Adtalem Global Education Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adtalem Global Education Bundle

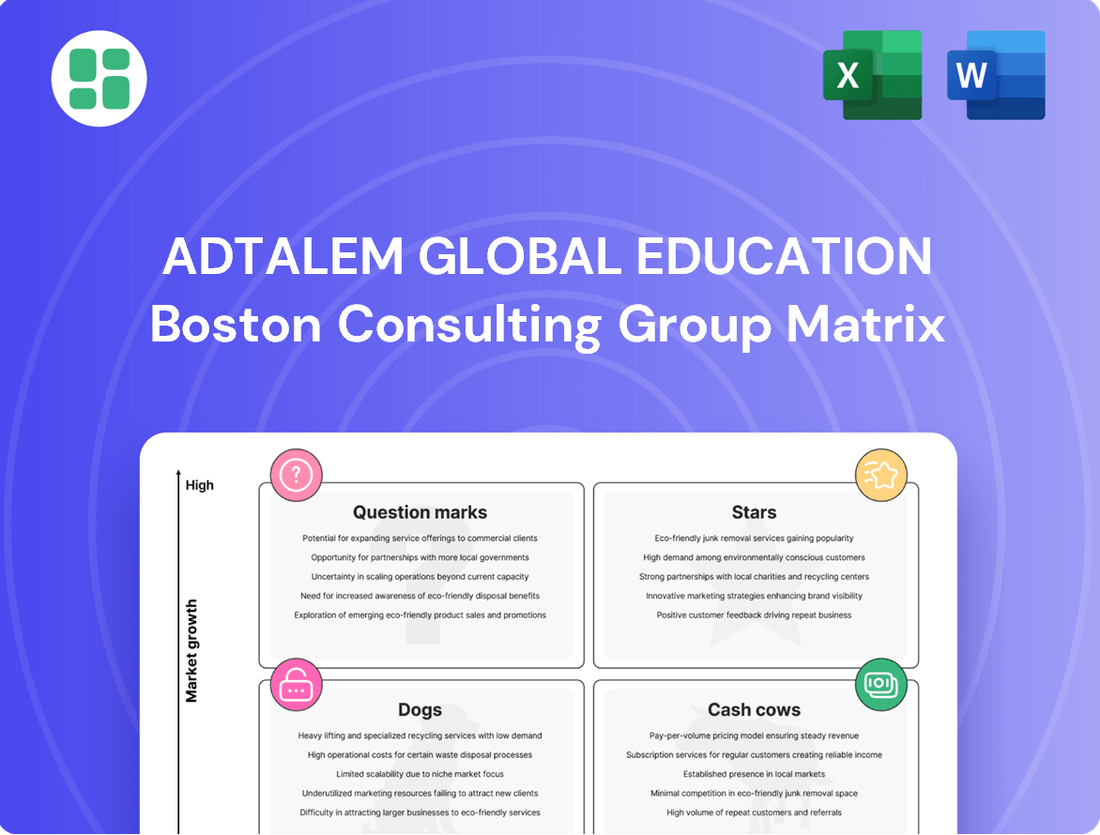

Uncover Adtalem Global Education's strategic positioning with our comprehensive BCG Matrix. See which of their educational offerings are poised for growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or require further investment (Question Marks). This preview is just the beginning; purchase the full report for detailed quadrant placements and actionable insights to optimize your investment strategy.

Stars

Chamberlain University's nursing programs are a star performer within Adtalem Global Education's portfolio. These programs are experiencing robust enrollment growth, evidenced by a 5.8% year-over-year increase in total enrollment in Q4 FY2025, bringing the student count to over 40,500. This consistent upward trend in student numbers directly translates into significant revenue contributions for Adtalem, underscoring Chamberlain's role as a primary growth engine.

Walden University's online healthcare programs are a significant driver for Adtalem Global Education, showcasing robust performance within the BCG matrix. These programs have experienced consistent double-digit enrollment increases, reflecting their strong market demand and Adtalem's strategic focus on the healthcare sector. In Q4 of fiscal year 2025, Walden achieved its eighth consecutive quarter of total enrollment growth, up 15.0% year-over-year, with a student body exceeding 48,500 individuals.

