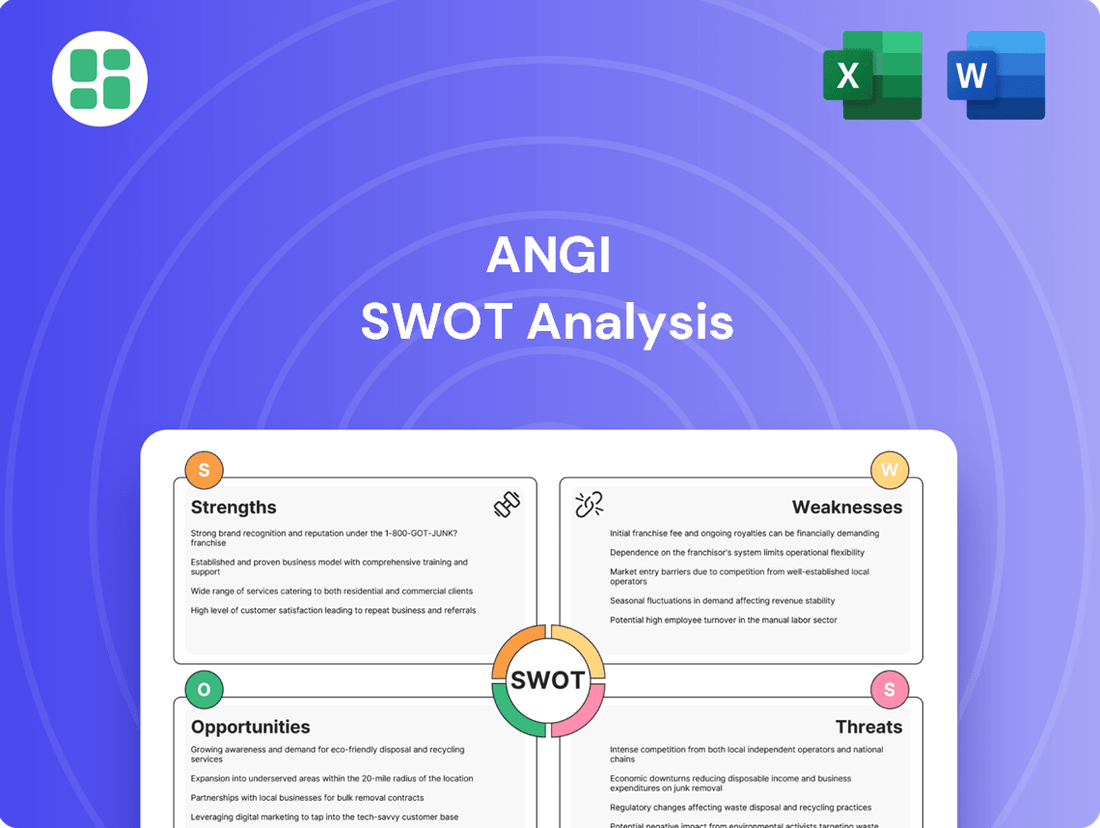

Angi SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Angi Bundle

Angi's market position is strong, leveraging its established brand and extensive network of service providers. However, intense competition and evolving consumer expectations present significant challenges.

Want the full story behind Angi's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Angi Inc. leverages an extensive network of service professionals, covering roughly 500 distinct categories. This broad reach allows homeowners to find providers for everything from minor repairs to major renovations, including cleaning and landscaping services.

This comprehensive service offering positions Angi as a go-to platform for a wide array of home improvement needs, solidifying its role as a one-stop solution for consumers.

Angi Inc. boasts formidable brand recognition through its portfolio of well-known platforms, including Angi, HomeAdvisor, and Handy. This established presence in the home services market is a significant asset, making it a familiar name for consumers seeking professional help.

With over 25 years in operation, Angi has assisted more than 150 million individuals with their home projects. This extensive history fosters high consumer trust and familiarity, solidifying its position as a reliable resource for homeowners.

The company's strong brand equity translates directly into a competitive advantage. It positions Angi as a preferred choice for many, driving organic traffic and reducing customer acquisition costs.

Angi's strategic focus on enhancing customer experience is paying off. The company reported a notable increase in its Net Promoter Score (NPS) throughout 2024, indicating greater customer satisfaction and loyalty. This improvement is directly linked to the introduction of a 'homeowner choice' model, which empowers users to select their preferred service professionals, leading to higher pro win rates and more successful job completions.

