Asia Timber Products Co. Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Timber Products Co. Ltd. Bundle

Asia Timber Products Co. Ltd. faces a dynamic competitive landscape, with moderate bargaining power from suppliers and buyers influencing profitability. The threat of new entrants is a significant concern, while the availability of substitutes presents a constant challenge.

The complete report reveals the real forces shaping Asia Timber Products Co. Ltd.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Asia Timber Products Co. Ltd. is significantly shaped by the concentration of timber and wood chip sources in the Asian market. A situation with only a handful of major suppliers for premium wood grades would naturally grant them greater leverage, potentially driving up the cost of essential raw materials for Asia Timber Products.

In 2024, reports indicated that certain specialized timber markets in Southeast Asia, crucial for high-grade furniture and construction, saw consolidation among a few key logging concessions. This concentration means these few suppliers can dictate terms more effectively, impacting Asia Timber Products' procurement costs.

The specific types of wood and resins Asia Timber Products Co. Ltd. needs for its high-end MDF, particleboard, and laminate flooring significantly influence supplier power. If the company relies on unique timber species or proprietary resins, the suppliers of these specialized inputs hold considerable leverage due to the scarcity of comparable alternatives. For instance, in 2024, the global market for specialty wood composites saw price increases of up to 8% for certain rare hardwoods, directly impacting manufacturers reliant on them.

The cost and complexity involved in switching raw material suppliers significantly impact the bargaining power of those suppliers. For Asia Timber Products Co. Ltd., if re-calibrating machinery for different wood types or renegotiating supply contracts is expensive and time-consuming, existing suppliers gain more leverage.

Conversely, if Asia Timber Products Co. Ltd. faces low switching costs, they can readily transition to alternative suppliers. This flexibility diminishes the influence of any single supplier, as the company can more easily find competitive alternatives. For instance, in 2024, the global timber market saw fluctuations in supply chains, with some regions experiencing increased logistics costs, potentially raising switching costs for companies reliant on those specific origins.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into finished wood product manufacturing, like MDF or particleboard, poses a significant challenge for Asia Timber Products Co. Ltd. This move would transform suppliers from raw material providers into direct competitors. For instance, if a major timber supplier in Southeast Asia, which saw its revenue grow by 8% in 2024, decided to invest in its own processing plants, it could disrupt Asia Timber's market share.

Such forward integration by suppliers directly escalates their bargaining power. If these suppliers can produce competing wood products efficiently, Asia Timber Products would be compelled to foster robust supplier relationships and offer highly competitive pricing to secure its raw material supply and maintain its profit margins.

- Increased Competition: Suppliers entering the finished product market directly challenge Asia Timber's existing customer base.

- Price Pressure: Asia Timber may face increased pressure to lower prices to remain competitive against its former suppliers.

- Supply Chain Vulnerability: Reliance on suppliers who also compete can create vulnerabilities in raw material availability and cost.

Importance of Supplier's Input to Product Cost

The significance of a supplier's input to a company's overall cost structure is a key determinant of their bargaining power. For Asia Timber Products Co. Ltd., if the cost of timber and resin, their primary raw materials, constitutes a substantial percentage of their total production expenses, then suppliers of these materials wield considerable influence. For instance, if timber and resin account for 40% of Asia Timber Products Co. Ltd.'s manufacturing costs, even a modest 5% increase in timber prices could translate to a 2% rise in overall product cost, directly impacting the company's profit margins.

This financial leverage allows suppliers to dictate terms and potentially command higher prices. Consider the market for sustainably sourced timber, a growing demand factor. If Asia Timber Products Co. Ltd. relies heavily on specific suppliers for certified timber, and these suppliers face increased demand or limited supply, their bargaining power escalates. In 2024, the global timber market experienced price volatility, with some regions seeing lumber prices increase by over 15% year-on-year due to supply chain disruptions and increased construction demand, illustrating the direct impact on companies like Asia Timber Products Co. Ltd.

- Raw Material Cost Percentage: The higher the proportion of raw material costs in the final product, the greater the supplier's bargaining power.

- Supplier Dependence: Reliance on a few key suppliers for critical inputs strengthens supplier leverage.

