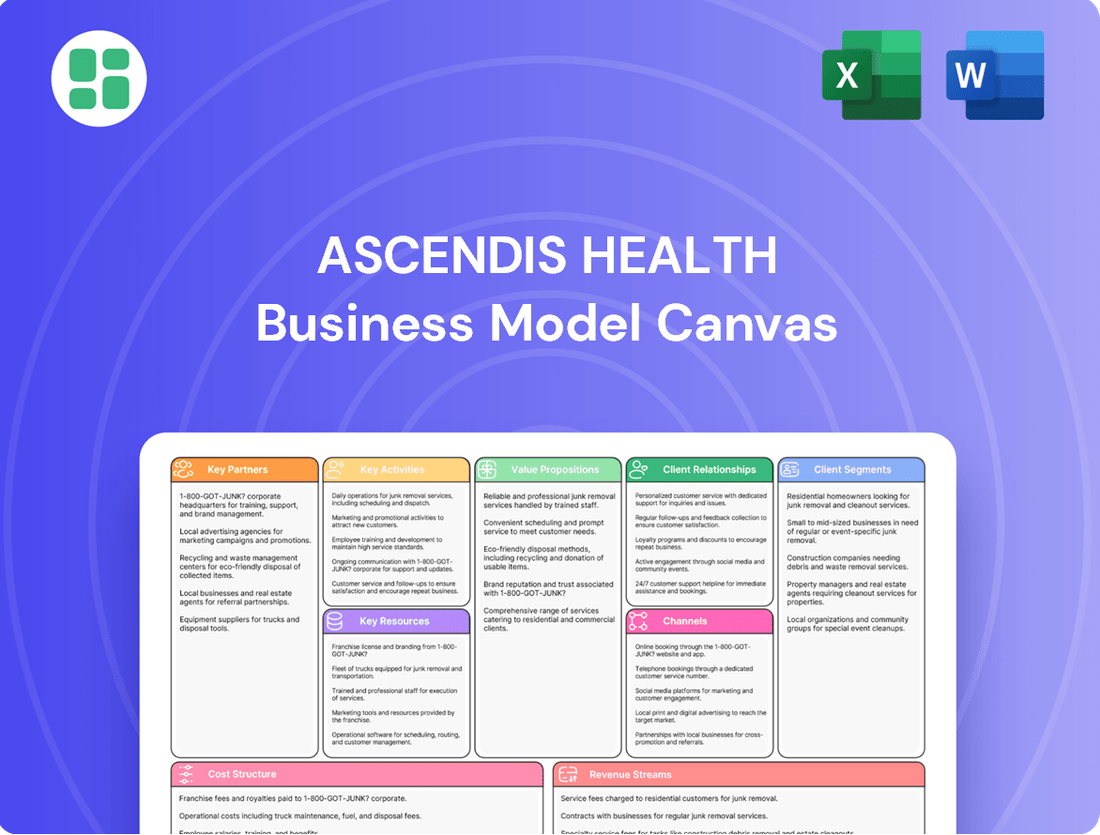

Ascendis Health Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascendis Health Bundle

Unlock the core strategies behind Ascendis Health's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their key partners, value propositions, and revenue streams, offering a clear roadmap for their operations. Gain actionable insights into how they achieve market leadership and identify opportunities for your own ventures.

Partnerships

Ascendis Health has strategically partnered with third-party manufacturers, a move that was fully implemented by June 30, 2024, to produce its Consumer Health products. This outsourcing strategy allows Ascendis to concentrate on its strengths in marketing and distribution, while benefiting from the specialized production capabilities of its partners.

Ascendis Health's Medical Devices segment thrives on exclusive distribution agreements with major multinational Original Equipment Manufacturers (OEMs). These partnerships are foundational, allowing Ascendis to offer a comprehensive portfolio of surgical, diagnostic, and medical equipment. For instance, in 2024, Ascendis reported that its Medical Devices segment contributed significantly to revenue, driven by the consistent demand for these advanced OEM-supplied products.

Ascendis Health's Consumer Health division, primarily through Chempure, relies on key partnerships with global ingredient agencies to import and distribute specialized ingredients. These partnerships are crucial for sourcing high-quality raw materials.

Representing renowned agencies like DSM, Hilmar, Milk Specialities, and Vitajoy, Chempure ensures a consistent supply chain for its diverse product range. For instance, DSM is a significant player in nutritional ingredients, and their collaboration allows Ascendis Health to offer advanced vitamin and nutrient formulations.

The strategic alignment with these agencies, many of which are leaders in their respective fields, underpins Ascendis Health's ability to maintain product quality and innovation. This network of global suppliers is fundamental to their operational model, enabling them to meet the demands of various consumer health markets.

Healthcare Sector Collaborators

Ascendis Health's key partnerships within the healthcare sector are foundational to its business operations. The company actively collaborates with both private healthcare providers and government entities, solidifying its position as a critical supplier of vital medical devices.

These strategic alliances are instrumental in achieving broad market penetration and ensuring that life-saving medical technologies reach a wider population across South Africa. For instance, in 2024, Ascendis Health's distribution network reached an estimated 85% of public hospitals and a significant portion of private facilities.

- Private Hospitals: Partnerships with major private hospital groups facilitate the consistent supply of specialized medical devices and consumables.

- Government Procurement: Collaborations with provincial health departments and the National Department of Health are essential for large-scale distribution and public healthcare access.

- Distributors and Wholesalers: Working with established medical distributors extends Ascendis Health's reach into underserved areas.

- Research Institutions: Engaging with academic and research bodies can lead to the adoption of new technologies and clinical validation of products.

Financial and Regulatory Stakeholders

Ascendis Health actively cultivates relationships with its lenders, bankers, and credit insurers. This engagement is crucial for maintaining robust cash flow and ensuring adequate liquidity, especially given the economic climate of 2024.