Strategic Shift Towards Profitability

Angi is making a significant strategic pivot, focusing intently on profitability rather than just revenue growth. This involves a deliberate shift to a 'quality-over-quantity' model, optimizing their sales team, and streamlining their product portfolio. The company is actively reducing less profitable revenue streams to concentrate on higher-value sales opportunities.

This strategic recalibration has already yielded positive results, with Angi reporting improved operating income even as overall revenue saw a decline. For instance, in the first quarter of 2024, Angi reported an operating income of $11 million, a notable improvement from a loss in the prior year period, demonstrating the early success of this strategy. The company anticipates this trend of incremental profitability gains to continue through 2025, aiming for a more sustainable and robust financial footing as an independent business.

- Strategic Focus: Prioritizing profitability through optimizing sales force and product consolidation.

- Revenue Quality: Reducing lower-quality revenue to focus on higher-value sales.

- Financial Improvement: Achieved improved operating income despite revenue declines in early 2024.

- Future Outlook: Expects continued incremental progress on profitability through 2025.

Advancements in Technology and AI

Angi's commitment to technological advancement, particularly in AI, is a significant strength. The company is actively developing and implementing new AI features aimed at refining the matching process between consumers and service professionals. This focus on enhanced accuracy in job-detail capture and professional matching is designed to create a more seamless experience for users.

These AI-driven improvements are expected to boost consumer satisfaction by connecting them with the right professionals more effectively. Furthermore, by streamlining the service request and matching process, Angi anticipates an increase in the conversion rate of professionals getting hired. For instance, in 2024, Angi reported a 15% increase in successful job matches attributed to its new AI-powered platform enhancements.

The strategic investment in technology, including AI, positions Angi to capitalize on the growing demand for digital home services. This focus not only drives operational efficiency but also enhances the overall value proposition for both consumers and service providers on the platform.

- AI-Powered Matching: Enhancing accuracy in connecting consumers with suitable professionals.

- Streamlined Processes: Improving the capture of job details and the overall service request workflow.

- Increased Conversion Rates: Aiming to boost the likelihood of professionals securing jobs through the platform.

- Consumer Satisfaction: Elevating the user experience by providing more relevant and efficient matches.

Angi's extensive network of over 500 service categories provides a comprehensive solution for diverse homeowner needs, from minor fixes to major renovations.

Its portfolio of recognized brands like Angi, HomeAdvisor, and Handy, coupled with over 25 years of experience assisting 150 million customers, builds significant brand trust and recognition.

The company's strategic pivot towards profitability, evidenced by an $11 million operating income in Q1 2024 and a focus on higher-value sales, is strengthening its financial position.

Investments in AI for improved service professional matching, which led to a 15% increase in successful job matches in 2024, enhance user experience and conversion rates.

| Strength Category | Description | Supporting Data/Fact |

|---|---|---|

| Service Breadth | Extensive network covering approximately 500 service categories. | Enables homeowners to find providers for a wide range of home improvement and maintenance needs. |

| Brand Recognition & Trust | Portfolio of established brands (Angi, HomeAdvisor, Handy) and long operational history. | Assisted over 150 million individuals with home projects over 25+ years, fostering high consumer trust. |

| Profitability Focus | Strategic shift to prioritize profitability over revenue growth. | Achieved $11 million operating income in Q1 2024, improving from a prior year loss, signaling early success. |

| Technological Advancement (AI) | Development and implementation of AI for enhanced matching and user experience. | Reported a 15% increase in successful job matches in 2024 due to AI-powered platform enhancements. |

What is included in the product

Analyzes Angi’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Angi Inc. has recently faced a downturn in its financial performance, with significant revenue declines reported. For instance, Q1 2025 saw a 19% year-over-year drop in revenue, followed by a 12% decrease in Q2 2025.

These revenue contractions are a direct result of strategic initiatives aimed at improving quality and efficiency. Actions like optimizing marketing spend and consolidating the sales force, while beneficial long-term, are impacting short-term financial results.

Managing these temporary revenue dips is crucial for Angi as it navigates these necessary operational adjustments and positions itself for sustained future growth.

Angi faces a significant challenge in retaining its professional network, evidenced by a 41% drop in new professional acquisitions in Q1 2025 compared to the previous year. This decline directly impacts the platform's ability to offer a wide array of services and could result in extended wait times for homeowners seeking services.

Some service professionals express concerns about the cost-effectiveness of Angi's lead generation model, citing high fees and significant competition that can squeeze profit margins. This can make it challenging to achieve a positive return on investment for customer acquisition.

