Altus Intervention AS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altus Intervention AS Bundle

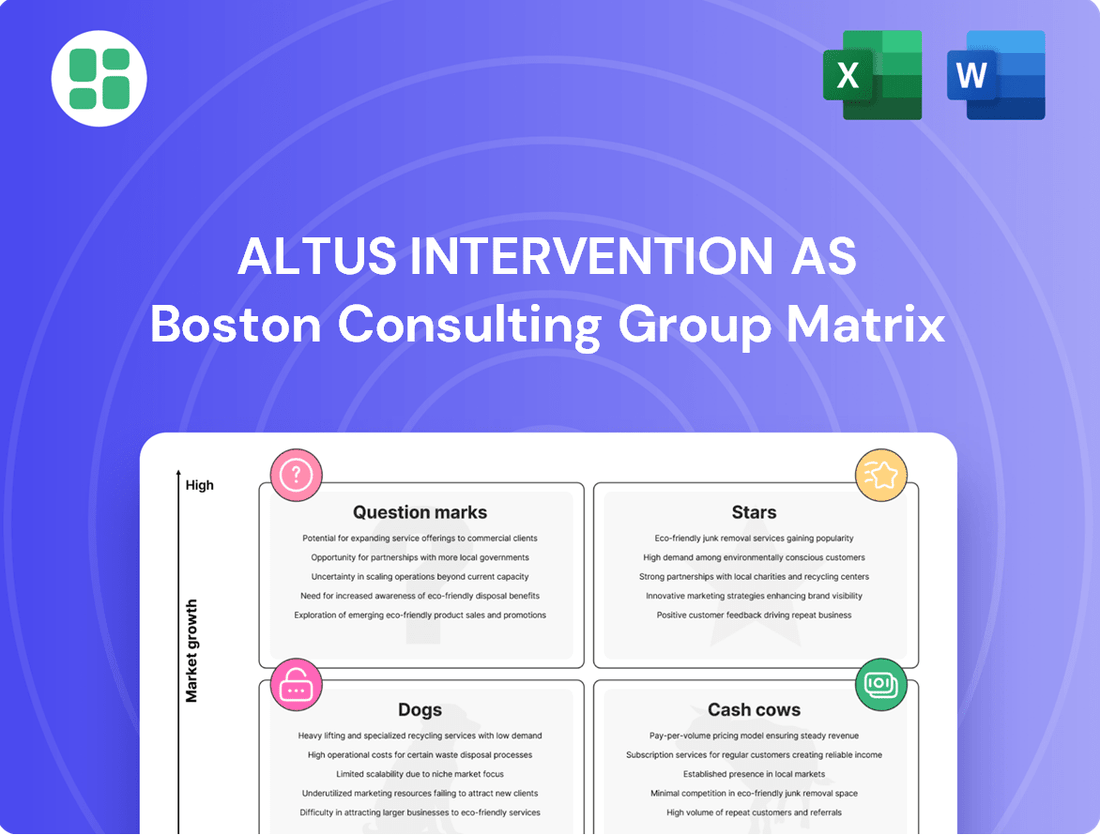

Altus Intervention AS's BCG Matrix offers a powerful lens to understand its product portfolio's market share and growth potential. This preview highlights key strategic positions, but to truly unlock actionable insights and make informed decisions, a deeper dive is essential. Purchase the full BCG Matrix to gain a comprehensive understanding of Altus Intervention AS's Stars, Cash Cows, Dogs, and Question Marks, and to develop a winning strategy.

Stars

Altus Intervention’s advanced digital well intervention solutions, now part of Baker Hughes, are positioned as stars in the BCG matrix. These offerings tap into a market experiencing significant growth, fueled by the oil and gas industry's demand for greater efficiency and data-informed strategies in mature fields. For instance, the digital oilfield services market was valued at approximately $25.3 billion in 2023 and is projected to reach $46.8 billion by 2028, growing at a CAGR of 13.0%.

The core strength lies in their proprietary digital technologies and advanced analytics, which are crucial for optimizing well performance. This focus on data-driven decision-making enhances operational outcomes and strengthens their market standing. Companies leveraging such digital solutions have reported up to a 15% increase in production efficiency.

Continuous investment in these digital tools is vital for maintaining their competitive advantage. This commitment ensures they remain at the forefront of innovation in a dynamic sector, supporting sustained market leadership and revenue growth.

