Alconix PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alconix Bundle

Unlock the hidden forces shaping Alconix's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are impacting its operations and market position. Gain a competitive edge by leveraging these expert insights for your strategic planning. Download the full version now for actionable intelligence.

Political factors

Global trade policies, including import/export tariffs and quotas on non-ferrous metals and electronic components, directly impact Alconix's procurement and sales costs. For instance, the imposition of tariffs on critical raw materials, as seen in various trade disputes throughout 2023 and early 2024, can inflate Alconix's cost of goods sold, potentially squeezing profit margins.

Changes in these policies, especially between major trading blocs like the US and China, can significantly alter the company's competitive landscape and supply chain efficiency. A shift towards protectionist measures could lead Alconix to re-evaluate sourcing strategies, potentially increasing reliance on regional suppliers to mitigate the impact of international trade barriers.

Geopolitical stability is a critical consideration for Alconix. For instance, ongoing conflicts in Eastern Europe, a significant region for certain raw material extraction, have demonstrably impacted global supply chains throughout 2024, leading to price fluctuations for key inputs. This instability directly affects Alconix's ability to secure materials at predictable costs, potentially disrupting production schedules and increasing operational expenses.

Governments globally are increasingly tightening regulations around resource extraction, impacting companies like Alconix. For instance, in 2024, the European Union continued to advance its critical raw materials act, aiming to diversify supply chains and promote sustainable mining practices within member states. This means Alconix must navigate varying compliance requirements for sourcing aluminum, copper, and other metals.

Stricter environmental standards, such as those focused on water usage and emissions in mining operations, can directly increase Alconix's procurement costs. In 2025, we anticipate further scrutiny on labor conditions in mining regions, potentially leading to higher operational expenses for suppliers and, consequently, for Alconix if these costs are passed on.

International Sanctions and Export Controls

International sanctions and export controls significantly impact Alconix's global operations. The imposition of sanctions on countries like Russia, for instance, can directly limit Alconix's market access and supply chain capabilities, as seen with broader restrictions affecting various industries in 2022-2023. Navigating these complex regulatory landscapes is paramount for maintaining legal compliance and operational continuity.

Alconix must adhere to stringent export control regimes, such as those administered by the U.S. Department of Commerce's Bureau of Industry and Security (BIS). Failure to comply can result in substantial fines and reputational damage. For example, in 2023, several companies faced significant penalties for violating export control regulations, underscoring the critical need for robust compliance programs.

- Market Access Restrictions: Sanctions can block Alconix from engaging in trade with targeted nations, potentially impacting revenue streams from those regions.

- Supply Chain Disruptions: Restrictions on exporting specific technologies or materials can hinder Alconix's ability to source necessary components for its manufacturing processes.

- Compliance Costs: Maintaining up-to-date knowledge of and adherence to evolving international regulations requires ongoing investment in legal and compliance personnel and systems.

- Reputational Risk: Non-compliance with sanctions or export controls can lead to severe penalties and damage Alconix's standing with customers, partners, and regulatory bodies.

Industrial Policy and Subsidies

Government industrial policies, especially those offering subsidies for domestic manufacturing and key technologies like electric vehicles and renewable energy, directly impact Alconix's market. For instance, the US Inflation Reduction Act (IRA) of 2022, with its significant clean energy tax credits, is expected to boost demand for materials and components used in these sectors, potentially benefiting Alconix's advanced materials division. This creates new avenues for growth but also signals a potential for increased competition as other companies pivot to capitalize on these incentives.

These policies can significantly shape Alconix's strategic planning and product development. For example, a government push for domestic semiconductor manufacturing, supported by substantial subsidies as seen in initiatives like the CHIPS and Science Act in the US, could create opportunities for Alconix to supply specialized chemicals or equipment. Conversely, if subsidies favor a particular domestic competitor, Alconix might face intensified pricing pressure or market share challenges in those specific segments.

- Government Support for EVs: The global electric vehicle market is projected to reach over $800 billion by 2025, with many governments offering direct purchase incentives and manufacturing subsidies, which could increase demand for Alconix's battery materials.

- Renewable Energy Investments: As of early 2024, many nations are earmarking billions for renewable energy infrastructure development, creating potential demand for Alconix's specialized coatings and composites used in wind turbines and solar panels.

- Domestic Manufacturing Initiatives: Policies aimed at reshoring manufacturing, such as those in the United States and Europe, can lead to increased domestic production of goods, potentially benefiting Alconix's supply chain and manufacturing operations.

Government industrial policies, particularly those promoting domestic manufacturing and key technologies like electric vehicles and renewable energy, significantly influence Alconix's market opportunities. For instance, the US Inflation Reduction Act (IRA) of 2022, with its substantial clean energy tax credits, is anticipated to drive demand for materials and components vital to these sectors, potentially benefiting Alconix's advanced materials division.

