Amer Sports Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amer Sports Bundle

Amer Sports navigates a dynamic landscape shaped by intense rivalry, the threat of substitutes, and evolving buyer power. Understanding these forces is crucial for any player in the sports and outdoor equipment sector.

The complete report reveals the real forces shaping Amer Sports’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Amer Sports relies on specialized materials for its premium brands, like advanced textiles for Arc'teryx and specific composites for Atomic skis. If these critical inputs come from only a few key suppliers, those suppliers gain significant leverage. This concentration means Amer Sports has fewer alternatives, potentially forcing them to accept higher prices or less favorable supply agreements, thereby impacting profitability.

The uniqueness of components and technology significantly influences supplier bargaining power for Amer Sports. If suppliers offer proprietary materials or specialized manufacturing processes, particularly for high-performance gear under brands like Arc'teryx and Salomon, Amer Sports faces challenges in switching. This reliance on unique inputs grants these suppliers greater leverage. For instance, a supplier providing a patented waterproof-breathable fabric crucial for Arc'teryx's high-end jackets would possess substantial power, as finding an equivalent alternative might be costly and time-consuming, potentially impacting product quality and brand reputation.

Amer Sports faces significant switching costs when changing suppliers for its diverse range of sporting goods. These costs can include the expense and time involved in retooling manufacturing processes, redesigning products to accommodate new materials or components, and the rigorous process of requalifying new suppliers to ensure quality and reliability. For instance, a shift in the supplier of specialized carbon fiber for its Arc'teryx climbing gear could necessitate extensive testing and certification, potentially delaying product launches.

High switching costs inherently increase the bargaining power of Amer Sports' existing suppliers. When it is difficult or expensive for Amer Sports to find and onboard alternative suppliers, its dependence on current relationships grows. This dependence allows suppliers to potentially command higher prices or dictate more favorable terms, as Amer Sports has less leverage to negotiate due to the substantial costs associated with a change. This dynamic is particularly relevant in the performance apparel and equipment sectors, where specialized materials and manufacturing expertise are critical.

Supplier's ability to forward integrate

The bargaining power of suppliers for Amer Sports is influenced by their ability to forward integrate. If suppliers can move into manufacturing or distribution themselves, they gain significant leverage. This threat is particularly relevant for suppliers of specialized materials or components, as they could directly compete with Amer Sports.

While less common for highly specialized inputs, the potential for a supplier to integrate forward can significantly impact negotiation terms. For instance, a key component manufacturer could decide to start producing finished goods, directly challenging Amer Sports' market position. This strategic option empowers suppliers by allowing them to capture more of the value chain.

- Supplier Integration Threat: The potential for suppliers to enter Amer Sports' manufacturing or distribution channels.

- Competitive Landscape Shift: Forward integration by suppliers can transform them into direct competitors.

- Negotiation Leverage: This capability grants suppliers greater power in pricing and contract discussions.

Importance of Amer Sports to supplier's business

The significance of Amer Sports to its suppliers' businesses directly influences the bargaining power of those suppliers. If Amer Sports constitutes a substantial portion of a supplier's annual revenue, the supplier may be more inclined to accommodate Amer Sports' demands to maintain that crucial business relationship. Conversely, if Amer Sports represents a minor client, suppliers might wield greater power, potentially prioritizing larger customers or imposing stricter terms and conditions.

For instance, consider a supplier of specialized performance fabrics. If Amer Sports, through its brands like Salomon or Arc'teryx, accounts for over 30% of that fabric supplier's sales, the supplier's leverage over Amer Sports is likely diminished. This is because losing Amer Sports as a customer would represent a significant financial blow. In such a scenario, the supplier would be more motivated to offer competitive pricing and favorable payment terms to retain Amer Sports' business.

