Asplundh Tree Expert Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asplundh Tree Expert Bundle

Asplundh Tree Expert navigates a landscape shaped by intense rivalry and the ever-present threat of new entrants in the utility vegetation management sector. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The full Porter's Five Forces Analysis reveals the real forces shaping Asplundh Tree Expert’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized equipment, like advanced tree trimming vehicles and aerial lifts, can wield considerable power over Asplundh. The market for this niche equipment, fueled by infrastructure spending, saw significant growth in North America during 2024, with industry reports indicating a 7% year-over-year increase in capital expenditures for specialized fleet vehicles.

The limited number of manufacturers producing this cutting-edge technology, coupled with the intricate maintenance requirements for these high-cost assets, restricts Asplundh's bargaining options. This reliance on a select few suppliers can translate into less favorable pricing and stricter contract terms, impacting Asplundh's operational costs.

The availability of skilled and certified arborists, line clearance specialists, and equipment operators is absolutely critical for Asplundh Tree Expert's operations. Without these specialized roles, essential services simply cannot be performed safely and effectively.

The tree care industry, particularly utility arboriculture, is currently grappling with significant workforce shortages. Factors contributing to this include an aging workforce, with many experienced professionals retiring, and ongoing challenges in retaining new talent. This scarcity directly impacts Asplundh's ability to staff projects efficiently.

This scarcity of qualified personnel, combined with the rigorous requirements for specialized training and strict safety compliance, inevitably drives up labor costs. Consequently, the workforce, particularly those with in-demand certifications, holds increased bargaining power when negotiating wages and benefits with companies like Asplundh.

Fuel and energy providers hold considerable bargaining power over Asplundh Tree Expert due to its extensive fleet of vehicles and heavy machinery. Asplundh's reliance on fuel makes it a significant buyer, and price volatility directly affects its operational expenses. For instance, in 2024, average diesel prices saw fluctuations, impacting the cost of maintaining Asplundh's large fleet.

While fuel is largely a commodity, the ability to secure favorable terms through large-scale supply contracts can be limited if alternative bulk suppliers are scarce. This can tip the scales in favor of the supplier, directly influencing Asplundh's cost structure and profitability. Asplundh's strategy to mitigate this includes exploring more efficient fuels and transitioning towards hybrids, aiming to reduce both emissions and reliance on traditional diesel.

Safety Gear and Personal Protective Equipment (PPE)

The bargaining power of suppliers for safety gear and personal protective equipment (PPE) is a significant factor for Asplundh Tree Expert. Given that safety is absolutely critical in vegetation management, Asplundh needs to ensure its workforce is equipped with high-quality, specialized PPE that adheres to rigorous industry standards. This necessity means Asplundh has a strong reliance on suppliers who can consistently deliver products meeting these demanding safety and quality benchmarks, limiting its ability to switch providers easily.

Suppliers of specialized PPE, such as chainsaw-resistant chaps, hard hats, and eye protection, can leverage their position due to the essential nature of these items. For instance, a supplier holding certifications for advanced impact absorption or flame-retardant materials, which are crucial for utility line clearance, can command higher prices. The market for such specialized safety equipment is not as commoditized as general supplies, meaning fewer suppliers can meet the stringent requirements. In 2023, the global PPE market was valued at over $60 billion, with specialized segments like those for arborists and utility workers experiencing steady demand, underscoring the importance of these suppliers.

- High Specialization: Suppliers offering PPE with advanced safety features and certifications possess greater leverage.

- Industry Standards: Compliance with stringent safety regulations (e.g., ANSI, CSA) restricts the pool of qualified suppliers.

- Limited Alternatives: The specialized nature of some PPE means fewer readily available substitutes, increasing supplier power.

- Reliability of Supply: Consistent availability of critical safety gear is paramount, making reliable suppliers more influential.

Disposal and Recycling Services

Asplundh Tree Expert, a major player in vegetation management, faces a significant need for disposal and recycling services due to the vast quantities of organic waste generated. In 2024, the company launched a research initiative to explore alternative vegetative waste management solutions, highlighting the critical nature of these services.

