Next Radio Tv SA (NXTV: PAR) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Next Radio Tv SA (NXTV: PAR) Bundle

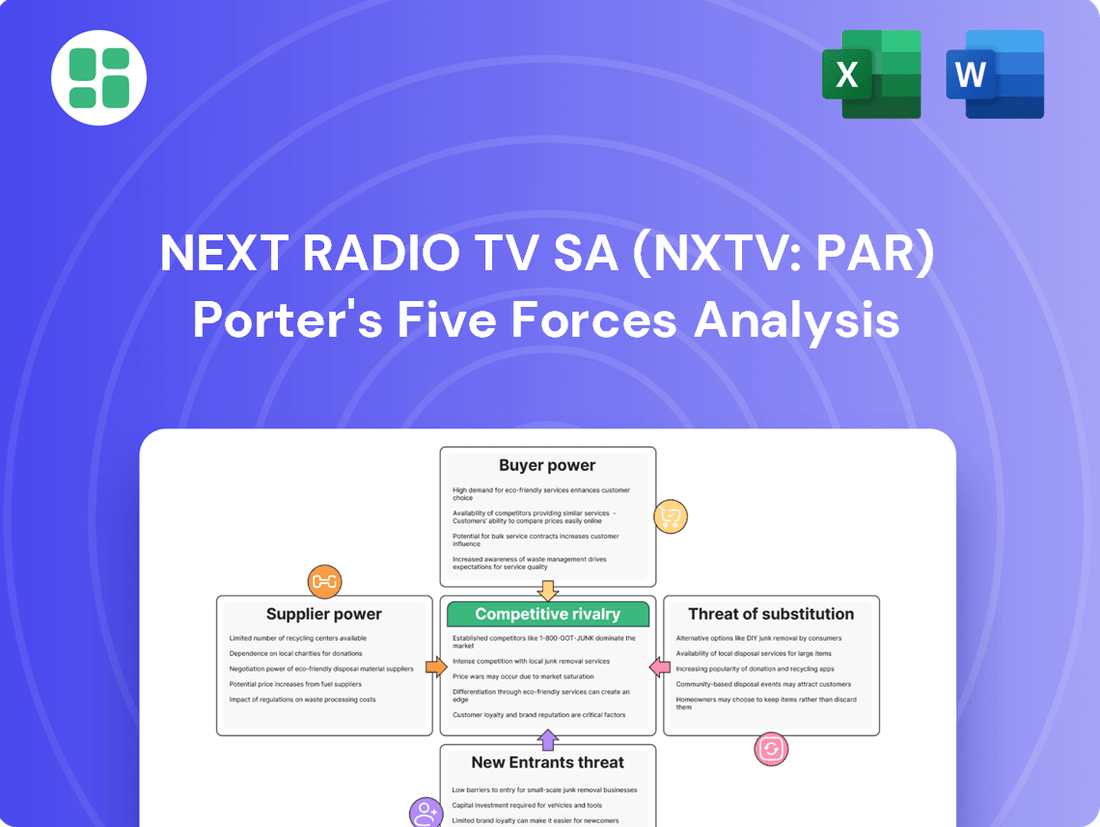

Next Radio Tv SA (NXTV: PAR) faces a dynamic media landscape where buyer power is significant due to content choices, while the threat of new entrants is moderate with high capital requirements. The bargaining power of suppliers, particularly content creators and distributors, presents a key challenge.

The complete report reveals the real forces shaping Next Radio Tv SA (NXTV: PAR)’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of content creators and on-screen talent for NextRadioTV SA (NXTV: PAR) is substantial, particularly when they possess unique or highly sought-after content. This includes exclusive news coverage, broadcasting rights for major sporting events, or the appeal of popular personalities who draw significant viewership.

NextRadioTV, operating prominent channels such as BFM TV and RMC, has historically depended on the strength of its journalistic output and the charisma of its radio hosts to attract and retain audiences. The availability of top-tier talent or exclusive rights to major events significantly influences these suppliers' leverage in negotiations.

This leverage directly impacts NextRadioTV's production expenses and its ability to secure and broadcast compelling content. For instance, securing rights for major Ligue 1 football matches, which BFM TV has covered in the past, requires substantial investment and gives rights holders considerable negotiating power.

