Haohai Biological Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haohai Biological Technology Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Haohai Biological Technology's trajectory. Our PESTLE analysis provides a vital external perspective, equipping you with the foresight to anticipate market shifts and capitalize on emerging opportunities. Don't be left behind; download the full, actionable report now and gain a decisive competitive advantage.

Political factors

China's government is strongly backing the life sciences sector, with new policies introduced in late 2024 and early 2025 designed to boost innovation in biotechnology and medical devices. These measures aim to streamline market entry for new medicines and equipment, while also upgrading overall healthcare services across the country. This robust government support creates a fertile ground for companies like Haohai Biological Technology, fostering investment and accelerating growth.

Recent policy shifts in September 2024 have significantly relaxed foreign investment restrictions within four key Free Trade Zones, notably Shanghai. This relaxation specifically targets sensitive biotechnology sectors, including stem cell research, gene therapy, and genetic diagnostics. These changes permit foreign-invested enterprises to actively participate in product registration, listing, and manufacturing, as long as they adhere to all Chinese regulations.

For Haohai Biological Technology, this policy evolution presents a dual-edged sword. On one hand, it signals the potential for heightened competition as more international players gain easier access to China's burgeoning biotech market. However, it also unlocks avenues for strategic partnerships and collaborations, potentially facilitating access to cutting-edge technologies and research advancements that could benefit Haohai's own development pipeline.

China's medical aesthetics sector is experiencing a significant shift towards stricter quality standards and increased regulatory scrutiny, a move designed to promote high-quality growth. This intensified oversight directly targets issues like commercial bribery and ensures adherence to regulations in the sales of medical devices and pharmaceuticals.

While these changes might initially raise compliance expenses for businesses, they are poised to create a more level playing field. For established and compliant companies such as Haohai Biological Technology, this regulatory tightening is beneficial, fostering a market characterized by greater fairness and transparency.

National Strategic Focus on Domestic Medical Devices

China's government is heavily invested in fostering its domestic medical device industry. This push is fueled by a rapidly aging population and the desire for greater self-sufficiency in healthcare, a lesson amplified by global supply chain disruptions. By 2025, initiatives like the 'One Thousand Counties Project' are set to significantly upgrade rural healthcare facilities, directly increasing the market for advanced medical equipment.

This strategic national focus creates a favorable environment for companies like Haohai Biological Technology. The emphasis on domestic solutions means increased opportunities for Haohai's established product categories, including orthopedics, ophthalmology, and advanced wound care materials. The government's commitment translates into tangible market growth potential.

- Government Mandates: Policies encouraging the use of domestically produced medical devices are becoming more prevalent.

- Healthcare Infrastructure Investment: The 'One Thousand Counties Project' aims to inject significant capital into rural healthcare, creating demand.

- Market Growth for Domestic Players: This national strategy directly supports companies like Haohai, which specialize in key medical areas.

- Aging Population Demographics: China's demographic shift towards an older population increases the overall demand for healthcare services and devices.

Geopolitical Tensions and Trade Policies

While China is actively clarifying policies to attract foreign investment in its life sciences sector, geopolitical tensions present a significant challenge. The U.S. BIOSECURE Act, for instance, could disrupt global supply chains and collaborative efforts within the industry, potentially impacting companies with international operations or aspirations.

Although Haohai Biological Technology's core operations are within China, its global expansion plans and reliance on international supply chains could face indirect pressure. Navigating these evolving international trade dynamics will be crucial for maintaining its growth trajectory and market access.

- U.S. BIOSECURE Act: This legislation, if enacted, could restrict the use of certain biotech products and services originating from specific countries, potentially impacting global supply chain configurations.

- Foreign Direct Investment (FDI) in China's Life Sciences: China has been working to create a more favorable environment for FDI, with policy adjustments aimed at encouraging foreign participation in its burgeoning life sciences industry, a trend observed throughout 2024 and anticipated to continue into 2025.

- Global Supply Chain Vulnerabilities: The COVID-19 pandemic highlighted the fragility of global supply chains, and ongoing geopolitical shifts continue to pose risks, necessitating diversification and resilience strategies for companies like Haohai.

China's government is actively promoting its domestic life sciences sector, with new policies in late 2024 and early 2025 designed to spur innovation and streamline market entry for biotech products. The aging population and a focus on healthcare self-sufficiency are driving significant investment in medical devices, exemplified by initiatives like the 'One Thousand Counties Project' set to upgrade rural facilities by 2025.

