, such as oncologists and geneticists, is substantial given the high demand and limited supply of their expertise in fields like precision medicine. The global shortage of radiologists, for instance, is a well-documented issue that amplifies their negotiating leverage. This scarcity directly impacts Atrys's ability to secure top talent, influencing operational costs and service delivery capabilities.

Atrys's reliance on specialized genomic sequencing equipment and consumables also grants suppliers considerable sway. The niche market for these high-tech components is often dominated by a few manufacturers, allowing them to influence pricing and availability. In 2024, the next-generation sequencing consumables market, crucial for Atrys, is expected to see continued growth, underscoring the sustained influence of its key suppliers.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Atrys Health | Relevant Market Data (2024 Estimates) |

|---|---|---|---|

| Medical Imaging & AI Software Providers | Proprietary technology, high switching costs, unique capabilities | Potential for higher equipment/software costs, limited vendor options | Global AI in healthcare market projected to exceed $150 billion |

| Specialized Medical Professionals | High demand, limited supply of niche expertise (oncology, genomics) | Increased labor costs, challenges in talent acquisition | Global shortage of radiologists estimated to impact diagnostic services |

| Genomic Sequencing Equipment & Consumables Suppliers | Niche market, limited manufacturers, specialized components | Price sensitivity, potential supply chain disruptions | Next-Generation Sequencing (NGS) market growth continues, emphasizing supplier importance |

What is included in the product

This analysis of Atrys's competitive landscape examines the five forces shaping its industry, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force.

Streamline strategic planning by pinpointing areas of vulnerability and opportunity within your industry landscape.

Customers Bargaining Power

Hospitals and larger healthcare systems represent a significant customer segment for Atrys Health, and their bargaining power is considerable. These institutions often procure diagnostic support and treatment planning services in large volumes, which naturally gives them leverage to negotiate better pricing and terms. For example, a major hospital network might represent a substantial portion of Atrys's revenue, making it difficult for Atrys to dictate terms without risking the loss of that business.

Furthermore, these sophisticated buyers frequently have established relationships with multiple diagnostic service providers or even possess in-house capabilities. This creates an environment where they can easily switch providers or leverage internal resources, thereby increasing their bargaining power over Atrys. In 2024, the trend of healthcare consolidation means that even more purchasing power is concentrated in fewer, larger entities, amplifying this effect.

While Atrys Health primarily operates through medical referrals, individual patients and direct consumers can still hold some bargaining power. Their ability to choose diagnostic providers, especially for specialized services like genetic testing or advanced imaging, is influenced by factors such as insurance reimbursement rates, personal out-of-pocket expenses, and the ease of accessing Atrys's facilities. In 2024, patient satisfaction surveys and online reviews became increasingly important, directly impacting Atrys's reputation and the likelihood of future referrals.

Insurance companies and national health systems hold substantial sway over Atrys, acting as key customers who frequently set reimbursement rates and determine coverage for advanced diagnostics and precision medicine. Their significant purchasing power and emphasis on cost-effectiveness directly impact Atrys's pricing and the scope of its services.

For instance, in 2024, many European national health services are implementing stricter cost-benefit analyses for new medical technologies, requiring demonstrable clinical utility and economic advantages. Atrys needs to present compelling data on improved patient outcomes and reduced long-term healthcare costs to negotiate favorable contracts and ensure market access.

Referral Physicians and Clinics

Referral physicians and specialized clinics hold substantial bargaining power over Atrys, acting as crucial gatekeepers for patient access to advanced diagnostic and therapeutic services. Their choice to direct patients to Atrys, rather than a competitor, directly impacts Atrys's revenue streams and market share.

The ability of these referring entities to influence patient flow means Atrys must actively cultivate and maintain strong, mutually beneficial relationships. This involves consistently demonstrating superior clinical outcomes, providing efficient patient pathways, and ensuring seamless integration with their existing workflows.

- Referral Influence: Physicians and clinics decide which diagnostic or treatment centers patients visit, directly impacting Atrys's patient volume.

