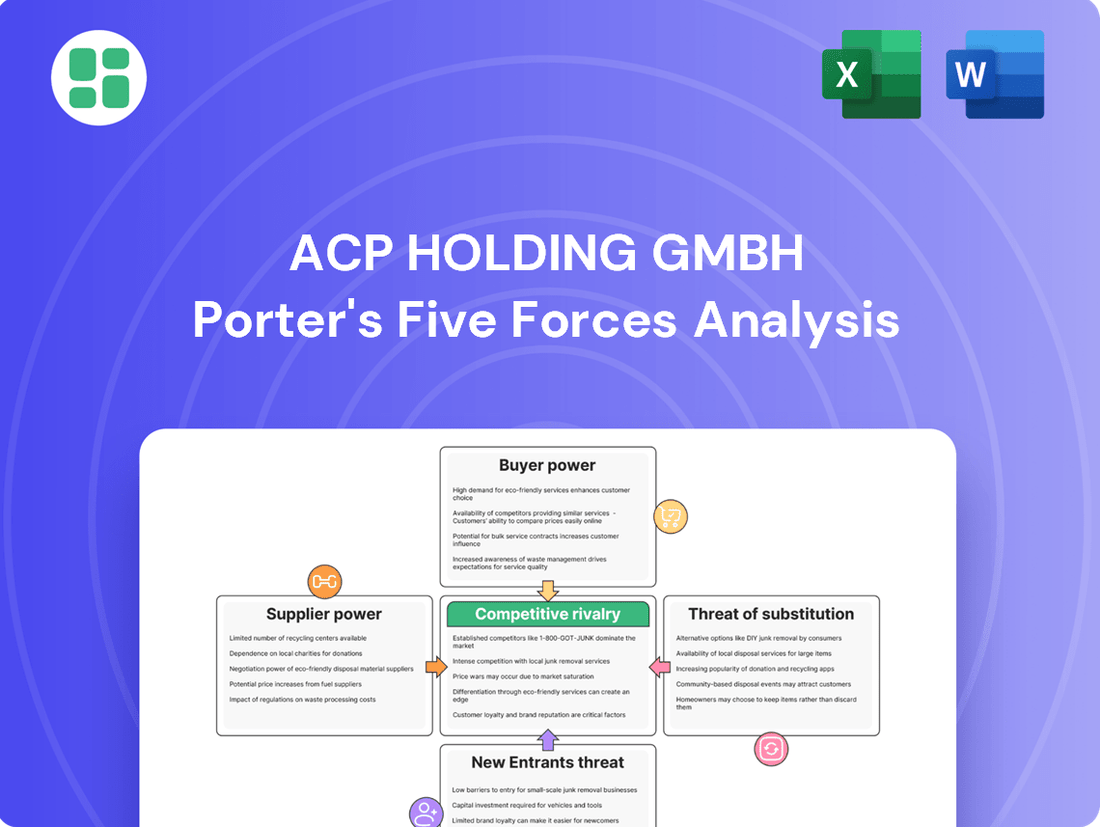

ACP Holding GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACP Holding GmbH Bundle

ACP Holding GmbH navigates a landscape shaped by intense rivalry and the ever-present threat of new entrants. Understanding the bargaining power of both suppliers and buyers is crucial for sustainable growth.

The complete report reveals the real forces shaping ACP Holding GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The IT sector often sees a limited number of major hardware manufacturers, such as Dell Technologies and Hewlett Packard Enterprise, alongside dominant software providers like Microsoft and SAP. This consolidation in the supply chain grants these key players substantial bargaining power.

For companies like ACP Holding GmbH, this concentration translates into fewer viable alternatives for essential hardware components and software licenses. This scarcity of options can significantly influence pricing and contract terms, giving suppliers a strong hand in negotiations.

The uniqueness of inputs significantly influences supplier bargaining power. For ACP Holding GmbH, reliance on specialized software licenses, proprietary hardware, or niche cybersecurity solutions, often from a limited vendor pool, grants these suppliers considerable leverage. For instance, if ACP's core operations depend on a patented technology, the supplier of that technology faces minimal competitive pressure, allowing them to dictate terms. In 2024, the cybersecurity market, a likely area for ACP, saw continued consolidation, with specialized firms commanding premium pricing for unique threat intelligence platforms.

