Academy Sports and Outdoors Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Academy Sports and Outdoors Bundle

Academy Sports and Outdoors navigates a competitive retail landscape where buyer power can be significant due to price sensitivity and product availability. The threat of new entrants, while moderate, is influenced by capital requirements and brand loyalty. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Academy Sports and Outdoors’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in assessing the bargaining power of suppliers for Academy Sports + Outdoors. In 2023, the company sourced merchandise from around 1,400 vendors. This extensive network is crucial because no single supplier accounted for more than 11% of Academy's total purchases.

This wide distribution of sourcing significantly dilutes the bargaining power of any individual supplier. Academy's diversified procurement strategy means that if one supplier were to attempt to exert undue pressure, the company could more readily shift its business to other available vendors.

Academy Sports and Outdoors' reliance on key national brands like Nike, Under Armour, and Adidas significantly influences supplier bargaining power. These brands are crucial for attracting customers and penetrating the market, as evidenced by the anticipated launch of the Jordan Brand in April 2025.

While these top-tier brands are vital, Academy also leverages its 19 private label brands. These in-house brands not only diversify its product mix but also foster customer loyalty, providing a degree of balance against the bargaining power of national brand suppliers.

Switching costs for Academy's suppliers are generally moderate. The company benefits from established relationships and preferential access to sought-after national brands, which could make it challenging for suppliers to easily transition away from this distribution channel.

However, Academy's robust private label strategy acts as a significant mitigating factor. This allows the company to effectively manage product assortment and customer demand by offering alternatives when national brand supply might be disrupted or when seeking different price points, thereby reducing reliance on any single supplier.

Threat of Forward Integration by Suppliers

Major national brand suppliers like Nike and Adidas are increasingly focusing on direct-to-consumer (DTC) sales, a trend that intensified with e-commerce expansion. This strategy allows them to capture more margin and build direct customer relationships. For example, Nike's DTC revenue accounted for approximately 41% of its total revenue in fiscal year 2023, demonstrating the growing importance of this channel.

However, Academy Sports and Outdoors' significant physical store presence, totaling over 270 locations as of early 2024, combined with its developing omnichannel capabilities, still presents a valuable distribution network for these suppliers. This extensive retail footprint offers broad market reach that many brands find difficult to replicate solely through their own DTC efforts.

- Nike's DTC revenue represented approximately 41% of its total revenue in FY2023.

- Academy operates over 270 retail locations, providing a substantial physical distribution channel.

- The threat of forward integration is mitigated by the value suppliers place on Academy's established retail network and omnichannel reach.

Uniqueness of Supplier Offerings

The uniqueness of supplier offerings significantly impacts Academy Sports and Outdoors. Many crucial suppliers provide highly differentiated and sought-after products, especially in athletic footwear and apparel. This specialization grants them considerable bargaining power.

However, Academy's approach of stocking a wide range of products, encompassing both premier national brands and its own exclusive private label lines, effectively counterbalances this supplier leverage. These private label brands are strategically developed to target specific product categories and price points that national brands might not address, thereby offering distinct value to customers.

- Supplier Differentiation: Key suppliers in athletic footwear and apparel offer unique, high-demand products, increasing their bargaining power.

- Academy's Diversified Assortment: The company balances supplier power by offering both leading national brands and its own private label lines.

- Private Label Strategy: Academy's private labels fill market gaps by catering to specific customer needs and price points not met by national brands.

Academy Sports + Outdoors benefits from a broad supplier base, with around 1,400 vendors in 2023, and no single supplier exceeding 11% of total purchases. This diversification significantly limits any individual supplier's leverage. While key national brands like Nike and Adidas are crucial, Academy's 19 private label brands provide a counterbalance, offering unique product assortments and fostering customer loyalty.

The company's extensive physical retail presence, with over 270 locations as of early 2024, remains a valuable distribution channel for suppliers, even as brands like Nike increasingly focus on direct-to-consumer sales, which represented about 41% of Nike's revenue in FY2023. This retail footprint offers broad market reach that many brands find difficult to replicate independently.