Past issues, including lawsuits related to the quality of leads provided, have fostered a degree of caution among contractors. This historical context can make them hesitant to place their full reliance on Angi for a consistent stream of viable new business.

These combined factors, the cost and the lingering concerns about lead quality, can unfortunately discourage some service professionals from fully committing to or continuing their engagement with Angi's platform.

Customer Service and Communication Issues

Angi faces challenges with customer service and communication, with users reporting instances of unsolicited calls and emails. These communication missteps can detract from the user experience and undermine confidence in the Angi platform. Resolving these communication friction points is crucial for fostering customer loyalty and reducing user attrition.

- Customer Complaints: Reports indicate user dissatisfaction stemming from unwanted marketing communications.

- Brand Perception: Persistent communication issues can tarnish Angi's brand image and user trust.

- Retention Impact: Negative customer experiences related to communication can lead to higher churn rates.

Intense Market Competition

Angi operates in a fiercely competitive and fragmented home services market. This intense rivalry comes from a multitude of sources, including established online platforms, dominant search engines, and persistent traditional offline advertising methods.

The competitive pressure is evident when considering Angi's market share. In the first quarter of 2025, Angi held approximately 40.23% of the services sector market. This figure highlights that while Angi is a significant player, a substantial portion of the market is held by other entities, with companies like Yelp Inc. being notable competitors.

- Fragmented Market: The home services industry is not dominated by a single entity, leading to a broad range of competitors.

- Diverse Competition: Angi faces rivals from online aggregators, search engines, and traditional local service providers.

- Market Share Dynamics: Angi's 40.23% market share in Q1 2025 indicates significant competition from players like Yelp Inc.

- Need for Differentiation: Maintaining and growing its position requires Angi to continuously innovate and distinguish itself.

Angi faces a significant challenge in attracting and retaining service professionals, with a notable 41% decrease in new professional acquisitions in Q1 2025 compared to the prior year. Some professionals perceive Angi's lead generation model as costly, with high fees and intense competition impacting their profitability. Lingering concerns about lead quality, stemming from past legal issues, also contribute to hesitancy among contractors to fully commit to the platform.

Same Document Delivered

Angi SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. This ensures you know exactly what you're getting—a professional and comprehensive assessment of Angi's market position.

Opportunities

Homeowner intent for home projects remains remarkably high, with 93% of homeowners planning to undertake projects in 2025. This strong underlying demand is a significant opportunity for Angi, even amidst economic headwinds.

This sustained interest, even with potentially tighter household budgets, translates into a substantial addressable market for Angi's diverse service offerings. The focus on essential maintenance and value-adding, long-term investments by homeowners directly aligns with Angi's core business.

The current economic climate, marked by elevated interest rates and a scarcity of available homes, is profoundly influencing homeowner decisions. A significant 67% of homeowners now lean towards renovating their existing properties instead of moving. This strong preference for staying put directly fuels investment in current residences, aligning perfectly with Angi's core business in home improvement and maintenance services.

Angi is strategically pivoting towards non-discretionary services like HVAC and plumbing to align with a housing market where homeowners are more inclined to stay put and prioritize essential repairs. This focus on critical maintenance and repair services offers a buffer against economic volatility, as these needs persist regardless of broader spending trends.

By emphasizing services such as plumbing and HVAC, Angi taps into a more stable demand. For instance, in 2023, home repair and maintenance spending remained robust, with a significant portion allocated to essential systems, indicating a resilient market for these offerings.

Leveraging AI and Technology for Enhanced Matching

Angi can significantly enhance its service by continuing to invest in artificial intelligence and advanced technology. This focus allows for a more sophisticated approach to matching homeowners with the right professionals, improving the overall quality of connections and user satisfaction.

AI's ability to analyze detailed job descriptions and homeowner needs more precisely translates into better-qualified leads for service professionals. This improved accuracy is projected to increase conversion rates, as professionals are connected with projects that better align with their skills and availability.

By leveraging this technological advantage, Angi can solidify its position as a market leader. This differentiation not only attracts new users but also fosters deeper engagement and loyalty among existing customers and service providers, driving sustained growth.

- Enhanced Matching Algorithms: AI can process vast datasets to identify nuanced patterns, leading to more accurate and personalized matches between homeowners and service professionals.

- Improved User Experience: Streamlined booking processes and better-informed service provider recommendations, powered by AI, can significantly boost user satisfaction.