- Relationship Management: Atrys's success hinges on its ability to foster loyalty and trust with its referring physician network.

- Competitive Differentiation: Offering superior service, better patient outcomes, and easier integration are key to retaining these valuable referral sources.

Demand for Integrated and Telemedicine Solutions

Customers across the healthcare spectrum are increasingly demanding integrated solutions that combine diagnostics, treatment planning, and remote monitoring through telemedicine. This trend, amplified by the need for accessible and efficient care, puts pressure on providers to offer more than just standalone services.

Atrys's ability to offer comprehensive, technologically advanced services reduces customer power by providing a unique value proposition that is not easily replicated by traditional providers. By consolidating diagnostic imaging, treatment planning, and remote patient management, Atrys creates a sticky ecosystem for its clients, enhancing its competitive standing.

- Growing Demand for Integrated Healthcare: A 2024 report indicated that over 60% of healthcare providers are actively seeking integrated digital health solutions to improve patient outcomes and operational efficiency.

- Telemedicine Adoption: Telemedicine usage saw a significant surge, with an estimated 40% of patient consultations occurring remotely in early 2024, highlighting customer preference for virtual care options.

- Atrys's Value Proposition: Atrys's platform integrates AI-powered diagnostics with telemedicine capabilities, offering a holistic approach that addresses the evolving needs of its customer base.

The bargaining power of customers for Atrys Health is substantial, driven by large healthcare systems, insurance providers, and referring physicians. These entities can leverage their purchasing volume, ability to switch providers, and influence over patient flow to negotiate better terms and pricing. The increasing demand for integrated healthcare solutions and the growing adoption of telemedicine in 2024 further empower customers, pushing providers like Atrys to offer comprehensive, technologically advanced services. Atrys's strategy of providing a unique, integrated value proposition aims to mitigate this customer power by creating a sticky ecosystem.

| Customer Segment | Bargaining Power Drivers | 2024 Trend Impact |

|---|---|---|

| Hospitals & Healthcare Systems | High volume purchasing, ability to switch providers, in-house capabilities | Consolidation concentrates purchasing power, increasing leverage. |

| Insurance Companies & National Health Systems | Setting reimbursement rates, coverage decisions, cost-effectiveness focus | Stricter cost-benefit analyses for new technologies require demonstrable ROI. |

| Referral Physicians & Clinics | Gatekeepers for patient access, influence patient flow | Need for strong relationships, superior outcomes, and seamless integration. |

| Individual Patients | Choice of providers, out-of-pocket costs, online reputation | Patient satisfaction surveys and online reviews directly impact reputation. |

Full Version Awaits

Atrys Porter's Five Forces Analysis

This preview shows the exact Atrys Porter's Five Forces Analysis document you'll receive immediately after purchase, offering a comprehensive evaluation of industry competitiveness. You'll gain immediate access to this fully formatted and professionally written analysis, enabling you to understand the strategic landscape and competitive pressures within Atrys's market. No surprises, no placeholders—just the complete, ready-to-use document for your strategic planning needs.

Rivalry Among Competitors

Atrys contends with formidable rivals in established diagnostic and imaging centers. These players, often boasting decades of experience, are aggressively adopting cutting-edge technologies, including AI-driven diagnostics and advanced imaging modalities, to broaden their service offerings, particularly in the burgeoning field of precision medicine.

These established competitors benefit from substantial advantages such as deeply ingrained brand loyalty, robust relationships with referring physicians, and considerable financial resources. For instance, many large imaging chains in 2024 reported significant capital expenditure increases, with some allocating over 15% of their revenue to technology upgrades and facility expansions, directly intensifying the competitive landscape for companies like Atrys.

Major hospital systems are increasingly building or enhancing their own specialized departments, particularly in areas like medical imaging, radiation oncology, and genomics. This internal development directly lessens their need for external service providers such as Atrys.