Suppliers of broadcasting technology, transmission infrastructure, and digital platforms hold moderate bargaining power over Next Radio TV SA (NXTV: PAR). While a variety of equipment and software vendors exist, the concentration of essential telecommunication networks for content distribution, particularly for digital terrestrial television and streaming, can be significant. This concentration among a few key players creates interdependencies and can lead to high switching costs, thereby granting these suppliers a degree of leverage.

For a company like Next Radio TV SA (NXTV: PAR), which operates news-focused channels such as BFM TV, the bargaining power of news agencies and information sources is a key consideration. Reliable and timely information from major agencies like Agence France-Presse (AFP) and Reuters is vital for content creation. These suppliers hold moderate power because while alternative news sources exist, the established reputation and speed of major agencies are highly valued by broadcasters.

Advertising Technology Providers

Advertising technology providers are becoming increasingly crucial for companies like NextRadioTV SA (NXTV: PAR) as digital advertising evolves. The sophistication of ad tech platforms, data analytics, and programmatic advertising tools directly impacts NextRadioTV's capacity to effectively monetize its audience.

Suppliers offering unique or deeply integrated solutions can leverage this position to negotiate higher prices. This can, in turn, affect NextRadioTV's profit margins on its advertising revenue. For instance, in 2024, the global ad tech market was valued at approximately $120 billion, showcasing the significant financial leverage these providers can wield.

- Growing Importance: Ad tech, data analytics, and programmatic tools are vital for audience monetization in modern digital advertising.

- Supplier Leverage: Companies with proprietary or highly integrated solutions can command premium pricing.

- Impact on Margins: Higher supplier costs can directly reduce NextRadioTV's advertising revenue margins.

- Market Size: The significant size of the ad tech market in 2024 (around $120 billion) underscores the potential bargaining power of its key players.

Regulatory Bodies and Licensing Authorities

Regulatory bodies, such as ARCOM in France, wield significant influence over media companies like Next Radio TV SA (NXTV: PAR). These authorities act as crucial gatekeepers, controlling access to broadcasting licenses and essential spectrum, which are fundamental to operations. Their decisions directly dictate a company's ability to function and pursue growth opportunities.

The bargaining power of these regulatory bodies is exceptionally high. They possess the authority to dictate market entry and enforce operational compliance, effectively setting the terms of engagement for all players. Adhering to their stringent rules and obtaining necessary permits represents a substantial, non-negotiable cost for any media business, directly impacting profitability and strategic flexibility.

- ARCOM's Role: ARCOM (Autorité de régulation de la communication audiovisuelle et numérique) is the French audiovisual and digital communications regulator.

- Licensing and Spectrum: These are critical resources for broadcasters, akin to raw materials for manufacturers.

- Impact on NXTV: ARCOM's decisions on license renewals, spectrum allocation, and content regulations directly affect NXTV's operational capacity and revenue potential.

- Cost of Compliance: Meeting regulatory requirements involves significant investment in technology, legal counsel, and operational adjustments.

The bargaining power of content creators and on-screen talent for NextRadioTV SA (NXTV: PAR) is substantial, particularly when they possess unique or highly sought-after content. This includes exclusive news coverage, broadcasting rights for major sporting events, or the appeal of popular personalities who draw significant viewership.

NextRadioTV, operating prominent channels such as BFM TV and RMC, has historically depended on the strength of its journalistic output and the charisma of its radio hosts to attract and retain audiences. The availability of top-tier talent or exclusive rights to major events significantly influences these suppliers' leverage in negotiations.

This leverage directly impacts NextRadioTV's production expenses and its ability to secure and broadcast compelling content. For instance, securing rights for major Ligue 1 football matches, which BFM TV has covered in the past, requires substantial investment and gives rights holders considerable negotiating power.

Suppliers of broadcasting technology, transmission infrastructure, and digital platforms hold moderate bargaining power over Next Radio TV SA (NXTV: PAR). While a variety of equipment and software vendors exist, the concentration of essential telecommunication networks for content distribution, particularly for digital terrestrial television and streaming, can be significant. This concentration among a few key players creates interdependencies and can lead to high switching costs, thereby granting these suppliers a degree of leverage.

