Ashok Leyland Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashok Leyland Bundle

Ashok Leyland faces moderate bargaining power from buyers due to product differentiation, while suppliers exert significant influence, especially for specialized components. The threat of new entrants is moderate, with high capital requirements acting as a barrier.

The competitive rivalry within the commercial vehicle sector is intense, driven by established players and aggressive pricing strategies. Furthermore, the threat of substitutes, though currently low, could increase with advancements in alternative transportation solutions.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ashok Leyland’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ashok Leyland, a major player in the commercial vehicle sector, faces significant bargaining power from its suppliers, particularly for specialized components like engines and advanced electronics. A concentrated supplier market means fewer options for Ashok Leyland, allowing these suppliers to potentially charge more or impose stricter terms. For instance, in 2023, the global automotive semiconductor shortage highlighted how dependent manufacturers are on a handful of chip producers, leading to production delays and increased costs for many in the industry.

Ashok Leyland faces significant switching costs when changing suppliers for critical components. The need for re-tooling manufacturing lines, re-designing existing vehicle modules, and re-certifying new parts to meet stringent quality and safety standards can be prohibitively expensive. These substantial upfront investments effectively lock in existing suppliers, granting them considerable bargaining power.

Suppliers who provide unique or patented technologies, particularly for crucial components like advanced safety systems or specialized engine parts, can exert significant leverage. As Ashok Leyland increasingly invests in electric and alternative fuel vehicles, its dependence on suppliers for these novel technologies is likely to grow, potentially amplifying supplier bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into vehicle manufacturing, while a potential lever to increase their bargaining power, is largely mitigated in the automotive sector. The immense capital investment and intricate manufacturing processes required to produce vehicles act as significant barriers to entry for most suppliers. For instance, establishing a new automotive manufacturing plant can easily run into billions of dollars, a scale few component makers can readily achieve or finance.

While this threat is generally low, its impact on a company like Ashok Leyland would be substantial if it were to materialize. A supplier successfully entering the vehicle assembly business could dictate terms more aggressively, potentially impacting Ashok Leyland's cost structure and market positioning. However, the industry's established players and the sheer complexity of the supply chain make this a rare occurrence.

In 2023, the global automotive industry saw significant investments in new manufacturing capacity, but these were primarily by established automakers or through joint ventures, not by component suppliers moving into full vehicle production. This trend underscores the high barriers to forward integration.

- Low Likelihood: The capital intensity and technical expertise required for vehicle manufacturing deter most suppliers from forward integration.

- High Impact: If a key supplier were to integrate forward, it would significantly increase their bargaining power over Ashok Leyland.

- Industry Norms: The automotive sector's established ecosystem and high entry barriers make this a rare strategic move for suppliers.

- Deterrents: The enormous financial commitment and operational complexity of vehicle production remain strong deterrents.

Importance of Supplier's Input to Ashok Leyland's Cost Structure

The cost of raw materials and components represents a substantial segment of Ashok Leyland's total production expenses. For instance, in fiscal year 2024, the cost of materials and components accounted for a significant portion of their revenue, directly influencing their bottom line.

Fluctuations in the prices of key commodities like steel and aluminum can directly affect Ashok Leyland's profitability and how they set their prices. This price sensitivity grants suppliers of these fundamental materials a degree of leverage.

- Significant Material Costs: In FY24, Ashok Leyland's raw material and component costs were a major driver of their overall expenditure.

- Commodity Price Impact: Volatility in steel and aluminum prices, critical inputs, directly impacts Ashok Leyland's profit margins and pricing decisions.

- Supplier Leverage: Suppliers of essential raw materials hold indirect power due to the critical nature of their products in Ashok Leyland's manufacturing process.

Suppliers to Ashok Leyland possess considerable bargaining power, especially those providing specialized or proprietary components, as seen with advanced electronics and engines. In 2023, the global semiconductor shortage demonstrated how reliance on a few key suppliers can lead to increased costs and production delays for vehicle manufacturers.

