Absolent Air Care Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absolent Air Care Group Bundle

Absolent Air Care Group navigates a landscape shaped by moderate buyer power and intense rivalry, with the threat of substitutes presenting a significant consideration. The group's ability to differentiate its air filtration solutions is key to managing these forces effectively.

The complete report reveals the real forces shaping Absolent Air Care Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Absolent Air Care Group's reliance on suppliers for specialized components like advanced filtration media, motors, and critical electronics significantly influences supplier bargaining power. The proprietary nature and intellectual property associated with these high-performance parts can empower suppliers, particularly when viable alternatives are scarce or the cost of switching is substantial.

The bargaining power of suppliers for Absolent Air Care Group is significantly influenced by supplier concentration. When a critical component or raw material is sourced from a limited number of providers, those suppliers gain leverage, potentially dictating higher prices or less favorable terms. For instance, if a specialized filtration media is only available from two global manufacturers, Absolent would have less room to negotiate.

Absolent's strategic approach, emphasizing modular product design, could lessen reliance on single suppliers for entire systems. By breaking down products into standardized modules, they might be able to source components from a broader base of manufacturers. Furthermore, their partnerships with Original Equipment Manufacturers (OEMs) can also shape supplier dynamics, potentially leading to more collaborative and stable supply chains, thereby mitigating some supplier power.

The bargaining power of suppliers for Absolent Air Care Group is significantly influenced by switching costs. If Absolent needs to change a key component supplier, the expenses related to redesigning their filtration systems, re-tooling manufacturing processes, and obtaining new certifications can be substantial. For instance, in 2024, companies in the industrial equipment sector often reported that the integration of new, specialized components could take upwards of 12-18 months and involve millions in R&D and validation.

Absolent's existing product portfolio, particularly its high-performance filtration units, likely relies on specialized materials or engineered parts. This deep integration means that a shift away from a current supplier could necessitate considerable investment in engineering changes and rigorous testing to ensure that the new components meet the same stringent performance and safety standards. This complexity inherently strengthens the leverage of their current suppliers.

Input Differentiation and Quality

The bargaining power of suppliers for Absolent Air Care Group is significantly influenced by the differentiation and quality of their inputs, especially concerning advanced filtration technologies. Suppliers providing unique or superior-quality materials for these critical components can exert considerable pricing power. For Absolent, which champions its world-leading filtration technology and product performance, securing high-grade materials is paramount. This focus on quality inherently grants leverage to suppliers who can consistently deliver exceptional performance and innovation in their offerings.

For instance, suppliers of specialized filter media, advanced polymers, or precision-engineered components crucial for Absolent's high-efficiency particulate air (HEPA) or ultra-low penetration air (ULPA) filters can command premium prices. The unique properties of these materials, often developed through proprietary research and development, make them difficult to substitute. This difficulty in finding alternatives reinforces the supplier's position, allowing them to negotiate more favorable terms. In 2024, the demand for high-performance air purification solutions continued to grow, driven by increased awareness of indoor air quality and stringent environmental regulations, further strengthening the hand of suppliers of specialized filtration materials.

- Supplier Material Specialization: Suppliers of unique, high-performance filter media or advanced composite materials essential for Absolent's filtration technology hold significant power.

- Quality Dependence: Absolent's commitment to superior product performance means it relies heavily on suppliers who can consistently deliver top-tier inputs, reducing its ability to switch suppliers easily.

- Limited Substitutability: The specialized nature of advanced filtration components means there are few, if any, readily available substitutes, enhancing supplier leverage.

- Market Demand for Quality: In 2024, the increasing market demand for advanced air purification solutions amplified the importance of input quality, thereby increasing supplier bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing Absolent Air Care Group's industrial air cleaning equipment is generally considered low. This is due to the highly specialized nature of the technology involved in producing such advanced filtration and air purification systems. Developing and mastering these complex manufacturing processes requires significant investment in research and development, proprietary knowledge, and specialized production facilities.

Furthermore, established players like Absolent have built strong brand recognition and extensive distribution networks. A component supplier would face substantial hurdles in overcoming these existing market positions and achieving economies of scale necessary to compete effectively. For instance, in 2024, the industrial air filtration market, while growing, is characterized by high capital expenditure requirements for new entrants, making backward integration by suppliers a less attractive proposition compared to focusing on their core competencies.