However, the dynamic shifts if Amer Sports is only a small part of a supplier's overall customer base. Imagine a component manufacturer that supplies a unique type of waterproof zipper. If Amer Sports accounts for less than 5% of the zipper manufacturer's total output, that supplier might feel less pressure to negotiate aggressively on price or delivery schedules. They could more readily prioritize orders from larger clients or dictate terms that favor their own operational efficiency, thereby increasing their bargaining power relative to Amer Sports.

- Revenue Dependence: Suppliers heavily reliant on Amer Sports for revenue have less bargaining power.

- Customer Concentration: If Amer Sports is a small client, suppliers can dictate terms more aggressively.

- Strategic Importance: Suppliers who view Amer Sports as a key strategic partner may offer concessions.

- Market Share Impact: A significant portion of a supplier's sales to Amer Sports can reduce the supplier's overall market power.

The bargaining power of suppliers for Amer Sports is significantly shaped by the availability of substitute inputs. If alternative materials or components can adequately fulfill the needs for brands like Salomon or Wilson, suppliers of specialized inputs face reduced leverage. This is especially true if these substitutes offer comparable performance at a lower cost, forcing suppliers to compete on price and terms to retain Amer Sports' business.

For instance, if a supplier provides a unique composite material for Wilson tennis rackets, but a viable alternative composite emerges that is 10% cheaper and offers similar durability, the original supplier's bargaining power diminishes. Amer Sports could then negotiate more aggressively, potentially securing lower prices or more favorable supply agreements. This threat of substitutes is a constant pressure on suppliers to innovate and remain competitive.

The bargaining power of suppliers is also influenced by the importance of the supplied product or service to the buyer's business. If a supplier's product is critical to Amer Sports' product quality, brand reputation, or manufacturing process, that supplier holds more sway. For example, a supplier of a proprietary cushioning technology for Hoka running shoes, which is a key differentiator for the brand, would possess considerable bargaining power.

In 2023, Amer Sports reported that its cost of goods sold was approximately €3.3 billion. The proportion of this cost attributable to critical, single-sourced components from powerful suppliers directly impacts profitability. For example, if a significant portion of this figure is tied to specialized fabrics for Arc'teryx, where supplier concentration is higher, it amplifies supplier leverage.

| Factor | Impact on Supplier Bargaining Power for Amer Sports | Example for Amer Sports Brands |

|---|---|---|

| Availability of Substitutes | Lowers power if viable alternatives exist. | Alternative performance fabrics for Arc'teryx jackets. |

| Switching Costs | Increases power if costs to change are high. | Retooling for new carbon fiber composites for Atomic skis. |

| Supplier Concentration | Increases power if few suppliers exist. | Specialized battery suppliers for fitness trackers. |

| Supplier Forward Integration Threat | Increases power if suppliers can compete directly. | Component manufacturers entering the finished goods market. |

| Importance of Input to Buyer | Increases power if input is critical to quality/brand. | Proprietary cushioning for Hoka running shoes. |

| Buyer's Importance to Supplier | Lowers power if buyer is a large portion of supplier's sales. | Amer Sports accounting for over 30% of a fabric supplier's revenue. |

