77 Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

77 Bank Bundle

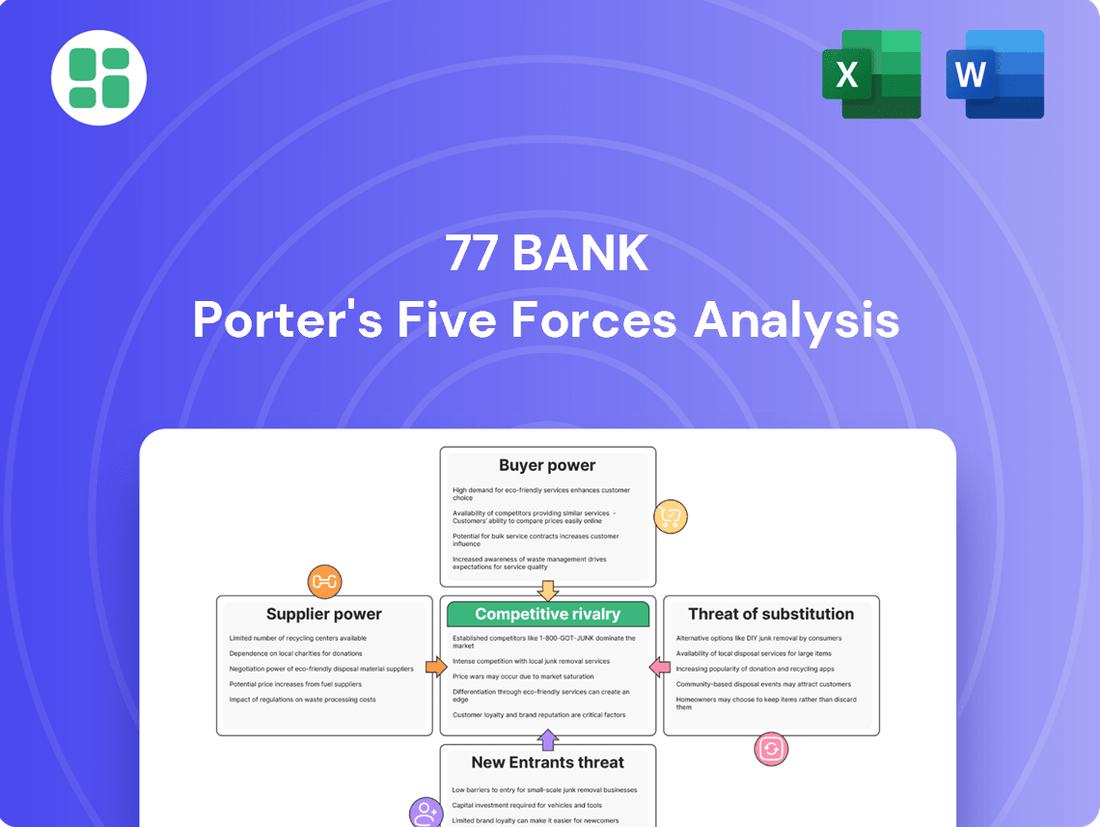

The 77 Bank Porter's Five Forces analysis reveals a competitive landscape shaped by moderate buyer power and significant threat from substitutes, particularly fintech disruptors. Understanding these dynamics is crucial for navigating the evolving financial services industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore 77 Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Technology and software providers hold considerable bargaining power over 77 Bank. The bank's reliance on specialized core banking systems, cybersecurity, and digital infrastructure means these suppliers are critical to its operations. The high costs and complexity associated with switching these systems can trap the bank, giving providers leverage, particularly for unique or proprietary solutions.

This supplier leverage is further magnified when the market for these essential technologies is concentrated, with only a few dominant players. In 2024, Japanese banks are collectively investing trillions of yen in digital transformation initiatives, underscoring the significant financial commitment and dependence on these technology vendors for competitive survival and modernization.

Financial market infrastructure providers, such as payment networks, data vendors, and clearinghouses, hold significant bargaining power over banks. These services are fundamental to a bank's daily operations and are often highly standardized, leaving banks with few viable alternatives for sourcing. This reliance grants these suppliers considerable leverage.

The essential nature and limited substitutability of these services mean that banks often face substantial costs or potential disruptions if these suppliers increase prices or alter terms. For instance, in 2024, the cost of market data subscriptions for major global banks continued to rise, impacting operational budgets. Any adverse changes directly affect a bank's efficiency and profitability, a concern amplified as Japan's financial sector navigates a new interest rate environment and accelerates digital transformation.