- Specialized Technology: The production of advanced industrial air cleaning equipment demands niche expertise and proprietary manufacturing processes.

- Market Entrenchment: Absolent and its competitors possess established market share, brand loyalty, and robust distribution channels.

- High Capital Investment: Forward integration would necessitate substantial financial outlay for R&D, specialized machinery, and production facilities.

- Limited Supplier Capability: Most component suppliers lack the technical know-how and resources to directly compete in the finished product market.

Suppliers of specialized components for Absolent Air Care Group, such as advanced filtration media and critical electronics, wield considerable bargaining power. This is amplified when these inputs are proprietary, difficult to substitute, or involve high switching costs for Absolent. For example, in 2024, the industrial equipment sector saw many companies struggle with supply chain disruptions for specialized electronic components, leading to increased supplier leverage.

Absolent’s reliance on a limited number of suppliers for key, high-performance materials directly translates to increased supplier power. The company's commitment to superior product performance necessitates sourcing from providers who consistently deliver exceptional quality, making it challenging to switch. This dependency, coupled with the growing market demand for advanced air purification solutions in 2024, further strengthens the negotiating position of these specialized suppliers.

| Factor | Impact on Absolent | 2024 Context |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | Limited availability of critical components |

| Switching Costs | Significant costs for Absolent to change suppliers | Extended integration and validation periods |

| Input Differentiation | Premium pricing for unique, high-quality materials | Increased demand for advanced filtration |

What is included in the product

This analysis meticulously dissects the competitive landscape for Absolent Air Care Group, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all tailored to the company's specific market position.

Instantly identify and mitigate competitive threats with a dynamic, interactive five forces model, enabling proactive strategic adjustments.

Customers Bargaining Power

Absolent Air Care Group's customer base is global and spans diverse industrial sectors, which inherently dilutes the power of any individual customer. This broad reach suggests that no single client likely accounts for a disproportionately large share of revenue, thereby limiting their leverage.

However, the presence of very large industrial clients or specific market segments demanding significant volumes of Absolent's air filtration solutions could still present a degree of purchasing power. For instance, if a major automotive manufacturer or a large-scale mining operation requires substantial, ongoing orders, they might negotiate more favorable terms.

For industrial clients, Absolent Air Care Group's air cleaning solutions are not merely optional; they are fundamental to worker well-being, adherence to environmental regulations, and the smooth running of operations. This essential nature means customers place a high premium on the effectiveness of these systems.

The critical role of clean air in protecting employees and ensuring compliance significantly reduces the customer's inclination to haggle over price. In 2023, workplace safety regulations continued to be a major driver for investment in air quality solutions across various industries.

Once an industrial air cleaning system like those offered by Absolent Air Care Group is installed and deeply integrated into a customer's production processes, the effort and expense to switch to a different vendor become significant deterrents. These switching costs can encompass not only the physical removal and reinstallation of new equipment but also the disruption to ongoing operations and the need for staff retraining.

For example, if a manufacturing plant relies on Absolent's filtration technology for critical air quality control, the downtime required to replace an entire system could lead to millions in lost production. This inherent stickiness, born from the initial investment and operational entanglement, effectively curbs a customer's ability to easily demand lower prices or more favorable terms from Absolent.

Price Sensitivity and Product Differentiation

Customers might be price-sensitive if they view air cleaning as a standard commodity. However, Absolent Air Care Group differentiates itself by offering specialized solutions for specific industrial contaminants like oil mist, oil smoke, dust, and fumes. This focus, coupled with features such as enhanced energy efficiency and a reduced environmental footprint, helps to lessen the impact of price sensitivity.

The bargaining power of customers is influenced by their price sensitivity, which can be significant if air cleaning products are perceived as undifferentiated. Absolent Air Care Group counters this by emphasizing its specialized solutions for oil mist, oil smoke, dust, and fumes. For instance, in 2024, industrial air filtration market growth was driven by stricter environmental regulations, pushing demand for higher-performance, albeit potentially higher-priced, solutions.

- Price Sensitivity: Customers may seek the lowest cost if air cleaning is seen as a basic requirement.