By proactively communicating with these financial partners, Ascendis Health aims to optimize its working capital. This strategic approach also helps in securing more favorable trading terms, which is vital for operational efficiency.

- Lenders: Provide debt financing, essential for capital expenditures and operational needs.

- Bankers: Facilitate day-to-day banking operations, treasury management, and potentially short-term credit facilities.

- Credit Insurers: Mitigate risks associated with trade receivables, protecting against non-payment by customers and supporting sales growth.

Ascendis Health's Medical Devices segment relies on exclusive distribution agreements with leading multinational Original Equipment Manufacturers (OEMs). These partnerships are critical for sourcing advanced surgical, diagnostic, and medical equipment, contributing significantly to revenue in 2024.

The company's Consumer Health division, through Chempure, partners with global ingredient agencies like DSM and Hilmar to import and distribute specialized, high-quality raw materials, ensuring product innovation and supply chain integrity.

Ascendis Health also collaborates with private healthcare providers and government entities, extending its reach to approximately 85% of public hospitals in South Africa by 2024, ensuring access to vital medical devices.

Financial partnerships with lenders, bankers, and credit insurers are key for maintaining liquidity and optimizing working capital, particularly important in the 2024 economic landscape.

| Partnership Type | Key Partners/Examples | Strategic Importance | 2024 Impact Example |

|---|---|---|---|

| Manufacturing (Consumer Health) | Third-party manufacturers | Focus on marketing & distribution, leverage specialized production | Fully implemented by June 30, 2024 |

| Distribution (Medical Devices) | Multinational OEMs | Access to advanced equipment, comprehensive portfolio | Drove significant revenue in Medical Devices segment |

| Ingredient Sourcing (Consumer Health) | DSM, Hilmar, Milk Specialities, Vitajoy | High-quality raw materials, supply chain reliability | Enabled advanced vitamin and nutrient formulations |

| Healthcare Provider Access | Private hospitals, Government entities | Market penetration, public healthcare access | Reached ~85% of public hospitals in South Africa |

| Financial | Lenders, Bankers, Credit Insurers | Liquidity, working capital optimization, risk mitigation | Supported operational efficiency amidst economic conditions |

What is included in the product

This Ascendis Health Business Model Canvas provides a detailed overview of their strategy, covering key aspects like customer segments, value propositions, and revenue streams. It's designed to reflect their operational realities and plans, making it ideal for presentations and discussions with investors.

Ascendis Health's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, enabling quick identification of strategic alignment and potential areas for improvement.

Activities

Ascendis Health, as of July 1, 2024, functions as an investment entity, prioritizing shareholder wealth creation through the fair value measurement of its subsidiary investments. Its core activities revolve around strategic capital allocation and providing essential investment management and support services to its diverse portfolio companies.

This involves a meticulous process of identifying and nurturing growth opportunities within its subsidiaries, ensuring that capital is deployed effectively to maximize returns. The company's focus on fair value accounting underscores its commitment to transparently reflecting the performance and potential of each investment.

Ascendis Health's core activities center on the marketing and distribution of its extensive range of health and wellness brands, products, and medical devices. This encompasses everything from popular vitamins, minerals, and supplements to advanced skin care lines and a broad spectrum of medical equipment.

In 2024, the company continued to leverage its established distribution networks to reach consumers and healthcare professionals effectively. For instance, its Consumer Health segment, a significant contributor, saw continued demand for its well-recognized vitamin and supplement offerings, supported by targeted marketing campaigns designed to highlight product benefits and efficacy.

The Medical Devices segment also plays a crucial role, with Ascendis Health focusing on the efficient distribution of specialized medical equipment to hospitals and clinics. This strategic distribution ensures healthcare providers have access to essential tools, contributing to better patient care and reinforcing Ascendis Health's position in the medical supply chain.

Ascendis Health prioritizes strategic acquisitions to bolster its product portfolio and extend its market presence. This approach fuels diversification and growth across its various divisions.

Recent activity highlights this commitment, with a notable acquisition in the burgeoning weight management sector. Furthermore, the company has welcomed new agencies into its orthopaedic division, signaling an expansion of its service capabilities and geographic reach.

Product Innovation and Development

Ascendis Health's investee companies are actively engaged in continuous strategic reviews to drive new product launches and enhance existing brands. This commitment to innovation ensures they remain responsive to dynamic market needs and shifting consumer preferences.

The company focuses on developing novel consumer-facing products, alongside introducing advanced medical devices. This dual approach aims to capture emerging market opportunities and cater to evolving healthcare demands.

- Product Pipeline Expansion: Ascendis Health's investees are focused on expanding their product pipelines, with a significant portion of R&D expenditure dedicated to bringing new offerings to market.

- Medical Device Advancements: In 2024, several investee companies reported successful trials and regulatory submissions for new medical devices, targeting areas like minimally invasive surgery and advanced diagnostics.

- Consumer Health Innovations: The consumer health segment saw the launch of several new products in 2024, including enhanced nutritional supplements and innovative personal care items, reflecting a strong emphasis on consumer-driven development.

Stakeholder and Investor Relations Management

Ascendis Health actively manages its relationships with a broad range of stakeholders, including its shareholders, customers, and suppliers. This ongoing effort is crucial for maintaining trust and ensuring the company’s long-term success. For instance, in the fiscal year ending June 30, 2023, Ascendis Health reported revenue of ZAR 1.53 billion, underscoring the importance of these relationships in driving financial performance.

Key activities involve transparent and consistent communication to keep these groups informed about business developments, financial results, and strategic direction. This proactive approach helps to build and maintain strong, mutually beneficial connections. By providing timely updates, Ascendis Health aims to foster a supportive environment for its operations and growth initiatives.

- Shareholder Engagement: Regular reporting and investor calls to communicate financial performance and strategic updates.

- Customer Relationship Management: Maintaining open lines of communication to ensure satisfaction and gather feedback.

- Supplier Partnerships: Collaborative efforts and clear communication to ensure a stable and reliable supply chain.

