ANZ Group Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ANZ Group Holdings Bundle

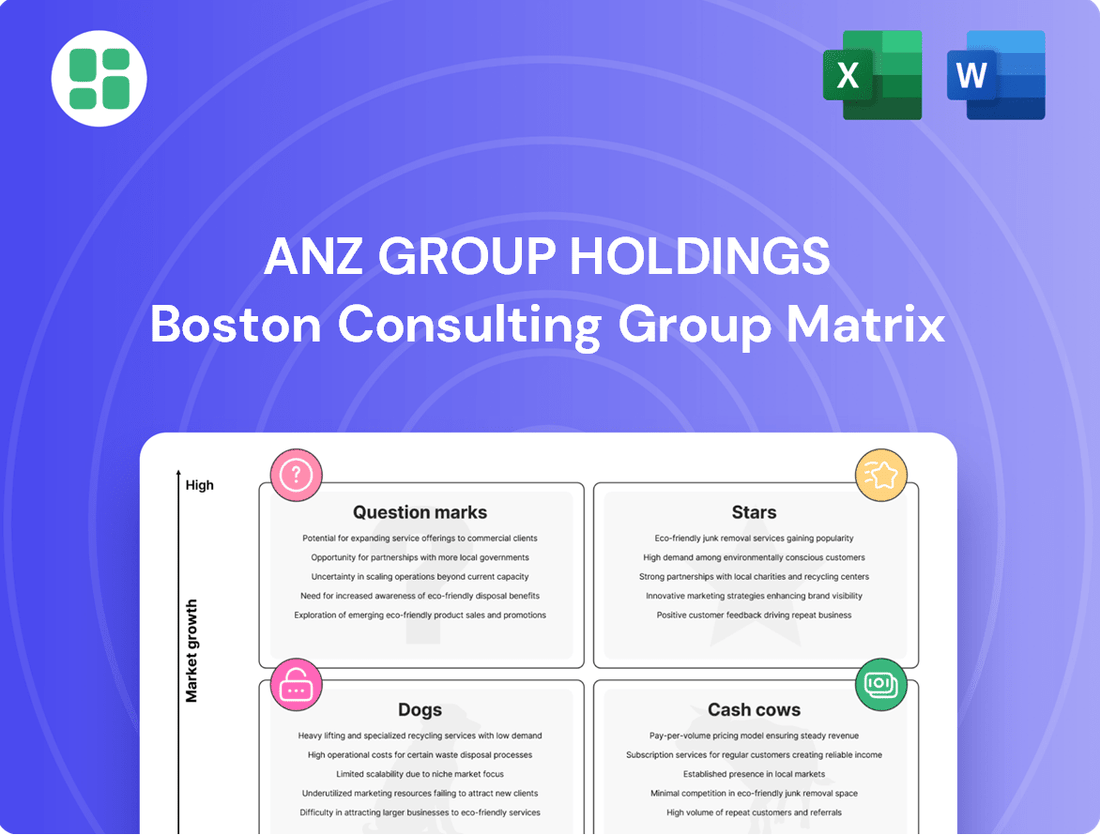

Explore the ANZ Group Holdings BCG Matrix and understand its strategic positioning across Stars, Cash Cows, Dogs, and Question Marks. This overview is just the tip of the iceberg; unlock a comprehensive understanding of their product portfolio's market share and growth potential.

Dive deeper into the ANZ Group Holdings BCG Matrix to uncover actionable insights and a clear roadmap for optimizing your investments. Purchase the full report for detailed quadrant analysis and strategic recommendations that drive growth and efficiency.

The complete ANZ Group Holdings BCG Matrix reveals the hidden strengths and potential weaknesses within their business units. Don't miss out on the opportunity to gain a competitive edge – secure your copy today for an in-depth strategic advantage.

Stars

ANZ Plus, a digital banking platform, has experienced significant growth, attracting one million customers and securing nearly $20 billion in deposits by March 2025. This rapid expansion is a key indicator of its strong market position.

Approximately half of ANZ Plus's customer base consists of individuals new to ANZ, highlighting its success in acquiring fresh market share. This influx of new customers underscores the platform's appeal in the digital banking space.

The platform is central to ANZ's strategic vision, focusing on enhancing customer financial wellbeing and driving ongoing innovation. Its role is crucial for ANZ's future growth trajectory in an increasingly digital financial landscape.

ANZ's Sustainable Finance Solutions are a star performer within its BCG Matrix, reflecting its strong market leadership and growth potential in ESG. The bank was recognized as the Best Bank for ESG and Sustainable Finance, underscoring its commitment and expertise in this rapidly expanding sector.