Recent policy shifts in September 2024 have eased foreign investment restrictions in key Free Trade Zones, specifically targeting sensitive biotech areas like gene therapy and diagnostics, allowing foreign-invested enterprises greater participation in product registration and manufacturing under Chinese regulations.

The medical aesthetics sector is facing stricter quality standards and increased regulatory scrutiny, aimed at curbing commercial bribery and ensuring compliance, which benefits established companies like Haohai by fostering a more equitable market.

Geopolitical tensions, such as potential impacts from the U.S. BIOSECURE Act, could disrupt global supply chains and collaborations, indirectly affecting Haohai's international expansion plans and supply chain dependencies.

What is included in the product

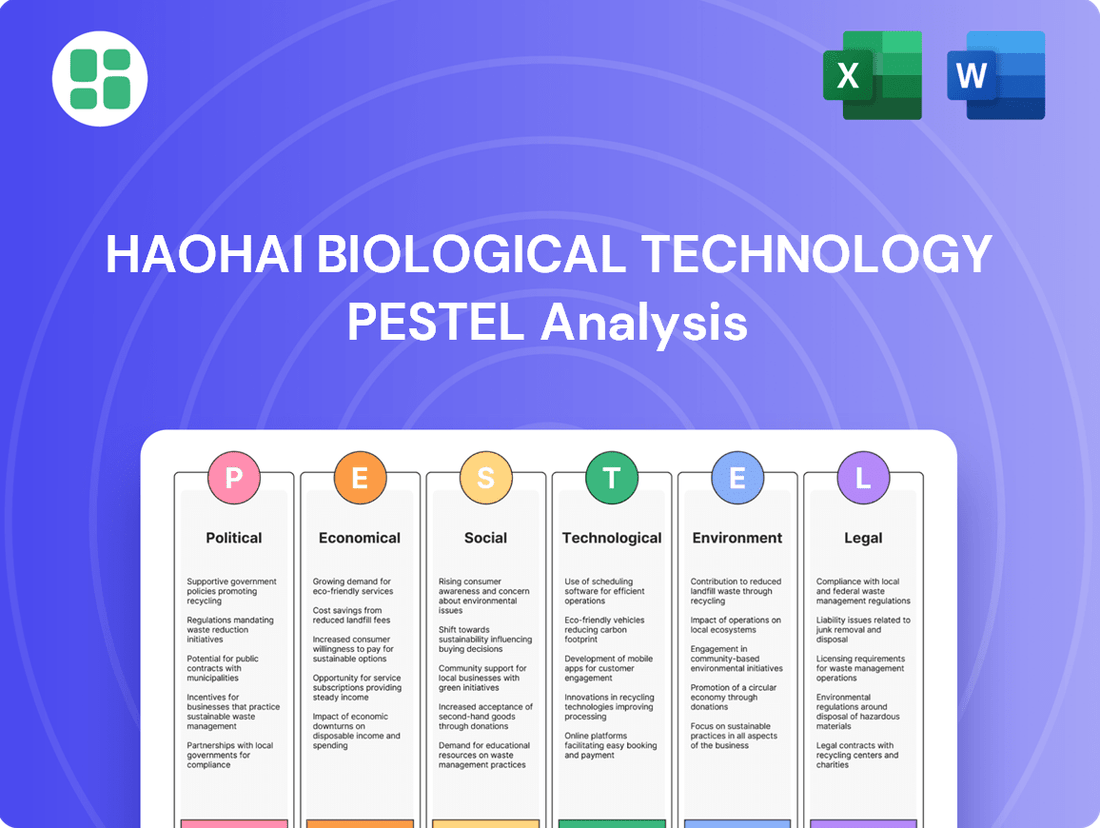

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Haohai Biological Technology, offering a comprehensive view of the external landscape.

It provides actionable insights into how these macro-environmental factors create both strategic opportunities and potential challenges for the company's growth and operations.

This Haohai Biological Technology PESTLE analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Visually segmented by PESTEL categories, this analysis allows for quick interpretation at a glance, acting as a pain point reliever by simplifying complex external factors for strategic decision-making.

Economic factors

The medical aesthetics market in China is booming, with projections showing it will grow from an estimated USD 1.75 billion in 2024 to a substantial USD 5.25 billion by 2035. This represents a compound annual growth rate of approximately 10.503% between 2025 and 2035, indicating a strong upward trend.

This robust expansion is fueled by a growing acceptance of non-invasive cosmetic procedures among consumers and an increasing demand for such treatments. Haohai Biological Technology is well-positioned to benefit from this trend, particularly with its established expertise in hyaluronic acid injections, a popular segment within the aesthetics industry.