These governmental initiatives can profoundly shape Alconix's strategic planning and product development. For example, a government emphasis on domestic semiconductor manufacturing, bolstered by substantial subsidies as seen in programs like the CHIPS and Science Act in the US, could present Alconix with opportunities to supply specialized chemicals or equipment.

Governmental support for electric vehicles is a major driver, with the global EV market projected to exceed $800 billion by 2025, supported by numerous government incentives and manufacturing subsidies. This trend could increase demand for Alconix's battery materials.

Furthermore, as of early 2024, many nations are allocating billions towards renewable energy infrastructure, creating potential demand for Alconix's specialized coatings and composites used in wind turbines and solar panels.

| Policy Area | Impact on Alconix | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Clean Energy Subsidies (e.g., IRA) | Increased demand for advanced materials, potential for new product lines. | Global renewable energy investments projected to reach $2 trillion by 2030; EV market growth driving demand for battery components. |

| Domestic Manufacturing Initiatives (e.g., CHIPS Act) | Opportunities for supplying specialized chemicals and equipment, potential for increased domestic sourcing. | US semiconductor manufacturing investment expected to grow by 20% in 2025; European initiatives aim to double local chip production by 2030. |

| Trade Tariffs & Protectionism | Increased procurement costs, supply chain re-evaluation, potential for regional sourcing. | Tariffs on critical metals impacting supply chains globally; ongoing trade negotiations between major economies creating policy uncertainty. |

What is included in the product

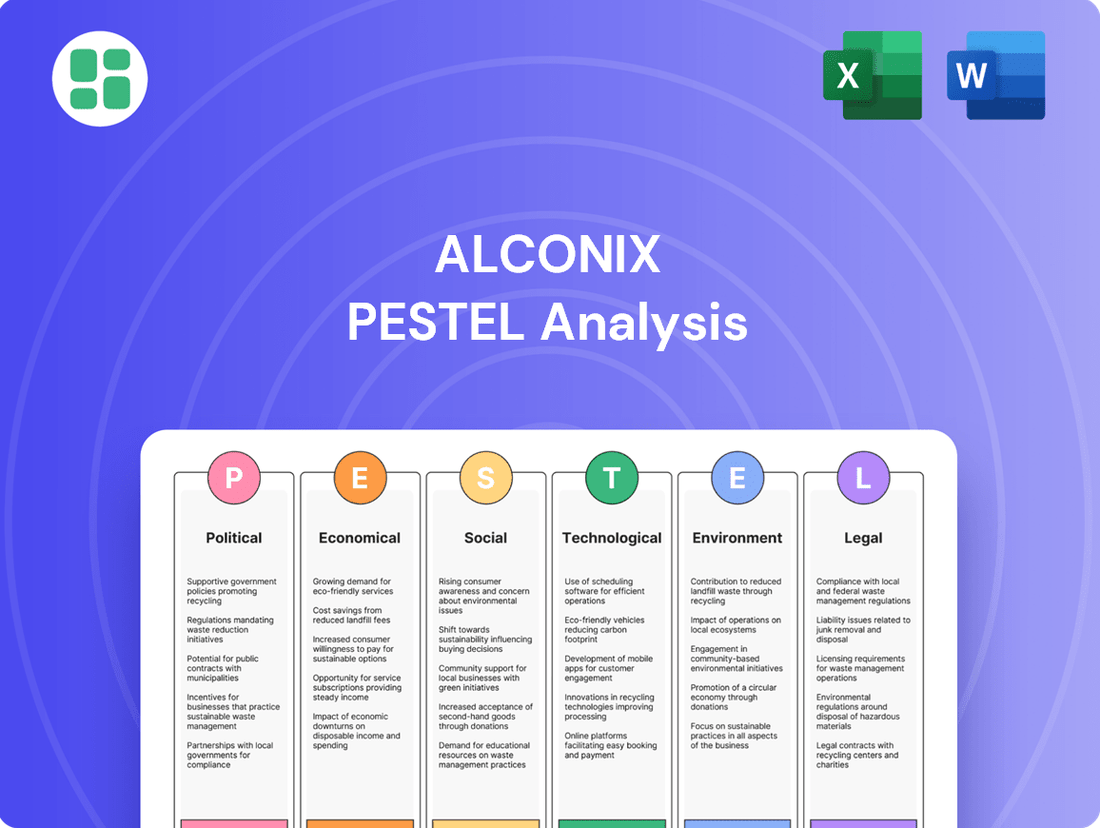

The Alconix PESTLE Analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's strategic landscape.