This growing trend intensifies competitive pressure on Atrys. To remain competitive, Atrys must clearly highlight its unique strengths, whether through deep specialization, operational efficiency, or the seamless integration of advanced technologies that external providers may not offer.

The precision medicine landscape is buzzing with activity, featuring a surge of startups carving out specialized niches. These agile newcomers are often focused on areas like AI-powered diagnostic tools, targeted genomic analysis, or innovative telemedicine solutions for personalized care delivery.

While individually small, these emerging companies can significantly disrupt the market. Their ability to innovate rapidly and cater to specific patient or disease segments presents a competitive challenge. For instance, by 2024, venture capital funding for health tech startups, including those in precision medicine, reached over $30 billion globally, indicating intense competition and a drive for specialized innovation.

Pharmaceutical and Biotech Companies Entering Diagnostics

The pharmaceutical and biotech sectors are increasingly moving into diagnostic services, a strategic push for vertical integration. This is particularly evident with companion diagnostics, which are designed to work alongside specific drug therapies, allowing companies to manage the patient journey from initial diagnosis through to treatment. This trend poses a significant competitive challenge, especially in segments where Atrys's genomic services overlap with the drug development pipeline.

For instance, in 2024, several major pharmaceutical companies announced acquisitions or partnerships with diagnostic firms, aiming to streamline the integration of diagnostic testing into their precision medicine offerings. This integration helps ensure that patients receive the right treatment at the right time, a crucial aspect of personalized healthcare. The market for companion diagnostics alone was projected to reach over $10 billion globally by 2024, highlighting the substantial investment and growth in this area.

- Vertical Integration: Pharmaceutical and biotech firms are acquiring or partnering with diagnostic companies to control the full patient pathway.

- Companion Diagnostics: This integration is most pronounced in companion diagnostics, which are essential for targeted therapies.

- Market Growth: The companion diagnostics market saw significant expansion in 2024, indicating a strong trend toward integrated diagnostic and therapeutic solutions.

- Competitive Threat: This creates a direct competitive threat for companies like Atrys operating in genomic services that align with drug development.

Global and Regional Healthcare Service Providers

Atrys competes in a dynamic global healthcare market, encountering rivals from large multinational corporations to specialized regional providers. These competitors often leverage established patient bases, extensive infrastructure, and deep understanding of local healthcare regulations, presenting significant challenges. For instance, in 2024, the global healthcare market was valued at over $13 trillion, with major players like UnitedHealth Group, CVS Health, and Johnson & Johnson demonstrating substantial market share and diversified service offerings.

The competitive intensity is further amplified by the varying strengths of regional players who possess strong local brand recognition and established referral networks. Atrys's strategic focus on technological innovation, particularly in telemedicine and advanced diagnostics, is designed to mitigate these traditional competitive advantages. By offering accessible, technology-driven solutions, Atrys aims to transcend geographical limitations and carve out a distinct market position, even against entities with greater physical presence.

- Global Healthcare Market Size (2024): Exceeded $13 trillion, indicating a vast and competitive landscape.

- Key Competitor Strengths: Scale, market penetration, local regulatory expertise, established patient bases, and referral networks.

- Atrys's Competitive Strategy: Technological innovation, telemedicine, and advanced diagnostics to overcome geographic barriers.

- Rivalry Impact: Forces Atrys to differentiate through advanced solutions rather than solely relying on traditional healthcare service models.

Competitive rivalry is intense, with established diagnostic and imaging centers aggressively adopting AI and advanced modalities. Large hospital systems are also building out their own specialized departments, reducing reliance on external providers like Atrys.