The biomaterials market in China is experiencing significant growth, with projections indicating it will reach US$ 25,374.1 million by 2030. This represents a compound annual growth rate of 15.7% from 2024 to 2030. Healthcare applications continue to dominate this expanding sector.

Haohai Biological Technology's primary business, which centers on biomaterials like hyaluronic acid and various medical solutions, is well-positioned to capitalize on this trend. The increasing demand for products such as orthopedic implants, cardiovascular stents, and advancements in tissue engineering directly fuels this market expansion.

Haohai Biological Technology demonstrated stable financial performance in 2024, achieving a modest revenue increase and a slight uptick in net profit attributable to shareholders. This resilience is noteworthy amidst a challenging economic landscape.

Further solidifying its commitment to shareholders, the company approved a final dividend for 2024, scheduled for payment in July 2025. Alongside this, an active equity buyback program is in place, underscoring the company's focus on capital structure optimization and shareholder value enhancement.

Increasing Healthcare Expenditure and Insurance Coverage

China's commitment to healthcare is evident in its rapidly growing expenditure. Between 2012 and 2022, total health expenditure in China more than tripled, reaching approximately RMB 9 trillion in 2022. This significant increase, coupled with the evolving landscape of insurance coverage, where commercial medical insurance plays an increasingly vital role alongside government and social contributions, directly impacts companies like Haohai Biological Technology.

The expanding affordability of medical treatments, driven by this increased spending and diversified payment channels, creates a larger addressable market for innovative drugs and advanced medical devices. This trend is particularly beneficial for companies specializing in high-value medical products, as it translates into greater market penetration and sales potential. For Haohai, this means a more receptive market for its ophthalmic, orthopedic, and cardiovascular products.

- Rising Health Expenditure: China's total health expenditure more than tripled from 2012 to 2022.

- Diversified Payment Sources: Commercial medical insurance is growing in importance, complementing government and social funding.

- Improved Affordability: Increased spending and varied insurance coverage enhance the financial capacity to purchase advanced medical solutions.

- Market Expansion: This directly benefits companies like Haohai by widening the market for their innovative drugs and medical devices.

Competition and Market Penetration Rates

China's medical aesthetics market, while experiencing rapid expansion, still exhibits a lower penetration rate than established markets such as Japan, the US, and South Korea. For instance, by the end of 2023, China's penetration rate was estimated to be around 3% to 5%, significantly trailing the 10%-15% seen in more mature economies. This disparity highlights substantial untapped potential for future market growth and development.

Haohai Biological Technology operates within this dynamic environment, facing considerable competition from both domestic Chinese companies and established international brands. However, the sheer size of the potential market, coupled with increasing consumer demand for aesthetic procedures, presents significant opportunities for companies like Haohai that possess strong product pipelines and robust research and development capabilities. By 2024, the Chinese medical aesthetics market was projected to reach approximately $30 billion, underscoring the scale of these opportunities.

- Low Penetration: China's medical aesthetics market penetration was estimated between 3% and 5% in 2023, considerably lower than the 10%-15% in developed markets.

- Market Size: The Chinese medical aesthetics market was projected to reach around $30 billion in 2024, indicating substantial growth potential.

- Competitive Landscape: Haohai competes with both domestic and international players in a highly dynamic market.

- Opportunity: The untapped market potential offers significant growth avenues for leading companies with strong R&D and product portfolios.

China's economic trajectory significantly influences Haohai Biological Technology's performance. The nation's commitment to healthcare spending, which more than tripled between 2012 and 2022 to approximately RMB 9 trillion, directly expands the market for medical products. This increased expenditure, combined with the growing role of commercial medical insurance, enhances affordability and market penetration for Haohai's offerings in ophthalmology, orthopedics, and cardiovascular care.

The burgeoning medical aesthetics market in China, projected to reach USD 5.25 billion by 2035 with a 10.5% CAGR from 2025-2035, presents a key economic driver. Despite a lower penetration rate (3-5% in 2023) compared to developed nations, this segment's growth, fueled by increasing consumer acceptance, offers substantial opportunities. Haohai's expertise in hyaluronic acid injections positions it to capitalize on this expanding sector, which was valued at approximately $30 billion in 2024.

The biomaterials market in China is also a significant economic factor, expected to reach US$ 25,374.1 million by 2030, growing at a 15.7% CAGR from 2024-2030. Haohai's core business in biomaterials, including hyaluronic acid, orthopedic implants, and cardiovascular stents, aligns perfectly with this robust market expansion, driven by healthcare applications.

What You See Is What You Get

Haohai Biological Technology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Haohai Biological Technology details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and market position.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain immediate access to a detailed breakdown of how external forces shape Haohai Biological Technology's strategic landscape.