For a company like Next Radio TV SA (NXTV: PAR), which operates news-focused channels such as BFM TV, the bargaining power of news agencies and information sources is a key consideration. Reliable and timely information from major agencies like Agence France-Presse (AFP) and Reuters is vital for content creation. These suppliers hold moderate power because while alternative news sources exist, the established reputation and speed of major agencies are highly valued by broadcasters.

Advertising technology providers are becoming increasingly crucial for companies like NextRadioTV SA (NXTV: PAR) as digital advertising evolves. The sophistication of ad tech platforms, data analytics, and programmatic advertising tools directly impacts NextRadioTV's capacity to effectively monetize its audience.

Suppliers offering unique or deeply integrated solutions can leverage this position to negotiate higher prices. This can, in turn, affect NextRadioTV's profit margins on its advertising revenue. For instance, in 2024, the global ad tech market was valued at approximately $120 billion, showcasing the significant financial leverage these providers can wield.

Regulatory bodies, such as ARCOM in France, wield significant influence over media companies like Next Radio TV SA (NXTV: PAR). These authorities act as crucial gatekeepers, controlling access to broadcasting licenses and essential spectrum, which are fundamental to operations. Their decisions directly dictate a company's ability to function and pursue growth opportunities.

The bargaining power of these regulatory bodies is exceptionally high. They possess the authority to dictate market entry and enforce operational compliance, effectively setting the terms of engagement for all players. Adhering to their stringent rules and obtaining necessary permits represents a substantial, non-negotiable cost for any media business, directly impacting profitability and strategic flexibility.

What is included in the product

This Porter's Five Forces analysis for Next Radio Tv SA (NXTV: PAR) dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes, revealing strategic vulnerabilities and strengths.

Our Porter's Five Forces analysis for Next Radio TV SA (NXTV: PAR) provides a clear, actionable framework to navigate competitive pressures, offering a pain point reliever by highlighting key areas for strategic focus and risk mitigation.

This analysis serves as a vital pain point reliever by offering a customizable pressure level assessment, allowing for dynamic adjustments based on evolving market dynamics and potential new entrants in the media landscape.

Customers Bargaining Power

The bargaining power of individual viewers and listeners for Next Radio Tv SA (NXTV: PAR) is typically low. This is because they are numerous and spread out, and it’s easy for them to switch between different free radio stations or TV channels without much hassle or cost. Their collective influence, however, is significant, as audience numbers and how much people engage with content directly impact how much NXTV can charge for advertising.

While individual power is limited, the growing availability of on-demand content and a wide array of digital platforms means audiences have many more options. This implicitly strengthens their position by making it a greater challenge for NXTV to keep them engaged and loyal. For instance, in 2024, the average daily time spent on streaming services by adults in France reached over 2 hours, highlighting the competition for audience attention.

Advertisers and the media agencies that represent them wield considerable influence over Next Radio TV SA. These buyers are focused on reaching specific audience segments and ensuring a certain level of exposure for their advertisements. In today's crowded advertising landscape, this power is amplified.

The increasing ease of precise audience targeting through digital channels means advertisers can demand more for their money. They are looking for guaranteed results and a clear return on their investment, which puts pressure on traditional media providers like Next Radio TV SA to offer competitive pricing and demonstrate effectiveness.

Content distributors and aggregators, such as cable operators and IPTV providers, hold significant bargaining power over content creators like NextRadioTV (NXTV: PAR). These platforms control access to a vast subscriber base, enabling them to negotiate favorable terms for carrying content. In 2024, the increasing fragmentation of media consumption means distributors can leverage their reach, potentially demanding revenue sharing or exclusive content deals from providers seeking distribution.

Subscription Platform Users

Subscription platform users wield significant bargaining power. Their willingness to pay for content and their ability to switch to competing services means they expect high-quality, exclusive programming and a smooth, reliable user experience. In 2024, the average monthly cost for a premium streaming service in France was around €9.99, highlighting the cost sensitivity of consumers.

