Adani Ports & Special Economic Zone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Ports & Special Economic Zone Bundle

Navigate the complex external landscape impacting Adani Ports & Special Economic Zone with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping its strategic direction and future growth. Gain a competitive edge by leveraging these expert insights to inform your investment decisions and market strategies. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The Indian government's unwavering focus on port-led development and enhancing maritime infrastructure is a significant tailwind for Adani Ports & Special Economic Zone (APSEZ). Initiatives like the Sagarmala program, launched in 2015 with a projected investment of over ₹4.5 lakh crore (approximately $54 billion) by 2035, aim to modernize ports and improve logistics, directly benefiting APSEZ's operations and expansion plans.

Furthermore, the National Logistics Policy, introduced in 2022, seeks to reduce logistics costs by 5-8% of GDP, a move that will boost efficiency for cargo handling and transportation, areas where APSEZ is heavily invested. This policy fosters an environment conducive to private sector involvement in port infrastructure development, presenting APSEZ with ample opportunities to broaden its port network and increase its overall capacity nationwide.

Adani Ports & Special Economic Zone (APSEZ) is significantly impacted by international trade agreements and geopolitical stability. These factors directly influence cargo volumes and the viability of shipping routes, affecting both APSEZ's global reach and its domestic operations. For instance, the stability of India's relationships with major trading partners is a cornerstone for maintaining consistent cargo throughput across its port network.

Geopolitical events can create both opportunities and challenges. The ongoing Israel-Iran conflict, while a source of global concern, has not hindered operations at APSEZ's Haifa port, demonstrating resilience. However, broader disruptions in global supply chains or regional conflicts can negatively impact trade flows, underscoring the need for APSEZ to navigate a complex international landscape.

Changes in Special Economic Zone (SEZ) regulations significantly influence Adani Ports & Special Economic Zone's (APSEZ) business. These zones are crucial for APSEZ's model, which integrates port services with SEZ development, attracting businesses through incentives and tax benefits. For instance, the Indian government's policy to allow SEZ units to sell goods and services in the domestic tariff area (DTA) without payment of duties, subject to certain conditions, as revised in recent years, directly impacts the revenue streams and operational flexibility of APSEZ’s SEZ developments.

Regulatory Framework and Ease of Doing Business

The regulatory environment for port operations significantly impacts Adani Ports & Special Economic Zone (APSEZ), influencing everything from obtaining necessary clearances and setting tariffs to adhering to environmental norms. These regulations directly affect APSEZ's operational efficiency and its strategic investment decisions. For instance, the Indian government's focus on improving the ease of doing business in the maritime sector, as seen in initiatives aimed at digitizing port processes and reducing red tape, can streamline operations for major players like APSEZ, potentially lowering compliance costs. Consistent and transparent regulatory practices are crucial for APSEZ's long-term strategic planning and ongoing investment commitments.

Key government initiatives impacting APSEZ include:

- Sagarmala Programme: This national coastal shipping and ports development program aims to improve logistics efficiency, with significant investments planned through 2024-25.

- Maritime India Vision 2030: This vision document outlines strategies to enhance port capacity, efficiency, and sustainability, directly benefiting large port operators.

- Facilitation of Trade: Efforts to digitize customs clearance and reduce documentation requirements aim to speed up cargo movement, positively impacting APSEZ's throughput.

- Environmental Regulations: Stricter environmental norms, while adding compliance layers, also drive investments in sustainable infrastructure, a focus area for APSEZ.

Privatization and Competition Policies

The Indian government's push for privatization in the port sector, a trend accelerating through 2024 and into 2025, directly shapes Adani Ports & Special Economic Zone's (APSEZ) operational landscape. Policies encouraging private investment, such as the Sagarmala program's continued focus on port modernization and private participation, create both opportunities and competitive pressures for APSEZ. For instance, the government aims to increase the share of private sector involvement in port development and operations, potentially leading to more private players entering the market.

APSEZ, as India's largest private port operator, is well-positioned to capitalize on these privatization trends. However, these same policies also foster increased competition. This includes rivalry from other private entities investing in port infrastructure and the modernization of existing public ports, which are also undergoing reforms to enhance efficiency and attract private capital. Ensuring a level playing field through robust competition policies is crucial for sustainable growth across the sector.

- Privatization Drive: India's commitment to privatizing state-owned assets extends to its port infrastructure, aiming to boost efficiency and attract private capital.

- APSEZ's Position: As the leading private port operator, APSEZ benefits from policies that favor private sector participation and investment in port development.

- Competitive Landscape: Increased private investment and modernization of public ports intensify competition, requiring APSEZ to maintain its competitive edge.

- Regulatory Focus: Government policies are increasingly emphasizing fair competition and the prevention of monopolistic practices to ensure a healthy port sector.