Sociological factors

China's demographic landscape is undergoing a significant transformation with its rapidly aging population. Projections indicate that by 2037, individuals aged 60 and above will constitute 30% of the total population. This substantial increase in the elderly segment directly translates to a heightened demand for healthcare services and medical devices.

This demographic shift presents a clear opportunity for companies like Haohai Biological Technology. The rising prevalence of age-related conditions, particularly in areas like orthopedics and ophthalmology, will naturally drive market growth for Haohai's specialized products.

Chinese consumers are increasingly prioritizing their health and appearance, driven by rising disposable incomes and a desire for self-improvement. This trend is particularly evident in the medical aesthetics sector, where demand for both minimally invasive and personalized treatments is surging.

The market for medical aesthetics in China experienced substantial growth, with reports indicating it reached approximately $29.2 billion in 2023 and is projected to continue its upward trajectory, potentially reaching over $40 billion by 2028. This expansion highlights a significant shift in consumer preferences towards enhancing well-being and appearance.

Haohai Biological Technology is well-positioned to capitalize on this trend, as its product portfolio, including hyaluronic acid injections, directly addresses the growing consumer demand for safe and effective aesthetic solutions. The company's offerings align perfectly with the market's preference for non-invasive procedures and customized patient care.

The pervasive influence of social media and an increasing emphasis on personal appearance are driving a surge in demand for medical aesthetic services, particularly among younger demographics. This cultural evolution is democratizing the medical aesthetics market, broadening its appeal beyond affluent consumers to become a more mainstream form of self-care and health enhancement.

Haohai Biological Technology is well-positioned to capitalize on this trend, experiencing significant growth in areas like facial aesthetics and skin rejuvenation. For instance, the global medical aesthetics market was valued at approximately USD 15.9 billion in 2023 and is projected to reach USD 34.9 billion by 2030, with a compound annual growth rate of 11.9% during this period, according to industry reports from 2024.

Demand for Quality and Safety in Medical Products

Consumers, particularly in developed markets, are increasingly prioritizing safety and efficacy when choosing medical aesthetic products. This heightened awareness, driven by media coverage and patient advocacy groups, translates into a demand for transparency regarding ingredients, manufacturing processes, and clinical trial data. For instance, in 2024, surveys indicated that over 75% of consumers in the US and Europe consider product safety a primary factor in their purchasing decisions for medical devices and treatments.

This societal shift is being mirrored by more stringent regulatory frameworks globally. Authorities are tightening oversight on medical products, pushing for greater accountability and a focus on evidence-based claims. Companies like Haohai Biological Technology, which have a strong track record of investing in research and development and maintaining rigorous quality control, are well-positioned to meet these evolving expectations. Their commitment to scientific validation and adherence to Good Manufacturing Practices (GMP) directly addresses the growing consumer and regulatory emphasis on medical expertise.

The trend towards demanding higher quality and safety in medical products has several key implications for companies in the sector:

- Increased consumer scrutiny: Patients are more informed and demand detailed information about product origins, ingredients, and potential side effects.

- Regulatory tightening: Governments worldwide are enhancing regulations, requiring more extensive clinical data and stricter manufacturing standards.

- Competitive advantage for quality-focused firms: Companies with robust R&D, strong quality management systems, and a history of product safety gain a significant edge.

- Market consolidation: The pressure for higher standards may lead to consolidation, as smaller players struggle to meet compliance costs, benefiting larger, established entities.

Urbanization and Healthcare Access Expansion

China's ongoing urbanization is a significant driver for Haohai Biological Technology. As more people move into cities, the demand for advanced healthcare services increases. This trend is further amplified by government efforts to bolster healthcare infrastructure in smaller cities and rural areas. For instance, by the end of 2023, China's urban population reached 932.67 million, representing 67.07% of the total population, a testament to this ongoing shift.

This expansion of healthcare access directly benefits Haohai by widening the market for its specialized medical devices and solutions. Hospitals and clinics in newly developed urban centers and upgraded rural facilities are increasingly equipped to adopt and utilize Haohai's innovative products. This creates new distribution channels and boosts sales potential across a broader geographical landscape.

- Urban Population Growth: China's urban population exceeded 932 million by the end of 2023, indicating a sustained migration towards urban centers.

- Healthcare Infrastructure Investment: Government initiatives are actively upgrading medical facilities, especially in lower-tier cities and rural areas, enhancing their capacity to adopt advanced medical technologies.