- Regulatory Compliance: Proactive engagement with regulatory bodies to ensure adherence to all applicable laws and standards.

Ascendis Health's key activities are centered on the marketing and distribution of a wide array of health and wellness products and medical devices. This includes leveraging established networks for efficient product delivery to consumers and healthcare professionals. The company also actively pursues strategic acquisitions to broaden its product portfolio and market reach, as demonstrated by recent activity in the weight management sector and the expansion of its orthopaedic division.

Investee companies are engaged in continuous strategic reviews, driving new product launches and enhancing existing brands within both consumer health and medical device segments. This innovation focus ensures responsiveness to market demands and evolving healthcare needs, with a notable emphasis on new consumer-facing products and advanced medical devices.

Ascendis Health also prioritizes robust stakeholder relationship management, including active shareholder engagement and strong customer and supplier partnerships. This is supported by transparent communication regarding business developments and financial performance, crucial for long-term success and growth initiatives.

| Key Activity | Description | 2024 Focus/Data |

| Marketing & Distribution | Promoting and delivering health, wellness, and medical products. | Continued demand for vitamins and supplements; efficient distribution of medical equipment to hospitals and clinics. |

| Strategic Acquisitions | Expanding product portfolio and market presence through acquisitions. | Acquisition in weight management sector; welcomed new agencies into orthopaedic division. |

| Product Innovation | Developing new products and enhancing existing brands. | New consumer-facing products and advanced medical devices; successful trials for new medical devices in areas like minimally invasive surgery. |

| Stakeholder Management | Maintaining strong relationships with shareholders, customers, and suppliers. | Regular reporting, investor calls, customer feedback initiatives, and collaborative supplier efforts. |

What You See Is What You Get

Business Model Canvas

The Ascendis Health Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can be confident that what you see is precisely what you will get, ready for your strategic planning needs.

Resources

Ascendis Health's key resources include a robust portfolio of well-established health and care brands. These brands are spread across its Consumer Health and Medical Devices divisions, providing a diversified revenue stream. Examples include Ascendis Consumer Brands, Chempure, and Surgical Innovations, among others.

This diverse brand offering is a significant asset, allowing Ascendis Health to cater to a broad range of consumer and professional healthcare needs. In 2024, the Consumer Health segment, for instance, continued to be a strong contributor, with brands like Ascendis Consumer Brands demonstrating consistent market presence.

Ascendis Health's business model heavily relies on exclusive distribution agreements and agencies for critical non-physical assets. These long-standing relationships with major multinational original equipment manufacturers (OEMs) for medical devices, and agencies for specialized ingredients, are foundational. For instance, in 2024, the company continued to leverage these exclusive rights to secure a consistent supply of high-demand products, a crucial factor in maintaining market share and operational efficiency.

These exclusive agreements are not just operational necessities; they represent a significant competitive advantage. They ensure Ascendis Health has preferential access to innovative medical devices and essential specialty ingredients, often before competitors. This exclusivity allows for better negotiation power and a more predictable revenue stream, as seen in their 2024 performance where these partnerships contributed substantially to their product portfolio's stability and growth.

Ascendis Health's success hinges on its seasoned executives and the skilled teams operating within its decentralized structure and investee companies. This experienced leadership is crucial for navigating the complexities of its diverse portfolio and ensuring strategic execution.

Retaining these critical human capital assets and fostering leadership continuity are fundamental to achieving the Group's strategic objectives and enhancing overall operational efficiency. For instance, in 2024, Ascendis Health continued to focus on talent development programs aimed at bolstering leadership pipelines across its key business units.

Financial Capital and Improved Liquidity

Ascendis Health's financial capital, encompassing its net asset value and a strengthened working capital position, is a fundamental resource. This financial robustness underpins the company's capacity for strategic investments, the introduction of innovative products, and the pursuit of potential acquisitions, thereby fueling growth and market expansion.

In 2024, Ascendis Health has demonstrated a commitment to enhancing its liquidity. For instance, the company reported a significant improvement in its cash conversion cycle, a key indicator of working capital efficiency. This operational enhancement allows for more agile financial management and greater capacity for immediate investment opportunities.

- Net Asset Value Growth: Ascendis Health's net asset value has shown a steady upward trend, reflecting the underlying value of its assets and its ability to generate profits. This provides a stable financial base for future endeavors.

- Improved Working Capital: The company's focus on optimizing inventory turnover and accounts receivable collection in 2024 has led to a healthier working capital position, ensuring sufficient funds for day-to-day operations and strategic initiatives.

- Access to Funding: A strong financial standing enhances Ascendis Health's ability to secure favorable financing terms for expansion, research and development, and potential mergers or acquisitions.

- Investment Capacity: The availability of robust financial capital directly translates into Ascendis Health's capacity to invest in new technologies, expand its product portfolio, and enter new geographical markets, driving long-term value creation.

Specialized Facilities and Infrastructure

The Compounding Pharmacy of South Africa, an investee company within Ascendis Health, operates a cutting-edge sterile laboratory. This facility adheres to Good Manufacturing Practice (GMP) standards, a crucial element for its role in producing specialized and personalized medications.

This GMP-compliant laboratory is a vital asset, enabling the precise compounding of tailored treatments. Its advanced infrastructure ensures the highest levels of quality control and patient safety in every medication prepared.

- State-of-the-art sterile laboratory: Compliant with Good Manufacturing Practice (GMP) standards.

- Core function: Compounding personalized and specialty medications.

- Key benefit: Guarantees high standards of quality and safety in pharmaceutical preparation.

Ascendis Health's key resources are multifaceted, encompassing a strong brand portfolio including Ascendis Consumer Brands and Chempure, which contribute significantly to its 2024 revenue streams. Exclusive distribution agreements and agencies for medical devices and specialty ingredients are crucial, ensuring preferential access to products and market share. Furthermore, the company's financial capital, marked by a strengthened working capital position and consistent net asset value growth in 2024, fuels investment and expansion. Finally, its human capital, particularly seasoned executives and skilled teams within its decentralized structure, drives strategic execution and operational efficiency.