Ashok Leyland faces substantial switching costs for critical components, making it difficult and expensive to change suppliers due to re-tooling, re-design, and re-certification requirements. This inertia grants existing suppliers significant leverage, as evidenced by the continued reliance on established partners for complex systems.

The bargaining power of Ashok Leyland's suppliers is further amplified by the critical nature of their inputs and the concentration within certain supply segments. For example, in fiscal year 2024, the cost of materials and components represented a significant portion of Ashok Leyland's operational expenses, making them sensitive to price fluctuations from these suppliers.

| Factor | Impact on Ashok Leyland | Supporting Data/Context |

| Supplier Concentration | High | Few suppliers for specialized parts like engines and electronics. |

| Switching Costs | High | Significant investment required for re-tooling, re-design, and re-certification. |

| Importance of Input | High | Critical components are essential for vehicle functionality and safety. |

| Supplier Differentiation | High | Unique or patented technologies in components grant leverage. |

What is included in the product

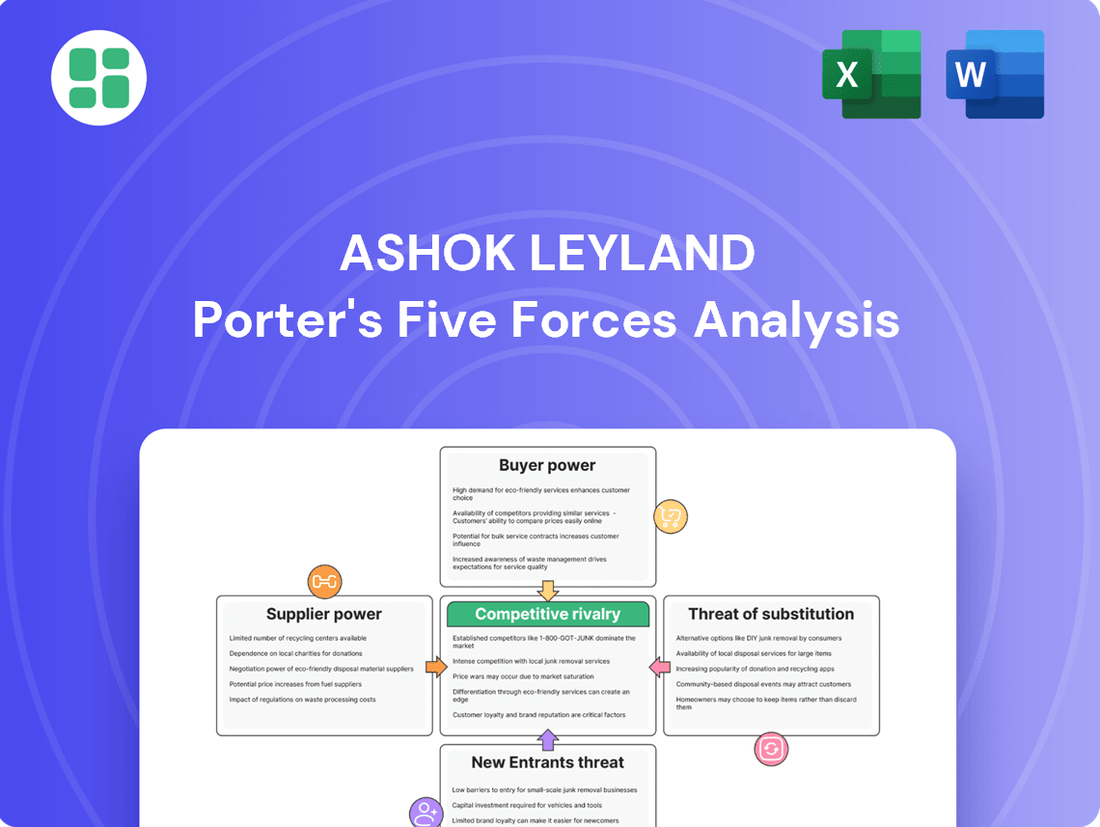

This analysis of Ashok Leyland's competitive environment examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes, providing a strategic overview of its market position.