Switching core technology platforms for ACP Holding GmbH can be a significant undertaking. For instance, if ACP relies heavily on a specific cloud infrastructure provider, migrating to a different one in 2024 could involve costs ranging from hundreds of thousands to millions of euros, depending on the scale of operations and data volume. This includes expenses for data transfer, system re-architecture, and extensive employee retraining.

The integration of new software ecosystems or hardware vendors also presents substantial financial and operational hurdles. Imagine ACP needing to replace its entire enterprise resource planning (ERP) system; this process alone can cost upwards of $1 million and take over a year to implement fully. Such investments in new systems, coupled with the learning curve for employees, solidify the position of existing suppliers.

These high switching costs inherently diminish ACP's bargaining power. When it becomes prohibitively expensive or time-consuming to change suppliers, incumbent vendors gain leverage. This makes it harder for ACP to negotiate better terms or explore alternative, potentially more cost-effective solutions, thereby increasing supplier power within the industry landscape.

Threat of Forward Integration by Suppliers

Large technology suppliers, particularly in the IT sector, possess the potential to integrate forward by offering direct services or consulting. This move could position them as direct competitors to their existing partners, such as ACP Holding GmbH. For instance, a major cloud service provider might begin offering managed IT solutions directly to businesses, bypassing intermediaries like ACP.

Should a significant supplier decide to move into direct end-user solutions, it could directly impact ACP's business. This forward integration could diminish the demand for ACP's own product offerings or services, and simultaneously exert upward pressure on the prices ACP pays for the supplier's components or technologies. In 2024, the IT services market saw significant growth, with global IT spending projected to reach over $5 trillion, highlighting the scale of potential competition from large tech firms.

- Potential for Supplier Competition: Major technology firms may offer IT services directly, competing with partners like ACP Holding GmbH.

- Impact on ACP's Demand: If suppliers integrate forward, it could decrease ACP's need for their products or services.

- Pricing Pressure: Forward integration by suppliers can lead to increased costs or reduced margins for ACP.

- Market Context: The IT services market's substantial growth in 2024 underscores the competitive landscape and the capabilities of large suppliers.

Importance of ACP to Suppliers

The bargaining power of suppliers is a key consideration in ACP Holding GmbH's operational landscape. While major suppliers can exert considerable influence, ACP's substantial purchasing volume and its establishment of strategic partnerships can effectively counter this. For instance, if ACP Holding GmbH constitutes a significant percentage of a supplier's annual revenue, that supplier is likely more amenable to negotiating favorable terms, offering discounts, or providing specialized support, thus diminishing their inherent bargaining leverage.

ACP's strategic approach to supplier relationships is crucial. By consolidating purchasing power and fostering long-term alliances, ACP can secure more competitive pricing and ensure a stable supply chain. This is particularly relevant in 2024, where supply chain resilience remains a paramount concern for many businesses. A strong negotiating position can translate directly into cost savings, enhancing ACP's overall profitability and competitive edge.

- Supplier Dependence: When ACP Holding GmbH represents a large portion of a supplier's business, the supplier's bargaining power is significantly reduced.

- Purchasing Volume: ACP's ability to buy in bulk allows it to negotiate better prices and terms, increasing its influence over suppliers.

- Strategic Partnerships: Cultivating strong, long-term relationships with key suppliers can lead to exclusive benefits and more favorable conditions.

- Market Conditions: In 2024, fluctuating raw material costs and logistical challenges mean that ACP's ability to manage supplier relationships directly impacts its cost structure.

Suppliers in the IT sector, especially those providing specialized hardware or software, hold considerable sway due to market concentration and the uniqueness of their offerings. For ACP Holding GmbH, reliance on a few key vendors for critical components or licenses means these suppliers can dictate pricing and terms, a situation amplified by high switching costs for ACP. For example, the global IT services market reached an estimated $1.3 trillion in 2024, indicating the scale of operations and the potential leverage of large service providers.

| Factor | Impact on ACP Holding GmbH | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier bargaining power. | Major hardware manufacturers like Dell and HPE dominate significant market shares. |

| Uniqueness of Inputs | Reliance on specialized or patented technology grants suppliers leverage. | Cybersecurity market consolidation in 2024 saw specialized firms command premium pricing. |

| Switching Costs | High costs to change platforms or vendors lock ACP into existing relationships. | Migrating cloud infrastructure can cost hundreds of thousands to millions of euros. |

| Forward Integration Potential | Suppliers offering direct services can become competitors. | Global IT spending exceeded $5 trillion in 2024, showing the competitive capacity of large tech firms. |

| ACP's Counter-Leverage | Large purchasing volumes and strategic partnerships can reduce supplier power. | Supply chain resilience was a key concern in 2024, rewarding strong supplier relationships. |

What is included in the product

This analysis of ACP Holding GmbH's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model for ACP Holding GmbH.