Startups in precision medicine, focusing on AI diagnostics and genomics, are rapidly innovating, fueled by significant venture capital. Pharmaceutical and biotech firms are vertically integrating, particularly in companion diagnostics, which directly challenges Atrys's genomic services.

| Competitor Type | Key Strengths | 2024 Data/Trends |

| Established Diagnostic Centers | Experience, brand loyalty, financial resources | Increased capital expenditure on technology (over 15% of revenue for some) |

| Major Hospital Systems | In-house capabilities, existing infrastructure | Expansion of specialized departments (imaging, oncology, genomics) |

| Precision Medicine Startups | Agility, niche focus, rapid innovation | Global health tech startup funding exceeded $30 billion |

| Pharma/Biotech Companies | Vertical integration, drug development pipeline | Companion diagnostics market projected over $10 billion |

SSubstitutes Threaten

Patients and healthcare providers have readily available alternatives to Atrys's advanced precision medicine. Conventional diagnostic methods, like standard blood tests and basic imaging, are often more accessible and cost-effective. For instance, a routine blood panel, costing as little as $50-$100 in 2024, can provide initial diagnostic information for many common ailments, presenting a significant substitute for more specialized, and thus more expensive, genomic or advanced imaging analyses offered by Atrys.

For many common health issues, individuals may opt for a general practitioner's advice and standard referrals, bypassing more advanced diagnostic tools. This is a significant substitute for Atrys's specialized genomic and AI-driven services, especially when the condition is straightforward and doesn't warrant the deeper analysis offered by precision medicine. For instance, a 2024 survey indicated that over 70% of primary care visits in the EU address non-complex conditions where advanced diagnostics are not typically the first line of investigation.

Proactive lifestyle changes and preventive care can act as substitutes for advanced diagnostic services. For instance, a growing focus on wellness and early detection through regular check-ups, as evidenced by the projected 5.1% compound annual growth rate (CAGR) of the global wellness market reaching $7.0 trillion by 2025, may reduce the immediate demand for certain diagnostic interventions.

While these measures don't directly replace sophisticated diagnostic tools offered by companies like Atrys, a population prioritizing prevention might delay or lessen the perceived necessity for complex diagnostic procedures, particularly in the initial stages of disease management. This shift in consumer behavior could indirectly impact the market for diagnostic services.

Less Advanced Telemedicine and Digital Health Tools

While Atrys Health focuses on sophisticated telemedicine and AI-driven diagnostics, simpler, less integrated remote consultation tools and readily available digital health apps represent potential substitutes. These alternatives, though often more accessible and less costly, do not offer the same depth of diagnostic precision or comprehensive insights that Atrys's advanced platforms provide.

These substitutes, such as basic video conferencing for medical advice or general wellness tracking apps, can satisfy a segment of the market seeking convenience over advanced functionality. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating a broad adoption of digital health solutions, including those less sophisticated than Atrys's offerings.

- Lower Cost of Entry: Basic telemedicine platforms and apps often have lower development and operational costs, allowing them to be offered at more attractive price points, potentially drawing price-sensitive customers away from Atrys.

- Wider Accessibility: Simpler digital health tools may require less advanced technology or infrastructure, making them accessible to a broader user base, including those in regions with limited internet connectivity or older devices.

- Focus on Specific Needs: Some substitutes cater to niche health needs or offer a more streamlined user experience for specific tasks, potentially appealing to users who find Atrys's comprehensive solutions overly complex for their immediate requirements.

- Market Penetration: The widespread availability of smartphones and internet access globally means that even basic digital health solutions can achieve significant market penetration, creating a competitive landscape where Atrys must clearly differentiate its advanced capabilities.

Off-label Drug Use or Alternative Therapies

The threat of substitutes, particularly in the form of off-label drug use or alternative therapies, presents a notable challenge for precision medicine providers like Atrys. Patients and physicians may opt for these alternatives if they perceive them as more accessible, cost-effective, or if they offer a perceived immediate benefit, even without robust clinical evidence. For instance, in oncology, while Atrys might offer advanced genomic profiling to guide targeted therapies, a patient might explore off-label use of an existing drug or a complementary therapy if the precision-guided treatment path seems complex or uncertain.