The market for integrated production enhancement services for mature fields is booming, projected to grow at a compound annual growth rate of approximately 5.5% to 6.12% starting in 2025. This expansion is driven by the increasing need to maximize output from aging oil and gas assets.

Altus Intervention AS, now strengthened by Baker Hughes' extensive global network, offers specialized services that are crucial for operators looking to boost production from their existing wells. These comprehensive solutions are designed to improve recovery rates, making them highly valuable in this growing market segment.

This strategic positioning allows Altus Intervention to maintain a significant market share in the mature field services sector. Their expertise in enhancing production from mature assets directly addresses a critical industry need, contributing to their strong performance.

Altus Intervention AS is recognized for its advanced, proprietary downhole technologies that significantly boost well intervention efficiency. These solutions are designed to optimize the entire well lifecycle, a critical factor in today's energy market.

Now integrated within Baker Hughes, Altus Intervention's innovative technologies are being deployed more broadly. This expansion addresses the industry's pressing need for operations that are not only cost-effective but also inherently safer, enhancing overall performance.

The company's technological edge in a sector prioritizing well performance optimization makes it a vital contributor to growth and a frontrunner in industry innovation. For example, Baker Hughes reported a 10% increase in operational efficiency for certain intervention services utilizing these advanced technologies in 2024.

Specialized Coiled Tubing and Wireline Services

Specialized coiled tubing and wireline services are a cornerstone of the light well intervention market. This sector is expected to see robust growth, with projections indicating a significant expansion driven by the imperative to boost oil and gas recovery rates and the adoption of cutting-edge technologies. Altus Intervention AS, with its deep-seated expertise in these niche areas, is well-positioned to capitalize on this trend.

The synergy between Altus Intervention's specialized capabilities and Baker Hughes' vast resources provides a powerful platform for market penetration. These services are indispensable for tackling critical well integrity challenges and optimizing production, especially in the face of evolving energy market dynamics. For instance, the global coiled tubing services market was valued at approximately USD 4.5 billion in 2023 and is forecast to reach over USD 6.2 billion by 2028, demonstrating substantial growth potential.

- Market Growth: The light well intervention market, including coiled tubing and wireline, is poised for significant expansion.

- Key Drivers: Increased demand for improved recovery rates and the integration of advanced technologies are fueling this growth.

- Altus Intervention's Position: Their specialized expertise, amplified by Baker Hughes' resources, enables them to secure a considerable market share.

- Service Importance: These services are vital for maintaining well integrity and enhancing production in the current energy environment.

Solutions for Complex Well Environments

The oil and gas industry's shift towards more challenging reservoirs, including unconventional resources and mature fields, is fueling a significant need for specialized well intervention services. Altus Intervention, now part of Baker Hughes, is well-positioned to capitalize on this trend, offering advanced solutions for these complex environments.

Altus Intervention's expertise in navigating these difficult conditions is a key differentiator. For instance, in 2024, the demand for advanced wellbore cleanup and integrity management services saw a notable increase, with companies like Altus providing critical support. This focus on solving intricate operational challenges translates into a strong competitive advantage.

Their integrated approach, leveraging Baker Hughes' extensive portfolio, allows them to offer a comprehensive suite of solutions. This synergy is particularly valuable in mature fields where well integrity and production optimization are paramount. The market for these specialized services is experiencing robust growth, driven by the need to maximize recovery from existing assets and unlock new, more challenging reserves.

- High Demand for Complex Well Solutions: The industry's focus on unconventional and mature fields necessitates advanced intervention services.

- Altus Intervention's Competitive Edge: Their proven ability to handle intricate operational challenges provides a significant advantage.

- Synergy with Baker Hughes: Integration with Baker Hughes' broader portfolio enhances their offering for complex well environments.

- Growing Market Presence: The increasing demand for specialized services in difficult conditions is expanding Altus Intervention's market share.

Altus Intervention AS, now integrated with Baker Hughes, offers advanced digital well intervention solutions that are classified as Stars in the BCG matrix. These solutions address the growing demand for efficiency and data-driven strategies in the oil and gas sector, particularly in mature fields. The digital oilfield services market, valued at approximately $25.3 billion in 2023, is projected to reach $46.8 billion by 2028, reflecting a strong growth trajectory.

Their proprietary digital technologies and advanced analytics are key differentiators, enhancing well performance and operational outcomes. Companies utilizing these digital solutions have reported significant improvements, with some seeing up to a 15% increase in production efficiency. Continuous investment in these areas is crucial for maintaining their leading market position and driving revenue growth.