Customers Bargaining Power

ACP Holding GmbH's customer base, spanning small businesses to large enterprises, presents a nuanced picture of customer bargaining power. Large enterprise clients, in particular, wield considerable influence due to their significant IT spending and complex requirements.

These major customers can leverage their volume and ability to negotiate for customized solutions and more favorable pricing. For instance, in 2024, the average IT budget for large enterprises in Germany exceeded €5 million, giving them substantial leverage when procuring services from IT providers like ACP Holding GmbH.

While individual small clients may have limited power, their collective impact can still be a factor. However, the concentration of business with a few large clients typically amplifies the bargaining power of those specific entities.

For customers, moving from one IT service provider to another often involves significant hurdles. This can include the complex and costly process of transferring data, re-integrating systems, and managing potential disruptions to ongoing operations. These factors create substantial switching costs for clients.

These high switching costs are particularly pronounced for customers utilizing integrated managed services or complex system integrations. This complexity directly diminishes the bargaining power of these customers.

Consequently, these elevated switching costs serve to bolster ACP's customer retention efforts, making it more challenging for clients to seek alternatives and thereby strengthening ACP's position in the market.

Customer price sensitivity is a key factor influencing ACP Holding GmbH's bargaining power. For standard IT services, where multiple providers offer similar solutions, customers are naturally more inclined to seek the lowest price. This is particularly true for businesses with tighter IT budgets, making them highly sensitive to price fluctuations.

However, this sensitivity diminishes significantly when dealing with specialized IT services that are critical to a company's operations. For instance, in areas like advanced cybersecurity or complex data center management, customers are more likely to prioritize the vendor's expertise, reliability, and the proven effectiveness of their solutions over simply the lowest cost. In 2024, the demand for robust cybersecurity solutions continued to rise, with many organizations willing to invest more for comprehensive protection against evolving threats, demonstrating a willingness to trade price for critical functionality.

Availability of Alternative Providers

The IT services market is characterized by intense competition, with a multitude of providers offering comparable infrastructure, networking, and cybersecurity solutions. This abundance of choice significantly strengthens the bargaining power of customers.

With numerous alternative system integrators, managed service providers, and consulting firms readily available, customers can easily switch or threaten to switch to a competitor. This dynamic empowers them to negotiate more favorable pricing, service level agreements, and contract terms with ACP Holding GmbH.

- Market Saturation: The IT services sector, particularly in areas like cloud migration and managed IT, saw continued market saturation in 2024, with many firms vying for contracts.

- Customer Choice: Reports indicate that businesses typically evaluate an average of 5-7 IT service providers before making a decision, highlighting the breadth of alternatives available.

- Price Sensitivity: Increased competition often leads to greater price sensitivity among buyers, compelling providers like ACP to remain competitive to retain and attract clients.

Customers' Ability to Integrate In-House

Large enterprises, particularly those with substantial financial backing and advanced technical know-how, can increasingly choose to build or enhance their internal IT departments. This capability to perform IT functions in-house, especially for routine operations, directly translates into greater bargaining power for these customers when negotiating with external IT service providers like ACP Holding GmbH. For instance, in 2024, the IT spending by Fortune 500 companies on internal IT development and maintenance reached hundreds of billions of dollars, highlighting their capacity for insourcing.

This potential for insourcing acts as a significant lever for customers during price and service negotiations. Knowing they can bring certain IT functions in-house, or at least have that as a viable alternative, empowers them to demand more favorable terms from ACP. This is particularly true for standardized IT services where the cost and complexity of insourcing are manageable.

- Customer Insourcing Potential: Large enterprises can leverage their financial strength and technical expertise to develop in-house IT capabilities.

- Negotiating Leverage: The option to perform IT functions internally provides customers with a powerful bargaining tool.

- Reduced Reliance: Insourcing allows customers to decrease their dependence on external IT service providers.

