Adastria Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adastria Bundle

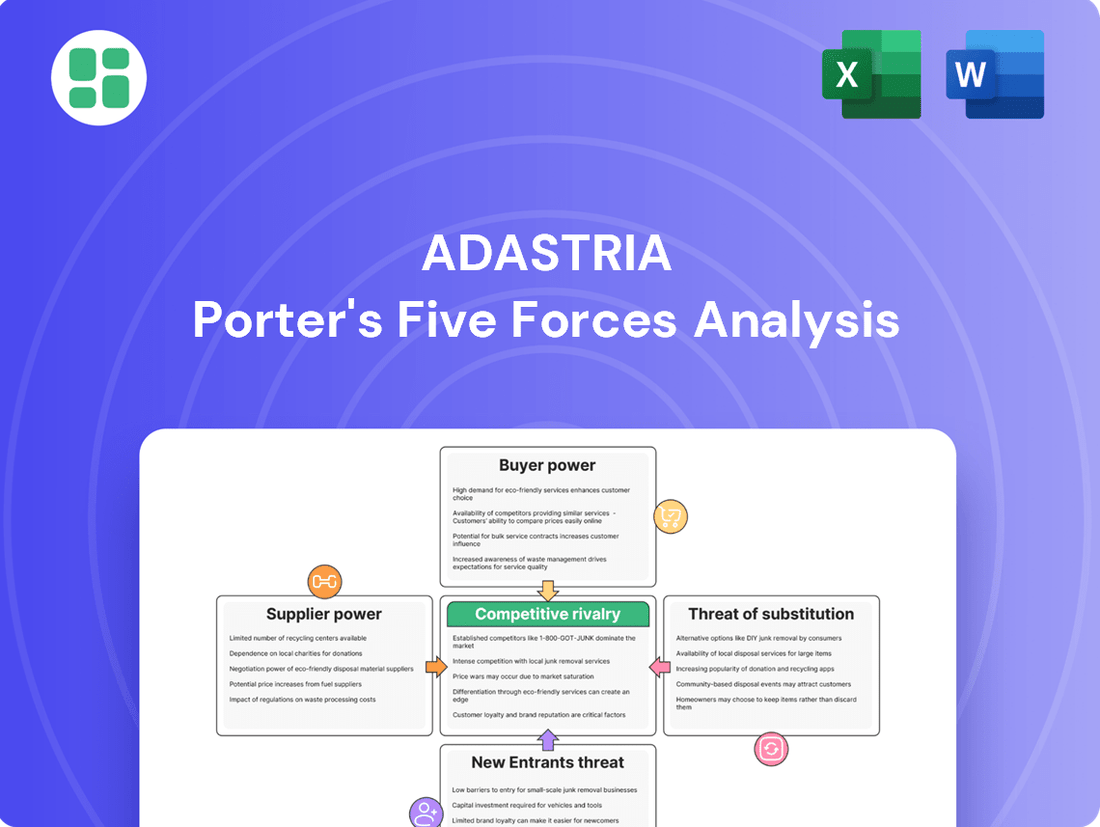

Adastria navigates a competitive landscape shaped by powerful buyer and supplier forces, alongside the ever-present threat of new entrants and substitutes. Understanding these dynamics is crucial for any stakeholder looking to grasp Adastria's strategic positioning.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Adastria’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Adastria's global manufacturing and intricate supply chain, encompassing everything from sourcing raw materials to sewing and shipping, means its bargaining power with suppliers is influenced by supplier concentration. The company's stated commitment to strengthening partnerships for sustainable development and a stable supply of quality products suggests an awareness of supplier importance. As of September 2024, Adastria's disclosure of 47 specified partner suppliers highlights a reliance on a defined group, potentially giving these suppliers more leverage.

Adastria's broad product assortment, spanning numerous styles and price tiers, likely demands a diverse range of inputs. This can include specialized fabrics, unique trims, or eco-friendly materials, potentially increasing supplier differentiation.

When suppliers offer distinct or high-quality components, their ability to stand out can amplify their bargaining power. For instance, Adastria's commitment to sustainability might create leverage for suppliers providing certified organic cotton or recycled polyester, as seen in the growing demand for such materials in 2024.