The Alconix PESTLE Analysis provides a visually segmented breakdown by PESTEL categories, allowing for quick interpretation at a glance and reducing the time spent deciphering complex external factors.

Economic factors

Alconix's performance is directly linked to global economic expansion. A robust global economy typically fuels demand for Alconix's non-ferrous metals, electronics, and machinery, as these are essential for industrial production and infrastructure projects. For instance, the IMF projected global growth at 3.2% for 2024, a slight uptick from 2023, which should support industrial demand.

Conversely, economic downturns or recessions in key markets can significantly dampen demand for Alconix's products. This reduced demand can lead to lower sales volumes and put downward pressure on the prices of the commodities Alconix trades. A slowdown in manufacturing output, a key indicator of industrial health, could directly impact Alconix's revenue streams.

Commodity prices, particularly for key inputs like aluminum and copper, are inherently volatile. In early 2024, aluminum prices hovered around $2,200 per metric ton, influenced by global industrial demand and energy costs, while copper saw significant swings, trading near $8,500 per metric ton due to supply concerns in major producing regions. These fluctuations, often exacerbated by geopolitical tensions or speculative trading, directly affect Alconix's cost of goods sold and overall profitability, necessitating robust risk management and hedging strategies to mitigate potential impacts.

As a global trading company, Alconix faces significant exposure to exchange rate fluctuations. For instance, a strengthening Japanese Yen against the US Dollar in late 2024 could increase the cost of imported goods for Alconix, while simultaneously making its exports more expensive for American buyers, potentially dampening sales volumes.

These currency shifts directly impact Alconix's bottom line. If the Yen appreciates by, say, 5% against the Euro by mid-2025, Alconix's revenues earned in Euros would translate into fewer Yen, negatively affecting reported profits. Conversely, a weaker Yen could boost export competitiveness but raise import costs.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Alconix, potentially escalating expenses for crucial inputs like raw materials, transportation, and workforce compensation. For instance, the US Producer Price Index (PPI) for manufactured goods saw an increase of 2.2% year-over-year in April 2024, indicating upward pressure on input costs across various industries.

Fluctuations in interest rates directly impact Alconix's financial flexibility. Higher rates can make borrowing more expensive, affecting the cost of managing its substantial inventory and the financing of its trade receivables. The Federal Reserve's decision to maintain the federal funds rate in the 5.25%-5.50% range through mid-2024, following a series of hikes, highlights the current environment of elevated borrowing costs.

- Increased Operating Expenses: Persistent inflation can lead to higher costs for raw materials, energy, and labor, squeezing Alconix's profit margins.

- Financing Costs: Elevated interest rates increase the expense of servicing debt and financing working capital, such as inventory and accounts receivable.

- Investment Decisions: Higher borrowing costs may deter Alconix from pursuing new capital expenditures or acquisitions, potentially slowing growth initiatives.

- Consumer Demand Impact: Inflation can reduce consumer purchasing power, indirectly affecting demand for Alconix's products if they are considered discretionary purchases.

Supply Chain Disruptions and Logistics Costs

Economic shocks, like the lingering effects of the COVID-19 pandemic and geopolitical tensions, continue to create significant volatility in global supply chains. These disruptions directly impact logistics costs, potentially increasing lead times for Alconix. For instance, shipping costs from Asia to Europe saw substantial increases in 2023 and early 2024, with some routes doubling in price compared to pre-pandemic levels due to port congestion and container shortages.

Alconix's ability to navigate these economic headwinds hinges on robust supply chain management and strategic diversification of its logistics partners. By spreading operations across multiple carriers and geographic regions, Alconix can reduce its reliance on any single point of failure. This proactive approach is essential for maintaining operational continuity and managing the financial implications of rising transportation expenses.

- Increased Freight Rates: Container shipping spot rates from Asia to the US West Coast averaged around $2,500-$3,000 per forty-foot equivalent unit (FEU) in early 2024, a significant jump from the sub-$1,500 levels seen in late 2023, reflecting ongoing capacity constraints and demand surges.

- Extended Lead Times: Average global shipping transit times remained elevated in 2024, with some routes experiencing delays of 20-30% longer than historical averages, impacting inventory management and production schedules.

- Diversification Benefits: Companies that diversified their logistics providers saw an average 5-10% reduction in overall logistics costs compared to those relying on a single provider during periods of peak disruption in 2023-2024.

Global economic growth directly influences Alconix's demand for industrial materials. The IMF's projection of 3.2% global growth for 2024 signals a supportive environment for industrial production, benefiting Alconix's sales volumes. However, volatile commodity prices, with aluminum around $2,200/ton and copper near $8,500/ton in early 2024, present ongoing cost management challenges.