The bargaining power of suppliers in this sector can be considerable. If Asplundh encounters a scarcity of local disposal or recycling facilities, or if environmental regulations tighten, these service providers could exert greater influence over pricing and terms. This scenario could directly impact Asplundh's operational costs and efficiency.

- Limited Local Options: A constrained number of qualified disposal and recycling providers in operational areas can concentrate power with those suppliers.

- Stricter Environmental Regulations: New or enhanced environmental mandates may necessitate specialized services, potentially increasing demand and supplier leverage.

- Asplundh's Waste Volume: The sheer scale of organic waste Asplundh produces makes reliable and cost-effective disposal a non-negotiable operational requirement.

- 2024 Research Initiative: Asplundh's proactive research into vegetative waste options underscores the strategic importance of managing this aspect of their business.

Suppliers of specialized equipment, like advanced tree trimming vehicles, hold significant power over Asplundh due to the niche nature of their products and the limited number of manufacturers. This reliance, coupled with high maintenance costs for these assets, restricts Asplundh's negotiation leverage, potentially leading to less favorable pricing and stricter contract terms, impacting overall operational expenses.

The scarcity of qualified arborists and line clearance specialists, driven by an aging workforce and retention challenges, grants these workers increased bargaining power. This shortage directly affects Asplundh's ability to staff projects efficiently and drives up labor costs, as companies compete for essential, certified personnel.

Fuel providers maintain considerable influence over Asplundh due to its extensive fleet, with fuel price volatility directly impacting operational costs. While fuel is a commodity, limited alternative bulk suppliers can strengthen the position of existing providers, influencing Asplundh's cost structure and prompting strategies for fuel efficiency and alternative energy sources.

Suppliers of specialized Personal Protective Equipment (PPE) wield power over Asplundh because of the critical need for high-quality, compliant safety gear. The limited availability of suppliers meeting stringent industry standards for items like chainsaw-resistant chaps means Asplundh has less flexibility in switching providers, potentially leading to higher costs for essential safety equipment.

Disposal and recycling service providers can exert considerable bargaining power over Asplundh, especially if local options are limited or environmental regulations become more stringent. Asplundh's substantial waste volume makes reliable disposal a necessity, amplifying the influence of these service providers on pricing and terms.

| Supplier Category | Impact on Asplundh | Key Factors Driving Power | 2024/2025 Relevance |

|---|---|---|---|

| Specialized Equipment Manufacturers | Higher equipment costs, less favorable terms | Niche market, limited manufacturers, high asset maintenance | Continued demand for advanced fleet vehicles |

| Skilled Labor (Arborists, Line Clearance) | Increased wage and benefit demands | Workforce shortages, aging workforce, retention issues | Ongoing competition for certified talent |

| Fuel & Energy Providers | Volatile operational costs, potential price hikes | High fleet dependency, limited alternative suppliers | Fluctuating energy prices impacting logistics |

| Specialized PPE Suppliers | Higher safety equipment costs | Strict safety standards, limited qualified suppliers | Critical need for compliant, high-quality gear |

| Vegetative Waste Disposal/Recycling | Increased service costs, potential operational disruptions | Limited local providers, stringent environmental regulations | Strategic focus on efficient waste management solutions |