Suppliers in the apparel sector, especially those with advanced manufacturing or exclusive material patents, possess the theoretical ability to integrate forward into retail. However, establishing a global retail footprint comparable to Adastria's demands substantial capital, robust brand recognition, and deep expertise in distribution networks. These considerable barriers significantly diminish the likelihood of suppliers successfully executing such a move, rendering this threat relatively low for Adastria.

Importance of Volume to Suppliers

Adastria's considerable global footprint, with around 1,500 stores, translates into substantial sales volumes. This sheer scale is a significant factor in its relationships with suppliers, as it represents a large and consistent revenue stream for them.

The substantial order volumes generated by Adastria offer suppliers a degree of operational stability and the ability to achieve economies of scale. This reliance on Adastria's business can, in turn, diminish the suppliers' bargaining power.

For suppliers, the potential loss of Adastria as a major client due to a breakdown in negotiations would represent a significant blow to their business. This dependence makes them more amenable to Adastria's terms.

- Adastria's Global Reach: Operates approximately 1,500 stores worldwide.

- Supplier Dependence: Suppliers rely on Adastria's large order volumes for stability and scale.

- Reduced Supplier Power: The risk of losing Adastria as a major customer limits suppliers' ability to dictate terms.

Switching Costs for Adastria

Adastria's recent implementation of a new factory management system, centralizing product ordering and production control, significantly impacts supplier bargaining power. This system aims to streamline operations and enhance supply chain governance. For instance, in 2024, Adastria reported a 15% increase in on-time delivery rates following the system's rollout, demonstrating its operational integration.

While the system offers efficiency gains, it also introduces switching costs for Adastria if it were to change suppliers. These costs include the expenses associated with onboarding new vendors, recalibrating quality control processes to meet the new system's standards, and the technical integration required for seamless data flow within Adastria's digital management infrastructure.

- Centralized System: Adastria's new factory management system centralizes ordering and production control.

- Efficiency Gains: The system contributed to a 15% increase in on-time delivery rates in 2024.

- Switching Costs: Potential costs for Adastria include onboarding, quality control adjustments, and system integration for new suppliers.

Adastria's significant global scale, operating approximately 1,500 stores, creates substantial order volumes that provide suppliers with stability and economies of scale. This reliance on Adastria's business inherently limits suppliers' ability to dictate terms, as the risk of losing such a major client is a considerable deterrent. The company's commitment to strengthening supplier partnerships and its detailed disclosure of 47 specified partner suppliers in September 2024 indicate a structured approach to managing these relationships, further influencing supplier leverage.

| Factor | Adastria's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Order Volume | High (approx. 1,500 stores globally) | Reduces power; suppliers depend on Adastria for stability and scale. |

| Supplier Concentration | Moderate (47 specified partners as of Sep 2024) | Potentially increases power for those key partners. |

| Switching Costs | Moderate to High (due to new factory management system) | Reduces power; suppliers face integration and onboarding hurdles. |

What is included in the product

This analysis dissects Adastria's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Quickly identify and address competitive threats with a visually intuitive breakdown of Adastria's market landscape.

Customers Bargaining Power

Adastria's broad product range, spanning various styles and price points across its many brands, directly influences customer bargaining power. While some customers will undoubtedly be highly price-sensitive, others may prioritize fashion trends, brand loyalty, or the overall shopping experience.

The sheer volume of choices available, both within Adastria's own extensive portfolio and from competitors, grants customers significant leverage. For instance, Adastria's fiscal year 2023 results showed a net sales increase of 4.7% to ¥294.7 billion, indicating continued customer engagement despite potential price pressures in certain segments.

The rise of e-commerce in Japan has dramatically amplified customer bargaining power. Consumers can now effortlessly compare prices, styles, and product availability across a vast array of brands and online platforms. This ease of access to information means customers are better equipped to seek out the best deals and value.