Currency fluctuations, such as a strengthening Yen in late 2024, can impact Alconix's profitability by altering the cost of imports and the competitiveness of exports. Persistent inflation, evidenced by a 2.2% year-over-year increase in US PPI for manufactured goods in April 2024, raises operating expenses and financing costs due to elevated interest rates, with the Federal Reserve maintaining rates between 5.25%-5.50% through mid-2024.

Supply chain disruptions continue to affect Alconix, with shipping costs from Asia to Europe doubling in early 2024. Diversifying logistics partners, which can reduce costs by 5-10%, is crucial for mitigating extended lead times, such as the 20-30% increases seen on some routes.

| Economic Factor | 2024 Data/Projection | Impact on Alconix |

|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Supports industrial demand and sales volume |

| Aluminum Price (Early 2024) | Approx. $2,200/metric ton | Affects cost of goods sold and profitability |

| Copper Price (Early 2024) | Approx. $8,500/metric ton | Affects cost of goods sold and profitability |

| US PPI (Manufactured Goods, YoY April 2024) | +2.2% | Indicates rising input costs |

| Federal Funds Rate (Mid-2024) | 5.25%-5.50% | Increases financing costs for inventory and receivables |

| Shipping Costs (Asia-Europe, Early 2024) | Doubled vs. pre-pandemic | Increases logistics expenses and lead times |

Same Document Delivered

Alconix PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Alconix PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's operations. You'll gain valuable insights into political, economic, social, technological, legal, and environmental considerations.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, directly impacting industries like metals trading by boosting demand for recycled and ethically sourced materials.

This heightened awareness is reshaping supply chains, pushing companies like Alconix to source materials with a demonstrably lower environmental impact. The demand for recycled aluminum, for example, saw a substantial increase in 2024, driven by both consumer preference and regulatory pushes for circular economy principles.

Societal expectations regarding fair labor practices and human rights are intensifying, directly influencing Alconix's operational and sourcing strategies. Growing public awareness of supply chain conditions, especially within mining and manufacturing sectors, means that any perceived missteps can significantly damage the company's reputation and affect consumer trust. For instance, reports in 2024 highlighted increased consumer boycotts of brands with unverified ethical sourcing, demonstrating the tangible financial risk involved.

Adherence to international labor standards, such as those set by the International Labour Organization (ILO), and robust ethical sourcing guidelines are no longer optional but critical for maintaining market access and investor confidence. Companies are increasingly being held accountable for the conditions of workers throughout their entire value chain. By 2025, many major investment funds are expected to integrate stricter human rights due diligence into their ESG screening processes, potentially impacting Alconix's access to capital if not proactively addressed.

Global demographic shifts are significantly reshaping workforce availability for industries like those Alconix serves. Developed nations, such as Japan and Germany, are experiencing an aging workforce, with the average age in Japan's labor force projected to reach 46.9 years by 2025, potentially leading to labor shortages and increased labor costs. Conversely, rapid urbanization in developing regions, like Southeast Asia, is creating a larger pool of available workers, but often with varying skill sets and training needs.

These demographic trends directly impact Alconix's partners by influencing the cost and accessibility of skilled labor for manufacturing and processing. For instance, a shortage of experienced technicians in a key component supplier's region could lead to production delays and higher material costs for Alconix. Conversely, access to a growing, younger workforce in another region might offer cost efficiencies but necessitate investment in training programs to meet Alconix's quality standards.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to everyday customers and Alconix's own workforce, are increasingly vocal about their expectations for robust corporate social responsibility. This isn't just about meeting minimum legal requirements anymore; it's about actively contributing to environmental sustainability, upholding the highest ethical standards in all business dealings, and engaging meaningfully with the communities where Alconix operates.

The pressure is mounting. For instance, a 2024 survey by Edelman found that 60% of consumers globally say they will buy or boycott a brand based on its social and political actions, highlighting a direct link between CSR performance and market success. Similarly, investors are channeling more capital into ESG (Environmental, Social, and Governance) funds, with global ESG assets projected to reach $50 trillion by 2025, demonstrating a clear financial incentive for companies like Alconix to prioritize these areas.

- Investor Scrutiny: A significant portion of institutional investment is now tied to ESG performance, pushing companies to report transparently on their social and environmental impact.

- Consumer Demand: Consumers are actively seeking out brands that align with their values, with a growing preference for products and services from companies demonstrating strong ethical and sustainable practices.

- Employee Expectations: Employees, particularly younger generations, prioritize working for organizations that have a positive societal impact, influencing talent acquisition and retention strategies.

- Regulatory Trends: While not always directly mandated, there's a global trend towards greater corporate accountability for social and environmental issues, often leading to stricter disclosure requirements and potential reputational risks for non-compliance.