Simplify competitive analysis with a visual Porter's Five Forces model for Ashok Leyland, instantly revealing key pressures to inform strategic adjustments.

Customers Bargaining Power

Large fleet operators represent a significant customer segment for Ashok Leyland, wielding considerable bargaining power. Their substantial order volumes allow them to negotiate for preferential pricing, tailored vehicle specifications, and enhanced after-sales support, directly impacting Ashok Leyland's profit margins and operational flexibility.

In 2024, the commercial vehicle market has observed a trend of consolidation, leading to an increase in inquiries from these large fleet operators. This heightened interest, while beneficial for sales volume, also amplifies their ability to dictate terms, potentially pressuring Ashok Leyland to offer more competitive deals to secure these bulk orders.

Customers in the commercial vehicle sector, especially smaller fleet operators, exhibit significant price sensitivity. This is because the upfront cost of a vehicle directly impacts their bottom line and overall profitability. For instance, in 2024, the average price of a medium-duty commercial truck in India hovered around ₹25-35 Lakhs, a substantial investment for many small businesses.

This high price sensitivity compels manufacturers like Ashok Leyland to engage in competitive pricing strategies and offer discounts. Market dynamics, including fluctuating fuel prices and economic conditions, further amplify this pressure. Ashok Leyland's ability to manage its cost structure and offer value propositions becomes crucial in retaining market share amidst this customer price consciousness.

The Indian commercial vehicle market is highly competitive, with major players like Tata Motors and Mahindra & Mahindra offering a wide range of vehicles. For instance, in the fiscal year 2023-24, Tata Motors reported sales of over 600,000 commercial vehicles, a significant portion of the market, directly impacting Ashok Leyland's customer base.

This robust competition means customers have numerous alternatives if Ashok Leyland's pricing, features, or after-sales service don't align with their needs. The availability of comparable products from these strong rivals empowers customers to negotiate better terms or simply switch, thereby increasing their bargaining power.

Customer Information and Transparency

Customers today have unprecedented access to information about vehicle specifications, pricing, and performance reviews. This transparency significantly boosts their bargaining power. For instance, online platforms and automotive review sites allow potential buyers to easily compare Ashok Leyland's offerings against competitors like Tata Motors and Mahindra & Mahindra, directly impacting pricing negotiations.

This heightened customer awareness empowers them to seek better deals and more favorable terms. Ashok Leyland, like other players in the commercial vehicle sector, faces pressure to offer competitive pricing and enhanced features to attract and retain customers. The ability for customers to readily access and cross-reference data diminishes the company's leverage in dictating terms.

- Informed Purchasing Decisions: Customers can easily access detailed specifications, fuel efficiency data, and maintenance costs for various truck models.

- Price Comparison Tools: Online portals and dealer networks provide transparent pricing information, enabling customers to compare offers effectively.

- Performance Reviews and Testimonials: Real-world performance reviews and customer testimonials influence purchasing decisions, putting pressure on manufacturers to maintain high quality.

- Negotiation Leverage: Increased transparency allows customers to negotiate more aggressively on price and after-sales service packages.

Product Differentiation and Brand Loyalty

While commercial vehicles might seem purely functional, Ashok Leyland has cultivated a strong brand reputation. This is built on pillars of reliability, impressive fuel efficiency, and an extensive service network. These factors contribute to significant customer loyalty, making buyers less inclined to switch to competitors based solely on price.

Ashok Leyland’s focus on differentiating its product offerings, coupled with superior after-sales support, plays a crucial role in mitigating customer bargaining power. By creating a distinct preference for their vehicles, they can command a certain level of pricing power and reduce the ease with which customers can switch to alternatives.