- Market Conditions: Fluctuations in raw material prices, driven by supply and demand, directly affect supplier power.

- Product Differentiation: If raw materials are undifferentiated commodities, switching suppliers is easier, reducing supplier power.

The bargaining power of suppliers for Asia Timber Products Co. Ltd. is influenced by the concentration of timber sources and the necessity of their specific inputs. When few suppliers dominate the market for essential wood types or specialized resins, their ability to dictate terms increases, potentially raising raw material costs for Asia Timber. For example, in 2024, certain niche timber markets in Southeast Asia experienced consolidation, granting a few key logging concessions greater leverage over procurement prices.

The cost and difficulty associated with switching suppliers also amplify supplier power. If Asia Timber Products faces significant expenses or lengthy delays in retooling machinery or renegotiating contracts for alternative wood sources, existing suppliers gain leverage. Conversely, low switching costs allow Asia Timber to shift to other providers more easily, diminishing any single supplier's influence.

The threat of suppliers integrating forward into finished product manufacturing, such as MDF or particleboard, directly challenges Asia Timber's market position and elevates supplier bargaining power. This move transforms former raw material providers into direct competitors, potentially impacting Asia Timber's market share and necessitating competitive pricing strategies to secure raw material supply.

| Factor | Impact on Asia Timber Products Co. Ltd. | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | High concentration grants suppliers greater pricing power. | Consolidation observed in specialized Southeast Asian timber markets in 2024. |

| Switching Costs | High switching costs empower existing suppliers. | Increased logistics costs in certain regions in 2024 may raise switching costs. |

| Forward Integration Threat | Suppliers entering finished product markets become competitors. | A major timber supplier in Southeast Asia with 8% revenue growth in 2024 could invest in processing plants. |

| Raw Material Cost Share | Higher share of raw material costs increases supplier leverage. | If timber/resin is 40% of costs, a 5% price hike impacts overall product cost by 2%. |

What is included in the product

This analysis tailors Porter's Five Forces to Asia Timber Products Co. Ltd., revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position and profitability.

A straightforward, actionable framework to navigate the competitive landscape of Asia Timber Products Co. Ltd., transforming complex market dynamics into clear strategic advantages.

Customers Bargaining Power

Asia Timber Products Co. Ltd. serves a broad market, including retail, commercial, and residential clients. This diversification generally softens customer power. However, if a few major commercial or retail buyers represent a substantial percentage of the company's revenue, their ability to negotiate favorable pricing or terms becomes more pronounced.

Asia Timber Products Co. Ltd. produces items like MDF, particleboard, and laminate flooring. These can be seen as similar goods, meaning customers can easily choose another supplier if the price is better. For example, the global particleboard market was valued at approximately $50 billion in 2023, indicating a competitive landscape where price is a significant factor.

When products are perceived as identical, buyers gain more leverage. They can readily switch to a competitor offering a lower price without sacrificing much in terms of product features or performance. This commoditization intensifies price competition.

However, if Asia Timber Products Co. Ltd. focuses on creating distinct offerings, such as premium quality materials, exclusive designs, or certifications like FSC for sustainable forestry, it can lessen customer power. For instance, a 2024 report highlighted that certified sustainable wood products command a premium, suggesting customers are willing to pay more for differentiated attributes.

The ease with which customers of Asia Timber Products Co. Ltd. can switch to a competitor's offerings significantly influences their bargaining power. For manufacturers in sectors like furniture, doors, or cabinets, switching costs can be substantial, encompassing the need for re-tooling production lines, obtaining new material certifications, or navigating disruptions to established supply chains.

In 2024, the global furniture market, a key sector for timber products, saw continued demand but also intense price competition. For instance, a survey of furniture manufacturers indicated that the average cost of re-tooling for a new wood supplier could range from $5,000 to $20,000, not including the potential downtime and lost production value, which can further escalate the effective switching cost.

When these switching costs are low, customers are more empowered to readily seek out and negotiate better pricing or terms from alternative timber suppliers, thereby increasing their leverage over Asia Timber Products Co. Ltd.