- Product Differentiation: Absolent's focus on specific industrial pollutants (oil mist, smoke, dust, fumes) and features like energy efficiency provides a competitive edge.

- Value Proposition: By offering solutions that reduce operational costs through energy savings and improved air quality, Absolent can justify premium pricing.

- Market Trends: In 2024, increased awareness of indoor air quality and sustainability in industrial settings bolstered demand for advanced filtration systems, potentially reducing the impact of price alone.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Absolent Air Care Group is significantly low. The highly specialized and complex nature of industrial air cleaning equipment, requiring substantial technical expertise and capital investment, makes it impractical for most customers to consider manufacturing their own systems. This lack of a credible backward integration threat consequently diminishes the bargaining power of customers.

For instance, the development and production of advanced filtration technologies and sophisticated control systems demand specific engineering capabilities and research and development resources that are not readily available to typical end-users of industrial air purification solutions. This barrier effectively shields Absolent Air Care Group from direct competitive pressure stemming from customers attempting to produce these systems in-house.

- Low Likelihood of Backward Integration: Customers generally lack the technical expertise and capital required to produce specialized industrial air cleaning equipment.

- High Complexity of Technology: The advanced filtration and control systems involved are difficult and costly for customers to replicate.

- Limited Customer Bargaining Power: The infeasibility of backward integration reduces the leverage customers have over Absolent Air Care Group.

Absolent Air Care Group's customer bargaining power is moderate, largely due to the essential nature of its products and high switching costs, which limit price sensitivity. While a global, diverse customer base dilutes individual power, large industrial clients can exert some leverage. The critical role of clean air in operations and compliance means customers prioritize effectiveness, reducing their willingness to push for lower prices. For example, in 2024, the industrial air filtration market saw growth driven by increasingly stringent environmental regulations, underscoring the demand for high-performance solutions.

| Factor | Impact on Absolent | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | Low to Moderate | Global customer base limits individual client leverage. |

| Switching Costs | High | Integration of systems and operational disruption deter switching. |

| Price Sensitivity | Moderate | Essential nature of clean air and product differentiation reduce price focus. |

| Backward Integration Threat | Very Low | High technical expertise and capital needed for specialized equipment. |

