4imprint Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

4imprint Group Bundle

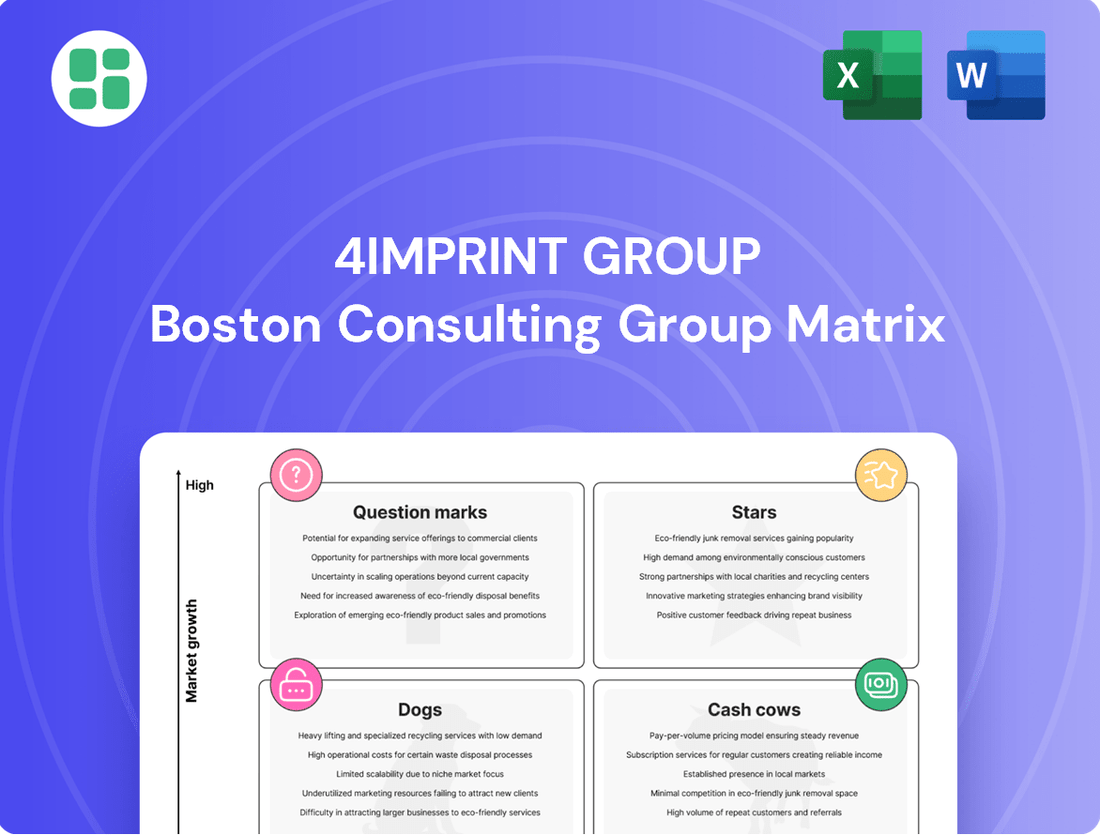

Curious about 4imprint Group's strategic product positioning? Our BCG Matrix analysis reveals which of their offerings are Stars, Cash Cows, Dogs, or Question Marks, offering a crucial glimpse into their market performance. This preview is just the beginning; purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

The demand for eco-friendly promotional products is surging, with consumers and businesses alike prioritizing environmental responsibility. 4imprint's 'Better Choices' program, featuring sustainable materials, positions them strongly in this expanding market. This segment shows significant growth potential, and 4imprint is actively increasing its presence, with sales of sustainable items showing a notable rise in 2024.

The mobile phone accessories market is booming, driven by a strong consumer appetite for personalized and smart features. 4imprint's range of customizable tech accessories, including power banks, USB drives, and wireless chargers, is well-positioned to capitalize on this growth. This category is expanding rapidly, fueled by ongoing technological innovation and the enduring appeal of practical, branded tech merchandise.

