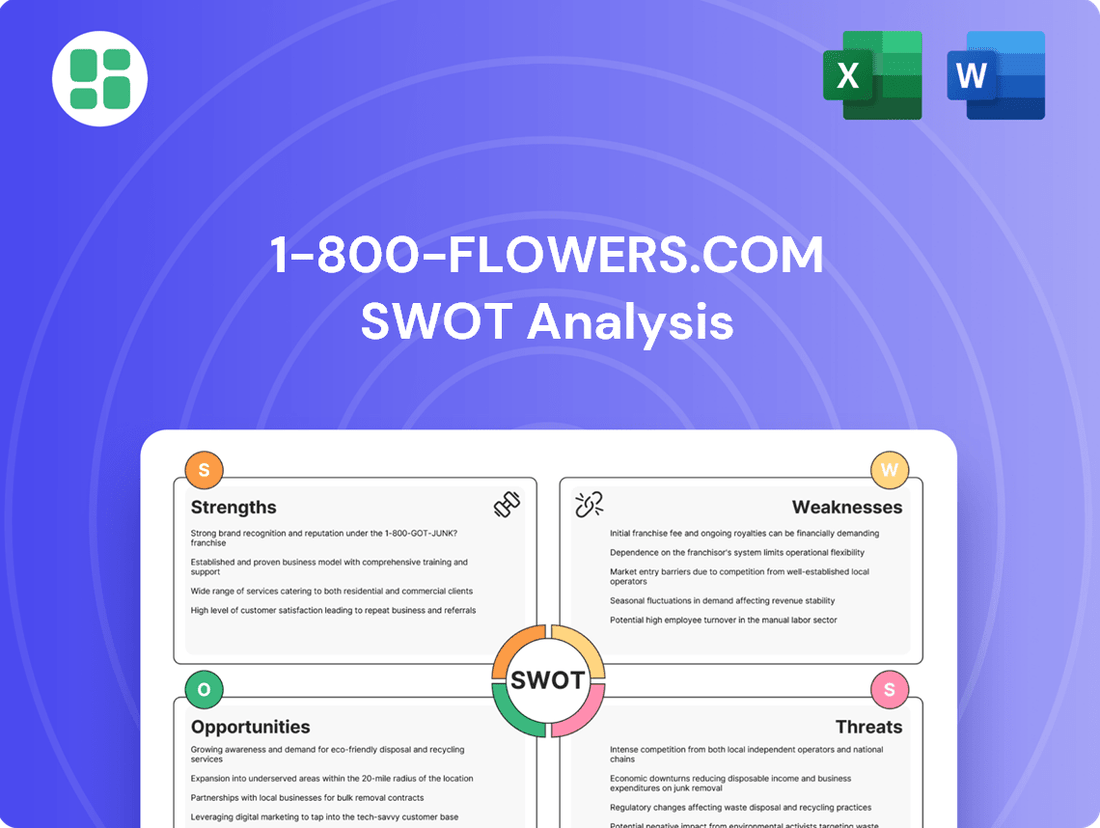

1-800-Flowers.com SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1-800-Flowers.com Bundle

1-800-Flowers.com leverages its strong brand recognition and extensive customer base as key strengths, while facing challenges like intense online competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to navigate the floral and gifting market.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

1-800-Flowers.com boasts a robust and diversified brand portfolio that extends well beyond its namesake floral offerings. This includes popular names in the gourmet food and gift sectors such as Harry & David and Cheryl's Cookies, alongside the recently acquired Scharffen Berger, which joined the company in July 2024, further strengthening its premium chocolate segment.

This strategic diversification is crucial for mitigating the inherent risks tied to the seasonality of the floral industry. By offering a wider array of products, 1-800-Flowers.com appeals to a broader customer base throughout the year, not just during peak floral gifting periods.