Preview the Actual Deliverable

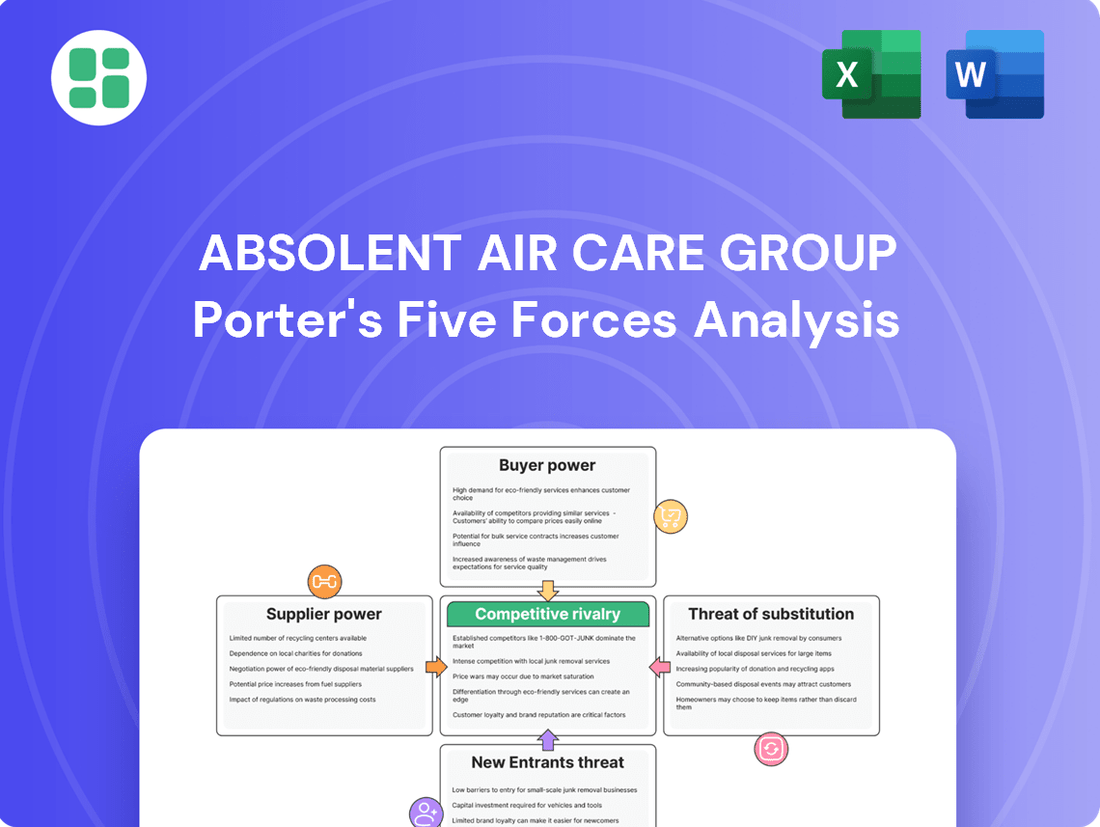

Absolent Air Care Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Absolent Air Care Group details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This professionally crafted report provides actionable insights into the market dynamics affecting Absolent Air Care Group.

Rivalry Among Competitors

The global industrial air filtration market is quite fragmented, meaning there are many companies vying for business. You'll find a mix of smaller, local outfits and some big international names like Donaldson, Camfil, and Halton. This variety suggests a pretty competitive environment where companies are constantly trying to outdo each other.

The global industrial air filtration market is expected to see a Compound Annual Growth Rate (CAGR) of around 5.7% to 7.9% starting from 2025. This growth is fueled by increasingly stringent environmental rules and ongoing industrial development worldwide.

This healthy market expansion can act as a moderating factor on competitive rivalry. With demand consistently rising, there's more room for all companies to operate and grow, potentially reducing the intensity of direct competition for market share.

Absolent Air Care Group distinguishes itself through deep product and application expertise, coupled with world-leading filtration technology. This focus on specialized knowledge, particularly in areas like energy efficiency and sustainability, sets them apart in a competitive landscape. For instance, their commitment to innovation is evident in the ongoing expansion of their A•erity range, designed to meet evolving customer needs.

Continuous product development is a cornerstone of Absolent's strategy to maintain its competitive edge. The recent introduction of the new AD range, specifically engineered for dust and fume applications, highlights this dedication. Such advancements are critical for capturing market share and addressing the increasingly stringent environmental and operational demands faced by their clientele, as seen in the growing demand for advanced air purification solutions across various industrial sectors.

Exit Barriers

High fixed costs in manufacturing, research and development, and specialized labor within the industrial air cleaning sector create substantial exit barriers for companies like Absolent Air Care Group. These considerable upfront investments mean that even underperforming firms may continue operations to amortize costs, thereby intensifying competition among existing players.

This situation can lead to a prolonged period of intense rivalry, as companies are hesitant to cease operations and incur further losses. In 2024, the industrial air filtration market, a key segment for Absolent, was valued at approximately $12.5 billion, with significant capital tied up in production facilities and technology development.

- High Capital Intensity: Significant investments in specialized manufacturing equipment and R&D for advanced filtration technologies create substantial sunk costs.

- Specialized Workforce: The need for highly trained engineers and technicians in developing and maintaining sophisticated air cleaning systems adds to employee-related exit costs.

- Asset Specificity: Manufacturing plants and equipment are often highly specialized for air purification, limiting their resale value if a company exits the market.

- Brand and Reputation: Companies may continue to operate to protect their established brand reputation and customer relationships, even if profitability is low.

Brand Identity and Customer Loyalty

Absolent Air Care Group's brands benefit from deep-rooted market positions, cultivated through extensive expertise and a vast portfolio of tailored customer installations. This legacy of proven performance significantly strengthens customer loyalty, creating a formidable barrier against new entrants and shaping the competitive landscape.

The established reputation and consistent product efficacy directly translate into high customer retention rates, making it challenging for rivals to gain market share. For instance, in 2024, Absolent reported continued success in its core markets, with a significant portion of its revenue stemming from repeat business and long-term service contracts, underscoring the power of its brand identity.