- Market Reach Expansion: This development broadens the geographic accessibility of Haohai's products, enabling them to reach a larger patient base through newly equipped medical institutions.

Chinese society is increasingly focused on health and wellness, with a growing middle class prioritizing preventative care and aesthetic enhancements. This societal shift is evident in the robust growth of the medical aesthetics market, which was valued at approximately $29.2 billion in 2023 and is projected to exceed $40 billion by 2028.

Haohai Biological Technology is well-positioned to benefit from this trend, as its product portfolio, including hyaluronic acid injections, directly caters to the rising demand for safe and effective aesthetic solutions.

The aging population in China, with projections indicating individuals aged 60 and above will represent 30% of the population by 2037, also drives demand for healthcare services and medical devices, particularly in areas like orthopedics and ophthalmology where Haohai has a strong presence.

Furthermore, increased consumer awareness regarding product safety and efficacy, coupled with a growing emphasis on personal appearance amplified by social media, creates a favorable market environment for Haohai's offerings.

Technological factors

Haohai Biological Technology's robust R&D is a key technological driver, with 23 projects in development. This includes a significant focus on medical beauty and ophthalmology, with 9 projects dedicated to each area, highlighting strategic investment in high-growth segments.

The company's innovation pipeline is evident in recent product approvals and advancements. For instance, its self-developed organic cross-linking hyaluronic acid product, 'Hai Mei Yue Bai,' received approval in July 2024, showcasing successful commercialization of R&D efforts. Furthermore, a topical botulinum toxin product is currently in Phase III trials, indicating a strong commitment to bringing novel treatments to market and securing future competitive advantages.

Technological advancements in biomaterial science are significantly reshaping the healthcare landscape. The global biomaterials market, projected to reach approximately $330 billion by 2028, is a testament to this innovation. This growth is fueled by breakthroughs in biodegradable implants, smart responsive materials, and the integration of nanotechnology, offering enhanced biocompatibility and functionality for medical devices.

For Haohai Biological Technology, these scientific leaps present a prime opportunity. By embracing cutting-edge research in areas like bioresorbable polymers and advanced drug delivery systems, the company can significantly bolster its product offerings. For instance, the development of novel hydrogels for tissue engineering, a rapidly expanding sub-sector, could position Haohai at the forefront of regenerative medicine solutions.

Technological advancements in drug delivery systems are revolutionizing how treatments reach patients, especially for complex biologics. Innovations like targeted nanoparticles and sustained-release formulations are enhancing efficacy and reducing side effects.

China's October 2024 pilot program for segmented production of biological products is a significant development. This initiative signals a commitment to aligning with global manufacturing standards, offering greater flexibility and potentially accelerating the adoption of novel drug delivery technologies within the country.

For Haohai Biological Technology, this evolving landscape presents a strategic opportunity. By leveraging these new drug delivery systems and adapting to China's more flexible manufacturing environment, Haohai can explore new product development and enhance its competitive edge in the biopharmaceutical market.

Integration of AI and Machine Learning in Healthcare

Technological advancements, particularly the integration of AI and machine learning, are significantly reshaping the medical aesthetics landscape. These technologies are being employed for more precise treatment planning and offering personalized consultations to patients. For instance, AI algorithms can analyze patient data to predict treatment outcomes and tailor approaches, a trend observed across the industry as of 2024.

While Haohai Biological Technology's specific engagement with AI in patient-facing applications isn't explicitly detailed, the broader implications for the company are substantial. Embracing AI and machine learning could streamline Haohai's internal operations, from accelerating product development cycles through advanced data analysis to optimizing clinical trial efficiency. Furthermore, these tools can enhance customer service by providing more personalized support and insights.

- AI in Aesthetics Market Growth: The global AI in healthcare market, encompassing aesthetics, was projected to reach over $30 billion by 2024, indicating strong industry adoption.

- Efficiency Gains: Companies leveraging AI in R&D have reported up to 30% faster drug discovery and development timelines.

- Personalization Trend: A significant portion of consumers in 2024 expressed willingness to share personal data for more tailored aesthetic treatments.

- Operational Impact: AI-driven customer service platforms have shown potential to reduce operational costs by 20-25% while improving customer satisfaction.

Collaborative Research and Global Trials

Haohai Biological Technology is strategically leveraging collaborative research and global trials to accelerate its product development and market penetration. A prime example is its joint development project with US-based Eirion for botulinum toxin products. This partnership is designed for simultaneous Phase III trials and market launches in both China and the United States, a move that significantly streamlines the path to commercialization.