- Brand Reputation: Ashok Leyland is recognized for dependable vehicles.

- Fuel Efficiency: Lower operating costs for customers enhance brand appeal.

- Service Network: A wide reach for maintenance and repairs builds trust.

- Product Differentiation: Unique features and capabilities set Ashok Leyland apart.

Large fleet operators, a key customer segment for Ashok Leyland, possess significant bargaining power due to their substantial order volumes. This allows them to negotiate favorable pricing and customized specifications, directly influencing Ashok Leyland's profit margins. In 2024, market consolidation has further amplified this power, with large operators increasing inquiries and dictating terms for bulk orders.

Price sensitivity among customers, particularly smaller fleet operators, is a major factor. The substantial investment in commercial vehicles, with average medium-duty trucks in India priced around ₹25-35 Lakhs in 2024, makes them highly cost-conscious. This necessitates competitive pricing and discounts from manufacturers like Ashok Leyland to maintain market share.

The highly competitive Indian commercial vehicle market, with major players like Tata Motors and Mahindra & Mahindra, grants customers numerous alternatives. For instance, Tata Motors' sales exceeding 600,000 commercial vehicles in FY 2023-24 highlight the intense rivalry. This competition empowers customers to negotiate better terms or switch providers, increasing their bargaining leverage.

Enhanced customer awareness, fueled by readily available online information on specifications, pricing, and performance reviews, significantly boosts bargaining power. Customers can easily compare Ashok Leyland's offerings against competitors, diminishing the company's ability to dictate terms and pressuring them towards competitive pricing and features.

| Factor | Impact on Ashok Leyland | Customer Leverage |

|---|---|---|

| Large Fleet Operators | Negotiate preferential pricing, tailored specs. | High, due to bulk orders and market consolidation (2024). |

| Price Sensitivity (Small Operators) | Pressure for competitive pricing, discounts. | High, due to significant upfront costs (e.g., ₹25-35 Lakhs for medium trucks in 2024). |

| Market Competition | Need to offer competitive terms to retain customers. | High, with alternatives like Tata Motors (600,000+ sales FY23-24) and Mahindra. |

| Information Transparency | Diminished leverage in dictating terms. | High, due to easy online comparison of specs and pricing. |

What You See Is What You Get

Ashok Leyland Porter's Five Forces Analysis

This preview shows the exact, comprehensive Five Forces analysis of Ashok Leyland Porter, detailing the competitive landscape, buyer and supplier power, threat of new entrants and substitutes, which you'll receive immediately after purchase.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering a deep dive into the strategic positioning of Ashok Leyland within the commercial vehicle sector.

You're looking at the actual document, a thorough assessment of the factors influencing Ashok Leyland's profitability and market dynamics, and once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

The Indian commercial vehicle sector is a battleground with numerous strong contenders. Ashok Leyland faces fierce competition from giants like Tata Motors and Mahindra & Mahindra, as well as other established players such as Eicher Motors. This crowded landscape means market share is constantly being fought over, making it a dynamic environment.

Tata Motors consistently leads the pack in market share, though its dominance has experienced some ebb and flow. Ashok Leyland itself commands a significant portion of the market, especially within the crucial Medium and Heavy Commercial Vehicle (MHCV) segment. For instance, in the fiscal year 2023-24, Tata Motors held a leading position in the domestic commercial vehicle market, while Ashok Leyland maintained its strong presence, particularly in the MHCV category, often vying for the second spot.

The commercial vehicle sector in India is inherently cyclical, experiencing phases of robust expansion followed by periods of contraction. This pattern means that demand can fluctuate significantly based on broader economic conditions.

Looking ahead, while the market is projected for modest growth, a high base effect from previous strong sales periods and the influence of events like general elections can temper demand. This scenario intensifies the rivalry among established players as they compete for a potentially smaller pool of available sales volume.