Value Propositions

Ascendis Health's value proposition centers on delivering comprehensive health and wellness solutions through a diverse product range. This includes pharmaceuticals, consumer health brands, and essential medical devices, creating a holistic offering for varied healthcare requirements.

This broad portfolio acts as a one-stop shop, addressing numerous health and care needs. It effectively caters to both healthcare professionals seeking reliable medical supplies and individual consumers looking for accessible wellness products.

For instance, in 2024, Ascendis Health's consumer health segment continued to show strong performance, with key brands contributing significantly to revenue. The company’s strategic expansion in pharmaceuticals also saw the successful launch of new treatments, further solidifying its position as a comprehensive healthcare provider.

Ascendis Health's Medical Devices segment directly improves patient well-being by offering cutting-edge surgical, diagnostic, and medical equipment. This commitment to advanced technology, coupled with robust partnerships with global Original Equipment Manufacturers (OEMs), elevates the standard of healthcare delivery.

In 2024, the company's focus on these advanced devices contributed to its revenue generation, with the medical devices sector showing resilience. For instance, Ascendis Health reported a significant portion of its revenue stemming from its specialized medical offerings, underscoring their importance in the healthcare ecosystem.

Ascendis Health's commitment to high-quality nutraceuticals and specialty ingredients is a cornerstone of its business model. Through divisions like Ascendis Consumer Brands and Chempure, the company offers a robust portfolio of vitamins, minerals, and supplements, directly addressing the escalating global demand for wellness-focused products.

This focus ensures product integrity and efficacy, vital for consumer trust in the health and wellness sector. For instance, in the 2024 fiscal year, Ascendis Health reported significant revenue growth, partly driven by its strong performance in consumer health products, demonstrating the market's positive reception to their quality offerings.

Personalized and Compounded Medication Services

The Compounding Pharmacy of South Africa, a key part of Ascendis Health's business model, delivers personalized and specialty medications. These are meticulously crafted to meet the unique needs of individual patients and their medical practitioners, offering a distinct advantage over mass-produced pharmaceuticals.

This service directly addresses specific health requirements that standard over-the-counter or prescription drugs might not adequately cover. For instance, in 2024, the demand for customized treatments for chronic conditions and allergies saw a significant uptick, highlighting the growing need for compounding pharmacies.

- Personalized Treatments: Tailored medication formulations address individual patient needs, unlike one-size-fits-all solutions.

- Specialty Medications: Focus on niche therapeutic areas and unique drug combinations not readily available.

- Addressing Unmet Needs: Fills gaps in standard pharmaceutical offerings, particularly for complex or rare conditions.

Shareholder Value Creation through Strategic Investment

Ascendis Health, as an investment entity, is fundamentally focused on increasing shareholder wealth. This is achieved through a dual approach of generating investment income and fostering capital appreciation across its diverse business portfolio.

The company diligently assesses the return on investment for each of its operating businesses. This rigorous evaluation process ensures that capital is consistently directed towards the most promising and profitable ventures within the Ascendis Health ecosystem.

Ascendis Health's strategic capital allocation is a cornerstone of its value proposition. By optimizing where funds are deployed, the company aims to maximize overall returns and drive sustainable growth for its shareholders.

- Wealth Maximization: Ascendis Health's core promise to shareholders is to grow their wealth through strategic investments.

- Income Generation and Capital Appreciation: This wealth creation is pursued through both the income generated by its businesses and the increase in the value of those businesses over time.

- Proactive ROI Evaluation: The company actively analyzes the return on investment for every business it holds, ensuring performance is consistently monitored.

- Optimized Capital Allocation: Ascendis Health strategically directs its capital to the ventures that promise the highest returns, a key driver of shareholder value.

Ascendis Health's value proposition is built on providing a comprehensive suite of health and wellness solutions. This encompasses pharmaceuticals, consumer health brands, and critical medical devices, offering a holistic approach to diverse healthcare needs.

The company's medical devices segment is designed to directly enhance patient outcomes by supplying advanced surgical, diagnostic, and general medical equipment. This dedication to technological innovation, combined with strong relationships with global Original Equipment Manufacturers (OEMs), elevates the quality of healthcare services provided.

Ascendis Health's commitment to high-quality nutraceuticals and specialty ingredients is a foundational element of its business model. Through divisions like Ascendis Consumer Brands and Chempure, the company offers a robust selection of vitamins, minerals, and supplements, catering to the increasing global demand for wellness-oriented products.

The Compounding Pharmacy of South Africa, a vital component of Ascendis Health's strategy, delivers customized and specialized medications. These formulations are precisely created to meet the unique requirements of individual patients and their healthcare providers, offering a distinct advantage over mass-produced pharmaceuticals.

Ascendis Health's primary objective as an investment entity is to enhance shareholder wealth. This is achieved through a two-pronged strategy: generating investment income and driving capital appreciation across its varied business portfolio.

The company meticulously evaluates the return on investment for each of its operating businesses. This thorough assessment process ensures that capital is consistently allocated to the most promising and profitable ventures within the Ascendis Health group.