Government policies directly shape APSEZ's growth, with the Sagarmala program investing heavily in port modernization through 2024-25. The National Logistics Policy aims to cut logistics costs, enhancing APSEZ's operational efficiency. New SEZ regulations allowing domestic sales for SEZ units offer revenue diversification.

The Indian government's push for privatization in the port sector, particularly through 2024 and 2025, presents both opportunities and increased competition for APSEZ. Policies favoring private investment, like those within the Sagarmala program, allow APSEZ to expand, but also encourage other private players and public port reforms.

| Government Initiative | Objective | Impact on APSEZ |

| Sagarmala Programme | Port modernization & logistics improvement | Direct benefit to APSEZ's operations and expansion |

| National Logistics Policy (2022) | Reduce logistics costs by 5-8% of GDP | Boosts cargo handling efficiency for APSEZ |

| SEZ Domestic Sales Policy | Allow SEZ units to sell in Domestic Tariff Area | Increases revenue streams and operational flexibility for APSEZ's SEZs |

| Port Sector Privatization | Boost efficiency, attract private capital | Creates opportunities and intensifies competition for APSEZ |

What is included in the product

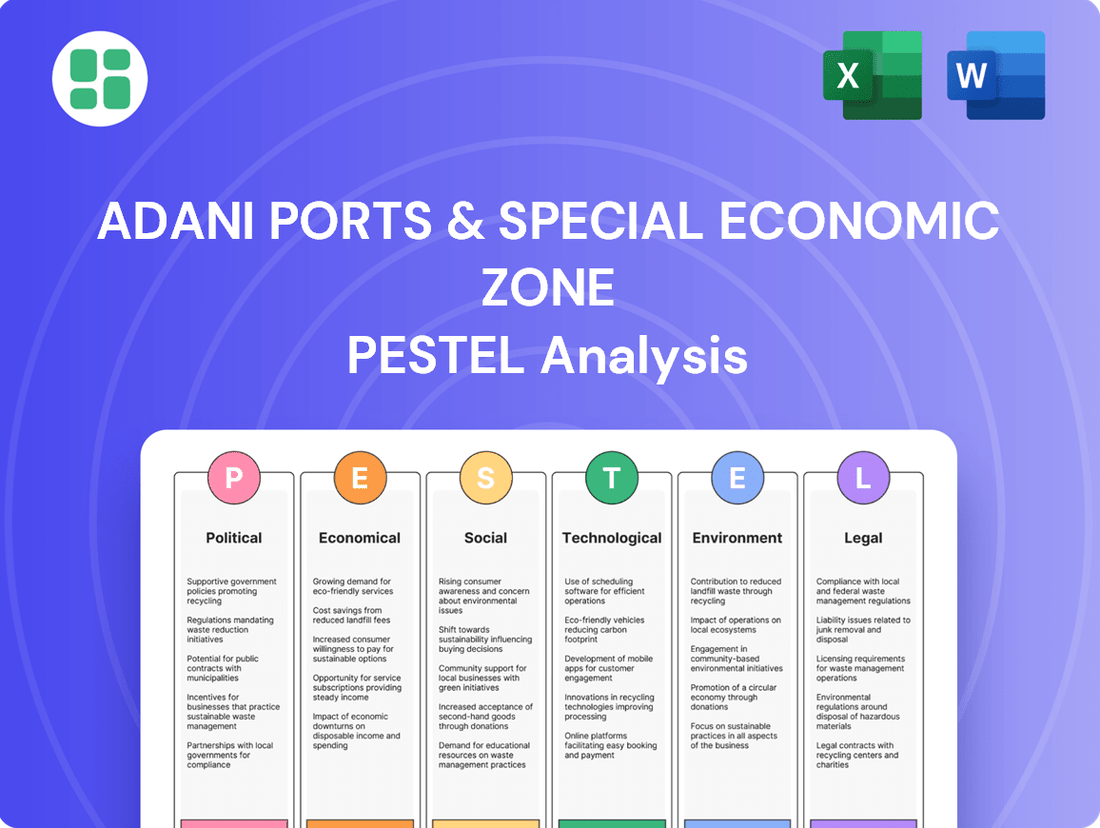

This PESTLE analysis examines the critical external factors influencing Adani Ports & Special Economic Zone's operations, from government policies and economic shifts to social trends, technological advancements, environmental regulations, and legal frameworks.

It offers a comprehensive understanding of the opportunities and threats arising from these macro-environmental forces, enabling strategic decision-making for sustained growth.

The Adani Ports & SEZ PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during meetings and presentations, thus streamlining strategic discussions.

Economic factors

India's economic expansion is a significant tailwind for Adani Ports & Special Economic Zone (APSEZ). The nation's GDP growth, projected to be around 6.5% for fiscal year 2024-25, directly fuels demand for goods, boosting both imports and exports. This translates into higher cargo volumes handled by APSEZ's ports, directly impacting their revenue streams.