Competitive rivalry in the commercial vehicle sector is intensifying as manufacturers, including Ashok Leyland, heavily invest in product differentiation through technological innovation. This focus includes developing alternative fuel solutions like electric vehicles (EVs), Liquefied Natural Gas (LNG), and hydrogen-powered engines, alongside integrating advanced features. For instance, in the fiscal year 2023-24, Ashok Leyland reported a significant increase in its EV sales, contributing to its overall market strategy.

Exit Barriers

The commercial vehicle sector, including Ashok Leyland's operating environment, is characterized by substantial exit barriers. These arise from the immense capital investment required for manufacturing facilities, specialized tooling, and a substantial, often unionized, workforce. For instance, setting up a new commercial vehicle plant can easily run into hundreds of millions of dollars, making it incredibly difficult for a company to simply walk away from its assets.

These high fixed costs mean that even companies struggling with profitability find it challenging to cease operations. Instead, they often continue to produce, albeit at reduced capacity or with lower margins, to try and recoup some of their investment. This dynamic keeps more players in the market than might otherwise be sustainable, thereby intensifying competitive rivalry as existing firms battle for market share.

The implications for competitive rivalry are significant:

- High Capital Intensity: The need for specialized, expensive machinery and extensive manufacturing infrastructure creates a high barrier to exiting the industry.

- Sunk Costs: Significant investments in plants and equipment represent sunk costs, making it economically unviable for many firms to shut down operations.

- Workforce Commitments: Large workforces and associated labor agreements can also contribute to the difficulty and cost of exiting the market.

- Market Presence: Companies may continue operating at a loss to maintain market presence and brand recognition, further fueling competition.

Brand Identity and Loyalty

Ashok Leyland benefits from strong brand identity and customer loyalty, built over decades of providing reliable commercial vehicles. This loyalty is reinforced by an extensive service network, a crucial factor in the trucking industry where uptime is paramount. For instance, in FY24, Ashok Leyland maintained a significant market share in the medium and heavy commercial vehicle (M&HCV) segment, demonstrating the enduring strength of its brand.

However, this established loyalty isn't impenetrable. New entrants with disruptive technologies or aggressive pricing strategies can challenge existing customer relationships. Furthermore, competitors who invest heavily in expanding their service infrastructure or offer compelling financing options can also chip away at brand loyalty.

- Brand Equity: Ashok Leyland's long-standing reputation for durability and performance fosters significant customer loyalty, especially among fleet operators who prioritize total cost of ownership.

- Service Network Reach: The company's widespread service and spare parts network is a key differentiator, reducing downtime for customers and reinforcing their commitment to the brand.

- Competitive Threats: While brand loyalty is a strong defense, aggressive pricing, technological advancements from rivals, and enhanced service offerings by competitors can pose a challenge to maintaining market share.

The Indian commercial vehicle market is intensely competitive, with Ashok Leyland facing strong rivals like Tata Motors and Mahindra & Mahindra. This rivalry is amplified by the industry's cyclical nature and the impact of macroeconomic factors, leading manufacturers to invest heavily in innovation, particularly in alternative fuel technologies, to gain an edge.

Companies like Ashok Leyland are focusing on product differentiation through EVs and other advanced powertrains, as evidenced by Ashok Leyland's increased EV sales in FY23-24. This technological race intensifies the battle for market share, especially as the market anticipates modest growth amidst potential demand fluctuations.

High exit barriers, stemming from massive capital investments in manufacturing and workforce commitments, keep numerous players in the market. This means that even struggling firms often continue operations, adding to the competitive pressure as they fight for market share.