These international collaborations are crucial for Haohai, fostering vital knowledge transfer and enhancing the speed of product development cycles. By working with global partners, Haohai gains access to diverse expertise and regulatory insights, which are invaluable in navigating complex international markets. This approach not only speeds up the innovation process but also broadens the company's market reach considerably.

The financial implications of such collaborations are substantial. For instance, in 2023, Haohai reported significant revenue growth, partly driven by its expanding pipeline which is fueled by these international R&D efforts. The ability to conduct trials concurrently across major markets like China and the US, as planned for the botulinum toxin, can drastically reduce time-to-market, leading to earlier revenue generation and a stronger competitive position.

Key aspects of Haohai's collaborative strategy include:

- Joint Development Projects: Partnerships like the one with Eirion for botulinum toxin products, aiming for synchronized Phase III trials and market entry in China and the US.

- Knowledge Transfer: Facilitating the exchange of scientific expertise and technological know-how with international partners.

- Accelerated Product Development: Shortening timelines for bringing new biological products to market through shared R&D efforts.

- Expanded Market Reach: Gaining access to new geographical markets and patient populations through global trial participation and launch strategies.

Technological advancements in biomaterials and drug delivery are critical for Haohai Biological Technology's growth, with the global biomaterials market expected to exceed $330 billion by 2028. Innovations like nanotechnology and biodegradable implants offer enhanced functionality for medical devices, presenting significant opportunities for Haohai to expand its product portfolio in regenerative medicine.

The integration of AI and machine learning is transforming the medical aesthetics sector, with the AI in healthcare market projected to surpass $30 billion by 2024. Haohai can leverage these technologies to accelerate R&D, optimize clinical trials, and improve customer service, potentially reducing development timelines by up to 30%.

Haohai's strategic collaborations, such as the joint development of botulinum toxin products with Eirion, are accelerating product development and market access. These partnerships facilitate knowledge transfer and allow for simultaneous trials in key markets like China and the US, significantly shortening time-to-market and driving revenue growth, as evidenced by its performance in 2023.

| Technological Factor | Impact on Haohai | Supporting Data |

|---|---|---|

| Biomaterial Advancements | Enhanced product offerings, particularly in regenerative medicine. | Global biomaterials market projected to reach ~$330 billion by 2028. |

| AI & Machine Learning | Accelerated R&D, improved clinical trial efficiency, enhanced customer service. | AI in healthcare market projected to exceed $30 billion by 2024; potential 30% faster drug discovery. |

| Drug Delivery Systems | Development of novel treatments and improved efficacy. | China's pilot program for segmented biological product production (Oct 2024) allows greater flexibility. |

| Collaborative R&D | Faster time-to-market, expanded market reach, knowledge transfer. | Joint development with Eirion for botulinum toxin products targeting simultaneous US/China trials. |

Legal factors

China's life sciences sector is experiencing significant regulatory shifts, with 2024 seeing the introduction of a draft law for medical devices and new rules to combat commercial bribery. Haohai Biological Technology must meticulously adhere to these evolving guidelines to secure product approvals and maintain market access.

China's commitment to strengthening intellectual property (IP) protection is a significant development for companies like Haohai Biological Technology. In 2024, China's Supreme People's Court reported a notable increase in IP infringement cases, underscoring the evolving legal landscape and the government's efforts to enforce these protections more rigorously. This enhanced framework is vital for Haohai, whose competitive edge hinges on its proprietary research and development, particularly in advanced hyaluronic acid products.

Robust IP protection directly fuels innovation by incentivizing the substantial investments required for biotechnology R&D. For Haohai, safeguarding its patents ensures that its unique formulations and technologies are shielded from imitation, thereby protecting its market share and encouraging continued investment in cutting-edge product development. This legal environment is a cornerstone for sustainable growth in the highly competitive biotech industry.

New policies are actively working to speed up and shorten the time it takes to get clinical trial approvals and supplemental applications for new drugs and medical devices. This means companies like Haohai Biological Technology can get their innovative products to market faster, which is a big plus for staying ahead of the competition in the healthcare sector.

Data Privacy and Human Genetic Resources Regulations

Haohai Biological Technology operates within a complex legal landscape in China, particularly concerning data privacy and the handling of human genetic resources (HGR). New regulations, such as those introduced in late 2021 and updated through 2022 and 2023, emphasize stringent data protection measures for all companies, especially those in the sensitive biotech sector. Compliance is paramount to avoid significant legal repercussions and maintain the trust of research partners and patients.

The management of HGR is a critical area, with China's regulatory framework requiring careful adherence to approval processes, especially for entities involved in international collaboration or research. While efforts have been made to streamline HGR approval procedures for foreign companies, ensuring these processes meet the latest standards is essential for Haohai's research and development activities. Failure to comply could lead to severe penalties, including fines and operational disruptions.