Increased participation in global trade, evidenced by India's growing share in international commerce, further benefits APSEZ. As trade volumes rise, so does the need for efficient port infrastructure, positioning APSEZ to capitalize on this trend. The company's performance is intrinsically linked to the vitality of the Indian economy and its engagement with the global marketplace.

The global and domestic appetite for robust logistics and supply chain solutions significantly fuels Adani Ports & Special Economic Zone's (APSEZ) integrated business. Businesses worldwide are increasingly prioritizing supply chain optimization, creating a direct demand for APSEZ's end-to-end services, from port operations to last-mile delivery.

This growing need for seamless connectivity, encompassing warehousing and multimodal transportation networks like rail and road, underpins the demand for APSEZ's comprehensive offerings. The company's logistics revenue doubling, reaching approximately INR 5,100 crore for the fiscal year ending March 2024, is a clear testament to this strong market pull.

Inflationary pressures significantly affect Adani Ports & Special Economic Zone (APSEZ). Rising costs for fuel, energy, and labor directly impact operational expenses. For instance, global energy prices saw considerable volatility throughout 2023 and into early 2024, directly increasing APSEZ's logistics and operational costs.

APSEZ must carefully balance managing these increased input costs with maintaining competitive service pricing to protect its profitability. Failing to do so could erode margins. The company's ability to pass on these costs or absorb them efficiently is a key determinant of its financial performance in the current economic climate.

Effective cost management strategies are therefore paramount. APSEZ's focus on operational efficiency, including optimizing fuel consumption and exploring alternative energy sources, is vital to mitigate the impact of persistent inflation. For example, investments in renewable energy at its port facilities can help stabilize energy costs.

Foreign Direct Investment (FDI) and Capital Availability

The Indian government's focus on infrastructure development, coupled with favorable policies, has spurred significant Foreign Direct Investment (FDI) inflows. For Adani Ports & Special Economic Zone (APSEZ), this translates into a more robust capital environment for its ambitious expansion projects, crucial for maintaining its growth trajectory.

APSEZ's ability to tap into diverse funding avenues, from international debt markets to domestic equity issuances, underpins its capacity to finance new port constructions, strategic acquisitions, and the integration of advanced technologies. This access to capital is a direct enabler of its operational scaling and market competitiveness.

The availability of capital directly impacts APSEZ's strategic execution. For instance, as of March 2024, India's FDI equity inflows reached $32.03 billion for the fiscal year 2023-24, indicating a healthy appetite for investment in the country's growth story, which APSEZ is well-positioned to capitalize on. Managing its debt-to-equity ratio effectively remains paramount for sustainable expansion and investor confidence.

- FDI Inflows: India's FDI equity inflows for FY23-24 stood at $32.03 billion, signaling strong investor confidence in the nation's infrastructure sector, a key beneficiary for APSEZ.

- Capital Access: APSEZ relies on a mix of debt and equity financing to fund its port development and expansion, with access to global capital markets being vital.

- Growth Strategy: The company's ability to raise substantial capital is directly linked to its capacity to execute new projects, acquire assets, and invest in technological upgrades, thereby fueling its growth.

- Debt Management: Maintaining a healthy balance sheet and managing its debt profile are critical for APSEZ to ensure continued access to capital and support its long-term strategic objectives.

Currency Fluctuations and International Operations

Currency fluctuations present a significant consideration for Adani Ports & Special Economic Zone (APSEZ), particularly with its growing international footprint. For instance, the company's acquisition of a majority stake in Israel's Haifa Port exposes it directly to the Israeli Shekel (ILS) and its volatility against the Indian Rupee (INR) and other major currencies. This means revenue earned in ILS, or costs incurred in foreign currencies for operations or financing, can see their rupee equivalent change considerably, impacting reported profits.

APSEZ's international expansion strategy inherently increases its exposure to global currency dynamics. As of early 2024, the company's international assets represent a growing portion of its overall portfolio. For example, the Haifa Port acquisition was valued at approximately $1.18 billion. Managing these foreign currency exposures through robust financial hedging instruments and risk management protocols is crucial for maintaining financial stability and predictable earnings.

- Currency Exposure: APSEZ's international operations, including the Haifa Port, mean revenue and expenses are denominated in various foreign currencies, directly linking its financial performance to exchange rate volatility.

- Hedging Necessity: To mitigate the impact of currency swings on profitability, APSEZ must employ sophisticated financial hedging strategies for its foreign currency-denominated assets and liabilities.

- Global Dynamics: The company's strategic international growth makes it increasingly susceptible to broader global currency trends and economic shifts in the regions where it operates.

India's economic growth is a significant driver for Adani Ports & Special Economic Zone (APSEZ). With a projected GDP growth of around 6.5% for FY2024-25, increased trade volumes are expected, directly benefiting APSEZ's cargo handling operations. The company's logistics segment also saw substantial growth, with revenue doubling to approximately INR 5,100 crore in FY2023-24, reflecting strong demand for integrated supply chain solutions.