The availability of skilled professionals in areas like IT, risk management, and financial analysis significantly impacts The 77 Bank's operational capacity. A scarcity of such talent, especially with the accelerated digital transformation in banking, can drive up labor costs. For instance, the demand for cybersecurity professionals, a critical skill set, saw a 42% increase in job postings in 2023, according to industry reports.

Fund Providers and Depositors (Indirect Suppliers)

While depositors are typically seen as customers, significant institutional depositors or wholesale funding sources can act as suppliers of capital. Their capacity to shift substantial funds can impact a bank's funding costs and overall liquidity management. For instance, in 2024, Japanese banks faced increased competition for deposits as the Bank of Japan signaled potential shifts in monetary policy, leading to a rise in deposit rates offered by many institutions to retain these vital capital providers.

The bargaining power of these indirect suppliers is amplified by their ability to withdraw large deposits, forcing banks to offer more attractive terms. This is particularly relevant as interest rates in Japan have seen upward adjustments. Banks like 77 Bank must remain competitive in their interest rate offerings and other financial terms to secure and maintain these crucial funding sources, especially in a tightening market.

- Institutional Depositors: Large corporations, pension funds, and other financial institutions can exert significant pressure on banks by demanding higher interest rates or better terms for their deposits.

- Wholesale Funding Markets: Banks also rely on borrowing from other financial institutions or capital markets. The cost and availability of this wholesale funding are influenced by the sentiment and pricing power of these market participants.

- Impact on Cost of Funds: Increased bargaining power from these suppliers directly translates to higher interest expenses for the bank, impacting its net interest margin.

- Liquidity Management: The ease with which these large depositors can move their funds necessitates robust liquidity management strategies for banks to avoid sudden funding shortfalls.

Regulatory and Compliance Service Providers

External legal firms, auditors, and compliance consultants are vital suppliers for The 77 Bank, particularly given Japan's intricate financial regulatory landscape. Their specialized expertise and necessary accreditations significantly limit the bank's options for securing highly qualified providers.

This reliance on a select group of specialized service providers can translate into increased operational costs and reduced flexibility for The 77 Bank. The constant evolution of banking and fintech regulations necessitates continuous engagement with these experts, further solidifying their bargaining power.

- Limited Provider Pool: The niche nature of financial regulatory compliance services in Japan restricts the number of readily available, accredited providers.

- High Switching Costs: Transitioning between external legal and compliance firms involves significant time and effort to onboard new providers and ensure continuity of critical functions.

- Regulatory Dependence: The 77 Bank’s need to adhere to evolving regulations, such as those impacting digital banking and anti-money laundering (AML) in 2024, makes it difficult to challenge supplier pricing or terms.

Suppliers of core technology and software hold substantial bargaining power over 77 Bank due to the bank's deep integration with these systems. The high costs and complexity involved in switching these critical operational platforms effectively lock the bank in, granting providers significant leverage, especially for proprietary solutions. This power is amplified when the market for these essential technologies is concentrated, with only a few dominant players controlling the supply. In 2024, Japanese banks are collectively investing trillions of yen in digital transformation, highlighting their dependence on these vendors for modernization and competitive standing.

Financial market infrastructure providers, such as payment networks and data vendors, also wield considerable influence. These services are fundamental and often standardized, leaving banks with limited alternatives. This reliance means that any price increases or unfavorable term changes from these suppliers can directly impact a bank's efficiency and profitability, a concern heightened in 2024 as Japan's financial sector navigates a new interest rate environment and accelerates digital transformation.

The bargaining power of suppliers is a critical factor for 77 Bank, particularly concerning technology providers and financial market infrastructure. High switching costs and limited alternatives for essential services grant these suppliers leverage, directly impacting the bank's operational expenses and strategic flexibility. In 2024, the increasing investment in digital transformation by Japanese banks underscores their reliance on these external partners, potentially leading to higher costs for critical IT and data services.

What is included in the product

This analysis meticulously examines the five competitive forces impacting 77 Bank, providing a strategic roadmap to navigate industry rivalry, buyer and supplier power, and the threat of new entrants or substitutes.

Instantly visualize competitive intensity across all five forces, allowing for rapid identification of key pressures and strategic adjustments.