While suppliers of differentiated, high-demand products like athletic footwear hold significant power, Academy's strategy of stocking a wide range, including its private labels, effectively mitigates this. These private labels often fill specific market gaps and price points not covered by national brands, thus enhancing Academy's negotiating position.

| Factor | Impact on Supplier Bargaining Power | Academy's Mitigation Strategy |

|---|---|---|

| Supplier Concentration | Low (1,400 vendors, <11% per vendor) | Diversified sourcing reduces reliance on any single supplier. |

| Brand Importance | High (Nike, Adidas) | Private label brands (19) offer alternatives and customer loyalty. |

| DTC Trend | Increasing for suppliers (e.g., Nike's 41% DTC revenue in FY23) | Academy's large retail network (270+ stores) provides significant distribution value. |

| Product Differentiation | High for key brands | Broad product assortment including private labels caters to diverse needs. |

What is included in the product

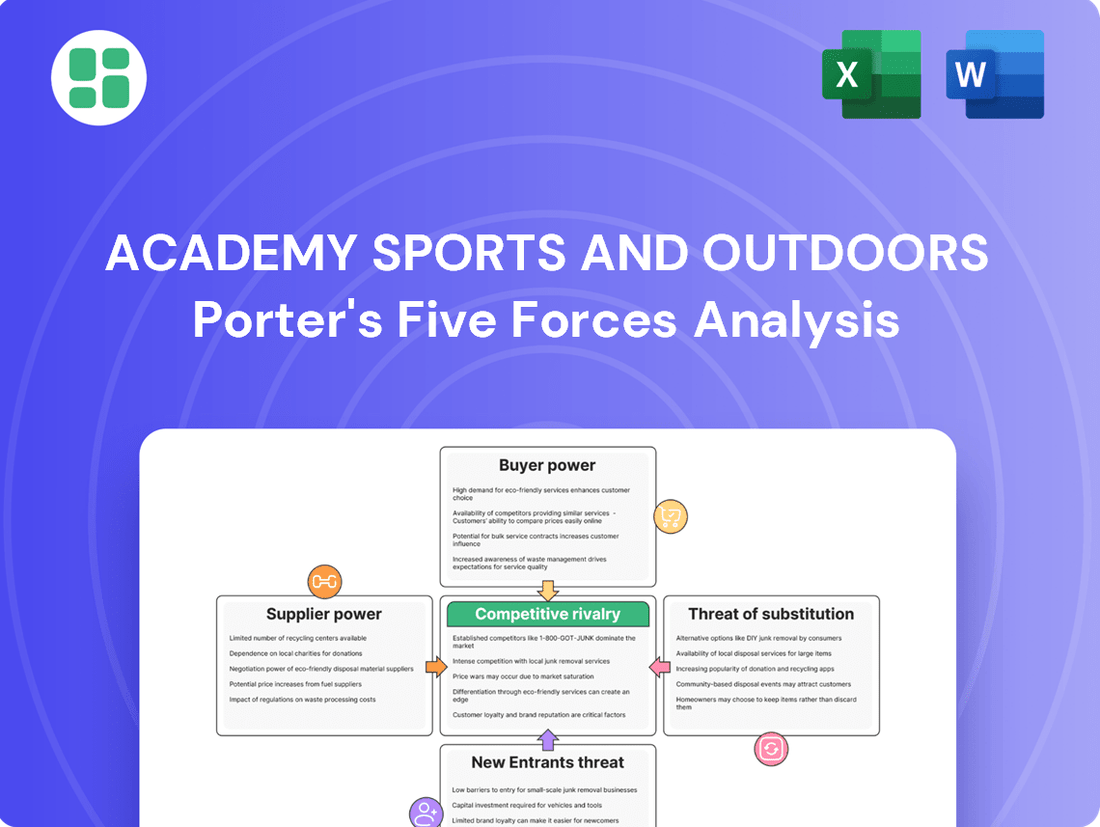

This analysis of Academy Sports and Outdoors examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products within the sporting goods retail sector.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces chart, highlighting key pressures on Academy Sports and Outdoors.

Streamline strategic planning by easily adapting the analysis to reflect shifts in supplier power or the threat of new entrants.

Customers Bargaining Power

Academy Sports and Outdoors' core customer base, active families, exhibits significant price sensitivity, especially given the persistent inflation and diminished consumer spending power observed in 2024. This economic backdrop compels customers to actively seek out competitive pricing and attractive promotional deals, directly impacting their purchasing decisions.