The company's ability to cultivate a comprehensive 'celebratory ecosystem' allows for significant cross-brand purchasing opportunities, enhancing customer lifetime value. For instance, a customer purchasing flowers might also be prompted to buy gourmet chocolates or cookies for the same occasion, driving incremental sales.

1-800-Flowers.com excels with its strong omnichannel retail strategy, seamlessly integrating online, phone, and physical store interactions. This approach significantly boosts customer convenience and broadens market accessibility by catering to various shopping preferences. In 2023, the company's e-commerce platform was a dominant force, contributing $782.4 million, which accounted for a substantial 62% of its total revenue, underscoring its robust digital footprint.

1-800-Flowers.com boasts nearly five decades of operation, solidifying its position as a highly recognizable brand within the floral and gifting sectors. This extensive legacy translates into significant brand equity, fostering consumer trust and encouraging repeat business, which in turn helps to lower customer acquisition costs.

The company's strong brand presence was further validated in 2024 when it was named among Newsweek's America's Most Trustworthy Companies. This recognition underscores the deep-seated loyalty and confidence customers place in the 1-800-Flowers.com brand, a crucial asset in a competitive market.

Established E-commerce and Logistics Infrastructure

1-800-Flowers.com boasts a robust e-commerce platform and a sophisticated logistics network, which are cornerstones of its business model. A substantial portion of its revenue is generated through online sales, highlighting the effectiveness of its digital infrastructure.

The company's ongoing efforts to streamline logistics and fulfillment operations have yielded positive financial results. For instance, in fiscal year 2024, these optimizations contributed to an enhanced gross profit margin, demonstrating the financial benefits of an efficient supply chain.

This well-oiled system is vital for ensuring prompt deliveries, a critical factor for customer satisfaction, particularly when dealing with time-sensitive and perishable products like floral arrangements. The infrastructure supports timely fulfillment and maintains product quality from order to doorstep.

Key aspects of this strength include:

- Advanced E-commerce Capabilities: A user-friendly website and mobile app facilitate seamless online transactions.

- Efficient Logistics Network: A well-established system for warehousing, inventory management, and delivery ensures timely fulfillment.

- Cost Optimization: Continuous improvements in logistics and fulfillment processes directly impact profitability, as seen in the improved gross profit margin in FY2024.

- Customer Satisfaction: The reliable delivery infrastructure is crucial for meeting customer expectations, especially for perishable goods.

Strategic Acquisitions and Innovation

1-800-Flowers.com has a strong history of strategic acquisitions to bolster its market position and service capabilities. For instance, the acquisition of Card Isle in April 2024 significantly enhanced its e-commerce greeting card offerings, while the May 2023 acquisition of SmartGift aimed at improving the overall customer gifting experience.

These moves, coupled with internal innovation like the May 2025 launch of 'Celebrations Wave,' underscore a commitment to expanding the company's gifting ecosystem. The integration of new technologies, particularly AI, is central to these efforts, promising more personalized and engaging customer interactions.

- Card Isle Acquisition (April 2024): Strengthened e-commerce greeting card segment.

- SmartGift Acquisition (May 2023): Enhanced customer gifting experience.

- 'Celebrations Wave' Launch (May 2025): Aims to enrich the gifting ecosystem.

- AI Integration: Focus on personalized customer experiences.

1-800-Flowers.com possesses a diversified brand portfolio including Harry & David and Cheryl's Cookies, further strengthened by the July 2024 acquisition of premium chocolate maker Scharffen Berger. This diversification mitigates floral industry seasonality and fosters cross-brand sales, enhancing customer lifetime value by creating a comprehensive celebratory ecosystem.

The company's strong brand recognition, built over nearly five decades and recognized by Newsweek's America's Most Trustworthy Companies in 2024, cultivates customer trust and repeat business. This brand equity is a significant asset in a competitive market, contributing to lower customer acquisition costs.