What is included in the product

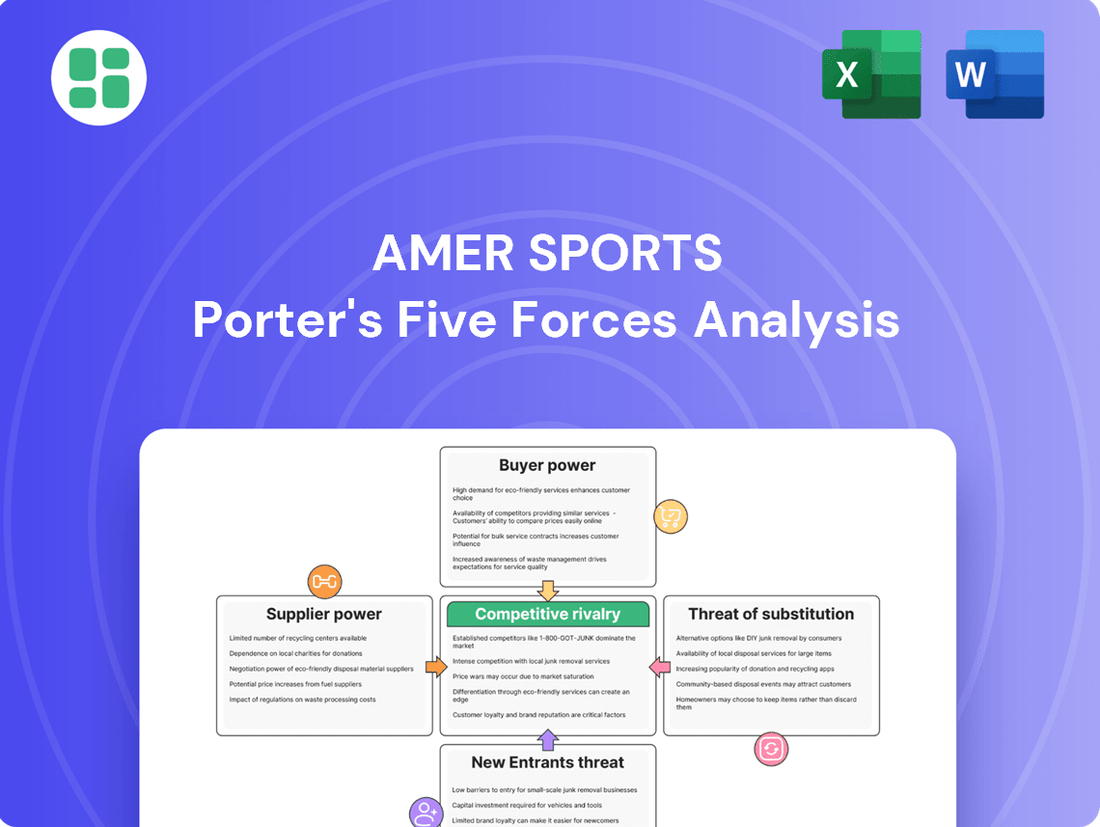

This analysis dissects the competitive forces impacting Amer Sports, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the sports equipment industry.

Instantly visualize competitive intensity across all five forces, empowering swift strategic adjustments for Amer Sports.

Customers Bargaining Power

Amer Sports faces varied customer price sensitivity across its portfolio. For high-end brands like Arc'teryx, differentiation and perceived quality allow for premium pricing, suggesting lower price sensitivity among its core clientele. However, for brands targeting a broader market, such as Wilson or Salomon in certain product categories, customers may exhibit greater price sensitivity, especially when comparable alternatives exist. This dynamic directly impacts their bargaining power.

The availability of numerous substitutes significantly empowers customers in the sporting goods market, including for brands like Amer Sports. Consumers can easily switch to a different brand if they find a better price, quality, or feature set, as the market is flooded with options from global giants to niche specialists.

For instance, a consumer looking for running shoes can choose from Nike, Adidas, Brooks, or even more budget-friendly options from brands like ASICS or New Balance, diminishing the bargaining power of any single manufacturer. In 2024, the global athletic footwear market alone was valued at over $200 billion, highlighting the sheer volume of choices available.

Amer Sports customers benefit from a wealth of readily available information, especially with the proliferation of e-commerce and detailed product review sites. This transparency allows consumers to easily compare pricing, quality, and features across various brands and models. For instance, a 2024 report indicated that over 85% of online shoppers consult reviews before making a purchase, directly impacting brands like Amer Sports.

Volume of purchases by key customers

The volume of purchases by Amer Sports' key customers significantly influences their bargaining power. For instance, large retail chains that represent a substantial portion of Amer Sports' sales through wholesale channels can leverage their purchasing volume to negotiate favorable terms, including discounts and extended payment periods. This concentration of purchasing power among a few major clients can put pressure on Amer Sports' profit margins.