Threat of Backward Integration by Customers

Large buyers in sectors like furniture manufacturing or construction possess the potential to integrate backward, meaning they could start producing their own wood components, such as MDF or particleboard. This capability directly strengthens their negotiating position with suppliers like Asia Timber Products Co. Ltd. For instance, a major furniture maker with significant capital and technical expertise might find it economically viable to set up its own production lines for essential materials, thereby reducing its reliance on external suppliers.

If these substantial customers have the necessary resources and capacity to manufacture these wood products in-house, they gain the leverage to bypass Asia Timber Products Co. Ltd. entirely if the terms of business are not agreeable. This threat is particularly potent when customers represent a significant portion of Asia Timber Products Co. Ltd.'s sales volume. In 2024, the global furniture market was valued at over $700 billion, with large-scale manufacturers often having the scale to consider such vertical integration strategies.

- Potential for Internal Production: Key customers in furniture and construction can explore manufacturing their own wood components.

- Increased Bargaining Power: The ability to produce internally gives customers leverage to dictate terms or seek alternatives.

- Reduced Supplier Dependence: Backward integration allows customers to bypass Asia Timber Products Co. Ltd. if pricing or supply conditions are unfavorable.

Price Sensitivity of Customers

Customers in the retail, commercial, and residential sectors for components like doors and cabinets can be highly price-sensitive, especially in competitive markets. For instance, in 2024, the global furniture market, a key sector for wood components, saw increased price competition, with consumers actively seeking value. This heightened sensitivity means Asia Timber Products Co. Ltd. faces pressure to maintain competitive pricing.

If the wood products supplied by Asia Timber Products Co. Ltd. represent a significant cost component for their customers' end products, customers will exert more pressure for lower prices. In 2024, rising input costs for many manufacturers meant that the cost of raw materials like timber became a more scrutinized element of their overall production expenses, directly impacting their ability to absorb price increases and thus amplifying customer bargaining power.

- Price Sensitivity: Customers in sectors like construction and furniture manufacturing are often highly attuned to price fluctuations for wood components.

- Cost Component: When timber represents a substantial portion of a customer's final product cost, their leverage to negotiate lower prices increases significantly.

- Market Competition: In 2024, the competitive landscape for building materials and finished wood products intensified, forcing suppliers to be more aggressive on pricing to retain market share.

- Margin Impact: Increased customer pressure for lower prices can directly compress profit margins for suppliers like Asia Timber Products Co. Ltd.

Customers of Asia Timber Products Co. Ltd. possess significant bargaining power, particularly when the timber products supplied are perceived as commodities. The global particleboard market, valued at approximately $50 billion in 2023, exemplifies this, where price is a primary driver for buyers. If Asia Timber Products Co. Ltd. cannot differentiate its offerings through quality or sustainability certifications, like the premium commanded by FSC-certified wood in 2024, customers can easily switch to competitors, increasing their leverage.

Switching costs for customers, such as furniture or cabinet manufacturers, can be substantial, potentially ranging from $5,000 to $20,000 in 2024 for re-tooling, plus downtime. When these costs are low, customers are more empowered to negotiate better terms. Furthermore, large buyers might consider backward integration, producing their own wood components, a strategy more feasible in the vast $700 billion global furniture market of 2024, thereby reducing their dependence on suppliers like Asia Timber Products Co. Ltd.

Price sensitivity among customers, especially in competitive markets like the global furniture sector in 2024, directly impacts Asia Timber Products Co. Ltd. If timber represents a significant cost in a customer's final product, they will exert greater pressure for lower prices, potentially compressing supplier margins. This is amplified by rising input costs for manufacturers in 2024, making raw material expenses a critical focus.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2023-2024) |

|---|---|---|

| Product Differentiation | Low differentiation increases power | Global particleboard market ($50B in 2023) is price-driven; FSC-certified wood commands a premium (2024). |

| Switching Costs | Low switching costs increase power | Re-tooling costs can range from $5,000-$20,000 for manufacturers (2024). |

| Backward Integration Potential | High potential increases power | Global furniture market ($700B in 2024) offers scale for large buyers to consider in-house production. |

| Price Sensitivity & Cost Component | High sensitivity and high cost component increase power | Rising input costs in 2024 make timber a scrutinized expense for manufacturers. |