- Established Market Presence: Absolent's brands are recognized for their longevity and specialized knowledge within their respective air purification segments.

- Customer Loyalty as a Barrier: Years of successful installations and demonstrated performance have fostered a loyal customer base, reducing the ease with which competitors can attract new clients.

- Impact on Rivalry: This strong brand loyalty directly moderates the intensity of competitive rivalry, as customers are less likely to switch to unproven alternatives.

The industrial air filtration market is characterized by a fragmented landscape with numerous players, including global giants and smaller regional firms, leading to intense competition. Absolent Air Care Group differentiates itself through specialized expertise and advanced filtration technology, such as its A•erity range, and continuous product development like the new AD range for dust and fume applications.

High capital intensity, specialized workforces, and asset specificity create significant exit barriers, keeping even less profitable firms in the market and intensifying rivalry. In 2024, the industrial air filtration market was valued at approximately $12.5 billion, with substantial capital invested in production and R&D.

Absolent's established brands benefit from deep market positions and proven performance, fostering strong customer loyalty that acts as a barrier to new entrants and moderates competitive intensity. In 2024, a significant portion of Absolent's revenue came from repeat business and long-term contracts, highlighting the impact of brand loyalty.

| Factor | Description | Impact on Absolent |

|---|---|---|

| Market Fragmentation | Numerous competitors, from global players to local firms. | Requires continuous innovation and differentiation. |

| Growth Rate (2025 onwards) | Projected CAGR of 5.7% to 7.9%. | Moderates rivalry by providing room for growth. |

| Exit Barriers | High capital investment, specialized labor, asset specificity. | Intensifies rivalry among existing players. |

| Brand Loyalty | Deep market presence and proven performance foster customer retention. | Strengthens Absolent's position and reduces competitor gains. |

SSubstitutes Threaten

While direct substitutes for Absolent Air Care Group's core industrial air cleaning equipment are scarce, alternative approaches to managing air quality do exist. These include increasing general ventilation, altering industrial processes to minimize pollutant creation, or even relying on personal protective equipment for workers. For instance, a 2024 report indicated that while enhanced ventilation might cost less upfront, it often fails to capture specific, hazardous industrial particulates as effectively as dedicated filtration systems.

Customers may choose less effective or cheaper air filtration alternatives, especially in sectors with relaxed regulations or tighter budgets. These alternatives, while potentially lower in cost, often fail to achieve the high performance standards of Absolent's specialized systems designed for oil mist, oil smoke, dust, and fumes. For instance, in 2024, the global industrial air filtration market saw a significant segment of lower-tier solutions catering to less demanding applications, impacting the market share of premium providers.

Changes in regulatory standards pose a significant threat of substitutes for Absolent Air Care Group. For instance, a hypothetical future tightening of emissions standards could make alternative, less intrusive air purification technologies more attractive, even if they don't directly replace Absolent's core offering. Conversely, a relaxation of such standards might reduce the perceived need for advanced air filtration.

In-house Solutions or DIY Approaches

For Absolent Air Care Group, the threat of customers developing their own in-house solutions or adopting do-it-yourself (DIY) approaches for highly specialized industrial air cleaning is generally quite low. This is primarily due to the significant complexity, substantial capital investment, and specialized technical expertise that are typically required to design, implement, and maintain effective industrial air filtration systems. For instance, advanced systems dealing with fine particulate matter or hazardous fumes often necessitate custom engineering and ongoing calibration that are beyond the scope of most internal maintenance teams.

However, the landscape can shift for less demanding applications. In situations involving simpler dust or fume issues, some customers might indeed explore internal solutions. This could involve purchasing basic off-the-shelf filtration units or attempting to adapt existing ventilation systems. For example, a small workshop with minimal airborne contaminants might find it feasible to install simpler, less sophisticated dust collectors internally rather than engaging a specialized provider for a full-scale system.

- Complexity Barrier: High-end industrial air purification demands intricate design and engineering, making DIY solutions impractical for most firms.

- Capital Investment: The substantial cost of specialized equipment and installation discourages in-house development for many businesses.

- Expertise Gap: Maintaining optimal performance of advanced air cleaning systems requires specialized knowledge that is often outsourced.

- Niche Application Consideration: Simpler dust or fume control needs might present a slightly higher threat of internal solutions, though still limited by effectiveness and compliance.