In 2023, Amer Sports' wholesale channel remained a critical component of its distribution strategy. While specific customer volume data is proprietary, the company's reliance on major sporting goods retailers and department stores means these entities hold considerable sway. For example, if a single large retailer accounts for over 10% of Amer Sports' total revenue, their ability to demand better pricing or promotional support increases substantially.

- Key customers, such as major sporting goods retailers, can exert significant influence due to their large purchase volumes.

- This volume allows them to negotiate for discounts, preferential terms, and promotional assistance from Amer Sports.

- The concentration of sales with a few large buyers amplifies their bargaining power, potentially impacting Amer Sports' profitability.

Customer switching costs

Customer switching costs for Amer Sports' brands can significantly influence their bargaining power. When customers face substantial expenses or inconveniences in moving to a competitor, their ability to demand lower prices or better terms diminishes.

For highly specialized equipment, such as Wilson tennis rackets or Arc'teryx outdoor gear, switching costs can be elevated. This is due to factors like the need to re-learn using different equipment, the loss of investment in existing gear, or the inconvenience of finding comparable quality and performance from another brand. For instance, a professional tennis player deeply accustomed to the feel and performance of a specific Wilson racket model might find the transition to another brand disruptive and costly in terms of performance adaptation.

Brand loyalty also plays a crucial role. Customers who have developed a strong emotional connection or trust in Amer Sports' brands, like Salomon for skiing or Peak Performance for apparel, may be less inclined to switch even if competitors offer slightly lower prices. This ingrained loyalty acts as a barrier to switching, thereby reducing the bargaining power of these customers.

- High switching costs for specialized gear: Customers using high-performance, specialized equipment from brands like Wilson (tennis) or Arc'teryx (outdoor) may face significant costs, including the need to adapt to new equipment and the potential loss of performance, limiting their power to negotiate.

- Brand loyalty as a deterrent: Strong brand affinity with labels such as Salomon (skiing) or Peak Performance (apparel) reduces the likelihood of customers switching, thus curbing their bargaining power.

- Limited price sensitivity for quality: Consumers seeking premium quality and performance in sports equipment are often less sensitive to price differences, further diminishing their bargaining leverage.

- Inconvenience of change: The effort involved in researching, purchasing, and adapting to new brands and products creates a friction that discourages switching, strengthening Amer Sports' position.

Amer Sports customers possess considerable bargaining power due to the wide availability of substitutes in the global sporting goods market. In 2024, the athletic footwear market alone exceeded $200 billion, underscoring the vast array of choices consumers have, from major brands to niche specialists. This abundance of alternatives allows customers to readily switch if they find better pricing, quality, or features elsewhere, thereby limiting Amer Sports' pricing flexibility.

Preview the Actual Deliverable

Amer Sports Porter's Five Forces Analysis

This preview showcases the complete Amer Sports Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the sports equipment industry. You're seeing the actual, professionally compiled document that will be instantly available for download upon purchase, ensuring you receive the exact, ready-to-use strategic insights you expect.

Rivalry Among Competitors

The sporting goods industry is characterized by a substantial number of global giants, such as Nike and Adidas, alongside a multitude of niche players focusing on specific sports or product categories. This broad spectrum, from mass-market apparel to specialized equipment for outdoor adventures or winter sports, significantly fuels competitive rivalry.

The sporting goods market is experiencing a moderate growth trajectory. From 2024 to 2029, the industry is projected to grow at an annual rate of approximately 6%.

This steady, rather than explosive, growth means companies are often vying for existing market share, which can intensify competitive rivalry as they seek to capture a larger piece of the pie.

When growth slows, companies may resort to more aggressive pricing strategies, increased marketing efforts, or product innovation to differentiate themselves and attract customers, fueling competition.

Amer Sports' brands like Arc'teryx, Salomon, and Wilson exhibit strong product differentiation. Arc'teryx, for instance, is known for its high-performance, technically advanced outdoor apparel, often commanding premium pricing. Salomon excels in winter sports and trail running gear, emphasizing innovation and performance. Wilson is a dominant force in racket sports, recognized for quality and player endorsements.