What is included in the product

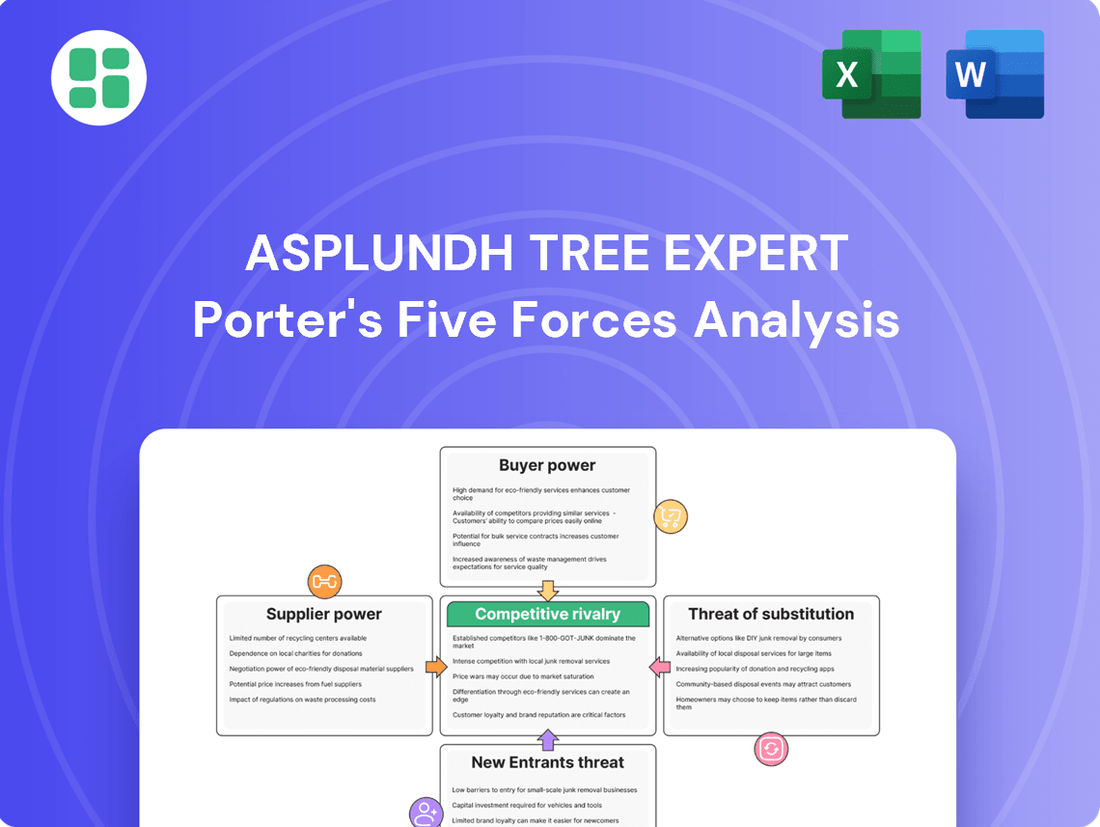

This Porter's Five Forces analysis for Asplundh Tree Expert dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the availability of substitutes within the utility vegetation management industry.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying Asplundh's strategic landscape.

Customers Bargaining Power

Asplundh's customer base is dominated by large, concentrated utility companies, municipalities, and government bodies. These sophisticated clients possess substantial purchasing power and often engage in competitive bidding for major contracts. In 2023, utility vegetation management spending was estimated to be in the billions, with a significant portion flowing to major players like Asplundh, highlighting the scale of these relationships.

Asplundh's vegetation management services are indeed vital for utility companies, ensuring the uninterrupted flow of electricity. However, this critical nature doesn't shield them from intense competition. Utilities routinely put these services out for bid, often seeking proposals from several providers.

This competitive bidding process grants significant leverage to utility customers. They can, and do, compare potential providers not just on cost but also on crucial factors like safety performance, advanced technology adoption, and a demonstrated history of dependable service delivery. This multi-faceted evaluation means that while the service is essential, the power remains firmly with the customer to select the best fit.

Utilities are boosting infrastructure spending, with the power sector's capital expenditures projected to climb. This surge is fueled by the need for grid modernization, enhancing resilience against weather events, and meeting rising electricity demand, which reached approximately 4.1 trillion kilowatt-hours in the U.S. in 2023. This increased investment presents a larger opportunity for companies like Asplundh.

However, this growing investment means utility customers are now demanding more sophisticated, data-driven vegetation management solutions. They are looking for partners who can demonstrate how their services directly contribute to mitigating risks and ensuring compliance with evolving reliability standards, pushing for greater efficiency and measurable outcomes.