Inflationary pressures, particularly rising fuel and energy costs, impact APSEZ's operational expenses. Global energy prices remained volatile through early 2024, necessitating careful cost management and efficiency improvements to maintain profitability. The company's strategy includes investing in renewable energy to stabilize energy costs.

Access to capital is crucial for APSEZ's expansion plans. India's FDI equity inflows reached $32.03 billion in FY2023-24, indicating a favorable investment climate for infrastructure projects. APSEZ leverages both debt and equity financing, with effective debt management being key to sustaining its growth strategy and investor confidence.

Currency fluctuations pose a risk due to APSEZ's international operations, such as the acquisition of Israel's Haifa Port for approximately $1.18 billion. Managing exposures to currencies like the Israeli Shekel against the Indian Rupee through hedging is vital for financial stability.

| Economic Factor | Data Point/Trend | Impact on APSEZ | Source/Period |

|---|---|---|---|

| GDP Growth (India) | Projected 6.5% | Increased cargo volumes, higher revenue | FY2024-25 |

| Logistics Revenue | INR 5,100 crore (doubled) | Strong demand for integrated logistics | FY2023-24 |

| Inflation | Volatile energy prices | Increased operational costs, need for cost management | Early 2024 |

| FDI Equity Inflows (India) | $32.03 billion | Supports capital access for expansion | FY2023-24 |

| Haifa Port Acquisition | ~$1.18 billion | Increased foreign currency exposure | N/A |

Full Version Awaits

Adani Ports & Special Economic Zone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Adani Ports & Special Economic Zone delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a complete understanding of the external forces shaping Adani Ports' strategy and operations.

Sociological factors

Adani Ports & Special Economic Zone (APSEZ) recognizes that its large-scale projects, often requiring substantial land acquisition, directly impact local populations. Maintaining a strong social license to operate hinges on robust community engagement. This involves actively addressing concerns related to displacement, local employment opportunities, and environmental stewardship to ensure smooth project execution and long-term operational sustainability.

In FY24, APSEZ reported a significant increase in its Corporate Social Responsibility (CSR) spending, reaching ₹250 crore, a jump from ₹180 crore in FY23. These investments are channeled into various community development programs, focusing on education, healthcare, and skill development in areas surrounding its port operations.

Adani Ports & Special Economic Zone (APSEZ) manages a substantial workforce, making effective labor relations paramount. In 2023, the company reported employing over 10,000 individuals across its diverse operations, highlighting the critical need for fair wages and safe working environments to ensure operational continuity and employee morale.

Maintaining a skilled and motivated workforce is key for APSEZ's productivity. The company's focus on skill development and managing union relations directly impacts its ability to attract and retain talent, a crucial factor in its ongoing expansion and operational efficiency.

India's rapid urbanization, with a significant portion of its population migrating to coastal cities and industrial hubs, directly fuels the demand for Adani Ports & Special Economic Zone's (APSEZ) services. For instance, by 2024, urban areas are projected to house over 40% of India's population, increasing the need for efficient cargo movement and warehousing.

These demographic shifts also present challenges and opportunities for APSEZ regarding labor. Increased population density around port areas can enhance labor availability for port operations and related industries, but it also necessitates investment in social infrastructure and community development to manage the impact of a growing workforce.

Health, Safety, and Well-being of Employees

Adani Ports & Special Economic Zone (APSEZ) places significant emphasis on the health, safety, and well-being of its workforce, a critical aspect for any large-scale industrial operation. This commitment is demonstrated through rigorous safety protocols and ongoing investment in employee welfare programs. For instance, APSEZ reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.17 in FY24, indicating a strong focus on minimizing workplace incidents. This proactive approach not only safeguards employees but also bolsters the company's operational resilience and public image.

APSEZ's dedication to a safe working environment is further evidenced by its continuous efforts in safety training and fostering a robust safety culture across all its facilities. This includes regular drills, equipment upgrades, and promoting employee participation in safety initiatives. In FY24, the company conducted over 150,000 hours of safety training for its employees and contract workers, underscoring its commitment to equipping its personnel with the necessary skills to prevent accidents. Such investments are vital for maintaining productivity and mitigating potential disruptions.

- Employee Safety: APSEZ's TRIFR of 0.17 in FY24 highlights a low incidence of workplace injuries.

- Training Initiatives: Over 150,000 hours of safety training were delivered in FY24 to enhance workforce competency.

- Well-being Programs: Investments in employee well-being contribute to a healthier and more productive workforce.

- Risk Mitigation: A strong safety culture directly reduces operational risks and potential liabilities.