Preview the Actual Deliverable

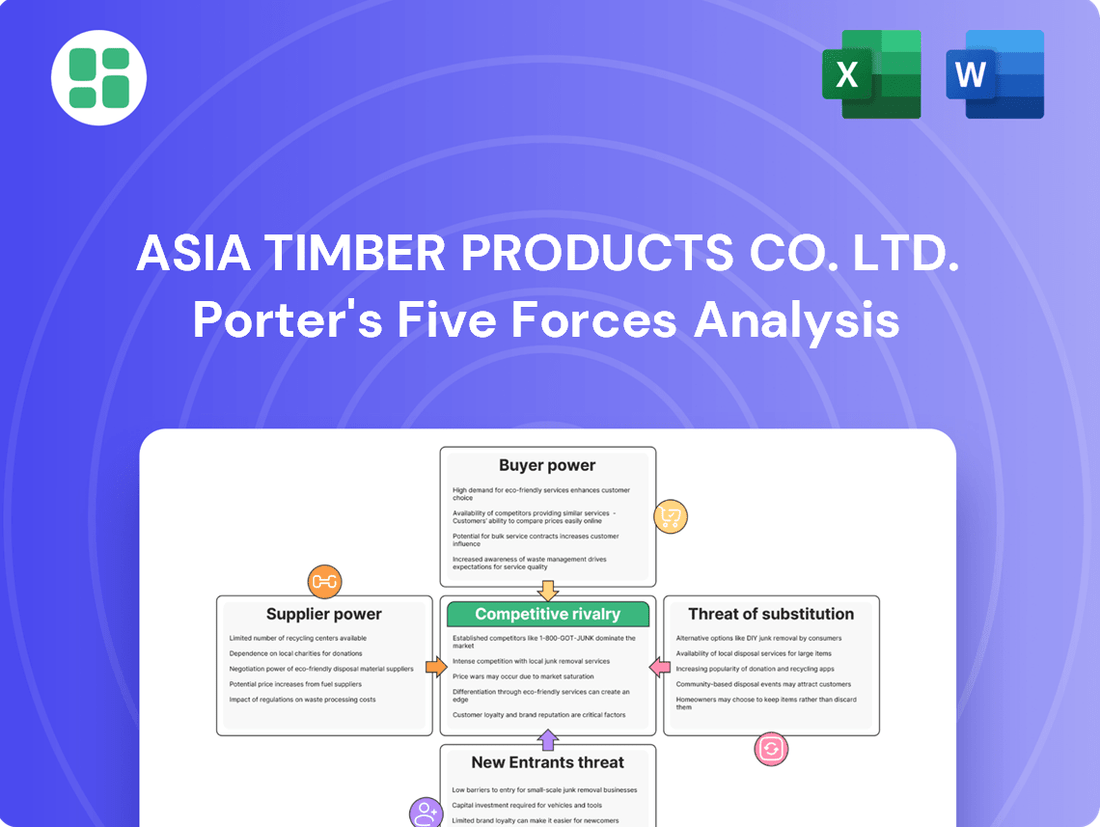

Asia Timber Products Co. Ltd. Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Asia Timber Products Co. Ltd.'s Porter's Five Forces Analysis, covering the intensity of rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products within the timber industry.

Rivalry Among Competitors

The Asian market for wood products, including MDF, particleboard, and laminate flooring, is characterized by intense competition. Numerous companies operate within this space, making it a crowded landscape for Asia Timber Products Co. Ltd.

Specifically, countries like China, India, and across Southeast Asia host a significant number of competitors that are often of comparable size. This parity in scale means that rivalry is particularly fierce, as each player actively seeks to capture a larger share of the market. For instance, China alone is estimated to have over 2,000 wood-based panel manufacturers, many of whom are expanding their capacity and product offerings.

The timber and wood products industry in Asia is experiencing varied growth rates, directly impacting competitive intensity. While specific segments like Medium-Density Fibreboard (MDF) and laminate flooring are demonstrating robust expansion across the region, others are seeing more moderate growth.