Regulatory and Public Pressure on Utilities

Asplundh’s utility clients face significant regulatory and public scrutiny concerning service reliability, safety, and wildfire prevention. This external pressure directly influences their demands on contractors, pushing for more proactive and strategic vegetation management. Consequently, utilities wield considerable bargaining power.

This dynamic translates into stringent service level agreements, where utilities dictate terms emphasizing performance and risk mitigation. For instance, in 2024, many utility companies faced increased regulatory fines for service disruptions, reinforcing their need for dependable contractor performance.

- Increased regulatory oversight: Utilities must adhere to strict standards for grid reliability, impacting their operational costs and contractor requirements.

- Public demand for safety: High-profile wildfire events in recent years have amplified public expectations for utilities to maintain safe and well-managed rights-of-way.

- Service level agreements (SLAs): Utilities leverage their position to negotiate aggressive SLAs with contractors like Asplundh, often including performance penalties and incentives.

- Focus on proactive management: The emphasis is shifting from reactive tree trimming to strategic, data-driven vegetation management to prevent outages and fires.

Potential for In-house Capabilities and Technology Adoption

Larger utility companies possess the potential to develop in-house vegetation management capabilities, thereby reducing their reliance on external providers like Asplundh. This threat is amplified by the increasing adoption of advanced technologies such as AI, drones, and remote sensing. For instance, utilities are investing in these tools for predictive analytics, allowing for more efficient and data-driven decision-making in vegetation management.

While these technological advancements often augment rather than completely replace physical services, they grant utilities greater oversight and control. This increased internal capacity and technological sophistication can translate into stronger bargaining power when negotiating contracts with service providers, potentially leading to more competitive pricing or service level agreements.

- In-house Development: Utilities may build or expand their own vegetation management departments.

- Technology Adoption: Increased use of AI, drones, and remote sensing for predictive analytics.

- Data-Driven Decisions: Enhanced utility control and informed decision-making capabilities.

- Negotiating Power: Greater leverage in contract discussions with service providers.

Asplundh's customers, primarily large utility companies and government entities, hold significant bargaining power due to their substantial purchasing volume and the competitive nature of the vegetation management market. These clients often engage in rigorous bidding processes, evaluating providers on a comprehensive set of criteria beyond just price, including safety records and technological capabilities. In 2023, the U.S. utility sector's capital expenditures were substantial, with a significant portion allocated to vegetation management, underscoring the financial clout of these buyers.

The critical nature of vegetation management for utility reliability and regulatory compliance, coupled with increasing infrastructure investments, means customers demand highly sophisticated, data-driven solutions. This pushes Asplundh to offer services that demonstrably mitigate risks and meet stringent performance standards, granting customers leverage in contract negotiations. For example, heightened regulatory scrutiny in 2024 for service disruptions has made utilities more insistent on robust performance guarantees from their contractors.

Utilities can also bolster their bargaining power by developing in-house capabilities, especially with the growing adoption of advanced technologies like AI and drones for predictive analytics in vegetation management. This trend allows them to exert greater control and potentially negotiate more favorable terms with external providers like Asplundh, as they gain more insight into optimal service delivery and cost structures.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data/Trend |

| Concentrated Customer Base | High | Dominated by large utility companies and government bodies. |

| Competitive Bidding Process | High | Clients routinely solicit multiple proposals, comparing cost, safety, and technology. |

| Critical Service Need | Moderate to High | Essential for utility reliability, but sophisticated clients demand more than just basic service. |

| Technological Advancements | Increasing | Utilities invest in AI, drones, and remote sensing, enhancing in-house capabilities and oversight. |

Preview Before You Purchase

Asplundh Tree Expert Porter's Five Forces Analysis

This preview shows the exact Asplundh Tree Expert Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitute services. This detailed analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The utility vegetation management sector is home to formidable, long-standing companies. Key rivals such as BrightView Holdings, Lewis Tree Service, and The Davey Tree Expert Company directly challenge Asplundh for market share. These established players possess significant resources and extensive operational histories, making them formidable competitors.