The bank has set a significant goal to fund and facilitate at least A$100 billion by the end of 2030, demonstrating a clear strategy for driving positive social and environmental change. This ambitious target positions ANZ to capitalize on the increasing demand for sustainable investments and financing.

ANZ is actively supporting its customers' transitions to a low-carbon economy, a key driver of growth in sustainable finance. This proactive approach not only aligns with global environmental goals but also creates significant opportunities for the bank's continued success in this area.

ANZ is strategically investing in digital transformation, aiming to enhance customer experience and operational efficiency. A key initiative is its partnership with fintech CitoPlus, designed to simplify and accelerate SME loan applications, with a planned launch in 2025. This move underscores ANZ's commitment to leveraging cutting-edge technology to serve its business clients better.

Furthermore, ANZ's external innovation arm, 1835i, plays a crucial role by actively fostering collaborations with promising startups. This proactive engagement with the startup ecosystem allows ANZ to identify and integrate emerging technologies and innovative solutions, driving digital advancements across the group. For instance, 1835i has invested in various startups in areas like data analytics and AI, which are expected to enhance ANZ's digital capabilities.

This dual approach of internal digital investment and external fintech partnerships positions ANZ to effectively compete and grow within the rapidly evolving digital financial services landscape. By embracing innovation and agility, ANZ aims to capture a larger share of the market, particularly among digitally-savvy customers and businesses seeking streamlined financial solutions.

Institutional Banking Platforms (e.g., Transactive Global)

ANZ's institutional banking, powered by platforms like Transactive Global, is a key strategic pillar, mirroring the importance of ANZ Plus. This segment is crucial for driving growth and innovation within the group.

The bank's strong market standing is evident, with recognition as the leading institutional bank for customer relationships in Australia in 2025. This highlights a robust position in a sector ripe with potential.

Opportunities abound in institutional banking, particularly with increased M&A activity and the growing demand for real-time payment solutions. These trends present avenues for further expansion and revenue generation.

- Market Leadership: Recognized as the top institutional bank for customer relationships in Australia in 2025.

- Strategic Focus: Core to ANZ's strategy, alongside the development of ANZ Plus.

- Growth Drivers: Benefiting from increased M&A activity and the adoption of real-time payments.

Advanced AI and Data Analytics Initiatives

ANZ is making significant strides in advanced AI and data analytics, establishing a dedicated group-wide data and analytics function set to be operational from March 2025. This new function will spearhead the bank's data strategy and guide the implementation of artificial intelligence across its operations. These efforts are crucial for maintaining a competitive edge.

The bank is actively piloting generative AI tools with a focus on boosting internal efficiencies and improving customer-facing operations. Key areas include enhancing fraud detection mechanisms and elevating the quality of customer service. By embracing these technologies, ANZ aims to unlock new avenues for growth and solidify its position in a dynamic market.

- Data Strategy Leadership: A new group-wide data and analytics function begins in March 2025, centralizing data strategy and AI governance.

- AI Piloting: Generative AI tools are being tested to improve operational efficiency and customer experience.

- Key Applications: Initiatives focus on strengthening fraud protection and enhancing customer service capabilities.

- Future Growth Driver: These advanced analytics and AI initiatives are designed to create future growth and competitive advantage.

ANZ's Sustainable Finance Solutions are a star performer within its BCG Matrix, reflecting its strong market leadership and growth potential in ESG. The bank was recognized as the Best Bank for ESG and Sustainable Finance, underscoring its commitment and expertise in this rapidly expanding sector.

The bank has set a significant goal to fund and facilitate at least A$100 billion by the end of 2030, demonstrating a clear strategy for driving positive social and environmental change. This ambitious target positions ANZ to capitalize on the increasing demand for sustainable investments and financing.

ANZ is actively supporting its customers' transitions to a low-carbon economy, a key driver of growth in sustainable finance. This proactive approach not only aligns with global environmental goals but also creates significant opportunities for the bank's continued success in this area.

| Category | Market Share | Growth Rate | Strategic Importance |

|---|---|---|---|

| Sustainable Finance | Leading | High | Star |

| ANZ Plus | Growing | High | Star |

| Institutional Banking | Strong | Moderate | Cash Cow/Question Mark (depending on specific segment) |

| AI & Data Analytics | Emerging | High | Question Mark/Star |

What is included in the product

This BCG Matrix overview for ANZ Group Holdings analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on investment, divestment, and resource allocation for each category.

The ANZ Group Holdings BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Australian and New Zealand home lending, a cornerstone of ANZ Group, functions as a classic Cash Cow within its BCG Matrix. These established markets, characterized by ANZ's significant market share, consistently deliver robust interest income and predictable cash flows.