- Standard IT Operations: The feasibility of insourcing is often higher for common and less complex IT tasks.

The bargaining power of customers for ACP Holding GmbH is influenced by several factors, including market saturation, customer choice, and price sensitivity. The IT services market in 2024 remained highly competitive, with numerous providers offering similar solutions, which naturally empowers customers to negotiate for better terms.

Customers, especially larger enterprises, can effectively leverage their purchasing volume and the availability of alternative providers to secure more favorable pricing and service level agreements. This is further amplified by the significant switching costs associated with changing IT service providers, which, while generally high, can be mitigated by customers with strong internal IT capabilities or a willingness to undertake the transition.

| Factor | Impact on ACP Holding GmbH | Supporting Data (2024) |

|---|---|---|

| Market Saturation | Increases customer bargaining power | IT services sector saw continued market saturation, with many firms competing for contracts. |

| Customer Choice | Strengthens customer negotiation leverage | Businesses evaluated an average of 5-7 IT service providers before decisions. |

| Switching Costs | Can diminish customer bargaining power | High costs for data transfer and system re-integration create client stickiness. |

| Insourcing Potential | Increases customer bargaining power | Large enterprises' IT spending on internal development reached hundreds of billions of dollars. |

Full Version Awaits

ACP Holding GmbH Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for ACP Holding GmbH, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

The IT services market, especially in Europe, is quite fragmented. It's filled with many companies, from big international ones to smaller local outfits. This means ACP Holding GmbH isn't just up against a few giants; it's dealing with a broad range of competitors across different service areas.

ACP Holding GmbH competes with major global IT service providers, specialized firms focusing on specific technologies or industries, and a vast number of smaller, regional IT companies. For instance, in 2023, the European IT services market was valued at over €300 billion, showcasing the sheer scale and diversity of players vying for business.

This wide array of competitors, each with its own strengths and market focus, naturally drives up rivalry. Companies are constantly competing for contracts and clients, pushing for innovation and competitive pricing to capture market share.

The IT services market, encompassing cloud adoption, cybersecurity, and digital transformation, is seeing significant expansion. For instance, the global IT services market was projected to reach approximately $1.3 trillion in 2024, indicating a healthy growth trajectory.

While a growing market can soften competitive pressures by allowing companies to grow without directly poaching customers, this rapid expansion also acts as a magnet for new competitors and spurs existing players to aggressively broaden their service portfolios.

Product and service differentiation is a key battleground for IT service providers like ACP Holding GmbH. Companies stand out through specialized technical expertise, unique implementation methodologies, customized service level agreements, and deep, long-standing customer relationships. For instance, a competitor might boast ISO 27001 certification for data security, a differentiator that resonates with clients prioritizing robust protection.

The intensity of rivalry for ACP Holding GmbH is directly influenced by how truly unique its IT service portfolio is when measured against its competitors. If offerings are largely commoditized, price becomes the primary competitive lever, escalating rivalry. Conversely, highly differentiated services can significantly dampen direct price-based competition, allowing for more stable margins.

Exit Barriers

High exit barriers can significantly impact competitive rivalry for ACP Holding GmbH. When it's difficult or costly for companies to leave a market, they might stay even when facing low profitability. This situation can lead to a crowded market with more players than demand can comfortably support.

These barriers can include specialized assets that are hard to repurpose, long-term contracts that lock companies in, and substantial investments in skilled personnel who are difficult to redeploy. For instance, in the German IT services sector where ACP Holding GmbH operates, the need for highly specialized cybersecurity professionals and long-term maintenance contracts for enterprise software can act as considerable exit barriers.

- Specialized Assets: Companies might have invested heavily in proprietary hardware or software solutions unique to their operations, making them difficult to sell or repurpose elsewhere.

- Long-Term Contracts: Commitments to clients for ongoing service delivery or support, often spanning several years, can prevent a swift exit.

- Skilled Personnel: The cost and time associated with retraining or relocating a highly specialized workforce can be prohibitive for companies looking to divest.

The persistence of these struggling competitors, even with low margins, often results in persistent overcapacity. This overcapacity forces companies to compete more aggressively on price to secure business, thereby intensifying the overall competitive rivalry that ACP Holding GmbH must navigate.