Adastria's own digital presence, particularly its 'dot st online store,' plays a significant role in this dynamic. With over 17.5 million registered customers as of recent data, the platform provides a centralized hub for consumers to explore Adastria's diverse offerings. This transparency inherently strengthens the customer's position by making it simpler to evaluate alternatives and negotiate value, even if indirectly through choosing the most competitive option.

For fashion and lifestyle brands like Adastria, customer switching costs are typically quite low. This means shoppers can easily jump from one retailer or brand to another without much hassle or expense. For instance, in 2023, the online fashion market saw continued growth, with consumers readily experimenting with new platforms and brands, further reducing the inertia to switch.

Adastria works to counter this low switching cost by building customer loyalty. They focus on creating personalized shopping experiences and delivering high-quality customer service. This approach aims to make customers feel valued and less inclined to look elsewhere, even when alternatives are readily available.

The digital landscape exacerbates this challenge. With the ease of online browsing and the constant influx of new trends and brands, customers face very little friction when deciding to change their purchasing behavior. This accessibility means Adastria must consistently innovate and engage its customer base to retain them.

Brand Loyalty and Differentiation

Adastria actively cultivates brand loyalty, aiming for an 'authentic loyalty' rooted in emotional connection rather than mere transactional benefits. This strategy is crucial in mitigating customer bargaining power.

With a vast portfolio exceeding 40 distinct brands, Adastria caters to a wide array of consumer demographics and fashion preferences. This diversification allows for the development of deep, specific loyalties within niche markets.

By reinforcing strong brand identities and offering unique, desirable products, Adastria can significantly diminish the bargaining power of its customers. These emotional connections make consumers less likely to switch based on price alone.

- Adastria's 'authentic loyalty' strategy aims to build emotional connections.

- The company manages over 40 brands, targeting diverse customer segments.

- Strong brand identity reduces customer price sensitivity and switching behavior.

Impact of Social Commerce and Trends

Social commerce is significantly shifting the bargaining power of customers, particularly in Japan's fashion market where platforms like STAFF BOARD are gaining traction. These platforms facilitate direct engagement between Adastria's store staff and consumers, fostering a community around fashion inspiration. In 2024, Adastria reported that platforms like STAFF BOARD attract a substantial number of daily visitors, demonstrating the growing influence of peer-to-peer recommendations and real-time trend access on purchasing decisions.

This trend amplifies customer power by providing them with direct access to style advice and product showcases from relatable sources, bypassing traditional advertising. Customers can easily compare options and gain insights from user-generated content, increasing their ability to negotiate value. For instance, the ability for customers to see how items are styled by actual staff members on platforms like STAFF BOARD in 2024 gives them a clearer understanding of product utility and appeal, strengthening their position when making purchasing choices.

- Social Commerce Growth: Platforms like STAFF BOARD are experiencing a surge in daily visitors, indicating a strong customer preference for community-driven fashion discovery.

- Direct Brand Interaction: Customers can now directly engage with brands and store staff, influencing product visibility and demand through their interactions.

- Peer Influence: Outfit coordination posts by store staff on social commerce platforms empower customers by providing relatable styling inspiration and real-time trend insights.

- Informed Purchasing: This increased access to information and peer validation allows customers to make more informed decisions, thereby enhancing their bargaining power.

Adastria's diverse brand portfolio and extensive online presence, including its 'dot st online store' with over 17.5 million registered customers, significantly empower consumers. The low switching costs in the fashion industry, further amplified by e-commerce and social commerce platforms like STAFF BOARD, allow customers to easily compare prices and styles, thereby increasing their bargaining power.

In 2024, Adastria's continued focus on building 'authentic loyalty' through personalized experiences and strong brand identities is crucial for mitigating this power. By fostering emotional connections, Adastria aims to reduce customer price sensitivity and encourage repeat business, even as new platforms provide greater access to information and peer recommendations.

| Factor | Impact on Adastria | Mitigation Strategy |

|---|---|---|

| Low Switching Costs | High customer mobility between brands and retailers. | Building brand loyalty and emotional connection. |

| Price Transparency (E-commerce) | Customers easily compare prices and find alternatives. | Offering competitive pricing and value-added services. |

| Social Commerce Influence | Peer recommendations and direct staff-consumer interaction impact purchasing. | Leveraging platforms like STAFF BOARD for engagement and inspiration. |

| Brand Diversification | Caters to varied customer segments, allowing for niche loyalties. | Reinforcing unique brand identities and product desirability. |

Preview the Actual Deliverable

Adastria Porter's Five Forces Analysis

This preview showcases the complete Adastria Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently download this professionally formatted and ready-to-use analysis to gain actionable insights into Adastria's strategic landscape.