Competition for major utility contracts is particularly fierce. Companies actively pursue business across both national and regional landscapes, often employing aggressive pricing and service strategies to secure lucrative agreements. This intense rivalry means that Asplundh must continuously innovate and optimize its operations to maintain its competitive edge.

The competitive landscape for Asplundh Tree Expert is heavily shaped by a bidding process for long-term contracts, primarily with utility and government organizations. This system naturally leads to intense price competition, where cost is a major factor for clients, alongside the crucial elements of service quality and safety protocols. For instance, many utility vegetation management contracts in 2024 are awarded through competitive bids, often with multi-year durations, putting pressure on pricing.

This continuous cycle of contract renewals means that companies like Asplundh are perpetually vying for market share. The need to win new business and retain existing clients intensifies the rivalry among established players and emerging competitors. This dynamic ensures that pricing strategies are a constant focus for all participants in the utility vegetation management sector.

While the fundamental service of tree trimming for utility lines is similar across the industry, companies like Asplundh Tree Experts actively pursue differentiation through cutting-edge technology. This includes the adoption of AI-driven systems for vegetation monitoring, drone technology for efficient and safe inspections, and sophisticated geospatial asset management tools. These advancements not only streamline operations but also offer clients enhanced data and predictive capabilities.

Beyond technological prowess, a strong emphasis on safety and environmental stewardship is a critical differentiator. Utilities, in particular, place a high premium on minimizing risks and adhering to stringent environmental regulations. Companies that can demonstrate superior safety records, often backed by industry certifications and robust training programs, alongside a commitment to sustainable practices, gain a significant competitive edge. For instance, Asplundh reported a total recordable incident rate (TRIR) well below industry averages in recent years, underscoring their commitment to safety.

Acquisitions and Market Consolidation

Competitive rivalry in the vegetation management industry is intensifying due to ongoing mergers and acquisitions. Larger entities are strategically absorbing smaller competitors to broaden their operational territories and enhance their service portfolios. This consolidation trend, exemplified by Asplundh's acquisition of Bobcat Power in 2025, means fewer, but larger, players dominate the market, leading to more direct and aggressive competition among them.

The drive for market consolidation presents a dynamic competitive landscape:

- Geographic Expansion: Acquisitions allow companies to quickly enter new regions and gain immediate market share.

- Service Offering Enhancement: Mergers enable the integration of complementary services, creating more comprehensive solutions for clients.

- Increased Scale: Larger, consolidated firms benefit from economies of scale, potentially offering more competitive pricing.

- Heightened Rivalry: As the number of major players decreases, the competition for contracts among these larger entities becomes more pronounced.

Geographic Overlap and Staffing Challenges

Competitive rivalry in the vegetation management sector is fierce, with many firms vying for the same contracts and, more importantly, the same skilled workforce. This geographic overlap means companies like Asplundh are constantly in direct competition with rivals in their operating territories.

Staffing is a significant battleground. Asplundh, like others in the industry, faces challenges in maintaining sufficient numbers of trained arborists and ground crews. For instance, reports from 2024 indicated that labor shortages in skilled trades, including tree care, continued to be a persistent issue across North America, impacting service delivery timelines and capacity.

When a company like Asplundh struggles with staffing, it can directly result in lost contracts to competitors who are better positioned to meet demand. This dynamic intensifies the rivalry, as successful workforce management becomes a key differentiator. The ability to consistently staff projects is crucial for securing and retaining business, making talent acquisition and retention a critical strategic imperative.

- Geographic Overlap: Competitors frequently operate in the same regions, leading to direct competition for contracts.

- Skilled Labor Scarcity: A shared challenge is securing and retaining qualified arborists and crews.

- Staffing Impacts Contracts: Shortages in personnel can cause companies like Asplundh to lose business to better-staffed rivals.

- Workforce Management as a Differentiator: The capacity to maintain adequate staffing levels is a key competitive advantage.