Adtalem's strategic partnerships, like Chamberlain University's Aspiring Nurse Program with SSM Health, are prime examples of Stars in the BCG Matrix. These collaborations directly tackle critical workforce shortages by establishing clear employment pathways for graduates.

This approach not only boosts student success but also solidifies Adtalem's position as a leader in developing talent that meets immediate industry demands. For instance, in 2024, such programs are crucial for addressing the projected nursing shortage, which the Bureau of Labor Statistics anticipates will require an additional 203,700 registered nurses by 2032.

Advanced & Specialized Healthcare Programs

Advanced & Specialized Healthcare Programs represent a key area for Adtalem Global Education. Programs such as the Doctor of Nursing Practice (DNP) at Chamberlain University are seeing substantial growth, reflecting the increasing demand for highly skilled nursing professionals. This expansion directly supports Adtalem's strategic focus on growth and purpose within the healthcare education sector.

These specialized offerings are designed to meet the dynamic needs of the healthcare industry. Professionals are increasingly seeking advanced degrees and certifications to enhance their expertise and career prospects in specialized fields. For instance, Adtalem's focus on areas like DNP programs aligns with market trends showing a significant need for advanced practice nurses.

- Growing Demand: The healthcare sector's continuous evolution drives demand for specialized skills, making advanced programs highly attractive.

- Career Advancement: Professionals pursue these programs to gain specialized knowledge and improve their career trajectory.

- Market Alignment: Adtalem's investment in these areas directly addresses a growing and evolving market need within healthcare education.

Integration of Healthcare Data Analytics (e.g., MAGIC partnership)

Adtalem Global Education is actively integrating healthcare data analytics into its medical programs, exemplified by initiatives like the MAGIC partnership. This strategic move positions Adtalem to capitalize on the burgeoning demand for professionals skilled in AI-driven healthcare solutions. These programs are designed to equip graduates for roles in rapidly expanding fields such as predictive diagnostics and virtual care delivery.

The focus on data analytics within medical education is a key driver for Adtalem's future growth. For instance, by 2024, the healthcare analytics market was projected to reach significant figures, indicating a strong demand for the skills Adtalem's programs aim to impart. While Adtalem's current market share in these highly specialized, emerging areas might be modest, the long-term growth trajectory is exceptionally promising.

- Focus on AI and Predictive Analytics: Adtalem's programs are cultivating expertise in areas like AI-driven diagnostics and personalized medicine.

- Telemedicine and Virtual Care: Graduates are being prepared for the increasing adoption of remote patient monitoring and telehealth services.

- Market Growth Potential: The healthcare analytics sector is experiencing exponential growth, with projections indicating continued expansion through 2025 and beyond.

- Strategic Partnerships: Collaborations like the MAGIC partnership are crucial for embedding cutting-edge data analytics into medical curricula.

Chamberlain University and Walden University's healthcare programs are key Stars for Adtalem Global Education. Chamberlain saw a 5.8% enrollment increase in Q4 FY2025, exceeding 40,500 students, while Walden achieved its eighth consecutive quarter of growth, up 15.0% year-over-year to over 48,500 students. These programs, including advanced offerings like DNP degrees and those integrating data analytics, are capitalizing on the strong demand for skilled healthcare professionals, particularly in areas like AI and virtual care.

| Adtalem Business Unit | Program Focus | BCG Category | Key Growth Driver | Recent Performance Metric (FY2025 Q4) |

|---|---|---|---|---|

| Chamberlain University | Nursing (Undergraduate & Graduate) | Star | High enrollment growth, strategic partnerships | 5.8% year-over-year enrollment increase |

| Walden University | Online Healthcare Programs | Star | Strong market demand, consistent growth | 15.0% year-over-year enrollment increase |

| Adtalem (Cross-segment) | Advanced Healthcare Programs (e.g., DNP) | Star | Demand for specialized skills, career advancement | Substantial growth in specialized offerings |

| Adtalem (Cross-segment) | Healthcare Data Analytics | Star | Emerging tech demand, AI integration | Focus on AI-driven diagnostics and virtual care |

What is included in the product

Adtalem's BCG Matrix categorizes its educational segments, identifying growth potential and market share.