The recent acquisition of Suncorp Bank in 2023, a transaction valued at AUD 4.9 billion, significantly bolsters ANZ's position in the Australian home lending landscape. This strategic move not only expands ANZ's scale but also reinforces its dominance in a mature, yet vital, segment of its business.

ANZ's core retail deposit base in Australia and New Zealand acts as a significant cash cow, offering a reliable and cost-effective funding stream. This traditional segment, though seeing slower growth in new accounts than digital alternatives, remains a bedrock for the bank's financial stability and profit generation.

As of the first half of 2024, ANZ reported a substantial retail deposit book, underscoring its importance. While specific growth rates for this segment are often embedded within broader figures, the consistent contribution to net interest margin highlights its cash cow status. This stability is crucial for funding other, potentially higher-growth but less certain, business areas.

ANZ's established commercial banking relationships across Australia, New Zealand, and the Asia-Pacific region are a significant cash cow. These long-standing ties generate consistent revenue from services such as business loans, payment processing, and treasury management. For instance, in the fiscal year 2023, ANZ reported a statutory profit after tax of A$7.1 billion, with its commercial banking segment contributing substantially to this performance.

Traditional Credit and Debit Card Products

ANZ's traditional credit and debit card offerings are firmly positioned as cash cows within its portfolio. These established products consistently deliver substantial fee and interest income, a testament to their enduring appeal and ANZ's extensive customer reach.

Despite a mature market, ANZ's significant customer base fuels consistent transaction volumes, translating into reliable, recurring revenue streams. This stability means these card products act as dependable cash generators, requiring minimal additional investment to maintain their performance.

- Fee and Interest Income: ANZ's card products are a significant contributor to its net interest margin and fee income. For the fiscal year 2023, ANZ reported a net interest income of AUD 15.4 billion, with card services playing a notable role.

- Customer Base Leverage: With millions of active card accounts, ANZ benefits from economies of scale, ensuring high transaction volumes that underpin consistent revenue generation.

- Mature Market Stability: The credit and debit card market, while competitive, offers predictable revenue streams due to its essential nature in daily commerce.

- Low Growth Investment: The cash cow status implies that these products are not the primary focus for aggressive expansion, allowing capital to be directed towards higher-growth areas.

Basic Transaction and Everyday Banking Accounts

Basic transaction and everyday banking accounts are the bedrock of ANZ's customer base, acting as primary financial hubs for millions. These accounts, while generating modest per-customer revenue, represent a significant volume of business.

Their stability is crucial, providing a consistent revenue stream through transaction fees and net interest margins on deposited funds. In 2024, ANZ reported that its retail and commercial banking segments, heavily reliant on these core accounts, continued to be a significant contributor to overall group performance.

- Stable Revenue: Transaction fees and interest on balances provide predictable income.

- Customer Foundation: These accounts are the entry point for most customer relationships.

- Cross-Selling Opportunities: They serve as a platform to offer higher-margin products.

- High Volume, Low Margin: Success hinges on managing a large customer base efficiently.

ANZ's Australian and New Zealand home lending operations are prime examples of cash cows, generating consistent interest income and stable cash flows due to their established market presence. The 2023 acquisition of Suncorp Bank for AUD 4.9 billion further solidified ANZ's leading position in this mature yet vital sector. This strategic move enhances scale and reinforces the predictable revenue streams essential for funding other business ventures.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Australian & NZ Home Lending | Cash Cow | High market share, stable interest income, predictable cash flows | Acquisition of Suncorp Bank (AUD 4.9 billion) in 2023 |

| Retail Deposit Base (AU/NZ) | Cash Cow | Cost-effective funding, stable financial bedrock | Significant contribution to net interest margin (FY23 Net Interest Income: AUD 15.4 billion) |

| Commercial Banking (AU/NZ/APAC) | Cash Cow | Long-standing relationships, consistent revenue from loans and services | Substantial contributor to FY23 Statutory Profit After Tax (A$7.1 billion) |

| Credit & Debit Cards | Cash Cow | High transaction volumes, reliable fee and interest income | Millions of active accounts, consistent revenue generation |

Preview = Final Product

ANZ Group Holdings BCG Matrix

The ANZ Group Holdings BCG Matrix you are previewing is the complete, unedited document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, is ready for your strategic planning without any watermarks or demo content. You can confidently use this exact file for presentations, internal reviews, or further business development.

Dogs

ANZ Group Holdings is actively working to streamline its technology landscape by moving applications to the cloud. This initiative highlights that their older, on-premise systems are proving expensive to maintain and are not as efficient as newer cloud-based solutions. For example, in fiscal year 2023, ANZ reported significant investments in technology modernization as part of its ongoing strategy to improve operational efficiency and reduce costs associated with legacy systems.