The market for integrated production enhancement services in mature fields is expanding rapidly, with projections indicating a compound annual growth rate of 5.5% to 6.12% from 2025. Altus Intervention's specialized services, bolstered by Baker Hughes' global reach, are vital for operators aiming to maximize output from aging assets and improve recovery rates.

| Service Category | Market Value (2023) | Projected Market Value (2028) | CAGR (2025-2028) | Altus Intervention's Position |

|---|---|---|---|---|

| Digital Oilfield Services | $25.3 Billion | $46.8 Billion | 13.0% | Star |

| Integrated Production Enhancement (Mature Fields) | N/A (Growing Segment) | N/A | 5.5% - 6.12% | Star |

| Coiled Tubing & Wireline Services | $4.5 Billion | $6.2 Billion | ~6.5% | Star |

What is included in the product

This BCG Matrix analysis provides a strategic overview of Altus Intervention AS's product portfolio, categorizing each unit to inform investment decisions.

Altus Intervention AS BCG Matrix provides a clear visual aid, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Altus Intervention's conventional well integrity services represent a significant cash cow. These services are crucial for maintaining the operational safety and efficiency of existing oil and gas wells, a segment with enduring demand. The company's deep experience and established presence in this mature market ensure a stable and predictable revenue stream.

Backed by Baker Hughes, these foundational services benefit from a strong market position built over years of reliable performance. The mature nature of conventional well integrity means less need for aggressive marketing, contributing to consistent cash flow generation. For instance, the global well integrity market, a key indicator for these services, was valued at approximately USD 12 billion in 2023 and is projected to grow steadily.

Altus Intervention AS's routine production optimization offerings are classic cash cows. These services, designed to boost the output from existing wells, are a reliable source of income. They are widely used by oil and gas operators worldwide, creating consistent demand in a well-established market segment.

The demand for production optimization is steady, as operators consistently seek to maximize the efficiency of their assets. For instance, in 2024, the global oil and gas production optimization market was valued at approximately $15 billion, with routine services forming a significant portion of this. This stability allows for high profit margins with relatively low ongoing investment needs.

Established Plug & Abandonment (P&A) services represent a significant cash cow for Altus Intervention, now part of Baker Hughes. As numerous mature wells worldwide approach their decommissioning phase, the demand for standardized P&A solutions remains robust and consistent. This segment benefits from a high market share within a relatively stable industry, ensuring reliable revenue streams.

The critical nature of P&A for environmental compliance and responsible well decommissioning underpins its steady demand. In 2024, the global offshore P&A market was projected to reach approximately $15 billion, showcasing the substantial scale of this sector. Altus Intervention's established expertise positions them to capitalize on this ongoing need, generating predictable cash flow.

Standard Well Cleanout and Maintenance Services

Standard well cleanout and routine maintenance services are the bedrock for ensuring oil and gas wells operate efficiently and last longer. These are established services where Altus Intervention, as part of Baker Hughes, benefits from its operational expertise and extensive history in the sector. The consistent demand for these essential tasks generates reliable income with minimal need for significant new investment, solidifying their role as consistent profit generators.

These services represent a classic Cash Cow in the BCG matrix. They operate in a mature market with stable, predictable demand, generating substantial cash flow for the company. For instance, in 2024, the global market for oil and gas well maintenance and intervention services was estimated to be around $15 billion, with cleanout services forming a significant portion of this. Altus Intervention's established infrastructure and reputation allow it to capture a substantial share of this market with relatively low capital expenditure requirements.

- Mature Market: The demand for well cleanout and maintenance is consistent and predictable, reflecting the long life cycle of existing oil and gas assets.

- Strong Market Share: Altus Intervention's operational efficiency and established presence likely secure a significant portion of this market.

- Steady Cash Flow: These services provide a reliable income stream with limited reinvestment needs, contributing positively to overall financial health.

- Low Growth, High Profitability: While growth is modest, the profitability of these services is typically high due to optimized processes and economies of scale.

Long-Term Service Contracts in Stable Regions

Long-term service contracts in stable regions for Altus Intervention AS are classic Cash Cows. These agreements, often in established oil and gas basins where the company has deep roots, offer a predictable inflow of cash. Think of it as a steady, reliable income source rather than a high-growth venture.