Adtalem's BCG Matrix provides a clear visual of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Adtalem's medical and veterinary schools, including AUC and RUSM, are firmly established as cash cows. They demonstrate robust and consistent performance, highlighted by impressive residency attainment rates. For instance, the combined first-time residency attainment rate for 2024-2025 graduates reached 95%, underscoring the quality of education and graduate preparedness.

These institutions operate within the healthcare education sector, a market that is both essential and mature. This stability translates into predictable and reliable cash flow, driven by consistent student enrollment and the strong brand recognition these schools have cultivated over time.

While these schools provide a steady stream of income, their growth trajectory is more measured compared to other segments within Adtalem, such as nursing or Walden. This aligns with the typical characteristics of a cash cow, where the focus is on maintaining market share and generating profits rather than aggressive expansion.

Chamberlain University's core pre-licensure nursing education programs are a powerhouse for Adtalem Global Education, acting as a significant cash cow. These foundational programs consistently attract a steady stream of students eager to enter the nursing profession, a field with enduring and high demand across the healthcare landscape.

The established nature of these nursing curricula and their proven delivery methods contribute to predictable enrollment numbers and robust financial returns. This stability means Adtalem can rely on these programs for consistent revenue without needing substantial new capital infusions, allowing resources to be allocated elsewhere.

In 2024, Adtalem reported that Chamberlain's nursing programs, including its pre-licensure offerings, continued to be a primary driver of revenue. For instance, Adtalem's fiscal year 2024 revenue was $1.4 billion, with the total revenue from its Medical and Nursing segment, which Chamberlain leads, showing strong performance.

Adtalem Global Education's established online learning infrastructure is a prime example of a cash cow. This robust platform, built on substantial prior investments, efficiently delivers educational content to a vast student population. Its scalability and established processes allow for high-margin operations, generating consistent revenue without significant ongoing capital outlays for core functionality.

Post-Licensure and Continuing Education for Healthcare Professionals

Adtalem's post-licensure and continuing education programs for healthcare professionals are a significant cash cow. These online offerings are designed for busy, working individuals looking to advance their careers or meet regulatory requirements. The consistent demand for professional development in the healthcare sector, coupled with Adtalem's established reputation, ensures a reliable revenue stream.

In 2024, Adtalem continued to see strong enrollment in these programs, reflecting the ongoing need for specialized skills and certifications within the healthcare industry. The flexibility of online delivery makes these courses particularly attractive to healthcare workers balancing demanding schedules.

- Stable Revenue: Programs like Chamberlain University's post-licensure nursing programs and Ross University School of Medicine's continuing education offerings generate predictable income.

- High Demand: The healthcare field consistently requires upskilling and specialization, creating a perpetual market for these educational services.

- Leveraging Existing Infrastructure: Adtalem utilizes its established online platforms and faculty expertise, minimizing incremental costs and maximizing profitability.

- Brand Loyalty: A strong alumni network and brand recognition encourage repeat engagement and referrals, further solidifying this segment as a cash cow.

Established Workforce Partnerships and Employer Solutions

Adtalem's Established Workforce Partnerships and Employer Solutions represent a significant cash cow within its BCG Matrix. These long-standing relationships with healthcare organizations are designed to deliver customized training and talent pipeline solutions, ensuring a steady stream of predictable and recurring revenue.

The strength of these partnerships lies in their proven track record of effectively addressing critical workforce shortages within the healthcare sector. This established success allows Adtalem to leverage existing contracts, essentially milking these revenue streams with considerably lower new market development costs.

For instance, Adtalem's commitment to employer solutions is evident in its continued focus on serving the needs of the healthcare industry. In fiscal year 2023, Adtalem reported total revenue of $1.4 billion, with a substantial portion attributed to its employer-sponsored programs and partnerships.

- Revenue Stability: These partnerships provide a reliable revenue base, insulated from the volatility of new student acquisition.

- Low Investment Needs: Existing infrastructure and established relationships minimize the need for significant new capital expenditure.

- Market Dominance: Adtalem's deep integration into healthcare talent pipelines solidifies its position and competitive advantage.