Public Perception and Brand Reputation

Public perception significantly shapes Adani Ports & Special Economic Zone's (APSEZ) social license to operate and investor sentiment. Negative public perception, often amplified by media coverage of environmental and social concerns, can hinder project approvals and increase the cost of capital. For instance, in early 2024, the Adani Group faced continued scrutiny regarding its environmental, social, and governance (ESG) practices, impacting its stock performance and public image.

Maintaining a robust brand reputation is paramount for APSEZ. This involves demonstrating transparency in operations, adhering to stringent ethical standards, and showcasing strong ESG performance. The company's commitment to sustainability initiatives, such as reducing carbon emissions and enhancing community engagement, directly contributes to its public image and investor confidence.

APSEZ's efforts to improve its corporate governance and sustainability metrics are crucial for navigating public opinion. The company has been actively reporting on its ESG progress, aiming to build trust and mitigate reputational risks. For example, APSEZ's FY24 sustainability report highlighted a reduction in Scope 1 and 2 emissions intensity by 11% compared to FY23, a key factor in its public perception strategy.

- Brand Reputation Impact: Public sentiment directly influences APSEZ's ability to secure financing and gain regulatory approvals for new port and SEZ developments.

- ESG Performance: Adherence to high ESG standards is increasingly a prerequisite for attracting institutional investors and maintaining a positive public image.

- Transparency Efforts: Open communication about environmental impact and community relations is vital for building trust and mitigating negative perceptions.

- Investor Confidence: A strong public perception, bolstered by ethical practices and sustainability achievements, is directly linked to sustained investor confidence in APSEZ.

Adani Ports & Special Economic Zone (APSEZ) must manage its significant impact on local communities, especially concerning land acquisition and resource utilization. By prioritizing community engagement and addressing concerns like displacement and local employment, APSEZ aims to secure its social license to operate, crucial for project continuity. The company's CSR spending in FY24 reached ₹250 crore, up from ₹180 crore in FY23, demonstrating a commitment to social development in its operational areas.

The company's large workforce, exceeding 10,000 employees in 2023, necessitates strong labor relations and a focus on fair wages and safe working conditions. APSEZ's commitment to employee well-being is underscored by its low Total Recordable Injury Frequency Rate (TRIFR) of 0.17 in FY24 and over 150,000 hours of safety training provided. This focus on safety and skill development is vital for talent retention and operational efficiency.

India's rapid urbanization, with over 40% of the population expected in urban areas by 2024, directly drives demand for APSEZ's logistics and infrastructure services. While this trend boosts labor availability, it also requires APSEZ to invest in social infrastructure and community development to manage population growth around its facilities.

Public perception and ESG performance are critical for APSEZ's reputation and investor confidence. The company's FY24 sustainability report noted an 11% reduction in Scope 1 and 2 emissions intensity, a key factor in its strategy to build trust and mitigate reputational risks. Strong ESG practices are increasingly essential for attracting institutional investment and maintaining a positive public image.

Technological factors

Adani Ports & Special Economic Zone (APSEZ) is actively embracing automation and digitalization to revolutionize its port operations. This strategic move is geared towards boosting efficiency and significantly cutting down vessel turnaround times. For instance, APSEZ's commitment to advanced technologies was highlighted by its investment in automated container terminals and cloud-based platforms for sophisticated data analysis.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) for optimizing vessel scheduling is a key component of APSEZ's strategy. These technologies are designed to streamline complex processes and ensure the most efficient use of resources, thereby enhancing APSEZ's competitive advantage and overall operational throughput in the dynamic maritime industry.

Technological advancements are reshaping logistics, with real-time tracking and predictive analytics becoming standard for efficient supply chain management. APSEZ's investment in integrated platforms allows them to offer seamless end-to-end solutions, extending their service from port to final customer delivery.

By leveraging these technologies, APSEZ enhances operational control and transparency, directly contributing to improved customer satisfaction and a stronger competitive edge in the logistics sector. For instance, the adoption of advanced yard management systems in 2024 has reportedly reduced truck turnaround times by up to 15% at key APSEZ facilities.

As Adani Ports & Special Economic Zone (APSEZ) continues to digitize its operations, cybersecurity becomes a critical concern. The increasing reliance on interconnected systems for managing cargo, logistics, and port infrastructure exposes APSEZ to significant cyber threats. A data breach could disrupt operations and erode customer confidence, highlighting the need for advanced security measures.

Protecting sensitive client data and critical port infrastructure is paramount for APSEZ's operational continuity. In 2023, the global cost of cybercrime was estimated to reach $8.44 trillion, underscoring the financial and reputational risks. APSEZ must invest in robust cybersecurity frameworks and data protection protocols to mitigate these threats effectively.

Green Port Technologies and Renewable Energy Integration

The push towards green port technologies is reshaping maritime operations. APSEZ is actively investing in the electrification of port equipment and the adoption of battery-powered vehicles to minimize its environmental footprint. This strategic shift aligns with their ambitious goal of achieving carbon-neutral port operations by 2025.