The profit margins on these contracts are typically robust. This is largely due to economies of scale and the operational efficiencies Altus Intervention has honed over years of working in these mature markets. Their established infrastructure and experienced teams mean they can deliver services cost-effectively, translating into higher profits. For instance, in 2024, the global oil and gas services market saw continued demand for maintenance and intervention services, areas where long-term contracts are prevalent, supporting stable revenue generation for established players.

- Predictable Revenue: Long-term contracts in stable regions provide a consistent and reliable income stream for Altus Intervention AS.

- High Profit Margins: Economies of scale and operational efficiencies in mature markets contribute to strong profitability on these services.

- Low Investment Needs: These segments require minimal aggressive investment for growth, focusing instead on maintaining existing market share and operational excellence.

- Stable Market Position: Altus Intervention's historical presence and established relationships in these regions ensure a secure position and continued demand for their services.

Altus Intervention AS's core well integrity services are firmly entrenched as Cash Cows. These are fundamental offerings that ensure the safe and efficient operation of existing oil and gas wells, a segment with consistent, enduring demand. The company's extensive experience and established market presence in this mature sector translate into a stable and predictable revenue stream, a hallmark of a Cash Cow.

These foundational services, bolstered by their integration with Baker Hughes, benefit from a strong market position built on years of reliable performance. The maturity of the conventional well integrity market means less pressure for aggressive marketing, which in turn supports consistent cash flow generation. For context, the global well integrity market, a key indicator for these services, was valued at approximately USD 12 billion in 2023 and is expected to see steady growth.

The established Plug & Abandonment (P&A) services are also significant Cash Cows for Altus Intervention, now part of Baker Hughes. With a substantial number of mature wells globally reaching their decommissioning phase, the demand for standardized P&A solutions remains robust and consistent. This segment benefits from a strong market share within a relatively stable industry, ensuring reliable revenue streams.

The critical nature of P&A for environmental compliance and responsible well decommissioning underpins its steady demand. In 2024, the global offshore P&A market was projected to reach approximately $15 billion, highlighting the considerable scale of this sector. Altus Intervention's established expertise positions them to capitalize on this ongoing need, generating predictable cash flow.

| Service Category | BCG Matrix Classification | Market Characteristics | Altus Intervention AS's Position | Financial Contribution |

| Conventional Well Integrity | Cash Cow | Mature, stable demand, low growth | Strong market share, established expertise | Consistent, predictable revenue generation |

| Plug & Abandonment (P&A) | Cash Cow | Growing regulatory drivers, stable demand | Significant market share, operational efficiency | Reliable cash flow, high profitability potential |

What You See Is What You Get

Altus Intervention AS BCG Matrix

The Altus Intervention AS BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you can confidently assess its quality and strategic insights, knowing that no alterations or additional content will be introduced. You'll gain immediate access to a professionally formatted and analysis-ready report that is designed to facilitate clear strategic decision-making for your business.

Dogs

Obsolete legacy intervention technologies within Altus Intervention AS, now part of Baker Hughes, represent offerings that have been surpassed by newer, more efficient methods. These technologies typically struggle to compete on performance or cost, leading to a diminished market presence. For instance, older hydraulic fracturing techniques might be less effective and more environmentally impactful than current multi-stage fracturing methods, contributing to their decline.

These legacy solutions are characterized by a low market share and operate within shrinking market segments, often yielding minimal or even negative returns. In 2024, the oil and gas industry's focus on enhanced oil recovery (EOR) and digitalized operations means technologies lacking advanced capabilities, such as real-time data analytics or remote monitoring, are increasingly sidelined.

Consequently, continued investment in these obsolete technologies is generally ill-advised. They are prime candidates for divestiture or a strategic phase-out, allowing resources to be redirected towards more promising and innovative intervention solutions that align with current industry demands and future growth prospects.

Niche services with limited geographic reach represent a challenging category within the BCG Matrix for Altus Intervention AS. These offerings, often specialized and catering to very specific, localized needs, struggled to achieve scale. For instance, if Altus offered a highly specialized subsea intervention technique primarily in a region with declining oil and gas activity, like a specific mature North Sea basin, it would fall into this quadrant.

Such services typically face low demand and intense competition, making it difficult to gain market share or achieve profitability. In 2024, many companies in the oilfield services sector, including those with niche offerings, experienced pressure on margins due to volatile commodity prices and a general slowdown in exploration and production in certain mature markets. These niche services consume valuable resources, such as skilled personnel and capital, without generating substantial returns or contributing to the company's overall growth trajectory.