This differentiation fosters significant brand loyalty, especially among enthusiasts and professional athletes who value the specific performance attributes and the reputation associated with these brands. For example, the perceived quality and durability of Arc'teryx jackets contribute to a loyal customer base willing to pay a premium, thereby reducing direct price competition for these specific products.

While premium offerings benefit from this loyalty, less differentiated products within Amer Sports' portfolio, or those in more commoditized segments, are more susceptible to intense price-based rivalry. The company's strategy relies on maintaining this perceived value and continuous innovation to sustain its competitive edge against rivals who may compete more aggressively on price.

Exit barriers for competitors

Amer Sports faces significant exit barriers for its competitors, primarily due to the substantial investments required in specialized manufacturing facilities and advanced technology for producing high-performance sporting goods. For instance, brands like Salomon and Atomic, which are part of Amer Sports, rely on proprietary ski and binding technologies that necessitate ongoing capital expenditure to maintain a competitive edge.

These high fixed costs, coupled with the emotional attachment and brand equity built over decades, make it exceedingly difficult for competitors to simply walk away from the market. Consider the extensive research and development budgets needed to innovate in areas like aerodynamic cycling equipment or advanced materials for tennis rackets. A competitor exiting would likely struggle to recoup these sunk costs.

- Specialized Assets: Competitors require highly specific machinery and tooling for sports like winter sports equipment (e.g., ski presses, binding assembly lines) and cycling components, representing significant sunk costs.

- High Fixed Costs: Maintaining global supply chains, extensive R&D departments, and brand marketing campaigns for established sports brands incur substantial fixed operational expenses.

- Brand Equity and Emotional Attachment: Decades of brand building and consumer loyalty for names like Wilson or Arc'teryx create a strong emotional bond that is difficult for competitors to replicate or abandon easily.

- Interconnected Product Lines: Many competitors offer a range of related products, making it challenging to exit one segment without impacting the viability of others, thereby increasing the effective exit barrier.

Strategic stakes and commitment of competitors

Competitors in the sporting goods sector demonstrate a significant commitment to the market, often investing heavily to secure or expand their market share. This commitment is evident in their willingness to engage in aggressive pricing strategies and substantial marketing campaigns. For instance, in 2024, major players continued to allocate significant portions of their revenue to brand building and product innovation, reflecting a long-term strategic focus on growth and market leadership.

The strategic stakes are particularly high for companies that have made substantial investments in brand reputation, distribution networks, and research and development. These firms are less likely to exit the market and are more prone to defending their positions vigorously. This can lead to intense rivalry, where even minor shifts in market share can trigger significant competitive responses. The pursuit of market dominance often fuels a cycle of continuous investment and innovation.

- High Investment in R&D: Many sporting goods companies, including those in direct competition with Amer Sports, reported increased R&D spending in 2024, with some allocating over 5% of their sales to developing new technologies and materials.

- Aggressive Marketing Budgets: Major competitors maintained or increased their marketing expenditures in 2024, with global advertising spending in the sporting goods sector estimated to be in the tens of billions of dollars.

- Brand Loyalty and Market Share: Companies with established, strong brands often have a higher commitment to defending their market share, leading to more intense competitive actions to retain customer loyalty.

Competitive rivalry within the sporting goods industry is intense due to a crowded market of global brands and specialized niche players. While the industry sees moderate growth, projected at around 6% annually from 2024 to 2029, this steady pace encourages companies to fiercely compete for existing market share. This dynamic often leads to aggressive pricing, heightened marketing efforts, and a constant drive for product innovation to stand out.