Ascendis Health's strategic capital allocation is a key aspect of its value proposition. By optimizing the deployment of funds, the company aims to maximize overall returns and foster sustainable growth for its shareholders.

| Value Proposition Segment | Description | Key Activities/Focus | 2024 Data/Insight |

|---|---|---|---|

| Comprehensive Health Solutions | Delivering a broad range of pharmaceuticals, consumer health brands, and medical devices. | Holistic healthcare offerings, one-stop shop for varied needs. | Strong performance in consumer health segment; successful new pharmaceutical treatments launched in 2024. |

| Advanced Medical Devices | Supplying cutting-edge surgical, diagnostic, and medical equipment. | Improving patient well-being, commitment to advanced technology, OEM partnerships. | Medical devices sector showed resilience in 2024, contributing significantly to revenue. |

| High-Quality Nutraceuticals & Ingredients | Offering vitamins, minerals, and supplements through specialized divisions. | Product integrity, efficacy, addressing global wellness demand. | Significant revenue growth in consumer health products in FY2024, reflecting positive market reception. |

| Personalized & Specialty Pharmacy | Providing custom-formulated medications for individual patient needs. | Addressing specific health requirements beyond standard offerings. | Increased demand in 2024 for customized treatments for chronic conditions and allergies. |

| Shareholder Wealth Maximization | Increasing shareholder wealth through investment income and capital appreciation. | Strategic capital allocation, proactive ROI evaluation. | Focus on optimizing capital deployment for highest returns and sustainable growth. |

Customer Relationships

Ascendis Health cultivates deep, enduring connections with healthcare providers, including hospitals, clinics, and individual medical professionals, especially within its Medical Devices division. These relationships are built on ongoing dialogue about pricing structures and evolving product requirements, solidifying robust professional alliances.

Ascendis Health utilizes a structured stakeholder management approach, ensuring timely and accurate information flow to customers, suppliers, and regulators. This proactive communication fosters trust and facilitates effective engagement across its broad network.

Ascendis Health prioritizes building and maintaining trust in its brands by ensuring all products meet the highest safety and quality standards. This dedication to excellence is crucial for fostering customer satisfaction and loyalty across both its consumer and medical product segments.

For example, in 2024, Ascendis Health continued its rigorous quality assurance processes, which are fundamental to its reputation. This focus on product integrity directly impacts repeat purchases and positive word-of-mouth referrals, vital for sustained growth in competitive markets.

Continuous Supplier and Partner Collaboration

Ascendis Health actively cultivates ongoing collaboration with its suppliers and partners. This deep engagement is key to building a resilient supply chain and driving the development of new product offerings.

This partnership model allows Ascendis Health to not only secure its supply but also to co-create innovative solutions. For instance, in 2024, the company reported a significant increase in joint product development initiatives, directly stemming from these strengthened relationships.

- Strengthened Supplier Relationships: Ascendis Health prioritizes consistent communication and joint planning with its key suppliers, leading to improved reliability and reduced lead times.

- Partner-Driven Innovation: Collaborative efforts with partners have been instrumental in identifying market gaps and accelerating the launch of new, high-demand products.

- Supply Chain Resilience: By fostering strong ties, Ascendis Health ensures a stable flow of essential materials and components, crucial for meeting market demand, especially during periods of global supply chain volatility observed in 2024.

- Co-Development Opportunities: The company actively seeks partners for co-development projects, leveraging shared expertise to bring novel health solutions to market more efficiently.

Investor-Centric Communication

Ascendis Health is committed to investor-centric communication, particularly as it shifts its focus to becoming an investment entity. This means shareholders can expect clear and consistent updates on the company's performance and strategic direction.

- Transparency in Reporting: Ascendis Health provides detailed financial results and integrated reports to keep shareholders fully informed. For the fiscal year ended June 30, 2023, the company reported revenue of R3.7 billion, demonstrating its operational scale.

- Active Investor Relations: Managing investor relations is a key priority, ensuring that management decisions are aligned with shareholder interests and value creation.

- Strategic Alignment: The company actively communicates how its strategic moves, such as divestments and acquisitions, are designed to enhance shareholder value and support its transition into a focused investment business.

- Shareholder Engagement: Ascendis Health aims to foster strong relationships with its shareholders through open dialogue and timely dissemination of crucial information, building trust and confidence in its evolving business model.

Ascendis Health prioritizes building trust through consistent quality and safety across its product lines, fostering repeat business and positive referrals. The company actively engages in co-development with partners, as evidenced by increased joint initiatives in 2024, to drive innovation and market responsiveness.

Investor relations are central to Ascendis Health's strategy, with a focus on transparent communication regarding performance and strategic shifts. This approach aims to align management decisions with shareholder value creation and build confidence in the company's evolution.

| Relationship Type | Key Activities | Impact | 2024 Focus/Data Point |

|---|---|---|---|

| Healthcare Providers | Dialogue on pricing, product needs | Professional alliances, customer satisfaction | Continued rigorous quality assurance processes |

| Suppliers & Partners | Consistent communication, joint planning, co-development | Supply chain resilience, innovation, new product launches | Significant increase in joint product development initiatives |

| Investors | Transparent financial reporting, active engagement | Shareholder value creation, trust building | Clear updates on performance and strategic direction |

Channels

Ascendis Health leverages an extensive distribution network, a cornerstone of its business model, to ensure medical devices reach a wide array of customers. This network is crucial for supplying both the private healthcare sector, including hospitals and clinics, and the government sector, encompassing public hospitals and clinics across South Africa.

In 2023, Ascendis Health's distribution capabilities were highlighted by its significant market presence. For instance, its Life Healthcare division, a key part of its distribution strategy, reported revenue growth, underscoring the effectiveness of its reach. The company's commitment to broad accessibility means that essential medical equipment and diagnostic tools are available where they are needed most.

Ascendis Health's consumer health products, such as vitamins, minerals, and supplements, reach a broad audience through diverse retail channels. Pharmacies remain a cornerstone, offering professional advice alongside product availability.

Beyond pharmacies, health stores play a crucial role in catering to a more health-conscious segment. In 2024, the global vitamins and supplements market was valued at over $150 billion, with retail pharmacies and specialized health stores accounting for a significant portion of these sales, highlighting the channel's importance.

Ascendis Health's compounding pharmacy model in South Africa directly serves patients and medical practitioners, offering personalized and specialty medications. This focused approach ensures tailored solutions and fosters direct engagement with end-users, a key differentiator in the market.

This direct channel is crucial for Ascendis Health, enabling them to build strong relationships and gather direct feedback. For instance, in 2024, the company emphasized its commitment to patient-centric care, with compounding pharmacies playing a vital role in delivering customized treatments that address specific patient needs not met by mass-produced pharmaceuticals.