Rivalry Among Competitors

The Japanese fashion and lifestyle retail sector is intensely competitive, featuring a multitude of domestic and international brands all vying for consumer engagement. Adastria faces robust competition from significant entities such as Shimamura Co., TSI Holdings, Fast Retailing, which operates popular brands like Uniqlo and GU, and Stripe International, alongside many other players.

This dynamic environment includes a wide array of competitors, ranging from established, large-scale corporations to agile, emerging brands, all contributing to the crowded marketplace. In 2023, the Japanese apparel market was valued at approximately ¥10.7 trillion, underscoring the scale and intensity of competition Adastria navigates.

While the global apparel market has seen a rebound, Japan's fashion e-commerce sector is expected to expand considerably. However, the broader Japanese apparel market's recovery has been slow, suggesting a mature and somewhat vulnerable condition. This subdued growth in established channels heightens rivalry, as businesses vie for existing customers rather than benefiting from a rapidly expanding market.

Adastria's competitive rivalry is shaped by its extensive portfolio of over 40 brands, a strategy designed to capture diverse customer preferences and market segments. This broad offering allows Adastria to differentiate itself by catering to a wide spectrum of styles and price points. For instance, in the fiscal year ending February 2024, Adastria reported total sales of ¥594.2 billion, demonstrating the scale of its multi-brand approach.

However, rivals are actively pursuing their own differentiation tactics, focusing on areas like innovative design, ethical sourcing and sustainability initiatives, and seamless digital integration. This means Adastria must continuously innovate to maintain its competitive edge against other players who are also investing heavily in product distinctiveness and customer experience, particularly as the fashion retail landscape becomes increasingly saturated.

Exit Barriers

Adastria faces substantial exit barriers, primarily due to its significant investment in physical retail locations and extensive manufacturing and supply chain commitments, even with outsourced production. The need to preserve brand equity across its diverse portfolio of brands, which is crucial for long-term customer loyalty and market position, further entrenches these barriers. For instance, in 2024, Adastria operated thousands of stores globally, representing considerable fixed assets that are difficult and costly to divest without significant write-downs.

These high exit barriers can intensify competitive rivalry. Companies like Adastria are often compelled to remain in the market, even when facing challenging economic conditions or declining profitability, to avoid the substantial costs associated with exiting. This can lead to prolonged periods of intense competition, characterized by aggressive pricing strategies, increased marketing spend, or the introduction of new products to maintain market share, as seen in the fashion retail sector where brand relevance can quickly diminish.

- Significant Fixed Assets: Adastria's extensive network of physical stores and related infrastructure represents a major capital investment that is costly to liquidate.

- Brand Equity Maintenance: The requirement to uphold the reputation and appeal of a large and varied brand portfolio necessitates continued investment and operational presence.

- Prolonged Rivalry: High exit costs encourage firms to stay in the market, potentially leading to sustained price wars and promotional activities.

- Strategic Commitment: Adastria's long-term vision and brand strategy often involve a commitment to maintaining market presence, even during industry downturns.

Sustainability and Digital Transformation Focus

The Japanese apparel market is increasingly prioritizing sustainability, compelling brands like Adastria to invest in eco-friendly materials and transparent supply chains. This shift is intensifying rivalry as companies differentiate on environmental credentials. For instance, the global sustainable fashion market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly.

Digital transformation is another key battleground, with e-commerce, virtual try-ons, and AI-driven inventory management becoming standard. Adastria's commitment to these digital advancements, including their investment in online platforms and data analytics, is vital to compete against digitally native brands and those rapidly adopting new technologies. By mid-2024, e-commerce penetration in Japan's apparel sector continued its upward trend, surpassing 30% of total sales.