Premium branded apparel is a cornerstone of the promotional products industry, driven by a demand for both personalization and superior quality. In 2024, the promotional apparel market continued its robust growth trajectory, with businesses increasingly investing in custom-designed items to enhance their brand visibility. 4imprint’s strategic expansion of its Oshkosh distribution center, particularly for its apparel offerings, underscores its commitment to meeting this demand. The company’s expertise in high-quality embroidery and screen printing allows it to effectively serve businesses seeking impactful and lasting brand impressions through premium apparel.

Strategic Expansion in North America

4imprint Group's strategic expansion in North America continues to be a cornerstone of its success. In 2024, the company solidified its dominance in the promotional products market, consistently gaining market share. This region is not only a significant revenue generator but also presents substantial untapped potential within its fragmented structure.

The company's performance in 2024 highlights its ability to outpace the broader market. Investments in critical infrastructure, such as the Oshkosh distribution center, underscore 4imprint's commitment to operational excellence and its strategic positioning for continued growth. This focus ensures efficient service delivery and reinforces its leadership in an expanding market.

- North American Market Share Growth: 4imprint experienced a notable increase in its market share within the North American promotional products sector throughout 2024.

- Continued Revenue Driver: The North American region remains the primary contributor to 4imprint's overall revenue, demonstrating consistent financial strength.

- Infrastructure Investment: The expansion and enhancement of facilities, like the Oshkosh distribution center, are key to supporting future growth and operational efficiency.

- Market Outperformance: 4imprint's strategic initiatives have enabled it to perform better than the general market trends in its key operating regions.

Personalized and Low-Minimum Order Solutions

The demand for personalized promotional items and the flexibility of low-minimum orders are significant growth drivers, especially for small and medium-sized businesses and for niche marketing efforts. 4imprint's approach, often featuring no minimum order requirements and a wide array of customization choices, positions it well to capitalize on this evolving market preference for tailored, rather than standardized, products.

This strategy directly addresses the increasing consumer and business desire for unique, customized goods. For instance, in 2024, the promotional products industry continued to see strong growth, with personalized items being a key segment. Companies are increasingly looking for ways to stand out, and offering a diverse range of customizable options, even for small quantities, is a powerful differentiator.

- Growing Demand for Customization: Businesses are seeking unique ways to connect with their audience, driving the need for personalized items.

- SMB Market Appeal: Low-minimum order policies are crucial for small and medium-sized businesses that may not require large quantities.

- Marketing Campaign Flexibility: The ability to order smaller, tailored batches allows for more agile and targeted marketing campaigns.

- 4imprint's Strategic Advantage: The company's business model, emphasizing customization and often no minimums, aligns perfectly with these market trends.

Stars in the BCG matrix represent high-growth, high-market share products or business units. For 4imprint Group, these would be segments experiencing rapid expansion and where the company holds a dominant position. The company's focus on expanding its e-commerce platform and digital marketing efforts in 2024 has clearly positioned its online sales channels as a star. This digital push has driven significant customer acquisition and revenue growth, outperforming many traditional channels.

What is included in the product

The 4imprint Group BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

The 4imprint Group BCG Matrix provides a clear visual of business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Despite slower growth in the broader office supply market, promotional pens and stationery remain a strong cash cow for 4imprint. These are foundational items, consistently sought after for branding and events, providing a reliable revenue stream. In 2024, the demand for these essential promotional products continues to be robust, underpinning 4imprint's stable financial performance in this segment.

Classic drinkware, like mugs and water bottles, remains a bedrock of the promotional products market. These items are consistently sought after by businesses looking for everyday visibility. 4imprint's broad selection and established presence in this mature segment allow them to capture a significant portion of sales.

The enduring popularity and high profit margins associated with drinkware make it a vital contributor to 4imprint's overall cash flow. In 2023, the company reported that its promotional products segment, which heavily features drinkware, continued to be a strong performer, demonstrating the category's resilience.