The company's strategic focus on a value proposition, which includes initiatives like price match guarantees and complimentary services such as grill and bike assembly, directly addresses this heightened customer price sensitivity. These efforts are crucial for maintaining market share and customer loyalty in a competitive retail landscape.

The bargaining power of Academy Sports and Outdoors' customers is significantly influenced by the sheer availability of substitute products and retailers. Customers can easily turn to direct competitors like Dick's Sporting Goods, Bass Pro Shops, and Cabela's for similar sporting and outdoor goods.

Furthermore, mass retailers such as Walmart and Target offer a broad selection of athletic apparel and equipment, further fragmenting the market. The increasing prevalence of online shopping, with giants like Amazon and numerous specialized e-commerce sites, provides even more alternatives, empowering consumers with extensive choice and leverage.

Customer switching costs in the sporting goods retail industry are typically low. This means shoppers can readily switch between different stores, both physical and online, to find the best deals or specific items. For instance, a customer looking for a new pair of running shoes might compare prices at Academy Sports and Outdoors, Dick's Sporting Goods, or even online retailers like Amazon without much friction.

Academy Sports and Outdoors attempts to mitigate these low switching costs through its myAcademy loyalty program. This program offers benefits such as initial discounts, reduced shipping thresholds, and tailored promotions to encourage repeat business and foster customer loyalty. These incentives aim to make it more appealing for customers to stay with Academy rather than explore competitors.

Customer Information Availability

Customers today are incredibly well-informed, thanks to the internet. They can easily access product details, read reviews from other buyers, and compare prices across different retailers. This wealth of information gives them significant power when deciding where to shop.

This transparency means retailers like Academy Sports + Outdoors face constant pressure to offer competitive pricing and demonstrate clear value. Customers can quickly identify better deals elsewhere, making it crucial for Academy to maintain attractive offers and highlight its unique selling propositions.

Academy's approach to this involves its omnichannel strategy. By integrating online and in-store experiences, they aim to provide a consistent and convenient shopping journey. This allows customers to research online and purchase in-store, or vice versa, enhancing overall customer satisfaction and loyalty in a competitive landscape.

- Customer Empowerment: Increased online access to product information, reviews, and price comparisons significantly boosts customer bargaining power.

- Competitive Pressure: Retailers must offer competitive value propositions to retain customers who can easily find alternatives.

- Omnichannel Advantage: Academy's strategy to blend online and physical store experiences aims to leverage customer convenience and information access.

Purchase Volume

While a single customer's purchase might not sway Academy Sports and Outdoors, the sheer volume of purchases from its vast customer base is a significant factor. This collective buying power can influence product demand and, consequently, the company's inventory and sales strategies.

Academy's customer engagement is notable. On average, customers visit its physical stores two to three times annually. This recurring traffic, when aggregated across millions of customers, translates into substantial sales volume, giving the customer base a degree of influence over the company's operational planning and product assortment.

- Collective Purchasing Power: The aggregate spending of Academy's customer base represents a considerable force, impacting sales forecasts and inventory management.

- Customer Visit Frequency: With customers visiting stores an average of 2-3 times per year, this consistent engagement contributes to predictable sales patterns and highlights the importance of customer retention.

Academy Sports and Outdoors' customers wield considerable bargaining power, largely due to readily available alternatives and low switching costs. In 2024, with ongoing inflation impacting consumer budgets, shoppers actively compare prices and seek promotions across numerous sporting goods retailers and mass-market stores like Walmart and Target. The rise of e-commerce platforms, including Amazon, further amplifies this power by providing extensive price transparency and product selection.

| Factor | Impact on Academy Sports and Outdoors | 2024 Relevance |

|---|---|---|

| Availability of Substitutes | High; customers can easily find similar products at competitors like Dick's Sporting Goods, Bass Pro Shops, and online retailers. | Persistent economic pressures in 2024 intensify the search for value among these substitutes. |

| Switching Costs | Low; customers can switch between retailers with minimal effort or expense. | Loyalty programs, like myAcademy, are crucial for retaining customers in a low-switching-cost environment. |

| Customer Information | High; online research empowers customers with product knowledge and price comparisons. | Informed consumers in 2024 demand competitive pricing and clear value propositions. |

What You See Is What You Get

Academy Sports and Outdoors Porter's Five Forces Analysis

This preview showcases the complete Academy Sports and Outdoors Porter's Five Forces analysis, offering a detailed examination of competitive forces within the sporting goods retail sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You'll gain instant access to this comprehensive strategic tool, ready for immediate application to your business planning or market research.