Switching Costs for Customers

High customer switching costs are a significant factor in reducing competitive rivalry for ACP Holding GmbH. When clients are deeply integrated with ACP's proprietary systems and services, the financial and operational burden of migrating to a competitor becomes substantial. This integration often includes specialized software, data migration, employee retraining, and potential disruptions to ongoing business operations.

These embedded costs make it less likely for customers to switch solely based on minor price differences offered by rivals. For instance, in the IT services sector, a company might invest heavily in custom configurations and ongoing support for a particular vendor's platform. According to a 2024 industry survey, over 65% of IT decision-makers cited integration complexity as a primary reason for not switching cloud providers, even when presented with more cost-effective alternatives.

- Integration Complexity: Deep integration of ACP's solutions into a client's existing IT infrastructure creates a high barrier to exit.

- Operational Disruption: The process of switching vendors can lead to downtime, data loss, and reduced productivity, which clients seek to avoid.

- Specialized Training: Employees often require extensive training on new systems, adding to the overall cost and time commitment of switching.

- Data Migration Challenges: Transferring large volumes of sensitive data securely and without corruption is a complex and costly undertaking.

The competitive rivalry within the IT services market is intense, driven by a fragmented landscape populated by global players, specialized firms, and numerous smaller regional companies. This broad spectrum of competitors means ACP Holding GmbH faces a constant battle for market share, often leading to price wars and a relentless pursuit of innovation to stand out.

The sheer size of the market, projected to exceed $1.3 trillion globally in 2024, attracts new entrants and encourages existing players to expand their offerings, further intensifying competition. Differentiation through technical expertise, unique methodologies, and strong client relationships is crucial for ACP Holding GmbH to mitigate direct price-based rivalry.

High exit barriers, such as specialized assets and long-term contracts, can keep struggling competitors in the market, leading to overcapacity and aggressive pricing tactics. Conversely, high customer switching costs, stemming from integration complexity and operational disruption, can provide ACP Holding GmbH with a degree of insulation from intense rivalry.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Market Fragmentation | Numerous global, specialized, and regional IT service providers. | High |

| Market Growth | Global IT services market projected over $1.3 trillion in 2024. | Intensifies rivalry as new players enter and existing ones expand. |

| Differentiation | Specialized expertise, unique methodologies, client relationships. | Can dampen price-based competition. |

| Exit Barriers | Specialized assets, long-term contracts, skilled personnel. | Can lead to overcapacity and aggressive pricing. |

| Switching Costs | Integration complexity, operational disruption, training needs. | Can reduce customer churn and competitive pressure. |

SSubstitutes Threaten

Many large corporations, including those in the DACH region where ACP Holding GmbH operates, possess robust in-house IT departments. These internal teams can handle everything from network management to cybersecurity, directly substituting for external IT service providers. For instance, a 2024 survey of German businesses revealed that over 60% of companies with more than 500 employees have dedicated IT personnel for core infrastructure tasks, limiting the need for outsourcing these functions.

The widespread availability of public cloud services like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud presents a significant threat of substitutes for traditional IT service providers. These platforms empower businesses with self-service capabilities for infrastructure, software, and platform needs, directly reducing reliance on external consultants for many IT functions.

For instance, in 2024, the global public cloud market was projected to reach over $600 billion, highlighting the immense scale and accessibility of these substitute solutions. This allows companies to bypass the need for extensive system integration and IT infrastructure consulting that ACP Holding GmbH might otherwise provide for certain projects, thereby diminishing the value proposition of such services.

The rise of robust open-source software presents a significant threat of substitution for ACP Holding GmbH's proprietary IT solutions. Mature open-source options for operating systems, databases, and cybersecurity tools offer businesses a compelling, cost-effective alternative, reducing the need for expensive licensed software and external integration consultants.

Standardized Software and SaaS Solutions

The rise of standardized Software-as-a-Service (SaaS) solutions presents a significant threat to ACP Holding GmbH. These readily available applications for core business functions like customer relationship management (CRM), enterprise resource planning (ERP), and human resources (HR) diminish the demand for ACP's traditional custom system integration and managed services. For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a massive shift towards these more accessible and often cost-effective alternatives.

These off-the-shelf SaaS offerings typically deliver robust functionality with significantly reduced IT overhead for businesses. This makes them an attractive substitute for companies seeking to streamline operations without the complexity and cost associated with bespoke integrations. The ease of deployment and ongoing updates inherent in SaaS models further lowers the switching costs for businesses, increasing the pressure on ACP to demonstrate superior value.