This dynamic is amplified when the perceived value proposition of Atrys's diagnostic services, which are crucial for identifying appropriate precision therapies, does not sufficiently outweigh the perceived advantages of these substitute approaches. In 2024, the market for complementary and alternative medicine (CAM) continued to grow, with global spending estimated to be in the hundreds of billions of dollars, indicating a significant patient willingness to explore non-conventional treatments. This trend suggests that Atrys must clearly articulate the tangible benefits and superior outcomes associated with its precision diagnostics to counter the appeal of these substitutes.

- Off-Label Drug Use: Physicians may prescribe approved drugs for conditions or dosages not officially indicated, sometimes driven by anecdotal evidence or early research, bypassing the need for specific diagnostic markers.

- Alternative Therapies: This encompasses a wide range of non-evidence-based treatments, including dietary interventions, herbal remedies, and other complementary approaches that patients might pursue alongside or instead of conventional precision medicine.

- Perceived Value vs. Accessibility: The threat is heightened if alternative therapies are seen as more readily available or if the diagnostic process for precision medicine is perceived as time-consuming or costly, diminishing the perceived value of Atrys's services.

- Market Trends: The substantial and growing global market for alternative therapies underscores a significant patient base that may be less inclined to rely solely on precision diagnostics, posing a direct competitive threat.

The threat of substitutes for Atrys's advanced precision medicine is considerable, stemming from both conventional healthcare practices and emerging digital health solutions. While not offering the same depth, these substitutes can satisfy specific patient needs, particularly those prioritizing cost-effectiveness or accessibility over cutting-edge diagnostics.

Conventional methods like standard blood tests, costing around $50-$100 in 2024, provide initial diagnostic insights for many common conditions, serving as a readily available alternative to more complex genomic analyses. Furthermore, a significant portion of primary care visits, over 70% in the EU according to a 2024 survey, address non-complex issues where advanced diagnostics are not the initial approach.

Simpler digital health tools, including basic telemedicine and wellness apps, also pose a threat. The global digital health market, valued at approximately $200 billion in 2023, demonstrates a broad adoption of these less sophisticated, yet accessible, solutions. These substitutes can attract users seeking convenience or addressing less complex health concerns, potentially diverting market share from Atrys's comprehensive offerings.

| Substitute Type | Key Characteristics | 2024 Cost Example | Market Context |

|---|---|---|---|

| Conventional Diagnostics | Accessibility, Cost-effectiveness for common ailments | Routine Blood Panel: $50 - $100 | Addresses over 70% of primary care visits for non-complex conditions |

| Basic Telemedicine/Apps | User-friendliness, Lower operational costs | Varies widely, often subscription-based | Global digital health market ~ $200 billion (2023) |

| Alternative Therapies | Perceived immediate benefit, Patient preference | Varies widely, often out-of-pocket | Global spending in hundreds of billions of dollars |

Entrants Threaten

The precision medicine and advanced diagnostics sector demands significant capital for cutting-edge equipment like genomic sequencers and advanced imaging systems. For instance, a single high-throughput sequencer can cost hundreds of thousands of dollars, with ongoing expenses for reagents and maintenance. This substantial upfront financial commitment acts as a major deterrent, limiting the number of new players who can realistically enter the market and compete effectively.

The healthcare sector is notoriously complex when it comes to regulations. New entrants face significant challenges with licensing, data privacy laws like GDPR and HIPAA, and the rigorous approval processes for medical devices and laboratory certifications. For instance, in 2024, the average time to obtain FDA approval for a new medical device can extend to several years, a substantial hurdle for any newcomer.

Entering Atrys's market demands a deep bench of specialized expertise, a significant barrier for newcomers. Think radiation oncologists, medical physicists, geneticists, and advanced AI engineers – professionals whose skills are in high demand across the healthcare sector. For instance, the global shortage of oncologists, projected to worsen, means competition for talent is already fierce.

The challenge extends beyond just finding these experts; it's about attracting and keeping them. High recruitment costs and retention bonuses are often necessary, making it a substantial upfront investment for any new player. Building a competitive team capable of innovating and operating complex medical technologies like Atrys's requires more than just capital; it requires access to this scarce, highly skilled workforce.