This disparity means that in slower-growing product categories, companies like Asia Timber Products Co. Ltd. can expect heightened competition as firms vie more aggressively for their existing market share. For instance, the overall Asian wood products market was projected to grow at a compound annual growth rate (CAGR) of around 4.5% from 2023 to 2028, but this masks significant differences between product types and sub-regions.

Asia Timber Products Co. Ltd. likely faces intense competitive rivalry due to high fixed costs inherent in timber manufacturing. These costs, stemming from significant investments in machinery, processing plants, and inventory management, create pressure to maintain high production volumes. For instance, the global timber and wood products industry saw capital expenditures in the billions annually leading up to 2024, reflecting the substantial upfront investment required.

When demand falters, companies with these high fixed costs are compelled to compete aggressively on price to cover their overheads, exacerbating rivalry. This dynamic is amplified by considerable exit barriers. Specialized equipment, like large-scale sawmills or treatment facilities, and long-term supply or customer contracts can make it prohibitively expensive for firms to leave the market, thus trapping them in a competitive landscape and intensifying the struggle for market share.

Product Differentiation Among Competitors

Competitive rivalry in the timber products sector, particularly for standard offerings like MDF, particleboard, and laminate flooring, often intensifies on price. However, companies that successfully differentiate their products can significantly reduce this price-based competition. Differentiation can stem from superior product quality, unique design aesthetics, a commitment to sustainable sourcing practices, or the adoption of advanced manufacturing technologies, such as those producing low-emission resins or specialized finishes. For instance, in 2024, the global wood flooring market saw a notable increase in demand for eco-friendly options, with companies highlighting their sustainable certifications and low VOC emissions as key selling points, thereby commanding premium pricing.

Asia Timber Products Co. Ltd. faces rivalry where competitors offering similar standard wood composite products will likely engage in price wars. However, those who invest in differentiating factors can mitigate this. For example, a competitor focusing on high-end, sustainably sourced hardwood with unique finishes might experience less direct price pressure compared to a manufacturer of basic particleboard.

- Price Competition: Intensifies when competitors offer identical standard MDF, particleboard, or laminate flooring.

- Differentiation Factors: Superior quality, innovative designs, sustainable sourcing, and advanced manufacturing technologies (e.g., low-emission resins) can reduce price-based rivalry.

- Market Trends (2024): Growing consumer preference for eco-friendly products and low VOC emissions allows differentiated products to command premium pricing.

Strategic Stakes of Competitors

The strategic importance of the Asian market for global and regional timber companies significantly intensifies competitive rivalry. Major players with substantial investments and ambitious growth targets in Asia are likely to employ aggressive pricing and marketing tactics to capture or defend market share. This heightened competition directly impacts profitability for all participants, including Asia Timber Products Co. Ltd.

For instance, in 2024, the Asia-Pacific region continued to be a major driver of global timber demand, with countries like China and Vietnam showing robust construction and furniture manufacturing sectors. Companies such as Weyerhaeuser and Stora Enso, with established operations in the region, are actively vying for dominance. This strategic focus means that pricing pressures can be considerable, forcing companies to optimize their cost structures and supply chains to remain competitive.

- Intensified Competition: Global timber giants are heavily invested in Asia, leading to aggressive market strategies.

- Pricing Pressure: High demand in key Asian markets like China and Vietnam in 2024 fuels price competition.

- Market Share Focus: Companies prioritize gaining or protecting their share, often through aggressive tactics.

- Profitability Impact: Aggressive strategies by competitors can squeeze profit margins for all players, including Asia Timber Products Co. Ltd.

Competitive rivalry in the Asian timber products market is fierce due to a large number of similarly sized competitors, especially in key markets like China and Southeast Asia. High fixed costs associated with timber manufacturing, such as machinery and plant investments, compel companies to maintain high production volumes, often leading to price competition when demand softens. Furthermore, significant exit barriers, including specialized equipment and long-term contracts, trap firms in this intense competitive environment.