- Profitability: The efficiency of serving existing partners contributes to strong profit margins for this segment.

Adtalem's medical and veterinary schools, along with Chamberlain University's core nursing programs, are prime examples of cash cows. These established institutions benefit from consistent student demand and strong brand recognition in mature, essential markets like healthcare education. Their predictable revenue streams, driven by high residency attainment rates and proven educational models, allow for steady profits with minimal need for new investment.

The company's established online learning infrastructure and post-licensure/continuing education programs also function as cash cows. These offerings leverage existing platforms and cater to ongoing professional development needs in healthcare, generating reliable income. Furthermore, Adtalem's workforce partnerships and employer solutions provide a stable revenue base through customized training, reinforcing their status as profit-generating assets.

In fiscal year 2024, Adtalem reported total revenues of $1.4 billion, with its Medical and Nursing segment, heavily featuring these cash cow programs, demonstrating robust performance. The consistent demand for healthcare professionals ensures these segments remain vital contributors to Adtalem's financial stability.

| Segment | BCG Category | Key Characteristics | FY24 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Medical & Veterinary Schools (AUC, RUSM) | Cash Cow | High residency attainment (95% first-time for 2024-25 grads), mature market, predictable cash flow. | Significant contributor to Medical and Nursing segment revenue. |

| Chamberlain University (Core Nursing) | Cash Cow | Enduring demand for nursing, established curricula, predictable enrollment, strong financial returns. | Primary driver of revenue within the Medical and Nursing segment. |

| Online Learning Infrastructure | Cash Cow | Scalable, high-margin operations, minimal ongoing capital for core functionality. | Supports multiple programs, contributing to overall segment profitability. |

| Post-Licensure & Continuing Education | Cash Cow | Consistent demand for upskilling, leverages existing platforms, reliable revenue. | Caters to healthcare professionals seeking advancement. |

| Workforce Partnerships & Employer Solutions | Cash Cow | Recurring revenue from long-term contracts, low new market development costs. | Addresses healthcare workforce shortages through talent pipeline solutions. |

What You See Is What You Get

Adtalem Global Education BCG Matrix

The Adtalem Global Education BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis is fully formatted and ready for immediate strategic application, providing a clear, professional overview of Adtalem's business units.

Dogs

Adtalem Global Education's BCG Matrix identifies non-core, stagnant non-healthcare programs as potential Dogs. These are likely legacy offerings, perhaps at Walden University, that aren't capitalizing on the robust demand for healthcare fields. They typically exhibit minimal enrollment growth and declining market relevance.

These programs often represent a drain on resources, consuming valuable capital and personnel without generating substantial returns. For instance, if a program's enrollment has been flat or declining for several consecutive years, it signals a lack of market demand and a potential candidate for divestiture or discontinuation.

Underperforming regional campuses, such as those that may have experienced localized low enrollment or higher operational costs than their digital offerings, could be categorized as question marks or even dogs in Adtalem's BCG Matrix. These physical locations might not be contributing significantly to overall growth or market share, potentially acting as cash drains.

Adtalem Global Education has a history of strategic adjustments, including the transfer of non-performing campuses in the past. For instance, in 2020, Adtalem completed the divestiture of its Carrington College campuses, a move that streamlined its portfolio and allowed for greater focus on core, higher-growth segments.

Adtalem's professional development segment may include legacy certification programs that haven't kept pace with evolving industry needs. For instance, if a certification in a now-obsolete software was offered, its market adoption would likely be minimal, generating little revenue. This reflects a potential 'Dog' in the BCG matrix, where resources are tied up in offerings with low growth and low market share.

Programs with High Attrition Rates

Adtalem Global Education, like many institutions, faces challenges with educational programs that exhibit high attrition rates. These programs, regardless of their specific market focus, often signal underlying issues with student outcomes or satisfaction. This leads to lower completion rates, which directly impedes market share expansion and can necessitate significant investment in recruitment and retention efforts. For instance, in the 2023 fiscal year, Adtalem reported a consolidated student retention rate of 77.5%, but specific programs within their portfolio likely experienced considerably lower figures.