1-800-Flowers.com leverages an efficient omnichannel strategy, with its e-commerce platform being a major revenue driver, accounting for 62% of its $782.4 million revenue in 2023. This robust digital infrastructure, coupled with a sophisticated logistics network, ensures timely delivery and product quality, contributing to improved gross profit margins in FY2024.

Strategic acquisitions, such as Card Isle in April 2024 and SmartGift in May 2023, alongside planned innovations like the May 2025 launch of 'Celebrations Wave' and AI integration, continually expand its gifting ecosystem and enhance personalized customer experiences.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Brand Diversification | Expanded Portfolio | Acquired Scharffen Berger in July 2024. |

| Brand Recognition | Customer Trust | Named one of Newsweek's America's Most Trustworthy Companies in 2024. |

| E-commerce & Logistics | Digital Revenue | E-commerce contributed 62% of $782.4M revenue in 2023. |

| Strategic Acquisitions | Ecosystem Enhancement | Acquired Card Isle (April 2024), SmartGift (May 2023). |

What is included in the product

Analyzes 1-800-Flowers.com’s competitive position through key internal and external factors, detailing its brand recognition and customer loyalty alongside challenges in a competitive online market and evolving consumer preferences.

Offers a clear breakdown of 1-800-Flowers.com's competitive landscape, highlighting opportunities and threats to inform strategic adjustments.

Weaknesses

1-800-Flowers.com's revenue is heavily concentrated around key holidays, particularly Valentine's Day and Mother's Day, creating significant seasonal demand. This reliance means a substantial portion of their annual sales is compressed into a few high-traffic periods.

This pronounced seasonality can lead to unpredictable revenue streams and operational challenges. The company must ramp up resources, including staffing and inventory, dramatically for these peak times, only to face underutilization during the quieter months. For instance, in the fiscal year ending July 2, 2023, 1-800-Flowers.com reported that approximately 40% of its annual revenue was generated in the third and fourth fiscal quarters, which include major holidays.

The stock's performance often mirrors these seasonal patterns, exhibiting increased volatility as key gifting holidays approach and recede. Investors closely watch these periods for indicators of the company's ability to capitalize on seasonal demand, with stock prices sometimes reacting sharply to holiday sales performance.

The core offering of fresh flowers is inherently perishable, creating substantial hurdles in managing inventory and logistics effectively. This fragility necessitates a highly efficient supply chain to guarantee freshness and quality at the point of delivery, a process that can be expensive and susceptible to unexpected disruptions.

The inherent nature of perishability means that spoilage and waste are constant risks, directly impacting the company's profit margins. For example, in the floral industry, unsold inventory can quickly lose its value, underscoring the need for precise demand forecasting and rapid turnover, a challenge amplified by seasonal fluctuations and unpredictable consumer demand.

The online floral and gift market is incredibly crowded. 1-800-Flowers.com faces stiff competition not only from other dedicated online florists but also from massive e-commerce giants like Amazon, which offers a wide range of gift options. This makes it challenging to stand out and capture customer attention.

This intense competition directly impacts profitability. Businesses like 1-800-Flowers.com often experience high customer acquisition costs as they must invest heavily in marketing to attract new buyers. Furthermore, consumers in this space tend to be very price-sensitive, forcing companies to compete on price, which can erode profit margins.

Declining Revenue Trends

1-800-Flowers.com has faced a significant downturn in its financial performance, with revenue showing a consistent decline. For fiscal year 2024, the company reported a 9.24% decrease in revenue. This downward trend continued into the third quarter of fiscal year 2025, where revenue fell by an even sharper 12.6% compared to the same period in the prior year.

These declining revenue trends highlight the company's struggle to adapt to current market conditions. Factors such as a challenging macroeconomic environment and reduced consumer discretionary spending are impacting its ability to grow its top line. Management has specifically pointed to these broader economic pressures as a key reason for the revenue contraction.