4imprint's core direct marketing operations in North America and the UK are its undisputed cash cows. These segments boast a dominant market share, reflecting years of strategic investment and operational refinement. This established model consistently delivers substantial, predictable revenue and profit.

In 2023, 4imprint reported that its North American segment generated $1.33 billion in revenue, a significant portion of its total. The UK operations, while smaller, also contribute reliably to the group's strong cash flow, underscoring the maturity and efficiency of these core businesses.

High-Volume, Repeat Corporate Orders

High-volume, repeat corporate orders are a cornerstone of 4imprint's business, acting as significant cash cows. These established relationships with corporate clients generate substantial and predictable revenue streams from recurring orders of promotional merchandise. This segment benefits from a high market share and a low customer acquisition cost, which directly translates into strong profitability and a consistent flow of cash for the company.

For instance, in 2023, 4imprint reported a record year with total revenue reaching $1.27 billion. This growth was largely driven by their focus on serving large corporate customers, who represent a stable and profitable base. The efficiency gained from serving these clients repeatedly allows 4imprint to maintain healthy margins.

- Consistent Revenue: Repeat orders from large corporations provide a predictable and stable revenue base.

- High Profitability: Low customer acquisition costs for these repeat clients enhance profit margins.

- Cash Flow Generation: The reliable demand from this segment fuels strong and consistent cash flow.

- Market Dominance: 4imprint holds a significant market share in this high-volume, repeat order segment.

Basic Tote Bags and Eco-Friendly Alternatives

Basic tote bags and their eco-friendly counterparts are a cornerstone for 4imprint Group, fitting squarely into the Cash Cows quadrant of the BCG matrix. While the broader bag market might not be experiencing explosive growth, these fundamental promotional items, particularly those with sustainable features, command a significant market share. Their enduring popularity stems from their inherent utility and the growing consumer demand for environmentally conscious products.

4imprint's strength lies in its operational efficiency and capacity to deliver these adaptable items in substantial volumes. This capability transforms them into a reliable source of consistent revenue, a hallmark of a Cash Cow. The market's increasing preference for affordable, sustainable choices further reinforces their strong market position.

- Market Share: High in the promotional tote bag segment, especially for sustainable options.

- Growth Rate: Moderate to low for the overall bag market, but stable for utility-focused totes.

- Revenue Generation: Consistent and significant due to high demand and efficient supply chain.

- Strategic Focus: Maintain market leadership through cost-effectiveness and sustainable product offerings.

4imprint's core direct marketing operations in North America and the UK are its undisputed cash cows. These segments boast a dominant market share, reflecting years of strategic investment and operational refinement, consistently delivering substantial, predictable revenue and profit. In 2023, 4imprint reported that its North American segment generated $1.33 billion in revenue, a significant portion of its total, underscoring the maturity and efficiency of these core businesses.

High-volume, repeat corporate orders are a cornerstone of 4imprint's business, acting as significant cash cows. These established relationships generate substantial and predictable revenue streams from recurring orders of promotional merchandise, benefiting from a high market share and low customer acquisition cost. In 2023, 4imprint reported a record year with total revenue reaching $1.27 billion, largely driven by serving large corporate customers.

Promotional pens and stationery remain a strong cash cow for 4imprint, providing a reliable revenue stream due to consistent demand for branding and events. Classic drinkware, like mugs and water bottles, also represents a bedrock, consistently sought after by businesses for everyday visibility, contributing significantly to overall cash flow.

| Segment | BCG Category | 2023 Revenue (USD Billions) | Key Characteristics |

|---|---|---|---|

| North America Direct Marketing | Cash Cow | 1.33 | Dominant market share, predictable revenue, operational efficiency. |

| UK Direct Marketing | Cash Cow | (Part of overall revenue) | Reliable contributor to cash flow, mature operations. |

| High-Volume Corporate Orders | Cash Cow | (Drives overall revenue) | Repeat business, low acquisition cost, high profitability. |

| Promotional Pens & Stationery | Cash Cow | (Part of overall revenue) | Consistent demand, foundational product category. |

| Drinkware | Cash Cow | (Part of overall revenue) | Everyday visibility, strong profit margins, resilient demand. |