- Data Privacy Laws: China's Personal Information Protection Law (PIPL), effective November 1, 2021, imposes strict rules on the collection, processing, and transfer of personal data, impacting Haohai's clinical trial data management.

- Human Genetic Resources Administration: Regulations on the Administration of Human Genetic Resources (effective July 1, 2019, with ongoing interpretations and enforcement) govern the collection, use, and export of HGR, requiring Haohai to secure necessary approvals for all relevant activities.

- Compliance Burden: Companies like Haohai face a substantial compliance burden, necessitating robust internal policies and robust data security infrastructure to meet regulatory requirements.

- International Collaboration Impact: Simplified HGR approval pathways are crucial for Haohai's ability to collaborate with international research institutions and access global markets, with recent updates aiming to clarify these processes.

Corporate Governance and Shareholder Scrutiny

Corporate governance at Haohai Biological Technology is facing heightened scrutiny, particularly following recent investigations by the China Securities Regulatory Commission (CSRC) into a controlling shareholder for suspected insider trading. This situation underscores the critical need for robust compliance and transparent information dissemination to maintain investor trust.

The increasing focus on corporate governance means Haohai must adhere to stringent regulatory standards. For instance, in 2023, the CSRC continued its efforts to enhance market fairness, with investigations into insider trading remaining a key priority. Companies like Haohai are expected to demonstrate strong internal controls and timely reporting to mitigate risks associated with governance failures.

Shareholder activism and regulatory oversight are pushing companies to adopt higher standards of accountability. Haohai's ability to navigate these legal and regulatory landscapes will depend on its commitment to:

- Strengthening internal compliance mechanisms to prevent and detect potential misconduct.

- Ensuring prompt and accurate disclosure of material information to all stakeholders.

- Proactively engaging with regulators and investors to build confidence in its governance practices.

- Implementing best practices in board oversight and executive accountability.

China's evolving legal framework for medical devices and pharmaceuticals presents both opportunities and challenges for Haohai Biological Technology. New regulations in 2024 aim to streamline approvals for innovative products, potentially accelerating market entry for Haohai's advanced hyaluronic acid offerings.

The strengthening of intellectual property (IP) protection in China, evidenced by increased IP infringement case enforcement in 2024, is a critical factor for Haohai. This enhanced legal environment safeguards its R&D investments and proprietary technologies, crucial for its competitive edge.

Haohai must navigate stringent data privacy laws like China's PIPL and regulations on Human Genetic Resources (HGR). Compliance with these rules, particularly concerning clinical trial data and international collaboration, is essential to avoid penalties and maintain stakeholder trust.

Heightened scrutiny on corporate governance, exemplified by CSRC investigations into insider trading in 2023, necessitates robust internal controls and transparent reporting for Haohai. Adherence to these standards is vital for investor confidence and regulatory compliance.

Environmental factors

The global biomaterials market is experiencing a significant shift towards sustainability, with a growing demand for biodegradable options fueled by widespread plastic bans and stringent environmental policies enacted worldwide. This trend presents both a challenge and a strategic opportunity for Haohai Biological Technology.

Haohai, as a key player in biomaterial production, is under increasing pressure to integrate eco-friendly manufacturing processes and innovate its product portfolio to include more sustainable offerings. For instance, the global market for biodegradable plastics alone was valued at approximately USD 47.6 billion in 2023 and is projected to reach USD 106.7 billion by 2030, growing at a CAGR of 12.2% during this period, according to various market analyses.

By aligning with these evolving environmental regulations and burgeoning consumer preferences for greener products, Haohai can enhance its market position and unlock new avenues for growth in the rapidly expanding sustainable biomaterials sector.

Haohai Biological Technology's manufacturing processes for medical devices and biomaterials inherently produce waste, demanding stringent waste management and pollution control. The company must comply with evolving environmental regulations, which are becoming increasingly rigorous globally. For instance, China's Ministry of Ecology and Environment has been actively strengthening its environmental protection laws, with significant updates expected in 2024 and 2025 to address industrial pollution more effectively.

Implementing responsible waste disposal practices is crucial for Haohai to minimize its ecological footprint and maintain its social license to operate. Companies in the biotechnology sector are facing growing pressure from investors and consumers to demonstrate a commitment to sustainability. In 2023, many publicly traded biotech firms reported increased spending on environmental, social, and governance (ESG) initiatives, with waste reduction and pollution prevention being key focus areas.