High attrition can be a significant drain on resources. Programs with poor retention may require more intensive support services, academic advising, and financial aid counseling to keep students enrolled. This increased operational cost, coupled with a reduced number of graduates, directly impacts the profitability and growth potential of these specific offerings within Adtalem's portfolio. Understanding these dynamics is crucial for strategic resource allocation.

- High Attrition Indicators: Programs struggle with student completion, suggesting issues with curriculum, support, or student fit.

- Market Share Impact: Low completion rates hinder market share growth and brand reputation.

- Resource Drain: These programs often demand disproportionate recruitment and retention resources.

- Financial Implications: Increased costs for support and lower graduate numbers negatively affect profitability.

Marginalized Legacy Offerings

Marginalized Legacy Offerings represent a small segment of Adtalem Global Education's portfolio, often stemming from acquisitions that haven't been fully integrated. These programs typically cater to very niche student interests and, as of recent reporting, show limited growth potential. For instance, in the fiscal year 2023, Adtalem reported that its legacy institutions, which house many of these offerings, contributed a smaller percentage to overall revenue compared to its core growth areas.

These programs struggle to align with Adtalem's overarching 'Growth with Purpose' strategy, leading to low student enrollment and minimal strategic impact. Their continued operation with limited student interest and a lack of clear integration path makes them candidates for future review and potential divestiture if performance does not improve. The company's focus remains on maximizing the value of its integrated and growing segments.

- Low Student Interest: These offerings often have declining enrollment numbers, making them less attractive to new students.

- Limited Strategic Value: They do not align with Adtalem's core educational mission or growth objectives.

- Acquisition Integration Challenges: Programs acquired through mergers may not have been effectively assimilated into the broader Adtalem structure.

- Potential for Divestiture: If these programs fail to demonstrate improvement, they may be considered for sale or closure.

Dogs in Adtalem Global Education's BCG Matrix represent programs with low market share and low growth potential. These are often legacy offerings or those in declining fields that consume resources without significant returns. For example, certain non-healthcare programs at Walden University might fall into this category due to stagnant enrollment and a lack of market relevance.

These underperforming segments, such as potentially underutilized regional campuses or outdated professional development certifications, drain capital and personnel. Adtalem's strategic divestiture of Carrington College campuses in 2020 exemplifies a move to shed such 'Dog' assets and refocus on growth areas.

Programs exhibiting high attrition rates, like those with retention figures significantly below Adtalem's 2023 consolidated rate of 77.5%, also function as Dogs. They demand extensive support, impacting profitability and hindering market share expansion.

Marginalized legacy offerings from acquisitions, which show limited growth and niche appeal, also fit the Dog profile. These programs, contributing a smaller percentage to overall revenue as seen in FY2023, may be candidates for divestiture if they don't align with Adtalem's growth strategy.

Question Marks

Adtalem's new healthcare technology programs, like the Master's in Healthcare Data Analytics, are positioned as question marks in the BCG matrix. These initiatives tap into high-growth areas within healthcare technology and data science, reflecting significant future market potential.

While these programs target emerging fields, they are in nascent stages for Adtalem, meaning market share and brand recognition are still being established. This requires substantial investment to capitalize on anticipated future demand and build a competitive presence.

Adtalem Global Education views international expansion as a significant opportunity, targeting new geographical markets with high growth potential. This strategic move aims to diversify revenue streams beyond its established U.S. base.

Currently, Adtalem's market share in regions outside the United States is likely modest, placing these initiatives in the "Question Mark" category of the BCG matrix. Significant investment in market research, localized marketing, and potentially strategic partnerships will be crucial for building brand awareness and capturing market share.

Adtalem Global Education is exploring innovative student financing models, like the Letter of Intent with Sallie Mae, signaling a strategic move to broaden access and potentially boost enrollment. This initiative aligns with a high-growth trajectory, aiming to attract a wider student base.

While these new financing options represent a significant strategic pivot, their ultimate market impact and profitability remain uncertain. The actual performance and financial returns generated by these models are still being assessed, placing them in the question mark quadrant of the BCG matrix.