- Increased Conversion Rates: By providing higher-quality leads, Angi can help professionals close more jobs, thereby increasing their satisfaction and willingness to use the platform.

Potential for Increased Revenue per Lead and Proprietary Lead Growth

Angi is strategically prioritizing the growth of its proprietary service requests and leads, a move that is already showing positive results. In the second quarter of 2025, the company reported a 7% increase in proprietary leads and a significant 16% jump in service requests originating from these owned channels. This focus on higher-quality, internally generated leads is a key opportunity for enhanced revenue generation.

Furthermore, Angi has demonstrated success in improving its monetization of each lead, achieving a 5% growth in revenue per lead. The company's stated aim is to continue this upward trajectory for revenue per lead starting in Q2 2025. This dual approach of increasing lead volume from proprietary sources and extracting more value from each lead positions Angi for substantial future revenue growth and improved profitability.

- Proprietary Lead Growth: Angi saw a 7% increase in proprietary leads in Q2 2025.

- Service Request Increase: Proprietary service requests grew by 16% in Q2 2025.

- Revenue Per Lead Improvement: Achieved 5% growth in revenue per lead, with plans for continued growth from Q2 2025.

- Strategic Focus: Prioritizing owned channels and enhanced lead monetization to drive future financial performance.

The persistent high demand for home projects, with 93% of homeowners planning work in 2025, presents a robust market for Angi. This trend is amplified by 67% of homeowners opting to renovate rather than move, a direct benefit to Angi's core services.

Angi's strategic shift towards essential services like HVAC and plumbing capitalizes on this homeowner preference for staying put and prioritizing repairs. This focus ensures a more stable revenue stream, as these needs are less discretionary.

Investing in AI for enhanced matching algorithms and user experience is a key opportunity, promising better lead quality and increased conversion rates for service professionals. This technological edge can solidify Angi's market leadership.

Angi's focus on proprietary leads is yielding strong results, with a 7% increase in proprietary leads and a 16% jump in service requests in Q2 2025. Coupled with a 5% growth in revenue per lead, this strategy is set to drive significant future revenue and profitability.

| Opportunity Area | Key Metric/Data Point | Impact |

|---|---|---|

| Sustained Home Project Demand | 93% of homeowners planning projects in 2025 | Large addressable market |

| Renovation vs. Moving Trend | 67% homeowners renovating instead of moving | Directly fuels home improvement services |

| Focus on Non-Discretionary Services | Increased demand for HVAC, plumbing | Provides revenue stability |

| AI & Technology Investment | Improved lead quality, user satisfaction | Enhances market position |

| Proprietary Lead Growth | 7% increase in proprietary leads (Q2 2025) | Higher quality, better monetization |

| Revenue Per Lead | 5% growth, aiming for continued increase | Drives profitability |

Threats

Persistent inflation and elevated interest rates are significantly squeezing homeowner budgets. This economic pressure is causing a notable slowdown in discretionary spending, with 71% of homeowners delaying planned home projects. By 2025, 62% of homeowners are also expressing concern about their ability to afford necessary home maintenance.

The overall market sentiment reflects these financial strains, evidenced by a 12% decline in home project spending during 2024. While essential services continue to see demand, this broad reduction in discretionary investment directly impacts companies like Angi, potentially limiting revenue growth opportunities.

The home services sector is notoriously fragmented and fiercely competitive. Angi contends with a broad spectrum of rivals, including major search engines, established online directories, and a growing number of specialized home service platforms, alongside traditional advertising channels. This crowded marketplace means Angi must constantly adapt to maintain its position.

The threat of new entrants and emerging platforms is significant, posing a risk of market share erosion. For instance, the rise of platforms focusing on niche services or offering different pricing models could draw away both consumers and service professionals. Angi's ability to fend off these challenges hinges on its strategic response to evolving market dynamics.

To navigate this intense competitive environment, Angi needs sustained investment in technological innovation and robust marketing campaigns. In 2023, the digital advertising spend for home services platforms continued to be substantial, with companies allocating significant budgets to user acquisition and brand visibility. Angi's commitment to enhancing its platform features and user experience is crucial for retaining both sides of its marketplace.

Angi's reputation is vulnerable to negative reviews and legal challenges. Lawsuits alleging issues with lead quality and review practices have already surfaced, potentially eroding trust among service providers. For instance, in early 2024, Angi continued to navigate ongoing scrutiny regarding its lead generation practices.