Technological Advancements in Other Fields

Breakthroughs in fields like advanced material science could introduce novel pollutant neutralization or capture methods that bypass traditional filtration entirely, posing a potential long-term threat to Absolent Air Care Group. For instance, research into self-healing materials or bio-integrated systems for air purification is ongoing.

However, the immediate focus within industrial air filtration, as observed in 2024, remains on incremental improvements to existing technologies. This includes integrating smart features for predictive maintenance and optimizing energy efficiency to reduce operational costs for clients.

While disruptive technologies are a consideration, the capital investment and regulatory hurdles for widespread adoption of entirely new air purification paradigms mean traditional filtration methods are likely to remain dominant in the near to medium term. For example, the global industrial filtration market was valued at approximately USD 50 billion in 2023 and is projected to grow, indicating continued reliance on established technologies.

- Material Science Innovations: Potential for new pollutant capture mechanisms not reliant on traditional filters.

- Focus on Enhancement: Current industry trends prioritize smart features and energy efficiency in existing filtration systems.

- Market Inertia: High investment and regulatory barriers for entirely new purification technologies suggest continued dominance of current methods.

The threat of substitutes for Absolent Air Care Group's specialized industrial air filtration solutions is generally low due to the high technical requirements and effectiveness of their systems. While general ventilation or personal protective equipment are alternatives, they often fall short in capturing specific industrial pollutants. For example, a 2024 market analysis showed that while basic ventilation systems have lower initial costs, they are significantly less effective at removing hazardous fine particulates compared to dedicated filtration.

Customers might opt for less sophisticated, cheaper filtration options, particularly in industries with less stringent regulations or tighter budgets. These alternatives, however, typically do not match the high performance standards of Absolent's equipment designed for oil mist, smoke, and fumes. In 2024, the industrial air filtration market included a substantial segment of lower-tier solutions, impacting premium providers.

The threat of substitutes is also influenced by regulatory changes; stricter emissions standards can make alternative, less intrusive purification methods more appealing, even if they don't directly replace Absolent's core products. Conversely, relaxed regulations might decrease the perceived need for advanced air filtration.

| Alternative Approach | Effectiveness vs. Absolent | 2024 Market Context |

| Enhanced General Ventilation | Lower capture of specific hazardous particulates | Lower upfront cost, but less effective |

| Personal Protective Equipment (PPE) | Protects individuals, not ambient air quality | Situational, not a system replacement |

| Basic Off-the-Shelf Filters | Lower performance for demanding applications | Significant market segment for less critical needs |

Entrants Threaten

Entering the industrial air cleaning equipment market, particularly for specialized solutions like those provided by Absolent Air Care Group, demands significant upfront capital. This includes substantial investments in research and development to create advanced filtration technologies, establishing state-of-the-art manufacturing facilities, and building robust global distribution and service networks.

The sheer scale of these capital requirements acts as a formidable barrier to entry for potential new competitors. For instance, companies looking to compete in this sector might need to allocate hundreds of millions of dollars for initial setup and ongoing innovation. This financial hurdle deters many smaller or less-resourced entities from even attempting to enter the market, thereby protecting established players.

Established players in the air filtration market, such as Absolent Air Care Group, often leverage significant economies of scale. This means they can produce goods more cheaply per unit due to their large production volumes, bulk purchasing power for raw materials, and spread of research and development costs across many units. For instance, in 2023, Absolent reported revenues of SEK 2.7 billion (approximately $250 million USD), indicating a substantial operational footprint that new entrants would find hard to replicate immediately.

New companies entering the air filtration sector would face a considerable challenge in matching these cost advantages. Without the established volume, they would likely incur higher per-unit costs for production and procurement. This makes it difficult for them to compete effectively on price against incumbents like Absolent, potentially hindering their ability to achieve profitability in the early stages of their operations.

Absolent Air Care Group benefits significantly from its well-established brands and deeply rooted customer relationships across the globe. These connections are not easily replicated by newcomers, as they are built on years of trust and demonstrable product performance in demanding industrial environments.