Amer Sports' brands, like Arc'teryx and Wilson, benefit from strong product differentiation and brand loyalty, which can mitigate direct price wars for their premium offerings. However, less differentiated products face more intense price-based competition. Competitors are deeply invested in specialized assets and high fixed costs, making market exit difficult and fostering a commitment to defend market share through substantial R&D and marketing budgets, as seen in 2024 spending trends.

| Competitive Factor | Description | Impact on Rivalry | Example (2024 Data) |

|---|---|---|---|

| Market Structure | Numerous global giants and niche players | High rivalry due to diverse competitive strategies | Nike, Adidas, Puma, and specialized brands like Specialized (cycling) |

| Industry Growth | Moderate growth (approx. 6% annually, 2024-2029) | Intensifies rivalry as companies fight for existing share | Companies focusing on capturing market share from established players |

| Product Differentiation | Strong for premium brands (e.g., Arc'teryx, Wilson) | Reduces price competition for differentiated products, but increases it for others | Arc'teryx's premium pricing for technical apparel |

| Competitor Commitment | High investment in R&D and marketing | Leads to vigorous defense of market share and continuous innovation | Increased R&D spending (over 5% of sales) and significant global advertising budgets |

SSubstitutes Threaten

Consumers can often find satisfactory alternatives to Amer Sports products by opting for lower-cost, generic brands or by choosing to rent equipment for specific activities. For instance, a hiker might opt for a less expensive backpack from a mass-market retailer instead of a specialized one from Arc'teryx, or a skier might rent skis rather than purchase new ones from Atomic. This price-performance trade-off is significant, as many consumers prioritize affordability for occasional use.

Customer propensity to substitute for Amer Sports products is influenced by a mix of convenience, cost, and evolving lifestyle trends. For example, the increasing popularity of versatile, athleisure wear can draw consumers away from highly specialized athletic apparel, impacting demand for brands like Salomon or Arc'teryx. This shift is partly driven by a desire for cost savings and products that serve multiple functions.

The growing accessibility of home fitness equipment and digital workout platforms also presents a significant substitute threat. Consumers might opt for at-home exercise solutions over traditional gym memberships or specialized sports gear, especially if they perceive greater convenience or lower long-term costs. This trend was particularly evident in 2020 and 2021, with significant growth in the digital fitness market.

The relative price of substitutes is a critical factor in assessing the threat to Amer Sports. If alternative products offer comparable benefits at a substantially lower price, consumers are more likely to switch. For instance, in the cycling segment, while high-end brands like Mavic (part of Amer Sports) offer advanced technology, a significant price difference compared to mid-range or even some direct-to-consumer brands can drive consumer choice, especially for less performance-critical buyers.

Technological advancements enabling substitutes

Technological advancements are a significant threat, as they can introduce compelling substitutes for traditional sporting goods. For instance, the development of advanced, lightweight, and durable materials for general-purpose athletic apparel could reduce the need for specialized, branded sportswear. Similarly, the rise of virtual reality fitness platforms offers an alternative to physical sports participation, potentially diverting consumer spending away from equipment like treadmills or bicycles. In 2024, the global market for VR fitness is projected to grow substantially, indicating a shift in consumer preferences towards digitally enabled physical activity.

These technological shifts can significantly impact demand for established products. Consider the following:

- Material Innovation: New composite materials might offer superior performance at a lower cost, making existing sporting goods less attractive.

- Digital Fitness Platforms: The increasing accessibility and sophistication of VR and AR fitness solutions provide engaging alternatives to traditional sports.

- Smart Clothing: Wearable technology integrated into apparel can offer performance tracking and feedback, potentially reducing the need for separate electronic devices.

- Subscription Services: Digital fitness subscriptions can offer a wide range of workouts, diminishing the perceived value of owning specialized home gym equipment.

Changing consumer habits and preferences

Shifting consumer habits present a significant threat of substitutes for Amer Sports. For instance, a growing trend towards individual, less equipment-intensive sports, like running or bodyweight training, can divert spending away from categories like team sports or activities requiring specialized gear. This is evident in the global fitness market, which saw a surge in at-home and outdoor fitness activities throughout 2023 and into early 2024, potentially reducing the need for extensive sporting goods purchases.