This power is amplified by the sheer volume of choices available. Users can easily cancel subscriptions if they are unsatisfied or if a better alternative emerges, putting pressure on platforms to constantly innovate and deliver value. For instance, a significant portion of users in the French market, estimated at over 15% in late 2024, reported cancelling at least one streaming subscription within a six-month period due to content dissatisfaction or price concerns.

- Content Expectations: Users demand exclusive, high-quality content that justifies their recurring payments.

- Switching Costs: Low switching costs allow users to easily move to competitors, increasing their leverage.

- Price Sensitivity: Consumers are increasingly aware of subscription costs and will cancel services that do not offer perceived value for money.

- User Experience: A seamless and intuitive platform experience is crucial for retaining subscribers.

Digital Platform Users and Creators

The bargaining power of customers for Next Radio TV SA (NXTV: PAR) is significantly influenced by the rise of digital platforms and user-generated content. As audiences increasingly shift towards social media and creator-driven content, traditional broadcasters face a dwindling and more fragmented customer base. This shift directly impacts advertising revenue, a primary income stream for companies like NXTV, as marketing budgets follow eyeballs to these digital spaces.

Users of these digital platforms, both as consumers and creators, wield considerable indirect power. They effectively divert attention and, consequently, advertising spend away from traditional broadcasters. For instance, in 2024, global digital ad spending was projected to surpass $600 billion, a substantial portion of which is channeled into social media and online video platforms, directly competing with traditional media advertising.

- Shifting Consumption Habits: In 2023, it was reported that the average person spent over 2.5 hours daily on social media, a trend that continued to grow in 2024, pulling audiences away from linear TV.

- User-Generated Content Dominance: Platforms like TikTok and YouTube saw continued exponential growth in user-generated video content throughout 2024, offering an alternative to professionally produced broadcast content.

- Advertising Revenue Diversion: Digital advertising revenue, particularly from social media and search, continued to capture a larger share of the total advertising market in 2024, impacting traditional media's ability to monetize their audiences.

- Demand for Interactivity: Users now expect interactive experiences, which many traditional broadcasters are struggling to replicate, further empowering them to seek content on more dynamic digital platforms.

Advertisers and media agencies represent a significant customer segment with considerable bargaining power for Next Radio TV SA (NXTV: PAR). Their ability to shift advertising budgets to platforms offering better reach or targeting directly influences NXTV's pricing and content strategy. In 2024, the demand for measurable ROI in advertising campaigns meant that advertisers could exert pressure on traditional media providers to demonstrate clear audience engagement and campaign effectiveness.

The increasing fragmentation of media consumption, with audiences spread across numerous digital platforms, further amplifies advertiser leverage. They can now cherry-pick specific demographics and psychographics with greater precision, making it essential for NXTV to offer compelling, targeted audience propositions. For instance, digital advertising spending in France was projected to continue its upward trajectory in 2024, reaching an estimated €17.5 billion, underscoring the competitive landscape for ad revenue.

While individual viewers have low bargaining power, their collective behavior is paramount. The sheer volume of available content across streaming services and social media in 2024 meant that audiences had unprecedented choice, making audience retention a key challenge for traditional broadcasters. This competition for attention indirectly strengthens the customer's position by forcing media companies to continuously offer value to maintain viewership and, consequently, advertiser appeal.

| Customer Segment | Bargaining Power Factor | 2024 Data/Trend Impact |

|---|---|---|

| Advertisers & Agencies | Shifting Ad Budgets, Demand for ROI | Increased pressure on NXTV for demonstrable audience engagement and effectiveness. |

| Individual Viewers/Listeners | Low individual power, High collective impact | Audience fragmentation and competition from digital platforms forces NXTV to compete for attention. |

| Content Distributors (e.g., IPTV) | Control over Subscriber Base | Distributors can leverage reach for favorable terms, demanding revenue sharing or exclusive content. |

Same Document Delivered

Next Radio Tv SA (NXTV: PAR) Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Next Radio Tv SA (NXTV: PAR), offering a comprehensive examination of competitive intensity and industry attractiveness. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic decision-making. You are looking at the actual, ready-to-use analysis, which delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Next Radio Tv SA's operating environment.