Customers Bargaining Power

Individual retail customers wield moderate bargaining power in the banking sector. The proliferation of regional banks, large national institutions, and increasingly sophisticated online financial platforms means customers have numerous choices for their banking needs. This accessibility often translates to a willingness to switch providers if better terms or services are offered.

While the cost of switching a basic checking account might be minimal, banks often employ strategies to retain customers. Loyalty programs, attractive bundled service packages, and the cultivation of personalized banking relationships can significantly increase customer stickiness, thereby dampening their individual bargaining power. However, the collective action of many individual customers choosing where to deposit funds or secure loans remains a potent force, especially as digital channels simplify the comparison and transfer process.

For instance, in 2024, the average consumer banking relationship in the United States involved multiple accounts across different institutions for a significant portion of the population, indicating a low barrier to exploring alternatives. Furthermore, the rise of fintech companies offering specialized services like high-yield savings accounts or streamlined loan applications further empowers consumers by providing accessible alternatives to traditional banking models.

Small and Medium-sized Enterprises (SMEs) often wield more bargaining power with banks than individual consumers. Their more complex financial requirements and larger loan volumes mean they can be more selective, actively seeking competitive rates and superior service. For instance, in 2024, the average SME loan size in many developed economies exceeded $250,000, making them significant clients.

SMEs are likely to compare offerings for business accounts, lending, and financial advice, especially those with robust financial performance. This shopping around can pressure banks like 77 Bank to offer more attractive terms and customized solutions to secure and retain these valuable relationships.

Given 77 Bank's strategic focus on supporting local economic development, maintaining strong relationships with SMEs is paramount. This commitment can translate into a willingness to negotiate more favorable loan covenants, interest rates, or a broader suite of integrated financial services to meet the evolving needs of these businesses.

Large corporations and institutional clients wield considerable influence over banks. Their ability to generate substantial transaction volumes, whether in loans, treasury management, or foreign exchange, gives them leverage. For instance, a single large corporate client can represent a significant portion of a bank's revenue, making them reluctant to lose this business.

This bargaining power allows these entities to demand and often receive highly competitive pricing. They can negotiate lower interest rates on borrowing, reduced fees for services, and more favorable exchange rates. This pressure on pricing directly impacts a bank's net interest margins and fee income, a key concern for financial institutions.

Banks actively compete for these high-value clients, often tailoring product offerings and service packages to meet specific needs. This intense competition can lead to concessions on pricing and terms, further empowering the customer. In 2024, many banks reported increased efforts to retain and attract large corporate clients through specialized relationship management and customized financial solutions.

Access to Alternative Financing and Services

Customers increasingly access alternative financial services like direct investment platforms, peer-to-peer lending, and fintech solutions. This expands their options and diminishes their dependence on any single bank, amplifying their collective bargaining power.

In 2024, the fintech sector continued its robust expansion, with global investment in financial technology reaching an estimated $150 billion, according to industry reports. This surge fuels the availability of diverse financial products, directly impacting customer choice and their leverage against traditional institutions like 77 Bank.

- Increased Customer Choice: Availability of P2P lending, robo-advisors, and digital payment platforms offers alternatives to traditional banking services.

- Reduced Switching Costs: Digital platforms often make it easier and faster for customers to move their funds or services compared to traditional banking.

- Fintech Growth: The global fintech market is projected to reach over $1.5 trillion by 2027, indicating a significant shift in financial service provision.

- Competitive Pressure: 77 Bank must innovate with competitive pricing and digital offerings to counter the growing influence of these alternative providers.

Price Sensitivity and Transparency

The digital age has dramatically amplified price transparency, enabling customers to effortlessly compare interest rates, fees, and service charges across financial institutions. This increased awareness directly fuels customer price sensitivity, making them more inclined to switch providers for more favorable terms. For instance, in early 2024, the average interest rate on new personal loans in Japan saw a slight uptick, prompting consumers to actively seek out the most competitive offers.

This heightened price sensitivity means 77 Bank must carefully calibrate its pricing strategies. Balancing the need to offer competitive rates to attract and retain customers against its own profitability objectives is crucial, particularly as Japan transitions away from its extended period of zero interest rates. Failure to do so could see a significant portion of its customer base migrate to rivals offering better value.

- Digital tools empower customers to compare financial products instantly.

- Increased transparency leads to greater price sensitivity among consumers.

- 77 Bank faces pressure to offer competitive pricing while maintaining profitability.

- The shift away from zero interest rates intensifies the need for strategic pricing.