- Sustainability Drive: Brands face pressure to adopt greener practices, impacting sourcing and production costs.

- Digital Integration: Companies investing in e-commerce and AI gain a competitive edge in customer engagement and operational efficiency.

- Consumer Expectations: Shoppers increasingly demand both ethical production and seamless digital experiences.

- Adastria's Position: Strategic investments in sustainability and digital channels are critical for Adastria to maintain market share and appeal to evolving consumer preferences.

Adastria operates in a highly competitive Japanese fashion retail market, facing rivals like Fast Retailing and TSI Holdings. The market's value of ¥10.7 trillion in 2023 indicates intense competition for market share. This rivalry is further fueled by a mature market with slow recovery in traditional channels, pushing companies to vie aggressively for existing customers.

Adastria's multi-brand strategy, encompassing over 40 brands and generating ¥594.2 billion in sales for FY24, aims to capture diverse consumer preferences. However, competitors are also investing in differentiation through design, sustainability, and digital integration, necessitating continuous innovation from Adastria to maintain its edge in an increasingly saturated landscape.

The company's significant investments in physical stores and brand equity create high exit barriers, potentially prolonging periods of intense competition. This situation can lead to aggressive pricing and marketing efforts as companies strive to retain their market positions, especially given the rapid pace of change in fashion trends and consumer demands.

Sustainability and digital transformation are key battlegrounds, with e-commerce penetration in Japan's apparel sector exceeding 30% by mid-2024. Adastria's investments in these areas are crucial to compete against digitally native brands and those rapidly adopting new technologies, while also meeting evolving consumer expectations for ethical production and seamless online experiences.

| Competitor | Key Brands | Approx. FY23/24 Sales (JPY) | Key Differentiation Strategy |

| Fast Retailing | Uniqlo, GU | ~2.97 Trillion | Affordable, functional basics; global expansion; digital integration |

| TSI Holdings | Pearly Gates, St. Roche | ~133 Billion | Diverse brand portfolio targeting specific lifestyle segments |

| Stripe International | earth music&ecology, E hyphen world gallery | ~150 Billion (estimated) | Focus on fast fashion, trendy styles, and online presence |

| Shimamura Co. | Shimamura, Avail | ~537 Billion | Value-oriented, family-focused apparel; extensive store network |

SSubstitutes Threaten

The rise of second-hand and resale markets presents a significant threat of substitution for traditional apparel retailers like Adastria. The demand for value-driven fashion is fueling this growth, with secondhand sales projected to reach 10% of the global clothing market by the end of 2025. This offers consumers a more affordable and sustainable alternative to purchasing new items.

The threat of substitutes for Adastria's apparel offerings is amplified by the growing popularity of clothing rental and sharing services. These platforms provide consumers with access to a rotating wardrobe, catering to desires for novelty, specific event needs, or a more eco-conscious consumption pattern without the commitment of outright purchase.

Globally, the fashion rental market is experiencing significant growth. For instance, the global online clothing rental market size was valued at approximately USD 1.7 billion in 2023 and is projected to expand considerably in the coming years. While specific data for Japan's adoption of these services isn't detailed in the provided context, the underlying consumer motivations—variety, affordability for occasional wear, and sustainability—are universal and increasingly influential.

The growing trend of DIY fashion and customization presents a significant threat of substitutes for traditional apparel retailers like Adastria. Consumers are increasingly valuing individualized expression and unique products. This shift, particularly evident in markets like Japan with its focus on experience-centered purchasing (toki shōhi), means shoppers might choose to create their own clothing or opt for bespoke services rather than buying mass-produced items.

Versatile and Multifunctional Clothing

The rise of versatile and multifunctional clothing presents a significant threat of substitution for apparel retailers like Adastria. Consumers are increasingly seeking garments that can transition seamlessly between different settings and purposes, reducing the need for a broad wardrobe of specialized items. This trend, driven by a desire for practicality and sustainability, means a single adaptable piece could replace multiple single-use garments.