While Ashok Leyland benefits from strong brand loyalty and an extensive service network, competitors can erode this advantage through aggressive pricing or superior service offerings. Maintaining market share requires continuous investment in brand building and customer retention strategies.

| Competitor | Market Share (FY23-24 Approx.) | Key Strengths |

|---|---|---|

| Tata Motors | Leading (approx. 40-45% in CV segment) | Extensive product portfolio, strong brand, wide service network |

| Mahindra & Mahindra | Significant (approx. 20-25% in CV segment) | Strong presence in LCV, growing MHCV segment, focus on utility |

| Ashok Leyland | Strong (approx. 30-35% in MHCV segment) | Dominance in MHCV, focus on alternative fuels, established brand loyalty |

| Eicher Motors | Growing (approx. 5-10% in CV segment) | Fuel efficiency, modern design, expanding product range |

SSubstitutes Threaten

The primary substitutes for road-based commercial vehicles are other transportation methods like railways, waterways, and air cargo. While each has its own drawbacks, improvements in rail freight efficiency or coastal shipping could potentially decrease the demand for long-haul road transport. For instance, in India, rail freight volume saw a significant increase, reaching approximately 1.50 billion tonnes in the fiscal year 2023-24, indicating a growing alternative for long-distance cargo movement.

The threat of substitutes for Ashok Leyland's core products, particularly heavy-duty trucks, can emerge from smaller commercial vehicles or even passenger vehicles adapted for commercial purposes, especially in urban last-mile delivery scenarios. This shift is driven by the need for greater maneuverability and lower operating costs in congested city environments.

Ashok Leyland is proactively countering this threat by strategically expanding its Light Commercial Vehicle (LCV) portfolio. For instance, in the fiscal year 2024, the company reported a significant increase in its LCV sales, indicating a growing market share in this segment, which directly addresses the substitution pressure from smaller vehicle types.

Technological advancements are significantly impacting the logistics sector, presenting a clear threat of substitutes for traditional vehicle manufacturers like Ashok Leyland. Innovations in areas like AI-powered route optimization and automated warehousing are streamlining supply chains, potentially reducing the overall need for large vehicle fleets.

For instance, the growth of integrated logistics platforms, which offer end-to-end supply chain visibility and management, can consolidate shipments and increase vehicle utilization. This efficiency gain means fewer vehicles might be required to move the same amount of goods, directly impacting demand for new trucks and buses.

Furthermore, the rise of alternative transportation modes, such as drone delivery for smaller packages or hyperloop technology for high-speed freight, although still developing, represents a long-term substitute threat. Ashok Leyland must therefore focus on developing more fuel-efficient, technologically advanced, and specialized vehicles to remain competitive.

Emergence of Autonomous or Drone Delivery Systems

The long-term emergence of autonomous or drone delivery systems presents a potential substitute threat to traditional commercial vehicle manufacturers like Ashok Leyland. These technologies, especially for specific cargo types or defined routes, could offer alternative logistics solutions.

While currently in early stages, the disruptive potential is significant. For instance, in 2024, companies are actively testing and investing in autonomous trucking, with some projections suggesting significant market penetration within the next decade. This could reduce demand for conventionally driven trucks.

- Autonomous Trucking Investment: Global investment in autonomous trucking technology exceeded $2 billion in 2023, with continued strong growth anticipated through 2025.

- Drone Delivery Expansion: By the end of 2024, drone delivery services are expected to be operational in over 50 cities worldwide, handling diverse types of last-mile deliveries.

- Efficiency Gains: Proponents of autonomous delivery highlight potential efficiency gains, such as reduced labor costs and optimized routing, making them attractive alternatives for certain logistics operations.

Shared Mobility and 'Vehicle-as-a-Service' Models

The increasing adoption of shared mobility and 'vehicle-as-a-service' (VaaS) models presents a significant threat of substitution for traditional vehicle manufacturers like Ashok Leyland. Companies are increasingly opting to lease commercial vehicles rather than purchase them outright, shifting the market from unit sales to service provision. This trend could potentially reduce the overall demand for new vehicle purchases.

For instance, the global mobility-as-a-service market was valued at approximately $80 billion in 2023 and is projected to grow substantially. This indicates a clear shift in customer preference towards flexible, service-based solutions. Ashok Leyland must strategically adapt its business model to cater to this evolving demand, potentially by offering its own VaaS solutions or partnering with existing service providers to remain competitive.