Urbanization and Infrastructure Development

Global urbanization continues to be a significant driver for Alconix, directly impacting demand for its non-ferrous metals and components. As more people move into cities, there's a greater need for construction materials and advanced electronics, which are core to Alconix's business. This sociological trend translates into sustained growth opportunities for the company's key segments.

The United Nations projects that by 2050, 68% of the world's population will live in urban areas, up from 57% in 2021. This increasing concentration of people necessitates substantial investment in infrastructure, from housing and transportation to energy grids and telecommunications. These are precisely the sectors that rely heavily on the materials Alconix supplies.

- Increased Demand: Urban growth fuels demand for metals used in buildings, vehicles, and electronic devices.

- Infrastructure Investment: Developing urban centers require extensive infrastructure projects, boosting Alconix's market.

- Technological Integration: Smart city initiatives and advanced electronics in urban environments increase the need for specialized components.

- Economic Concentration: Urban areas often become hubs for economic activity, leading to higher consumption of manufactured goods.

Societal expectations around ethical sourcing and fair labor are increasingly influencing Alconix's operations. Consumers and investors alike are scrutinizing supply chains, with a 2024 Edelman report showing 60% of consumers willing to boycott brands based on social actions. This pressure means companies must demonstrate robust due diligence, as investor focus on ESG is projected to reach $50 trillion by 2025, directly impacting capital access.

Demographic shifts, such as aging workforces in developed nations and growing urban populations in developing regions, present both challenges and opportunities for Alconix. For instance, labor shortages in key manufacturing hubs due to an aging workforce could increase costs, while urbanization drives demand for Alconix's materials in infrastructure and electronics.

The growing emphasis on corporate social responsibility (CSR) is reshaping how companies like Alconix engage with stakeholders. Employees, particularly younger generations, prioritize working for organizations with a positive societal impact, affecting talent acquisition. This societal shift necessitates proactive engagement with community and environmental initiatives to maintain brand reputation and market relevance.

Technological factors

Innovations in metal extraction and refining are significantly boosting efficiency and lowering costs for companies like Alconix. For instance, advancements in hydrometallurgy and electrometallurgy are enabling the recovery of valuable metals from complex ores and waste streams with greater purity. This directly impacts the quality and cost-effectiveness of the raw materials Alconix utilizes.

Recycling technologies are also seeing rapid development, particularly for specialty metals. New methods for separating and purifying metals from electronic waste and industrial byproducts are becoming more viable. This not only reduces reliance on primary mining but also presents opportunities for Alconix to develop new business lines focused on circular economy principles, enhancing their sustainability profile.

The global market for metal recycling is projected to grow substantially. For example, the market for electronic waste recycling alone was valued at over $50 billion in 2023 and is expected to expand at a compound annual growth rate of around 10% through 2030, according to various industry reports. This growth underscores the increasing importance of efficient recycling processes for materials Alconix may source or process.

The constant evolution in material science presents a dual-edged sword for Alconix. For instance, the development of lighter, stronger composite materials in the aerospace sector could reduce demand for traditional aluminum alloys, a core Alconix product. Conversely, breakthroughs in superconductive materials could open entirely new avenues for Alconix's expertise in specialized metal processing, potentially driving growth in emerging energy technologies.

Alconix's supply chain is poised for a significant uplift through the integration of automation, artificial intelligence (AI), and blockchain. These technologies are streamlining logistics, enhancing inventory accuracy, and building more transparent trading environments. For instance, AI-powered demand forecasting can reduce stockouts by up to 20%, a crucial benefit for a company managing a global network.

The ongoing digital transformation is fundamental to optimizing Alconix's intricate global supply chain operations. By embracing these advancements, Alconix can expect to see improvements in operational efficiency, a clearer view of its inventory and shipments, and a more robust approach to managing potential risks within its supply network.

Energy Efficiency Technologies

Technological advancements in energy efficiency are significantly impacting industrial operations. For instance, innovations in induction heating and advanced furnace designs are reducing energy consumption in metal production. These improvements can lower operational costs for Alconix's manufacturing partners, thereby enhancing the competitiveness of the materials Alconix trades.

The drive towards sustainability further amplifies the importance of these technologies. Companies are increasingly prioritizing suppliers and materials that demonstrate a commitment to reduced environmental impact. This trend is reflected in the growing investment in green technologies within the manufacturing sector, with a focus on minimizing carbon footprints.

- Energy Savings: Advanced induction heating systems can offer up to 30% energy savings compared to traditional methods in metal processing.

- Cost Reduction: Lower energy bills directly translate to reduced production costs for manufacturers, making materials more attractive.