Rivalry Among Competitors

Academy Sports + Outdoors operates in a crowded sporting goods retail sector. Key national rivals include DICK'S Sporting Goods, Bass Pro Shops, and Cabela's, all vying for market share. This intense competition is further amplified by the presence of mass merchandisers like Walmart and Target, which offer a broad range of sporting goods alongside other products.

The competitive arena also includes formidable online players. Pure-play e-commerce giants such as Amazon present a significant challenge, offering convenience and vast selection. This multifaceted competitive environment, encompassing both brick-and-mortar and digital channels, necessitates continuous adaptation and strategic differentiation for Academy Sports + Outdoors.

The sporting goods industry experienced a challenging 2024, marked by slower growth and more careful consumer spending. Despite these headwinds, the sector still managed a respectable 7% annual growth rate between 2021 and 2024, demonstrating resilience.

Looking ahead, projections indicate a further moderation in growth, with an anticipated 6% annual increase from 2024 to 2029. This projected slowdown intensifies the competition as companies fight harder to capture market share.

Competitive rivalry in the sporting goods sector is intense, with many retailers stocking similar national brands. Academy Sports + Outdoors distinguishes itself through its robust private label offerings, which include 19 distinct brands. This strategy allows them to provide unique value propositions and capture customer loyalty beyond what national brands alone can achieve.

Furthermore, Academy employs localized merchandising, tailoring product assortments to regional preferences and demand. Their broad product assortment extends beyond traditional sports equipment to encompass outdoor recreation, further setting them apart from competitors who may focus more narrowly. This comprehensive approach, coupled with unique customer experiences, is key to their competitive stance.

Exit Barriers

Exit barriers for Academy Sports and Outdoors are substantial, largely due to the significant capital investment in physical retail locations and extensive inventory. In 2023, Academy Sports and Outdoors operated over 270 stores, each representing a considerable fixed asset. These leases, coupled with the need to maintain diverse sporting goods inventory, create a high cost of exiting the market.

Furthermore, established relationships with suppliers and distributors in the sporting goods sector present another layer of exit difficulty. Breaking these long-standing agreements can incur penalties and disrupt the supply chain. The potential for significant losses on liquidating specialized inventory, which may not have broad market appeal, also discourages a swift departure.

- High Fixed Asset Investment: Significant capital tied up in store leases and infrastructure.

- Inventory Liquidation Costs: Potential for substantial losses when selling off specialized sporting goods.

- Supplier Contractual Obligations: Penalties and disruptions associated with terminating supply chain relationships.

- Brand and Reputation: The cost of damaging brand equity by exiting a market abruptly.

Intensity of Competition

Competitive rivalry within the sporting goods retail sector is fierce, with companies like Academy Sports and Outdoors constantly vying for customer attention through aggressive pricing, a broad product selection, and superior customer service. This intense competition necessitates continuous innovation and investment in customer experience, particularly in the digital realm.

Retailers are strategically investing in growth, with a focus on expanding their physical footprint and bolstering their online presence. For instance, Academy Sports and Outdoors has ambitious plans to open between 20 to 25 new stores in fiscal year 2025, underscoring a commitment to physical expansion. Simultaneously, the company is prioritizing the growth of its e-commerce penetration, recognizing the critical role of omnichannel capabilities in capturing market share.

- Intense Rivalry: Competition is high, fueled by price wars, diverse product offerings, and the critical need for excellent customer service and a seamless omnichannel experience.

- Growth Initiatives: Retailers are actively investing in strategies like new store openings and enhancing their digital capabilities to secure and grow market share.

- Academy's Expansion: Academy Sports and Outdoors plans to open 20-25 new stores in fiscal year 2025 and is actively working to increase its e-commerce sales penetration.