Integrating renewable energy sources is a cornerstone of APSEZ's sustainability strategy. The company is focused on developing captive renewable energy capacity, a move that supports their broader objective of reaching net-zero emissions by 2040. This commitment is driving significant investments in cleaner energy solutions across their port infrastructure.

- Electrification: APSEZ is transitioning port equipment to electric power for reduced emissions.

- Battery-Based Vehicles: The company is incorporating battery-powered vehicles within port operations.

- Renewable Energy Integration: APSEZ is expanding its use of solar and wind power for port operations.

- Carbon Neutrality Goal: A key target is achieving carbon-neutral port operations by 2025.

Innovation in Cargo Handling and Storage

Adani Ports is actively integrating advanced technologies to streamline cargo operations. For instance, the adoption of automated guided vehicles (AGVs) and robotic systems at facilities like Mundra Port is significantly reducing turnaround times for container handling. This focus on innovation directly translates to improved efficiency and a greater capacity to manage diverse cargo types.

The company's commitment to enhancing storage solutions is evident in its development of specialized warehousing facilities, including temperature-controlled environments for agricultural and pharmaceutical products. Furthermore, advancements in yard management systems, utilizing AI and IoT, optimize the placement and retrieval of containers, leading to better utilization of port assets and faster transit times.

- Automated Equipment: Implementation of AGVs and robotic cranes to boost handling speed.

- Specialized Warehousing: Development of advanced storage for temperature-sensitive goods.

- Yard Optimization: Use of AI for efficient container placement and retrieval.

- Efficiency Gains: Innovations contribute to faster processing and improved asset utilization.

Adani Ports & Special Economic Zone (APSEZ) is heavily investing in technological advancements to bolster its operational efficiency and competitive edge. The company is actively deploying automation, AI, and IoT across its facilities to streamline cargo handling, optimize vessel scheduling, and enhance supply chain visibility. For example, APSEZ reported a 15% reduction in truck turnaround times at key ports in 2024 due to advanced yard management systems.

The company's strategic focus on digitalization extends to improving warehousing capabilities, with investments in specialized, temperature-controlled storage solutions for sensitive cargo like pharmaceuticals and agricultural products. This technological integration aims to provide seamless, end-to-end logistics services, thereby increasing APSEZ's value proposition to its clients.

APSEZ is also prioritizing green technologies, aiming for carbon-neutral port operations by 2025 through the electrification of equipment and the adoption of battery-powered vehicles. Furthermore, the company is expanding its renewable energy capacity to support its net-zero emissions goal by 2040, demonstrating a commitment to sustainable technological integration.

| Technology Focus | Impact/Goal | Example/Data Point |

|---|---|---|

| Automation & Robotics | Increased efficiency, reduced turnaround times | 15% reduction in truck turnaround times (2024) |

| AI & IoT | Optimized scheduling, enhanced visibility | Advanced yard management systems |

| Green Port Technologies | Reduced environmental footprint, carbon neutrality | Electrification of port equipment |

| Renewable Energy | Support for net-zero emissions goal | Captive renewable energy capacity development |

Legal factors

Adani Ports & Special Economic Zone (APSEZ) navigates a stringent regulatory landscape governed by national and international maritime laws. These include critical areas such as port security, navigation protocols, vessel traffic management, and efficient cargo handling procedures. For instance, in 2023, APSEZ continued to invest in enhanced security measures across its ports, aligning with global best practices and national mandates.

Adherence to these regulations is not optional; it directly shapes APSEZ's operational frameworks, safety benchmarks, and capital expenditure plans. For example, the implementation of new International Maritime Organization (IMO) environmental regulations concerning fuel sulfur content can require significant upgrades to port infrastructure and vessel support services, impacting operational costs and investment strategies.

The legal framework for Special Economic Zones (SEZs) in India, including land acquisition and labor laws, directly shapes Adani Ports & Special Economic Zone's (APSEZ) development strategies. These regulations, alongside specific economic incentives, are crucial for the operational success and financial viability of APSEZ's SEZ ventures.

APSEZ's adherence to evolving SEZ laws, such as those aimed at improving the ease of doing business and refining export-import policies, is paramount. For instance, the Special Economic Zones Act, 2005, and its subsequent amendments, continue to influence how APSEZ structures its operations and attracts investment, with ongoing discussions in 2024 and early 2025 focusing on further streamlining these processes to boost exports.

Adani Ports & Special Economic Zone (APSEZ) operates under stringent environmental regulations, particularly concerning air and water pollution, waste disposal, coastal zone management, and biodiversity. These laws directly influence project approvals and ongoing operational standards.

Compliance with environmental impact assessments and obtaining necessary clearances for new developments are critical to avoid significant penalties and protect APSEZ's reputation. For instance, in 2023, the company continued to invest in environmental management systems across its ports.