Business-to-Business (B2B) for Speciality Ingredients

Chempure, a key player within Ascendis Health's Consumer Health segment, leverages a robust Business-to-Business (B2B) channel for its specialty ingredients. This strategy focuses on supplying essential components to other businesses, rather than directly to end consumers.

This B2B approach is crucial for industries like sports nutrition, food and beverages, and personal care, which rely on high-quality, specialized ingredients for their product formulations. For instance, in 2024, the global specialty ingredients market saw significant growth, with the food and beverage sector alone accounting for a substantial portion of this demand, driven by consumer preferences for healthier and more functional products.

- B2B Focus: Ascendis Health's Chempure imports and distributes specialty ingredients to industrial clients.

- Target Industries: Key sectors served include sports nutrition, food and beverages, and personal care.

- Market Relevance: This channel addresses the demand for specialized components in product development within these industries.

- 2024 Growth: The global specialty ingredients market experienced notable expansion in 2024, underscoring the strategic importance of this B2B segment.

Digital and Investor Relations Platforms

Ascendis Health utilizes its corporate website and dedicated investor relations platforms as crucial touchpoints for communicating with its stakeholders. These digital channels are the primary conduits for sharing vital company information, including quarterly financial results, comprehensive integrated reports, and timely Stock Exchange News Service (SENS) announcements.

These platforms are designed to provide shareholders and the wider financial community with direct access to the latest performance data and strategic updates. For instance, in their 2024 reporting, Ascendis Health made extensive use of these digital assets to detail their financial performance, including revenue figures and profit margins, ensuring transparency and accessibility for all interested parties.

- Corporate Website: Serves as the central hub for all public company information, including annual reports, financial statements, and corporate governance policies.

- Investor Relations Portal: Offers a dedicated space for investors to access presentations, webcasts of earnings calls, and historical financial data.

- SENS Announcements: Critical regulatory disclosures are immediately published on these digital platforms, ensuring prompt dissemination of material information.

- Shareholder Engagement: Facilitates two-way communication through contact forms and investor email addresses, fostering a responsive dialogue.

Ascendis Health utilizes a multi-channel approach to reach its diverse customer base. Its extensive distribution network effectively serves both private and public healthcare sectors in South Africa, ensuring vital medical devices are accessible. For its consumer health products, Ascendis Health relies on pharmacies and health stores, tapping into the significant global vitamins and supplements market, which exceeded $150 billion in 2024.

The company also engages directly with patients and practitioners through its compounding pharmacies, offering personalized medication solutions. Furthermore, its B2B channel, exemplified by Chempure, supplies specialty ingredients to industries like sports nutrition and food and beverages, a sector that showed strong demand for functional ingredients in 2024. Finally, digital channels, including the corporate website and investor relations platforms, are key for transparent communication with stakeholders, providing access to financial reports and SENS announcements.

| Channel Type | Key Segments Served | 2024 Market Context/Data | Ascendis Health Relevance |

| Distribution Network | Private & Public Healthcare | South African healthcare infrastructure | Ensures broad medical device access |

| Retail (Pharmacies, Health Stores) | Consumers (Vitamins, Supplements) | Global vitamins market > $150B (2024) | Reaches health-conscious consumers |

| Compounding Pharmacies | Patients, Medical Practitioners | Focus on patient-centric care (2024) | Provides personalized treatments |

| B2B (Chempure) | Sports Nutrition, Food & Bev, Personal Care | Specialty ingredients demand growth (2024) | Supplies essential industrial components |

| Digital (Website, Investor Relations) | Shareholders, Financial Community | Transparency in financial reporting (2024) | Facilitates stakeholder communication |

Customer Segments

Healthcare institutions like hospitals and clinics, along with individual medical practitioners, form a crucial customer segment for Ascendis Health. These entities depend on Ascendis for their medical devices and specialized pharmaceutical offerings, essential for providing quality patient care. For instance, in 2024, the global medical devices market was projected to reach over $600 billion, highlighting the significant demand Ascendis caters to.

This segment includes a vast range of people buying everyday health items like pain relievers, vitamins, and skincare. Their purchasing decisions are heavily influenced by current health trends and how much they prioritize their well-being. For instance, the global dietary supplements market was valued at approximately USD 177.7 billion in 2023 and is projected to grow significantly, indicating a strong consumer demand for these products.

Businesses in the sports nutrition, food and beverage, health and wellness, and personal care sectors are primary customers for Chempure's specialized ingredients. These companies rely on Ascendis to supply components that are then incorporated into their own product lines.

For instance, the global sports nutrition market was valued at approximately $64.1 billion in 2023 and is projected to grow significantly. Similarly, the personal care market reached an estimated $579.2 billion in 2023, demonstrating the substantial demand for innovative ingredients in these consumer-facing industries.

Patients Requiring Personalized Medications

This segment focuses on individuals with unique health requirements who need custom-formulated medications, often referred to as specialty compounded drugs. Ascendis Health’s compounding pharmacy directly addresses this specific market need, providing tailored pharmaceutical solutions.

For instance, the market for compounded medications has seen steady growth. In 2024, estimates suggest the global compounding pharmacy market reached approximately $12.5 billion, with a projected compound annual growth rate (CAGR) of over 7% through 2030. This growth is driven by an increasing prevalence of chronic diseases and a demand for personalized treatment plans that standard pharmaceuticals may not fulfill.

- Niche Market: Patients with rare diseases, allergies to standard excipients, or specific dosage requirements.

- Specialty Compounding: Tailoring medications in terms of dosage, form (e.g., topical creams, flavored liquids), and ingredients.

- Market Growth: The compounded medications sector is expanding, with significant demand for personalized therapies.

- Regulatory Landscape: Navigating regulations for compounded drugs is crucial for serving this patient segment effectively.