Differentiation through superior quality, design, sustainability, or advanced technology can mitigate price-based rivalry. For instance, the 2024 market saw increased demand for eco-friendly wood products, allowing companies highlighting sustainable sourcing and low VOC emissions to command premium prices. Global timber giants are also heavily invested in the strategically important Asia-Pacific region, driving aggressive pricing and marketing tactics to secure market share, which consequently puts pressure on profit margins for all players.

| Factor | Description | Impact on Asia Timber Products Co. Ltd. |

| Number of Competitors | High, with many similarly sized players in China and Southeast Asia. | Intense pressure to capture market share. |

| Fixed Costs | Significant investments in manufacturing plants and machinery. | Drives need for high production volume, leading to price competition. |

| Exit Barriers | Specialized equipment and long-term contracts make leaving the market difficult. | Traps companies in a competitive landscape, intensifying rivalry. |

| Differentiation | Product quality, design, sustainability, and technology. | Opportunity to reduce price-based competition and command premium pricing. |

| Market Trends (2024) | Growing demand for eco-friendly and low VOC products. | Companies focusing on these aspects can gain a competitive edge. |

| Strategic Importance of Asia | Major global players are actively competing in the region. | Increased pricing pressure and aggressive market strategies. |

SSubstitutes Threaten

Asia Timber Products Co. Ltd. faces a significant threat from substitutes. Their timber products are used in doors, furniture, cabinets, countertops, and flooring, but these same functions can be served by materials like steel, plastic, glass, stone, ceramics, and concrete.

The market is also seeing a rise in non-wood composites and a growing consumer preference for recycled or rapidly renewable materials, further intensifying this competitive pressure. For instance, the global market for engineered wood products, a key area for timber, is projected to grow, but this growth must contend with the increasing adoption of alternative materials in construction and interior design.

The attractiveness of substitutes for Asia Timber Products Co. Ltd. hinges significantly on their price-performance trade-off. If alternative materials like engineered wood, plastics, or even metals offer comparable durability, aesthetics, and ease of installation at a lower cost, the threat of substitution intensifies. For instance, the global market for engineered wood products, a key substitute, was valued at over USD 240 billion in 2023 and is projected to grow, indicating a strong competitive landscape.

Asia Timber Products Co. Ltd. faces a moderate threat from substitutes because customer switching costs are generally not prohibitive. For instance, while a furniture manufacturer might need to invest in new tooling if switching from wood to metal, the cost of this equipment is often a fraction of overall production expenses. In 2024, the global market for engineered wood products, a key substitute for traditional timber, saw growth driven by sustainability initiatives, but the capital expenditure for many manufacturers to fully transition remained a consideration.

Perceived Value and Aesthetics of Substitutes

The threat of substitutes for Asia Timber Products Co. Ltd. is influenced by how well alternative materials can replicate the perceived value and aesthetic of wood. While wood offers a natural charm, modern manufacturing allows substitutes like engineered wood, laminates, and vinyl to convincingly mimic wood grains and textures. For instance, in 2024, the global market for luxury vinyl tile (LVT), a key wood substitute, was projected to reach over $20 billion, highlighting its growing appeal and ability to emulate natural materials.

If customers begin to believe that these substitutes provide comparable aesthetic qualities or even superior functional benefits, such as enhanced water resistance for flooring applications or lighter weight for construction panels, all at a competitive price point, the threat of substitution intensifies. For example, advancements in high-definition printing technology have significantly improved the realism of wood-look porcelain tiles, which saw a global market valuation exceeding $30 billion in 2023, directly challenging traditional wood flooring.

- Mimicry of Wood Aesthetics: Engineered wood and laminates now offer sophisticated printing techniques to replicate diverse wood species and grain patterns, reducing the unique aesthetic advantage of natural timber.

- Performance Advantages: Substitutes like vinyl and composite materials often boast superior durability, moisture resistance, and lower maintenance requirements compared to natural wood, particularly in demanding environments.

- Price Competitiveness: The cost-effectiveness of many synthetic substitutes, especially when factoring in installation and long-term maintenance, can make them a more attractive option for budget-conscious consumers and developers.

- Market Penetration of Alternatives: The increasing market share of materials like LVT and wood-look porcelain tiles in sectors traditionally dominated by wood, such as residential and commercial flooring, indicates a rising threat of substitution.