Rivalry Among Competitors

Established broadcasters like TF1, France Télévisions, and M6, along with the former NextRadioTV channels, create a highly competitive environment in France. This fierce rivalry centers on capturing audience share, securing advertising revenue, and obtaining exclusive rights to popular content. For instance, in 2023, TF1 Group reported advertising revenue of €1.15 billion, highlighting the financial stakes involved in audience acquisition.

The significant fixed costs inherent in broadcasting operations and content creation compel these entities to aggressively pursue maximum viewership. This pressure translates into intense competition through innovative programming, extensive marketing campaigns, and strategic talent acquisition. The need to recoup substantial investments in production and distribution fuels this aggressive market behavior.

Within the competitive French news landscape, BFM TV, a key player for Next Radio Tv SA (NXTV: PAR), experiences fierce rivalry from established 24/7 news broadcasters like CNews and LCI. This intense competition centers on capturing real-time audience engagement, especially during breaking news situations.

The battle for viewers is characterized by rapid content dissemination and the strategic deployment of expert commentary, with audience share often shifting based on the immediacy of current events and the perceived journalistic responsiveness of each channel. In 2023, BFM TV maintained a strong position, often leading in daily audience figures within the news channel segment.

Radio Station Competition for Next Radio Tv SA (NXTV: PAR) is intense, with RMC facing a broad spectrum of national and local radio networks. These competitors vie for audience share across diverse genres, including music, talk, news, and sports, making it crucial for RMC to differentiate its offerings.

The competitive landscape in radio is heavily influenced by factors like specific show formats, the appeal of popular hosts, and the ability to connect with local audiences. Success hinges on RMC's capacity to consistently innovate its programming and implement robust listener engagement strategies.

For instance, in 2024, the French radio market saw significant activity, with major players like RTL and France Inter consistently reporting high listenership figures, often exceeding 10% market share each, highlighting the challenge RMC faces in capturing and retaining its audience.

Cross-Platform Content Competition

Competitive rivalry for Next Radio Tv SA (NXTV: PAR) is intense and multifaceted. It's not just about other TV stations; online news sites, social media giants, and streaming services are all vying for audience attention. These platforms increasingly offer news, sports, and entertainment, directly competing for viewers' time and engagement across all devices, from traditional televisions to smartphones. For instance, in 2024, digital advertising spending in France was projected to reach over €25 billion, highlighting the significant competition for advertising revenue across these diverse platforms.

This broad competitive landscape forces media companies like Next Radio Tv SA to adopt a multi-platform strategy. Simply relying on traditional broadcasting is no longer sufficient to remain relevant. Capturing diverse audiences requires a presence and tailored content strategy across various digital channels. In 2023, streaming services accounted for a significant portion of media consumption, with platforms like Netflix and Disney+ continuing to grow their subscriber bases in Europe, further intensifying the competition for eyeballs.

- Cross-Platform Competition: Rivalry includes online news, social media, and streaming services, not just traditional broadcasters.

- Audience Attention: Media companies compete for consumer attention across all screens, from TVs to mobile devices.

- Multi-Platform Necessity: A multi-platform strategy is crucial for relevance and reaching diverse audiences.

- Digital Ad Spend: In 2024, France's digital ad spending was estimated to exceed €25 billion, indicating fierce competition for advertising revenue.

Advertising Market Competition

The competition within the advertising market is fierce, with numerous media companies actively seeking a share of advertising budgets. This intense rivalry is further amplified by the ongoing migration of advertising spend towards digital platforms and highly targeted campaigns. Traditional broadcasters like Next Radio Tv SA must therefore highlight robust audience demographics and strong engagement levels to validate their advertising rates.

This dynamic directly affects profitability and the capacity for investment in new content. For instance, in 2024, global digital ad spending was projected to reach over $600 billion, a significant portion of the total advertising pie, putting pressure on traditional media's revenue streams.

- Intensified Digital Shift: Advertising budgets increasingly favor digital channels, demanding that traditional broadcasters prove their value through audience data.

- Audience Engagement as a Differentiator: To maintain ad rates, companies like Next Radio Tv SA must showcase strong viewership and listener engagement metrics.

- Profitability and Content Investment Pressure: The competitive advertising landscape directly impacts financial performance and the ability to fund content creation.