Competitive rivalry in the utility vegetation management sector is intense, with established players like BrightView Holdings and The Davey Tree Expert Company constantly vying for contracts. This fierce competition is often driven by aggressive pricing strategies and a continuous need to secure long-term agreements with utility and government clients, as many contracts awarded in 2024 were multi-year, emphasizing cost-effectiveness alongside service quality.

The battle for skilled labor is a significant aspect of this rivalry, with companies like Asplundh facing persistent challenges in acquiring and retaining qualified arborists and crews, a trend highlighted by labor shortage reports in 2024. Companies that can effectively manage their workforce and ensure consistent project staffing gain a critical advantage, as staffing shortfalls can directly lead to lost business to better-staffed competitors.

Mergers and acquisitions are further consolidating the market, creating larger entities that engage in more direct and aggressive competition. This trend, exemplified by Asplundh's acquisition of Bobcat Power in 2025, leads to fewer but larger players dominating the landscape, intensifying the rivalry as these consolidated firms expand geographically and enhance their service offerings.

| Key Competitors | 2024 Market Focus | Key Differentiators |

| BrightView Holdings | Utility vegetation management, landscape services | Scale, broad service offerings, technology integration |

| The Davey Tree Expert Company | Utility and commercial tree care, residential services | Long operational history, strong safety record, arboricultural expertise |

| Lewis Tree Service | Utility vegetation management, line clearance | Extensive regional presence, specialized equipment, workforce development |

SSubstitutes Threaten

The most direct substitute for Asplundh's outsourced vegetation management services is for utility companies to handle this work in-house using their own internal teams. While this approach can sometimes be less cost-effective due to the specialized scale and equipment required, larger utilities may opt for insourcing to maintain greater operational control and reduce their dependence on external contractors. This possibility of utilities bringing vegetation management back in-house represents a persistent substitute threat.

While Asplundh Tree Expert leans heavily on mechanical methods for vegetation management, chemical herbicides represent a potential substitute in certain scenarios. These are particularly relevant for large-scale projects or in areas that are challenging to reach with machinery, offering an alternative approach to clearing unwanted plant growth.

Despite current limitations stemming from stringent regulations and public sentiment against broad chemical application, the threat of substitutes could evolve. Innovations in selective herbicides, if they can address environmental concerns and demonstrate enhanced effectiveness, might present a more substantial competitive challenge to Asplundh's core services in the future.

Advanced technologies like AI, drones, and LiDAR mapping are revolutionizing vegetation management. These tools enable utilities to move from reactive to proactive, data-driven approaches, predicting growth and pinpointing high-risk zones for optimized trimming. This shift can reduce the need for traditional, cyclical tree work, presenting a significant threat of substitution.

Undergrounding Utility Lines

The threat of substitutes for Asplundh's vegetation management services is relatively low but present, primarily through the undergrounding of utility lines. This method completely eliminates the need for overhead vegetation management. For instance, in 2024, many new housing developments and areas identified as high-risk for storm damage are increasingly incorporating underground power lines. This trend, while currently expensive and not a widespread solution for existing infrastructure, represents a significant long-term substitute.

While the upfront cost of undergrounding is substantial, it removes the ongoing expense and operational necessity for services like those provided by Asplundh. For example, the average cost to bury a single mile of overhead power line can range from $200,000 to $1 million, depending on terrain and existing infrastructure. This high capital expenditure limits its immediate adoption, but as technology advances and the long-term benefits of reliability and reduced maintenance become more apparent, it could erode a portion of the market.

- Undergrounding eliminates the need for vegetation management entirely.

- High upfront costs are a barrier to widespread adoption in 2024.

- New developments and high-risk zones are more likely to adopt this substitute.

- The long-term trend towards undergrounding poses a niche but significant threat.

Non-Traditional Energy Sources and Microgrids

The long-term trend toward distributed energy generation, including rooftop solar and microgrids, poses a potential threat by reducing reliance on traditional overhead transmission and distribution infrastructure. This shift, while gradual, could eventually decrease the demand for extensive utility vegetation management services over several decades.