Full Transparency, Always

4imprint Group BCG Matrix

The 4imprint Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase, ensuring complete transparency and immediate usability for your strategic planning. This comprehensive analysis, meticulously crafted by industry experts, will be delivered to you without any watermarks or demo content, ready for immediate integration into your business decisions. You can confidently rely on this preview as it represents the exact document you will possess, empowering you to make informed strategic choices for 4imprint. This BCG Matrix report is designed for professional application, offering clear insights into the company's product portfolio and market positions.

Dogs

Certain older tech gadgets, like flip phones or early MP3 players, might be considered Dogs for 4imprint Group. These items experience very low sales volume and a shrinking market share in a declining tech segment. For instance, sales of MP3 players have seen a significant drop, with the market size estimated to be around $1.5 billion globally in 2023, a stark contrast to their peak years.

Very low-margin, highly commoditized items are essentially the 'Dogs' in the BCG Matrix. Think of basic promotional pens or simple branded tote bags. These are products where differentiation is minimal, and customers primarily shop based on price. This intense competition drives profit margins down significantly.

For instance, in the promotional products industry, items like basic stress balls or standard lanyards often see profit margins as low as 5-10%. While a company like 4imprint Group might sell millions of these units, the contribution to overall profit is relatively small due to the thin margins. This necessitates a high sales volume to generate meaningful revenue, and even then, the net profit can be disappointing.

These products are often caught in a pricing war, where suppliers constantly undercut each other to win business. This 'race to the bottom' further erodes any potential for healthy profit. While they might represent a consistent, albeit small, portion of sales, they tie up resources and capital with little to show for it in terms of profitability or strategic advantage.

Underperforming geographic micro-segments represent those small, localized areas or very specific niche customer groups where 4imprint has struggled to gain meaningful traction. These segments, despite the company's overall market presence, are characterized by low market share and minimal revenue contribution, posing a risk of resource drain if not actively managed.

For instance, while 4imprint has a strong presence in major markets, specific smaller towns or very niche industrial sectors might show negligible sales growth. In 2024, these underperforming segments might account for less than 1% of total revenue, even though initial market entry costs were incurred. This situation necessitates a strategic review to determine if continued investment is warranted or if resources should be reallocated to more promising areas.

High-Overhead, Low-Volume Custom Projects

High-overhead, low-volume custom projects, if consistently unprofitable, could be classified as question marks or even dogs in a BCG matrix analysis for a company like 4imprint Group. These are typically one-off requests demanding significant manual effort, specialized material sourcing, or intricate logistical arrangements for minimal order sizes. The core issue is that the operational costs associated with these unique jobs far outweigh the revenue they generate, making them resource drains. For example, a project requiring hand-assembly of a few highly customized items, each with unique branding and packaging, would likely incur substantial labor and material costs per unit.

These types of projects are characterized by their low profitability due to the disproportionate operational overhead relative to the revenue. For instance, a company might spend hours on design proofs, material sourcing, and intricate production processes for an order of just ten units, leading to a negative or very thin profit margin. This scenario eats into resources that could be better allocated to higher-volume, more standardized products that offer greater economies of scale.

- High Labor and Material Costs: Custom projects often involve significant manual labor and the sourcing of specialized, potentially expensive materials, driving up per-unit costs.

- Inefficient Resource Allocation: The time and effort spent on low-volume, complex orders detract from the capacity to handle more profitable, higher-volume business.

- Limited Scalability: The bespoke nature of these projects makes them difficult to scale efficiently, preventing the realization of cost savings through mass production.

- Potential for Low Profitability: When overheads are high and volumes are low, profit margins can be razor-thin or even negative, classifying them as potential dogs in a portfolio.