These legacy systems often demand substantial resources, including IT staff time and budget, without providing a clear competitive edge in today's market. Consequently, they represent potential candidates for divestment or require substantial investment for modernization to align with ANZ's future strategic goals.

ANZ Group's underperforming physical branch locations can be viewed as potential 'dogs' in a BCG Matrix context. As digital banking adoption accelerates, these branches may see reduced customer engagement and lower transaction volumes. For instance, ANZ reported a significant shift in customer interactions, with a substantial portion of transactions now occurring through digital channels, increasing the cost-to-serve for physical locations.

ANZ Private is actively launching new, customized wealth management products, signaling a potential challenge for their existing, less competitive offerings. This suggests that some of ANZ's older wealth management products might be classified as Dogs in the BCG Matrix, struggling with low market share in a saturated market and delivering minimal returns.

Certain Niche, Non-Core International Operations

Certain Niche, Non-Core International Operations within ANZ Group Holdings would likely be classified as Dogs in the BCG Matrix. These are operations that, despite potential historical significance, now represent a small portion of the group's overall business and may incur higher costs relative to their contribution to profit or strategic advancement. ANZ's ongoing efforts to refine its international footprint, such as the partial divestment of its stake in Malaysia's AmBank in 2024, exemplify this strategic pruning.

These remaining, often high-cost, international ventures are candidates for divestment or restructuring. Their limited strategic alignment and profitability make them less attractive for further investment, fitting the profile of a Dog. For instance, if any remaining operations are in markets with declining growth prospects or intense competition where ANZ lacks a strong competitive advantage, they would be prime examples.

- Limited Profitability: Operations that consistently generate low returns or losses.

- High Operating Costs: Ventures with disproportionately high expenses relative to revenue.

- Strategic Non-Alignment: Businesses that do not fit with ANZ's core strategic objectives or future growth plans.

- Divestment Potential: Operations that are considered for sale or closure to redeploy capital more effectively.

Highly Manual or Paper-Based Processes

ANZ Group Holdings, like many established financial institutions, likely retains some highly manual or paper-based processes. These are often remnants of older operational models, and in the context of ANZ's stated focus on automation and digital self-service, they represent significant inefficiencies. These processes would typically exhibit low growth potential, as the industry shifts towards digital solutions, and would hold a diminishing market share in terms of modern banking practices. Consequently, they act as a drag on overall productivity and profitability.

These legacy processes are prime candidates for divestment or significant overhaul within the BCG framework. Their low growth and low market share position them as Dogs.

- Inefficiency & Cost: Manual processes incur higher operational costs due to labor, error correction, and slower transaction times compared to automated systems.

- Low Growth Potential: The banking sector's rapid digitalization means these paper-based systems are unlikely to see significant growth in adoption or transaction volume.

- Market Share Erosion: As customers increasingly prefer digital channels, the market share of services reliant on manual processes will naturally decline.

- Productivity Drag: These processes divert resources and employee focus from more value-adding, growth-oriented activities.

ANZ Group's older wealth management products, struggling in a competitive market, are likely classified as Dogs. These offerings face low market share and minimal returns, prompting the launch of new, customized wealth solutions to address these weaknesses.

Certain niche, non-core international operations within ANZ are also considered Dogs. These ventures contribute a small fraction to the group's overall business and may have higher costs relative to their profit contribution, as seen in the 2024 partial divestment of its stake in Malaysia's AmBank.

Highly manual or paper-based processes represent inefficiencies and are prime candidates for divestment or overhaul. These legacy systems exhibit low growth potential and diminishing market share in the rapidly digitalizing banking sector, acting as a drag on productivity.

Question Marks

Within the ANZ Group Holdings BCG Matrix, ANZ Plus is positioned as a Star, reflecting its high growth potential and significant market share in the digital banking space. New features like the digital home loan offset and equity access are designed to further solidify this position by enhancing customer value and competitive advantage.

However, the recent adjustment in ANZ Plus home loan interest rates, specifically a hike that diverged from broader market trends in early 2024, indicates a strategic move to optimize profitability for this burgeoning product. This action suggests ANZ is actively exploring the product's pricing power and demand elasticity as it continues to mature.

ANZ Group Holdings is actively integrating Artificial Intelligence (AI) into its operations, aiming to revolutionize customer service and data analysis. This includes leveraging AI for real-time insights, a critical component for emerging advisory services.