- Growing VaaS Adoption: Companies are moving from owning fleets to leasing, impacting traditional sales volumes.

- Market Shift: Focus is transitioning from vehicle manufacturing to providing mobility services.

- Competitive Pressure: New service-oriented players could erode market share for traditional manufacturers.

- Potential for Reduced Unit Sales: Increased leasing may lead to fewer outright vehicle purchases in the long term.

The threat of substitutes for Ashok Leyland's commercial vehicles is multifaceted, encompassing alternative transport modes and evolving logistics models. Railways and waterways remain significant substitutes for long-haul freight, with Indian rail freight volume reaching approximately 1.50 billion tonnes in FY2023-24, highlighting their growing efficiency.

Emerging technologies like drone delivery and autonomous trucking also pose a long-term threat. Global investment in autonomous trucking exceeded $2 billion in 2023, and by the end of 2024, drone delivery services are expected to operate in over 50 cities, potentially reducing the need for conventional vehicle fleets.

Furthermore, the rise of Vehicle-as-a-Service (VaaS) models, where companies lease rather than purchase vehicles, is a growing concern. The global mobility-as-a-service market, valued at around $80 billion in 2023, indicates a shift towards service-based solutions, potentially impacting Ashok Leyland's unit sales.

| Substitute Type | Key Characteristics | Impact on Ashok Leyland | Supporting Data (2023-2024) |

|---|---|---|---|

| Railways/Waterways | Cost-effective for bulk, long-distance cargo | Reduces demand for long-haul trucking | Indian Rail Freight: ~1.50 billion tonnes (FY2023-24) |

| Drone Delivery | Fast, efficient for small packages, last-mile | Substitutes for LCVs in specific urban logistics | Operational in 50+ cities by end of 2024 |

| Autonomous Trucking | Potential for reduced operating costs, increased efficiency | Threatens demand for conventionally driven trucks | Global Investment: >$2 billion (2023) |

| VaaS/Shared Mobility | Leasing over ownership, service-oriented | Shifts market from unit sales to service provision | Mobility-as-a-Service Market: ~$80 billion (2023) |

Entrants Threaten

Entering the commercial vehicle manufacturing sector, like the one Ashok Leyland operates in, demands substantial financial resources. We're talking about billions of dollars needed for state-of-the-art manufacturing facilities, cutting-edge research and development to innovate new models, and establishing an extensive network for sales, service, and spare parts across the country.

This immense capital requirement acts as a formidable barrier, effectively deterring many potential new players from even attempting to enter the market. For instance, setting up a new automotive plant can easily cost upwards of $1 billion, a sum that most aspiring companies simply cannot raise.

Economies of scale present a significant barrier for new entrants in the commercial vehicle sector. Established players like Ashok Leyland leverage their massive production volumes to achieve lower per-unit costs through bulk purchasing of raw materials and optimized manufacturing processes. For instance, in 2023, Ashok Leyland's production capacity allowed them to spread fixed costs over a much larger output compared to a hypothetical new entrant starting from scratch.

Ashok Leyland benefits from strong brand loyalty, cultivated over decades, which translates into repeat business and a preference for its vehicles. This loyalty is a significant deterrent for new entrants who would struggle to replicate the trust and established relationships Ashok Leyland enjoys with its customer base.

The company's extensive pan-India distribution and service network, comprising over 1,200 touchpoints as of early 2024, represents a substantial barrier. New players would need to invest heavily and dedicate considerable time to build a comparable infrastructure, making it difficult to offer the same level of accessibility and after-sales support that Ashok Leyland provides.

Regulatory Requirements and Compliance

The commercial vehicle sector, including companies like Ashok Leyland, faces substantial hurdles for newcomers due to rigorous regulatory frameworks. These rules govern everything from exhaust emissions to crash safety and overall vehicle design. For instance, India's Bharat Stage VI (BS-VI) emission norms, implemented in April 2020, demanded significant technological upgrades, requiring substantial capital investment in R&D and manufacturing processes.