The bargaining power of customers in the banking sector is significant and multifaceted, driven by increased choice, reduced switching costs, and the rise of digital alternatives. Individual customers have numerous options, and while switching costs for basic accounts may be low, banks employ loyalty programs to retain them. SMEs and large corporations wield even more power due to their transaction volumes and financial needs, pushing banks to offer competitive pricing and tailored services.

The fintech boom of 2024, with global investment in financial technology reaching an estimated $150 billion, has further empowered consumers. This expansion provides accessible alternatives to traditional banking, intensifying competitive pressure on institutions like 77 Bank. Consequently, banks must focus on innovative digital offerings and strategic pricing to retain their customer base in this dynamic environment.

| Customer Segment | Bargaining Power Factors | Impact on Banks (e.g., 77 Bank) |

|---|---|---|

| Individual Retail Customers | Numerous choices, low switching costs for basic services, digital comparison tools. | Pressure on pricing and fees for standard accounts; need for loyalty programs. |

| Small and Medium-sized Enterprises (SMEs) | Larger loan volumes, complex financial needs, active comparison shopping. | Demand for competitive rates, customized solutions, and superior service for business accounts and loans. |

| Large Corporations & Institutional Clients | Substantial transaction volumes (loans, treasury, FX), significant revenue impact. | Ability to negotiate highly favorable pricing, reduced fees, and tailored financial packages. |

| Fintech-savvy Customers | Access to P2P lending, robo-advisors, digital payment platforms. | Increased competition from alternative providers, driving innovation and price sensitivity. |

What You See Is What You Get

77 Bank Porter's Five Forces Analysis

This preview showcases the complete 77 Bank Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the banking industry. The document you see is precisely what you will receive immediately after purchase, ensuring you get the full, professionally formatted analysis without any placeholders or omissions. This detailed report is ready for your immediate use, providing actionable insights into the strategic landscape of 77 Bank.

Rivalry Among Competitors

The Tohoku region is home to several other regional banks, directly competing with 77 Bank for deposits, loans, and various financial services. This intense rivalry often sees these institutions targeting the same customer base and geographic markets.

Competition among these regional players frequently involves aggressive pricing strategies, the introduction of new financial products, and robust marketing campaigns aimed at capturing market share. For instance, in 2023, the Japanese banking sector saw continued consolidation efforts, with smaller regional banks merging to enhance efficiency and cope with demographic shifts and market saturation.

Japanese mega-banks like Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho represent a significant competitive force due to their national reach and substantial resources. These institutions offer a broad spectrum of financial services, often at more attractive rates for larger corporate clients.

While The 77 Bank is deeply rooted in its local community, the sheer scale and service breadth of these mega-banks can attract high-value corporate accounts and even some retail customers. This is particularly true for clients seeking sophisticated international banking capabilities or cutting-edge digital platforms, areas where larger banks often have a distinct advantage.

Credit cooperatives and Shinkin banks represent a significant competitive force for 77 Bank, particularly within their local Japanese communities. These institutions often boast deep roots and strong relationships with small and medium-sized enterprises (SMEs) and individual customers, offering a personalized touch that larger banks may struggle to replicate. For instance, Shinkin banks, or credit unions, are designed to support local economies and often provide more flexible lending terms to businesses that might not meet the stringent criteria of major commercial banks.

The intense rivalry from these community-focused financial players necessitates that 77 Bank clearly articulates its unique value proposition. In Japan's demographic landscape, marked by an aging and shrinking population, the ability to attract and retain customers hinges on differentiation. 77 Bank needs to highlight specialized services, digital innovation, or broader product offerings that go beyond the localized support typically provided by credit cooperatives and Shinkin banks to maintain its competitive edge.

Digital Banking and Fintech Competition

The competitive landscape for The 77 Bank is intensifying due to the burgeoning digital banking and fintech sectors. Online-only banks and agile fintech firms, often operating with significantly lower overheads, are increasingly capturing market share. These digital players, while not physically present in Miyagi, can appeal to a tech-forward customer base or offer niche services, compelling traditional institutions like The 77 Bank to bolster their digital offerings and customer engagement strategies.

This digital disruption presents a clear challenge, pushing banks to innovate. For instance, in 2024, global fintech investment reached over $150 billion, highlighting the sector's rapid growth and the pressure it exerts on incumbent banks to adapt. The 77 Bank must therefore focus on enhancing its digital platforms and user experience to remain competitive against these nimble challengers.