- Sustainability Alignment: Adoption of these technologies helps Alconix's partners meet their corporate sustainability targets and environmental regulations.

- Market Competitiveness: Efficiently produced materials are more competitive in a market increasingly sensitive to environmental and cost factors.

Data Analytics and Market Forecasting

Alconix can significantly improve its market foresight by employing big data analytics and sophisticated predictive modeling. These tools are crucial for accurately forecasting fluctuations in commodity prices, anticipating shifts in consumer demand, and identifying potential supply chain bottlenecks.

By harnessing these advanced technological capabilities, Alconix can make more strategic trading decisions and streamline its inventory management processes, leading to greater efficiency and cost savings. For instance, in 2024, companies heavily invested in AI-driven analytics saw an average improvement of 15% in demand forecasting accuracy.

The integration of data analytics offers several key advantages:

- Enhanced Price Forecasting: Alconix can leverage historical data and real-time market feeds to predict commodity price movements with greater precision, enabling better hedging strategies.

- Optimized Inventory: Predictive models can help Alconix maintain optimal stock levels, reducing carrying costs and minimizing the risk of stockouts or excess inventory.

- Supply Chain Resilience: By analyzing vast datasets, Alconix can identify potential disruptions early, allowing for proactive mitigation and ensuring business continuity.

- Informed Trading Decisions: Data-driven insights empower Alconix to make more confident and profitable trading decisions in volatile markets.

Technological factors are reshaping Alconix's operational landscape. Advancements in metal extraction and recycling, such as hydrometallurgy, are improving efficiency and purity, directly impacting raw material costs. For example, the electronic waste recycling market, valued over $50 billion in 2023, is growing at approximately 10% annually, presenting new sourcing opportunities.

Legal factors

Alconix faces significant operational considerations due to stringent environmental protection laws across its global footprint. These regulations, covering everything from air emissions to hazardous waste disposal, directly influence manufacturing processes and supply chain management, potentially increasing compliance costs. For instance, in 2024, the European Union's updated Industrial Emissions Directive (IED) mandates stricter limits for pollutants, requiring substantial investment in abatement technologies for facilities within its member states.

Alconix's global reach means its operations are deeply intertwined with international trade law. Navigating a landscape of customs regulations and trade pacts is crucial for market access and smooth cross-border dealings.

For instance, the World Trade Organization (WTO) agreements, which govern 98% of global trade as of 2024, set the foundational rules. Any shifts in these, or the emergence of new bilateral agreements like the US-UK Free Trade Agreement discussions, could directly influence Alconix's tariff structures and overall cost of international transactions.

Alconix must navigate a complex web of national and international labor laws, impacting everything from minimum wage requirements and working condition standards to the right to unionize. For instance, in 2024, many European nations continued to strengthen worker protections, potentially increasing compliance costs. Failure to adhere to these regulations, such as those concerning overtime pay or workplace safety, can lead to significant fines and legal challenges, directly affecting operational expenses and human resource strategies.

Maintaining ethical labor practices is paramount for Alconix's brand image and stakeholder trust. Reports in early 2025 highlighted increased consumer and investor scrutiny on supply chain labor conditions across various industries. Demonstrating a commitment to fair wages, safe working environments, and prohibiting child labor is not just a legal obligation but a critical component of corporate social responsibility, influencing Alconix's reputation and market positioning.

Anti-Trust and Competition Laws

Alconix faces scrutiny under anti-trust and competition laws across its operating regions. These regulations are designed to prevent monopolies and ensure fair market competition, impacting Alconix's pricing strategies, potential mergers, and distribution agreements. Failure to comply can result in substantial penalties; for instance, the European Commission imposed fines totaling €1.48 billion on several companies in 2023 for cartel activities, highlighting the severity of violations.

Navigating these complex legal frameworks is crucial for Alconix's continued growth and market presence. The company must ensure its business practices, from product bundling to exclusive dealing arrangements, do not stifle competition or exploit a dominant market position. Recent regulatory actions, such as the ongoing investigations into tech giants for alleged anti-competitive practices in 2024, underscore the increasing enforcement focus globally.

- Regulatory Scrutiny: Alconix must adhere to competition laws in key markets like the EU, US, and China, which govern market dominance and anti-competitive behavior.

- Compliance Costs: Ensuring adherence involves significant investment in legal counsel and compliance programs, with fines for violations potentially reaching billions of dollars.

- Market Impact: Non-compliance can lead to forced divestitures, restrictions on business operations, and damage to Alconix's reputation, impacting its ability to secure favorable partnerships and acquisitions.

- Enforcement Trends: Global regulators are increasingly proactive in investigating and penalizing anti-competitive practices, as seen in recent antitrust actions across various sectors in 2023-2024.