Investor and public scrutiny of environmental, social, and governance (ESG) performance is intensifying, compelling companies like Haohai Biological Technology to showcase robust environmental stewardship. Sustainalytics’ ESG risk rating for Haohai suggests opportunities for ongoing enhancement in this domain, building on their past issuance of ESG reports.

Proactive engagement with ESG principles is crucial for Haohai to bolster its corporate image and attract capital from ethically-minded investors. For instance, a strong ESG profile can positively influence a company's cost of capital, as demonstrated by studies showing lower borrowing costs for highly-rated ESG companies.

Ethical Considerations of Biomaterials and Biotechnology

The ethical implications surrounding biomaterials and biotechnology are significant for companies like Haohai Biological Technology. Concerns often revolve around the responsible sourcing of materials, potential animal testing protocols, and the long-term ecological footprint of their advanced products. Ensuring robust ethical frameworks in research and development is crucial, as it directly impacts public trust and the ease of navigating regulatory approvals.

For instance, the debate around gene editing technologies, a key area in biotechnology, continues to evolve. In 2024, discussions intensified regarding the ethical boundaries of germline editing, with many international bodies advocating for strict oversight and public consultation. Haohai's commitment to transparency in its R&D, particularly concerning any novel biological materials or processes, will be paramount.

- Ethical Sourcing: Ensuring raw biological materials are obtained without exploitation or harm to ecosystems.

- Animal Welfare: Adhering to stringent guidelines for any necessary animal testing, prioritizing alternatives where possible.

- Environmental Impact: Assessing and mitigating the life-cycle effects of biomaterials and biotechnological products on the environment.

- Public Perception: Proactive engagement on ethical matters can build consumer confidence and support for innovative healthcare solutions.

Climate Change Impact on Supply Chain Resilience

Climate change poses significant threats to supply chain resilience, a concern for companies like Haohai Biological Technology within the pharmaceutical and medical device sectors. Extreme weather events, such as floods and droughts, can directly disrupt manufacturing, logistics, and the availability of raw materials. For instance, the UN’s Intergovernmental Panel on Climate Change (IPCC) reports that the frequency and intensity of such events are projected to increase throughout the 21st century, impacting global trade routes and production facilities.

Haohai Biological Technology, like its peers, needs to proactively assess and mitigate these environmental risks. This involves understanding how climate-related disruptions could affect its sourcing of biological materials, manufacturing processes, and distribution networks. A failure to do so could lead to significant operational delays and financial losses, impacting its ability to meet market demand.

To enhance resilience, Haohai should consider several strategic measures:

- Diversify supply chain geographically: Reducing reliance on single regions prone to climate-related disasters.

- Invest in climate-resilient infrastructure: Fortifying manufacturing sites and warehouses against extreme weather.

- Develop contingency plans: Establishing backup suppliers and alternative transportation routes.

- Enhance forecasting and early warning systems: Utilizing climate data to anticipate potential disruptions.

Environmental regulations are tightening globally, pushing companies like Haohai Biological Technology towards more sustainable practices. The increasing demand for biodegradable materials, projected to grow significantly by 2030, presents a clear market opportunity for Haohai to innovate and align its product portfolio with eco-friendly trends.

Haohai must manage its waste and pollution effectively to comply with stricter environmental laws, especially in key markets like China, which are enhancing their environmental protection measures. Demonstrating strong environmental stewardship is also becoming crucial for attracting investment and maintaining public trust, as ESG performance gains prominence among investors.

Climate change poses a tangible risk to Haohai's supply chain and operations, necessitating proactive measures like supply chain diversification and investment in resilient infrastructure to mitigate disruptions from extreme weather events.

| Environmental Factor | Impact on Haohai Biological Technology | Key Data/Trend (2023-2025) |

|---|---|---|

| Sustainability Demand | Opportunity for eco-friendly product innovation; pressure to adopt greener manufacturing. | Global biodegradable plastics market: USD 47.6 billion (2023), projected USD 106.7 billion by 2030 (CAGR 12.2%). |

| Regulatory Compliance | Need for stringent waste management and pollution control; adherence to evolving environmental laws. | China's Ministry of Ecology and Environment strengthening environmental laws in 2024-2025. |

| Climate Change Risks | Threats to supply chain resilience, raw material availability, and manufacturing operations. | Increased frequency and intensity of extreme weather events impacting global trade and production. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Haohai Biological Technology is built on a robust foundation of data from reputable sources, including official government publications on healthcare regulations and economic indicators from international financial institutions. We also incorporate insights from leading market research firms specializing in the biotechnology sector and reports detailing technological advancements.