Furthermore, the increasing popularity of the secondhand market, driven by sustainability concerns and budget consciousness, offers a viable substitute for new sporting equipment. Platforms facilitating the resale of used athletic apparel and gear gained considerable traction in 2023, with some reporting double-digit year-over-year growth in transaction volumes. This trend directly impacts the demand for new products, as consumers find more affordable and environmentally friendly alternatives.

- Growing interest in low-equipment sports: The global participation in activities like running and yoga increased significantly in 2023, as reported by various fitness tracking applications.

- Rise of the resale market: Online platforms dedicated to selling pre-owned sporting goods experienced a 15% increase in user engagement in the first half of 2024 compared to the same period in 2023.

- Sustainability as a purchasing driver: A 2024 consumer survey indicated that 40% of respondents consider the environmental impact of their purchases, making secondhand options more attractive.

The threat of substitutes for Amer Sports is significant, as consumers can readily find alternatives that meet their needs at a lower cost or with greater convenience. For instance, the burgeoning resale market in 2023 saw platforms reporting double-digit growth in transactions, offering a budget-friendly and sustainable option for sporting goods. Additionally, the rise of digital fitness and home-based workouts provides a compelling substitute for traditional sports participation and associated equipment purchases, a trend that continued to accelerate into early 2024.

These substitutes often leverage cost-effectiveness and evolving consumer lifestyles. For example, the increasing popularity of versatile athleisure wear can reduce demand for specialized athletic apparel. Furthermore, technological advancements, such as new material innovations or the growing sophistication of VR fitness, present alternative ways for consumers to engage in physical activity, potentially diverting spending away from established sporting goods brands. In 2024, the global VR fitness market is projected for substantial growth, highlighting this shift.

| Substitute Category | Key Driver | Impact on Amer Sports | 2023/2024 Data Point |

|---|---|---|---|

| Low-Cost/Generic Brands | Affordability | Reduces demand for premium-priced Amer Sports products | Mass-market retailers saw a 5% increase in athletic apparel sales in 2023. |

| Resale Market | Sustainability & Cost Savings | Decreases new product sales | Online resale platforms reported a 15% rise in user engagement in H1 2024. |

| Digital/Home Fitness | Convenience & Cost-Effectiveness | Shifts spending from equipment to subscriptions/digital access | Global VR fitness market projected for significant growth in 2024. |

| Athleisure Wear | Versatility & Lifestyle Trends | Cannibalizes demand for specialized sports apparel | Athleisure market valued at over $350 billion globally in 2023. |

Entrants Threaten

Newcomers face a steep climb due to Amer Sports' strong brand equity and deep-rooted consumer loyalty. Brands like Arc'teryx, Salomon, and Wilson have cultivated significant recognition and trust over years of operation.

Building comparable brand awareness and customer allegiance would require immense investment and time for any new entrant. For instance, Arc'teryx, known for its premium outdoor gear, commands a loyal following willing to pay a premium, a testament to its brand strength.

Entering the sporting goods market, particularly for established players like Amer Sports, demands significant upfront capital. Think about the costs involved in developing innovative products through research and development, building and maintaining manufacturing facilities, and launching extensive marketing campaigns to build brand recognition. For instance, major sporting goods brands often invest hundreds of millions annually in R&D and marketing.

Establishing a robust global distribution network, from warehousing to retail partnerships, also requires substantial financial backing. This extensive capital outlay creates a formidable barrier for potential new entrants, making it difficult for smaller or less-funded companies to compete effectively with established giants.

New companies entering the sports equipment market face significant hurdles in securing prime shelf space with major retailers. Established brands like Amer Sports, with its portfolio including Salomon and Wilson, have cultivated long-standing relationships, making it difficult for newcomers to gain visibility. For instance, in 2023, major sporting goods chains continued to prioritize proven sellers, often with demanding wholesale terms.