The competitive rivalry for Next Radio Tv SA (NXTV: PAR) is intense, extending beyond traditional broadcasters to include digital news outlets, social media platforms, and streaming services. This broad competition for audience attention forces media companies to adopt multi-platform strategies to remain relevant and capture diverse viewer segments. In 2023, streaming services continued their growth in Europe, intensifying the battle for eyeballs.

The advertising market is particularly competitive, with a significant shift towards digital platforms and targeted campaigns. Traditional broadcasters must demonstrate strong audience engagement and demographics to justify their advertising rates, impacting profitability and content investment. For example, in 2024, global digital ad spending was projected to exceed $600 billion.

| Competitor Type | Key Competitive Factors | 2023/2024 Data Point |

|---|---|---|

| Traditional Broadcasters | Audience share, advertising revenue, content rights | TF1 Group reported €1.15 billion in advertising revenue in 2023. |

| News Channels | Real-time reporting, expert commentary, audience responsiveness | BFM TV often led daily audience figures in the French news channel segment in 2023. |

| Radio Networks | Show formats, host appeal, local connection, genre diversity | RTL and France Inter reported over 10% market share each in 2024. |

| Digital Platforms | Content variety, accessibility, user engagement, targeted advertising | France's digital ad spending projected to exceed €25 billion in 2024. |

SSubstitutes Threaten

The threat from online streaming services, encompassing subscription video on demand (SVOD), advertising video on demand (AVOD), and free ad-supported streaming TV (FAST), is exceptionally high for Next Radio Tv SA. These platforms, including giants like Netflix, Amazon Prime Video, and Disney+, offer extensive libraries of content, frequently featuring exclusive and globally produced shows and movies. This vast selection directly competes with traditional linear television programming.

Consumers are increasingly drawn to the convenience and tailored viewing experiences that streaming provides. The ability to watch content on demand, without rigid schedules, and often with personalized recommendations, makes these services a powerful substitute for traditional broadcast or cable television. This shift in consumer preference directly impacts the audience share and advertising revenue potential for companies like Next Radio Tv SA.

By mid-2024, the global SVOD market was projected to reach over 1.5 billion subscribers, highlighting the significant penetration of these services. Furthermore, the FAST market is experiencing rapid growth, with major players investing heavily in new channels and content, further intensifying the competitive landscape and the threat of substitution for traditional media providers.

Social media platforms like YouTube, TikTok, and Instagram represent a substantial threat of substitutes for Next Radio TV SA. These platforms offer a vast and constantly updated stream of news and short-form entertainment, directly competing for audience attention. In 2024, global social media users reached over 5 billion, highlighting the immense reach and engagement these platforms command.

The ability of social media to deliver instantly tailored content, often for free, diverts both viewers and advertising budgets from traditional broadcasters. For instance, TikTok's user base grew by an estimated 15% in 2024, demonstrating its rapid expansion and appeal, particularly among younger demographics that Next Radio TV SA might target.

This user-generated content ecosystem, characterized by its interactive nature and perceived authenticity, directly challenges the value proposition of professionally produced broadcast content. Advertising revenue, a critical component for media companies, is increasingly flowing to these digital platforms, with digital advertising spending projected to exceed $700 billion globally in 2024.

Podcasts and digital audio platforms like Spotify and Deezer are significant substitutes for traditional radio operations such as RMC, a part of Next Radio TV SA. These platforms offer listeners the flexibility of on-demand content across a wide array of genres, directly competing with scheduled radio programming.

The personalized listening experience and the availability of highly niche content on digital platforms can attract audiences away from linear radio broadcasts. For instance, by mid-2024, Spotify reported over 600 million monthly active users, highlighting the substantial reach of these digital audio substitutes.

Online News Websites and Aggregators

Online news websites and aggregators present a significant threat of substitution for traditional news broadcasters like Next Radio TV SA (NXTV: PAR). Consumers increasingly turn to digital platforms for immediate news updates and a broader range of perspectives, often finding more in-depth content than linear television offers. This shift means traditional broadcasters must robustly invest in their digital offerings and breaking news capabilities to remain competitive.

The ease of access and often lower cost or free nature of online news sources makes them highly attractive substitutes. For instance, in 2024, a substantial portion of the global population relies on digital channels for news, with many news aggregators curating content from numerous sources, providing a one-stop shop for information. This directly challenges the audience share of TV news programs.