Further exacerbating these issues, 1-800-Flowers.com has also encountered operational hurdles. Recent difficulties with the implementation and performance of new order management systems have directly contributed to the revenue declines, creating internal friction that impacts customer experience and sales.

- Fiscal Year 2024 Revenue Decline: 9.24%

- Q3 Fiscal Year 2025 Revenue Decline: 12.6% (year-over-year)

- Contributing Factors: Macroeconomic challenges, softer discretionary spending, new order management system issues.

Thin Profit Margins

1-800-Flowers.com faces the challenge of thin profit margins, with net profit margins hovering around 3.2% as of recent reports. This figure is notably lower when compared to the broader e-commerce retail sector average. While the company has seen some positive movement in gross profit margins, largely attributed to enhanced logistics and reduced freight expenses, maintaining overall profitability remains a persistent hurdle in a market characterized by intense competition and sensitivity to costs.

The company's profitability is impacted by several factors:

- Erosion of Net Profitability: A net profit margin of approximately 3.2% indicates that for every dollar of revenue, only a small fraction translates into profit.

- Competitive Landscape: The e-commerce market is highly competitive, often leading to price wars that squeeze margins.

- Operational Costs: Despite efforts to optimize logistics and reduce freight costs, the inherent costs of operating an e-commerce business, including marketing, fulfillment, and customer service, continue to pressure profitability.

The company's reliance on seasonal sales, particularly around major holidays like Valentine's Day and Mother's Day, creates significant revenue volatility and operational strain. This concentration means a substantial portion of annual income is compressed into short, high-demand periods, necessitating costly resource scaling.

The perishable nature of its core product, fresh flowers, presents ongoing challenges in inventory management and logistics. This fragility demands a highly efficient supply chain to ensure quality, which can be expensive and prone to disruptions, directly impacting profit margins through spoilage and waste.

Intense competition within the online floral and gift market, including from large e-commerce players, forces 1-800-Flowers.com to compete heavily on price, potentially eroding profitability and increasing customer acquisition costs.

Recent financial performance shows a concerning downward trend, with revenue declining significantly in fiscal year 2024 and continuing into fiscal year 2025, partly due to macroeconomic pressures and issues with new order management systems.

Full Version Awaits

1-800-Flowers.com SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual 1-800-Flowers.com SWOT analysis, complete with insights into its Strengths, Weaknesses, Opportunities, and Threats. The full, detailed report will be available immediately after purchase, offering a comprehensive understanding of the company's strategic position.

Opportunities

The U.S. floral gifting market is increasingly leaning towards personalization, with younger demographics like Gen Z and millennials actively seeking unique, customized options. This presents a prime opportunity for 1-800-Flowers.com to enhance its offerings through bespoke arrangements, personalized message options, and specialized packaging across its various brands. Data analytics can be a powerful tool here, enabling more precise marketing and product suggestions tailored to individual customer preferences.

The subscription economy is booming, and 1-800-Flowers.com can tap into this by expanding its flower and gourmet food subscription offerings. This trend is driven by consumer desire for convenience and personalized selections, creating a strong avenue for recurring revenue. In 2024, the global subscription e-commerce market was projected to reach over $80 billion, highlighting the significant potential for companies that can effectively cater to this demand.

1-800-Flowers.com can significantly boost customer engagement and operational efficiency by integrating advanced technologies like AI. This strategic move promises to personalize recommendations, streamline the supply chain, and elevate the overall customer journey, ultimately driving repeat business and fostering loyalty.

The company has already signaled its intent to harness AI for a more sophisticated gifting experience, a move that aligns with the growing consumer demand for personalized interactions. For instance, AI-powered chatbots can handle customer inquiries 24/7, freeing up human agents for more complex issues and improving response times, a critical factor in the fast-paced floral and gifting industry.