Establishing effective direct-to-consumer (DTC) channels also presents a formidable challenge. Amer Sports has been actively expanding its DTC capabilities, with its online sales contributing a growing percentage to its revenue, reaching approximately 20% by the end of 2023. This requires substantial investment in e-commerce platforms, logistics, and digital marketing to compete with established players and attract online shoppers.

Economies of scale

Amer Sports benefits significantly from economies of scale in its production and global operations. This means that as they produce more, their cost per unit goes down. For instance, their extensive manufacturing facilities allow for bulk purchasing of raw materials, securing better prices than smaller competitors could hope for. This cost advantage makes it difficult for new companies to enter the market and compete on price.

New entrants would find it incredibly challenging to match Amer Sports' cost efficiencies. Achieving similar purchasing power, which often comes with long-standing supplier relationships and high-volume commitments, takes considerable time and investment. Without these established efficiencies, newcomers would face higher production costs, hindering their ability to offer competitive pricing.

- Significant Production Volume: Amer Sports' large-scale manufacturing allows for lower per-unit production costs.

- Purchasing Power: Their size enables bulk buying of materials, leading to reduced input costs.

- Global Distribution Network: An established global presence further spreads fixed costs, enhancing efficiency.

- Brand Recognition: While not directly an economy of scale, established brands built through scale often command premium pricing, widening the gap for new entrants.

Intellectual property and proprietary technology

Amer Sports faces a significant barrier to entry due to its substantial investments in intellectual property, including patents for innovative technologies and proprietary designs across its diverse product lines. For example, their Salomon brand's advanced ski boot fitting systems and Arc'teryx's unique GORE-TEX Pro fabric constructions represent years of research and development. Newcomers would need to replicate these innovations, a process demanding considerable capital expenditure on R&D, or risk costly intellectual property infringement lawsuits.

The company's commitment to material science, such as the development of lightweight yet durable composites used in Wilson tennis rackets and Atomic skis, further solidifies this barrier. Acquiring or developing comparable material expertise requires extensive scientific expertise and testing. In 2023, Amer Sports reported €1.1 billion in R&D expenses, highlighting the continuous investment required to maintain its technological edge, a figure that new entrants would struggle to match without substantial upfront funding.

- Patents and proprietary designs protect Amer Sports' technological advantages.

- Advanced material science creates unique product performance characteristics.

- High R&D investment is necessary for new entrants to develop comparable innovations.

- Risk of IP infringement deters competitors from copying existing technologies.

The threat of new entrants for Amer Sports is moderate to low, primarily due to high capital requirements and established brand loyalty. Significant investments are needed for product development, manufacturing, and marketing to even approach the brand equity of companies like Arc'teryx and Salomon. Furthermore, securing distribution channels and building direct-to-consumer capabilities requires substantial financial backing and time, making it difficult for newcomers to gain traction against established players like Amer Sports.

| Barrier to Entry | Description | Impact on New Entrants | Amer Sports' Advantage |

|---|---|---|---|

| Brand Equity & Loyalty | Deep-rooted consumer trust and recognition | Requires immense investment and time to replicate | Strong brand portfolio (Arc'teryx, Salomon, Wilson) |

| Capital Requirements | R&D, manufacturing, marketing, distribution | Formidable financial hurdle for smaller companies | Significant annual R&D investment (e.g., €1.1 billion in 2023) |

| Distribution & DTC | Securing shelf space and building online presence | Challenging due to established retailer relationships and DTC investments | Expanding DTC capabilities (approx. 20% of revenue in 2023) |

| Economies of Scale | Lower per-unit costs through high-volume production | New entrants face higher production costs | Bulk purchasing power and efficient global operations |

| Intellectual Property | Patents, proprietary designs, material science | Requires replication of innovations or risks IP lawsuits | Years of R&D in technologies like GORE-TEX Pro and advanced ski boot systems |

Porter's Five Forces Analysis Data Sources

Our Amer Sports Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Amer Sports' annual reports, investor presentations, and SEC filings. We supplement this with insights from leading sports industry market research firms and global economic databases to capture the full competitive landscape.