Meeting these evolving standards necessitates deep technical knowledge and considerable financial resources. New entrants often lack the established infrastructure and specialized expertise to navigate these complex compliance landscapes efficiently. This can make it difficult and costly for them to bring products to market that meet all legal requirements.

- Stringent Emission Standards: Compliance with BS-VI norms in India, for example, required substantial investment in cleaner engine technologies.

- Safety Regulations: Adherence to global safety standards, such as those mandated by the Global New Car Assessment Programme (GNCAP) for heavy vehicles, adds to R&D and production costs.

- Homologation and Certification: The process of getting vehicles approved for sale involves lengthy and expensive testing and certification procedures.

- Capital Intensity: Setting up manufacturing facilities that meet these high regulatory and safety standards requires significant upfront capital expenditure.

Access to Raw Materials and Supply Chains

For Ashok Leyland, the threat of new entrants concerning access to raw materials and supply chains is significant. Establishing reliable and cost-effective supply chains for the hundreds of components and raw materials needed in vehicle manufacturing is a complex challenge. Newcomers face an uphill battle in securing competitive supplies when established players, like Ashok Leyland, have cultivated long-standing relationships and optimized their procurement processes over years of operation.

The automotive industry, including commercial vehicles, relies on a vast network of suppliers for everything from steel and aluminum to specialized electronic components. Ashok Leyland's established presence means they likely benefit from bulk purchasing power and preferential terms with many of these suppliers. For instance, in 2024, the automotive sector's global supply chain disruptions continued to highlight the importance of robust supplier relationships. New entrants would need substantial capital and strategic partnerships to even begin matching the procurement advantages Ashok Leyland already possesses.

- Supplier Relationships: Ashok Leyland's deep-rooted ties with suppliers provide a significant advantage in terms of pricing, quality assurance, and delivery reliability.

- Procurement Scale: The sheer volume of materials Ashok Leyland procures allows for greater negotiation leverage, leading to more competitive pricing compared to a new entrant.

- Supply Chain Resilience: Existing players have likely developed more resilient supply chains, capable of weathering disruptions, a critical factor in the volatile global market of 2024.

- Component Specialization: Securing specialized components, often requiring specific manufacturing capabilities, can be a major hurdle for new companies lacking established supplier networks.

The threat of new entrants for Ashok Leyland is relatively low due to several formidable barriers. The immense capital required for manufacturing facilities and R&D, coupled with the need to establish extensive sales and service networks, deters many potential competitors. Furthermore, established brand loyalty and the sheer scale of operations enjoyed by Ashok Leyland, allowing for significant economies of scale, make it challenging for newcomers to compete on cost and customer preference.

Regulatory hurdles, including stringent emission and safety standards, demand substantial investment and technical expertise, which new entrants often lack. The company's robust supply chain and long-standing supplier relationships also provide a competitive edge in terms of procurement and resilience, further limiting the ease of entry for new players in the commercial vehicle market.

| Barrier | Impact on New Entrants | Ashok Leyland's Advantage |

|---|---|---|

| Capital Intensity | Very High | Established infrastructure, economies of scale |

| Economies of Scale | High | Lower per-unit costs, bulk purchasing power |

| Brand Loyalty | High | Decades of trust, repeat business |

| Distribution & Service Network | Very High | 1,200+ touchpoints (early 2024), pan-India reach |

| Regulatory Compliance | High | Expertise in BS-VI norms, safety standards |

| Supply Chain Access | High | Long-term supplier relationships, procurement leverage |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ashok Leyland is built upon comprehensive data from Ashok Leyland's annual reports, investor presentations, and official company statements. We also incorporate industry-specific market research reports from reputable firms and economic data from government agencies to provide a robust competitive landscape assessment.