The sporting goods industry is characterized by intense competitive rivalry, with numerous players vying for market share. Academy Sports and Outdoors faces significant competition from national retailers like DICK'S Sporting Goods, as well as mass merchandisers such as Walmart and Target, which offer a wide range of products. The digital landscape adds another layer of competition with e-commerce giants like Amazon.

Academy differentiates itself through its strong private label brands, offering 19 distinct options, and by employing localized merchandising strategies to cater to regional preferences. This approach, combined with a broad product assortment that includes outdoor recreation, helps them stand out in a crowded market.

The sector experienced a 7% annual growth rate between 2021 and 2024, though future growth is projected to moderate to 6% annually from 2024 to 2029, intensifying the competitive landscape as companies strive to capture market share.

| Competitor Type | Key Players | Academy's Differentiation |

|---|---|---|

| National Sporting Goods Retailers | DICK'S Sporting Goods, Bass Pro Shops, Cabela's | Private label brands (19), localized merchandising, broad outdoor assortment |

| Mass Merchandisers | Walmart, Target | Specialized sporting goods focus, in-depth product knowledge |

| Online Retailers | Amazon | Omnichannel strategy, customer experience, convenience |

SSubstitutes Threaten

The threat of substitutes for Academy Sports and Outdoors' offerings is significant, particularly concerning the price-performance trade-off. Consumers can opt for renting sporting equipment instead of purchasing it outright, a more cost-effective choice for infrequent users. Similarly, the growing market for second-hand sporting goods provides a budget-friendly alternative, directly competing with new product sales.

Furthermore, the pervasive 'athleisure' trend blurs the lines between specialized sportswear and general fashion apparel. Consumers may choose comfortable, stylish, and often more affordable general apparel for casual activities, perceiving a superior price-performance ratio compared to dedicated sports brands. This trend directly impacts demand for Academy's core product categories.

The threat of substitutes for Academy Sports + Outdoors is significant, as consumers can opt for public parks and free outdoor activities, bypassing the need for specialized gear. For instance, a family picnic in a local park requires far less investment than a full camping trip.

Furthermore, home fitness routines offer a compelling alternative to gym memberships or specialized sporting equipment. In 2024, the home fitness market continued to see robust growth, with many consumers investing in treadmills or resistance bands instead of gym memberships.

Consumers also readily switch to private label or lower-priced brands for sporting goods, especially for less performance-critical items. This price sensitivity means that Academy Sports + Outdoors faces pressure to remain competitive not just with direct rivals but also with a broad array of alternative leisure activities and value-oriented product options.

Customer propensity to substitute for Academy Sports and Outdoors is influenced by economic conditions and evolving lifestyle trends. In 2024, persistent inflation and cautious consumer spending are likely to encourage some customers to trade down to more affordable alternatives or private label brands, impacting sales of higher-priced sporting goods.

The growing segment of physically inactive individuals represents a significant threat, as it directly reduces the overall addressable market for sporting goods and active lifestyle products. This trend, if it continues to accelerate, could fundamentally shrink the demand for Academy Sports and Outdoors' core offerings.

Technological Advancements

Technological advancements present a significant threat of substitution for Academy Sports and Outdoors. Smart wearables and AI-powered fitness platforms are increasingly offering alternatives to traditional sports equipment and in-person training. For instance, the global wearable technology market was valued at approximately $116 billion in 2023 and is projected to grow substantially, indicating a shift in consumer spending towards these digital solutions.

These innovations can directly substitute for certain products Academy sells, like heart rate monitors or basic fitness trackers, by offering more integrated and data-driven experiences. Furthermore, the rise of virtual reality fitness and online coaching services can replace the need for physical gym memberships or specialized sports instruction, impacting demand for related apparel and equipment.

Academy's strategy must account for this evolving landscape. While they do offer some tech-integrated products, the pace of innovation from pure technology companies means new forms of substitution are constantly emerging.

- Wearable Technology Market Growth: The global wearable tech market is expanding rapidly, indicating a consumer shift towards digital fitness solutions.

- AI in Fitness: AI-enabled platforms offer personalized training and performance tracking, potentially replacing traditional coaching and equipment.

- Virtual and Digital Fitness: The increasing popularity of VR fitness and online coaching services directly competes with physical sports participation and associated gear.