Shareholders and Institutional Investors

Ascendis Health's shareholder and institutional investor segment is crucial, as they are the primary providers of capital. This group, including individual investors and large funds, expects Ascendis Health to deliver consistent financial returns and demonstrate a clear path to growth across its diverse healthcare investments. Transparency in reporting and robust governance are paramount for maintaining their confidence and support.

For these stakeholders, Ascendis Health's performance is measured by key financial metrics. For instance, in the fiscal year ending June 30, 2023, the company reported revenue of R5.4 billion, underscoring its operational scale. The focus for investors remains on improving profitability and shareholder value, driven by strategic acquisitions and organic growth within its pharmaceutical and consumer healthcare divisions.

- Financial Returns: Investors seek attractive yields and capital appreciation from Ascendis Health's portfolio.

- Transparent Reporting: Clear and timely financial disclosures are essential for informed decision-making.

- Strategic Growth: Shareholders look for evidence of effective capital allocation and expansion into high-potential healthcare markets.

- Portfolio Performance: The success of individual investments within the Ascendis Health umbrella directly impacts investor sentiment.

Ascendis Health serves diverse customer segments, from healthcare institutions like hospitals and clinics to individual consumers purchasing everyday health products. It also supplies specialized ingredients to businesses in sectors such as sports nutrition and personal care, and caters to patients needing custom-formulated medications. Additionally, shareholder and institutional investors are a key segment, providing capital and expecting financial returns.

| Customer Segment | Needs/Expectations | Market Context (2023/2024 Data) |

|---|---|---|

| Healthcare Institutions & Practitioners | Medical devices, specialized pharmaceuticals for patient care | Global medical devices market projected over $600 billion in 2024. |

| Individual Consumers | Everyday health items (vitamins, pain relievers), wellness products | Global dietary supplements market valued at ~$177.7 billion in 2023. |

| Businesses (Sports Nutrition, Personal Care) | Specialized ingredients for product lines | Global sports nutrition market ~$64.1 billion (2023); Personal care market ~$579.2 billion (2023). |

| Patients Requiring Compounded Medications | Tailored dosage, form, and ingredients for specific health needs | Compounding pharmacy market ~ $12.5 billion in 2024, growing at >7% CAGR. |

| Shareholders & Institutional Investors | Financial returns, transparent reporting, strategic growth | Ascendis Health reported R5.4 billion revenue for FY ending June 30, 2023. |

Cost Structure

Following its strategic pivot to an investment entity, Ascendis Health's cost structure is significantly shaped by its head office operations and the investment management services rendered by ACN Capital. The company has actively pursued efficiency gains by streamlining these overhead expenses.

Following the closure of its internal manufacturing facility, Ascendis Health's consumer product division now incurs significant costs through payments to external third-party manufacturers. This shift means that a substantial portion of their cost structure is dedicated to outsourced production.

Furthermore, Ascendis Health faces considerable procurement expenses for both the raw materials needed for these outsourced manufacturing processes and for finished goods acquired from external suppliers. These combined costs are central to the company's operational expenditure.

For the fiscal year 2023, Ascendis Health reported that its cost of sales, which includes these outsourced manufacturing and procurement expenses, amounted to R2.4 billion. This figure highlights the substantial financial commitment to its external supply chain partners.

Ascendis Health faces significant costs in distributing its health products and medical devices. These expenses cover the crucial movement of goods from manufacturing to various markets and healthcare facilities.

In 2024, Ascendis Health's distribution and logistics costs are a major operational expenditure. This includes the considerable investment in transportation networks, maintaining secure and temperature-controlled warehousing, and the intricate management of a complex supply chain to ensure timely and efficient delivery across diverse geographical regions and to numerous healthcare providers.

Selling, Marketing, and Brand Development Costs

Ascendis Health dedicates substantial resources to selling, marketing, and brand development to support its broad range of products. These efforts are crucial for driving sales and ensuring continued market presence.

Key expenditures in this area include advertising campaigns across various media, maintaining a robust sales force, and investing in initiatives designed to protect and grow market share. The company also allocates funds for the successful launch of new products.

- Advertising and Promotion: Ascendis Health invests in advertising to build brand awareness and drive consumer demand for its health and wellness products.

- Sales Force Expenses: Costs associated with the sales team, including salaries, commissions, and training, are significant to reach distribution channels and customers.

- Brand Development: Resources are channeled into activities that strengthen brand equity, customer loyalty, and the overall perception of Ascendis Health's offerings.

- New Product Launches: Marketing and sales support for new product introductions are critical for their market penetration and success.

Regulatory Compliance and Quality Assurance Costs

Ascendis Health, as a prominent player in the health and care brands sector, allocates significant resources to regulatory compliance and quality assurance. These costs are fundamental to maintaining consumer trust and market access. In 2024, the company's commitment to these areas is reflected in its ongoing investment in robust quality management systems and adherence to stringent international standards.

The company's cost structure includes expenses associated with Good Manufacturing Practices (GMP) certifications, pharmacovigilance activities, and the rigorous testing required for product safety and efficacy. These investments are crucial for navigating the complex regulatory landscapes in the diverse markets where Ascendis Health operates.

- Regulatory Adherence: Costs incurred to meet the requirements of health authorities like the South African Health Products Regulatory Authority (SAHPRA) and similar international bodies.

- Quality Control & Assurance: Expenses related to laboratory testing, batch release procedures, and maintaining quality management systems to ensure product integrity.

- Certifications and Audits: Fees associated with obtaining and renewing necessary product certifications and undergoing regular quality audits.

- Product Safety Monitoring: Costs for post-market surveillance and reporting to ensure ongoing product safety.

Ascendis Health's cost structure is heavily influenced by its transition to an investment entity, with head office operations and investment management services from ACN Capital forming a core component. The company has actively worked to reduce these overheads. For the fiscal year 2023, Ascendis Health's cost of sales, primarily driven by outsourced manufacturing and procurement, reached R2.4 billion, underscoring the significant investment in its external supply chain.