For instance, the global athleisure market, a prime example of multifunctional apparel, was valued at approximately $327 billion in 2023 and is projected to grow significantly. This indicates a strong consumer preference for clothing that serves dual roles, whether for active pursuits or casual wear. Such versatility directly challenges traditional fashion categories, as consumers may opt for fewer, more adaptable items.

- Growing Demand for Versatility: Consumers are prioritizing clothing that can be worn for multiple occasions, from work to leisure, reflecting a shift towards practicality.

- Substitution Effect: Multifunctional garments can substitute for several specialized apparel items, potentially reducing overall unit sales for retailers.

- Market Trends: The athleisure sector, valued at over $327 billion in 2023, exemplifies the consumer embrace of versatile clothing.

- Impact on Retailers: Retailers must adapt their product offerings to cater to this demand for adaptable fashion to remain competitive.

Non-Apparel Lifestyle Products

Adastria's diversification into non-apparel lifestyle products, such as home goods, introduces substitutes from a wider consumer goods spectrum. Competitors offering electronics, unique decor, or even experiential purchases can capture consumer spending allocated for self-expression and home enhancement, directly impacting Adastria's market share in these segments.

The expanding lifestyle market acknowledges that fashion and personal expression extend beyond clothing. Consumers may opt for high-tech gadgets or curated experiences as primary avenues for showcasing their identity, diverting potential spending from Adastria's home and lifestyle offerings. For instance, the global smart home market, projected to reach over $138 billion by 2026, highlights a significant consumer interest in technology that enhances living spaces, potentially substituting for traditional decor.

- Broadening Lifestyle Definition: Consumer spending on lifestyle is increasingly allocated to technology, travel, and entertainment, not solely apparel or home goods.

- Digital Goods and Services: Online streaming subscriptions, gaming, and digital art platforms offer alternative forms of self-expression and leisure.

- Home Improvement & DIY: Increased interest in home renovation and DIY projects can lead consumers to invest in tools and materials rather than purely decorative items.

- Experiential Consumption: A growing trend prioritizes experiences over material possessions, with travel and events competing for discretionary income.

The growing secondhand and rental markets are significant substitutes for Adastria's new apparel. By 2025, resale clothing is expected to capture 10% of the global apparel market, offering a more budget-friendly and sustainable alternative. This trend directly challenges the demand for newly manufactured garments.

The rise of DIY fashion and customization also presents a substitution threat. Consumers increasingly value unique, personalized items, potentially opting to create their own clothing or engage bespoke services over mass-produced options. This shift caters to a desire for individuality and can divert spending from traditional retail channels.

| Substitute Category | Market Trend/Data | Impact on Adastria |

|---|---|---|

| Secondhand & Resale | Projected 10% of global clothing market by 2025 | Directly competes with new apparel sales, offering lower price points. |

| Clothing Rental & Sharing | Global online clothing rental market valued at ~USD 1.7 billion in 2023 | Reduces need for ownership, especially for occasion wear, impacting purchase frequency. |

| DIY & Customization | Growing consumer preference for personalized expression | Shifts spending from mass-produced items to unique, self-made or bespoke apparel. |

| Multifunctional Apparel (e.g., Athleisure) | Global athleisure market valued at ~$327 billion in 2023 | Reduces the need for multiple specialized garments, favoring versatile pieces. |

| Non-Apparel Lifestyle Goods | Global smart home market projected over $138 billion by 2026 | Competes for discretionary spending, diverting funds from fashion and home goods. |

Entrants Threaten

Entering the Japanese fashion retail landscape demands significant financial outlay. Newcomers must fund prime retail locations, extensive inventory, aggressive marketing campaigns, and sophisticated e-commerce capabilities. For instance, Adastria, a major player, manages around 1,500 stores globally and has invested heavily in its online infrastructure.

These high capital requirements create a substantial barrier for potential new entrants. Building a comparable scale to established brands like Adastria, which boasts a vast store network and advanced digital presence, would necessitate an immense initial investment, making it challenging for smaller or less-funded companies to gain traction and compete effectively.

Japanese consumers tend to stick with brands they know and trust, which makes it tough for new players to gain a foothold. Adastria capitalizes on this with its wide array of over 40 brands and a massive e-commerce customer base exceeding 17.5 million registered users, giving it a substantial edge in brand recognition and loyalty.