APSEZ's commitment to environmental stewardship is demonstrated by its Zero Waste to Landfill certification and its A- rating from CDP for climate change and water security in 2024, reflecting proactive measures in environmental compliance.

Labor and Employment Laws

Adani Ports & Special Economic Zone (APSEZ) must navigate India's complex labor and employment laws. Compliance with regulations covering wages, working hours, employee benefits, and industrial relations is paramount for smooth operations. For instance, the recent implementation of new labor codes in India, aimed at consolidating various existing laws, presents both opportunities for streamlined compliance and potential challenges in adapting existing HR practices.

Changes in these labor codes or increased regulatory scrutiny on employment practices can directly impact APSEZ's human resource management strategies and overall operational expenses. The company's commitment to fair labor practices is also crucial for fostering positive industrial relations and maintaining social harmony within its workforce, which is vital for sustained growth and reputation.

- Wage Regulations: APSEZ must adhere to minimum wage laws and any revisions affecting its diverse workforce across various operational sites.

- Working Hours and Conditions: Compliance with mandated working hours, overtime rules, and occupational safety standards is non-negotiable.

- Employee Benefits: Ensuring statutory benefits like provident fund, gratuity, and health insurance are provided as per Indian law is critical.

- Industrial Relations: Managing trade union relationships and adhering to industrial dispute resolution mechanisms are key to operational stability.

Corporate Governance and Anti-Corruption Laws

Adani Ports & Special Economic Zone (APSEZ) must navigate a complex web of corporate governance and anti-corruption laws. As a publicly traded company and a key component of the Adani Group, adherence to strict norms is paramount for sustained operations and investor trust. This includes robust transparency in financial reporting and ethical business practices.

Compliance with company laws and anti-corruption regulations is non-negotiable for APSEZ. The company's commitment to these legal frameworks helps mitigate risks associated with regulatory penalties and reputational damage. Maintaining integrity in all dealings is a cornerstone of its operational strategy.

Recent adjustments, such as the re-designation of Gautam Adani from Executive to Non-Executive Chairman, reflect APSEZ's proactive approach to corporate compliance. This move aligns with evolving corporate governance standards and reinforces the company's dedication to best practices in board oversight and management structure.

Key legal considerations for APSEZ include:

- Adherence to SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, ensuring timely and accurate disclosures to the market.

- Compliance with the Prevention of Corruption Act, 1988, and other anti-bribery legislation to prevent unethical practices.

- Upholding insider trading regulations to maintain market integrity and investor confidence.

- Adherence to the Companies Act, 2013, governing corporate structure, management, and financial reporting.

Adani Ports & Special Economic Zone (APSEZ) operates under a robust legal framework that dictates maritime operations, SEZ development, and corporate governance. Compliance with national and international maritime laws, including those related to port security and vessel management, is paramount, with ongoing investments in 2023 to meet global standards. The company's SEZ ventures are significantly shaped by Indian SEZ laws, with continuous efforts in 2024 and early 2025 to streamline export-import policies and enhance the ease of doing business.

Environmental regulations concerning pollution control, waste management, and coastal zone protection directly influence APSEZ's project approvals and operational standards, with the company demonstrating commitment through initiatives like its Zero Waste to Landfill certification and a CDP A- rating in 2024 for climate and water security.

Adherence to India's labor laws, including the recent consolidation into new labor codes, impacts APSEZ's HR practices and operational costs, highlighting the importance of fair labor standards for operational stability and reputation.

APSEZ's corporate governance is guided by SEBI regulations, the Prevention of Corruption Act, and the Companies Act, with recent structural adjustments like the re-designation of Gautam Adani as Non-Executive Chairman in 2024 underscoring a commitment to evolving corporate compliance standards and maintaining investor trust.

Environmental factors

Climate change presents significant physical risks for Adani Ports & Special Economic Zone (APSEZ). Rising sea levels and more frequent extreme weather events like cyclones and floods directly threaten port infrastructure, potentially causing damage and operational disruptions. Coastal erosion is another growing concern that could impact land-based facilities.

To counter these threats, APSEZ must prioritize investments in climate-resilient infrastructure and adaptation strategies. This includes reinforcing existing structures, developing advanced early warning systems for extreme weather, and potentially relocating vulnerable assets. Such measures are crucial for safeguarding APSEZ's extensive port network and ensuring uninterrupted operations, especially considering the vital role these ports play in India's trade and logistics.

Adani Ports & Special Economic Zone (APSEZ) faces the critical environmental challenge of managing diverse pollution streams. This includes tackling air emissions from port operations and vessel traffic, controlling water discharge quality, and responsibly handling solid waste generated across its facilities. Effective pollution control is paramount for regulatory compliance and maintaining operational sustainability.

APSEZ is actively working to minimize its environmental impact through strategic initiatives. A key focus is achieving Zero Waste to Landfill certification for its various ports, demonstrating a commitment to circular economy principles. Furthermore, the company implements robust recycling and waste repurposing programs, aiming to divert significant volumes of waste from landfills.