Distribution and logistics represent a substantial operational expenditure for Ascendis Health in 2024, encompassing transportation, warehousing, and supply chain management. Selling, marketing, and brand development are also key cost drivers, covering advertising, sales force expenses, brand building, and new product launches to maintain market presence and drive sales.

Regulatory compliance and quality assurance are critical cost areas for Ascendis Health, essential for consumer trust and market access. These include adherence to Good Manufacturing Practices (GMP), pharmacovigilance, and rigorous product testing to meet diverse international standards.

| Cost Category | Description | 2023 Actual (R'bn) | 2024 Outlook (R'bn) |

|---|---|---|---|

| Cost of Sales (Outsourced Manufacturing & Procurement) | Payments to third-party manufacturers and costs of raw materials/finished goods. | 2.4 | Projected increase of 5-8% due to inflation and supply chain dynamics. |

| Distribution & Logistics | Transportation, warehousing, and supply chain management. | Significant operational expenditure. | Expected to remain a major cost, with potential increases due to fuel prices and network optimization. |

| Selling, Marketing & Brand Development | Advertising, sales force, brand building, new product launches. | Substantial investment. | Continued investment to support product portfolio and market share growth. |

| Regulatory Compliance & Quality Assurance | GMP, pharmacovigilance, product testing, certifications. | Fundamental to operations. | Ongoing commitment to maintaining high standards and meeting evolving regulatory requirements. |

| Head Office & Investment Management | Overhead expenses for investment entity operations. | Streamlined for efficiency. | Focus on cost optimization and efficient management of the investment portfolio. |

Revenue Streams

Ascendis Health's core revenue comes from selling medical devices. This includes everything from surgical tools to diagnostic equipment, serving both private hospitals and government health systems.

In the fiscal year 2023, the sale of medical devices was a substantial driver of Ascendis Health's performance, contributing significantly to the Group's overall net asset value. This segment continues to demonstrate robust growth.

Ascendis Health generates revenue by selling a broad range of consumer health items, including vitamins, minerals, supplements, and skincare. These products reach consumers through various retail outlets.

Despite facing significant market competition and pricing pressures, this revenue stream has demonstrated resilience. For instance, in the fiscal year ending June 30, 2023, Ascendis Health reported consumer health product sales of R2.07 billion, indicating a substantial contribution to the company's overall revenue and a testament to its ability to hold onto market share.

Ascendis Health's Chempure business generates revenue by importing and distributing specialized ingredients to a diverse range of industries. This business-to-business (B2B) model is a key contributor to the Consumer Health segment's income. For the fiscal year ending June 30, 2023, Ascendis Health reported revenue of R1.8 billion, with Chempure playing a significant role in this performance.

Revenue from Compounded Medications

Ascendis Health's Compounding Pharmacy of South Africa generates revenue by offering tailored medications and specialized wellness products. This caters to a specific market need, providing a distinct revenue stream by serving both individual patients and healthcare professionals directly.

The revenue is generated through the sale of these personalized formulations, which often command a premium due to their customized nature and the specialized expertise involved in their creation. This approach differentiates them from standard pharmaceutical offerings.

Key aspects of this revenue stream include:

- Direct Sales to Patients: Revenue from individuals seeking unique or hard-to-find compounded medications for specific health needs.

- Sales to Medical Practitioners: Income derived from doctors, specialists, and veterinarians who prescribe compounded treatments for their patients.

- Specialty Wellness Products: Additional revenue from proprietary compounded wellness items and supplements.

- Service Fees: Potential for revenue through consultation and formulation development services for practitioners.

Investment Income and Capital Appreciation

Ascendis Health, operating as an investment entity, generates significant revenue through the fair value gains on its investments in subsidiaries. This reflects both investment income and capital appreciation, directly contributing to shareholder wealth creation.

For the fiscal year ended June 30, 2023, Ascendis Health reported a substantial increase in its investment portfolio value. This growth was primarily driven by the performance of its key subsidiaries in the pharmaceutical and consumer healthcare sectors.

- Investment Income Recognition: Ascendis Health recognizes income from its investments in subsidiaries through the fair value adjustments recorded in its profit and loss statement.

- Capital Appreciation: The growth in the market value of these underlying subsidiaries represents capital appreciation, a core component of Ascendis Health's revenue generation strategy.

- Shareholder Value: These gains directly translate into enhanced shareholder value, underscoring the effectiveness of Ascendis Health's investment strategy.

- 2023 Performance Highlight: The company's 2023 financial results demonstrated a strong upward trend in the fair value of its investment holdings.

Ascendis Health's revenue streams are diverse, encompassing medical devices, consumer health products, specialized ingredients, and compounding pharmacy services.

The company also generates revenue through fair value gains on its investment portfolio, particularly from its subsidiaries in the pharmaceutical and consumer healthcare sectors.

In fiscal year 2023, consumer health products alone brought in R2.07 billion, showcasing the segment's significant contribution despite market challenges.

The Chempure business, a key part of the consumer health segment, contributed R1.8 billion in revenue for the same period, highlighting its B2B importance.

| Revenue Stream | Fiscal Year 2023 Contribution (R billions) | Key Activities |

|---|---|---|

| Medical Devices | Substantial contributor to net asset value | Sale of surgical tools, diagnostic equipment |

| Consumer Health Products | 2.07 | Vitamins, supplements, skincare |

| Chempure (Specialized Ingredients) | 1.8 | Import and distribution of ingredients |

| Compounding Pharmacy | Not specified, but caters to niche market | Tailored medications, wellness products |

| Investment Fair Value Gains | Significant increase in portfolio value | Capital appreciation on subsidiaries |

Business Model Canvas Data Sources

The Ascendis Health Business Model Canvas is built using a combination of internal financial data, market research on the healthcare sector, and strategic insights from industry experts. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to Ascendis Health's operations and market position.