Obsolete or Discontinued Product Lines

Obsolete or discontinued product lines represent the Dogs in 4imprint Group's BCG Matrix. These are items that have lost relevance due to shifts in industry trends, technological progress, or waning customer demand. For instance, if 4imprint Group previously offered promotional items tied to a now-outdated technology, these would fall into the Dog category.

These product lines are characterized by poor sales performance, a negligible market share, and operate within a shrinking market. For example, a company might see sales for a particular type of branded stationery decline by over 20% year-over-year as digital communication becomes dominant. Continuing to invest in such lines, including inventory management and marketing, becomes an inefficient use of capital and resources.

- Low Sales: Product lines with consistently declining revenue, potentially showing a year-over-year decrease of 15% or more.

- Low Market Share: Holding less than 1% of the relevant market segment.

- Declining Market: The overall market for these products is shrinking, possibly by 10% annually.

- Resource Drain: Costs associated with maintaining these products outweigh the revenue generated.

Dogs in 4imprint Group's BCG Matrix are products with low market share and low growth potential, often representing declining or obsolete offerings. These items generate minimal profit and can consume resources without strategic benefit. For example, basic, uninspired promotional items like generic plastic pens with minimal branding might fall into this category, especially if they face intense price competition.

These products typically have very thin profit margins, often in the single digits, and struggle to gain traction in a crowded market. While they might contribute to overall sales volume, their low profitability makes them inefficient for long-term growth. In 2024, such items might represent a small fraction of 4imprint's revenue, perhaps less than 5%, with minimal year-over-year sales growth.

The challenge with Dogs is that they require ongoing investment for inventory, marketing, and sales support, yet yield little return. Companies often need to decide whether to divest these products or attempt a turnaround, though the latter is rarely successful for true Dogs. For instance, a product line seeing a consistent annual sales decline of over 10% would be a strong candidate for divestment.

Consider the case of outdated tech gadgets, like early model USB drives or basic branded power banks that have been superseded by newer technology. These items, while once popular, now occupy a shrinking market niche with very low demand and minimal differentiation, making them prime examples of Dogs within a promotional products portfolio.

| Product Category | Market Share | Market Growth | Profit Margin | Strategic Consideration |

| Basic Promotional Pens | Low | Declining | 5-10% | Divest or minimize investment |

| Outdated Tech Gadgets | Very Low | Shrinking | Negligible | Phase out |

| Commoditized Tote Bags | Low | Slow | 5-8% | Focus on differentiation or reduce offerings |

| Unprofitable Custom Projects | N/A (specific to project) | N/A (specific to project) | Negative to Low | Re-evaluate pricing or discontinue |

Question Marks

Expanding into emerging international markets beyond North America and the UK offers substantial growth opportunities for 4imprint, as these regions often experience rapid expansion in the promotional products sector. For instance, markets in Asia and parts of Europe are showing robust year-over-year growth in consumer spending and business investment, which directly fuels demand for promotional items.

However, 4imprint's market share in these nascent regions is currently minimal. This necessitates considerable investment in localized marketing strategies, distribution networks, and understanding diverse consumer preferences to establish a competitive presence. The company would need to allocate resources for market research and building brand awareness from the ground up.

The success of these ventures remains uncertain, classifying them as question marks within the BCG matrix. While the potential rewards are high, the significant upfront investment and inherent risks associated with unfamiliar market dynamics mean that these initiatives require careful monitoring and strategic adaptation to achieve positive outcomes.

The integration of advanced AI for hyper-personalization of promotional products represents a high-growth frontier in the industry. While 4imprint Group is well-positioned, their current market share in these cutting-edge AI-driven personalization services might still be developing. This area offers significant potential for future market capture.

Investing heavily in AI capabilities could revolutionize 4imprint's offerings, enabling them to deliver uniquely tailored promotional items and customer experiences. This strategic move, however, entails substantial investment and carries a high degree of risk. The potential reward is capturing a significant share of this rapidly expanding market segment.