- Digital Dominance: Over 70% of adults in many developed nations now consume news primarily through digital platforms, a trend that continued to grow through 2024.

- Aggregator Appeal: News aggregators saw continued user growth in 2024, with platforms like Google News and Apple News becoming primary news discovery tools for millions.

- Cost-Effectiveness: Many online news sources are free or available through affordable subscription models, presenting a cost advantage over traditional cable or satellite TV packages that include news channels.

Gaming and Interactive Entertainment

The burgeoning gaming and interactive entertainment sector presents a significant threat of substitutes for Next Radio TV SA (NXTV: PAR). As video games and streaming platforms capture more leisure time, they directly compete for audience attention that might otherwise be directed towards traditional television and radio content.

This trend is particularly pronounced among younger demographics. For instance, in 2024, global gaming revenue was projected to reach over $200 billion, highlighting the massive engagement with this form of entertainment. This means less time is available for consuming radio and TV programming.

The appeal of interactive experiences, such as online multiplayer games and immersive virtual reality, offers a compelling alternative to passive media consumption. This forces traditional broadcasters like Next Radio TV SA to innovate constantly to remain relevant.

- Growing Gaming Market: Global gaming revenue is expected to surpass $200 billion in 2024, indicating a substantial diversion of leisure time.

- Audience Attention Competition: Interactive entertainment platforms directly vie for consumer attention, reducing opportunities for traditional media engagement.

- Need for Innovation: Media companies must develop engaging, interactive content to compete effectively against the allure of gaming and other digital entertainment.

The threat of substitutes for Next Radio TV SA is substantial, stemming from diverse digital platforms that offer alternative content consumption methods. Online streaming services, social media, podcasts, digital news, and gaming all vie for audience attention and advertising revenue, directly challenging traditional radio and television models. By mid-2024, the global SVOD market surpassed 1.5 billion subscribers, and social media users exceeded 5 billion, underscoring the significant shift in media consumption habits.

| Substitute Category | Key Platforms | 2024 Data/Projections | Impact on NXTV |

|---|---|---|---|

| Streaming Services | Netflix, Amazon Prime Video, Disney+, FAST platforms | SVOD subscribers > 1.5 billion; FAST market growth | Diverts viewers from linear TV, reduces ad revenue |

| Social Media | YouTube, TikTok, Instagram | Global users > 5 billion; TikTok user growth ~15% | Captures audience attention, shifts advertising spend |

| Digital Audio | Spotify, Apple Music, Podcasts | Spotify monthly active users > 600 million | Competes with radio for listening time and ad dollars |

| Online News | News aggregators, digital publications | Digital news consumption > 70% in developed nations | Reduces viewership of TV news, challenges information gatekeeping |

| Gaming & Interactive | Online games, streaming platforms | Global gaming revenue > $200 billion | Consumes leisure time, competes for audience engagement |

Entrants Threaten

The threat of new companies entering the traditional TV and radio broadcasting space for Next Radio Tv SA (NXTV: PAR) is quite low. This is primarily because setting up the necessary infrastructure, obtaining broadcasting licenses, and producing high-quality content all require a massive amount of money. For instance, in 2024, the average cost to launch a new regional television station in a developed market could easily run into tens of millions of dollars, encompassing studio equipment, transmission towers, and initial programming acquisition.

Building a nationwide network, securing the rights to popular shows or sporting events, and establishing a recognizable brand name all demand a substantial financial commitment. This high barrier to entry acts as a significant deterrent for potential new competitors looking to challenge established players like Next Radio Tv SA.

Strict regulatory frameworks and the need to obtain broadcasting licenses from authorities like ARCOM in France act as significant barriers to entry for new players in the television broadcasting market. These licenses are often limited in number, require adherence to specific content quotas, such as a minimum percentage of French and European content, and involve complex, time-consuming application processes. For instance, ARCOM's regulations, updated in 2024, continue to emphasize local content production, making it challenging for newcomers without established local production capabilities to comply.