High-cost, low-efficiency manual operations in well intervention, particularly those lagging in automation, are prime candidates for the Dogs category within the BCG matrix. These services, often characterized by extensive labor input and outdated methodologies, struggle to compete with streamlined, technologically advanced alternatives. For instance, a manual wireline operation might cost significantly more per day than an automated coiled tubing unit, impacting profitability.

These operations face intense market pressure, resulting in diminished market share and profitability. Companies relying heavily on these methods may find themselves losing contracts to more cost-effective service providers. In 2024, the global well intervention market saw increasing demand for efficiency gains, with automated solutions often commanding higher utilization rates and better margins, further marginalizing manual approaches.

Non-Core Consulting or Advisory Services

If Altus Intervention AS had non-core consulting or advisory services that didn't directly utilize their specialized well intervention technology and struggled to capture significant market share, these would likely be categorized as Dogs in the BCG Matrix. For instance, if they offered general energy sector consulting that lacked differentiation, it would fall into this category.

These services would exhibit low growth potential and a weak competitive position. In 2024, the market for specialized energy consulting remained robust, with reports indicating growth in areas directly tied to operational efficiency and technological advancement. Services outside this core focus would struggle to compete.

- Low Market Share: These services would represent a small fraction of Altus Intervention's overall revenue.

- Low Growth Prospects: The demand for these non-core advisory offerings would be stagnant or declining.

- Lack of Competitive Advantage: They would not leverage Altus Intervention's core competencies in well intervention.

- Resource Drain: Continued investment in these services would divert resources from more profitable core operations.

Underperforming Regional Operations

Underperforming Regional Operations for Altus Intervention AS, within the context of a BCG Matrix analysis post-acquisition by Baker Hughes, would represent those segments with a low market share and low market growth potential. These are the Dogs in the portfolio, demanding significant management attention and capital without generating substantial returns. For instance, if a particular region, say Southeast Asia, saw Altus Intervention's market share decline from 5% to 3% between 2023 and 2024, while the overall market growth in that segment slowed to 2% annually, it would likely fall into this category.

These operations are characterized by their inability to generate sufficient cash flow to cover their own costs, let alone contribute to the growth of other business units. They often require ongoing investment simply to maintain their current, albeit weak, market position. For example, a report in early 2024 might indicate that a specific operational division, previously acquired by Baker Hughes, is experiencing a negative EBITDA margin, perhaps -2%, despite receiving 10% of the company's operational expenditure.

The strategic imperative for these Underperforming Regional Operations is clear: a thorough review to determine their future. Options typically include:

- Restructuring: Implementing cost-saving measures, operational efficiencies, or a change in management to try and turn the business around.

- Divestment: Selling off the underperforming unit to another company that may be better positioned to manage or benefit from it.

- Harvesting: Minimizing further investment and extracting any remaining value before eventual closure.

Baker Hughes' integration of Altus Intervention in 2023 aimed to streamline operations and eliminate redundancies. Therefore, any regional operations that continue to exhibit the characteristics of Dogs, such as declining revenues and persistent losses, would be prime candidates for such strategic decisions to optimize the consolidated portfolio's overall performance and resource allocation.

Dogs within Altus Intervention AS's portfolio, now part of Baker Hughes, represent services or technologies with low market share and low growth prospects. These are often legacy offerings that have been outpaced by innovation or niche services that struggle to scale. For instance, outdated manual intervention techniques that are less efficient and more costly than automated solutions would fall into this category.

In 2024, the oil and gas sector's drive for efficiency and digitalization further marginalized these low-performing assets. Services that do not offer advanced capabilities like real-time data analytics or remote monitoring are increasingly becoming liabilities, consuming resources without generating significant returns.

The strategic approach for Dogs typically involves divestment, phasing out, or minimizing investment to redirect capital towards higher-growth areas. This ensures resources are allocated to innovations that align with current industry demands and future market opportunities.

| Category | Description | 2024 Market Context | Strategic Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Pressure from efficient, digitalized competitors | Divest, Phase-out, or Minimize Investment |

| Example: Manual Wireline | High cost, low efficiency | Automated coiled tubing offers better margins | Likely candidate for divestment or discontinuation |

| Example: Niche Consulting | Lack of differentiation, low demand | Market favors specialized, operational consulting | Resource drain, potential for divestment |

Question Marks

Altus Intervention's next-generation digital twins for well optimization are positioned as a potential Star within the BCG matrix. While currently holding a low market share due to their cutting-edge nature and the need for substantial R&D and market education, these solutions represent a high-growth frontier in the digital oilfield. Their success is contingent on rapid market adoption, transforming them into future revenue drivers.