Port development and operations inherently carry risks to sensitive coastal and marine ecosystems, such as mangroves, wetlands, and diverse marine life. APSEZ's commitment to biodiversity protection is evident in its significant mangrove plantation initiatives. For instance, by the end of March 2024, APSEZ had planted over 3.5 million mangroves across its various locations, a substantial undertaking aimed at mitigating ecological impact and enhancing biodiversity.

Responsible stewardship of these vital natural habitats is paramount for the long-term sustainability of APSEZ's operations and the surrounding environment. These efforts not only address regulatory requirements but also contribute to ecological resilience, supporting the health of marine ecosystems which are crucial for coastal protection and fisheries.

Resource Management (Water and Energy)

Adani Ports & Special Economic Zone (APSEZ) recognizes the paramount importance of sustainable resource management for its extensive port and logistics operations. This includes a strong focus on water conservation and energy efficiency across its facilities. For instance, APSEZ has been actively pursuing initiatives to reduce its water footprint, a critical aspect given the coastal nature of many of its ports.

A significant environmental priority for APSEZ is the transition towards cleaner energy sources and more efficient operations. The company is committed to electrifying its port equipment, including cranes, to reduce reliance on fossil fuels. Furthermore, APSEZ is phasing out diesel-powered vehicles within its special economic zones, replacing them with battery-operated alternatives. This strategic shift aligns with broader environmental goals and aims to lower operational emissions.

APSEZ's commitment to renewable energy is also a key component of its environmental strategy. The company is investing in solar power projects to meet a portion of its energy needs. As of early 2024, APSEZ has a significant renewable energy portfolio, with plans to further expand its capacity. For example, by the end of fiscal year 2023-24, APSEZ had commissioned over 100 MW of solar power capacity across its various locations.

- Water Conservation: APSEZ implements water-saving technologies and practices at its port facilities, particularly in water-scarce regions.

- Energy Efficiency: The company focuses on optimizing energy consumption through improved infrastructure and operational processes.

- Electrification of Equipment: APSEZ is actively electrifying cranes and other heavy machinery to reduce direct emissions from port operations.

- Renewable Energy Adoption: Investments in solar power generation are a core part of APSEZ's strategy to power its operations with cleaner energy.

Sustainability Reporting and ESG Performance

Growing pressure from stakeholders and investors for greater transparency in environmental, social, and governance (ESG) performance is driving the need for comprehensive sustainability reporting. Adani Ports & Special Economic Zone (APSEZ) has demonstrated a commitment to this by achieving strong rankings in sustainability assessments and receiving favorable CDP ratings, underscoring its dedication to disclosing and enhancing its environmental impact.

This focus on sustainability reporting not only bolsters APSEZ's corporate reputation but also improves its access to sustainable finance options. For instance, APSEZ's inclusion in the Dow Jones Sustainability Index (DJSI) for multiple consecutive years, including 2023, highlights its robust ESG practices and appeals to a growing pool of environmentally conscious investors.

- Stakeholder Demand: Increasing calls for transparency in ESG metrics from investors and the public.

- APSEZ's Performance: High rankings in sustainability assessments and positive CDP scores validate its environmental efforts.

- Financial Implications: Enhanced reputation and improved access to sustainable finance and green bonds.

- Market Recognition: Continued inclusion in indices like the DJSI signals strong ESG credentials.

Adani Ports & Special Economic Zone (APSEZ) is actively investing in climate resilience and pollution control measures to mitigate environmental risks. The company is committed to sustainable resource management, focusing on water conservation and energy efficiency, including electrifying port equipment and increasing renewable energy adoption. APSEZ's dedication to biodiversity protection is demonstrated through significant mangrove plantation efforts, with over 3.5 million planted by March 2024.

| Environmental Factor | APSEZ Initiatives/Data | Impact/Implication |

| Climate Change Risks | Investment in climate-resilient infrastructure, advanced early warning systems. | Safeguarding port infrastructure against rising sea levels and extreme weather. |

| Pollution Management | Zero Waste to Landfill certification efforts, robust recycling programs. | Minimizing air, water, and solid waste pollution; ensuring regulatory compliance. |

| Biodiversity Protection | Over 3.5 million mangroves planted by March 2024. | Mitigating ecological impact and enhancing biodiversity in coastal areas. |

| Resource Management | Electrification of port equipment, phasing out diesel vehicles, solar power projects (over 100 MW commissioned by FY24). | Reducing operational emissions and reliance on fossil fuels, enhancing energy efficiency. |

PESTLE Analysis Data Sources

Our Adani Ports & SEZ PESTLE analysis is built on a robust foundation of data from official government publications, international financial institutions, and leading market research firms. We incorporate economic indicators, regulatory updates, and industry-specific reports to ensure comprehensive coverage of all PESTLE factors.