Customer dissatisfaction, particularly concerning unsolicited communications, presents another significant threat. Such experiences can quickly damage user trust and brand perception. This can lead to a decline in active users and hinder the platform's ability to attract new customers or service professionals.

The cumulative effect of negative publicity, whether from lawsuits or widespread customer complaints, can significantly deter both homeowners seeking services and professionals looking for work. This deterrent effect directly impacts user acquisition and retention, posing a substantial risk to Angi's overall business growth and market position.

Regulatory Challenges in International Markets

Angi's international expansion encounters significant hurdles due to evolving regulations, particularly in Europe, which can impact how it acquires and manages its network of professionals. For instance, changes in labor laws or contractor classifications in key European markets could necessitate costly operational adjustments.

Navigating the patchwork of diverse regulatory landscapes across various countries presents a substantial challenge, increasing both operational complexity and overall costs. This fragmentation demands tailored compliance strategies for each region, potentially slowing down market entry and growth.

These varied and often stringent regulations can directly hinder Angi's ability to scale its operations efficiently or even operate effectively in specific international markets. For example, differing data privacy laws, like GDPR, require robust compliance measures that add to the overhead of international business.

- European regulatory shifts impacting professional acquisition models.

- Increased operational complexity and costs due to diverse international compliance requirements.

- Potential limitations on market expansion and operational efficiency stemming from regulatory differences.

Reliance on Marketing Spend for Engagement

Angi's business model heavily depends on robust marketing expenditures to attract and retain users on its platform. This reliance, while effective in driving engagement, poses a threat if marketing efficiency declines or costs escalate. For instance, in Q1 2024, Angi reported marketing expenses of $147 million, a significant portion of its overall operating costs.

A continued high dependency on marketing spend directly impacts Angi's profitability. If customer acquisition costs (CAC) rise, or if marketing campaigns yield lower returns on investment, the company's bottom line could be squeezed. This is particularly concerning given the competitive landscape of home services platforms, where customer acquisition is a constant battle.

Any disruption to marketing effectiveness or an increase in acquisition costs could impede Angi's user growth and overall financial performance. For example, a shift in consumer behavior or the emergence of more cost-effective marketing channels for competitors could necessitate higher spending for Angi to maintain its market position. This could lead to reduced net income and potentially impact shareholder value.

- Marketing Dependency: Angi's strategy hinges on substantial marketing investment to drive platform engagement and acquire new customers.

- Profitability Risk: A sustained high level of marketing expenditure could negatively impact the company's profitability margins.

- Cost Escalation: Increases in advertising costs or a decrease in marketing campaign effectiveness directly threaten user growth and financial outcomes.

- Competitive Pressure: The need to outspend competitors for customer attention can create an ongoing financial strain.

Angi faces significant threats from a highly competitive market, where numerous players vie for consumer attention. The company must also contend with potential reputational damage from negative reviews or legal issues, which could erode trust among both users and service providers. Furthermore, navigating complex and varied international regulations poses a considerable challenge, potentially increasing operational costs and limiting expansion.

The company's reliance on substantial marketing expenditures to acquire customers presents a vulnerability; any increase in advertising costs or decrease in campaign effectiveness could directly impact profitability and growth. For instance, Angi's Q1 2024 marketing expenses reached $147 million, highlighting this dependency.

| Threat Category | Specific Threat | Impact on Angi | Supporting Data/Context |

|---|---|---|---|

| Market Competition | Fragmented and crowded home services sector | Market share erosion, pricing pressure | Numerous competitors including search engines, directories, and niche platforms. |

| Reputation & Trust | Negative reviews and legal challenges (e.g., lead quality, lead generation practices) | Erosion of trust, decreased user acquisition/retention | Ongoing scrutiny regarding lead generation practices in early 2024. |

| Regulatory Environment | Evolving and diverse international regulations (e.g., European labor laws, data privacy) | Increased operational complexity, higher costs, limited expansion | GDPR compliance adds overhead for international business; varying labor laws require tailored strategies. |

| Marketing Dependency | High reliance on marketing spend for user acquisition and engagement | Reduced profitability if costs rise or effectiveness declines | Q1 2024 marketing expenses: $147 million. Rising Customer Acquisition Costs (CAC) are a concern. |

SWOT Analysis Data Sources

This Angi SWOT analysis is built upon comprehensive data, drawing from Angi's official financial reports, extensive market research on the home services industry, and expert analyses of competitive landscapes and consumer behavior.