- Increased SaaS adoption: Businesses are increasingly opting for SaaS for CRM, ERP, and HR functions.

- Reduced need for custom integration: Standardized solutions lessen the demand for ACP's integration services.

- Lower IT overhead: SaaS offers comprehensive functionality with minimal IT burden for clients.

- Cost-effectiveness: Off-the-shelf solutions are often more budget-friendly than custom builds.

Hybrid IT Models and Co-management

The increasing adoption of hybrid IT models, where businesses blend on-premise infrastructure with cloud services, presents a significant threat of substitutes for comprehensive managed service providers like ACP Holding GmbH. This trend is amplified by a growing preference for co-managed IT environments. In 2024, an estimated 70% of enterprises were operating with some form of hybrid cloud strategy, indicating a substantial shift away from fully outsourced IT solutions.

Businesses opting for hybrid or co-managed IT often selectively outsource specific functions rather than entire IT operations. This fragmentation of services means that ACP Holding GmbH might face competition from specialized providers for individual components, such as cloud security or data backup, rather than competing for a monolithic managed services contract. For instance, a company might use a cloud provider for storage but manage its own network security, thereby limiting the potential revenue from a unified managed service agreement.

- Hybrid IT Adoption: Over 70% of enterprises utilized hybrid cloud strategies in 2024.

- Co-management Preference: Businesses increasingly prefer to manage certain IT functions internally while outsourcing others.

- Service Fragmentation: Specialized providers for individual IT components can substitute comprehensive managed service offerings.

- Reduced Contract Scope: The shift to hybrid and co-managed models can limit the breadth and depth of managed service contracts.

The threat of substitutes for ACP Holding GmbH is substantial, driven by readily available public cloud services, mature open-source software, and the widespread adoption of standardized Software-as-a-Service (SaaS) solutions. These alternatives offer cost-effectiveness and reduced IT overhead, diminishing the demand for ACP's custom integration and managed services.

In 2024, the global public cloud market was projected to exceed $600 billion, while the SaaS market was anticipated to surpass $200 billion. This indicates a massive shift towards accessible, often more affordable, IT solutions that can bypass the need for extensive external consulting. Additionally, over 60% of large German companies in 2024 maintained dedicated IT staff for core infrastructure, further reducing their reliance on outsourcing.

| Substitute Type | 2024 Market Projection (USD Billion) | Impact on ACP Holding GmbH |

|---|---|---|

| Public Cloud Services | > 600 | Reduces need for infrastructure consulting |

| SaaS Solutions | > 200 | Lowers demand for custom integration and managed services |

| Open-Source Software | N/A (Cost Savings) | Displaces proprietary software and related integration services |

| In-house IT Departments (Large Enterprises) | N/A (Internal Capacity) | Limits outsourcing opportunities for core IT functions |

Entrants Threaten

Establishing a robust IT service provider like ACP Holding GmbH demands significant capital. Think substantial investments in data centers, cutting-edge networking gear, and advanced cybersecurity solutions. For instance, building a Tier III data center alone can cost tens of millions of dollars, a figure that immediately sets a high bar.

These considerable upfront capital needs serve as a major deterrent for aspiring new companies. Smaller firms or startups often struggle to secure the necessary funding to compete on a similar scale, effectively limiting the number of potential new entrants into the market.

The IT services industry, a crucial sector for companies like ACP Holding GmbH, is heavily reliant on specialized expertise. Think cybersecurity, cloud architecture, and advanced data analytics. Newcomers often struggle to find and keep these highly skilled individuals, which is a significant hurdle.

For instance, a 2024 report indicated that the demand for cloud computing skills outstripped supply by nearly 70%, making it difficult for new IT service firms to assemble competent teams. This talent gap, coupled with the high cost of recruitment and training, acts as a powerful deterrent for potential entrants seeking to compete with established players who have robust talent pipelines.

In IT services, particularly for vital sectors like data centers and cybersecurity, a strong brand reputation and deep customer trust are absolutely crucial. Established companies like ACP Holding GmbH have cultivated enduring relationships and demonstrated reliability over years, creating significant hurdles for newcomers attempting to build credibility and secure major enterprise deals swiftly.