For instance, by the end of 2023, the U.S. solar capacity had surpassed 150 gigawatts, a significant increase that highlights the growing adoption of non-traditional energy sources. This decentralization trend means fewer miles of traditional power lines requiring maintenance.

- Distributed Generation Growth: The increasing adoption of rooftop solar and community microgrids directly challenges the necessity of large, centralized power grids.

- Reduced Infrastructure Need: As more energy is generated locally, the demand for extensive overhead transmission and distribution networks, and consequently their associated vegetation management, may decline.

- Long-Term Impact: While not an immediate threat, a sustained and significant decentralization of the energy grid could lead to a substantial reduction in the market for traditional utility vegetation management services over the coming decades.

While Asplundh's core business is vegetation management for overhead power lines, the increasing trend of undergrounding utility infrastructure presents a significant substitute threat. This method completely bypasses the need for trimming trees near power lines. For example, many new infrastructure projects and upgrades in 2024 are prioritizing undergrounding, especially in areas prone to severe weather, to enhance reliability and reduce maintenance costs associated with vegetation interference.

The financial implications of undergrounding are substantial; the cost to bury a mile of power lines can range from $200,000 to over $1 million, a considerable upfront investment. However, this investment eliminates ongoing vegetation management expenses, making it an attractive long-term alternative for utilities. As technology improves and the perceived value of grid resilience grows, this substitute could gain more traction, particularly in new developments and critical infrastructure zones.

| Substitute Method | Description | Impact on Asplundh | 2024 Relevance | Cost Factor |

|---|---|---|---|---|

| Undergrounding Utilities | Burying power lines to eliminate overhead infrastructure. | Reduces or eliminates the need for vegetation management services. | Increasing adoption in new builds and high-risk areas. | High upfront cost, lower long-term operational cost. |

| In-house Utility Management | Utilities performing vegetation management with their own crews. | Direct competition, potentially reducing outsourcing opportunities. | Larger utilities may opt for this for greater control. | Variable, depends on utility scale and efficiency. |

| Advanced Vegetation Tech | AI, drones, LiDAR for predictive trimming and data-driven management. | Optimizes trimming schedules, potentially reducing overall service volume. | Enables proactive, data-informed approaches. | Requires capital investment in technology. |

Entrants Threaten

Entering the utility vegetation management sector, like the one Asplundh operates in, requires a significant upfront financial commitment. Think about the specialized equipment needed: bucket trucks, powerful chippers, and sophisticated mapping technology. These aren't cheap; a single high-end bucket truck can cost upwards of $300,000 to $500,000, and a fleet quickly escalates costs.

Beyond just machinery, new players must invest heavily in safety infrastructure and training. This includes everything from personal protective gear to robust operational protocols to meet industry standards. For instance, maintaining compliance with OSHA regulations for working at heights and around power lines adds another layer of expense, making it difficult for smaller entities to compete effectively against established companies with existing economies of scale.

The utility vegetation management sector, Asplundh's core business, demands a high degree of specialized expertise. This includes deep knowledge of arboriculture, understanding tree biology and growth patterns, alongside proficiency in utility line clearance operations. Newcomers face a steep learning curve and significant investment in acquiring this specialized skill set.

Furthermore, the industry is heavily regulated, with strict adherence to safety and environmental protocols being paramount. For instance, OSHA regulations for utility line clearance, along with various state and local environmental permits, create substantial barriers. New entrants must invest heavily in training, certification, and compliance infrastructure, which can take years to establish, making rapid market entry challenging.

Established customer relationships and reputation act as a significant barrier for new entrants. Incumbents like Asplundh have cultivated deep, long-standing ties with major utility companies, founded on unwavering trust, consistent reliability, and a proven history of performance in maintaining critical infrastructure. For instance, Asplundh's extensive experience, often spanning decades, provides a level of assurance that new, unproven companies simply cannot match.