- Digital Transformation Imperative: Fintechs and online banks are setting new customer expectations for speed and convenience, forcing traditional banks to invest heavily in digital infrastructure.

- Lower Overhead Advantage: Digital-first competitors often avoid the costs associated with physical branches, allowing them to offer more competitive pricing or specialized services.

- Customer Acquisition: Tech-savvy demographics are increasingly drawn to digital banking solutions, representing a significant customer segment that The 77 Bank needs to actively court.

- Service Specialization: Fintechs frequently target specific financial needs, such as payments, lending, or wealth management, with highly tailored digital solutions.

Market Saturation and Slow Growth

The Japanese banking sector, especially at the regional level, is grappling with an aging demographic and sluggish economic expansion in certain regions. This environment often translates to a shrinking customer base for conventional banking products, intensifying rivalry among institutions.

Banks are therefore compelled to engage in aggressive competition, often focusing on price or service differentiation, to retain their existing market share. This pressure cooker environment has been a significant driver for the ongoing consolidation trend within the industry.

- Market Saturation: The Japanese banking market, particularly for regional banks, is highly saturated.

- Demographic Challenges: An aging population and declining birth rates in Japan (as of early 2024, Japan's population is projected to continue its decline) directly impact the demand for traditional banking services.

- Intensified Competition: This saturation and demographic shift force banks to compete fiercely for a limited or shrinking customer pool, often leading to price wars or aggressive service offerings.

- Consolidation Trend: The intense competition and slow growth are key catalysts for mergers and acquisitions as banks seek scale and efficiency.

Competitive rivalry for 77 Bank is multifaceted, encompassing regional banks, national mega-banks, and emerging fintech players. Regional banks directly vie for local customers through aggressive pricing and product innovation, a trend amplified by industry consolidation efforts seen in 2023. Mega-banks, with their vast resources and national presence, attract larger corporate clients and digitally inclined customers, posing a significant challenge to 77 Bank's market share.

Fintech companies and online banks, operating with lower overheads, are increasingly disrupting the market by offering specialized, convenient digital services. This digital shift is underscored by global fintech investments exceeding $150 billion in 2024, compelling traditional banks like 77 Bank to enhance their digital offerings to remain competitive against these agile challengers.

The intense competition is further exacerbated by Japan's demographic challenges, including an aging and shrinking population, which limits the customer base for traditional banking products. This environment necessitates differentiation through specialized services or digital innovation to retain customers amidst market saturation and a trend towards industry consolidation.

SSubstitutes Threaten

Peer-to-peer (P2P) lending platforms offer a direct channel for individuals and businesses to secure loans from other individuals or investors, effectively sidestepping traditional banking institutions. This emerging fintech trend, while still developing in Japan, presents an alternative for those needing swift funding or seeking yields beyond conventional savings.

These platforms can act as a substitute for bank loans by providing an alternative source of capital, particularly for borrowers who may not meet traditional bank criteria or are looking for more flexible terms. In 2023, the global P2P lending market was valued at approximately $105.3 billion, indicating a significant and growing alternative to traditional finance.

Fintech payment and digital wallet services present a significant threat of substitution for traditional banking. Platforms like PayPay and Line Pay in Japan offer seamless alternatives for daily transactions, reducing reliance on bank-issued cards or direct transfers. This shift diminishes the bank's role as a primary financial intermediary for everyday spending.

The push towards a cashless society, particularly in markets like Japan, amplifies this threat. In 2023, Japan's cashless payment ratio reached approximately 36.7%, a notable increase from previous years, demonstrating the growing adoption of these digital alternatives. This trend directly impacts banks by siphoning off transaction volume and customer engagement for routine financial activities.

Online brokerage platforms and crowdfunding sites present a significant threat of substitutes for traditional bank investment products and advisory services. These platforms allow investors to bypass banks and directly access a broader spectrum of assets, from stocks and bonds to alternative investments, thereby diminishing reliance on bank-managed funds. For instance, the global crowdfunding market was valued at approximately $20 billion in 2023 and is projected to grow substantially, indicating a clear shift in investment behavior.

Non-Bank Lenders and Specialty Finance Companies

Various non-bank entities, including consumer finance companies and specialized industry lenders, present a significant threat of substitutes for traditional bank loans. These firms often cater to specific market niches or offer more adaptable loan structures, thereby attracting segments of The 77 Bank's potential clientele.