Specialized Certifications in Emerging Healthcare Niches

Adtalem's development of specialized certifications in emerging healthcare niches, such as telehealth and niche medical device operations, represents a strategic move into areas with high future demand but currently low market penetration. These new ventures are designed to meet the evolving needs of the healthcare workforce, addressing skill gaps in rapidly advancing fields. For instance, the demand for telehealth professionals surged, with a significant increase in telehealth utilization reported across the US in 2024, highlighting the market's potential.

These specialized certifications are positioned as question marks within Adtalem's BCG Matrix. While they target high-growth areas, their current market share is minimal, necessitating significant investment in marketing and program development to establish brand recognition and attract learners. The success of these offerings will depend on Adtalem's ability to effectively communicate their value proposition to a targeted audience of healthcare professionals seeking to upskill or reskill.

- Targeting High-Demand, Low-Share Niches: Focus on areas like virtual care coordination and specialized medical equipment maintenance.

- Investment for Growth: Significant marketing and curriculum development are required to capture market share.

- Addressing Workforce Gaps: Certifications are designed to fill specific, emerging skill requirements in healthcare.

- Future Potential: These ventures represent Adtalem's strategy to capitalize on the future of healthcare delivery and technology.

New Program Launches in Untapped Workforce Gaps

Adtalem Global Education is strategically launching new academic programs to fill critical gaps in the healthcare sector, a classic move for a question mark in the BCG matrix. These initiatives target emerging workforce shortages, aiming to establish a strong foothold in growing markets.

For instance, Adtalem's Chamberlain University has expanded its online Doctor of Nursing Practice (DNP) program, responding to the projected shortage of advanced practice registered nurses. In 2024, the U.S. Bureau of Labor Statistics anticipated a 45% growth for Nurse Practitioners, a significant increase indicating a robust market for such specialized education.

- Targeted Program Expansion: Adtalem is investing in programs like the DNP to address the increasing demand for advanced healthcare professionals.

- Market Opportunity: The healthcare sector, particularly in specialized nursing roles, presents a growing market with identified workforce deficits.

- Investment Phase: These new programs require substantial investment to build market share and achieve long-term profitability, characteristic of question mark products.

- Future Potential: Success in these early-stage programs could lead to significant growth and market leadership for Adtalem in these underserved areas.

Adtalem's new healthcare technology programs, like the Master's in Healthcare Data Analytics, are positioned as question marks in the BCG matrix due to their nascent stage and high growth potential. While these initiatives tap into emerging fields, Adtalem is still establishing market share and brand recognition, necessitating significant investment to capitalize on future demand.

The company's international expansion efforts also fall into the question mark category, targeting new geographical markets with high growth potential but currently modest market share. Building brand awareness and capturing market share in these regions will require substantial investment in market research and localized marketing strategies.

New student financing models, such as the Letter of Intent with Sallie Mae, are also considered question marks. While aiming to broaden access and potentially boost enrollment in a high-growth trajectory, their ultimate market impact and profitability remain uncertain, requiring assessment of their actual performance.

Adtalem's specialized certifications in emerging healthcare niches, like telehealth and niche medical device operations, are question marks. These ventures target high-growth areas with low current penetration, demanding significant investment in marketing and program development to establish brand recognition and attract learners, especially given the 2024 surge in telehealth utilization.

The expansion of Chamberlain University's online Doctor of Nursing Practice (DNP) program addresses critical healthcare gaps and workforce shortages, making it a question mark. With the U.S. Bureau of Labor Statistics anticipating a 45% growth for Nurse Practitioners in 2024, these programs require investment to build market share and achieve long-term profitability.

| Initiative | BCG Category | Market Growth | Market Share | Investment Need |

| Healthcare Data Analytics Programs | Question Mark | High | Low | High |

| International Expansion | Question Mark | High | Low | High |

| Innovative Student Financing Models | Question Mark | High | Uncertain | High |

| Specialized Healthcare Certifications (e.g., Telehealth) | Question Mark | High | Low | High |

| Online DNP Program Expansion | Question Mark | High (e.g., 45% NP growth projected for 2024) | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Adtalem's financial reports, industry growth projections, and competitive market analysis to provide a strategic overview.