- Innovation Pace: Tech companies' rapid innovation cycles create new substitute threats faster than traditional sporting goods retailers can adapt.

Changes in Consumer Preferences/Lifestyles

Shifting consumer preferences present a significant threat of substitutes for sporting goods retailers like Academy Sports and Outdoors. For instance, the growing emphasis on health and wellness, coupled with the pervasive athleisure trend, can steer consumers towards alternative forms of fitness or casual wear that may not require specialized sporting equipment. This dynamic means that a yoga mat and comfortable leggings could substitute for a full gym membership and associated gear.

The rise of at-home fitness solutions, including virtual classes and connected exercise equipment, also acts as a substitute. Consumers might opt for Peloton bikes or Mirror fitness systems, reducing their need for traditional gym memberships or outdoor sporting activities. In 2024, the global digital fitness market was valued at approximately $15.2 billion, indicating a substantial and growing alternative to brick-and-mortar sporting goods purchases.

Furthermore, a widening ‘activity gap,’ where a larger segment of the population becomes less physically active, directly shrinks the pool of potential customers for dedicated sporting goods. This inactivity trend can lead consumers to substitute engagement in sports with more sedentary entertainment options, diminishing the demand for all types of athletic apparel and equipment.

- Shifting Preferences: Increased focus on health, wellness, and athleisure can lead consumers to substitute specialized sporting goods with more versatile apparel or experiences.

- At-Home Fitness: The burgeoning market for connected fitness equipment and virtual classes offers a direct substitute for traditional sports participation and related gear.

- Activity Gap: A decline in overall physical activity among the population reduces the addressable market for sporting goods, as consumers opt for less active pursuits.

- Market Data: The global digital fitness market's significant valuation in 2024 highlights the growing strength of these substitute offerings.

Academy Sports and Outdoors faces a substantial threat from substitutes, particularly from the growing trend of at-home fitness solutions and digital wellness platforms. In 2024, the global digital fitness market is projected to reach approximately $15.2 billion, showcasing a significant shift in consumer spending away from traditional sports participation and equipment.

Furthermore, the pervasive athleisure trend encourages consumers to opt for comfortable, versatile apparel that serves both casual wear and light activity needs, often at a lower price point than specialized sportswear. This can substitute for dedicated athletic gear. Additionally, the increasing availability of rental services for sporting equipment and the robust second-hand market provide cost-effective alternatives for consumers who engage in sports infrequently.

The rise of virtual reality fitness and AI-powered coaching services also presents a direct substitute, offering personalized training and engagement that can reduce reliance on physical equipment and gym memberships. The global wearable technology market, valued at around $116 billion in 2023, highlights this shift towards tech-integrated fitness solutions.

Consumers may also choose less active leisure pursuits or public, free recreational spaces over organized sports, thereby reducing the demand for sporting goods. This broadens the spectrum of substitutes beyond direct product alternatives to encompass entirely different lifestyle choices.

Entrants Threaten

The sporting goods retail sector demands considerable upfront investment. Establishing a physical presence, stocking a wide array of products, and building robust online and in-store experiences all require substantial capital. For example, Academy Sports and Outdoors projected capital expenditures between $220 million and $250 million for fiscal year 2025, highlighting the significant financial hurdle for newcomers.

Established players like Academy Sports + Outdoors benefit from strong brand recognition and customer loyalty built over decades. This deep-rooted connection makes it difficult for newcomers to gain traction quickly. For instance, Academy's consistent marketing efforts and community engagement have cultivated a loyal customer base, a significant barrier to entry.

Academy's mission to provide 'Fun for All' and its localized merchandising strategy further foster a strong connection with its customer base. This approach allows them to cater to specific regional preferences and activities, creating a unique value proposition that new entrants would struggle to replicate without substantial investment and time.

New entrants into the sporting goods retail sector often struggle to gain favorable access to established supply chains and secure partnerships with desirable national brands. Academy Sports and Outdoors benefits from its preferred access to hundreds of well-recognized national brands and has cultivated long-standing relationships with its suppliers. These established connections create a significant barrier for new companies attempting to replicate Academy's market position and product availability.