Product Safety and Quality Standards

Alconix must adhere to stringent legal mandates governing product safety and quality, especially within the electronics sector. These regulations, such as those from the Consumer Product Safety Commission (CPSC) in the US, outline critical specifications and rigorous testing procedures for all materials and components. For instance, in 2024, the CPSC reported over 40,000 consumer product-related injuries requiring medical attention, highlighting the importance of compliance.

Failure to meet these established standards can result in severe repercussions for Alconix. These include costly product recalls, significant legal liabilities, and irreparable damage to the company's reputation. In 2023, the automotive industry alone faced billions in costs due to safety-related recalls, a stark reminder of the financial impact of non-compliance.

- Regulatory Compliance: Alconix must ensure all electronic materials meet safety certifications like UL, CE, and RoHS, which restrict hazardous substances.

- Testing Protocols: Implementing comprehensive testing for durability, electrical safety, and material integrity is legally mandated and crucial for market access.

- Liability Management: Proactive risk management and robust quality control systems are essential to mitigate potential legal liabilities arising from product defects.

Alconix operates under a complex framework of intellectual property (IP) laws, safeguarding its innovations and technologies. Protecting patents, trademarks, and copyrights is vital to maintaining a competitive edge and preventing unauthorized use of its proprietary information.

The company must also respect the IP rights of others to avoid costly litigation and potential injunctions. For example, in 2024, the global IP market saw continued growth, with significant investments in patent filings and licensing agreements, underscoring the economic importance of this legal domain.

Navigating patent landscapes, especially in rapidly evolving technological sectors, requires constant vigilance and strategic legal counsel to ensure freedom to operate and to leverage its own innovations effectively.

| Legal Factor | Description | Implication for Alconix | Example/Data Point (2023-2025) |

|---|---|---|---|

| Intellectual Property Rights | Protection of patents, trademarks, copyrights, and trade secrets. | Secures competitive advantage, prevents infringement, and enables licensing revenue. | Global IP filings increased by an estimated 5% in 2024, reflecting heightened innovation and protection efforts. |

| Contract Law | Enforcement of agreements with suppliers, customers, and partners. | Ensures reliable supply chains, customer commitments, and partnership stability. | In 2023, contract disputes represented a significant portion of commercial litigation, highlighting the need for robust contract management. |

| Data Privacy & Cybersecurity Laws | Compliance with regulations like GDPR, CCPA, and similar global standards. | Protects sensitive customer and company data, avoids hefty fines, and maintains trust. | The number of data breaches reported globally continued to rise in early 2025, with regulatory fines for non-compliance reaching millions of dollars. |

Environmental factors

The long-term availability of essential non-ferrous metal ores, critical for Alconix's operations, is a significant environmental challenge. As global demand continues to rise, concerns about the depletion of these finite resources are intensifying, directly influencing Alconix's long-term procurement strategies and the stability of its supply chain.

To address this growing scarcity, Alconix is increasingly prioritizing circular economy principles. This involves a strategic shift towards sourcing a greater proportion of its raw materials from recycling streams. For instance, the global recycling rate for aluminum, a key non-ferrous metal, has been around 75% in recent years, demonstrating the potential of recycled materials to offset reliance on primary extraction.

Global and national climate change policies, including carbon pricing and emissions targets, are increasingly impacting energy-intensive sectors like metal production. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, imposes a levy on carbon-intensive imports, directly affecting supply chains. This policy, along with national renewable energy mandates, puts pressure on companies like Alconix to ensure their suppliers are also reducing their carbon footprint, influencing sourcing decisions and potentially increasing operational costs.

The global drive towards a circular economy is significantly boosting waste management and recycling initiatives, particularly for key metals like aluminum and copper. This trend aims to minimize landfill waste and maximize material reuse. For instance, the London Metal Exchange (LME) saw a 2.5% increase in its audited warehouse stocks of aluminum in the first quarter of 2024 compared to the previous year, reflecting growing interest in recycled aluminum availability.

Alconix, operating as a trading company, is strategically positioned to capitalize on this shift by facilitating the trade and processing of recycled aluminum and copper. By connecting suppliers of recycled materials with manufacturers, Alconix can actively contribute to environmental sustainability goals while developing a robust business segment. In 2023, the global recycling rate for aluminum reached approximately 76%, showcasing a strong market for these materials.

Water Usage and Pollution

Water scarcity and pollution are significant environmental factors affecting Alconix's upstream partners, especially those involved in mining and metal processing. These issues can directly impact their social license to operate, potentially disrupting supply chains. For instance, by 2025, many regions are projected to face increased water stress, with some studies indicating that over two-thirds of the global population could experience water shortages by 2050.