These specialized lenders can provide alternatives for businesses and individuals seeking financing that might not fit the standard offerings of larger, more traditional banks. For instance, leasing companies offer a direct substitute for asset financing, a core banking product.

The 77 Bank's own engagement in financial services like credit cards and leasing demonstrates an understanding of this competitive landscape. This internal operation suggests the bank recognizes the potential for substitutes and the need to compete within a broader financial services ecosystem.

- Growing Non-Bank Lending Market: The non-bank financial sector has seen substantial growth, with reports indicating a significant increase in assets under management by alternative lenders in recent years, reaching trillions globally.

- Niche Market Penetration: Specialty finance companies often excel in serving underserved markets or specific industries, capturing market share by offering tailored solutions that traditional banks may overlook.

- Competitive Loan Terms: Non-bank lenders can sometimes offer more competitive interest rates or more flexible repayment schedules, particularly for borrowers with unique risk profiles or specific financing needs.

Cryptocurrencies and Decentralized Finance (DeFi)

While still in early stages for widespread use, cryptocurrencies and decentralized finance (DeFi) platforms pose a potential long-term threat to traditional banking services. These digital assets and platforms offer alternative avenues for payments, lending, and managing investments, potentially siphoning customers away from established financial institutions.

Japan's regulatory approach highlights this evolving landscape. By actively addressing crypto-assets and stablecoins, Japanese authorities acknowledge their growing significance as alternative financial instruments. This regulatory attention indicates a recognition of their potential to disrupt traditional banking models.

- Growing DeFi Market Cap: The total value locked in DeFi protocols reached over $100 billion in early 2024, showcasing significant user adoption and capital inflow into these alternative financial systems.

- Cross-Border Payment Innovations: Ripple's XRP, for instance, facilitated over $10 billion in cross-border payments in 2023, demonstrating the efficiency and potential of blockchain technology as a substitute for traditional remittance services.

- Stablecoin Adoption: Stablecoins, pegged to fiat currencies, are increasingly used for transactions and as a store of value within the crypto ecosystem, offering a more stable alternative to volatile cryptocurrencies and potentially competing with traditional deposit accounts.

The threat of substitutes for banks like The 77 Bank comes from various non-traditional financial channels. Peer-to-peer lending platforms offer direct connections for borrowers and lenders, bypassing banks entirely. In 2023, the global P2P lending market was valued at approximately $105.3 billion, highlighting its growing significance as an alternative to bank loans.

Digital payment services and fintech platforms are also major substitutes, handling everyday transactions and reducing reliance on bank-issued cards or transfers. Japan's cashless payment ratio reached about 36.7% in 2023, a clear indicator of this shift, impacting banks' transaction volumes and customer engagement.

Online investment platforms and crowdfunding sites provide alternatives to bank-managed investment products, allowing direct access to a wider range of assets. The global crowdfunding market, valued at around $20 billion in 2023, demonstrates this trend of individuals seeking investment opportunities outside traditional banking channels.

Furthermore, specialized non-bank lenders and leasing companies cater to niche markets or offer flexible loan structures, capturing segments of the lending market that traditional banks might not serve as effectively. Cryptocurrencies and DeFi platforms also represent a potential long-term threat, offering alternative systems for payments and finance, with the DeFi market cap exceeding $100 billion in early 2024.

Entrants Threaten

Entering Japan's banking sector requires overcoming formidable regulatory obstacles, including obtaining specific licenses and meeting rigorous capital adequacy standards. These stringent requirements significantly deter potential new entrants, making it challenging to establish a full banking operation. For instance, as of early 2024, the Financial Services Agency (FSA) continues to enforce strict licensing procedures, with only a handful of new banking licenses issued in recent years, highlighting the high barrier to entry.

Establishing a bank, such as 77 Bank, demands enormous capital for physical branches, advanced technological systems, and crucially, regulatory reserve requirements. For instance, in 2024, many jurisdictions require new banks to demonstrate significant seed capital, often in the tens or even hundreds of millions of dollars, before they can even begin operations. This substantial financial commitment acts as a formidable barrier, effectively deterring all but the wealthiest and most well-funded organizations from entering the banking sector and challenging incumbents like 77 Bank.

Established regional banks like The 77 Bank possess a significant advantage due to decades of cultivated brand loyalty and deep-seated customer trust within Miyagi Prefecture and the broader Tohoku region. This trust is hard-won and integral to customer retention in financial services.