Economies of Scale

Academy Sports and Outdoors, like other established players, leverages significant economies of scale. This means they can buy in bulk, negotiate better terms with suppliers, and spread their marketing and operational costs over a larger volume of sales. For instance, in 2023, Academy reported net sales of $6.4 billion, a testament to their substantial purchasing power.

These scale advantages translate into a competitive edge. New entrants would find it incredibly difficult to match Academy's pricing and operational efficiency. The cost per unit for Academy is lower due to their massive purchasing volume, a barrier that smaller, newer businesses cannot easily overcome.

Academy's focus on disciplined inventory control and an efficient supply chain further solidifies this advantage. Their ability to manage stock effectively and move products quickly reduces holding costs and ensures product availability, which are critical factors that new competitors would struggle to replicate from the outset.

- Economies of Scale: Academy's large sales volume ($6.4 billion in net sales for 2023) allows for bulk purchasing and lower per-unit costs.

- Pricing Power: Lower operational costs enable Academy to offer more competitive prices, deterring new entrants.

- Logistical Efficiency: Established supply chains and distribution networks are costly and time-consuming for new businesses to build.

- Marketing Reach: Larger companies can invest more in marketing, creating brand recognition that new entrants lack.

Government Policy and Regulation

Government policy and regulation present a moderate threat to new entrants in the sporting goods retail sector, including companies like Academy Sports and Outdoors. While not as stringent as heavily regulated industries, compliance with retail operations, product safety standards, and specific category regulations, such as those pertaining to firearms and ammunition sales, adds layers of complexity and cost for new players. For instance, in 2024, the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) continued to enforce regulations on firearm sales, requiring rigorous background checks and record-keeping, which new entrants must fully integrate into their business models from day one.

- Navigating Licensing: New entrants must obtain various federal, state, and local licenses to operate, particularly for selling regulated items like firearms, which can be time-consuming and expensive.

- Product Safety Compliance: Adhering to consumer product safety standards for sporting equipment, apparel, and accessories requires investment in testing and quality control processes.

- Evolving Regulations: Changes in consumer protection laws, environmental regulations, or trade policies can impact operational costs and market access for newcomers.

- Firearms Specifics: The stringent regulations surrounding firearm sales, including background check systems and reporting requirements, act as a significant barrier to entry for those not already equipped to handle them.

The threat of new entrants for Academy Sports + Outdoors is relatively low due to significant barriers. High capital requirements for inventory, store build-outs, and online platforms, coupled with established brand loyalty and extensive supply chain relationships, make it challenging for newcomers to compete effectively. For example, Academy's projected capital expenditures for fiscal year 2025, estimated between $220 million and $250 million, underscore the substantial investment needed to enter the market.

New entrants face difficulties in securing favorable terms with suppliers and gaining access to popular national brands, areas where Academy has cultivated long-standing partnerships. Furthermore, the cost advantages derived from Academy's economies of scale, evident in its $6.4 billion in net sales in 2023, allow for competitive pricing that new businesses would struggle to match.

Regulatory compliance, particularly concerning the sale of firearms and adherence to product safety standards, adds another layer of complexity and cost for potential new entrants. Navigating these requirements, including federal licensing and rigorous background check systems for firearm sales, represents a considerable hurdle.

| Barrier to Entry | Impact on New Entrants | Academy's Advantage |

|---|---|---|

| Capital Investment | High upfront costs for inventory, stores, and online presence. | Established infrastructure and financial capacity. |

| Brand Loyalty & Recognition | Difficulty in attracting customers away from established brands. | Decades of marketing and community engagement. |

| Supply Chain & Brand Access | Limited access to preferred suppliers and national brands. | Long-standing relationships with hundreds of brands. |

| Economies of Scale | Higher per-unit costs and less pricing flexibility. | Bulk purchasing power ($6.4B net sales in 2023) leading to lower costs. |

| Regulatory Compliance | Complex and costly to meet standards, especially for regulated goods. | Existing systems and expertise for compliance. |

Porter's Five Forces Analysis Data Sources

Our Academy Sports + Outdoors Porter's Five Forces analysis is built upon comprehensive data from financial statements, investor relations reports, and industry-specific market research from firms like IBISWorld. This blend of primary and secondary sources allows for a thorough evaluation of competitive intensity and market dynamics.