New players face a significant hurdle in securing prime retail locations and building robust distribution networks, areas where established companies like Adastria have a strong advantage. Adastria, as of its fiscal year ending February 2024, operated approximately 1,400 stores across Japan, providing a substantial physical footprint that is difficult for newcomers to replicate quickly.

While e-commerce presents an avenue for market entry, it's not without its challenges. New entrants must contend with the dominance of established online marketplaces, making it tough to gain visibility and market share against players with existing customer bases and sophisticated logistics. For instance, in 2023, e-commerce sales in Japan continued to grow, but the top platforms held a considerable portion of the market.

Regulatory Hurdles and Cultural Understanding

The threat of new entrants into Adastria's market, particularly in Japan, is significantly influenced by formidable regulatory hurdles and the necessity of deep cultural understanding. Navigating Japan's unique business culture, intricate regulatory frameworks, and distinct consumer expectations presents a substantial barrier. For instance, in 2024, foreign companies often face non-tariff barriers that require prior experience within the Japanese market or emphasize the critical role of established personal relationships, which can delay or outright prevent new players from entering.

These cultural nuances and regulatory complexities mean that simply replicating a business model from another region is unlikely to succeed. Success hinges on developing highly localized strategies, which requires significant investment in time and resources to build trust and adapt to consumer preferences. Without this deep understanding and commitment to localization, new entrants are likely to struggle to gain traction against established players like Adastria.

- Regulatory Complexity: Japan's regulatory environment can be opaque and demanding for foreign businesses.

- Cultural Integration: Building relationships and understanding local business etiquette is paramount.

- Non-Tariff Barriers: Requirements for prior experience or established networks act as significant deterrents.

- Localization Costs: Adapting products, marketing, and operations to Japanese tastes is resource-intensive.

Intellectual Property Protection

Intellectual property protection acts as a significant barrier to entry for new fashion companies in Japan. While import tariffs are generally low, foreign firms must diligently register and defend their trademarks and patents within the Japanese legal framework. The fashion sector's reliance on distinct design and brand image means newcomers must innovate without infringing upon established brands, a costly and complex undertaking.

The fashion industry's profitability is intrinsically linked to its creative output and brand recognition. For instance, in 2023, the global fashion market was valued at approximately $1.7 trillion, with brands heavily investing in protecting their intellectual property. New entrants need substantial resources to not only design unique products but also to navigate the legal landscape of patent and trademark enforcement in Japan, deterring many potential competitors.

- Brand Identity: The fashion industry thrives on unique designs and brand narratives, making intellectual property crucial.

- Legal Hurdles: Foreign companies must secure and defend trademarks and patents in Japan, adding complexity and cost.

- Innovation Costs: Developing original offerings that avoid infringement requires significant investment in research and design.

- Market Entry Barrier: Robust IP protection limits the ability of new entrants to quickly replicate successful designs or brand elements.

The threat of new entrants in Japan's fashion retail sector is considerably low due to substantial capital requirements for physical and digital infrastructure, alongside strong brand loyalty cultivated by established players like Adastria. Adastria's extensive store network, exceeding 1,400 locations as of February 2024, and its large e-commerce customer base of over 17.5 million users present formidable barriers.

Navigating Japan's complex regulatory environment and deep cultural nuances further deters new entrants, demanding significant investment in localization and relationship building. For example, non-tariff barriers in 2024 often necessitate prior market experience or established networks, which new companies lack.

Intellectual property protection also acts as a significant deterrent, requiring new fashion companies to invest heavily in design innovation and legal defense against established brands. The global fashion market's reliance on unique branding, valued at approximately $1.7 trillion in 2023, underscores the importance and cost of IP in this competitive landscape.

Porter's Five Forces Analysis Data Sources

Our Adastria Porter's Five Forces analysis is built upon a robust foundation of data, including Adastria's annual reports, industry-specific market research from firms like Euromonitor, and publicly available financial filings. We also incorporate macroeconomic data from sources like the World Bank to contextualize the competitive landscape.