While the market for AI-driven financial advisory is poised for significant growth, ANZ's current position within this nascent sector is likely that of a developing player. Their market share in this specific niche is probably low as these services are still in their formative stages and building customer trust and adoption.

ANZ Group is actively exploring asset tokenization, particularly for improving cross-border payments. This aligns with a high-growth potential in fintech, though current market adoption and ANZ's specific share in these nascent offerings are likely still in experimental stages.

For instance, in 2023, the global market for tokenized assets was estimated to be around $310 billion, with projections suggesting it could reach $5.5 trillion by 2030, according to some industry reports. ANZ's involvement in testing these technologies places them at the forefront of a potentially transformative shift in financial services, even if their immediate market penetration is minimal.

Targeted High-Net-Worth (HNW) Private Banking Growth

ANZ Private is aggressively targeting Australia's high-net-worth (HNW) individuals, aiming to capture a larger slice of the burgeoning intergenerational wealth transfer market. This strategic push involves introducing innovative products and forging key partnerships to attract these affluent clients.

While the opportunity is substantial, with significant wealth set to change hands, ANZ's current private banking asset under management (AUM) lags behind global peers. This positions the HNW segment as a potential 'star' or 'question mark' within the BCG matrix for ANZ, indicating high growth potential but a currently low market share.

- Market Opportunity: Australia's wealth transfer market is projected to see trillions move between generations in the coming decades, presenting a significant growth runway.

- ANZ's Position: ANZ Private aims to leverage this trend by enhancing its offerings and client relationships to compete more effectively.

- Competitive Landscape: Global private banks often manage substantially higher AUM for HNW clients, highlighting ANZ's potential to gain market share.

- Strategic Focus: The growth of ANZ Private's HNW segment is critical for the group's overall portfolio diversification and profitability.

Expansion into Niche or Emerging Asia-Pacific Markets

ANZ Group's expansion into niche or emerging Asia-Pacific markets aligns with a "Question Mark" strategy. While ANZ has a substantial footprint across the region, focusing on specific, less-penetrated segments or rapidly developing economies presents a high-growth potential where current market share is likely low. This approach acknowledges the inherent risks but also the significant rewards of early entry into promising markets.

The 2025 outlook for ANZ Institutional specifically points to both volatility and opportunity within Asia. This suggests that while some established markets may offer stability, there are distinct areas within the region where ANZ could cultivate new ventures. These targeted, potentially unproven, initiatives are characteristic of a Question Mark, requiring careful investment and strategic nurturing to determine their future success.

For instance, consider the burgeoning digital payments sector in Southeast Asia. While major players dominate, smaller, specialized fintech firms are emerging with innovative solutions tailored to specific local needs. ANZ could strategically invest in or partner with such entities, aiming to capture a significant share of these developing ecosystems. The Asian Development Bank projected robust digital payment growth across emerging Asia, with transaction values expected to reach trillions of dollars by the mid-2020s, underscoring the potential.

- Targeted Investment: ANZ could allocate capital to fintech startups or specific digital banking initiatives in markets like Vietnam or the Philippines, where digital adoption is accelerating rapidly.

- Strategic Partnerships: Collaborating with local e-commerce platforms or mobile wallet providers can offer a less capital-intensive entry point into niche consumer segments.

- Regulatory Navigation: Successfully entering these markets will require a deep understanding of diverse and evolving regulatory landscapes, a key challenge for Question Marks.

- Growth Potential: These emerging segments, despite current low market share, offer the prospect of becoming future stars if ANZ can effectively build its presence and offerings.

ANZ's foray into niche Asia-Pacific markets and emerging digital payment sectors represent classic Question Marks. These ventures offer substantial growth potential, but ANZ's current market share in these nascent areas is minimal, requiring careful strategic investment and nurturing to ascertain their future success. The group's institutional focus on Asia in 2025 acknowledges both the inherent volatility and the significant opportunities within these developing economic landscapes.

By targeting specific, less-penetrated segments or rapidly developing economies, ANZ aims to establish an early foothold. This strategy is characterized by high risk but also the potential for high reward, as these emerging markets could evolve into future revenue drivers for the group.

The Asian Development Bank's projections for digital payment growth in emerging Asia, potentially reaching trillions of dollars by the mid-2020s, highlight the significant upside for ANZ's strategic investments in this space. Success hinges on navigating diverse regulatory environments and forming effective local partnerships.

ANZ's expansion into these markets is a calculated gamble, aiming to transform low-market-share, high-growth opportunities into future stars within its portfolio.

BCG Matrix Data Sources

Our ANZ Group Holdings BCG Matrix is informed by ANZ's official financial reports, industry growth data, and market share analysis to accurately position each business unit.