By leveraging AI, 1-800-Flowers.com can analyze vast amounts of customer data to predict purchasing patterns and offer highly relevant product suggestions, potentially increasing average order value. Furthermore, AI can optimize inventory management and delivery routes, reducing waste and ensuring timely delivery, which is paramount for perishable goods like flowers. This technological adoption is expected to be a key differentiator in the competitive online gifting market.

Strategic Partnerships and Corporate Gifting Expansion

Forming strategic partnerships is a key opportunity for 1-800-Flowers.com. For instance, a collaboration with Uber Direct for Valentine's Day 2025 deliveries could significantly bolster their capacity to handle peak demand and improve overall delivery efficiency. This type of alliance allows them to leverage external logistics networks, ensuring timely service even during high-volume periods.

Expanding the corporate gifting segment offers another substantial growth avenue. Initiatives like integrating with platforms such as SmartGift can streamline the process for businesses sending gifts, making it easier to manage employee or client appreciation programs. This B2B focus taps into a market segment that values convenience and personalized gifting solutions.

The corporate gifting market itself is robust. In 2024, the global corporate gifting market was valued at approximately $250 billion, with projections indicating continued growth. 1-800-Flowers.com is well-positioned to capture a larger share of this market by offering tailored solutions and leveraging technology.

Key opportunities include:

- Securing partnerships with logistics providers like Uber Direct for enhanced delivery during peak seasons.

- Developing and promoting integrated gifting platforms for the B2B market.

- Targeting specific industries with customized corporate gifting packages.

- Leveraging data analytics to personalize corporate gifting offers.

International Market Expansion

While 1-800-Flowers.com's international revenue currently represents a small fraction of its overall business, there's a significant long-term opportunity for global market expansion. As digital commerce continues to grow worldwide, the company can leverage its established e-commerce capabilities to introduce its various brands to new international customer bases, potentially unlocking substantial new revenue streams.

This strategic move would involve carefully adapting its product offerings and marketing strategies to resonate with local consumer preferences in target markets. For instance, understanding regional gifting traditions and floral preferences will be crucial for success. The company's existing expertise in online sales and customer service provides a strong foundation for navigating these complexities.

- Global E-commerce Growth: The global e-commerce market is projected to reach over $8 trillion by 2025, presenting a vast opportunity for digital-first retailers like 1-800-Flowers.com.

- Untapped Markets: Many developed and emerging economies show increasing demand for online retail, including specialized sectors like floral and gift delivery.

- Brand Diversification: Expanding its portfolio of brands, such as Harry & David and Shutterfly, into international markets could appeal to a broader range of global consumers.

Expanding into international markets presents a significant growth opportunity for 1-800-Flowers.com, leveraging the global surge in e-commerce. The company can adapt its successful online model and brand portfolio, like Harry & David and Shutterfly, to new regions. This strategic expansion taps into increasing demand for online retail in both developed and emerging economies, potentially unlocking substantial new revenue streams.

Threats

1-800-Flowers.com navigates a fiercely competitive landscape. Beyond direct rivals like FTD and From You Flowers, the company contends with giants such as Amazon, which offers a vast array of gift options, and the enduring presence of local brick-and-mortar florists.

This market fragmentation, coupled with the low barrier to entry for online retail and the ease with which consumers can switch between providers, creates significant price sensitivity. Consequently, 1-800-Flowers.com often faces pressure on its profit margins as it strives to remain competitive in a crowded marketplace.

Economic uncertainties, including persistent inflation, create a challenging consumer environment that directly impacts discretionary spending on items like flowers and gifts. Recent data from the Bureau of Labor Statistics shows consumer price index increases continuing through early 2024, squeezing household budgets.

This dynamic consumer landscape has led to softer demand, as evidenced by 1-800-Flowers.com's reported revenue declines in certain segments, particularly affecting lower-income households less able to absorb rising costs for non-essential purchases.

Should the economy experience a continued slowdown or recessionary pressures, consumer purchasing of non-essential goods like floral arrangements is likely to be further suppressed, presenting a significant threat to sales volumes.