Utilities, by their very nature, place an immense premium on dependability and safety, especially when it comes to essential services like power and water. This means they are inherently hesitant to risk service disruptions or public safety by engaging with new, less experienced providers. The high stakes involved in ensuring uninterrupted service and protecting the public make it exceedingly difficult for newcomers to displace established players who have already demonstrated their capabilities and built a solid reputation over many years.

Workforce Shortages and Recruiting Challenges

The tree care industry is facing a critical shortage of skilled labor, making it tough to find and keep good people. This directly impacts the threat of new entrants because building a capable team is a major hurdle.

New companies would struggle to attract certified arborists and experienced equipment operators. They'd be up against established players like Asplundh, which often have robust training programs and attractive benefits packages already in place, making it hard for newcomers to compete for talent.

- Skilled Labor Deficit: The U.S. Bureau of Labor Statistics projects a need for more arborists, with demand expected to grow.

- Training Investment: New entrants must invest heavily in training, which is costly and time-consuming, unlike established firms with existing infrastructure.

- Retention Challenges: High turnover rates in the industry mean new companies would constantly battle to retain their newly trained workforce.

Acquisition Strategy by Incumbents

Larger established companies, including Asplundh, often engage in aggressive acquisition strategies. This involves buying out smaller, potentially disruptive companies to consolidate market share and eliminate emerging competition. For instance, in 2023, the utility vegetation management sector saw significant M&A activity, with major players acquiring regional specialists to bolster their capabilities and geographic reach.

This consolidation makes it increasingly difficult for new entrants to achieve the necessary scale to compete effectively. Established firms can leverage their existing financial resources and operational efficiencies to integrate acquired businesses, thereby creating formidable barriers to entry. The ability to quickly absorb innovative technologies or service models through acquisition means new players often struggle to gain traction against these larger, more integrated entities.

- Market Consolidation: Incumbents acquire smaller firms, limiting organic growth opportunities for new entrants.

- Financial Strength: Established companies use their capital to buy out competitors, creating scale disadvantages for startups.

- Barriers to Entry: Acquisitions by major players like Asplundh can raise the capital and operational hurdles for new companies entering the market.

The threat of new entrants in the utility vegetation management sector, where Asplundh operates, is significantly mitigated by substantial capital requirements for specialized equipment and infrastructure. High upfront costs for machinery like bucket trucks, which can range from $300,000 to $500,000 each, alongside mandatory investments in safety training and compliance with stringent regulations such as OSHA standards, create formidable financial barriers.

The industry's reliance on highly specialized knowledge, encompassing arboriculture and utility line clearance, coupled with rigorous regulatory compliance, presents a steep learning curve and extensive training investment for newcomers. Furthermore, established customer relationships built on trust and proven reliability make it difficult for new companies to displace incumbents like Asplundh. The critical shortage of skilled labor, with demand for arborists projected to grow, further exacerbates the challenge for new entrants to build and retain a capable workforce, as they compete against established firms with robust training and benefits.

Market consolidation through acquisitions by larger players, a trend observed in 2023, also limits organic growth opportunities for new entrants. These acquisitions create scale disadvantages for startups, as established companies leverage financial strength to integrate competitors, raising capital and operational hurdles for new market participants.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | Specialized equipment (e.g., bucket trucks) | $300,000 - $500,000+ per unit |

| Regulatory Compliance | Adherence to safety (OSHA) and environmental standards | Significant investment in training, certification, and infrastructure |

| Skilled Labor | Shortage of certified arborists and experienced operators | High recruitment and retention costs; competition for talent |

| Established Relationships | Trust and proven performance with utility companies | Difficult to displace incumbents with long-standing contracts |

| Market Consolidation | Acquisition of smaller firms by major players | Creates scale disadvantages for new entrants |

Porter's Five Forces Analysis Data Sources

Our Asplundh Tree Expert Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, financial filings from publicly traded competitors, and expert commentary from trade publications. This blend ensures a comprehensive understanding of the competitive landscape.