Established players like the former NextRadioTV brands, including BFM TV and RMC, have cultivated significant brand loyalty and recognition through years of consistent content delivery. This deep-rooted connection with audiences presents a substantial barrier for newcomers aiming to capture market share.

Furthermore, incumbent broadcasters benefit from well-established distribution networks, spanning terrestrial, cable, and satellite platforms, ensuring broad reach. New entrants must invest heavily in marketing and time to build comparable distribution channels, a costly endeavor that can deter potential competitors.

Talent Acquisition and Content Scarcity

The threat of new entrants to Next Radio Tv SA (NXTV: PAR) is significantly mitigated by the intense competition for scarce, high-quality talent and exclusive content. Securing top-tier journalistic, entertainment, and sports talent, along with exclusive content rights, is paramount for audience attraction and retention. New players would face considerable difficulty in outbidding or securing these vital resources, which are often locked into long-term agreements with incumbents.

The financial barrier to entry is substantial, given the high costs associated with acquiring premium talent and exclusive content licenses. For instance, major sports broadcasting rights can run into hundreds of millions of euros annually, a prohibitive cost for nascent competitors. This scarcity and expense create a formidable obstacle, making it challenging for new entrants to establish a competitive footing against established entities like NXTV.

- Talent and Content as a Moat: NXTV's ability to secure and retain leading talent and exclusive content rights acts as a significant barrier to entry.

- High Acquisition Costs: The prohibitive expense of acquiring premium talent and content rights deters new market participants.

- Long-Term Contracts: Existing exclusive content deals and talent agreements limit the availability of these resources for potential new entrants.

- Competitive Disadvantage: New entrants would struggle to match the established content libraries and talent rosters of incumbent players.

Digital Entry Points and Niche Players

The threat of new entrants for a company like NextRadioTV (now part of Altice France) is evolving significantly due to digital advancements. While traditional broadcasting historically presented high capital barriers, the digital media landscape offers lower entry points.

New digital-only news outlets, podcast producers, and niche streaming services can launch with considerably less initial investment compared to building a traditional broadcast infrastructure. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, indicating substantial growth and opportunities for new players to capture a share.

- Digital-Native Competitors: The rise of online platforms allows for the creation of specialized content channels that can directly challenge established media groups by focusing on specific audiences or topics.

- Lower Capital Requirements: Unlike the expensive infrastructure needed for terrestrial broadcasting, digital entry typically involves software, content creation, and marketing, which can be scaled more flexibly.

- Scalability Challenges: Despite lower initial barriers, achieving significant scale and competing with established, multi-platform media groups that possess strong brand recognition, extensive content libraries, and robust distribution networks still necessitates substantial investment in content production, marketing, and advanced technology.

The threat of new entrants for Next Radio Tv SA (NXTV: PAR) remains relatively low in traditional broadcasting due to substantial capital requirements for infrastructure and licensing. However, the digital landscape presents a more accessible entry point for new players, as evidenced by the growing digital advertising market, projected to exceed $600 billion globally in 2024.

While digital-native competitors can launch with less initial investment, achieving significant scale against established media groups with strong brand recognition and extensive content libraries still demands considerable investment in content, marketing, and technology.

Securing top-tier talent and exclusive content rights, often tied up in long-term contracts with incumbents, poses a significant financial and strategic hurdle for newcomers, further solidifying the competitive advantage of established players.

| Factor | Impact on NXTV | Notes |

|---|---|---|

| Capital Requirements (Traditional) | High Barrier | Tens of millions for regional TV station launch in 2024. |

| Regulatory Hurdles | Significant Barrier | Complex licensing, content quotas (e.g., French/European content). |

| Brand Loyalty & Recognition | Strong Barrier | Years of consistent content delivery build audience connection. |

| Distribution Networks | Established Advantage | Incumbents possess broad reach across platforms. |

| Talent & Content Acquisition | High Cost & Scarcity | Major sports rights can cost hundreds of millions annually. |

| Digital Entry Points | Lower Initial Barrier | Digital-native outlets require less infrastructure investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Next Radio Tv SA (NXTV: PAR) is built upon a foundation of verified data. This includes publicly available financial statements, investor relations materials, industry-specific market research reports, and relevant regulatory filings to ensure a comprehensive understanding of the competitive landscape.