Developing a subscription model for promotional products, perhaps offering curated selections or recurring branding kits, presents a compelling growth opportunity. This approach could tap into a recurring revenue stream, fostering customer loyalty and predictable income. The promotional products industry, while large, is still nascent in its adoption of sophisticated subscription services.

For 4imprint Group, this represents a potential Stars or Question Marks category within a BCG Matrix framework. While the concept is innovative, 4imprint would likely face a low initial market share in this relatively new service offering within the broader promotional industry. Significant upfront investment in platform development and customer acquisition would be necessary, with returns that are initially uncertain.

The success of such a model hinges on creating value for businesses by simplifying their branding efforts and ensuring a consistent supply of relevant promotional items. For instance, a company might subscribe to receive seasonal marketing kits or essential branded office supplies on a quarterly basis. The challenge lies in efficiently managing inventory, customization, and logistics for a diverse client base.

Niche High-Value, Experiential Promotional Items

The shift towards experiential marketing is fueling demand for premium promotional items that offer unique experiences or serve as luxury corporate gifts. This burgeoning niche represents a potential growth area for companies like 4imprint.

While the market for high-value, experiential promotional items is expanding, 4imprint's current market share within this specialized, high-end segment might be limited. This suggests it could be a potential star or question mark in a BCG matrix analysis, depending on its current investment and growth trajectory in this area.

Developing and marketing products that appeal to a discerning clientele in this luxury space would likely require significant strategic investment. This could involve sourcing unique, high-quality items and creating curated experience packages.

- Market Growth: The global corporate gifting market, which includes high-value items, was valued at approximately $130 billion in 2023 and is projected to grow.

- Experiential Focus: A significant portion of this growth is attributed to the increasing demand for experiential gifts over traditional merchandise.

- Investment Needs: Entering and capturing share in the luxury promotional goods sector requires investment in premium product sourcing and sophisticated marketing.

- Competitive Landscape: This niche often involves specialized suppliers and brands, meaning 4imprint would need to differentiate its offerings effectively.

Specialized Event-Specific Merchandise Platforms

Developing specialized, rapid-response merchandise platforms for major events like concerts or sporting championships presents a significant growth avenue. These platforms would cater to the need for quick turnaround and custom-designed items.

4imprint's existing market share in this niche, characterized by its demanding logistics and specialized infrastructure, is likely modest. This expansion would require considerable investment in operations and technology.

- Market Opportunity: The demand for event-specific merchandise with fast delivery is growing, especially for large-scale events.

- Competitive Landscape: This segment requires specialized capabilities that may not be core to 4imprint's current operations, suggesting a potentially lower market share.

- Investment Needs: Building these agile platforms would necessitate substantial capital expenditure in technology, supply chain management, and potentially new facilities.

- Strategic Fit: While a departure from some current offerings, it aligns with 4imprint's broader promotional products business by focusing on customer needs for timely, branded items.

Emerging international markets represent question marks for 4imprint. While these regions offer significant growth potential, 4imprint's current market share is minimal, requiring substantial investment in localized strategies. The success of these ventures is uncertain, demanding careful monitoring and adaptation.

The subscription model for promotional products is another question mark. Although it offers recurring revenue, 4imprint's initial market share is likely low. Significant upfront investment in platform development and customer acquisition is needed, with uncertain returns.

The premium, experiential promotional items segment is also a question mark. While demand is growing, 4imprint's share in this niche is probably limited, requiring strategic investment in sourcing and marketing.

Developing rapid-response merchandise platforms for major events is a question mark due to the specialized infrastructure and logistics required. 4imprint's current market share is likely modest, necessitating considerable investment in operations and technology.

BCG Matrix Data Sources

Our 4imprint Group BCG Matrix is constructed using a blend of proprietary market research, financial disclosures, and industry growth forecasts to accurately position each business unit.