Establishing Brand Reputation and Trust in Healthcare

The healthcare sector, particularly for companies like Atrys focused on advanced diagnostics and treatments, presents a high barrier to entry due to the critical need for established brand reputation and trust. Newcomers must overcome significant hurdles in gaining the confidence of patients, physicians, and insurance providers, a process that often takes years and substantial investment. Atrys's commitment to demonstrable patient outcomes and integrated care models has been instrumental in building this essential credibility, making it difficult for unproven entities to compete effectively.

For instance, in 2024, the average time for a new healthcare provider to achieve significant patient volume and insurer acceptance can extend beyond five years. This extended ramp-up period, coupled with the inherent risks associated with patient care, deters many potential new entrants. Atrys's existing network and established relationships with key stakeholders serve as a robust defense against this threat.

- High Capital Requirements: Establishing state-of-the-art diagnostic facilities and securing necessary certifications demand substantial upfront investment, often in the tens of millions of euros for advanced imaging centers.

- Regulatory Hurdles: Navigating complex healthcare regulations, licensing, and accreditation processes is time-consuming and resource-intensive, creating a significant barrier for new market participants.

- Physician and Payer Relationships: Building trust and referral networks with physicians and securing favorable reimbursement rates from insurance companies are critical for patient access and financial viability, a process Atrys has cultivated over time.

Proprietary Technology and Data Accumulation

Atrys's competitive edge is significantly bolstered by its proprietary AI algorithms and the vast datasets it accumulates for its diagnostic and treatment planning platforms. The development of similar advanced AI models necessitates substantial investment in research and development, access to extensive, high-quality medical data, and considerable computational resources. This technological prowess and data advantage act as formidable barriers to entry.

For instance, the AI in medical imaging, a core area for companies like Atrys, is heavily reliant on data volume and quality. Reports from 2024 indicate that leading AI diagnostic tools are trained on datasets often exceeding millions of images, with continuous refinement crucial for accuracy. This makes it exceptionally challenging for newcomers to match the sophistication and reliability of established players without similar data access and R&D capabilities.

- Proprietary AI Algorithms: Atrys utilizes unique AI models for diagnostics and treatment planning.

- Data Accumulation Advantage: Access to and processing of large, high-quality medical datasets is key.

- High R&D and Computational Costs: Replicating Atrys's technology requires significant financial and technical investment.

- Barriers to Replication: New entrants face substantial hurdles in matching Atrys's technological sophistication and data advantage.

The threat of new entrants in Atrys's market is significantly mitigated by the immense capital required for sophisticated technology and infrastructure. For example, establishing a cutting-edge radiation therapy center can easily cost upwards of €20 million in 2024, encompassing linear accelerators, imaging equipment, and specialized facilities. This high financial barrier prevents many potential competitors from even entering the market.

Navigating the stringent regulatory landscape of healthcare also presents a formidable challenge. New companies must contend with lengthy approval processes for medical devices and treatments, as well as strict data privacy compliance. In 2024, the average time for a new medical device to gain FDA clearance can stretch over several years, a significant deterrent for agile startups.

Furthermore, the need for highly specialized talent, such as radiation oncologists and medical physicists, creates another substantial barrier. The global shortage of oncologists, projected to intensify, means that attracting and retaining these experts is costly and difficult. Atrys's established relationships and reputation also make it challenging for newcomers to build the necessary trust with physicians and payers.

| Barrier Type | Example Cost/Timeframe (2024) | Impact on New Entrants |

|---|---|---|

| Capital Investment | €20M+ for radiation therapy center | Prohibitive for most new players |

| Regulatory Approvals | Years for medical device clearance | Significant time and resource drain |

| Skilled Workforce Access | High recruitment/retention costs for oncologists | Intensifies competition for talent |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from financial statements, analyst reports, and industry-specific trade publications to provide a comprehensive understanding of competitive dynamics.