Technological Advancements in Substitutes

Technological advancements are continuously improving the performance and cost-effectiveness of substitute materials, posing a significant threat to Asia Timber Products Co. Ltd. Innovations in material science, such as the development of high-strength composites and advanced plastics, are making these alternatives more appealing. For instance, the global market for engineered wood products, a direct competitor, is projected to reach USD 250 billion by 2028, demonstrating sustained growth driven by technological improvements.

These emerging materials can offer advantages like enhanced durability, moisture resistance, and design flexibility that may surpass traditional wood products in certain applications. The increasing sophistication of manufacturing processes, including 3D printing, also allows for the creation of custom components that could displace wood in niche markets. Asia Timber Products Co. Ltd. needs to closely track these evolving material capabilities to proactively address potential market erosion.

Key areas of technological advancement impacting substitutes include:

- Advanced Composites: Development of lighter, stronger, and more sustainable composite materials derived from recycled sources or bio-based feedstocks.

- Smart Materials: Integration of sensors or self-healing properties into substitute materials, offering enhanced functionality.

- Manufacturing Innovations: Increased adoption of automation and additive manufacturing (3D printing) for cost-effective production of complex shapes and custom designs.

- Performance Enhancements: Ongoing research into improving properties like fire resistance, insulation, and structural integrity of non-wood alternatives.

The threat of substitutes for Asia Timber Products Co. Ltd. is moderate, primarily due to the increasing sophistication and cost-competitiveness of alternative materials. While wood offers a natural aesthetic, engineered wood products, plastics, and composites are becoming adept at mimicking wood grains and textures. For instance, the global market for luxury vinyl tile (LVT), a key wood substitute, was projected to exceed $20 billion in 2024, demonstrating its growing appeal.

These substitutes often provide enhanced performance benefits, such as superior durability and moisture resistance, making them attractive for flooring and construction applications. The price-performance ratio is a critical factor; if alternatives offer comparable or better functionality at a lower overall cost, including installation and maintenance, the threat intensifies. In 2024, the engineered wood market continued its growth trajectory, driven by sustainability concerns, but the capital investment required for manufacturers to fully transition to these alternatives remained a consideration.

| Substitute Material | Key Applications | 2024 Market Projection (USD Billion) | Key Advantage vs. Wood |

|---|---|---|---|

| Engineered Wood | Flooring, Furniture, Construction | ~250 (projected by 2028) | Stability, Cost-effectiveness |

| Luxury Vinyl Tile (LVT) | Flooring, Wall Coverings | >20 | Durability, Water Resistance |

| Wood-Look Porcelain Tiles | Flooring, Wall Cladding | >30 | Scratch Resistance, Low Maintenance |

| Plastics/Composites | Furniture, Construction Panels | Varies by segment | Lightweight, Moisture Resistance |

Entrants Threaten

The timber products manufacturing sector, particularly for sophisticated items like high-end MDF, particleboard, and laminate flooring, demands substantial upfront investment. Companies need significant capital for advanced machinery, building extensive plant infrastructure, and maintaining substantial raw material inventories. For instance, a new, state-of-the-art particleboard production line can easily cost upwards of $50 million to $100 million, presenting a formidable financial hurdle for aspiring competitors.

Established timber producers, including Asia Timber Products Co. Ltd., often leverage significant economies of scale in their operations. This means they can purchase raw materials in bulk, negotiate better prices with suppliers, and optimize their manufacturing processes, leading to lower per-unit production costs. For instance, a large-scale operation might reduce its manufacturing cost per cubic meter of processed timber by 10-15% compared to a smaller competitor due to these efficiencies.

New entrants face a substantial hurdle in matching these cost advantages. Without the same purchasing power or production volume, they may find it challenging to compete on price with established players. This disparity in cost structure can deter new companies from entering the market, as they would need to either accept lower profit margins or find innovative ways to differentiate their offerings, perhaps through specialized wood treatments or unique product designs.

New companies entering the timber products market face significant hurdles in securing consistent, high-quality raw materials and setting up efficient distribution. For instance, in 2024, the global timber market saw price volatility, with some key hardwood species experiencing a 15% increase due to supply chain disruptions, making it harder for new entrants to forecast costs.