AI-driven predictive maintenance for downhole equipment represents a significant investment for companies like Altus Intervention, a Baker Hughes business. These advanced solutions, while holding immense growth potential, require substantial capital for development and initial deployment, reflecting their position as potential question marks in a BCG matrix. For instance, the global predictive maintenance market was projected to reach over $11 billion by 2024, indicating a strong underlying demand for such technologies in the oil and gas sector.

Altus Intervention's potential foray into specialized services for geothermal well intervention aligns with the accelerating energy transition. This represents a strategic move into a nascent market with substantial long-term growth prospects, leveraging existing expertise in well intervention to tap into a new energy source.

While the current market share for geothermal well intervention services is relatively low, Altus Intervention's investment in developing these capabilities positions them to capture future demand. This strategic investment is crucial for establishing a competitive advantage in this emerging sector.

The development of specialized geothermal well intervention services requires significant capital outlay. This investment is necessary to build the necessary infrastructure, technology, and expertise to effectively serve the unique challenges of geothermal wells, aiming for a leading position in this evolving market.

Expansion into Untapped Emerging Markets with Niche Needs

Altus Intervention AS, now part of Baker Hughes, aims to aggressively expand its highly specialized well intervention services into emerging markets. These markets, while currently having a low Altus market share, show significant potential for oil and gas sector growth. Think of countries in Southeast Asia or parts of Africa where new exploration and production are ramping up, creating a demand for advanced intervention techniques.

This strategic move requires considerable upfront capital for establishing local operations, training personnel, and building necessary infrastructure. For instance, setting up a new service base in a developing region might cost several million dollars, covering equipment, facilities, and initial staffing. The objective is to quickly gain a dominant position in these nascent markets, transforming them from question marks into future stars within the BCG matrix.

- Targeted Emerging Markets: Focus on regions with growing oil and gas activity and a clear need for specialized intervention solutions, such as the Philippines or certain West African nations.

- Investment Requirements: Significant capital outlay for market entry, including logistics, equipment depots, and local workforce development, potentially running into tens of millions of dollars for a comprehensive launch.

- Market Share Capture: Aims to achieve a leading market share within 3-5 years by offering superior technology and service quality.

- Conversion to Stars: The ultimate goal is to establish these new ventures as high-growth, high-market-share businesses, mirroring the success of Altus's existing Star segments.

Advanced Robotics for Remote Well Intervention

Developing and deploying advanced robotic solutions for remote well intervention is a key area of innovation for Altus Intervention AS, positioning them in a high-growth technological frontier. While the market share for these advanced robotic systems is currently low, their potential to significantly improve safety and efficiency in challenging or remote operations is substantial.

These initiatives demand considerable research and development investment to mature and achieve broader market acceptance. The strategic aim is to establish Altus Intervention AS as a future leader in this specialized segment of the oil and gas services industry.

- Market Potential: The global market for subsea robotics in oil and gas is projected to grow, with advanced intervention systems expected to capture an increasing share. For instance, the subsea robotics market was valued at approximately USD 3.5 billion in 2023 and is anticipated to reach over USD 6 billion by 2030, with remote intervention technologies being a key growth driver.

- Investment Focus: Significant R&D expenditure is allocated to enhancing the capabilities and reliability of these robotic platforms, aiming to reduce operational costs and risks for clients.

- Strategic Positioning: By focusing on these cutting-edge technologies, Altus Intervention AS aims to differentiate itself and capture future market leadership in remote well intervention services.

Altus Intervention's strategic expansion into emerging markets represents a classic Question Mark scenario. These ventures require substantial investment to establish a foothold, with current market share being minimal. The success hinges on rapid adoption and efficient capital deployment to transform these nascent operations into high-growth Stars.

The company's investment in AI-driven predictive maintenance for downhole equipment also falls into the Question Mark category. While the global predictive maintenance market is expanding, projected to exceed $11 billion by 2024, these advanced solutions demand significant capital for development and initial rollout. Altus must navigate this high-growth potential while managing the associated costs and market penetration challenges.

BCG Matrix Data Sources

Our Altus Intervention AS BCG Matrix is informed by comprehensive market research, financial disclosures, and industry growth forecasts to provide strategic insights.