For instance, in the German IT services market, where ACP Holding GmbH operates, customer loyalty often hinges on proven security protocols and guaranteed uptime, factors that take considerable time and investment to establish. A 2024 survey indicated that over 60% of German businesses prioritize vendor reliability and existing client testimonials when selecting IT partners for critical infrastructure.

Economies of Scale and Scope

Existing IT service providers, like those within ACP Holding GmbH's competitive landscape, often leverage significant economies of scale. This means they can spread their fixed costs, such as R&D and infrastructure, over a larger output, leading to lower per-unit costs. For instance, a large provider might negotiate bulk discounts on hardware and software licenses, a benefit not readily available to smaller, new entrants. In 2024, major IT service firms reported operating margins that reflect these efficiencies, with some larger players achieving margins upwards of 15% compared to an industry average closer to 8-10% for smaller, less established firms.

Furthermore, economies of scope play a crucial role. Companies that offer a broad suite of integrated IT services, from cloud computing and cybersecurity to managed IT and digital transformation consulting, can cross-sell and up-sell more effectively. This integration allows them to utilize shared resources and expertise across different service lines, reducing overall operational costs. A new entrant typically starts with a narrower service offering, making it challenging to compete on price and breadth of service against established firms that have already built this integrated capability.

- Economies of Scale: Larger IT firms benefit from lower per-unit costs due to higher production volumes and spread fixed costs over more units.

- Procurement Advantages: Established players secure better pricing on hardware, software, and talent through bulk purchasing and long-term contracts.

- Operational Efficiencies: Standardized processes and shared infrastructure reduce the cost of delivering services for incumbent IT providers.

- Economies of Scope: Integrated service offerings allow for cross-selling and resource optimization, creating cost advantages for diversified IT companies.

Regulatory and Compliance Hurdles

The IT services sector, especially for companies handling sensitive data or critical infrastructure, faces substantial regulatory and compliance barriers. Laws like GDPR and various industry-specific standards demand significant investment in security, privacy, and operational protocols. For instance, achieving certifications such as ISO 27001, a benchmark for information security management, can take months and considerable financial outlay, acting as a strong deterrent for nascent competitors.

These regulatory landscapes are not static; they evolve, requiring ongoing adaptation and investment from all players. For new entrants, the initial capital expenditure and the continuous cost of maintaining compliance can be prohibitive. This complexity means that established firms with existing compliance frameworks and resources have a distinct advantage, making it harder for newcomers to gain a foothold.

- High Compliance Costs: New IT service providers must invest heavily in meeting data privacy laws (e.g., GDPR, CCPA) and industry-specific regulations.

- Certification Requirements: Obtaining essential certifications like ISO 27001 or SOC 2 can be time-consuming and expensive, posing a barrier to entry.

- Evolving Regulatory Landscape: Continuous updates to regulations necessitate ongoing investment in compliance infrastructure and expertise.

- Data Security Investments: Significant upfront and ongoing spending on robust cybersecurity measures is mandatory, particularly for cloud and managed service providers.

The threat of new entrants for ACP Holding GmbH is moderate. Significant capital investment is required for IT infrastructure, and specialized talent is scarce, with a 2024 report highlighting a 70% gap in cloud computing skills. Established players benefit from economies of scale and scope, offering lower per-unit costs and integrated services that are difficult for newcomers to replicate.

Regulatory compliance, such as GDPR and ISO 27001 certification, adds substantial costs and complexity, acting as a barrier. Brand reputation and customer trust, built over years, are also critical differentiators that new firms struggle to establish quickly, especially in a market where 2024 data shows over 60% of German businesses prioritize vendor reliability.

| Factor | Barrier Strength | Impact on New Entrants |

| Capital Requirements | High | Requires substantial funding for infrastructure and technology. |

| Talent Acquisition | High | Difficulty in finding and retaining specialized IT professionals. |

| Economies of Scale/Scope | Moderate | Established firms have cost advantages through volume and integrated services. |

| Brand Reputation/Customer Trust | High | New entrants need time and investment to build credibility. |

| Regulatory Compliance | High | Significant costs and effort to meet legal and certification standards. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACP Holding GmbH is built upon a comprehensive review of publicly available financial statements, annual reports, and investor presentations. We supplement this with insights from reputable industry research reports and market intelligence databases to capture current competitive landscapes.