Established players like Asia Timber Products Co. Ltd. benefit from long-standing relationships with timber concessions and existing distribution networks that reach retail, commercial, and residential sectors. Building these relationships and channels from the ground up would require substantial investment and time for any new competitor, presenting a considerable barrier to entry.

Government Policy and Environmental Regulations

Government policies and environmental regulations present a substantial barrier to new entrants in the timber industry, especially within Asia. For instance, many Asian countries have implemented stringent forestry laws and sustainability mandates, requiring new companies to invest heavily in compliance and certification processes. In 2024, countries like Indonesia and Malaysia continued to enforce regulations such as the Forest Law and various environmental impact assessment requirements, which can significantly increase the upfront costs and operational complexity for any new player looking to enter the market.

Navigating these regulatory landscapes is a significant challenge. New entrants must contend with lengthy permitting procedures, adhere to evolving environmental standards, and secure necessary certifications like the Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC). These requirements are not just bureaucratic hurdles; they often necessitate substantial capital investment in sustainable practices and traceability systems, making it difficult for smaller or less capitalized firms to compete with established players who already have these systems in place.

- Permitting Complexity: New entrants face time-consuming and costly processes to obtain logging and operational permits, often involving multiple government agencies.

- Environmental Standards: Adherence to strict standards for reforestation, waste management, and biodiversity protection adds significant operational costs.

- Sustainability Certifications: Obtaining recognized certifications (e.g., FSC, PEFC) is crucial for market access but requires substantial investment in sustainable practices and auditing.

- Trade Policies: Import/export restrictions and tariffs on timber products, influenced by government policies, can deter new entrants by affecting market access and profitability.

Brand Loyalty and Product Differentiation

While wood components can appear similar, Asia Timber Products Co. Ltd. has cultivated significant brand loyalty through a consistent focus on quality and specific product attributes. For instance, their engineered wood products often boast superior moisture resistance, a key differentiator in humid Asian markets. Newcomers would face substantial marketing expenses and product innovation costs to challenge this established reputation.

The threat of new entrants is further mitigated by the significant capital investment required to establish production facilities and achieve economies of scale comparable to existing players. In 2024, the global wood panel market, a key segment for Asia Timber Products, was valued at over $250 billion, indicating the substantial financial barrier to entry for new companies aiming for significant market share.

- Brand Loyalty: Asia Timber Products has built trust through consistent quality, making customers less likely to switch to unknown brands.

- Product Differentiation: Features like enhanced moisture resistance in their MDF products offer a tangible advantage over generic offerings.

- Marketing Investment: New entrants would need to allocate considerable resources to build brand awareness and highlight product superiority.

- Capital Requirements: Establishing modern, efficient timber processing facilities demands significant upfront investment, deterring smaller players.

The timber products sector, especially for advanced items, requires substantial capital for machinery and infrastructure, creating a high barrier for new companies. For example, a new particleboard line can cost $50 million to $100 million. Established players like Asia Timber Products Co. Ltd. benefit from economies of scale, leading to lower per-unit costs, making it difficult for newcomers to compete on price.

Securing consistent, quality raw materials and establishing efficient distribution networks are significant challenges for new entrants. In 2024, timber prices saw volatility, with some hardwoods increasing by 15% due to supply chain issues, further complicating cost forecasting for new businesses.

Government regulations and environmental standards are also major deterrents. In 2024, countries like Indonesia and Malaysia continued to enforce strict forestry laws and environmental impact assessments, increasing upfront costs and operational complexity for new players.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | High cost of advanced machinery and plant infrastructure. | Significant financial hurdle, deterring smaller or less capitalized firms. |

| Economies of Scale | Lower per-unit costs due to bulk purchasing and optimized processes. | New entrants struggle to match price competitiveness. |

| Raw Material & Distribution Access | Difficulty in securing consistent, quality materials and building distribution networks. | Increased operational complexity and cost for new players. |

| Regulatory Environment | Stringent forestry laws, environmental standards, and certification requirements. | Adds significant upfront costs, lengthy permitting, and compliance burdens. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Asia Timber Products Co. Ltd. is built upon a robust foundation of data, including industry-specific market research reports, company annual filings, and trade association publications. This blend of sources provides comprehensive insights into market trends, competitive landscapes, and regulatory environments.