New entrants face a formidable hurdle in replicating this established goodwill; building comparable brand recognition and community ties would require substantial time and investment, making customer acquisition a significant challenge. For instance, in 2023, regional banks in Japan saw a median customer retention rate of 92%, a testament to the power of established relationships.

The 77 Bank actively reinforces this loyalty by highlighting its contributions to the local community, such as its 2024 sponsorship of the Sendai Tanabata Festival, which demonstrably strengthens its connection with residents and deters potential switching to unfamiliar institutions.

Access to Distribution Channels and Networks

The threat of new entrants is significantly limited by the substantial investment required to establish comparable distribution channels. 77 Bank boasts an extensive physical branch network, a widespread ATM presence, and robust digital platforms, offering customers broad accessibility.

New players would face a considerable challenge in replicating this reach, necessitating massive capital outlay for both physical infrastructure and advanced digital capabilities to compete effectively.

For instance, establishing a single new bank branch can cost upwards of $2 million, a figure that escalates dramatically when considering a nationwide network.

- High Capital Investment: Replicating 77 Bank's extensive branch and ATM network requires millions in upfront capital.

- Digital Infrastructure Costs: Developing and maintaining sophisticated, secure digital banking platforms is a significant ongoing expense.

- Customer Acquisition Hurdles: Gaining market share against an established player with broad accessibility demands substantial marketing and incentive budgets.

- Regulatory Compliance: New entrants must navigate complex and costly regulatory frameworks, adding another barrier to entry.

Threat from Fintech Startups (Niche Entry)

While the prospect of a new bank setting up shop and competing across the board is daunting due to heavy regulation and capital requirements, fintech startups are finding ways to enter the financial services landscape by focusing on specific, profitable niches. These nimble players aren't trying to be full-service banks overnight. Instead, they target areas like digital payments, peer-to-peer lending, or robo-advisory services, often offering a more streamlined and user-friendly experience than traditional banks.

These specialized fintechs can significantly impact established banks by siphoning off valuable customer segments and revenue streams. For instance, a successful payments app can reduce a bank's transaction fee income, or a popular online lending platform might capture a significant portion of the small business loan market. In Japan, for example, regulators have been actively fostering fintech innovation, with initiatives aimed at encouraging new digital solutions. This regulatory support can lower barriers to entry for these specialized firms, amplifying their threat. By 2024, the digital payments sector alone saw substantial growth, with transaction volumes continuing to rise, indicating the lucrative nature of these niches.

- Niche Focus: Fintech startups excel by targeting specific, profitable segments like payments, lending, or wealth management, rather than attempting full-scale banking.

- Revenue Erosion: These specialized entrants can chip away at a bank's traditional revenue streams by offering innovative and often more convenient alternatives in their chosen niches.

- Regulatory Environment: In markets like Japan, regulatory encouragement of fintech innovation can lower entry barriers, thereby increasing the threat from new, specialized players.

- Market Growth: The digital payments sector, for example, experienced significant growth in 2024, highlighting the attractive revenue potential within these fintech-dominated niches.

The threat of new entrants to the banking sector, particularly for an established institution like 77 Bank, is significantly mitigated by the immense capital required to establish operations and gain regulatory approval. Stringent licensing and capital adequacy requirements, as enforced by bodies like Japan's Financial Services Agency, create substantial hurdles. Furthermore, the need to build a comprehensive distribution network, encompassing both physical branches and robust digital platforms, demands massive upfront investment, making it exceedingly difficult for newcomers to compete with the established reach of banks like 77 Bank.

| Barrier to Entry | Estimated Cost/Impact | Relevance to 77 Bank |

|---|---|---|

| Regulatory Licensing & Capital Requirements | Tens to hundreds of millions of dollars (2024 estimates) | High barrier, necessitates significant financial backing and compliance expertise. |

| Branch Network Establishment | $2 million+ per branch | Costly to replicate 77 Bank's established regional presence. |

| Digital Infrastructure Development | Millions for secure, advanced platforms | Ongoing significant investment required for competitive digital offerings. |

| Brand Loyalty & Customer Trust | Decades to build; 92% median retention rate for regional banks (2023) | Difficult and time-consuming for new entrants to overcome established relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for 77 Bank is built upon a foundation of comprehensive data, including the bank's annual reports, regulatory filings from financial authorities, and industry-specific market research reports. This blend of internal and external data allows for a robust assessment of competitive pressures.