For any new entrant, the hurdle of gaining customer trust and displacing established suppliers is substantial. This process is inherently time-consuming and resource-intensive, particularly in sectors where reliability and proven track records are paramount. For instance, in the industrial filtration market, switching suppliers often involves extensive testing and validation, making incumbent advantages particularly strong.

Regulatory Hurdles and Certifications

The industrial air cleaning sector faces significant regulatory barriers that deter new entrants. Compliance with evolving environmental protection laws, such as those from the EPA in the United States and REACH in Europe, demands substantial investment in research, development, and product testing. For instance, in 2024, companies seeking to introduce new air purification technologies often need to demonstrate efficacy against a range of pollutants, a process that can involve extensive laboratory and field trials, adding considerable time and expense before market entry.

Obtaining necessary certifications is another critical hurdle. These can include ISO standards for quality management, specific product safety certifications, and industry-specific accreditations that validate performance claims. The process for achieving these can take months, if not years, and requires meticulous documentation and adherence to strict manufacturing protocols. For example, a new entrant in 2024 might need to secure certifications like UL Listed or ETL Verified for electrical safety and performance, adding a layer of complexity and cost that established players have already absorbed.

- Stringent Environmental Regulations: Compliance with evolving laws like EPA standards (US) and REACH (EU) requires significant investment in R&D and testing.

- Health and Safety Standards: Meeting rigorous health and safety requirements adds to the complexity and cost of product development and manufacturing.

- Certification Processes: Obtaining industry-recognized certifications (e.g., ISO, UL Listed, ETL Verified) is time-consuming and necessitates adherence to strict protocols.

- Cost and Time Investment: Navigating these regulatory and certification landscapes represents a substantial financial and temporal commitment for new market participants in 2024.

Access to Distribution Channels and Specialized Expertise

Absolent Air Care Group’s established network of wholly-owned subsidiaries and carefully chosen distributors, spanning approximately 50 countries, presents a significant hurdle for newcomers. This extensive reach, coupled with the deep technical knowledge required for industrial air filtration, makes it difficult for new entrants to compete effectively.

The capital investment and time needed to replicate Absolent's global distribution infrastructure and specialized expertise act as a strong deterrent. For instance, building out a comparable sales and service network in key industrial regions would likely require millions in upfront costs and years of relationship building.

- Global Reach: Absolent operates in roughly 50 countries, a significant barrier to entry for new players.

- Specialized Expertise: The technical knowledge in industrial air filtration is a critical, hard-to-replicate asset.

- Distribution Control: Absolent’s mix of subsidiaries and select distributors ensures market access and brand consistency, which is challenging for new entrants to match.

The threat of new entrants into Absolent Air Care Group's market is moderately low, primarily due to high capital requirements for R&D, manufacturing, and global distribution. For example, developing advanced filtration technologies in 2024 can cost millions, a sum many potential competitors cannot readily access. Furthermore, established brand loyalty and the need for extensive certifications, like ISO 9001, create significant hurdles.

The specialized nature of industrial air filtration demands deep technical expertise, which new entrants must acquire or hire, adding to initial costs. Absolent's established global presence, reaching about 50 countries through subsidiaries and distributors, provides a competitive edge that is difficult and expensive to replicate. This extensive network, built over years, ensures market access and customer support that new players would struggle to match quickly.

| Barrier Type | Description | Example Impact (2024) |

|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and distribution networks. | New entrants may need $50M+ for a competitive setup. |

| Brand Loyalty & Customer Relationships | Established trust and proven performance are hard to displace. | Switching costs for industrial clients can be substantial, involving re-validation. |

| Regulatory & Certification Hurdles | Compliance with environmental and safety standards (e.g., REACH, UL Listed). | Certification processes can add 1-2 years and significant costs to market entry. |

| Economies of Scale | Lower per-unit costs for established, high-volume producers. | Absolent's 2023 revenue of SEK 2.7 billion (~$250M USD) indicates scale advantages. |

| Technical Expertise & Distribution Network | Specialized knowledge and widespread market access. | Replicating Absolent's ~50-country reach requires immense investment and time. |

Porter's Five Forces Analysis Data Sources

Our Absolent Air Care Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports, investor presentations, and industry-specific market research from reputable firms. We also incorporate insights from competitor websites, news releases, and regulatory filings to capture a holistic view of the competitive landscape.