Sustainable water management is becoming crucial for the long-term viability of Alconix's supply chain. Companies are facing growing pressure from regulators and investors to demonstrate responsible water usage and minimize pollution. This includes investments in advanced water treatment technologies and closed-loop systems to reduce freshwater intake and wastewater discharge.

- Water Scarcity: Regions critical for raw material extraction often overlap with areas facing severe water stress. Projections suggest that by 2025, the demand for water will exceed supply by 40% in many parts of the world.

- Pollution Concerns: Mining and metal processing can lead to the contamination of water sources with heavy metals and chemicals, posing risks to ecosystems and human health.

- Regulatory Pressure: Governments worldwide are implementing stricter regulations on water discharge and usage, increasing compliance costs for upstream partners.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) investors are increasingly evaluating companies based on their water management practices, influencing capital allocation.

Biodiversity Loss and Ecosystem Impact

Alconix faces growing pressure regarding the environmental footprint of its operations, particularly concerning biodiversity loss. The mining and manufacturing sectors, which are integral to Alconix's supply chain, are increasingly scrutinized for their impact on ecosystems. For instance, a 2024 report by the UN Environment Programme highlighted that over 1 million species are currently threatened with extinction, a significant portion of which is linked to habitat destruction driven by industrial activities. This trend necessitates that Alconix rigorously vet its sourcing practices and ensure its partners demonstrate robust environmental stewardship to avoid reputational damage and potential regulatory penalties.

Ensuring responsible sourcing is paramount for Alconix. The company must actively monitor and enforce environmental standards throughout its supply chain, from raw material extraction to manufacturing processes. Failure to do so could lead to increased operational costs due to stricter environmental regulations and potential supply chain disruptions. For example, in 2025, several European countries are expected to implement enhanced due diligence laws requiring companies to map and mitigate their environmental impacts, including those on biodiversity. Alconix's proactive engagement in this area can translate into a competitive advantage.

The impact of biodiversity loss extends beyond regulatory compliance; it can directly affect Alconix's long-term resource availability. Ecosystem degradation can compromise the quality and accessibility of raw materials essential for Alconix's products.

- Ecosystem Services: Alconix relies on healthy ecosystems for clean water and air, crucial for manufacturing and employee well-being.

- Resource Scarcity: Biodiversity loss can lead to the depletion of natural resources, potentially increasing raw material costs for Alconix.

- Reputational Risk: Negative publicity surrounding environmental damage can significantly harm Alconix's brand image and customer loyalty.

- Regulatory Compliance: Adhering to evolving environmental laws, such as those focusing on habitat protection, is critical to avoid fines and operational disruptions.

Alconix faces increasing pressure to manage its environmental footprint, particularly concerning biodiversity. The mining and manufacturing sectors, vital to its supply chain, are under scrutiny for ecosystem impact. For instance, a 2024 UN report noted over 1 million species face extinction, partly due to industrial activities, highlighting the need for Alconix to ensure its partners practice strong environmental stewardship.

Ensuring responsible sourcing is paramount for Alconix, requiring active monitoring of environmental standards throughout its supply chain. Failure to do so could lead to higher operational costs from stricter regulations and potential supply chain disruptions. By 2025, several European nations are set to implement enhanced due diligence laws focusing on environmental impacts, including biodiversity, making Alconix's proactive engagement a competitive advantage.

The impact of biodiversity loss extends to resource availability, as ecosystem degradation can compromise the quality and accessibility of raw materials essential for Alconix. This necessitates robust environmental management to mitigate risks and ensure long-term supply chain stability.

| Environmental Factor | Impact on Alconix | Relevant Data/Projections (2024-2025) |

|---|---|---|

| Resource Scarcity & Circular Economy | Long-term availability of non-ferrous metals. Increased reliance on recycled materials. | Global aluminum recycling rate ~76% (2023). LME audited aluminum stocks increased 2.5% Q1 2024 vs Q1 2023. |

| Climate Change & Emissions | Pressure to reduce carbon footprint across supply chain. Potential increased operational costs due to carbon pricing. | EU Carbon Border Adjustment Mechanism (CBAM) effective Oct 2023. |

| Water Management | Supply chain disruption risk due to water scarcity and pollution impacting upstream partners. | 40% water demand vs supply deficit projected by 2025 in many regions. |

| Biodiversity Loss | Reputational risk and potential regulatory penalties. Impact on raw material quality and accessibility. | Over 1 million species threatened with extinction (UNEP 2024 report). Enhanced due diligence laws expected in Europe by 2025. |

PESTLE Analysis Data Sources

Our Alconix PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable market research firms, and leading economic forecasting agencies. This ensures that every political, economic, social, technological, legal, and environmental factor is grounded in current, verifiable data.