1-800-Flowers.com faces significant threats from supply chain disruptions, particularly for its perishable floral products. Climate change impacts, such as extreme weather events, can damage crops and disrupt sourcing, while global transportation challenges and geopolitical instability further strain the movement of goods. For instance, the 2021-2022 period saw widespread shipping delays and increased freight costs globally, directly affecting the delivery of fresh flowers.

The company is also exposed to considerable cost volatility. Fluctuations in agricultural input costs, like fertilizer and labor, alongside unpredictable transportation expenses, directly squeeze gross margins. In 2024, many agricultural sectors reported rising input costs, and the cost of air and ground freight continued to be a significant factor, impacting the profitability of seasonal and time-sensitive products.

Shifting Consumer Preferences Towards Non-Floral Gifts

Consumers are increasingly exploring alternatives to traditional floral arrangements, favoring personalized items, cutting-edge tech gadgets, and memorable experiential gifts. This shift directly impacts the demand for floral products, presenting a significant challenge for companies like 1-800-Flowers.com.

The growing popularity of personalized and experience-based gifting options could siphon market share away from established floral and gourmet food providers. To counter this, continuous innovation in product offerings and marketing strategies is crucial for maintaining relevance in a dynamic gifting landscape. For instance, a 2024 survey indicated that 35% of consumers aged 18-34 are more likely to purchase an experiential gift over a physical one.

- Diversification of Gift Categories: Consumers are actively seeking unique and personalized gifts beyond flowers, including custom-made goods and digital experiences.

- Rise of Experiential Gifting: A growing segment of the market prioritizes memorable experiences, such as concert tickets or weekend getaways, over traditional material presents.

- Technological Influence: The integration of technology into gifting, from smart home devices to virtual reality experiences, offers new avenues for gift-giving that bypass traditional channels.

Rising Operational Costs and Labor Market Challenges

Operational expenses for 1-800-Flowers.com, particularly those tied to labor and warehousing, are on an upward trajectory. For instance, the average hourly wage for retail and wholesale trade workers in the U.S. saw an increase of approximately 4.5% year-over-year as of early 2024, impacting the company's staffing costs. Furthermore, investments in essential technology infrastructure and the potential for future wage adjustments present ongoing financial pressures that could squeeze profit margins.

The company faces the persistent challenge of rising operational costs, which directly impact its bottom line. These costs encompass not only increasing labor wages but also the expenses associated with maintaining and upgrading warehouse facilities and investing in advanced technology to stay competitive. For example, a report from the Bureau of Labor Statistics indicated a 3.8% rise in warehousing and storage costs in late 2023, a trend likely to continue. These escalating expenses necessitate careful financial management and strategic cost-control measures to preserve profitability.

- Rising Labor Costs: Average hourly wages for retail workers, a significant cost component, have been increasing, putting pressure on 1-800-Flowers.com's payroll expenses.

- Warehouse Operations: Expenses related to running and maintaining fulfillment centers are also on the rise, impacting logistics and delivery costs.

- Technology Investments: Continuous investment in e-commerce platforms, data analytics, and automation is crucial but adds to the overall operational expenditure.

- Potential Wage Increases: The tight labor market may necessitate further wage adjustments to attract and retain qualified staff, further impacting profitability.

Intense competition from online retailers like Amazon and local florists puts pressure on 1-800-Flowers.com's pricing and profit margins, especially given low barriers to entry and consumer ease of switching. Economic headwinds, such as ongoing inflation observed through early 2024, reduce discretionary spending, impacting demand for non-essential items like flowers. Furthermore, evolving consumer preferences towards personalized and experiential gifts, with a notable 35% of 18-34 year olds favoring experiences in 2024, pose a significant threat to traditional floral businesses.

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of 1-800-Flowers.com's financial statements, recent market research reports, and expert industry analyses to provide a robust and actionable strategic overview.